Digital wallet for business - Complete guide for 2025

Digital wallets are a facility to make contactless payments. Recently there has been a lot of talk about these wallets and their utilities in the business world. Though there are many other alternative payment options that have surged up in the payments industry, what are digital wallets and their benefits, this is essential knowledge required to build a smart business.

Instead of using a physical debit or credit card, a digital wallet is a much more convenient option. As your card details and no personal information is shared with the vendor or the merchant, the purchase made is completely safe. A unique token number is generated to facilitate all transactions.

What is digital wallet?

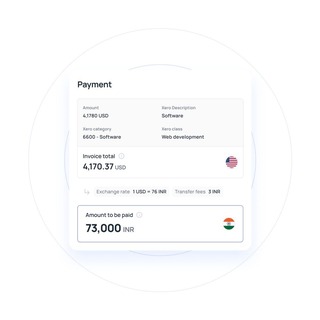

A digital wallet is basically a software-based system that facilitates money transfers and protects and securely stores the user's transaction information through passwords and encryption technology.

It is an electronic payment method that lets the user keep a digital copy of their credit or debit cards, which the user uploads on the app which is required to make payments. Digital wallets are extremely beneficial for businesses for managing and organizing their funds, analyzing their spending, and enforcing spending policies easily.

How do digital wallets work?

Once you download a virtual wallet, you are supposed to fill in your company’s important information like bank accounts details, email id, phone number, etc. To make payments using any digital wallet you can use either the QR code given by the vendor.

The other way to make expenses is through using tokenized technology. Digital wallets convert your card information to tokens. Every transaction is backed by instant password generation and digital recognition.

Redefine the way you do business payments

What is the ease of using digital wallets?

Though digital wallets are becoming very popular, still no payment method stands against the popularity and use frequency of cash. The real question here is, “Is cash actually the most convenient mode of the transaction?”

With digital wallet, you can simply just swipe or scan through your phone and the exact amount gets transacted, you don’t even have to worry about where you kept your money, and how is it stored.

A digital wallet for businesses possesses many advantages over cash. For instance, you cannot make any online transactions or purchases using cash, you also get the facility to have complete records of all your transactions, this feature is not available with cash.

Using a digital wallet does require passwords, accounts, and biometrics, it significantly organizes your purchase process. All the company’s private and confidential information related to credit cards and bank accounts is encrypted, which ensures that none of your information is revealed.

Benefits of digital wallets for businesses

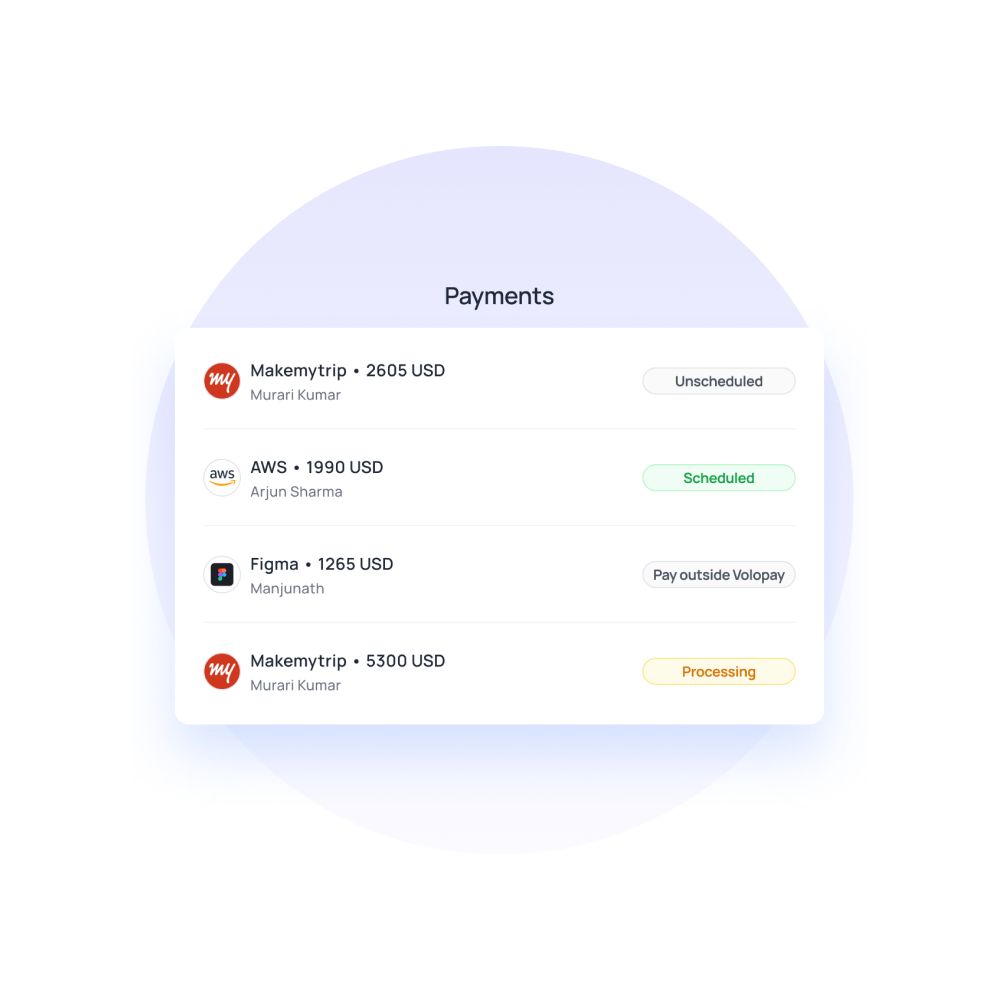

More control over payments

By using a digital wallet there is no requirement to carry cash or cards around with you. Through a digital wallet, you can make payments in various ways, for example, some digital wallets have features that allow you to withdraw cash from ATMs.

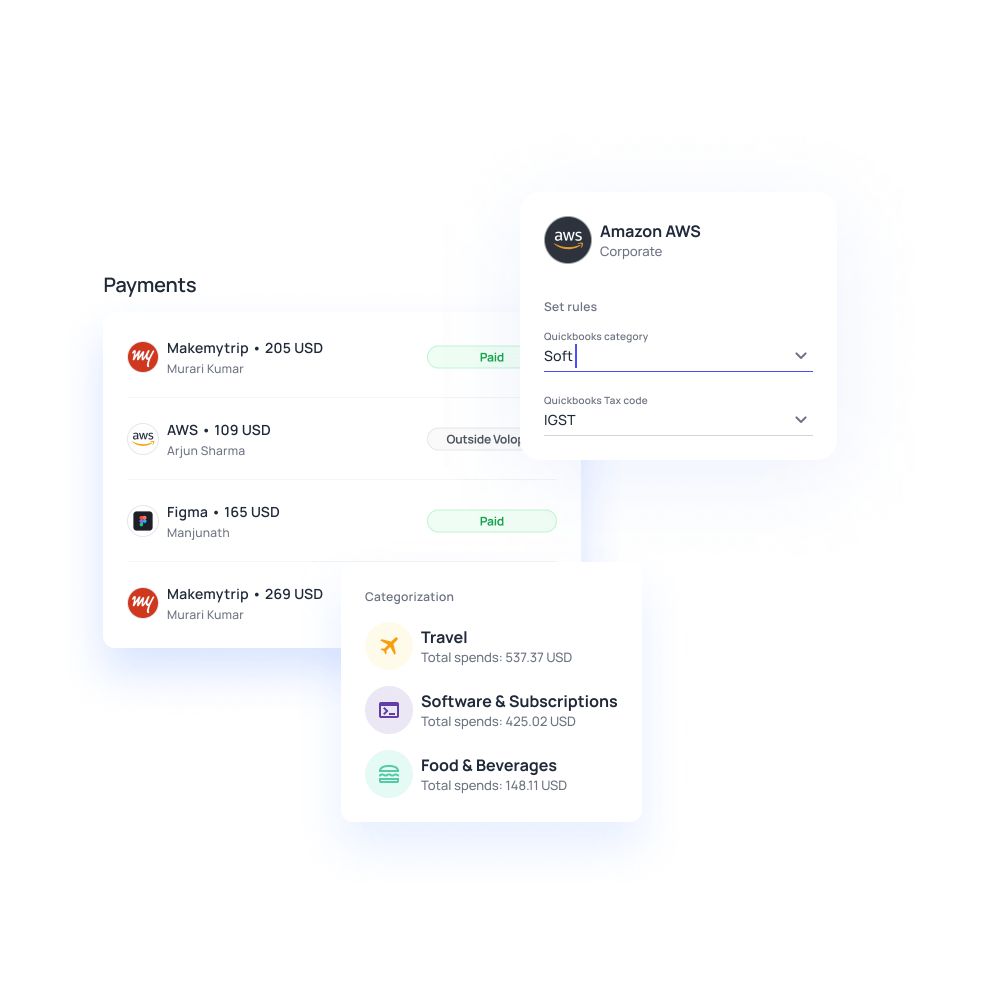

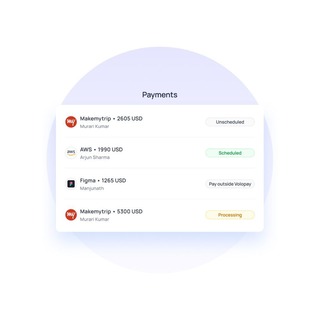

With digital wallet payments all your transaction information is stored in one app, in which you can check your balances, look over the transactions made by your company in a particular month, get overall transaction history, etc. These features facilitate a company to have better control over its finances and plan the funds according to easily available information.

More secure

Digital wallets immensely reduce the security risks that come with any other method of payment. While using these mobile wallets the user does not have any share or reveal any personal information or bank details with any vendor or store or online website.

Electronic wallets are more secure because they are encrypted with biometrics and passwords, which makes any theft or fraud almost impossible. Along with this, the user card detail is substituted with a number or token which is given forwards, meaning no one can get direct access to your cards.

Access to real-time data

Virtual wallets are the storage houses for tons of information. It provides you with the feature to access real-time data like customer preferences and purchase history.

You can use this information and send your customers, suggestions of related products or give them some loyalty rewards programs. This real-time data can be very profitable because you might even cross and upsell other products before the customers finish the payment and checkout procedure.

Furthermore, real-time transaction data can help you organize your budget and costs as you won’t have to wait for the paper receipt to arrive. This also implies you can have better control and management over your company finances.

Less manual work

With digital wallets for business, you don’t have to go back and forth with cards all around the company. This means that the buyers and retailers or vendors are no more required to pass cards, you can just scan through your phone, and voila the payment is done.

Ease of access

Since the launch of credit cards in 1950, it has become the most easiest and popular mode of transaction. It is almost impossible for any company to survive without them. However, there are certain drawbacks to credit cards that a digital wallet simply solves through technology.

Such as, credit cards occupy a slot in your wallet and if you have lots of cards your wallet starts looking like a balloon with all the cards, cash, and loose change. Now, imagine standing at a store and looking through all the cards to find the correct one. Nightmare!

Although you don’t have to worry, digital wallets are at your rescue. They provide you with a greater level of convenience, and an easy payment gateway in compliance with the modern expectations of security and speed.

With just one account on your phone and simply scanning or making a gesture, you can unlock a whole new realm of financial freedom. Along with this, you also sidestep the whole cumbersome process of filling in your card details every time you make payment.

Improved customer experience

Mobile wallets have opened up a new universe of seamless payments options that are backed with efficiency and speed. The other benefits of these digital wallet payments are user-friendly, less fidgeting with cards, and no need for entering card details every time you make payment.

A long payment or checkout process has proven to be one of the factors that companies lose their sales or customers, but with one simple mobile wallet, your customer can have a better and more positive shopping experience.

How do virtual cards work with digital wallets?

With mobile wallet virtual cards the whole accounting and transaction system of your company becomes streamlined and approachable.

For example, if your employee makes a payment for some office supplies and meets requirements, they won't have to wait long for the approval of that expense, and simultaneously you will get the information regarding that expense like time, date, amount, and purpose.

Furthermore, every expense will automatically get stored in the wallet, which reduces the headache of running behind people for receipts. One of the best features of mobile wallet virtual cards is that you can set spending limits on the virtual cards and tag them so only some particular expenses are automatically approved. This discards any possibility of fraud or mishappenings.

Start using digital wallets today

Digital wallet payments can be your first step towards changing the face of your business. With benefits like streamlined finances, advanced level protection, less manual work, access to real-time data, better internal control, and many more smart features, what else can you ask for.

Now, that you are intrigued and all ready to take this step, choose Volopay's business account to divide your funds properly between teams and projects, spend no time in collecting receipts, and get all your accounts automatically updated and organized. Volopay is the modern solution to all your financial problems.

Related pages

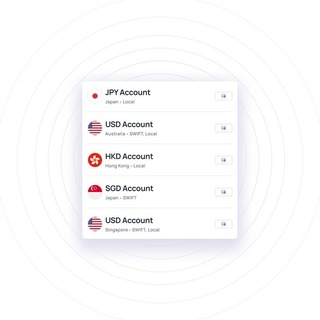

Read our article to get an indepth understanding of the workings of multi-currency wallets, its importance for you business and much more.

Explore the innovation involved in multi-currency accounts and the several advantages that it offers to understand if your business needs it.

Discover what a digital business account is and how it can streamline your financial management. Learn about its key benefits for businesses.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free