All you need to know about remittance money transfer

When your business needs to handle remittance money transfer, it’s crucial to understand the basics. Money remittance services allow you to send funds securely across borders.

By leveraging these services, you can streamline transactions, stay compliant with international financial regulations, and expand your global reach. Learning how remittance money transfers work can further enhance your operations and provide a competitive edge.

What is a remittance transfer?

A remittance money transfer is a solution that enables your business to send funds internationally.

With money remittance services, you can securely and efficiently handle cross-border transactions, ensuring timely payments and swift operations.

These services help you manage global financial flows with multi-currency support and expand your business reach.

What is business remittance?

Business remittance involves using remittance money transfer to handle cross-country payments between businesses.

With money remittance services, you can efficiently manage international transactions, ensuring secure and timely payments to partners, vendors and suppliers globally.

This comes with transparent fee structures and real-time monitoring of transactions while ensuring adherence to global monetary regulations.

Difference between personal and business remittance

Personal remittance is for individual use, often involving smaller amounts and occasional transfers.

Conversely, business remittance is designed for handling higher-value transactions between companies.

With money remittance services, you facilitate global payments smoothly with detailed transaction reports and analytics, guaranteeing reliable and punctual transactions that support your overseas business activities.

Parties involved in remittance money transfer

1. Sender

The sender initiates the remittance money transfer by providing the funds to be sent. Your business is responsible for initiating and authorizing the transaction, ensuring accurate details for successful transfers.

Utilizing money remittance services, you optimize the process, enhancing efficiency.

2. Sending agent

The sending agent processes the remittance money transfer on your company’s behalf. This agent facilitates the transfer from your business to the recipient, ensuring compliance with regulatory requirements and smooth transaction execution.

They further play a crucial role in maintaining security and efficiency throughout the transfer process.

3. Receiving agent

The receiving agent handles the funds upon arrival. Your business relies on the agent to process and deliver the funds to the recipient. Using money remittance services, the receiving agent ensures accuracy, guaranteeing that the recipient receives the funds promptly and correctly.

4. Recipient/receiver

The recipient or receiver is the final party in the remittance money transfer chain. The recipient receives the transferred funds and ensures proper allocation.

By using money remittance services, your business ensures that transactions are completed successfully, allowing the recipient to access and utilize the funds as intended.

Types of remittance money transfer

Domestic vs. international remittance

Domestic remittance money transfer occurs within your country, ensuring funds are sent and received locally, within the state, or inter-state.

International remittance money transfers involve sending funds across borders, often requiring additional regulatory compliance.

With money remittance services, you can efficiently handle both types, ensuring smooth transactions whether dealing with local or global business partners.

Bank transfers

Bank transfers are a traditional method for remittance money transfer, involving direct deposits from one bank account to another.

Using remittance services, your business can manage secure and reliable transactions.

Leveraging banks’ infrastructure ensures efficient financial exchanges, providing peace of mind through well-established banking systems and protocols.

Wire transfers

Wire transfers are a fast and secure way to handle cross-border transfers, suitable for high-value transactions.

Your business can use wire transfers to ensure quick and reliable payments to suppliers and partners.

This method enhances transaction efficiency, offering expedited service and robust security measures for international business dealings.

Electronic funds transfer (EFT)

Electronic funds transfer (EFT) is a system for remittance money transfer using electronic networks.

Your business can utilize money remittance services to manage various types of transactions, including payroll and vendor payments.

EFT systems offer efficiency and security, streamlining financial operations and reducing the risk of errors.

Mobile money transfers

Mobile money transfers enable remittance money payment via mobile devices, offering flexibility and convenience.

Your business can manage transactions on the go, making it easier to manage payments and receipts from anywhere.

This method supports real-time processing, enhancing business agility and responsiveness in financial management.

Peer-to-peer (P2P) payment systems

Peer-to-peer (P2P) payment systems facilitate remittance money transfer directly between individuals or businesses using online platforms.

Your business can optimize transactions, benefiting from the speed and ease of P2P systems for B2B payments.

This approach simplifies the payment process, reducing intermediary involvement and associated costs.

Streamline your cross-border transactions with Volopay

Who are the key players in the remittance ecosystem?

Banks and financial institutions

Banks and financial institutions are central to the remittance money transfer ecosystem.

They provide the infrastructure for secure transactions and manage accounts involved in cross-border payments.

Your business can rely on these institutions for reliable, regulated financial services, utilizing their established networks and compliance frameworks for efficient transactions.

Money transfer operators (MTOs)

MTOs specialize in facilitating remittance money transfer across borders. They offer platforms and networks to ensure efficient and cost-effective transfers.

Partnering with MTOs can accelerate international payment processes for your business, providing a streamlined approach and enhancing transaction reliability through their specialized services.

Fintech companies

Fintech companies innovate in the remittance money transactions space by offering digital solutions and technologies.

They provide faster and more flexible methods for transferring funds, such as mobile apps and online platforms.

Your business can benefit from these modern tools to optimize payment operations and stay ahead in the financial technology landscape.

Payment processors

Payment processors handle the technical aspects of remittance money payments, ensuring secure and seamless transactions between parties. They manage transaction data, authorization, and settlement processes.

Your business relies on these processors to ensure smooth, efficient processing of cross-border payments, minimizing errors and enhancing overall transaction security.

Regulatory bodies and government agencies

These bodies and agencies oversee the remittance money transfer framework to ensure compliance with laws and regulations. They set standards for security, transparency, and operational practices.

Your business must adhere to these regulations to operate effectively, maintaining compliance and avoiding potential legal issues in the remittance process.

Remittance money transfer process

Initiation of transfer

To start a remittance money transfer, you begin by providing the necessary details to your chosen provider.

This includes specifying the amount to be sent and providing recipient information. Using money remittance services, you ensure that the process is initiated smoothly.

Further, with accurate transfer set up, you can ensure successful completion of the transaction.

Selection of transfer method

Choose the most suitable method for your remittance money transfer by considering factors like speed, cost, and convenience.

Whether you opt for bank transfers, mobile solutions, or fintech platforms, your choice will affect how efficiently your business transactions are completed.

Select the method that aligns with your needs to optimize the transfer process.

Providing recipient information

Ensure you provide precise recipient details for a successful remittance money transfer.

Accurate information is essential to avoid delays and guarantee that the funds reach the intended party.

By using money remittance services, you take proactive steps to prevent errors, ensuring that the transfer is executed smoothly and the recipient receives the funds correctly.

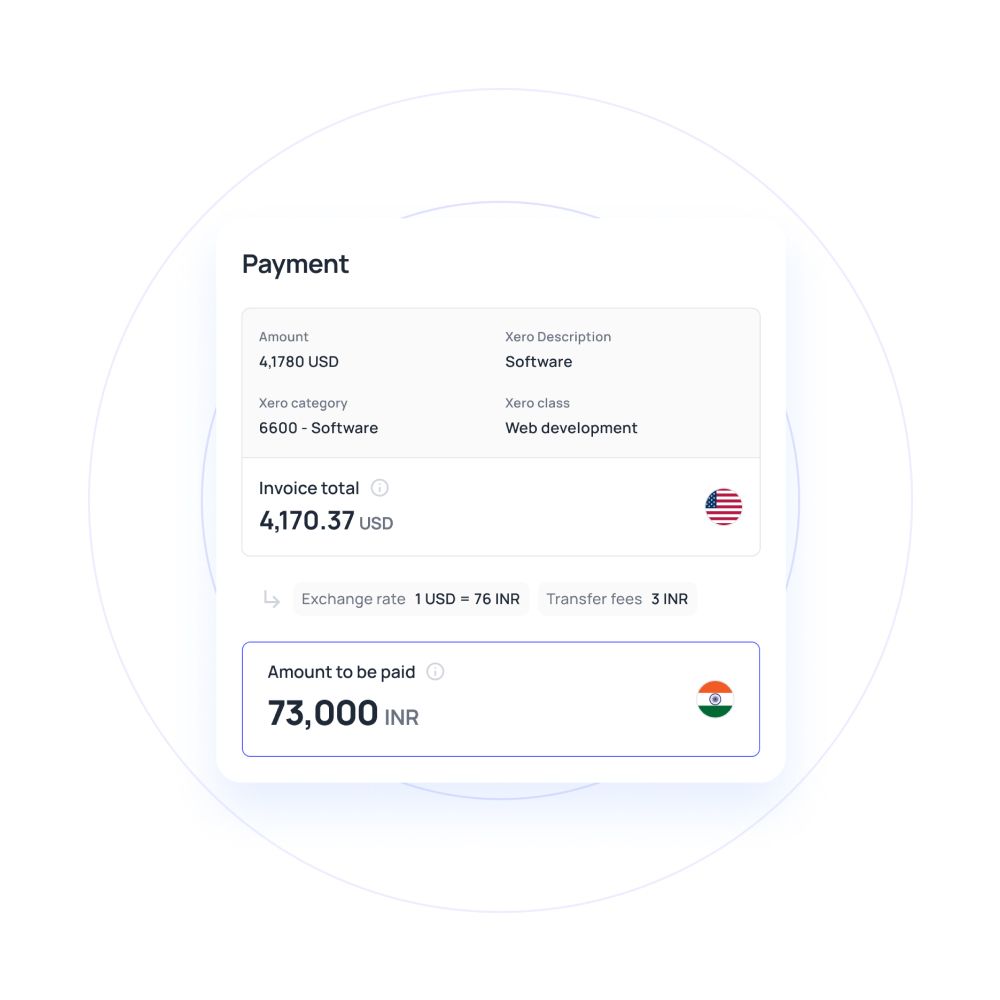

Payment of transfer fees

Pay the required fees associated with cross-border transfers, which can vary based on the method chosen and the transfer amount.

You should account for these costs when managing the total expense of the transaction.

By thoroughly understanding the fee structure, you can maintain better control over your budget and ensure that all financial aspects of the transfer are handled effectively.

Processing the transfer

After providing all necessary details and paying the fees, the remittance money transfer is processed.

Your selected money remittance solution takes care of securely transmitting the funds from your business to the recipient.

This step involves ensuring the transaction is executed efficiently, with all security measures in place to protect the transfer.

Delivery of funds to recipient

Once the transfer is processed, the funds are delivered to the recipient.

With money remittance services, you ensure that the transferred amount reaches the recipient promptly and securely.

This final step completes the transaction, confirming that the recipient received the funds and concluding the remittance process.

Fees associated with remittance money transfers

Types of fees

When managing a remittance money transfer, your business may encounter various fees.

Common types include service fees, charged by providers for handling the transaction, and currency conversion fees, which apply when exchanging one currency for another.

Additional charges might include transfer fees and intermediary bank fees.

Factors affecting remittance costs

Several factors influence the cost of remittance money transfers.

These include the transfer method chosen, the amount being transferred, the currencies involved, and the service provider’s fee structure.

Additionally, exchange rates and regulatory requirements in both the sending and receiving countries can impact the overall cost.

How to minimize fees and get the best exchange rates

To minimize fees and secure the best exchange rates for remittance money payments, compare different money remittance services and their fee structures.

Consider using spend management platforms like Volopay, which offer competitive rates and lower fees, helping your business save on international transactions while ensuring efficient fund transfers.

Experience seamless and secure international money transfers

Benefits of remittance money transfer for businesses

1. Enhanced cash flow management

Utilizing remittance money transfer helps your business manage cash flow more effectively. By leveraging reliable money remittance services, you can ensure timely payments and receipts, reducing delays.

This efficiency maintains smooth financial operations, which is crucial for sustaining daily business activities and ensuring that your cash flow remains consistent and manageable.

2. Expansion and growth opportunities

Remittance money transfer facilitates international transactions, enabling your business to expand into new markets. Efficient transfer methods help you establish and maintain global partnerships, which opens up opportunities for growth.

By utilizing these services, you increase your competitive edge and tap into emerging markets, driving your business’s expansion and success.

3. Supports SMEs

Remittance transfers are vital for supporting small and medium-sized enterprises (SMEs). By providing access to global financial networks and efficient money remittance services, your business can engage in international trade.

This involvement improves your financial stability and fosters sustainable growth, making it easier to compete and thrive in a global marketplace.

4. Boosting local economies

Engaging in remittance payments can positively impact local economies by facilitating the flow of funds. Your business’s transactions contribute to economic development in receiving regions, supporting local businesses and creating jobs.

This enhances the overall economic landscape, helping to drive local prosperity and development.

5. Strategic investment opportunities

Remittance money transfer opens up strategic investment opportunities for your business. By managing international payments efficiently, you can invest in global ventures, diversify your portfolio, and capitalize on emerging market opportunities.

This approach ensures long-term growth and profitability, positioning your business advantageously in the global financial landscape.

Challenges and risks in remittance money transfer

High transaction costs

One significant challenge in remittance money transfer is high transaction costs.

Fees for services, currency conversion, and intermediaries can add up, impacting your business's bottom line.

To manage expenses effectively, compare different money remittance services and choose the most cost-effective options for your international transactions.

Security risks (fraud, cyber threats)

Security risks, such as fraud and cyber threats, pose a major concern in remittance transfers.

Ensure you use a secure money remittance system with robust cybersecurity measures to mitigate these risks.

Protect your financial data and transactions by selecting providers that prioritize security and offer advanced protection against potential threats.

Regulatory and compliance issues

Navigating regulatory and compliance issues is a complex aspect of remittance money transfer. Different countries have varying regulations that your business must adhere to.

Thoroughly understand and follow these legal requirements to avoid penalties and ensure smooth operations. Also, stay informed about relevant regulations to ensure your business remains compliant and operates efficiently.

Delays and inefficiencies

Delays and inefficiencies in the remittance payments process can disrupt your business operations. Factors such as intermediary banks and varying processing times may cause delays.

To minimize these issues, choose reliable money remittance services that offer efficient processing times and a track record of timely transactions to keep your operations running smoothly.

Currency control measures

Currency control measures imposed by governments can affect remittance money transfer. These restrictions may limit the amount you can transfer and complicate the process.

Stay informed about these measures and plan your transfers accordingly. Understanding currency control regulations helps you navigate potential obstacles and execute transfers more effectively.

Mitigating challenges and risks

Choosing reliable service providers

Choosing reliable service providers is essential for mitigating challenges in remittance money transfer. Opt for well-established providers with strong security protocols and a proven track record of reliability.

This ensures that your business transactions are secure, efficient, and compliant with international standards, reducing the risk of issues and enhancing overall performance.

Staying informed on regulations

Staying informed on regulations is crucial for smooth remittance transfer operations. Regularly update your knowledge of international and local compliance requirements.

This proactive approach helps your business avoid legal issues and ensures you adhere to all necessary regulatory frameworks, maintaining compliance and preventing potential disruptions in your financial operations.

Monitoring exchange rates

Monitoring exchange rates can significantly impact the cost of remittance money transfer. By keeping a close eye on currency fluctuations, you can time your transactions to secure the best rates.

This practice helps your business save on transfer costs and maximize the value of your international payments, improving financial efficiency.

Developing contingency plans

Developing contingency plans is vital for addressing potential issues in remittance payments. Prepare for scenarios like transaction delays or regulatory changes.

Having a robust plan in place ensures your business can quickly adapt to unexpected challenges, maintaining smooth and uninterrupted operations even when faced with unforeseen obstacles.

Experience effortless international money transfers with Volopay

Key advantages of using remittance services

Speed and efficiency

Using remittance money transfer services ensures speed and efficiency in your business transactions.

These services streamline the process, allowing for quick and reliable transfers that help you maintain smooth operations and meet urgent financial commitments promptly.

The efficiency of these services is crucial for staying competitive and managing cash flow effectively.

Security

Security is a major advantage of using money remittance services. Providers employ advanced security measures to protect your financial data and transactions from fraud and cyber threats.

This ensures that your business’s financial assets are safeguarded, giving you peace of mind and enhancing the overall security of your financial operations.

Flexible options

Remittance transfer services offer flexible options tailored to your business needs. Whether you need to transfer funds domestically or internationally, these services provide various methods and platforms.

You can choose the most suitable and convenient option for your transactions, allowing for greater flexibility and better alignment with your business requirements.

Cost-effective

Using remittance money transfer services can be cost-effective for your business.

By comparing different providers and choosing those with the best rates, you can minimize transaction fees and optimize your financial resources.

This approach ensures that more funds are allocated to essential business activities, improving overall financial efficiency and resource management.

Future trends in business remittance money transfer

Growth of digital remittance platforms

The growth of digital platforms is revolutionizing remittance money transfer for businesses.

These platforms offer enhanced convenience, speed, and accessibility, allowing you to manage international transactions more efficiently.

As the trend towards digital solutions continues, expect to see more robust and user-friendly money remittance services that streamline your financial operations.

Increasing adoption of blockchain technology

The increasing adoption of blockchain technology is transforming the remittance transfer landscape.

Blockchain provides secure, transparent, and immutable transaction records, which can significantly benefit your business.

By reducing costs and accelerating processing times, blockchain technology becomes an essential tool for modernizing your remittance solutions and improving overall transaction efficiency.

Role of fintech in remittance landscape

Fintech is playing an increasingly pivotal role in the remittance money transfer system. Innovations from fintech companies offer advanced solutions for faster, cheaper, and more secure transactions.

By leveraging these fintech advancements, you can stay ahead in the competitive remittance market, enhancing your business’s efficiency and maintaining a cutting-edge approach to financial management.

Why choose Volopay for your business money transfers?

Owning a business is never easy. As a business owner, you have to don multiple hats and be on top of everything while growing your business simultaneously.

At the same time, even if you hire employees to delegate important tasks such as managing finances, you want them to work at their utmost productive self, and not indulge in unnecessary time-consuming duties such as managing bank accounts, credit cards, and remittances. Volopay can do all that for you, and then some more!

With Volopay, you can eliminate the need to have multiple online money transfer accounts. Deposits, payments, and tracking are easy —with no minimums, lowest FX fees, and unlimited transactions, with Volopay:

Lowest FX charges

We know how annoying those sky-high bank charges can be, especially when you and your finance team are looking for ways to cut down on costs.

Volopay offers better conversion and also charges lesser remittance fees compared to banks which helps with savings. As these payments can be recurring, you can enjoy better savings with each transaction, without having to reach deeper into your pockets.

Payment status at every stage

Don’t you just hate it when you’ve made a remittance through the bank (after paying their exorbitant fees as well!) but still have to wait for your vendor or employee to confirm that the payment has been received? Us too.

That’s why Volopay has a live dashboard with a real-time payment status that lets you know whenever your online money transfer goes through, within a few clicks.

Global accounts

Do you have vendors and employees worldwide and are positively tired of calculating conversions charges for every remittance payment?

Volopay offers you a global multi-currency account that lets you hold money in up to 11 different currencies, so you don’t have to indulge in money transfer overseas.

Not only is it extremely convenient, but it is also faster and more advanced than your conventional business bank account on any given day!

Security

Give your online money transfer an extra layer of security and use Volopay unlimited virtual cards with built-in budget restrictions for all recurring vendor payments.

Create a virtual card for each online vendor (AWS, Google, LinkedIn, etc.) and never miss out on any payment due date. Every payment request is authorized by a customized multi-level approval workflow set by you, ensuring that no single remittance goes unchecked.

As card numbers are unique, even if fraudulent activity occurs for one card, it will be isolated only to that card. So you don't need to go through every single online vendor and change your card number.

Transfer money in 130+ countries

Send money to your vendors or employees around the world in over 130+ countries using Volopay and manage all payments from a single dashboard.

Our cards are VISA-powered, enabling you to make payments to any place where VISA is accepted.

With Volopay, you gain full transparency over where, when, and why every international money transfer is made, elevating your business's spend visibility.

Bring Volopay to your business

Get started free

FAQs

Several factors influence the exchange rates in remittance money transfer, including economic conditions, inflation rates, interest rates, political stability, and market demand for currencies. To get the best possible exchange rates for your transactions, monitor these factors closely and time your transfers effectively based on market conditions.

Typical methods for sending remittance money include bank transfers, wire transfers, electronic funds transfers (EFT), mobile money transfers, and peer-to-peer (P2P) payment systems. Choose the method that best suits your needs for speed, cost, and convenience. This ensures you efficiently manage your international transactions and meet your business requirements.

Cancellation or refund of remittance transfers depends on the service provider’s policies. Generally, you can cancel transfers before processing, but once completed, refunds may not be possible. Review your money remittance provider’s terms and conditions to understand their specific cancellation and refund policies, ensuring you’re informed about your options.

Yes, you can use Volopay to send remittance payments to multiple countries. Volopay provides a comprehensive platform for international remittance money transfer, offering a seamless experience for managing global transactions. This capability allows you to efficiently handle cross-border payments to various destinations, streamlining your financial operations.

Yes, Volopay offers tracking and reporting facilities for remittance money transfer. These features allow you to monitor transaction statuses, ensuring transparency and accountability. By using Volopay’s detailed reports, you can maintain accurate records and optimize your financial management processes, making it easier to track and manage your international payments.

The reversal value on the refund for an XYZ transaction might differ if it is an international transaction as exchange rate and forex charges will be applied.

Volopay offers unlimited payments on all our plans.

Volopay charges conversion fees plus FX charges on all international transfers.

Absolutely! For recurring international vendor payments, you can set virtual cards with a recurring amount and cycle so that all your consistent payments are automated for you.

Related pages to remittance

A comprehensive guide to remittance advice, covering its importance, types, key details, and common challenges in financial transactions.

Essential guide for small businesses on international money transfers, including transfer methods, advantages, security, and key considerations.

Learn how international wire transfers work for businesses, covering types, fees, security, and common mistakes to avoid.