Automated bill payment - Definition, benefits and working

Every accounts-payable associate knows how challenging it is to process bills on time. Regardless of the size of your company, this task is still insurmountable and frustrating. Errors are inevitable and cost your company unsalvageable losses your accounting team can have numerous employees process bills and invoices manually.

But you will still be far away from making this error-free, transparent and uncomplicated. Living in a technologically advanced world, we don’t have to rant about this anymore. Automated bill pay is there to save us from this cumbersome process, where everything happens on auto-pilot mode.

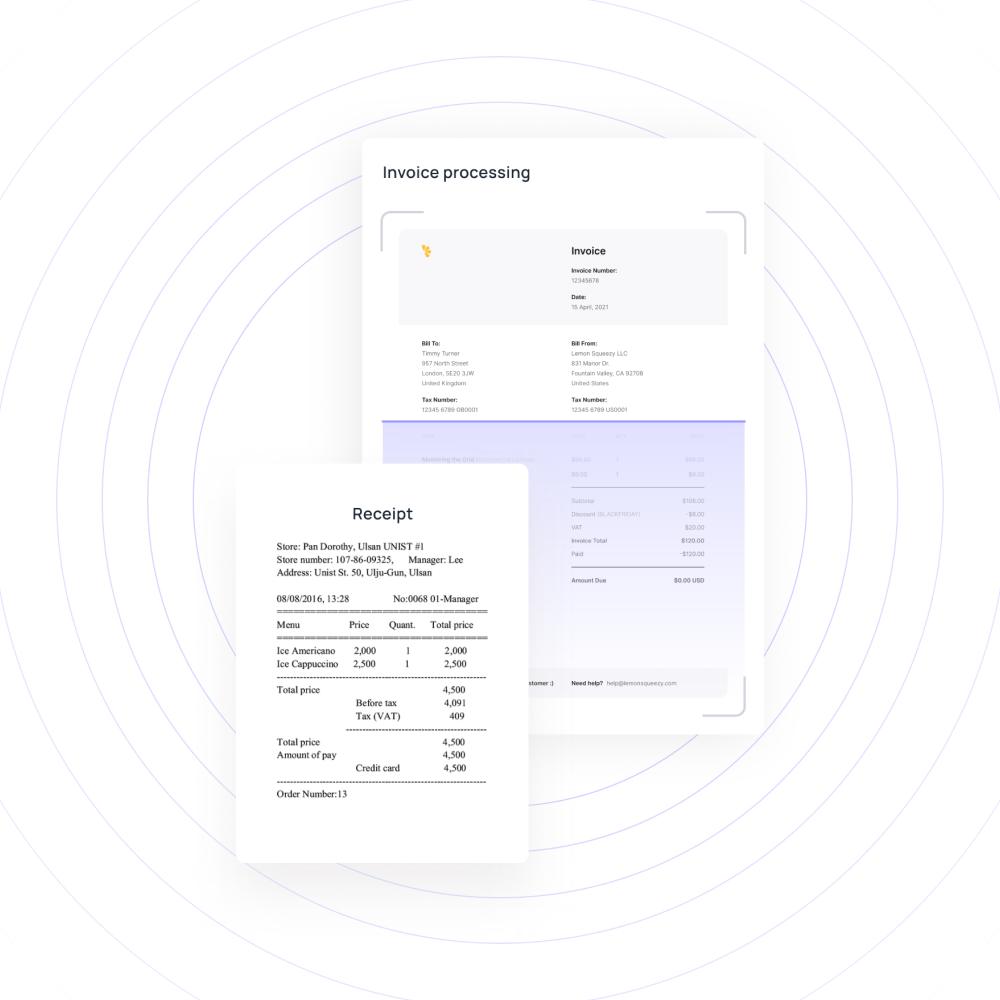

Use bill pay software to schedule, get approval, and process the payment or take it to the next level by leveraging the power of AI to auto-read invoices, feed them into the system, and work on the payment part.

What is automated bill payment?

Typically, the bill payment process involves employees from diverse teams. Here is the shortest version of how bill processing works.

1. An invoice gets released from the biller.

2. The buyer company receives it and verifies the information like date, quantity, amount, etc.

3. This information is then passed to the approver who approves or denies the bill.

4. If approved, the finance team processes the payment by initiating ACH, wire transfer, or writing checks.

Automatic bill payment is the process where the payer receives an invoice, captures its details, schedules the payment to their vendors on a particular date and sends it through levels of approvals, and finally processes the payment on the predetermined date and all of this happens automatically with the help of bill pay software. It also opens the door for increased efficiency and prompt vendor payments, saving time, money, and effort.

How to automate bill payments

Your company might handle tons of payments on a day through different modes. Our goal is to transfer and streamline this process, automate bill payments, and set up a foolproof automated payment system. The entire process happens within the automatic bill payment system that anyone can monitor anytime from one place.

Estimate workflow

To begin with, go through and analyze your current workflow on the bill payment process. Find out the approval levels for each type of payment. Along with that, find out how the clearance is made. When you are clear with the strategy followed, it gets easier to automate with the help of technology.

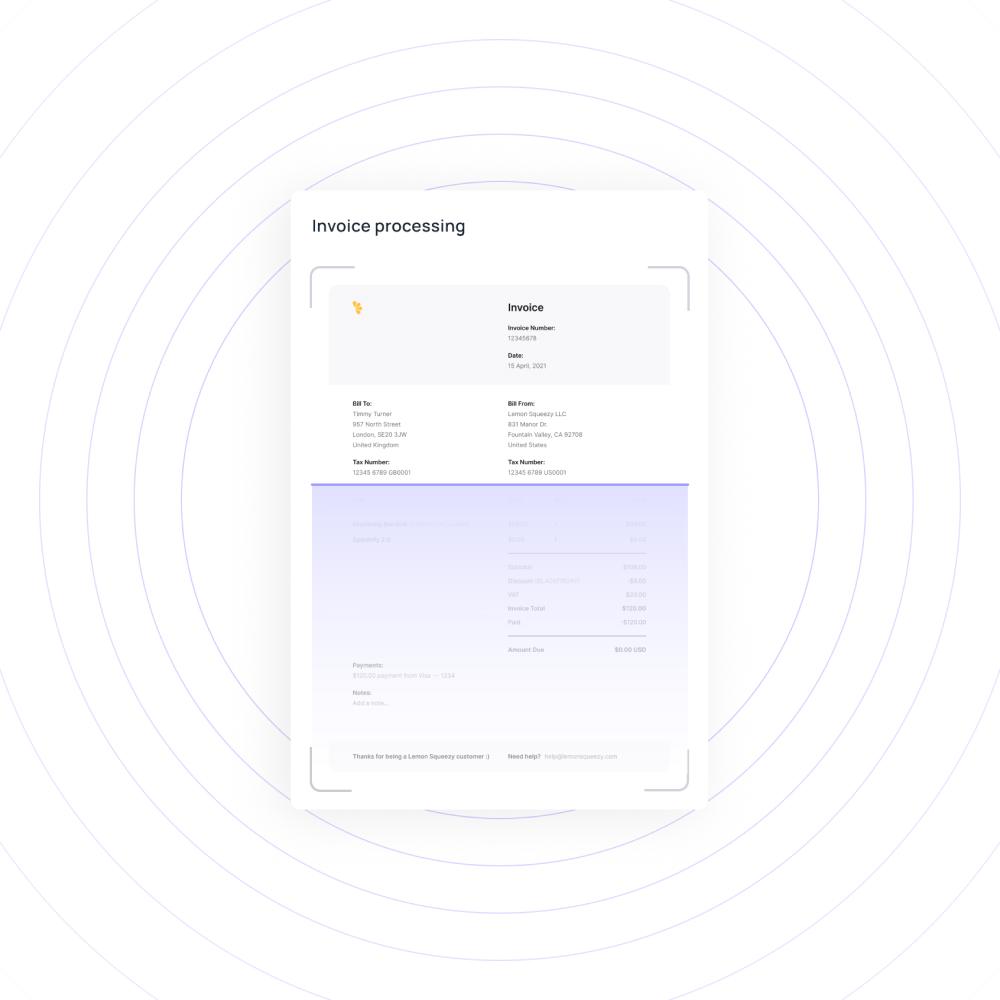

Setting up invoice scanning

Receiving invoices from the vendor is the first step in invoice processing. You can automate this process in three ways to reduce the manual work of filling this into the ERP. As a rule, invoices are sent in papers through the mail. In this scenario, data capture software like a scanner or OCR (optical character recognition) can help you convert this into an electronic format. If the invoice from the biller is already in electronic form, then we can move to the next step.

Invoice matching

Approvers will always be busy and will not have time to verify if the invoice is from the right biller or not. Before processing, an invoice has to be verified and matched with the order placed to avoid predicaments like double payment or to send payment to the wrong account, late payment, etc.

Your invoice processing software can read and verify the invoice with the PO (Purchase order) and receipt based on the preset rules. This way, the AP can also identify a duplicate invoice and prevent double payment. It also matches the vendor information with the vendor management data available in the bill pay software.

Schedule payment

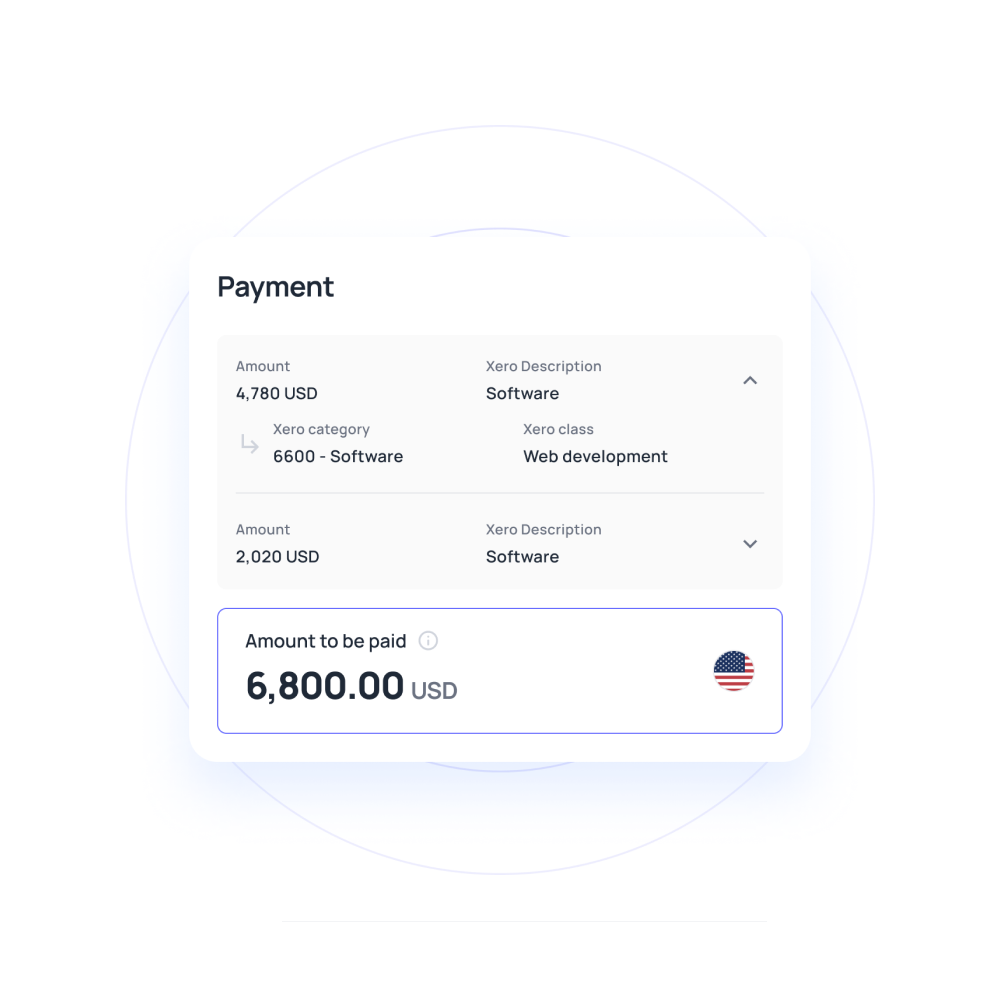

Bill pay software lets you schedule the payment by drawing payment information from the invoice or the vendor data already available. Bill pay solutions like Volopay also allow companies to forward bulk invoices to create payments and get them ready for approval.

Approval workflows

As discussed, the accounts payable team is responsible for customizing the workflows for different payers. Once the invoice is matched and payment information is entered, it goes to the primary and secondary approvers based on the workflows assigned. Traditionally, one has to walk to the approver's desk to get this done. But with the help of the automatic payment system, you can do it from anywhere.

On-time bill payment

Once approved, the payment is scheduled on its respective date and time. And the remittance is paid on-time status, which you can track on the bill payment system. That is how the bill pay process has been automated from one end to another.

You can also check out our blog for a detailed step-by-step guide on how to automate bill payment and streamline your payment processes.

Automate your bill payment process today

How does automated bill payment work

These are the steps involved in automated bill payment:

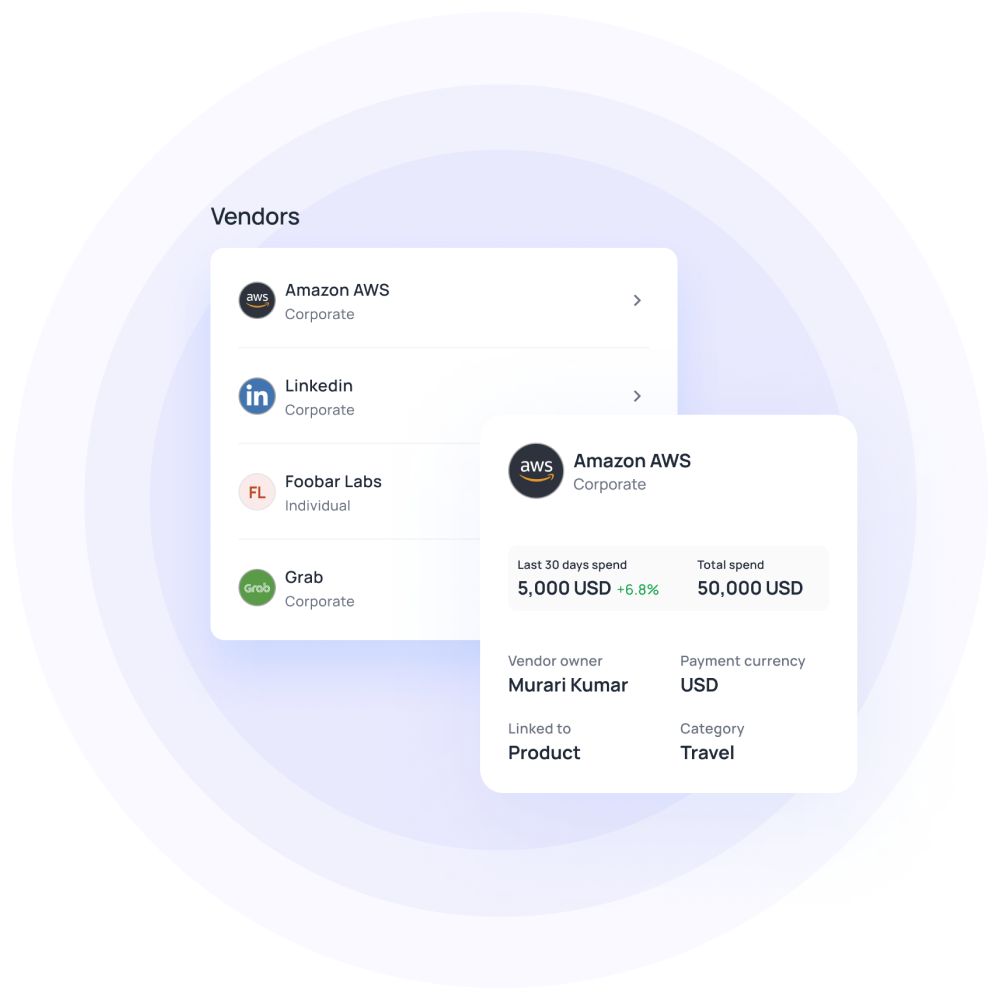

1. You onboard a new vendor into the bill payment system after purchasing goods/services from them. Here you will add specifics like currency, account information, and contact details.

2. The accountant who receives the invoice from the vendor uploads it into the bill pay software.

3. Every detail of the invoice is entered in the automatic bill payment system, and thus a bill is created.

4. With the bill, on the one hand, the accountant tries to pull up the vendor information they uploaded already. Once found, it gets mapped with the bill and gears towards payment processing.

5. Now it’s the approvers’ turn to get it to the next stage. They can see who the vendor is, which department is related to this expense, mode of payment, etc.

6. Once they approve the bill, it goes to the ‘scheduled’ tab and waits until the processing time and date.

7. Once the bill is processed and payment is withdrawn from the business account, it gets synced with the accounting software.

8. A notification gets triggered to the accounting department, vendor, and the system admin to notify the transaction status. And that’s the end of the bill payment process.

Bill pay checklist to automate your payment system

Here are some of the factors you should consider before setting up your automatic bill payment system for your company.

The importance of security cannot be stressed enough. You are not just dealing with your money here but your vendors’ information also. Using a password-protected, two-level authentication system in cloud applications isn’t enough. Your bill pay system should have robust and bank-level encryption technologies and safeguard your privacy as well as your vendors’.

The accounting team spends 40% of its time only on manual tasks. Integrations are necessary to bring it down, as it will auto-sync the data from one system to another. Apart from accounts payable, they use other accounting software like Quickbooks to manage overall accounting. If your bill pay system is compatible enough to work along with this software, you are free from manually tracking and entering them.

Wouldn’t it be great if you could do everything from invoice uploading to payment processing in one portal? It simplifies your bill payment process and also gives you a peek into overall activities. It would be a nightmare for any accountant to see multiple applications scattered all over for different stages of this work. Pay attention to the features that come along with your bill pay application.

Not all the vendors would be up with receiving payments in a modernized way. As a buyer, you should give them the privilege of choosing their own payment mode. It can be through cards or ACH or account transfer or even check; your bill pay system should let you pick an option you want.

Application updates and downtime can be expected. But it shouldn’t affect your accounting operations in any way. Fintech companies are constantly on the lookout for new innovative features for their products. This backend update can cause running updates that may or may not hinder the performance of the bill pay software. But these will be of little effect when you use modern bill pay solutions that employ cloud solutions.

There will be more moments when the bill pay admin or the user wants expert assistance. Not getting help on time can be unfavorable to your business and delay basic functionalities. So, it becomes crucial to go for bill pay software that offers exceptional customer service. Here at Volopay, you will be accommodated with dedicated account managers who will work with you and assist in any issue thenceforth.

Benefits of setting up automated bill payment process for your business

Time-saving

A smart, automated bill pay system can save the precious time wasted on going through a bunch of invoices and running to different desks for approval. It’s the modern way of communicating with different teams involved in invoice processing and bill generation. This clear, automated communication, in turn, quickens the work, and there is no typing distress too.

Improved vendor relationships

The importance of vendors in business continuity and development is innumerable. You can sustain this relationship by paying them on time and sending friendly reminders. Timely attention to payment matters will make your vendors work with you for a long time and fetch you great references. When you have ample vendors, it is quite a task to follow up with them and maintain a good rapport. But your bill pay software can do that for you.

Saves money

An automated payment system saves money in two ways. You will never pay your bills beyond their due date. So there won’t be any late payment charges. Additionally, you can utilize the early bird offers your vendor might provide for making early payments.

Strict adherence to compliance

Dealing with sensitive and confidential information can put pressure on the accounting team to ensure security and compliance. Automatic bill pay systems ensure compliance and confidentiality. This software exhibits risk-based control measures that make sure your information is safe and secure within the system.

Ability to pay in different currencies

When your organization is spread globally, the foremost concern would be to do business in their currency without holding an account there. Bill pay software eases off this situation and hands over control to you by allowing you to hold accounts in different currencies.

Paperless

As an ethical and responsible business owner, it becomes a liability to do one’s part in saving the environment. If every company starts avoiding paper invoices and manual bill processing, we can prevent an ample amount of waste from going into landfills. Automated bill pay promotes this by transferring the whole bill processing to digital format, leaving no space for manual paperwork.

No room for error

A small mistake in an account number can send the payment to a completely different person. Computing errors can happen in many other ways too. These errors can sabotage your relationship with vendors and make you look unprofessional. An automatic bill payment system leaves no room for even minute errors and is 100% accurate if the data fed into that is.

Benefit your business from automatic bill payments

How can Volopay help your business automate bill payments?

One of the most productive and structured modules of Volopay’s spend management suite is Bill pay. Through this, you can automate the bill payments process no matter how complex and cumbersome it is. It facilitates both local and international payments and has a well-organized vendor management system, too, where you can upload your vendor data.

Our goal is to avoid using multiple bank accounts, credit cards, accounts payable software, etc. Hence we have designed a simple unified platform where you can process, track and automate bill payments on the go.

Now you can process international payments at unbeatably low FX prices. Low foreign transaction fees are excellent for companies that expand their customers and employees all over. You will face zero trouble in syncing the data from Volopay to other software as it effortlessly integrates with different accounting systems.

Volopay simplifies the bill payment process by efficiently automating the complex parts like sluggish approval processes, invoice data uploading, invoice-vendor mapping, etc.

Typical bill pay process vs. automated bill pay with Volopay

A typical bill payment process.

1. Buyer purchases goods from the vendor and receives invoice at the month-end

2. The accountant from the buyer side receives this invoice and uploads it in the accounts payable portal of her company. The invoice copy is added to the company’s filing system.

3. Now the accounts team should get this invoice approved. They either walk into the approver’s office and get it signed or send a formal email and wait for their approval.

4. Once approved, it gets forwarded to the team that handles the company’s finance.

How Volopay’s bill pay process works

Uploading invoice data

If your accounting software is synced with Volopay already, you can initiate invoice processing right away through auto-capture or you can forward the invoice to Volopay’s team, who will upload and create the bill for you.

Approval and payment

Per custom workflow, the created bill goes from one approver to another. Once approved, it waits in the scheduled payments queue till its due date. You can customize the approval workflow process by adding multiple approvers to your approval step.

Creating vendor

With a few clicks, you can create a vendor and add their information into the vendor management column of the bill pay module. It requires their contact and bank account information and once added, you will never repeat typing them. Additionally, auto-categorization of vendors and invoices will help you stay organized.

Bill creation

The data from the invoice like vendor name, mode of payment, and amount to be paid gets extracted for bill generation. Here is the place where invoice verification also happens. Once verified, it tries to match the vendor data with the invoice and creates a bill in the system.

Related pages

Check out our comprehensive guide on online bill payment for businesses and streamline your financial processes effortlessly.

Confused about invoices, purchase orders, receipts, and bills? Check out our blog to understand how each document plays a role in your business's financial processes.

Discover how an automated billing system simplifies SaaS payments. Check out our blog to learn its features, benefits, and importance.

FAQs

Any kind of supplier or contractor payment invoice is acceptable if it has the necessary information like invoice number, vendor’s name, why they are charging, the total amount due, issued date, and due date.

It is possible to edit the bill anytime after the data is entered into the automated payment system before its approval.

Volopay doesn’t have any limitation on the number of bills that get created and processed. Depending on the size of your business, you can make as many as needed and process it.

Yes. It is possible to schedule bill payments in an automated payment system way ahead of time. You can choose the payment date and time and schedule it till the due date.

Auto bill pay feature refers to the facility in the Automatic bill payment system when you set up a payment that will repeat itself automatically on the preset duration between a specific frequency.

Get Volopay for your business

Get started now