Accounts payable software features for your business

Any finance professional who has been in the industry for some time knows that the traditional Accounts Payable (AP) processes are far from being efficient. In fact, they can be quite tedious, time-consuming, and highly prone to errors.

The same professional, if aware of current industry trends, will also tell you that there’s a revolution in the field being brought about by accounts payable software. But, what is AP software?

AP software consists of a set of pre-set instructions customized for automated start-to-finish business payment processes. The software classifies, matches, verifies information, and then forwards it to your accounting system to be posted.

It covers all forms of payments ranging from reimbursements to invoice processing and even ERP integration. The percentage of enterprises shifting towards AP automation software is growing every day.

Whether you are a CEO, finance head, or simply a member of an accounts team, you need to get on board as well if you want to keep up with the competition.

Why use accounts payable software?

AP automation software is a must-have for any business. This is because it drastically reduces the need for data entry and paper invoices and improves consistency and efficiency in payment processes. AP software also boosts security when paying suppliers, and regulates cash flow while at the same time minimizing spending on accounts payables.

Alongside these benefits, the accounts payable software features allow your company’s finance specialists to spend more time on more strategic roles as analysts, business advisors, and internal controls experts.

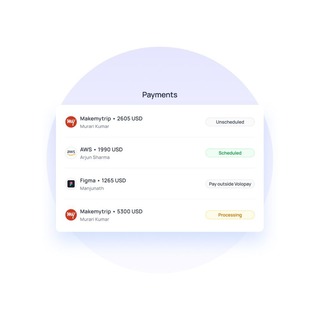

Another major reason why you should use accounts payable software is its ability to provide real-time reporting without requiring any human involvement. Not only does it cut down the need for manual intervention but automation also means faster, more accurate, updates and the facility to be informed about exactly what stage the process is at.

So, an AP automation software has the capacity to integrate multiple processes in one place. It can serve as a cash flow manager, expense management specialist, invoice management software, and even as a data-entry tool.

Get the best accounts payable software for your business

Essential features of accounts payable software

Invoice handling capabilities

A robust and efficient invoice management software should be an integral feature that any best AP automation software should have. An airtight invoice management software will help you track, verify and approve payments on time, every time.

Such a system will allow you to streamline cash flow and help you stay on course for timely invoice payments. You should ideally go for a system with features that are equipped with automatic reminders and notifications, recurring or periodic billing, invoice emailing and tracking, reporting, and more.

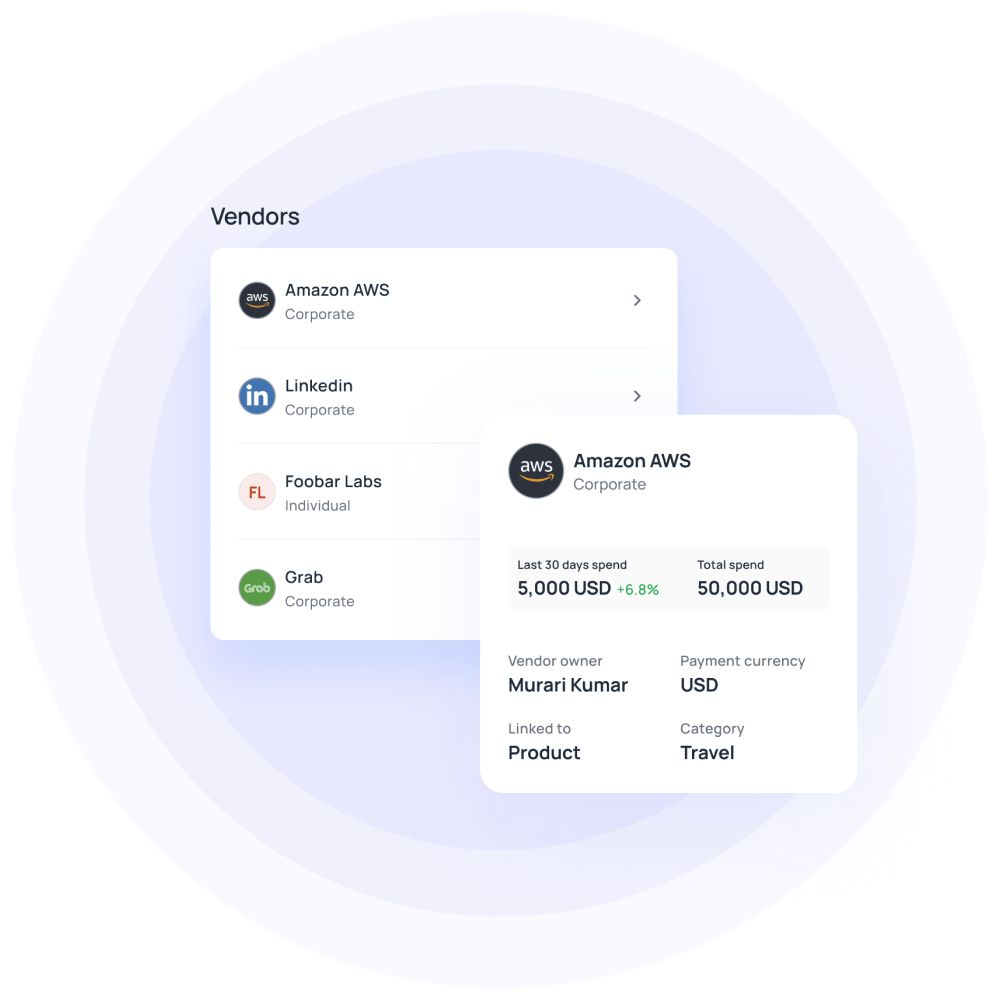

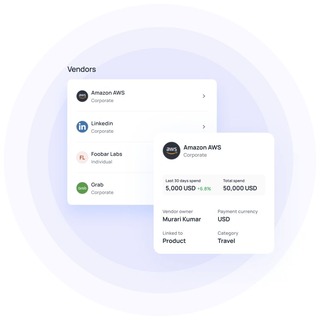

These analytical tools provide total visibility and control, even when processing the same in large batches. Speaking of large batches, your software should also be capable of auto-categorizing invoices as per date, type, vendor, etc.

Having a system that helps you keep in check who your debtors or creditors are, eradicates the need to spend time following up on delayed payments. It also ensures that errors that usually come along with manual invoicing are completely eradicated, making your AP system more efficient and comprehensive.

Automated approval workflow

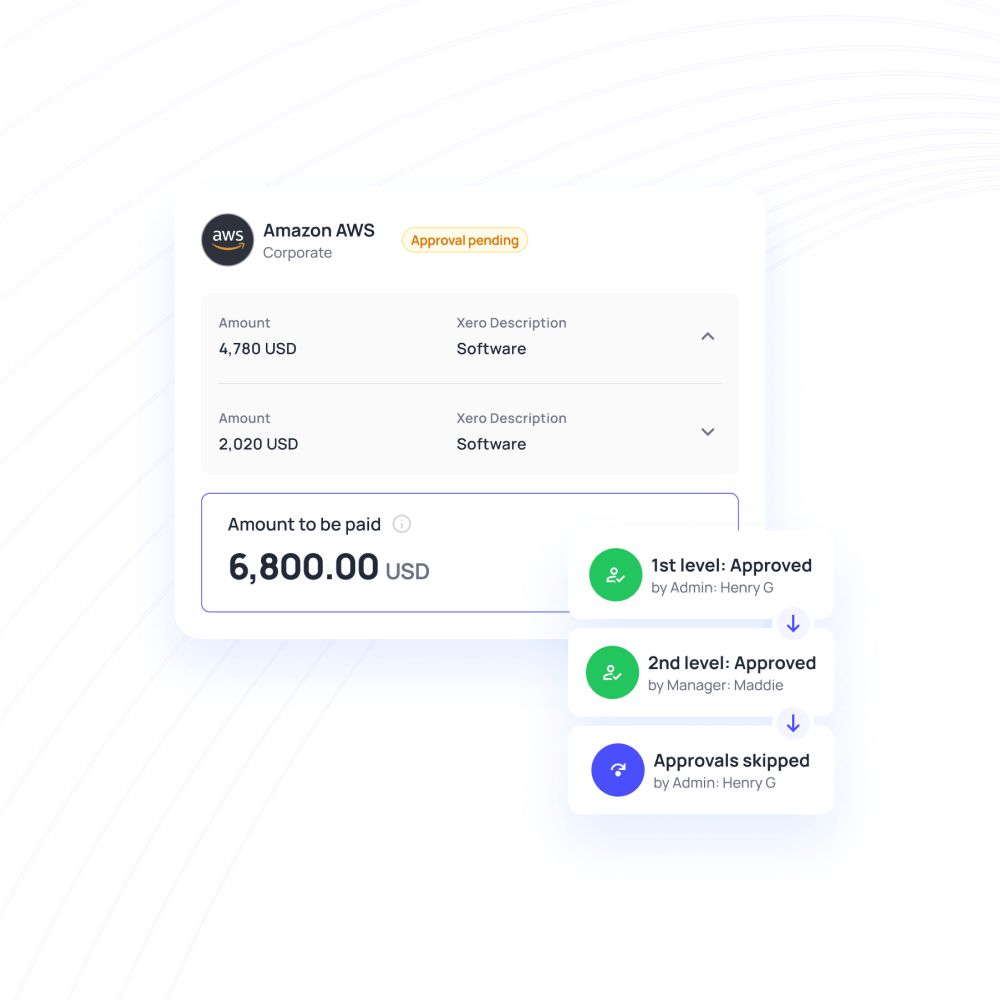

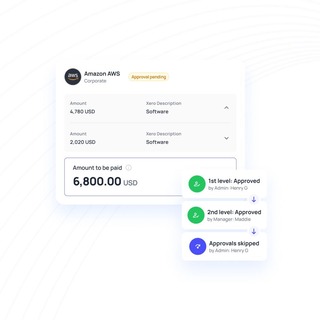

An automated approval workflow is highly impactful in optimizing your spending behavior. This feature is one of the key accounts payable software features that make automation so convenient.

It helps you to fast-track simple to complex multi-level approval structures. Automated approval workflow also means your Accounts team can work with improved transparency and make informed decisions at every touchpoint in your approval line.

Besides this, approval automation also promotes accountability and transparency. The need for micromanagement is significantly cut down as managers do not have to worry about delegating ownership of tasks.

Best-in-class accounts payable software is powered by agile routing engines that improve efficiency and significant cost savings. The automated approval workflow is all about striking a balance between efficiency and control.

Real-time reporting

Comprehensive expense reports are the records based on which you can create blueprints for future spending and at the same time audit past expenses. With manual expense management, these reports used to take time, effort, and personnel to compile. Now, accounts payable software can do the same for you with only the click of a few buttons, in real-time.

When choosing the right software for your company real-time reporting is another integral feature you should look for. Real-time reporting lets you monitor expenses in real-time and make instant reimbursements. It also helps you control budgets, approve requests and eliminate tedious administrative tasks with just the click of a button.

Gone are the days when you would have to wait till the end of the month to verify and/or approve expense requests. With AP automation you now get real-time, customized reports, including accounts payable aging reports.

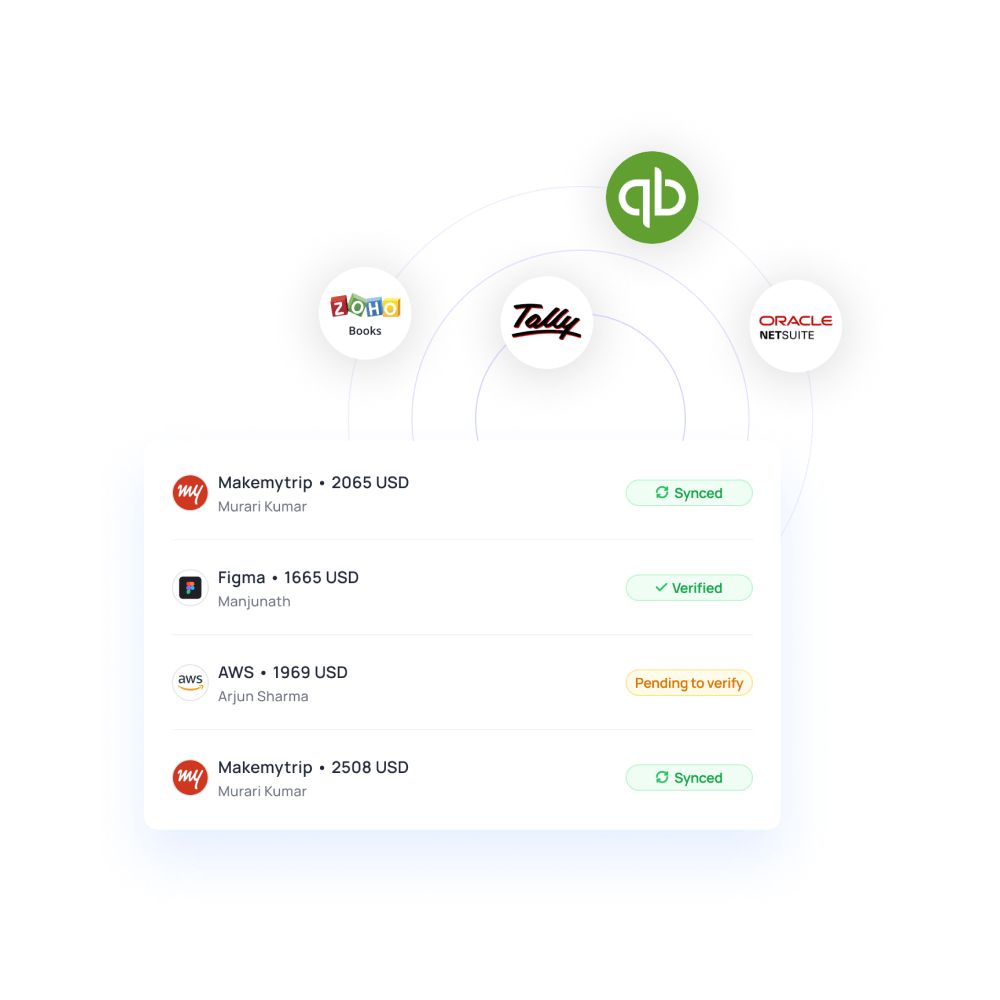

Integration with other accounting software

Without the integration feature, automation software loses relevance. Integration enabled accounts payable software allows you to merge your existing accounting systems (e.g. Xero, Quickbooks, Netsuite, etc.) with AP software, without the hassle of having to transfer data manually.

The whole point behind automation is to reduce the amount of manual attention you have to give to have a seamless experience. If you choose software that does not allow integration this point becomes irrelevant because you will then have to manually transfer data from one database to another.

Integration is an account payable software feature that ties the whole platform together. It helps you centralize data, maintain records when switching providers, and access past records with ease.

Automated invoice management software

Volopay is an all-in-one expense management software that does all of the above, and more. It represents a new-age expense management system, made available to businesses to give them a combined platform to manage not just accounts payables but all expenses, invoices, cards, vendors, and pretty much every aspect of expense management.

It enables businesses to outsource spend management to a trusted, state-of-the-art SaaS and spend more time focusing on more niche tasks.

The software is a ‘Financial Control Centre’, the cockpit of your business’s money-ship manned by a real-time expense management system that takes care of the nitty-gritty, manual labor and eradicates errors while all you have to do is focus on your working capital, and maybe press a few buttons here and there. Some of the features provided include:

Expense management software

Request and approval of funds on the go. Now spend only a few clicks to file expense reports.

Subscription management software

Virtual cards & smart software to manage recurring SaaS subscriptions.

Invoice management software

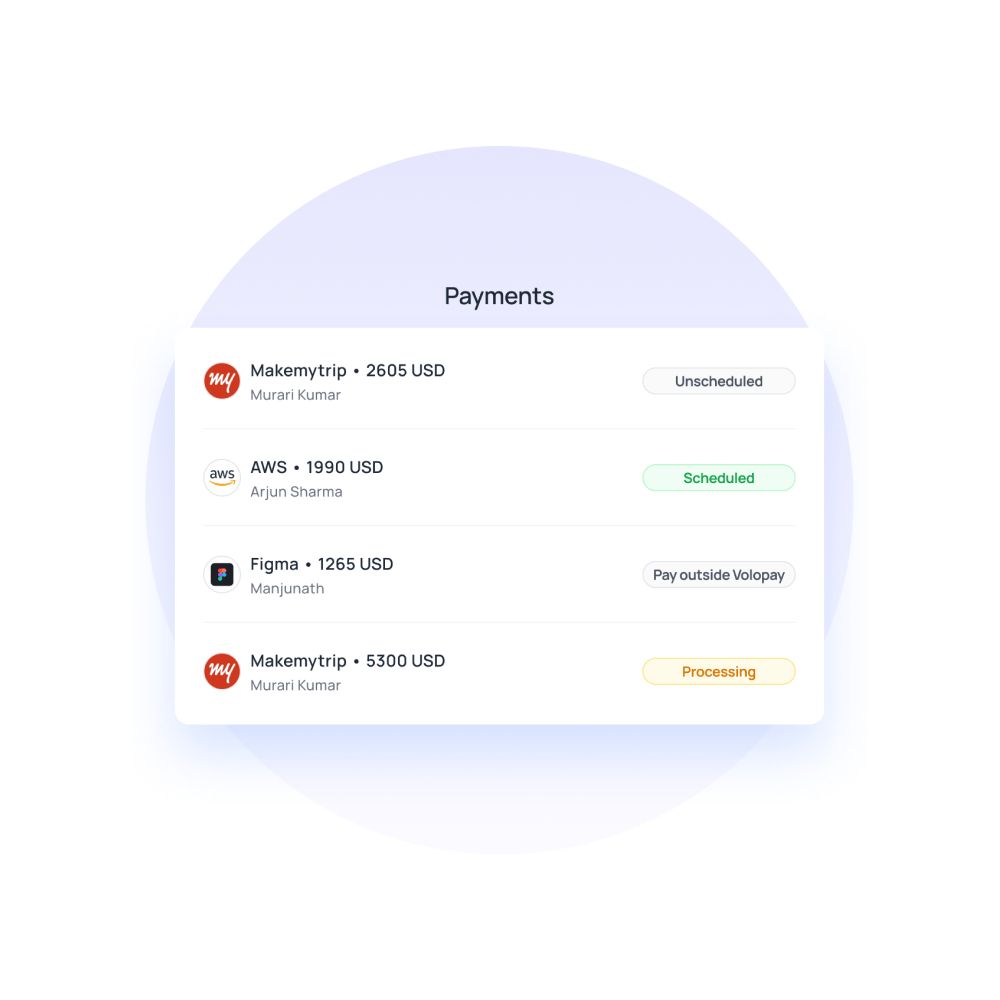

Collection, tracking, and paying of all supplier invoices in one place. Earn cashback for early payments. No exceptions, no useless “points”.

Corporate cards

Secure and hold money in 11+ different currencies. Convert FX at markedly low & transparent fees.

Through these features, Volopay gives you absolute control over all your business spending and enables you to have better control, visibility, and savings. By seamlessly merging with your existing setup, this accounts payable software ensures efficient automated approval workflow, invoice management, and real-time reporting.

Trusted by finance teams at startups to enterprises.

Get started with Volopay's accounts payable software for your business

Related pages

Learn about the challenges of paper-based accounting systems and why businesses should switch to accounts payable automation.

With the accounts payable automation, you can improve vendor relationships, prevent invoice duplication and pay the vendor on time.

Cost reduction, control over expenses, and improved accuracy, are some of the benefits of accounts payable automation.