How to create a smooth automated invoice approval workflow?

Have you struggled with creating a workflow that will make invoicing a breeze? With a good invoice approval workflow, you can ensure that the workflow is faster, more accurate, and more efficient.

What is an invoice approval workflow?

Invoice approval workflow in accounts payable involves a set of actions to be followed for the invoice to be cleared. It serves as a checklist to ensure the invoice is valid, error-free, and paid promptly.

The invoice approval process involves evaluating and approving invoices before payment. It starts when the company receives an invoice, which undergoes verification, then is sent for approval to the person who made the purchase.

The invoice is subsequently forwarded to the accounting department after the details have been verified. From there, the payment is processed.

What is invoice approval automation?

Paper-based and manual processes slow down invoice approval, especially when it comes to tasks like manual invoice matching. Invoice approval automation streamlines this with a complete solution for manual workflows.

There are many advantages to invoice approval automation, including its ability to connect with existing accounting systems, allowing both PO and invoices to be approved more quickly. It sends bills to review to the selected approver automatically.

A central dashboard shows approved and pending invoices. Invoices with a PO are automatically matched and flagged for exceptions. Once approved and verified, the invoice is entered into the accounting system for payment, eliminating late fees.

Key considerations for an effective invoice approval workflow

Common mailbox or document repository

A centralized mailbox or document storage is an essential component of an automated invoice approval workflow. Vendors and suppliers can send invoices to a single email address or save the invoice in a centralized invoice document repository.

After all of your vendors' bills have arrived in one place, the portal can be configured to route invoices to the proper approver based on the information provided in the invoice, such as product, department, or amount.

Invoice submission criteria

While submitting an invoice, make sure vendors adhere to strict rules when submitting an invoice. All details about the purchase should be mentioned in the invoice, such as the invoice number, PO number, date of purchase, description of the item, number of units, and payment terms.

If any important information is missing from an invoice, it may need to be questioned and even returned to the seller, which ultimately delays payment.

Two or three-way matching

It's critical to verify your invoices with purchase orders or other purchase-related documents. Automated invoice processing with 2-way/ 3-way matching ensures that each invoice is compared to the appropriate purchase order and receipt.

The accounts payables team checks for data accuracy reduces duplicate payments, takes advantage of early payment discounts, and improves the payment cycle by processing early payments.

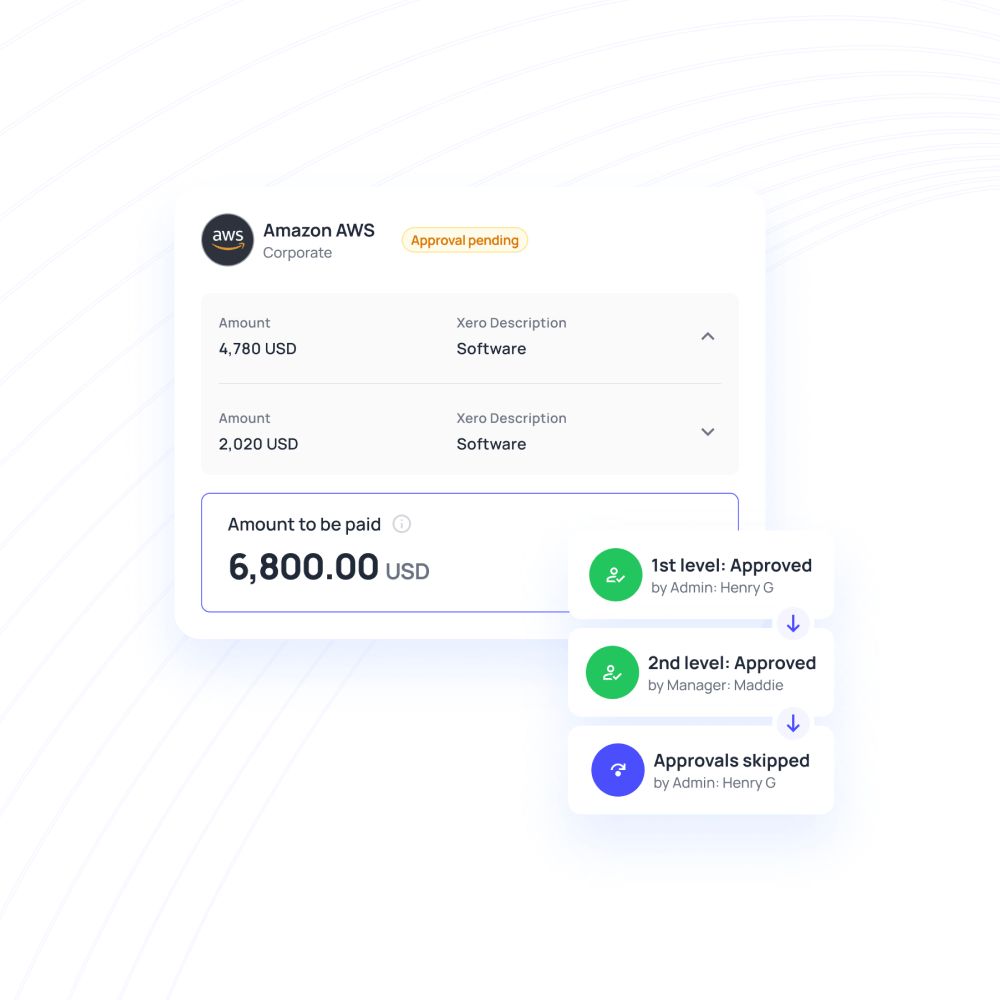

Delegate approvers

Set approvers at each stage of the invoice approval process are pretty critical. Without relevant approvers, it will lead to payment delays, which will mean jeopardizing relationships with vendors.

Make sure to set a multi-level approval process and identify the person or entity responsible for authorizing at each stage. When an invoice is approved at one level, it is immediately forwarded to the next approver in the chain before being deemed ready for payment, thanks to an automated approval workflow.

Automatic reminders and notifications

The most exciting and beneficial part of automated accounts payables is that once the invoice is routed for approval, assigned approvers will receive an automatic notification or a message from taking action on the invoice.

They can approve the invoice via email or by logging into the AP system. This ensures that the invoice approval process is smooth and efficient. If the invoice is not paid immediately, reminders will be sent at predetermined intervals to avoid further delays.

Additionally, batch payment processing allows businesses to group multiple invoices together and process them in a single transaction, simplifying the payment process and improving overall efficiency.

Measure KPIs

Measure parameters through statistical data analysis. It will give you a complete audit trail to help you with Internal audits and investigations. The benefits of automated invoice processing are clear, as it improves accuracy and efficiency across critical metrics:

- Invoice cycle time- From invoice data entry to payment processing.

- Total invoices received vs. invoices processed

- The percentage of invoices is manually entered into the accounting system.

- Days it takes to remedy an invoice problem.

- Cost of processing an invoice.

Why choose Volopay's invoice approval system?

Process and approve invoices in one place

Submit all invoices on the fly with Magic Scan invoice processing, ensuring timely authorization by department heads and on-time payments by finance.

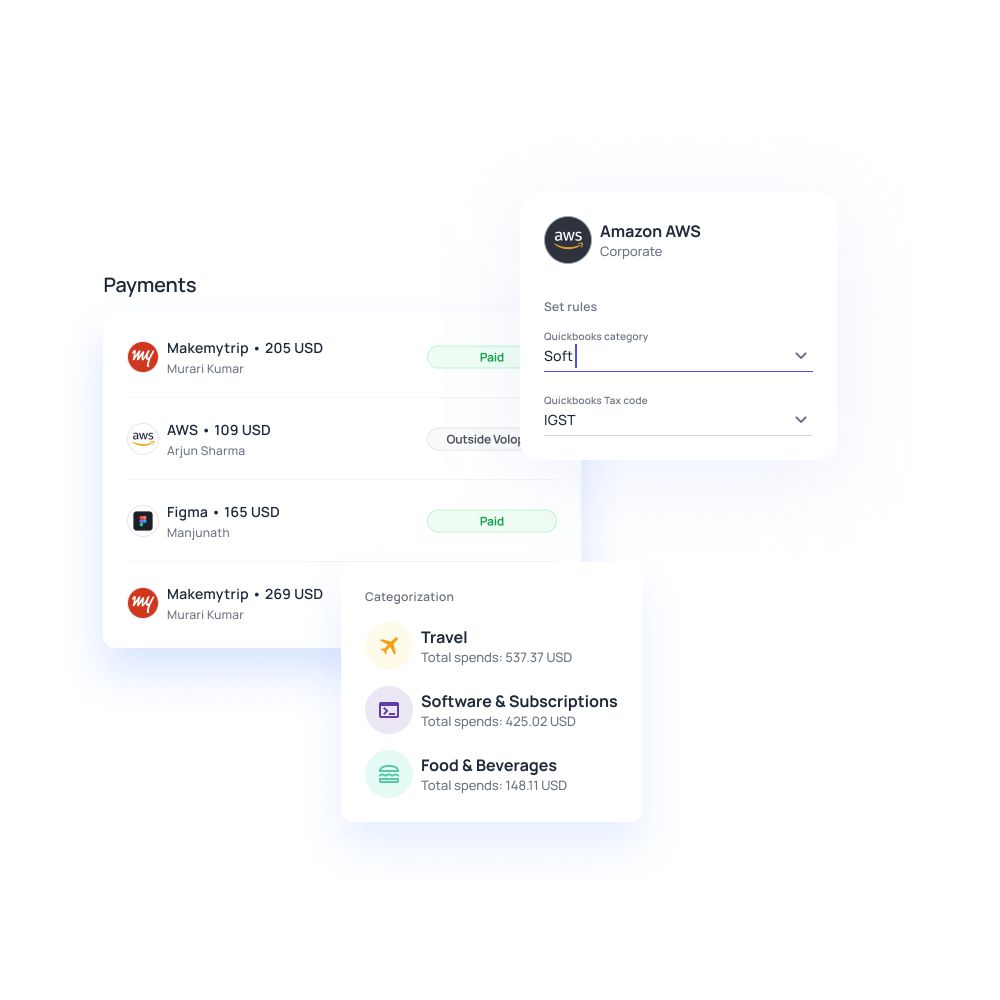

Sync up all of your transactions

Sync all paid invoices to your accounting software and ensure they're associated with the correct vendors with automatic reconciliation.

Access data on your business operations

Have visibility to the entire digital invoice workflow, allowing you to adopt better reporting mechanisms and make more informed strategic decisions.

Reduce the hassle of late payments

Assign specific vendors to your expenses and automate the process, allowing you to manage and track them effortlessly while on the move.

Potential risk of fraud exposure

As you can track all the orders and invoices through one platform, it lowers the chances of fraud, ensuring transparency.

Trusted by finance teams at startups to enterprises.

What are you waiting for, get started with Volopay today!

Related pages

Explore the benefits and challenges of manual vs. automated invoice approval to streamline payments and improve business efficiency.

Learn how automating supplier invoice processing boosts accuracy, reduces errors, and accelerates payments, in our complete guide.

Discover how automating purchase order matching streamlines workflows, improves accuracy, and minimizes errors in the accounts payable process.