Accounts payable automation process for businesses

Optimized accounts payable helps businesses serve their suppliers and stakeholders diligently. Developing strategies to streamline AP workflow is critical to maintaining adequate working capital at all times. Failing to do so can damage a company's cash flow and financial ratios resulting in an acute cash crunch.

Accounts payable automation is an intelligent tool for coherent invoice processing, vendor management, and supply chain management. Through automation, companies can approve invoices faster, pay outstanding dues of suppliers in time, and have a systematic approach towards reconciliation.

5 steps involved in accounts payable automation

Ideally, companies should adopt an automated accounts payable system rather than a manual one. A manual system consists of steps for verifying and approving invoices. Not to mention, it exposes companies to the risk of errors and fraud.

Invoice receiving

The process kicks start when the finance team receives an invoice from the delivered goods and services supplier.

Verification

The invoice is then verified with the inventory management system, confirming the product type, quantity received, defects found, etc. Upon checking all the order details, the accounts team verifies the invoice.

Payment initiation

If the goods received are under the issued purchase order (PO), the finance team prepares to initiate the invoice payment. If the goods are not approved, the invoice is canceled and sent back to the supplier for any changes.

Payment record

The payment mode, amount credited, invoice no., are manually entered into the accounting system. Paper receipts for the payment intimation are sent to the supplier.

Receipt confirmation

The supplier then checks the amount received against invoice no. and confirms the payment receipt to the purchaser.

Manual system vs automated system

Manual system

1. Decluttered vendors.

2. Manually, approval of invoices.

3. Possibility of unverified invoices.

4. Wait for month-end to reconcile books.

5. Manual preparation of financial reporting and compliance reports.

6. Traditional payment methods like net banking, wire transfers, etc.

Automated system

1. Fraud detection mechanism.

2. System approves the invoices.

3. Systemic vendor management.

4. Instant reconciliation of every ledger.

5. Pay directly to the vendor’s bank account using corporate cards.

6. Easy generation of expense reports and tax & auditing documents.

How AP Automation can help businesses?

Having a computerized accounting system allows organizations to promote a solid and healthy company-wide spend culture. Employees are held accountable for every action as the system is crystal clear and leaves no scope of susceptibility.

Faster invoice cycle

Accounts team is surrounded by various invoices, outstanding dues, auditing, tax reports, etc. Negligence or misstep in any work can cause huge bucks to the company. Invoice processing might look like an easy-breezy task but is a laborious and tedious job to be in.

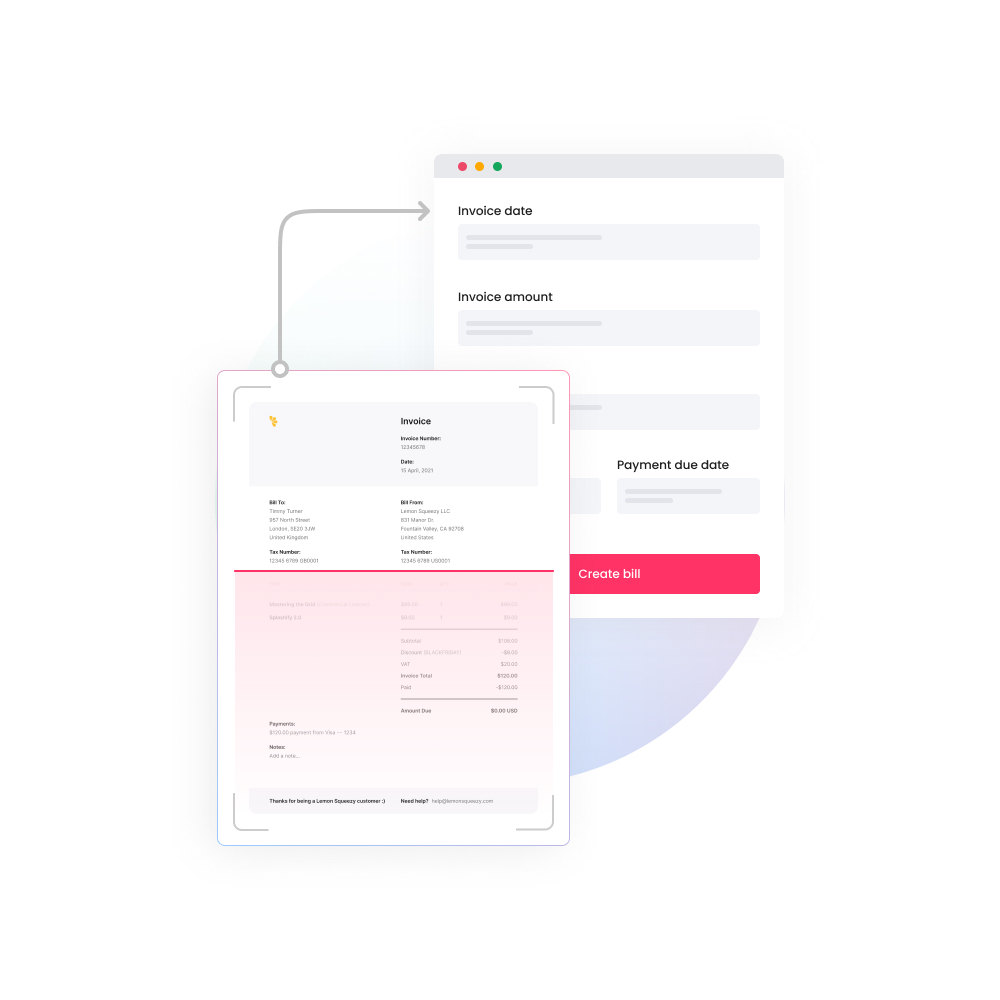

Deploying automation in accounting works allows employees to save a significant amount of time and energy. The vendor can directly send the invoices to our system through automated software, which can be processed automatically with minimal human intervention. E-invoicing helps maintain similar records and reduces the redundancy of duplicate invoices. The processing time of each invoice can be reduced down to a few hours as compared to the traditional method, which involves around seven days to get approved.

Less paper-based accounting

Juggling between multiple records and documents is the most wearying task of the accounts team. It might open up the possibility of misplacing records, getting torn, or placing them in the wrong file. This calls for repetition of the entire process. Not to mention, opting for this method can result in data blind spots, which hamper the financials of a company.

Adopting paperless accounting promotes less implementation of paper-based accounting systems. The cost per invoice can also be reduced significantly. Work can be done seamlessly without having to breathe between multiple documents. Additionally, the data entered and procured is error-free, as the system works on a pre-decided matrix, and any discrepancies in that will not be entertained by the software.

Timely payment, happy vendors

Manual systems do not guarantee on-time payments of outstanding dues. Late payments, part-payments display a negligent image of the company. This also increases the chances of not receiving new orders in the near future. Altogether, this harms the relationship between suppliers and other stakeholders.

Automated accounts payable are equipped with payment notifications and alerts. They remind you of the upcoming payments to invoices, credit cards, loan interest, EMI, or other scheduled payments. This way, companies stay on the top by making arrangements for these payments. Also, advance notifications allow companies to prioritize payments according to their importance. Payments that need to be addressed first, like 3rd party payments, credit card bills, etc., should be paid first to avoid penalties.

Paying vendors on time helps companies secure early-payment discounts and avoid any penalties from late payments. Thus, good faith is established between the two parties.

Switching to corporate payment

Gone are the days when cash was considered the safest mode of payment. Alternatives to cash payments are winning the race now. Cash payments can take up costs in the long term through ATM withdrawal fees. Methods like net banking, wire transfer, cheques, etc., also involve processing costs and transfer fees. Repetitive payments can cost companies much more than expected.

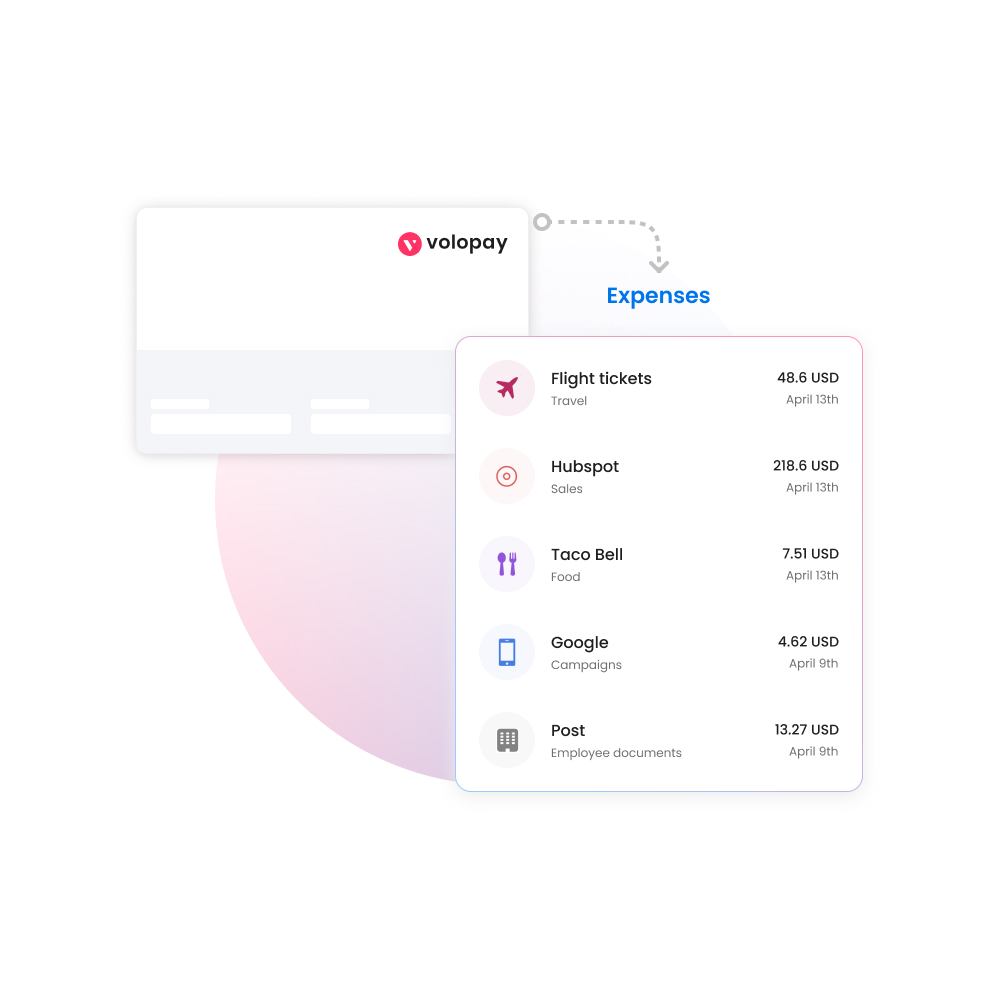

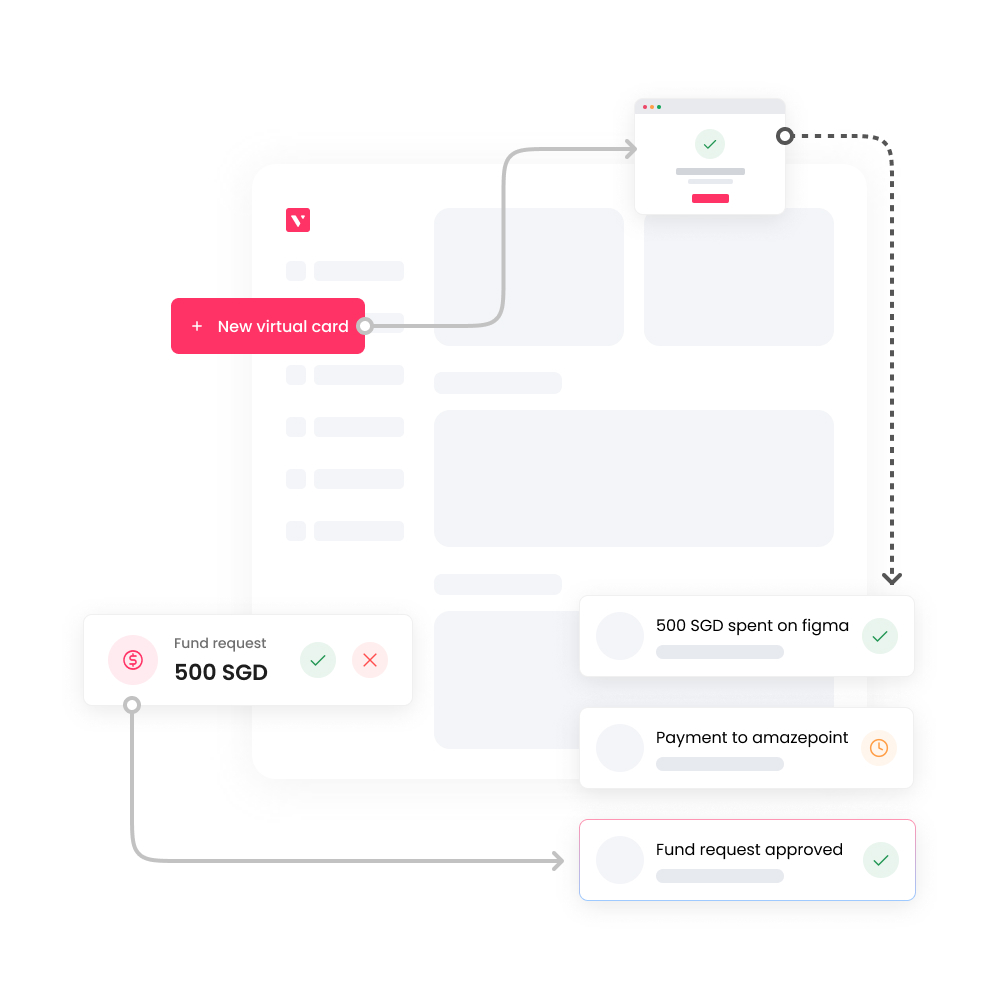

Using corporate card programs offers payment protection and comes with diverse functions. Employees can be issued these cards to make vendor payments, in-store or online purchases. Payments via corporate cards are automatically reconciled into the accounting system without any manual work.

Why should you choose Volopay for AP automation?

Volopay brings users comprehensive accounts payable software. Enabled with modern technology, Volopay ensures that once you start your business in the US, our platform would seamlessly bridge the gap between you and the vendors.

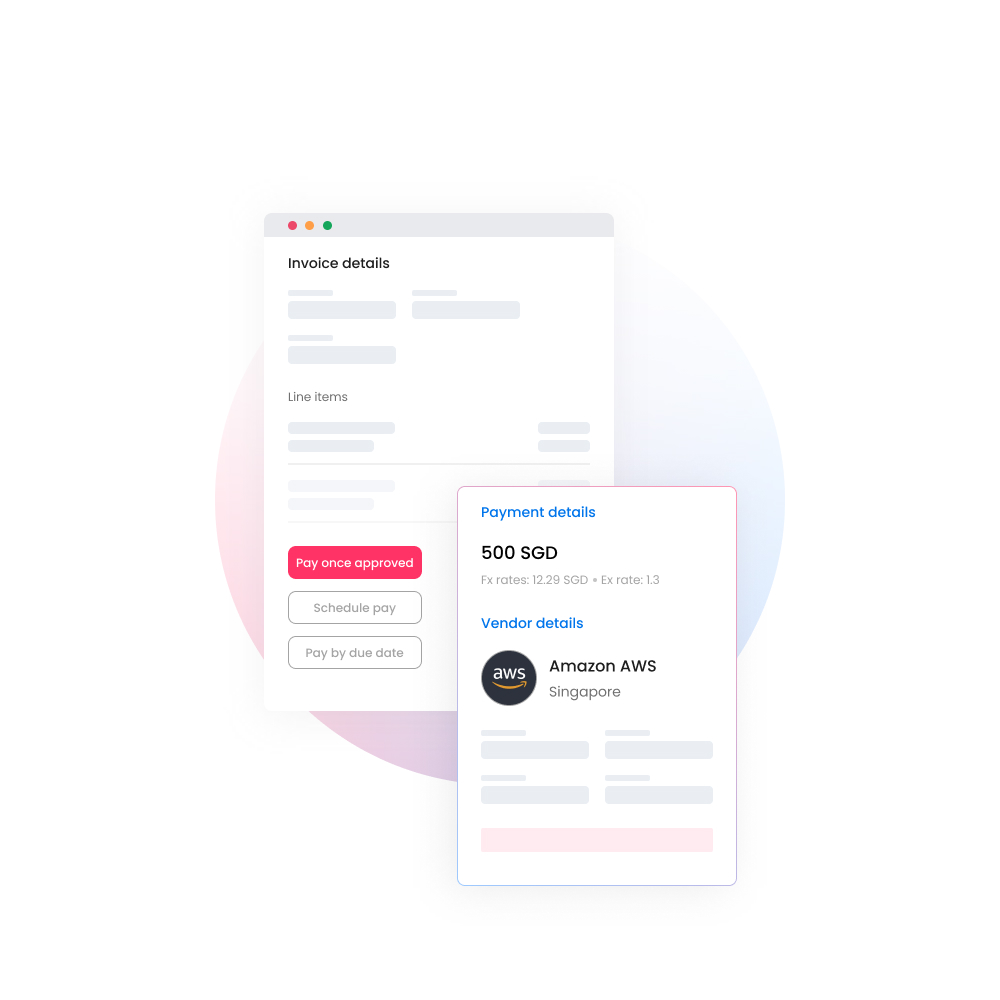

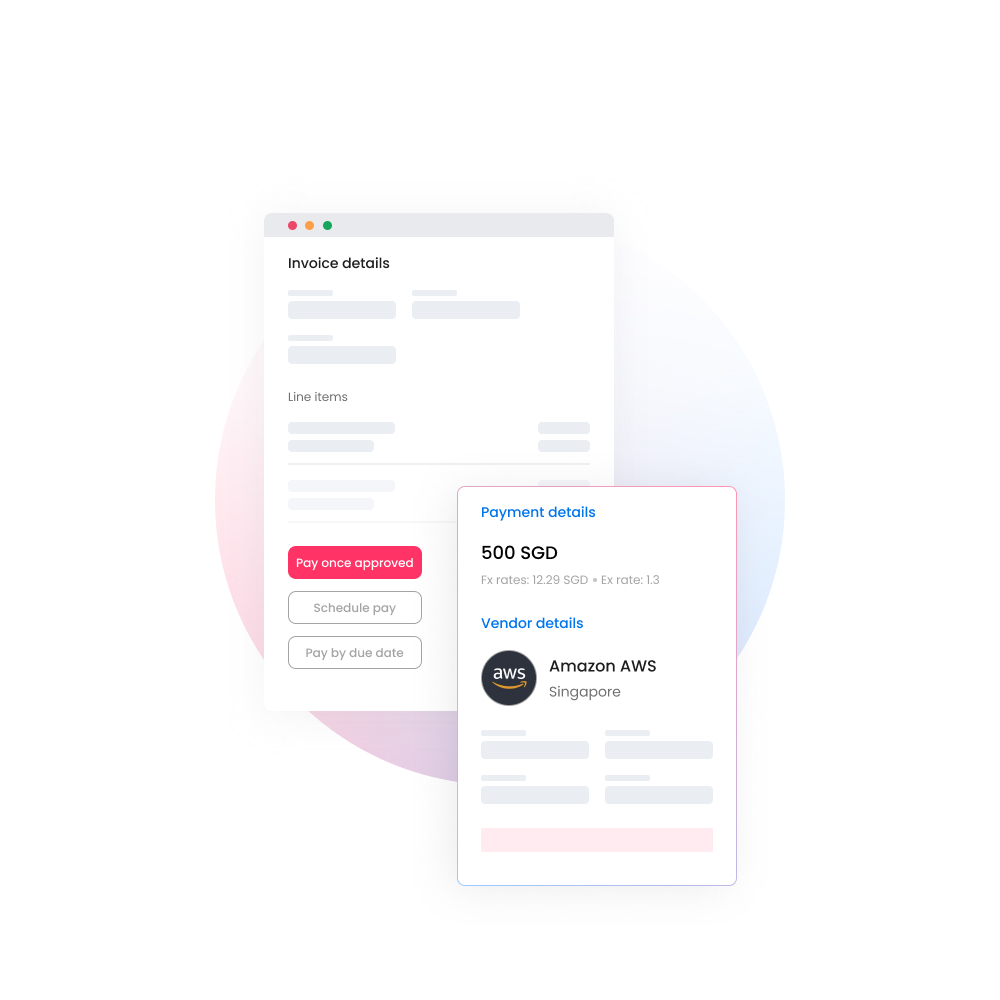

Payment alert

Alerts and notifications for future invoice payments, subscriptions, bills, etc.

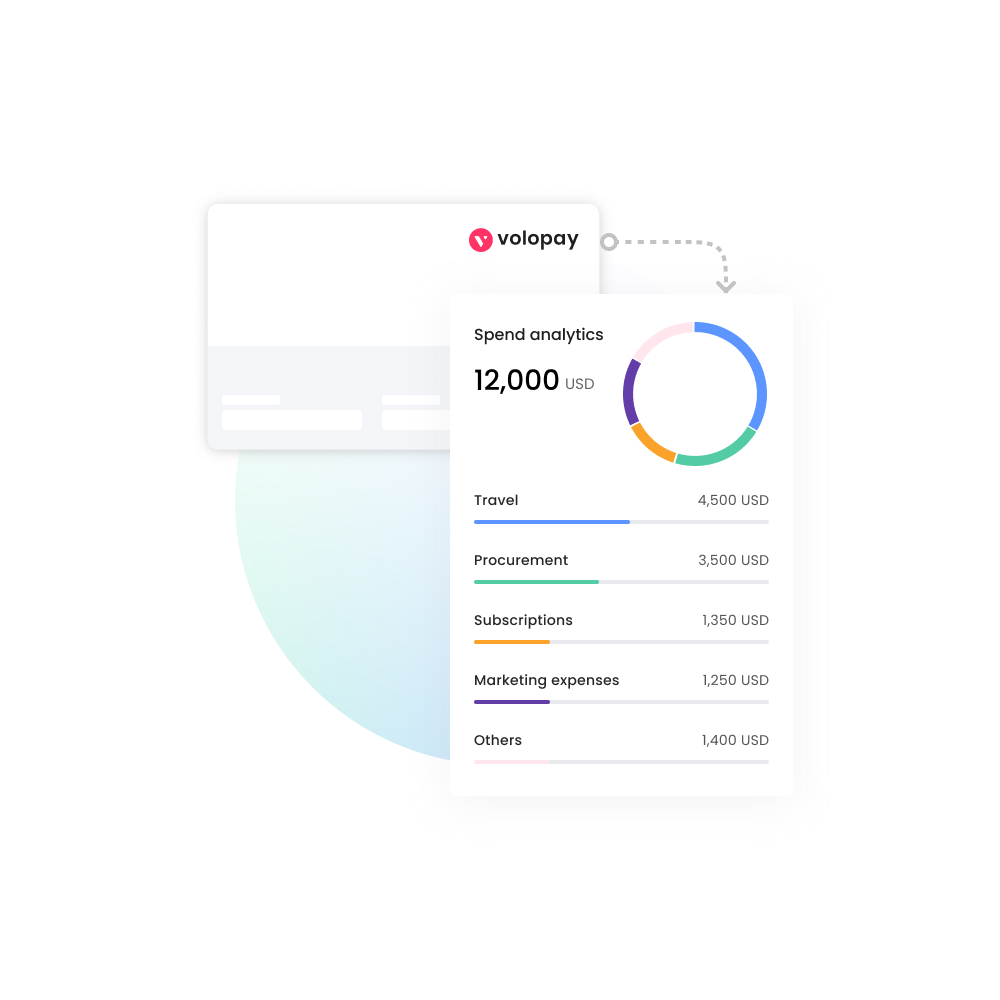

Spend analytics

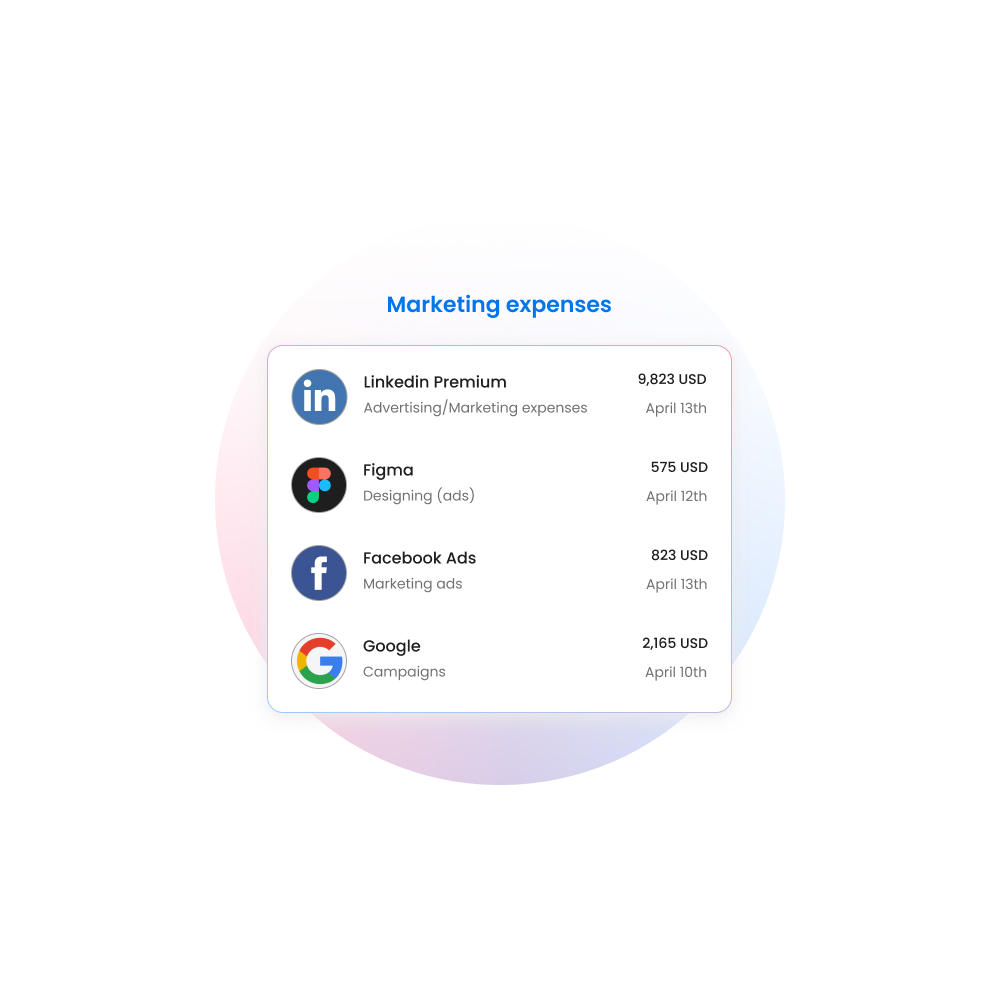

A pictorial presentation of each card's monthly spending and monthly savings is displayed. The amount used in Bill pay is reflected in the graph, too.

Easy syncing on invoices

After receiving the approval, the invoice makes space in every necessary ledger and report. Manual reconciliation of any invoice is not required at any time.

Easy to use dashboard

A consolidated dashboard for managing multi-entity finances that reflects Bill Pay balance, payments pending for approval, card balance, cashbacks received, etc., to give a clear picture of all significant activities.

Instant invoice approvals

Every invoice area will be pre-checked before the system sends the invoice for final approvals. Instantly verify the invoices as they are sent to the approver (who can approve them immediately).

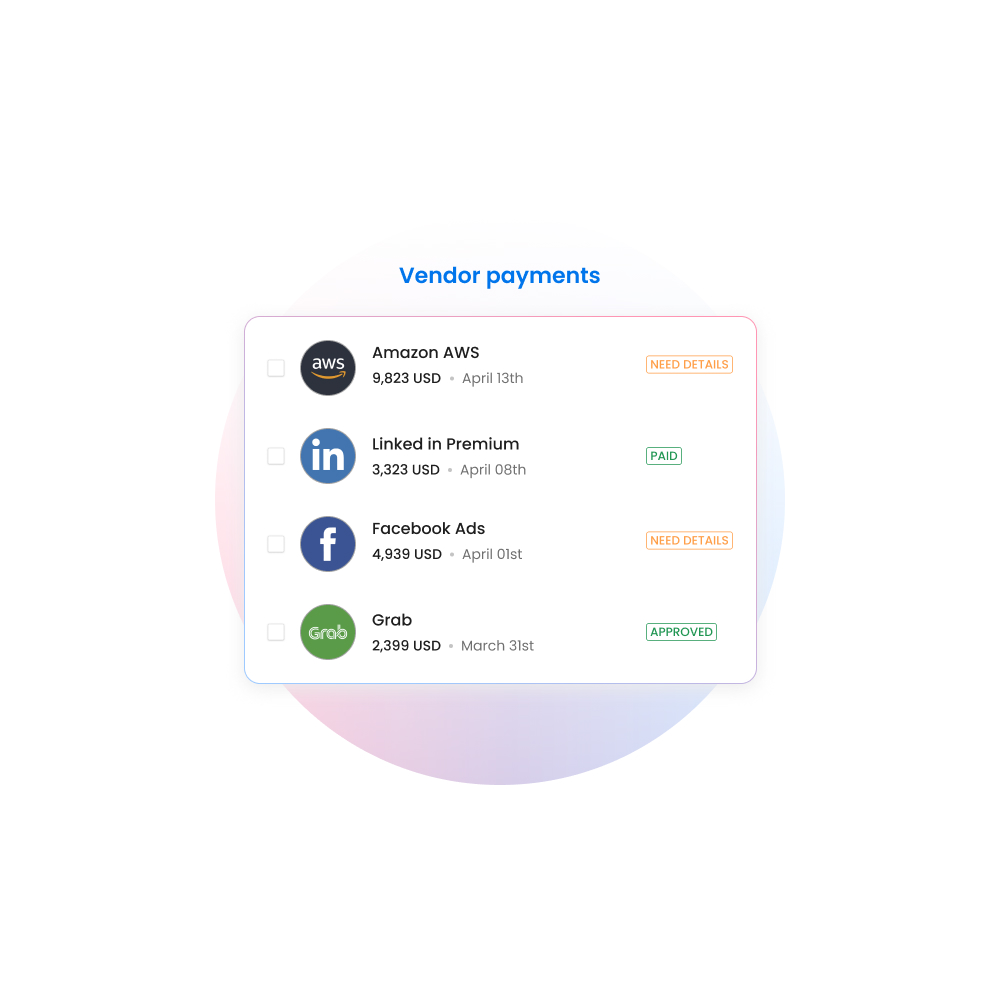

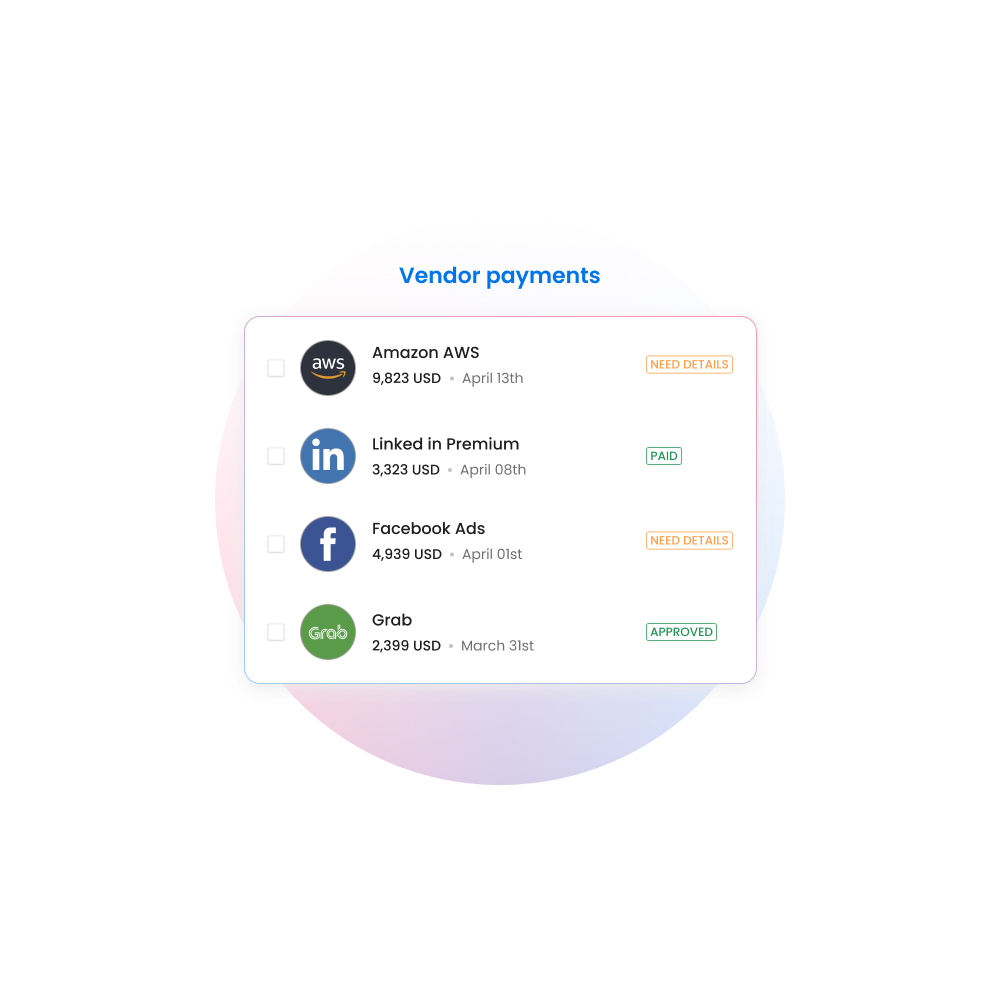

Systematic vendor payments

Vendor data for each vendor category is neatly displayed. Through auto-categorization, clicking the vendor name lists all the invoices received and payments made against those invoices.

Real-time tracking

Track all invoices generated and ongoing approvals in real-time. Know the status of purchase orders received from the suppliers. Create accountability by knowing where, how, why, and by whom every penny was spent.

Seamless payments

Pay each vendor to their respective bank account directly through the Bill Pay feature. Our platform supports payments to more than 130 countries with almost negligible transfer fees and the lowest exchange rate. Create payment approvals that are tailored to your company's needs.

Trusted by finance teams at startups to enterprises.