Invoice approval workflow: Automation or manual?

Review and approve invoices from suppliers or vendors before beginning the payment process. Manual or automation invoice approval workflow help validate invoices before processing them for payments.

Why automate your invoice approval workflow?

Move away from writing paper checks, sending invoices through mail, following up with vendors, disappearing invoices, and missing early payments discounts. Automate the entire supplier invoice processing workflow for your business.

The invoice approval workflow is a series of invents to check that the invoice is valid and that there are no conflicts between the invoice and the original purchase documentation.

Invoice management is not a 2-step process of receiving and paying invoices. An effective invoice management procedure involves a complete cycle that starts from receiving invoices and ends with the payment. But in between, various other steps take place from approvals, identifying errors, matching invoices with purchase orders to vendors reissuing receipts if lost.

-You may save time, make better use of available resources, and avoid waiting for a manager to authorize invoices by using automated workflow software for OCR invoice processing.

-You get the real-time visibility of all your vendor transactions approved invoices. You get to know who, what and when of all your purchase transactions. It ensures complete transparency into your accounts payable process.

-Faster invoice approvals with automated notifications and reminders. As all the invoices are directly uploaded into the system, managers can approve the invoice on the go.

-Electronic invoices eliminate the need for missing documents. All the invoices are stored digitally and can be used later to match the transactions.

-By eliminating late payments, you can take advantage of opportunities such as early payment discounts. It can help you build stronger ties with your suppliers, leading to better future transactions.

-You'll gain access to vital data about your business operations and expenditures with fully digital workflows, allowing you to adopt better reporting mechanisms and make more informed strategic decisions, potentially resulting in improved profit margins.

Still processing invoices manually?

Challenges with manual invoice approval

The traditional methods of handling accounts payable approvals are prone to errors, long-timeframes, and fraud. This could significantly influence your company's capacity to run its operations as effectively and efficiently as feasible.

Slow approvals

Manual approvals are a cumbersome and lengthy process. The more the paper-based bills are delivered for approval, the slower the overall process becomes.

Late payments

Delays in getting approvals may lead to delays in payments. And delays in payments will hamper your organization's reputation and relationships with vendors.

Invisibility into the accounts payable management process

Fewer insights and visibility during the accounts payables process leave room for discrepancies.

Missing invoices

When a payment is delayed, and the cause is not communicated, the vendor may believe that the invoice has gone missing. Handling many invoices is a difficult task, and with such a large stack of paper invoices, some might go missing.

Duplicate payments

The same invoice might be sent again in some situations, potentially resulting in a duplicate invoice payment. Due to many invoices, it can be difficult for AP teams to notice such duplications in a manual setting.

Errors

Manually filling up those thousand stacks of invoices leads to many mistakes. You might miss filling in some information, wind up overpaying or underpaying your vendors, or forget to pay them on time.

Typical invoice approval procedure

The typical invoice process is generally what is followed in most organizations. And it looks like this:

Capture the data

Once the organization receives an invoice AP team enters all the invoice details, such as products, payable amount, vendor address and bank details, etc., into the computer system or in the general ledger. This is a time-consuming process. Invoices are sent by email or fax.

Invoice validation through a 3-way matching process

Once the details are filled, the invoice is matched with other two documents such as Purchase Order, Delivery receipt, and other purchasing-related documents.

Specify invoice exceptions

An exception is raised when the invoice doesn't match any purchase-related documents. This involves missing PO, discrepancy, or omission of data. The invoice is redirected to the appropriate individuals to track and rectify the problem. And all this is followed by fraud investigation in the case of unresolved exceptions.

Send for approvals

Once all the re-verification is done, the invoice is routed to various workforce levels for approvals depending on the company's policies. Approvals varied for different businesses, departments, product types, and invoice amounts.

Process Payments

When all the invoices are authorized, they should be sent to the finance department for payment processing.

Closure

An invoice can be closed once the payment has been processed.

Though this seems to be an easy 6-step process, it involves a cumbersome and lengthy sequence of events if done all these steps manually. Starting from receiving an invoice to the payment.

In a manual approval process, a manual method is used to fill all the invoice details, review the invoice and determine who needs to authorize it. And then, an email is sent to the recipient, followed by repeated reminders, to get the invoice completed and processed for the payment.

The cost of your manual invoice approval workflow is even more than just productivity loss. The cost is measured in time and money.

So what's the solution?

Hence, the key to efficient invoice processing is determining the best process and then automating the invoice approval process with software.

Automate your invoice approval workflow with Volopay

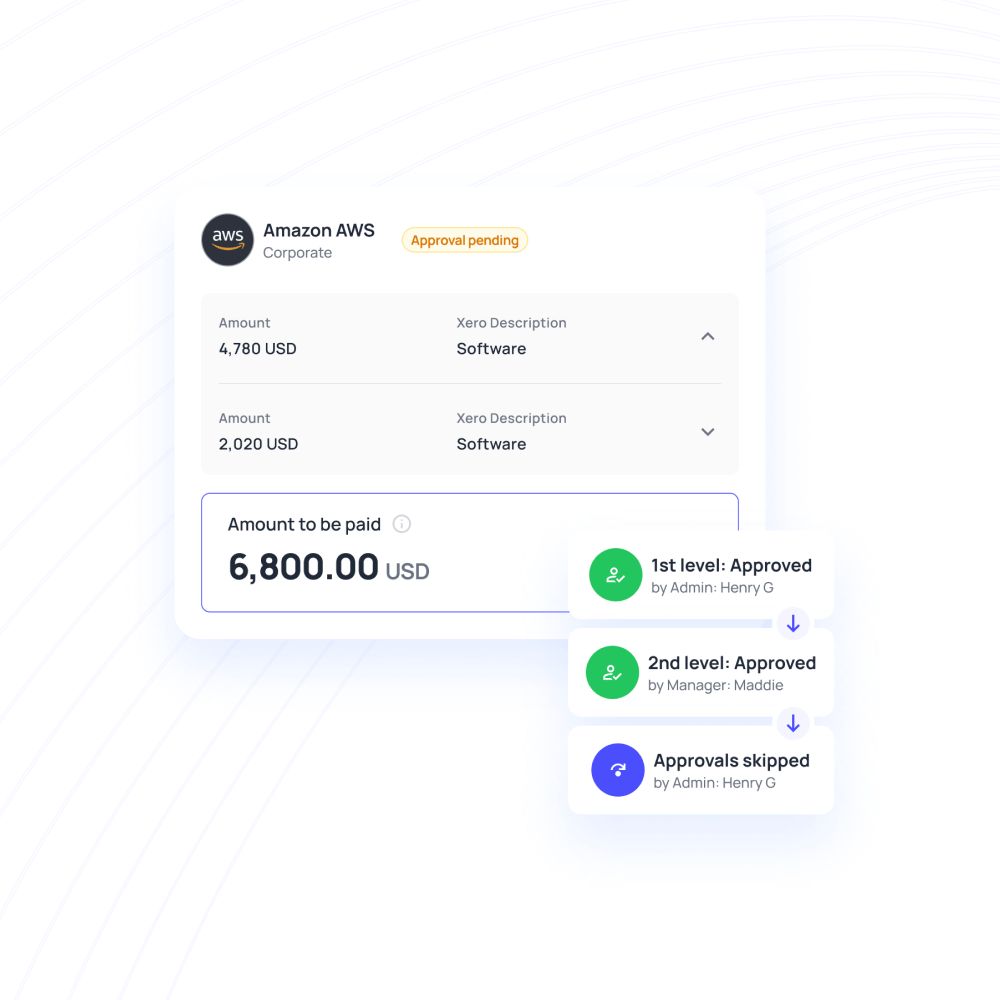

Invoice approval automation workflow

Automating your invoice involves managers submitting invoices. They can start a new invoice approval by clicking a dashboard button, rapidly filling in the appropriate information, attaching applicable files, and submitting. Meanwhile, approvers are notified of new requests and can swiftly evaluate the details through the portal or email before approving, rejecting, or returning the demand for more information.

Digitization of invoices

Once you receive your invoice, digitize the invoice by uploading them into a standard format. This format contains all the relevant invoice details such as product, department, invoice number, amount, supplier details (name, address), and remarks. The optimization of invoices is helpful in easy accounting, data extraction, auditing, and decision making.

Automated 3-way matching

After you have recorded the invoices, you'll need to automate the matching process between the invoice, purchase order, and other purchasing documents. The AI-enabled processing can also compare and match records and decide whether to pass the transaction, highlight issues or raise exceptions. This will significantly speed up the invoice process as you don't have to waste time manually determining whether or not the invoice is accepted for payment.

Exception handling

When an invoice or purchase order doesn't match with each other due to any errors or missing information, it will automatically raise an exception for that particular invoice to fix the errors. You can set up business rules for what should happen if the system encounters an anomaly. You could, for example, set up a process in which the appropriate individual is automatically contacted to fix the exceptions.

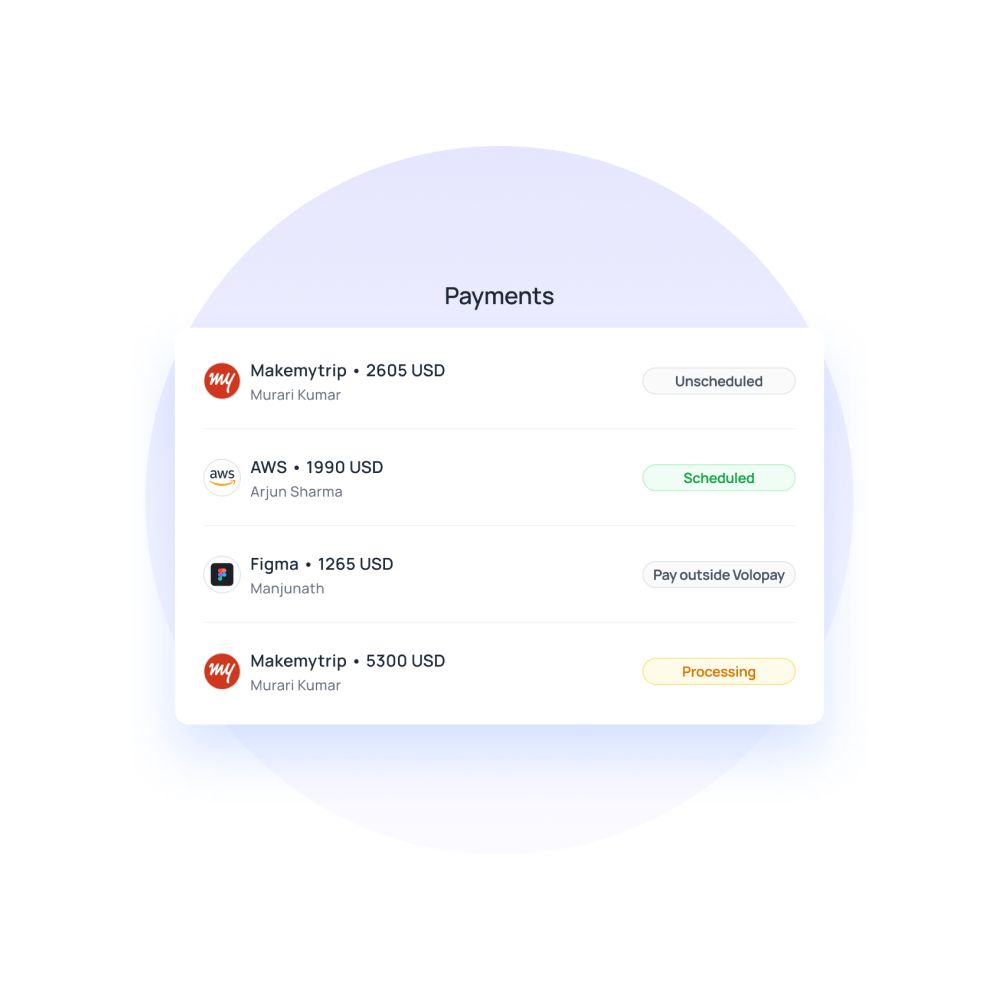

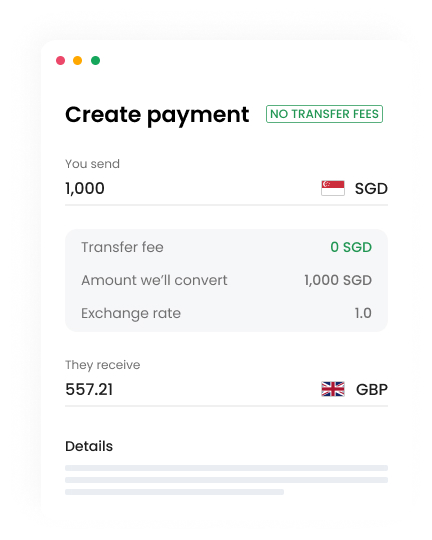

Automated payments

Once, according to your set rules, approvers at all levels have approved the invoices, it automatically goes to the finance team to process payments. Once done, those invoices can be marked as closed.

Automated approvals

Once the invoice is validated and re-verification checks are done, it can be routed for approvals. Again, here you can set business rules on how your invoices will be approved so that it delivers the invoice to the concerned person for approval. You can indicate the primary and secondary approving authorities or determine the circumstances under which approval will be granted.

Choosing a reliable automated solution

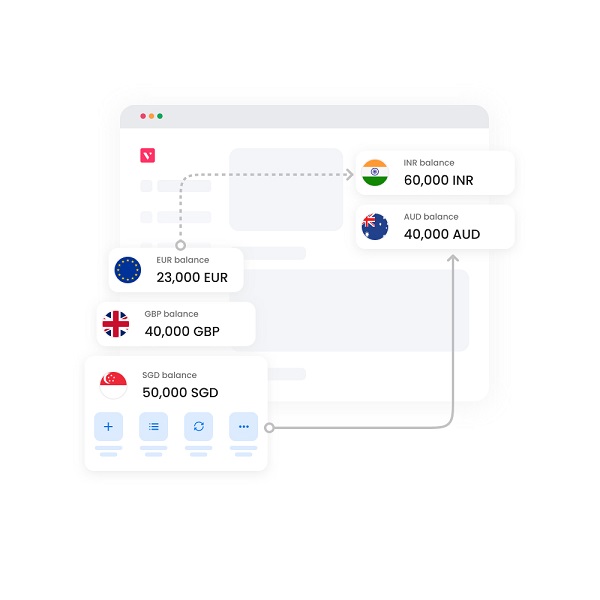

Your company must select an effective procurement system such as Volopay. A system that can generate, send and receive purchase orders, and invoices are required. Volopay streamlines the approval process and makes invoice processing more efficient.

From removing time-consuming processes to streamlining the purchasing process, checking relevant details, quickly generating invoices, and auto-categorizing invoices, you can eliminate all these bottlenecks with Volopay's procure-to-pay software.

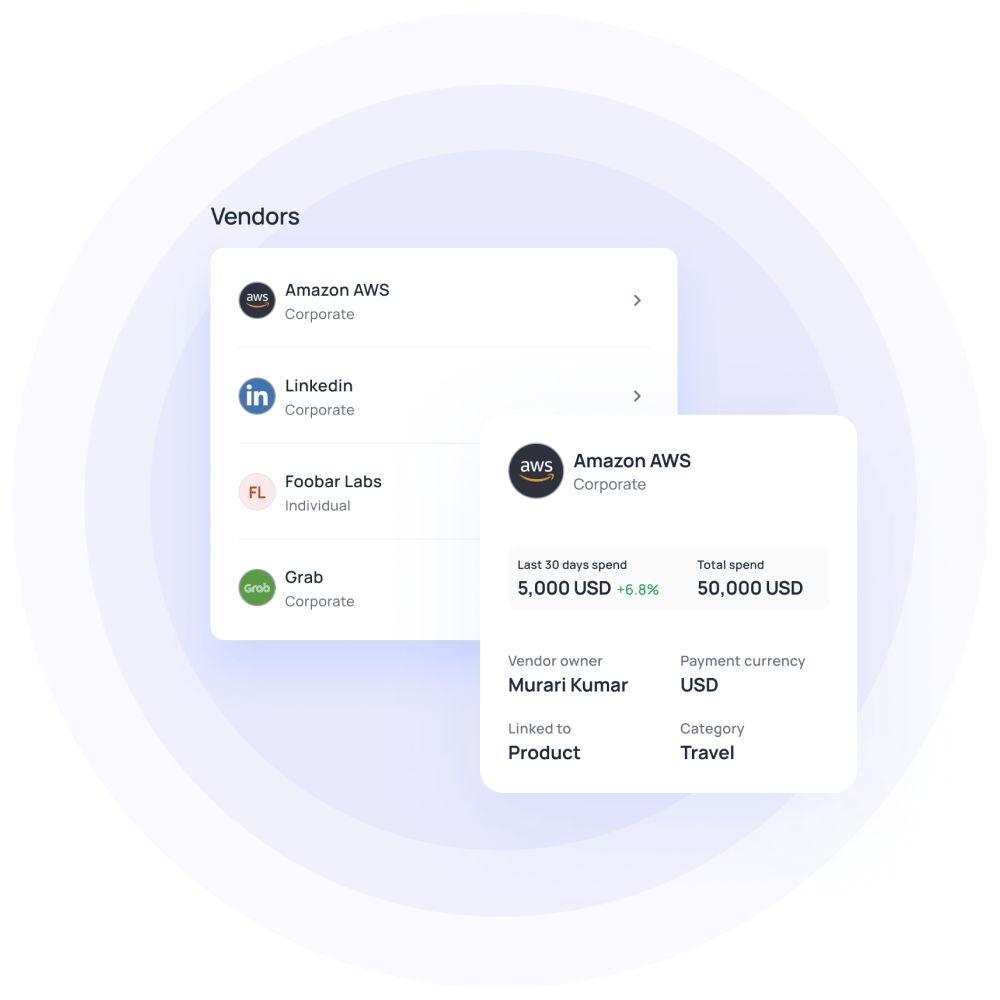

From receiving the invoice to paying the vendor to reconciling the vendor payments, you have complete control over the entire process.

Volopay's intake to procure software further enhances this automation by streamlining the entire procurement journey, from requisition to payment.

Supported by

We are proud to be supported by world's leading investors, founders and senior leadership of world's leading companies

Bring Volopay to your business

Get started free

Related pages

Faster invoice approvals, avoiding duplicate payments & detailed spend visibility, are some of the advantages of invoice approval automation.

Better relationships with vendors, eliminating errors & saving time, are some of the benefits of streamlining your invoice management process.

Find out the checklist of what you should consider while creating the automated invoice approval workflow.