7 best accounting software for SaaS companies - Volopay's choice

In the context of Software as a Service (SaaS) companies, accounting plays a pivotal role in ensuring success. Choosing the right accounting software for SaaS companies is crucial, particularly in Australia where the SaaS industry is flourishing.

The ideal software offers extensive bookkeeping features and seamless integration with other business tools, enabling SaaS enterprises to streamline their financial operations and maintain precise record-keeping.

Nonetheless, the abundance of options available can make the task of finding the best accounting software for SaaS companies in Australia a daunting one.

Benefits of using an accounting software

Automate processes

Accounting software streamlines and automates various processes such as generating invoices, managing billing, and handling payments. It eliminates the need for manual data entry and reduces the chances of errors, saving valuable time and effort for SaaS businesses.

Automation ensures timely and accurate financial transactions, enhancing efficiency and productivity.

Financial transactions

Accounting software for SaaS companies enables SaaS companies to track and record their financial transactions in a centralized system. It provides a comprehensive view of income and expenses, allowing businesses to monitor cash flow, identify trends, and make informed financial decisions.

With real-time data, companies can quickly assess their financial health and adjust their strategies accordingly.

Prepare financial statements

The best accounting software for SaaS companies simplifies the process of preparing financial statements, such as income statements, balance sheets, and cash flow statements.

It automatically generates these reports based on the recorded transactions, eliminating the need for manual calculations. This not only saves time but also ensures accuracy and compliance with accounting standards.

Tax filing

Accounting software can significantly ease the burden of tax filing for SaaS companies. It tracks and categorizes expenses, calculates tax obligations, and generates relevant reports for tax purposes.

With built-in tax features and integration with tax filing systems, the software streamlines the tax filing process, reducing the likelihood of errors and ensuring compliance with tax regulations.

Organize records

Maintaining organized and easily accessible financial records is essential for SaaS companies. Accounting software provides a centralized platform to store and organize financial data, including invoices, receipts, and bank statements.

This allows businesses to retrieve and review records efficiently, facilitating audits, financial analysis, and decision-making processes.

7 best accounting software for SaaS companies

1. Volopay

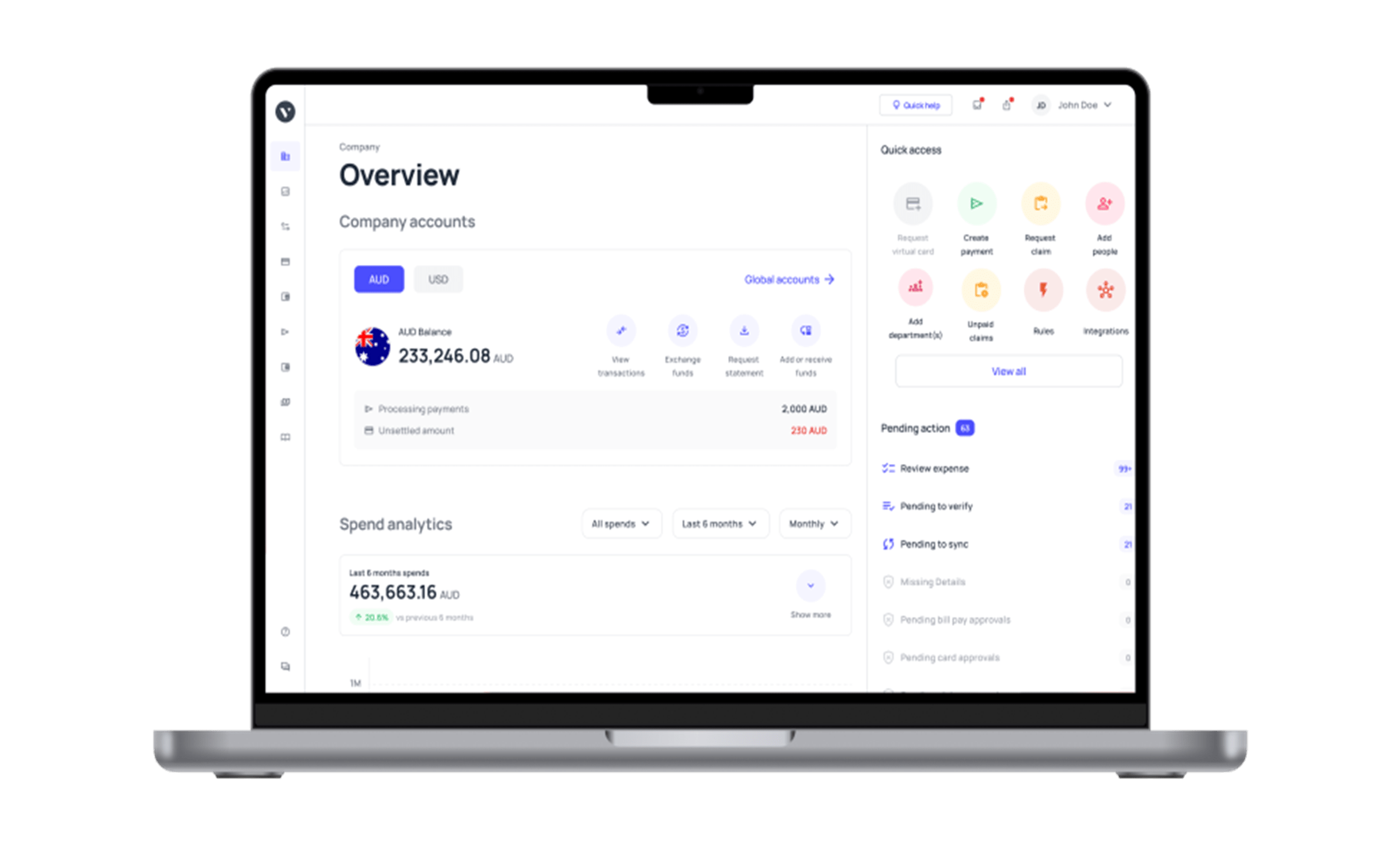

Volopay is definitely one of the best accounting software for SaaS companies. The platform offers a unique combination of expense management, corporate cards, and accounting functionalities within a unified platform.

By integrating physical and virtual corporate cards with the accounting system, Volopay simplifies expense tracking, enabling real-time monitoring and categorization of expenses. This streamlined process facilitates the reconciliation process.

Volopay also provides additional features such as automated invoice creation, reimbursement management, and seamless integration with popular accounting platforms like QuickBooks and Xero. Its emphasis on expense management and accounting integration makes Volopay an invaluable all-in-one solution for SaaS companies.

2. QuickBooks

QuickBooks is a popular accounting software widely used by SaaS companies due to its comprehensive features and user-friendly interface. It offers a range of functionalities including invoicing, expense tracking, financial reporting, and tax management.

QuickBooks also integrates seamlessly with other business tools, such as payment processors and CRM systems, making it a convenient choice for SaaS companies. Additionally, it provides multi-user access, allowing collaboration among team members and accountants.

With its robust capabilities and scalability, QuickBooks is a reliable choice of accounting software for saas companies of all sizes.

3. Xero

Xero is another top accounting software that caters to the needs of SaaS companies. It offers a cloud-based platform with a wide array of features, including invoicing, bank reconciliation, expense tracking, and project accounting.

Xero stands out for its strong focus on automation and integration. It can automatically import bank transactions, reconcile accounts, and generate financial reports. Integration with third-party apps enables seamless management of CRM, payroll, and inventory.

Xero's intuitive interface and user-friendly design make it a popular choice among SaaS companies looking for efficient and flexible accounting software.

4. FreshBooks

FreshBooks is an accounting software known for its user-friendly interface and robust features. It offers invoicing, time tracking, expense management, and project accounting capabilities tailored to the needs of service-based businesses, including SaaS companies.

FreshBooks' invoicing features allow for professional and customizable invoice creation, automated payment reminders, and online payment acceptance. The time tracking functionality enables accurate billing based on hours worked.

Additionally, FreshBooks provides financial reporting and integration with popular payment gateways and CRM systems. With its simplicity and functionality, FreshBooks is an ideal choice for SaaS companies focused on service-oriented invoicing and project accounting.

5. Sage

Sage is a comprehensive accounting software that meets the needs of businesses across various sectors, including SaaS companies. It offers a diverse set of features encompassing accounts payable and receivable management, budgeting, financial reporting, and inventory management.

Sage's robust capabilities are particularly well-suited for SaaS companies with intricate financial requirements. The software provides advanced analytics and forecasting tools, empowering businesses to gain valuable insights into their financial performance and make well-informed decisions based on data.

Sage also extends support for multi-currency transactions and incorporates tax management features, catering to the needs of SaaS companies operating on a global scale.

With its extensive functionality and ability to scale, Sage stands as a dependable choice for SaaS companies seeking a comprehensive accounting solution.

6. Zoho Books

Zoho Books is an accounting software for saas companies offering features such as invoicing, expense tracking, bank reconciliation, and financial reporting. What sets Zoho Books apart is its seamless integration capabilities with other Zoho applications, such as CRM, project management, and inventory management.

This integration facilitates a smooth flow of data, eliminating the need for manual data entry. Moreover, Zoho Books supports multiple currencies and provides tax management functionalities, making it well-suited for SaaS companies operating on an international scale.

Zoho Books presents itself as a highly attractive option as accounting software for saas companies.

7. Maxio

Maxio is an accounting software specifically designed for SaaS and subscription-based businesses. It offers features such as recurring billing, revenue recognition, customer management, and financial reporting.

Maxio provides a comprehensive view of revenue and subscription metrics, allowing SaaS companies to effectively manage their recurring revenue streams. The software supports complex revenue recognition rules and offers robust reporting capabilities tailored to subscription-based businesses.

Maxio's focus on revenue management and subscription analytics makes it a valuable tool for SaaS companies seeking specialized accounting software.

What are the features to look for in accounting software?

1. Integration capabilities

The best accounting software for SaaS companies is ideally one that offers seamless integration with third-party applications and systems. This includes integration with payment gateways, CRM platforms, project management tools, and other business software.

Integration eliminates manual data entry, enhances data accuracy, and enables streamlined workflows across different departments.

2. Scalability

Choose accounting software that can accommodate the growth of your SaaS company. It should have the flexibility to handle increasing transaction volumes, support multiple users, and adapt to evolving business needs. Scalable software ensures that you can efficiently manage your financial operations as your SaaS business expands.

3. Automated invoicing

Automation of invoicing processes saves time and reduces errors. Look for software that allows you to generate and send invoices automatically based on predefined rules and templates.

Automated invoicing streamlines the billing process and ensures prompt payments from customers.

4. Subscription management

For SaaS companies, effective management of subscriptions is vital. Seek software that enables you to easily track and manage recurring subscriptions, including billing cycles, renewals, and upgrades or downgrades.

A comprehensive subscription management feature ensures accurate revenue recognition and facilitates customer relationship management.

5. Revenue recognition

Revenue recognition is critical for SaaS companies with subscription-based business models. The accounting software should support automated revenue recognition based on revenue recognition standards (such as ASC 606 or IFRS 15).

It should enable you to accurately track and recognize revenue over the subscription lifecycle, ensuring compliance and providing transparent financial reporting.

6. Compliance and security

The accounting software should comply with relevant accounting standards and regulatory requirements. Look for software that offers built-in compliance features, such as tax management tools, automated tax calculations, and support for tax filing.

Additionally, prioritize security features like data encryption, user access controls, and regular data backups to protect your financial information.

7. Inventory management

If your SaaS company deals with physical products or digital goods, consider accounting software with inventory management capabilities. It should enable you to track and manage inventory levels, monitor costs, and streamline order fulfillment processes.

8. Real-time analytics

Real-time analytics provides valuable insights into your financial performance. Look for accounting software for SaaS companies that offers dashboards and reporting features with up-to-date data. Real-time analytics empowers you to make data-driven decisions, identify trends, and proactively address financial issues.

Volopay - all-in-one solution for SaaS companies

Volopay is an all-in-one solution that is perfectly suited for SaaS companies, providing a comprehensive set of features that align with their unique accounting needs. This platform combines expense management, corporate cards, and accounting functionalities into a single, easy-to-use, integrated platform.

Volopay addresses the accounting requirements of SaaS businesses by streamlining expense tracking and reconciliation processes. It offers virtual and physical corporate cards that are directly linked to the accounting software for SaaS companies. This integration enables real-time monitoring and categorization of expenses, simplifying the reconciliation process and ensuring accurate record-keeping.

In addition to expense management, Volopay provides automated invoice creation, reimbursement management, and integration with popular accounting platforms such as QuickBooks and Xero. These features help SaaS businesses streamline their financial operations and improve efficiency.