Embrace automation with Volopay's accounting automation software

From swiping cards to closing books, Volopay's accounting integrations and automation are poised to revolutionize your financial workflow. Gone are the days of manual entry, reshuffling, and cumbersome tasks.

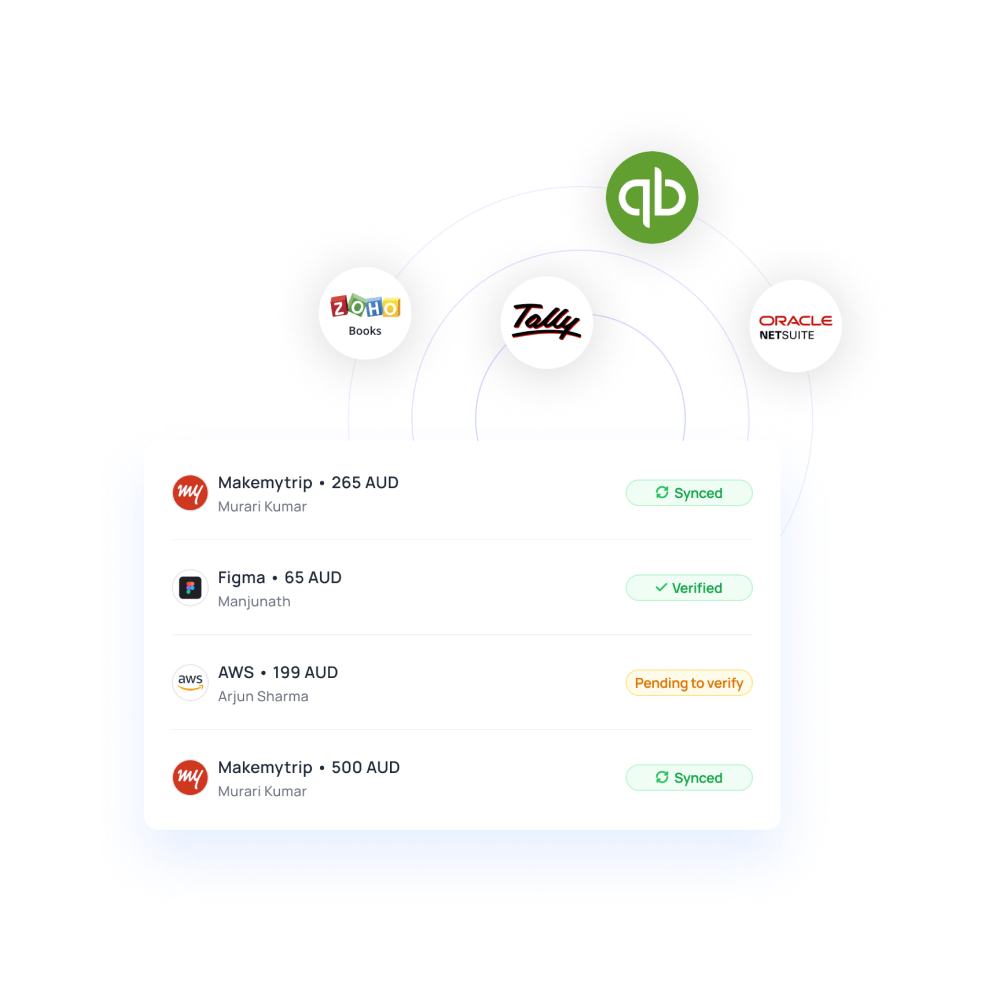

Now, sync and reconcile expenses in real-time with top accounting software instantly.

Customized controls for unique requirements

Volopay offers adaptable integration with your preferred software, ensuring compatibility with existing systems. Tailor integration rules to suit unique needs and requirements.

Experience uninterrupted Bill Pay operations with continuous and normal sync capabilities, ensuring real-time data updates for smooth financial management.

With Volopay, adaptability, customization, and reliability come together to streamline your workflow.

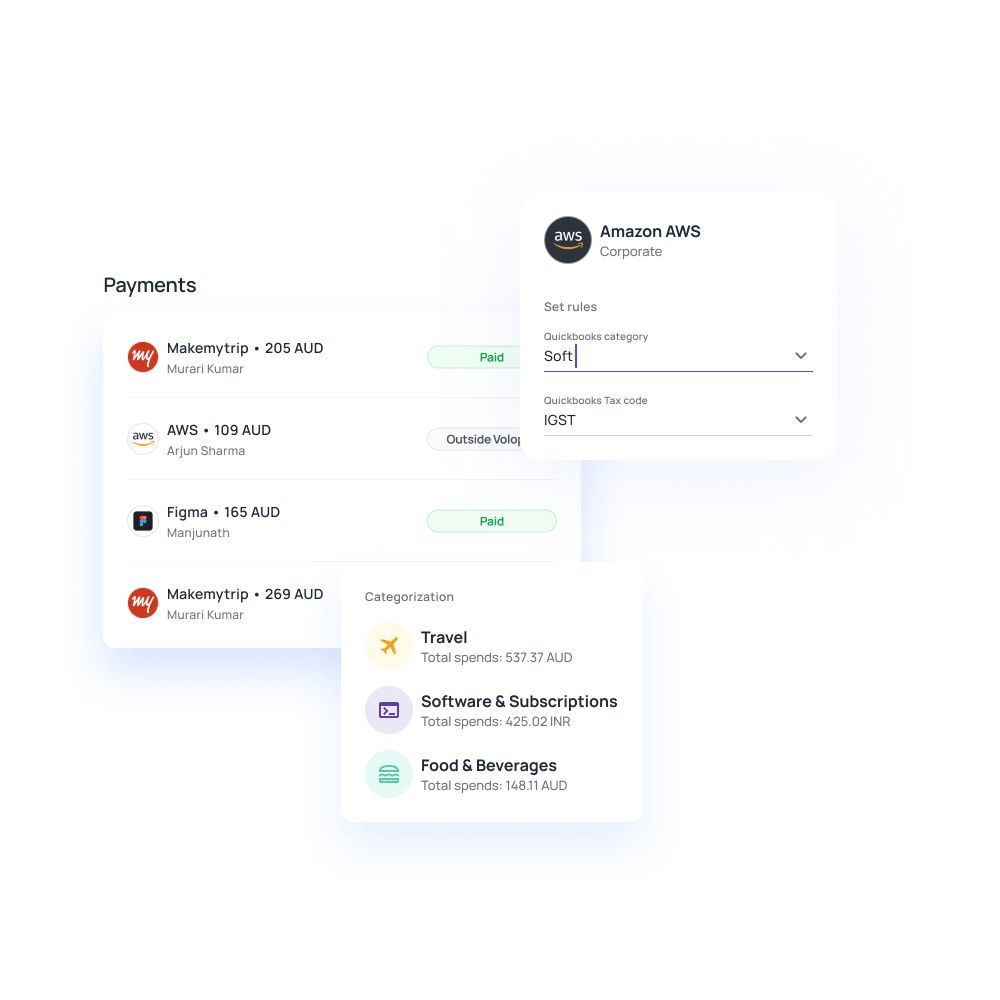

Smart categorization of expenses

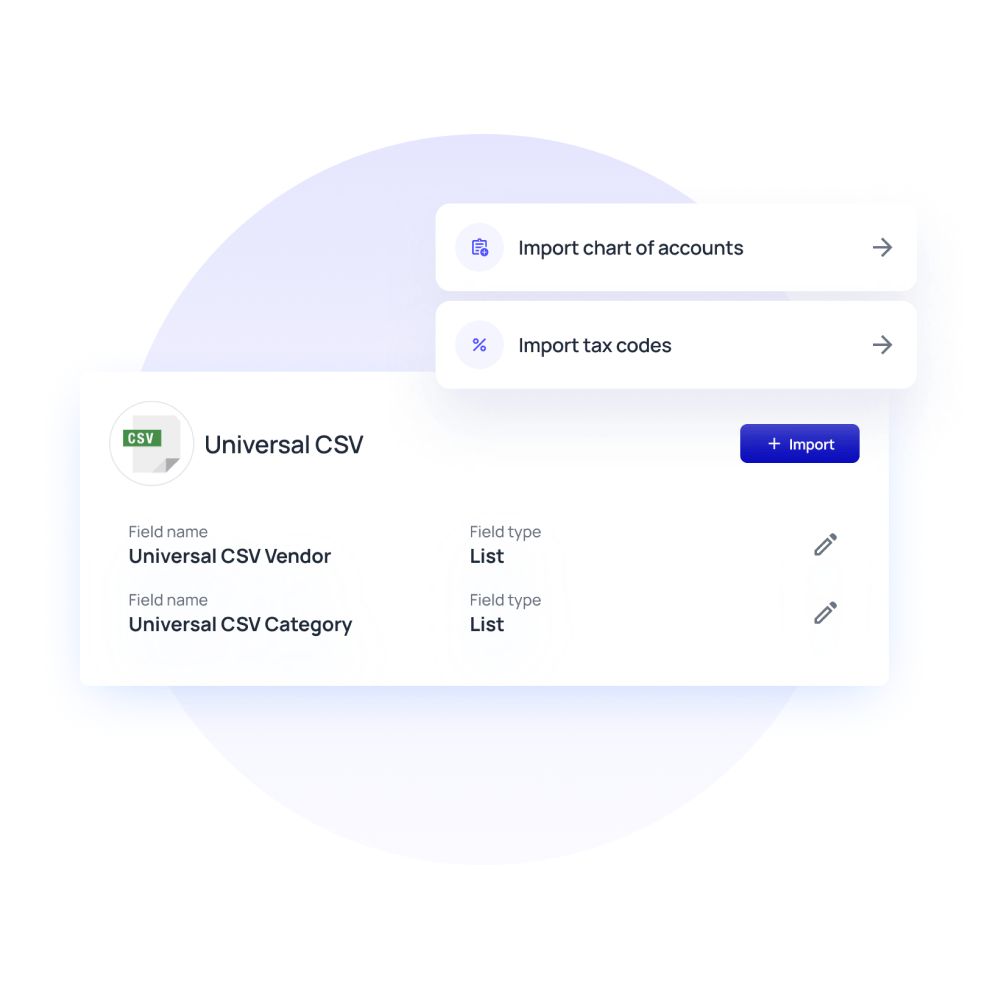

Empower users to create specific and advanced rules that automatically kick in when a transaction is being accounted for.

Users can also create custom fields to align with their accounting software's requirements and use the Universal CSV feature to integrate accounting data with software of their choice in a flash.

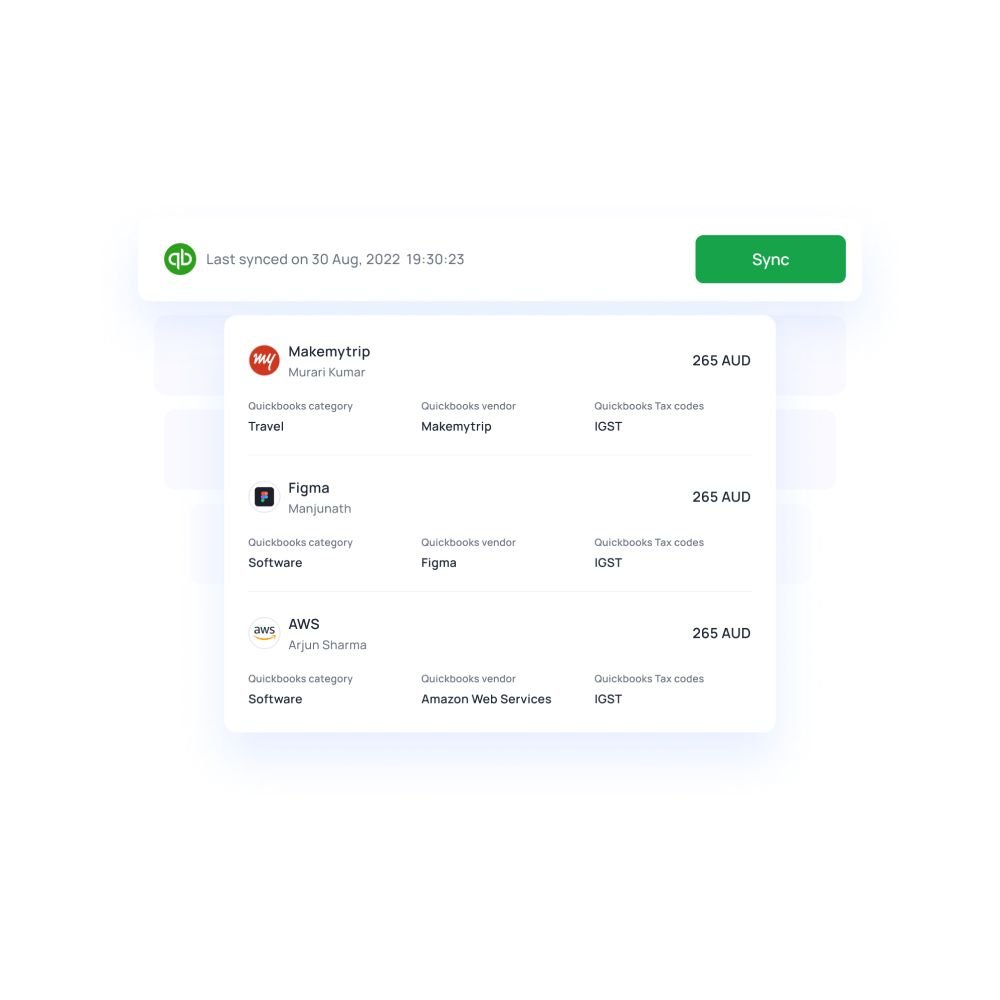

Synchronized updates across platforms

Ensure financial data stays up-to-date across all platforms. All bill payment transactions are synced with accounting software as soon as bills are generated.

Easily track changes with the sync history feature, providing valuable insights into transaction updates over time.

Plus, direct links to synced transactions offer quick access to detailed information whenever you need it.

Simplified reconciliation to close books faster

Volopay offers a seamless experience, ensuring transparent tracking by syncing transfer fees directly with bill payments. Users can sync card transactions for expense reports as well. Moreover, you get unparalleled efficiency with continuous syncing for bill payments, as transactions are automatically synced with accounting software upon bill generation, eliminating manual effort.

With Volopay, you can bid farewell to manual tasks, and welcome the benefits of intuitive automation and seamless integrations, freeing up valuable time to focus on strategic initiatives.

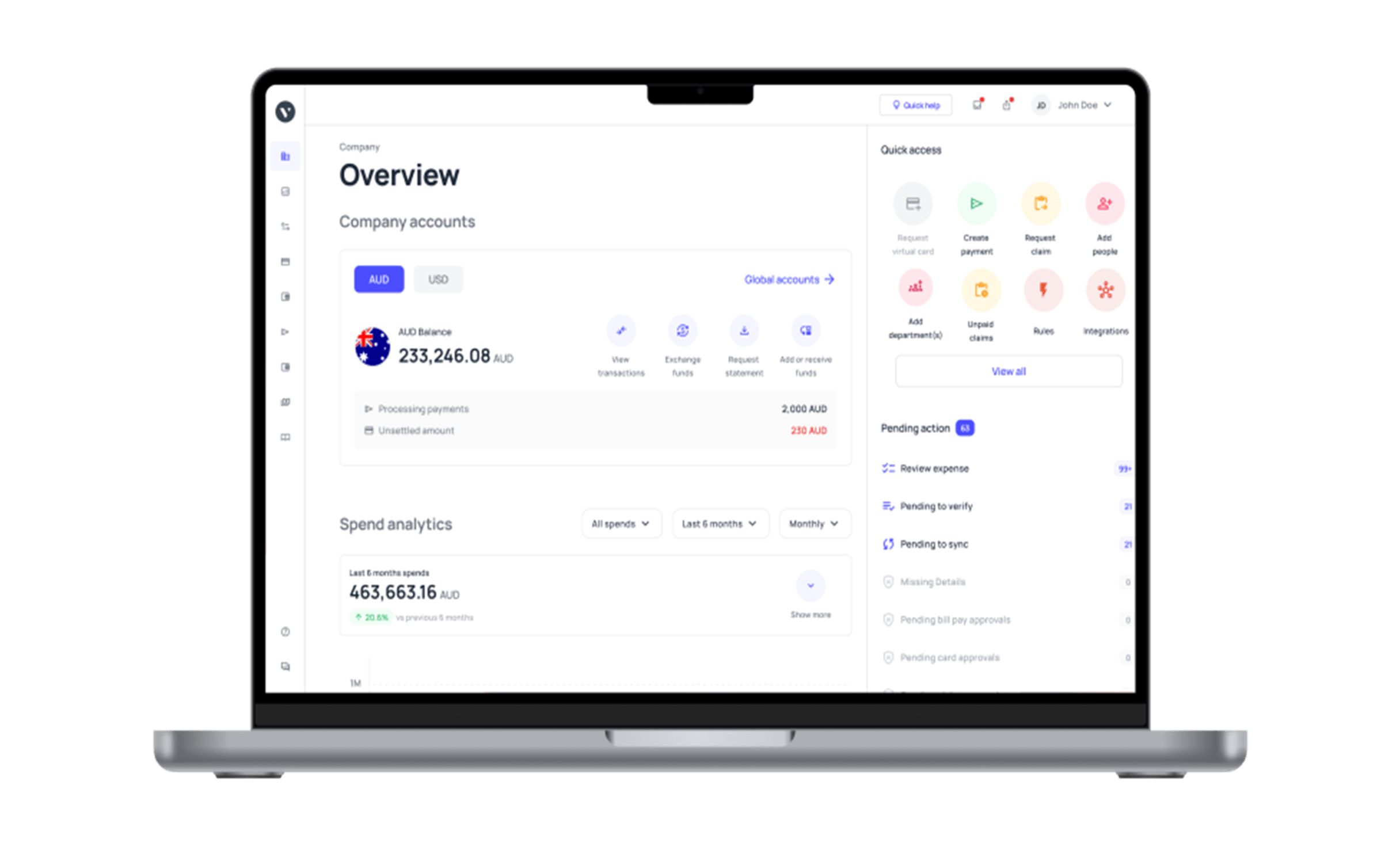

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Approvals, bill payments, reimbursements, corporate cards, and accounting automation - Volopay has it all on a single platform. It’s a one-stop-shop for all your expense management needs.

Corporate cards

Reimbursements shouldn’t be a headache. Instead of constantly dealing with the influx of expense reports, you can equip your team with corporate cards. Usable like a regular card, they can be used for offline payments and carried with team members wherever required. Built-in controls, approval tiers, and instant reporting ensure that nothing flies under the radar.

Virtual cards

All the benefits of a physical card without the hassle of an offline tool. Virtual Cards are secure and allow you to make innumerable online purchases. SaaS subscriptions, one-time gift cards, allowances - generate unlimited cards with set budgets and expiration dates. Empower every employee and make company funds accessible to the right people.

Vendor payouts

Manage vendors across the globe with the help of a seamless accounts payable dashboard. Establish multi-currency wallets to make payments in different countries, as well as speedy local payments.

The FX rates and remittance fees Volopay offers are competitive, with some of the lowest rates in the market. Quit wasting time and bucks on wiring money across the globe.

Bring Volopay to your business

Get started now

FAQs on accounting automation

Yes, you can use accounting automation software like Volopay to fully automate your accounting system, accounts payables, and accounts receivables included. On Volopay, for example, from the point where you receive an invoice, a payment, or when you make a transaction to the actual bookkeeping process, the end-to-end process of accounting can be automated.

Volopay helps with making accounting more efficient by automating most processes that require time and labor. With the primary dashboard, you have the ability to access ledgers and expense reports immediately, and transactions are all recorded in real-time.

Additionally, all line-item data has information attached to it that is relevant to that transaction (like invoices, receipts, and statements).

Yes, it can. Any accounting integration you activate allows data to be synced in a two-way manner. This means that your accounting system gets updated with changes made in your expense management system - but any changes made in the accounting system also get updated in the expense management system.

We strictly follow all international and local standards of data protection. Our systems and fund-storage mechanisms meet ASIC standards of security. All information is stored on the cloud and can only be accessed through the dashboard.

You can also add an extra layer of security by giving permissions only to specific users to be able to access certain data.

Yes, certainly. When a bill is created on Volopay, you can add the invoice associated with it. The details are filled in automatically, and the bill is then part of the automation cycle. As and when it’s paid, receipts get attached to it as do the transaction details.

If you choose to set up accounting triggers, the tax codes and reconciliation information also gets automatically added to it and it syncs with your accounting software. The entire process can be automated end-to-end.

The accounting automation software can definitely manage multi-currency transactions. Whether that’s an international transfer or the use of one of your multi-currency wallets, all the information is converted into data that the accounting software can process with ease.

Using accounting automation software like Volopay, you can pretty much automate any accounting function you want. Processes like invoice management, reimbursements, expense reconciliation, accounts payables, accounts receivable, accounting integration, and bookkeeping or book closing process can all be done via Volopay.

Accurate data, enhanced data security, improved KPIs, no human mistake, quicker systems, real-time updates and reporting, simple integrations, cloud storage, increased productivity, are some of the many pros to using automated accounting.

The automated accounting system uses software to collect, process, and analyze financial data without human intervention. This system can be implemented by using automated accounting software (e.g. Volopay, Divipay etc.). When equipped with the right software, businesses can automate their entire accounting system.