Accounts payable reconciliation - Importance, best practices and automation

Accounts payable reconciliation is the process of ensuring that the sum total of all outstanding accounts payable is identical to the accounts payable balance in the master ledger. This might sound easy in theory, but in reality, as businesses boom, so does the complexity of reconciling accounts payables amount with your balance sheet.

When this situation arises, it becomes crucial to pivot your business from the drudgery of manual reconciliation to an efficient automated account reconciliation solution, saving you loads of time and money.

Importance of accounts payable reconciliation

Without timely reconciliations, there could be wide, glaring differences between the amount in the general ledger and your total accounts payable. Mismatch in the bank statement and the general ledger also incur huge losses to the company.

Companies receive up to 500 invoices every month, which means manually checking up to 500 transactions. A single mistake during any of these checks could set you back for the next reporting period.

A quarterly reconciliation error means your finance team sifting through roughly 1500 invoices. That’s time that could be utilized to build better financial automation for your company.

An automated account reconciliation solution could help prevent fraudulent activities like duplicate invoicing and reduce manual invoicing errors. One of the benefits of reconciliation process automation is that it raises your credibility in front of your vendors and exposes potential financial bottlenecks in any department.

AP reconciliation - Best practices

Automate your AP reconciliation process to improve efficiencies and control costs. Having an all-in-one financial portal can help you prioritize bill payments with seamless approvals and smooth reconciliation on a centralized database.

A smooth accounts payable reconciliation process depends on the practices followed by a company to ensure that they are up-to-date with all the necessary information.

Here’s how you can resolve the challenges of reconciliation and optimize your AP reconciliation process with these steps:

1. Review your data and reports religiously

Regularly analyzing your financial data and KPIs will keep you informed of your company’s financial performance, potential bottlenecks, and help you strategize your decision-making process more effectively.

Consistent monitoring can help you identify fraud, duplicate invoicing, and even reduce compliance risks with a detailed audit trail.

2. Limit access and exercise extensive control

To maintain order and efficiency in your financial processes, it’s essential to restrict access to the master ledger and vendor files to specific individuals, such as the accountant, CFO, and company owner.

This way you can keep track of all the invoices with multi-level approvals and reduce expenses such as late payment fees, human error, etc.

3. Reconcile and address issues daily

No matter the size of your company, the best reconciliation practice you could follow is doing it daily to reduce the risk of discrepancies in your cash flow and loss of credibility.

One small error identified even a month later can disrupt your company’s bookkeeping process. To avoid this, it's best to reconcile daily and address issues as they arise.

Streamline your reconciliation process with automation today!

Choose the best accounts payable solution to automate reconciliation

Automating your AP Reconciliation process sounds like the right fit for your company, but it’s important to narrow down what specific needs you’d like an AP reconciliation software to meet.

Here are a few things to consider while choosing the perfect AP software solution for your business:

Does this solution address the key problems I’m facing?

An AP Solution that works best for you is the one that addresses each of your concerns. You can create a list of your concerns and ask the solution provider to show how the software deals with them during demos.

Note that while not every solution will be able to provide you with all the answers, it’s important to see whether or not they can provide a workaround or some form of customization for your business needs.

Does the solution adapt to the growth and scalability of my business?

You want an AP Solution that doesn’t just address your present problems but can adapt and support a larger number of invoices and payments, both domestic and international, in line with the growth of your business.

Accounting is an indispensable part of your company and therefore you should choose an AP solution that is streamlined with not just your present goals but also your future aspirations.

Is the AP solution software easy to use by my team, my vendors, and clients?

Technology is not everyone’s cup of tea. Most vendors and clients who are accustomed to sending and receiving faxes and physical mails might feel overwhelmed with non-user-friendly software.

Therefore, it is extremely important to think of the accessibility concern during demos and check in with your team to make sure that the software aids them in carrying out AP reconciliation easily.

How well does the AP solution integrate with my existing accounting software?

You are looking for a solution that integrates with your business, not the other way around. Your accounting department might already be using an ERP module, alongside accounting tools.

It is crucial to look for an AP solution that seamlessly integrates with any accounting tool you use such as bank account reconciliation software or cash reconciliation automation software.

Is it within my budget?

Any company aims to reduce costs as much as possible, therefore it makes no sense in getting an AP solution software that costs you more than manual labor.

Many accounts payable software solutions offer sky-high monthly subscriptions full of features and tools that you may never use in your line of business. Instead of paying for extra fluff, find the right accounts payable reconciliation software that’s customizable and offers multi-level subscription packages.

How can Volopay automate accounts payable reconciliation process?

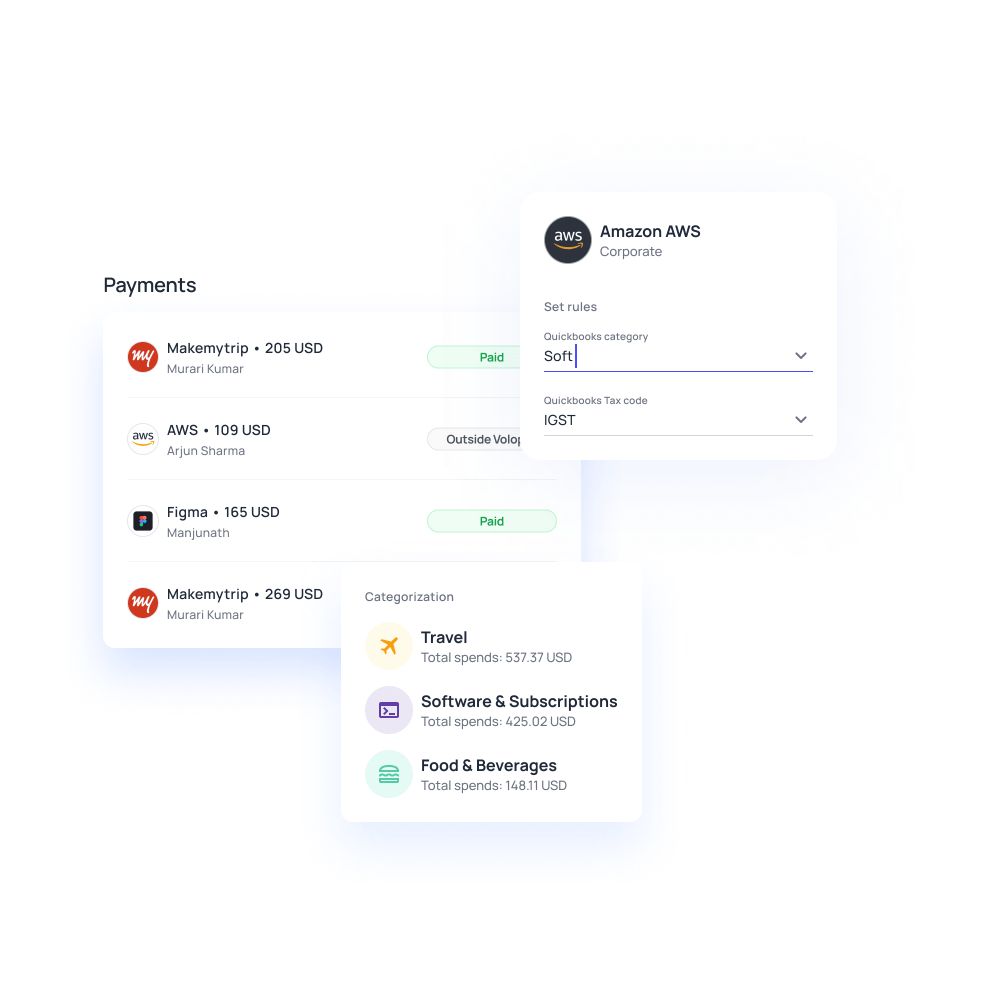

Volopay offers targeted and scalable AP reconciliation solutions for your unique business needs, all the while being cost-effective, easily accessible, and instantly integrated into your existing accounting software.

Capture invoices with smart OCR technology to collect, track, and pay vendor invoices thus eliminating paper receipts and losing documents.

Submit all bills on the fly, and ensure that they are approved by department heads and paid on time by the finance team.

Reduce the time it takes to get approvals from different departments. Gone are the days of chasing people for approvals.

With an automated workflow, everyone—from the purchase order initiator to the CFO—will know exactly what data they need to complete their approvals.

Manual data entry is the most error-prone and time-consuming areas in the accounting process.

Automate your data-entry process through seamless approval channels with auto-categorization and cut down your data-entry process!

Volopay provides physical and unlimited virtual corporate cards that come with extremely high security.

The amount in the card is always predetermined by you, therefore there is zero chance of overspending.

A payment reconciliation solution provides the feature of departments for your physical and virtual corporate cards.

Whether it’s a one-time payment or a recurring expenditure, your budget won’t budge unless you allow it.

Accounts payable automation helps you track expenses in real-time using a user-friendly dashboard.

With an overview of your expense log, you can also enjoy faster cash and bank account reconciliation.

Related pages

Explore the transformative benefits of accounts payable automation for your business, enhancing efficiency, accuracy, and control while reducing costs.

Learn how to effectively reconcile accounts payable transactions, ensuring accurate financial records and preventing costly discrepancies in your business.

Learn how effective vendor reconciliation in accounts payable strengthens vendor relationships for better financial management.

Get the perfect accounts payable solution for your business

FAQs

Data is a driving force of any business, and if that data is riddled with errors, it can be harmful to the financial well being of your company.

To counteract this problem, it becomes necessary to find an electronic accounts payable system that seamlessly integrates with your existing accounting software, thereby eliminating any possibility of manual data entry error that so often happens when writing in values from one software to another.

Manual invoice approval is a time-consuming process that requires multiple levels of approvals before being processed, leading to delays in payments that can sour your relationship with your vendors. The solution? An AI-powered accounts payable reconciliation system such as Volopay brings all your digitized invoices on one platform for easy approvals and faster processing.

By automating your accounts payable processes, you can easily compile purchase orders, invoices, and receipts for every transaction. Instead of maintaining a separate record, Volopay helps you pay your vendors, maintain a record of the transactions and their documents and easily export it to the accounting system of your choice.

With Volopay, you can easily upload all your invoices onto the application, create a bill, and either pay it manually or automate the system to pay it at a certain date. Alternatively, you can use Volopay’s corporate credit cards to automate spending on one-time or recurring expenses such as SaaS tools, ad spends, etc.