How to prevent vendors from overcharging my business?

Every business had seen that point when they suddenly realized that their vendors are overcharging them. What has been overlooked once is now gulping a substantial amount of cash flow while alerting with a red flashlight. You are not alone! Increasing vendor charges is an upshot of improper or zero vendor management that a business must fix, before the vendor drops out.

Many companies don’t pay attention to vendor relationship management and think it’s easier said than done. And when the number of vendors starts elevating, all hell breaks loose. But it’s only this challenging, when you are not armed with proper tools. What’s vendor management? How can I maintain a smooth relationship with vendors and control vendor pricing?

What is vendor overcharging?

Your vendor may have agreed to supply products/services at a fixed price (equal to or lower than existing standards) for a set period or indefinitely. However, after reviewing recent invoices, you notice an unexpected price increase.

Although rare, inconsistent vendor pricing can occur both intentionally and unintentionally. If not noticed quickly, you could be overcharged for a long time. In such cases, the client can contact the vendor, explain the issue with proper invoices, and claim back the excess payment, provided a contract is in place.

How do vendors overcharge you?

Vendor overcharging and bill disputes can happen due to many reasons. Sometimes, this is temporary, so it gets ignored or lost among other payments.

Miscommunication

Miscommunication occurs when vendors intend to inform clients about price increases, but the message is lost.

Lack of contractual agreement

Without a contract, vendors can adjust prices based on circumstances, and verbal promises are not a valid defense.

Making blunders while generating invoices

Overcharging can occur when vendor charges are quoted incorrectly due to errors or glitches, and neither party verifies the details.

Increase in prices due to external factors

Vendors may increase their pricing plans due to unforeseen social, political, or economic crises in their locality or region.

Ways to prevent vendors from overcharging you

Going back after the vendor, post overcharging is too much work, and there can be unpredicted legal repercussions imposed on your end. Here are some tried and tested methods to follow to prevent vendor overcharging.

Establish a clear line of communication

Staying quiet doesn’t help when you notice something wrong with your vendor’s service or pricing. Make sure that your concerns are heard, and problems are ironed out. Mistakes do happen, and it’s okay for a few discrepancies to occur here and there.

But if this is not communicated early, it can further escalate the complexities in the relationship shared between two parties. When you notice something wrong with vendor charges, no matter how minor it is.

And never miss out on email or other modes of communication from your vendor’s side so that you can acknowledge or show objection. Negotiating with vendors can help in creating long-lasting relationships.

Invest in an expense management software

How can you track expenses and charges for a specific vendor if your invoices are disorganized? An expense management app organizes expenses as they come, showing their details and current status.

You can track them in real-time, which means you can sort them based on vendor name, and let the data guide you to predict overcharging. Also, you get to pay bills on time, or schedule beforehand to avoid late payments.

Early payments go a long way in preserving your reputation and gaining goodwill from your vendors. Features of vendor management system and the benefits of having it is not just limited to these, there are many more to it.

Use credit card to pay the selected amount

Using corporate cards is the best vendor relationship management strategy. Payment management software like Volopay has unlimited credit card options which you can create and assign to your vendors.

A corporate card functions like a normal credit card, and using that, you can automate payments, and set spending limits to prevent overcharging. By using a corporate card, you can easily automate payments, set customized spending limits, and have greater control over your financial transactions.

It takes only a few clicks to create the card and schedule the payment. If it requires more than the preset limits, the app triggers alerts, and you know there is an overcharging.

Register everything in words

When you fail to put everything in writing, you will have no proof to support your argument when overcharging or any other calamity happens. Prepare vendor management agreement and be aware of all terms and clauses regarding vendor pricing plans.

When you send a work order to the vendor, make sure it’s recorded and has every detail mentioned. Don’t hesitate to ask questions about pricing for additional services, deadlines or extensions, and what they can deliver.

This interrogation can save a lot of time and make sure that either side doesn’t get dissatisfied. Request an acknowledgment copy from the vendor to corroborate that, they have understood their goals and expectations.

Go with work units rather than pricing

As a rule, clients start with requesting the vendor charges quotation, and then go into the work details and numbers required to fulfill the job. But when this is done in reverse order, you can notice them quoting a low, reasonable price than the former.

The work unit reporting works better than cost reporting. Imagine hiring a team of people for your office renovation. Instead of asking them the pricing plan, ask for the work report, which will include resources needed to finish this job, labor charges, shipping, and other inclusive costs.

This imbibes a sense of accountability in them, that we monitor their work, and aware of the approximate cost required to fulfill the project.

Elevate the level of vendor management

Vendor relationship management doesn’t stop with maintaining records, placing orders, and paying bills. It takes serious, dedicated efforts to strengthen the bonds with vendors, who are now an irreplaceable part of the business.

Some vendors may look befitting at first, but their service, sincerity, and value for money could go for a toss over time. So, there should be a team who constantly keeps a check on this, as well as the quality of products/services received.

For a successful vendor relationship, a centralized vendor management team has to focus on evaluating the vendor, finding the best for your business, paying bills on time and clearing disputes as it goes.

Effective vendor evaluation process

Vendor evaluation process helps to estimate their business practices, performance levels, goods quality, risk assessment, and many other factors, and see if the vendor meets the organizational standards. Vendor evolution is a must, if you want to get the best value for your money and establish effective purchasing habits.

Vendors play a crucial role in gearing up the production work in your organization, and keeping it up and running. By gauging the above factors, you can see, whether you both are on the same page, and they are equally interested and invested in serving you.

Vendor risk assessments can throw light on risk factors that have been swept under the rug. Overall, vendor evaluation helps in centralized vendor management, and assessing if this partnership is beneficial in all aspects of your business’s growth.

Want to manage your vendors more efficiently?

What does vendor evaluation process look like?

Vendor evaluation and management should be a continual process that should exist as a part of your vendor relationship management strategy. Apart from a few industry-specific standards, the the following metrics should be analyzed and scored for every vendor.

Production capacity

A supplier should be able to cater to your requirements and scale productions if it needs. So, you must thoroughly analyze the vendor’s production capacity, and include that in vendor management agreement.

Quality

Quality is a factor that can be hard to enumerate. But, you can evaluate the measures they take to assure quality, and certifications they obtained from global or local quality standards organizations.

Risk

Risk is an inevitable factor in every business. But we need to ensure that our supplier is taking steps to mitigate risks all the way along the supply chain. You can start from how likely a risk is to occur, and how it can disrupt the production and supply process.

Performance

Checking the vendor’s previous experiences with similar companies like yours can help you identify their performance levels. Ask as many questions related to their other works and future advancements in the pipeline, if any.

Environmental impact

Are they carrying out business activities ethically and sustainably? How do they treat and discard their waste? What waste management techniques do they follow in disposing toxic, industrial waste, without harming the environment? How do they procure supplies? By estimating this, we can rank the supplier’s direct and indirect impact on the environment.

You should also assess other metrics like cybersecurity, previous complaint records, overall reputation, and financial soundness through a centralized vendor management team.

Steps to create effective vendor evaluation workflow

Vendor evaluation needs diligent planning, and a rough workflow to follow. Follow these steps to designate your vendor evaluation process successfully.

Establishing goals and objectives

It’s crucial to clearly define and communicate the expectations for your vendors across all key areas, ensuring that their services align with your specific business needs and goals

Performing proper supplier evaluation

Once the supplier is selected, invite them to submit documents related to their terms and conditions, pricing plans, projects handled, and how they plan to meet your requirements.

Setting a dedicated team

This team is to perform the complete vendor evaluation process, and take care of selecting vendors, assessing them, setting up and monitoring KPI metrics.

Make sure the right teams participate

If you are evaluating your supplier's financial stability and risk, then you should include the finance head or CFO (Chief Financial Officer) in the decision-making process.

Finalizing or rejecting vendors

By now, the team will have an idea and understanding of your vendors and their business practices. Based on their rating, they can be finalized or rejected.

What are the best practices?

Vendor management is a crucial process that helps organizations maximize the value of their vendor relationships and manage them effectively for long-term success. By implementing a strategic approach and utilizing a robust vendor management system, businesses can learn how to negotiate favorable deals, collaborate efficiently, and secure advantageous terms while minimizing risks.

One of the most effective best practices in vendor management is the creation of a comprehensive vendor management policy. This policy serves as a guideline for managing vendor interactions, setting expectations, and ensuring consistent, successful partnerships.

How to formulate a vendor management policy

An effective vendor management policy document comprises factors that help in cost control measures, risk factors assessment, performance measurement and ability to scale, and other factors that contribute to strategic vendor management.

This process can guide you to weigh vendors and their performance and choose the right and best among all. Establish the steps and metrics, site visits planning, and other financial and risk mitigation requirements.

A purchasing committee should be formed where key members like stakeholders, vendor managers, and other executives discuss metrics and KPIs, vendor policies, and how they can be improvised.

Each member involved should know their roles, and how they perform together as a team must be evaluated. Evaluating how these roles work together as a cohesive unit is crucial for ensuring that the team operates efficiently.

Once the policies are formulated, they should be developed as a formal document and approved by the company. Set the limit for the number of vendors your company will work with: Estimate the ideal number of vendors you can have and attain it based on the categories and requirements.

Metrics tracking is a recurring process. Identify the means or software going to be used for this. You should discuss your KPI metrics with your vendors to let them know what’s expected of them. The team should also convey if they meet, don’t meet, or overperform during the assessment period.

Constitute how to perform a risk assessment and its guidelines. Risk assessment is a separate process on its own, and requires an independent committee or a professional. Establish what documents will be assessed, e.g. bank statements, tax-related documents, etc.

Protect your business from overcharges and overbilling with Volopay

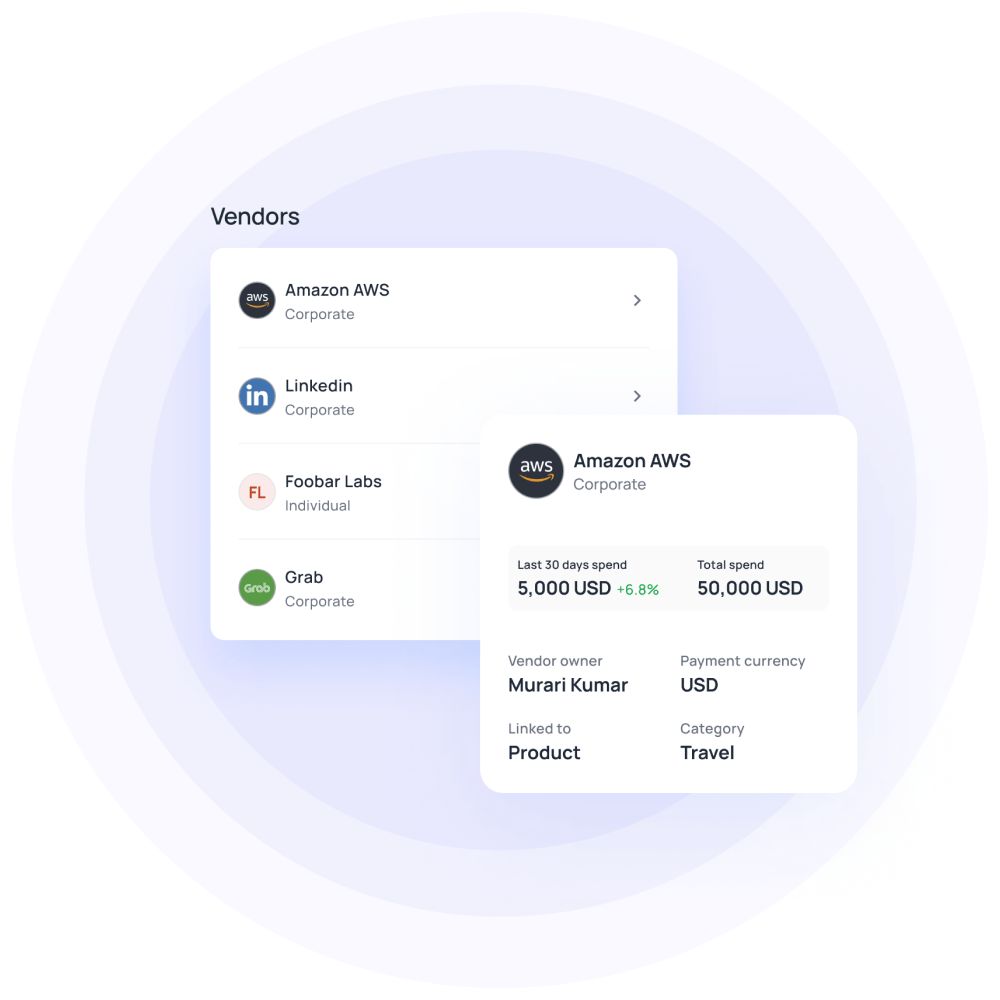

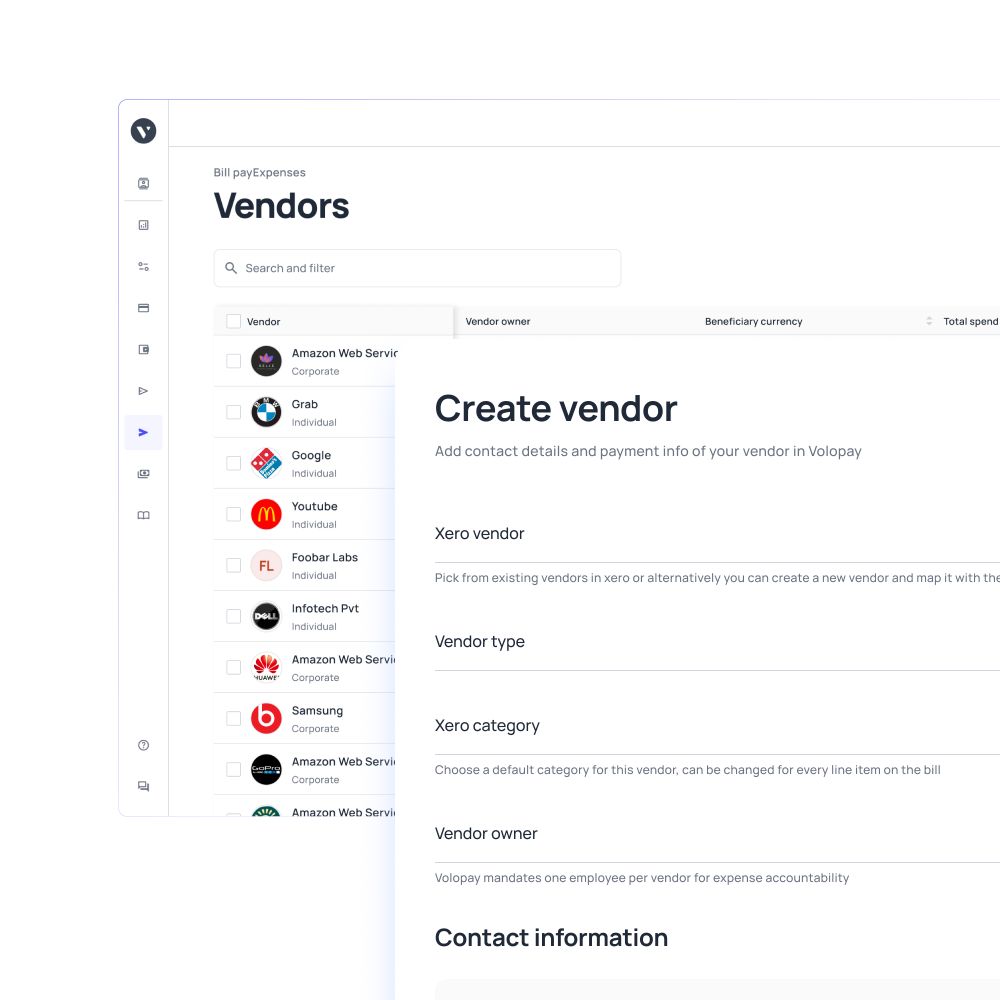

Vendor overcharging and vendor management are two separate concepts yet share a strong connection. Both can be collectively managed when you have access to well-organized vendor data. Saving them on spreadsheets or files can make this more chaotic than it is, and eat up time. Volopay, a single unified solution, brings your payment operations and vendor management together is here.

Volopay is a simplified payment management platform where you can add vendors, schedule and make vendor payments, pay your employees’ salary and other bills, and all sorts of business payments. For effective vendor management, you need all of your vendor information in one place, which is possible in Volopay. Not just you can view them, but tag them under departments, set custom approvals, view payment history and their statuses.

No overcharging can happen beyond your control as you can set multi-level approvals and view past spending anytime. Virtual cards are easy to use, distribute and delete. Set budgets and use them for online vendor payments to trap payments beyond limits. With a centralized payment and vendor management system, you can decentralize your overall financing operations and spend within limits and without fear.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free