Simplify matching invoices to purchase orders

Matching invoices to purchase orders is an account payable function undertaken to ensure that the invoice data obtained from the vendor matches the information collected by the company in different documents such as purchase orders and delivery receipts. Though this may seem like an easy process, doing it manually can cause serious consequential issues.

Normally invoices arrive at the AP department. But just in case the invoices are sent to some other department, either they will have to be emailed to the AP department or if it is a hard copy, they will have to be delivered physically. This delay in the transfer gives way to errors and the removal of these errors turns out to be a humongous task for many people.

Matching invoices to purchase orders is an immensely essential part of accounts payable because without it duplicate payments, faulty payment amounts, missed payment dates would become a forever problem for the company.

What is purchase order (PO) matching?

Purchase Order matching (PO matching) refers to the process of analyzing data on an invoice in contrast to the information on documents like purchase orders, contracts, goods receipts, etc.

PO matching is basically done to make sure that the vendor payments are faultless and precise and also to certify that these payments are under the accurate accounting of costs.

Through PO matching you can be positively certain that the purchase contract terms are followed and all the incorrect or fraudulent invoices are detected painlessly. Purchase order matching is a complex, cumbersome, labor and resources intensive task if performed manually.

Manual PO matching and its challenges

The whole PO matching process consists of several steps. Invoice processing and purchase order matching are laborious and difficult tasks when performed manually, especially for large-scale businesses.

Steps like invoice capturing, purchase order verification, parameters comparison, and resolution of various parameters open opportunities for committing serious errors when performed manually.

Even after the digitization of information in some departments, AP personnel have infinite tasks to perform. Such as:-

● Physically scanning or opening purchase orders.

● Manually tallying purchase orders and delivery receipts.

● Inputting information from invoice receipts to the computer.

● Analyzing and detecting frauds the hard way.

● Entering the accurate invoice information in the ERP

● Looking for duplications and errors

● Checking invoices against payments

● Updating the master vendor file

Some of the colossally challenging tasks while manually doing the purchase order matching are data discrepancies, cost per invoice processing, organizing multiple invoice data, detecting fraud and theft.

While matching the purchase order against the Goods Received Note (GRN) and contracts, manually staring and comparing the data is a labor-intensive and error-saturated task. This leads to potential loss of data, a decrease in productivity, and strain on the client relationship.

Along with this, while manually processing invoices and purchase orders there are other extra costs entailing it such as the cost of paper, manual hours, postage, etc.

Generally, large-scale organizations deal with numerous suppliers/clients which implies multiple files of POs and invoices in various formats like MS.Word, MS.Excel, PDFs, image files, and hard copy documents. The merging of these files in an organized manner is an extremely time-consuming and fault-prone task when done manually.

What is automated purchase order matching?

All the above-mentioned problems can be easily resolved through an automated purchase order matching process. By automating this critical process, businesses can improve accuracy, efficiency, and overall financial control.

Automated accounts PO matching

This is further divided into three types-

● Artificial learning: Imitates human judgment and behavior

● Machine learning: Learns through algorithms and learn from brain processing

● Robotic process automation: Impersonates repetitive human actions

All these automation types are designed to capture relevant information from purchase orders, invoices, and other contract documents and automatically process that information just like a human mind.

This automated processing is also capable of matching and contrasting the data and making decisions like pointing errors, payments reminders, etc. accordingly.

Optical character recognition (OCR)-based data capture

This type of automation procures data using an amalgamation of image capture hardware and conversion software.

This just merely turns the image into text which needs to be analyzed manually. Using just an OCR system would not fulfill the purpose of reducing errors and labor effort.

Want to eliminate the pain in manual PO matching process?

How does Volopay’s automated PO matching simplify matching invoices to purchase orders?

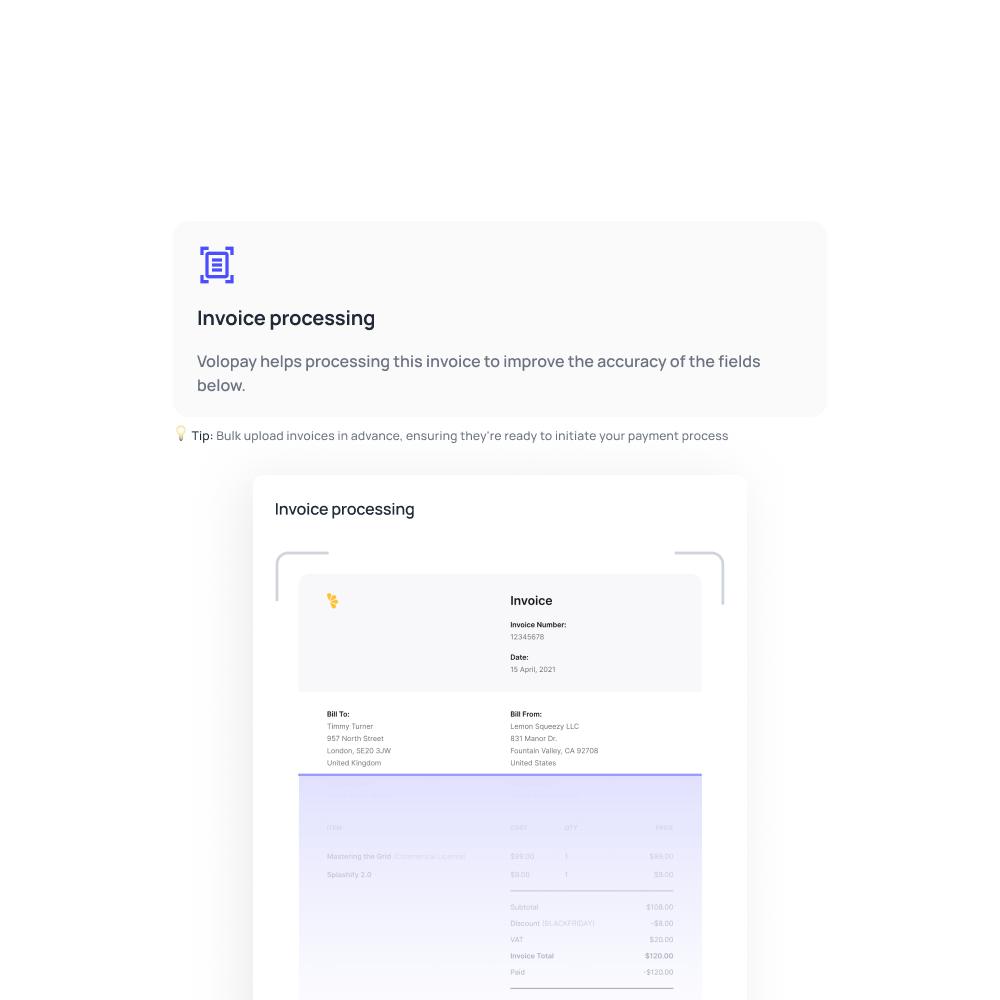

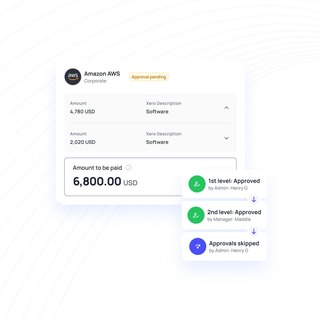

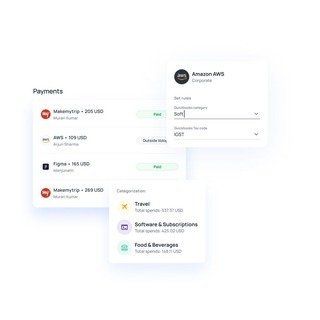

Volopay's invoice management system uses OCR technology to check the PO against the uploaded invoice to ensure that all the details are legit and precisely matched. Along with this, the system effectively prevents any duplicate payments of invoices or any other errors in vendor payments.

The most relieving advantage is that you can be free from any concerns regarding double invoicing or double payments. As the tallying is completely automated the whole purchase order matching process is simplified.

Benefits of automated purchase order matching

Save time and resources

Purchase orders are tallied with PO number, shipment, PO receipt, and release, and organized into different forms within a matter of seconds. In contrast, manual invoice matching would make this task a humongous one, turning it into a task prone to errors and time consuming.

Touchless processing

Once all the documents like invoices, receipts, purchase orders, etc., are transformed into electronic data, the use of paper in the whole process decreases significantly and the human labor requirement also minimizes. This directly results in improved performance and swift functioning.

All the accounts documents are processed and approved without any extra effort or chaos. The AIs used are trained by machine learning for enhanced functioning. This means that the system grasps information from both the company’s customer base and the specifics of each customer.

Prepared for audits

While auditing, some of the common documents required are POs, GRNs, and invoices. In an AI-based purchase order matching these documents are pre-approved, organized, and matched. This makes the audit process effortless and error-free.

Protection against payment fraud & duplicate payments

AI-based automation systems do get bored or tired of the repetitive action, this means that the system upgrades over time and experience. While human error may not be completely removed but automated accounting can significantly help in maintaining stability and reducing a major accounts payable challenge.

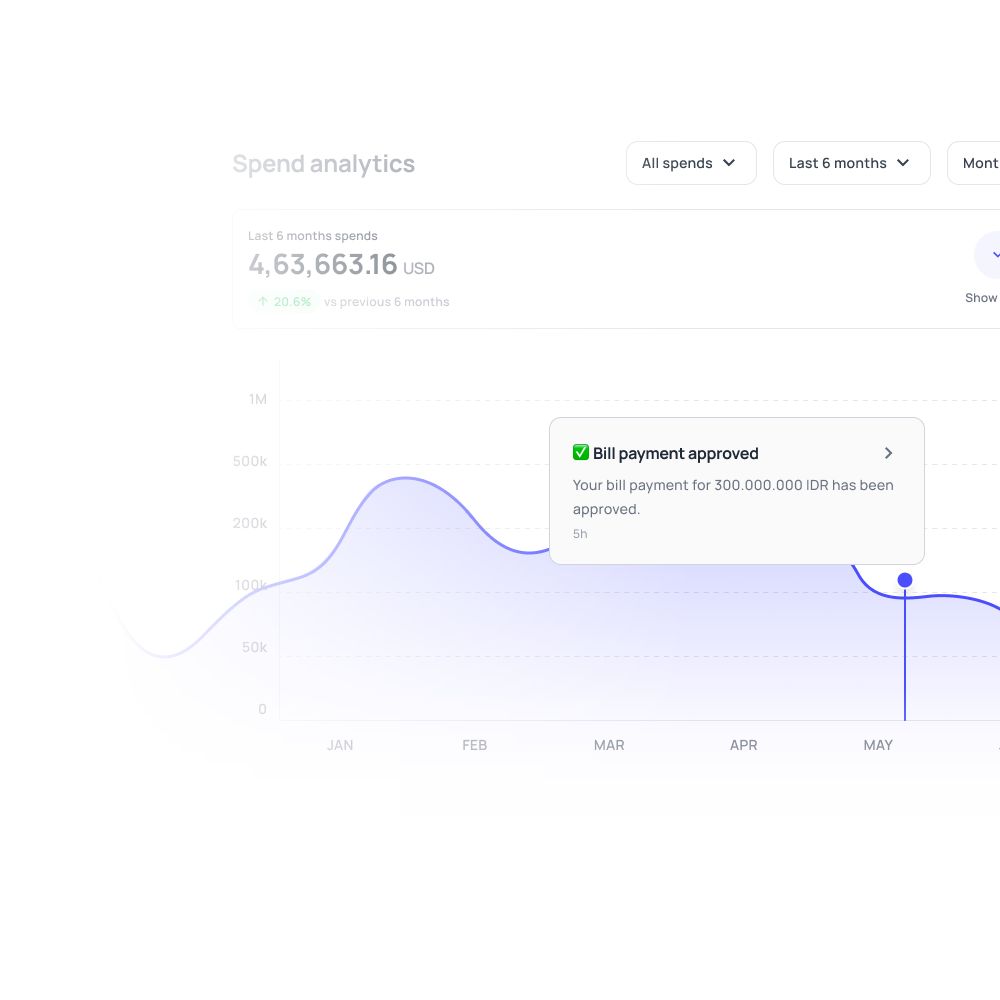

If there is any error or fault detected a red flag alert is automatically launched to the team so that they can quickly resolve the problem. Automated error detection like duplicate payments and fraud payments are extremely beneficial for security purposes.

Increased productivity

Once you adopt an automated invoice processing system, the human effort and time invested in these activities minimizes. Implying that now the accounts payable team members can direct all their energies towards other human-centered tasks. These tasks include financial planning, evaluation, scrutinizing, framing ideas for improvements, and strengthening business and client relationships.

Data security and scalability

Humans have a limited scope of working and abounded mental capacity. To become a globally acing player your company should have the ability to work literally all the time. With the data security and scalability that Automated invoice processing systems offer, being a universal ranker becomes a realistic and achievable goal.

Workforce economizing

AI systems consist of multiple beneficial features for an enhanced accounts payable performance. AI operators can detect patterns and relationships from the given data very much similar to how we humans do it.

Along with this it also boosts performance, displays in-depth learning capacities, and increases accuracy to the level of perfection. With all these features human force requirement is almost eliminated which helps in economizing or saving the human efforts involved.

Trusted by finance teams at startups to enterprises.

What are you waiting for, get started with Volopay today!

Related pages

Better relationships with vendors, eliminating errors & saving time, are some of the benefits of streamlining your invoice management process.

Find out the checklist of what you should consider while creating the automated invoice approval workflow.

Read our article to understand how invoice management works, the challenges of manual processes and the role of automation in it.

FAQs

A three-way match procedure includes matching purchase orders, invoices, and goods receipt notes against the invoice received from the vendor’s or supplier’s side, before making the payment. This three-way matching is done to clarify if a payment has to be done in full or half and also to endure that no faulty reimbursements are approved.

The following steps are undertaken to match invoices and purchase orders:

1. Details are transferred from the invoice to the system.

2. The invoice is then reviewed to determine the method of payment.

3. This is then matched to the purchase order.

4. Assets and taxes are evaluated.

5. Final validation and approval.

Yes! The invoices need to match the purchase order to make sure that all the payments you make are of the correct amount because without invoice and purchase order matching you may end up paying for things you did not order or subscribe to. Invoice matching also helps your company to be prepared for audits, maintain an organized documenting system, and promote transparency.