6 reasons to automate accounts receivable process

Accounts receivable is an important part of your company’s accounting. Having an accurate and updated accounting system for AR is crucial to expand sales, prevent late payments, and not get involved in disputes.

Manual accounts receivable system isn’t efficient enough to handle complex processes, implement workflow solutions, and eliminate errors that seriously cause damage to the collections process. In today’s market scenario, AR teams require technologically advanced resources to manage and organize all the accounts receivable processes.

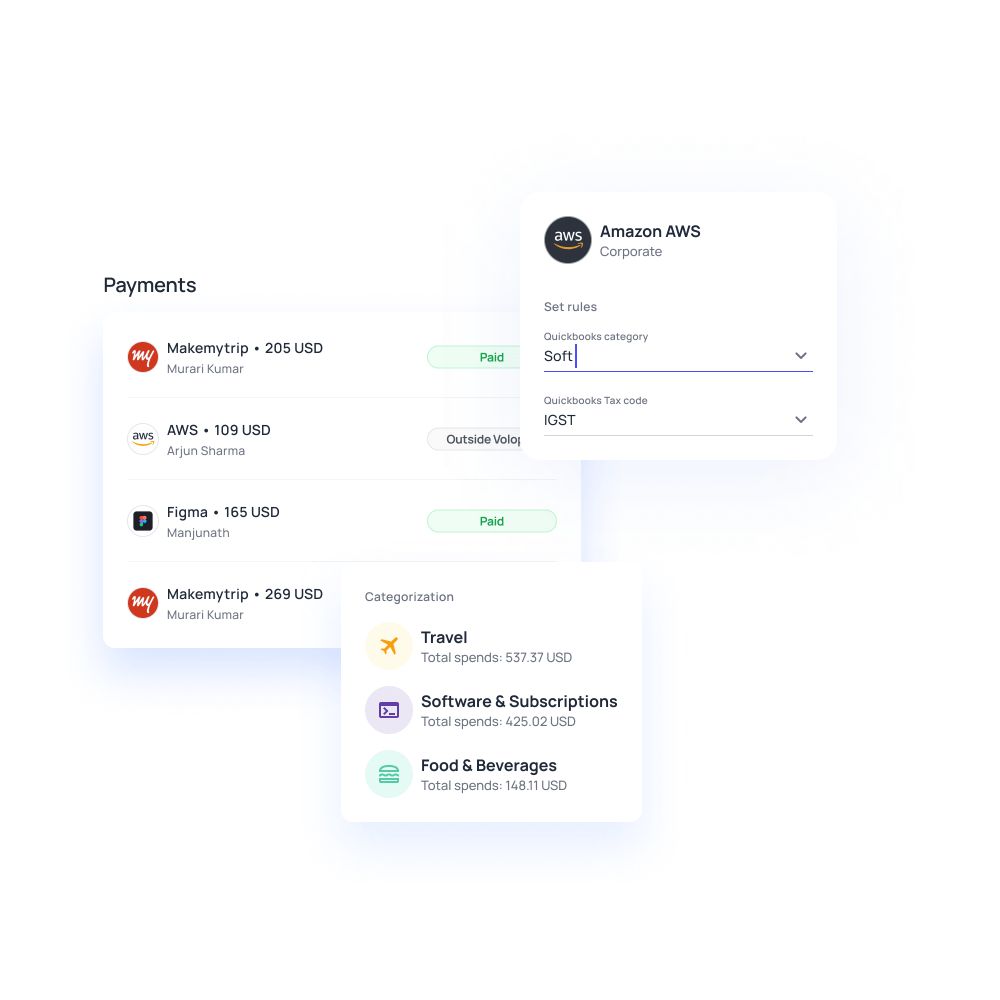

Here is where accounts receivable software kick in. AR software provides facilities like enhanced transparency, credit management, automated reminders, etc. Accounts receivable automation helps your business’s AR system work efficiently to reap benefits for both you and your vendors.

What are accounts receivable?

The money that other businesses and suppliers owe to your company for the goods and services you provide is called accounts receivable. For all the goods and services your business has provided to its customers.

The invoices for the same can either be sent physically or through email. Your client is then supposed to pay the amount on the payment terms agreed between your company and them. Accounts receivable automation software has approachable and easy methods for customers to make payments through e-invoices.

You can also check our article on accounts payable vs accounts receivable to know more about accounts receivable.

Accounts receivable can be further divided into various subcategories

Employee receivables

Interest receivables

Vendor receivables

Trade receivables

Notes receivables

Accounts receivable process

Track payments

Key out a deposited payment into the supplier's bank account, enter it into the AR system and assign it to an invoice. Comply with invoices with the AR ledger to ensure all payments are accounted for accurately and issue monthly statements to clients. This statement shows all the details related to the amount the customer owes you as per other previous invoices.

Accounting for accounts receivables

The finance department determines the due dates for all payments. Once they are able to identify all the unpaid debts, journal entries are made to record all the sales. Accounting involves recording bad debts, unpaid debts, and also early payment discounts.

Establish credit system

Establishing a credit system by developing a credit application process helps determine credit score and credit history. Decide all the terms and conditions of the credit in accordance with the federal laws.

The terms and conditions document clarifies the commitments and the requirements of the company and the information necessary for the credit sales.

Send invoice

When a supplier or vendor sends an invoice to the buyer, it should have details of the purchase, its cost, the number of units bought, and the expected payment date.

Every smart business prefers to send invoices electronically because it is an effective cost-cutting measure and helps stay digital.

Want to automate your AR workflow?

Benefits of automating your accounts receivable

Improve cash flow

Using a conventional accounting system means that all the payment reminders and invoices have to be sent manually by the AR team members. However, you can automate this process by adopting an accounts receivable automation solution. This will send all the reminders and invoices on time to all the customers and along with this AR automation software also provide more approachable payment platforms. With this, your AR team is relieved from all the difficult and monotonous work and they can now focus more on monitoring the cash flow it also helps in improving your company’s working capital.

Employee retention

Doing repetitive and monotonous manual tasks like accounts receivable tasks such as data entry, invoice mailing, sending reminders, etc. daily can be demotivating and tiring for your employees. However, with an automated accounts receivable workflow you can free your employees from these tasks and give them the opportunity to enjoy working and perform better.

Happily, working employees will do their best to bring in new customers and also take the best care of the existing customers. This means that the whole process is streamlined which results in faster payments and fewer problems.

Reduced costs

Accounts receivable automation simply increases your productivity which in turn increases your profits. Also, errors that occur in manual account receivable workflow are eliminated which means that the overall cost is reduced. You don't have to be concerned about fines and fees regarding expense reporting because through AR automation you get the guarantee that all the information is correct.

Faster payments

With accounts, receivable automation software customers can easily make payments through online portals with just a few clicks. The patent link can be attached with the invoice you send to your clients through which they can transfer the payment. For a regular customer, you can also create recurring invoice profiles using various bank methods, through which the payment is automatically credited in your account from the client’s account. This saves and results in timely or early payments which also helps in increasing cash flow.

Automatic reminders

Using accounts receivable automation solution means that following up with your customers becomes easy. You just have to schedule reminder emails and billing schedules and the system automatically emails your clients every time reminding them of their due payments.

Standardized procedures

The accounts receivable automation system ensures that everyone has the same information there are no gaps or missing data. When all the information is accurate and all the data sources are similar, everyone is doing their jobs based on the same information and through this, any chances of errors and confusion are discarded.

Robust revenue management system to automate your AR

Being customer-driven is an important quality every business must possess in order to succeed. So why waste time on cumbersome, repetitive, and monotonous tasks when you can be using that time to improve your company’s customer experience and attract new customers. Accounts receivable automation is one thing but integrating a suitable and accountable billing system that takes care of the billing complexities gives you the scope to actually focus your energy on more human-centric tasks or tasks which require more attention from you and your employees.

FAQs

All types of receivables are generally reported at their net realizable value on the balance sheet. This is the amount of cash a company expects to receive.

Accounts receivable turnover ratio is an accounting measure used to see how effective a company is able to collecting its debts and extending credit. This is an activity ratio that measures how the assets of any company are performing.

Yes, you can outsource your accounts receivable process. In this method, you are required to pay only for the services you have outsourced; you don’t have to bear the costs of building an accounts receivable department, setting up an infrastructure, or hiring staff.

The following details must be included in an invoice-

-The title ‘Invoice.’

-Unique invoice number

-Name and address of your company.

-Customer company name and address.

-Product description.

-Date of supply.

-Date of the invoice.

-Cost per unit.

-Total payment amount.

-Payment terms.

-Purchase order number.

-How to pay the invoice.

The major responsibility of the account receivable department is to ensure that the company gets all its payments on time and all the transactions are recorded accurately.

Bring Volopay to your business

Get started free