9 best business debit cards in Australia - Top picks for 2025

In the era of digital payments, it’s no surprise that many businesses can benefit from using the best business debit card in Australia. While what is best for your business may differ from other businesses depending on your needs and requirements, you’ll still want a business debit card that can help you separate business expenses from your personal finances.

Manage your business finances and track your spending easily with one of the best business debit card providers in the country.

What is a business debit card?

At its core, a business debit card does the same thing that personal debit cards do. It allows you to make payments in-store and online, as well as withdraw money from an ATM. Even the best business debit card will function similarly to a personal debit card.

However, a debit card for business offers some extra features that you may not get with its personal counterpart. From higher daily transaction limits to built-in control functions on your card management dashboard, you’ll get what you need to manage business expenses.

9 best business debit cards in Australia in 2025

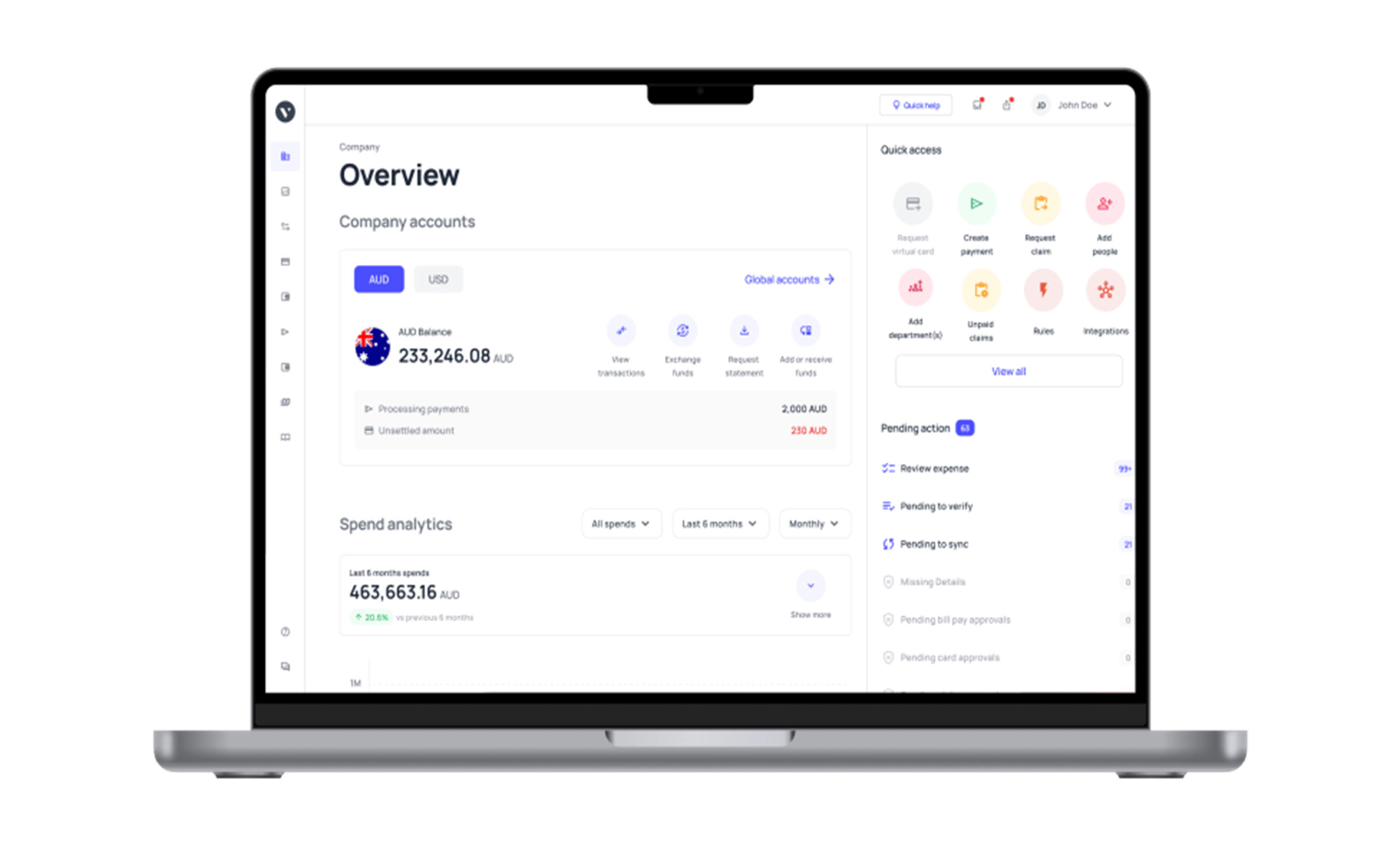

1. Volopay Cards

● Overview

As an all-in-one solution for your business finances, Volopay offers business prepaid cards that you can issue to each employee to make expenses conveniently and in a controlled manner.

● Key features of the card

What makes Volopay the best business debit card provider is that every card you issue can be directly linked to your dashboard. All transactions are automatically recorded in real-time and can be synced with your accounting software.

● Pros and cons

Not many other card providers offer multiple business debit cards per account. With Volopay, you won’t have to worry about card sharing. The one downside of Volopay is that there isn’t a physical bank branch, so digital literacy is crucial to managing your Volopay cards.

● Review

A modern fintech solution that is user-friendly with intuitive business debit card features for your company. Assigning a card to each employee can be invaluable.

● Target customer

Businesses registered as companies in Australia can leverage Volopay business debit cards. Startups and SMEs that are looking for modern ways to manage business expenses will find that Volopay cards suit them well.

2. Revolut Corporate Cards

● Overview

Revolut Corporate Cards give businesses a convenient way to handle business expenses, offering flexibility and efficiency in managing the financial aspects of their operations. They enable multi-currency transactions with enhanced security and easy integration with company tools that modern enterprises seek.

● Key features of the card

Businesses can hold and payout in 25+ currencies without the necessity of several accounts. Both physical and virtual cards are available, with a limit of 200 virtual cards per employee. Financial efficiency and control are enhanced through expense management tools, accounting integrations, and anti-fraud security features.

● Pros and cons

Revolut Corporate Cards enable global transactions and won't incur a foreign exchange cost. It offers a cost-effective solution, allowing the first physical card and unlimited virtual cards free of cost. However, a 2% fee is charged for each cash withdrawal, which can be detrimental if the business frequently needs cash.

● Review

Revolut Corporate Cards are a perfect solution for businesses that have travel-related expenses. They are efficient, given the multi-currency support and seamless integration capabilities, but before making a decision, users should bear in mind the withdrawal fees and limited support.

● Target customer

These cards are designed for SMEs and freelancers who conduct transactions around the world and need an efficient yet economical means of managing their expenses. The Revolut Corporate Cards are most suitable for a company prioritizing digitized solutions and seamless integration with the financial system.

3. Commonwealth Bank Business Visa Debit Card

● Overview

Use your Commonwealth Bank Business Visa Debit Card to make online purchases, pay your business bills, and more.

● Key features of the card

Your CommBank Business Visa Debit Card can be used in-store, online, and even over the phone through digital wallets. You can control spending through the CommBank app to set up your card as you see fit. Each authority who has access to your business account can be issued one card.

● Pros and cons

Getting a CommBank Business Visa Debit Card is free with your business bank account. You also get access to a variety of deals and discounts when you use CommBank’s best business debit card. However, you can’t earn points or participate in a rewards program with it.

● Review

CommBank customers are generally happy with how the banking services are hassle-free. It’s good for businesses looking for a card that is easy to use.

● Target customer

You’ll need an eligible Commonwealth Bank business account to get a business debit card with the bank. The bank account and debit card are suitable for sole traders, private companies, funds, and partnerships looking for a card with low fees.

4. Westpac Business One Debit Mastercard

● Overview

Any business operating in Australia, including sole traders and not-for-profit organizations, can take advantage of the Westpac Business One Debit Mastercard.

● Key features of the card

Your Westpac debit card can be used worldwide with all vendors that accept Mastercard. There are no annual card fees and you get the Westpac Fraud Money Back Guarantee on unauthorized transactions.

● Pros and cons

Get the flexibility of allowing employees to have full or limited access cards. While your Westpac debit card for business doesn’t have monthly fees, a 3% foreign transaction fee applies.

● Review

As a general review, the Westpac Business One Debit Mastercard can be the best business debit card for businesses who are looking for a bank account and debit card with no monthly fees.

● Target customer

The Westpac Business One Debit Mastercard is geared toward any business that is operating in Australia. Any sole trader or Westpac business customer can apply for a card online, meaning that it is easiest to get a card if your business fits the bill above.

5. NAB Business Visa Debit Card

● Overview

Your NAB Business Visa Debit Card can be used to make all kinds of business payments with ease—separating business expenses from personal ones.

● Key features of the card

You can view, track, and manage your cards and expenses using the NAB app at any time as long as you have internet access.

Easily integrate other systems such as your accounting software and add your debit card for business to your digital wallets.

● Pros and cons

As a Visa debit card, you get access to the Visa commercial offers and Visa Zero Liability features.

However, the NAB debit card delivery time is a little slower compared to other banks. It could take between 10 to 15 days before you can start using your card for all purchases.

● Review

As one of the most reputable banks in Australia, customers can trust the NAB Business Visa Debit Card. Overall, it offers great deals through its business partners and Visa.

● Target customer

The NAB Business Visa Debit Card is suited for businesses wanting an everyday account with a low monthly fee. It can be used by Australian sole traders, partnerships, and companies.

6. Bendigo Bank Business debit Mastercard

● Overview

Bendigo Bank Business Debit Mastercard offers business owners easy access to their funds, allowing them to handle their finances easily. The card provides easy cash access through a debit Mastercard, making payments efficient and seamless while monitoring spending.

● Key features of the card

The Bendigo Bank Business Debit Mastercard is integrated across multiple business accounts, offers unlimited free domestic transactions, and supports numerous cardholders at no extra charge. It provides 24/7 fraud monitoring, Mastercard Zero Liability, and supports Apple Pay and Google Pay™ for easy payments.

● Pros and cons

The Bendigo Bank Business Debit Mastercard has no monthly fee when combined with eligible accounts and it offers free local transactions by 'credit' or Tap & go™. However, this may not be ideal for businesses with frequent overseas transactions due to the overseas fees.

● Review

As an overview, the Bendigo Bank Business Debit Mastercard is a great product for businesses dealing with day-to-day expenses. It has perfect integration and security, but foreign exchange transaction fees may be a weakness for enterprises operating globally.

● Target customer

This card is suited to small and medium enterprises needing a low-cost banking option with simplified, secure expense management. It's highly beneficial for businesses that do the bulk of their business in Australia, with easy access to funds and minimal fees when packaged with eligible accounts.

7. ANZ Business Visa Debit Card

● Overview

The ANZ Business Visa Debit Card is a card that allows businesses to manage expenses effectively using their funds. It provides hassle-free payment access, with convenience and security for local and foreign transactions

● Key features of the card

This card enables worldwide payments wherever Visa is accepted, with ANZ Falcon™ fraud protection and Visa Zero Liability for added security. It allows for contactless payment via Apple Pay and Google Pay and integrates free of cost with eligible ANZ business accounts like Business Essentials and Business Advantage.

● Pros and cons

ANZ offers the card free of charge to qualified business accounts that are economically viable. It also has flexible payment options such as mobile and contactless payments providing convenience to the user. But, there can also be additional costs when making foreign transactions, affecting businesses with international transactions.

● Review

Generally, the ANZ Business Visa Debit Card is a good option for businesses because of its great security and simple expense management. However, companies that have a lot of overseas transactions must be conscious of foreign transaction fees.

● Target customers

This card is perfectly suitable for small to medium-sized businesses looking for a secure, low-cost banking solution. It is ideal for those businesses that operate primarily in Australia and require centralized control over their expenses along with modern payment features.

8. Bank of Melbourne Business Visa Debit Card

● Overview

The Bank of Melbourne Business Visa debit card allows businesses to access funds easily and transact within Australia and overseas. It integrates seamlessly with a variety of business accounts and issues multiple cards to employees, permitting the efficient and simple handling of business expenses.

● Key features of the card

Businesses can make payments anywhere in the world using their funds wherever Visa is accepted. Employee access can be issued up to eight cards. Benefits include Visa Secure for online purchase protection, Visa Offers + Perks, contactless payments, and no-fee ATM access at participating banks.

● Pros and cons

Bank of Melbourne Business Visa Debit Card provides wide ATM access with no operator fees, and there are also no annual fees on this card lowering operating expenses significantly. But, with each overseas ATM withdrawal, a $5 charge applies, which can add up if a business requires more than a few withdrawals in a month.

● Review

In the overall review, the Bank of Melbourne Business Visa Debit Card is a great option for businesses needing hassle-free expenditure control. Its dual card issue capability is helpful, though overseas transaction charges need to be weighed in the mix.

● Target customer

It is a solution aimed at SMEs looking for a cost-effective banking solution adaptable to global needs. It is well suited for companies that issue multiple cards to employees and require centralization of all expenses while doing business primarily inside Australia.

9. Airwallex International Business Debit Card

● Overview

The Airwallex International Business Debit Card enables seamless global transactions, allowing businesses to manage expenses efficiently across multiple currencies. With competitive exchange rates and no foreign transaction fees, it provides a cost-effective solution for international operations.

● Key features of the card

Companies can retain and spend in 60+ currencies directly from their Airwallex account. Both virtual and physical Visa debit cards are available. The card offers no foreign transaction fees, real-time spend tracking, and compatibility with digital wallets like Apple Pay and Google Pay.

● Pros and cons

Airwallex offers competitive exchange rates, supports transactions in 180+ countries, and charges no hidden fees while being highly secure. However, its online-only presence and lower physical card availability may not be suitable for companies that need face-to-face banking services.

● Review

Being a leading fintech product, the Airwallex International Business Debit Card provides businesses with a convenient way of managing international expenses. With competitive exchange rates and no foreign transaction fees, it is a simple choice for international transactions.

● Target customer

This card is ideal for SMEs, e-commerce businesses, and multinational companies managing cross-border transactions. Companies seeking a flexible, low-cost international payment solution will benefit most from its offerings.

Simplify business expenses with a debit card

What are the benefits of using a business debit card?

Considering that business debit cards are designed specifically for businesses, you’ll be able to see a lot of benefits by using them for your company spending.

Here are some reasons why you should use the best business debit card for your expenses.

1. Separation of personal and business expenses

Making business spending on your personal debit card will cause confusion over which expenses are made personally and which ones are made on behalf of your business. You’ll have a hard time sorting through these when it comes to expense and tax reporting.

By using the best business debit card, your business expenses will automatically be separated from your personal finances.

2. Expense tracking and budgeting

With all business expenses segregated and centralized on a debit card for business, tracking your funds is easier. You won’t have to manually list expenses anymore. Every transaction made on your debit card will be automatically tracked and recorded.

You’ll also be able to link your card with the appropriate business bank account and the right amount of company funds for more efficient budgeting.

3. Convenience and accessibility

The best business debit card will provide you with a convenient payment method. With most merchants accepting card payments, you won’t need to carry cash around anymore. All it takes is a swipe of your card.

Some providers may even allow you to assign one card to each employee to simplify payments further. No more card sharing—every employee can have their own card to make expenses!

4. No interest charges

Unlike a credit card, using a business debit card ensures that you won’t have to contend with interest charges. While credit may be helpful, you also have to consider how much interest charges will cost you.

With a debit card, you’ll only be able to spend as much money as you have in your bank account, but you can do so without worrying about interest.

5. No risk of debt accumulation

Similarly, business debit cards are also helpful in making sure that your business doesn’t go into debt. It keeps your spending under better control, as you can only access what is in your account.

Although some banks and financial institutions may have overdraft facilities, these are usually small enough that you won’t end up accumulating large amounts of debt.

6. Accessibility for employees

You could use a personal card for business expenses, but it would be under your name, which means you would have to authorize the payment. Employees will need to wait for you to initiate the transaction when they need something purchased.

With the best business debit card, however, you can curb card-sharing. You may even be able to issue a card for every employee.

7. Integration with accounting software

Business debit cards typically will come with card management dashboards that are accessible online to track your expenses. The great thing about platforms like these is that you’ll be able to integrate them with your accounting software.

As a result, you can say goodbye to manual data entry and reconciliation. All it takes are a few clicks to sync your card expense data.

8. Safer than cash

Carrying large sums of cash comes with huge risks. If your money gets stolen, you’ll have a difficult time getting it back or ensuring that it isn’t being spent inappropriately.

The best business debit card, however, will have better security features.

Not only is a plastic card easier to carry around discreetly but should your card get compromised, you’ll also be able to easily freeze or block it.

9. International transactions

The best business debit card providers will have a wide range of acceptance, both domestically and internationally. This means that doing business with foreign vendors and making expenses on international business trips are much simpler to do.

Some cards may also have multi-currency functionalities, meaning that you can easily buy different currencies to use your card with to avoid expensive exchange rates and fees.

What are the key features to look for in a business debit card?

1. Fees and charges

When researching a business debit card, make sure that you know exactly what fees and charges come with the card. The last thing that you want is to be blindsided with hidden fees.

Look for a provider that is open about all its fees. You also want a card that doesn’t cost you a lot of money.

2. Rewards and benefits

You can get additional benefits from some of the best business debit card providers. This could be in the form of cashback or rewards programs. Find out what different providers offer.

If you could get discounts for using a particular card, that’s also a feature you don’t want to overlook.

3. Account integration and management

One of the most important features that you should look for in a debit card for business is management capabilities. Automated expense tracking, for example, is key to your card usage.

You also want integrations with other important systems in your business, such as your accounting software or ERP.

4. Overdraft and credit options

It’s true that debit cards prevent you from accumulating credit card debt, but you still want options available to you in difficult situations.

Many banks and financial institutions now offer overdraft facilities, which could be invaluable for your business when you just need a bit more funds but are still waiting on customer payments.

5. Security measures

As with any other payment method, the best business debit card in Australia is one that has sufficient security measures. Make sure that your provider of choice has easily accessible freeze and block features.

You also want OTP authentication for online transactions, as well as two-factor authentication when you log into your card management system.

6. Flexibility and customization

Every business will have different needs even when they’re all using similar tools. The best business debit card for your company should allow you to customize it accordingly.

Starting from merchant category blocking to spending limits, you want to be able to adjust these features as needed. Expense reporting flexibility is also equally important.

7. Customer support and services

You want access to great customer support. Even if you run into issues with your card, you want to be able to contact a representative or account manager and get it sorted as soon as possible.

If you’re between two providers with similar features, the one with better customer service should be your choice.

What is the eligibility to get a business debit card in Australia?

While the exact eligibility criteria to get a business debit card in Australia will differ depending on the provider, there are some things that most if not all providers will require from any business.

For example, to have the best business debit card in Australia, your business needs to be operating in Australia. Even if your headquarters are overseas, you have to have a business entity in Australia that is attached to a valid Australian address. If you have no base of operation in Australia, you will not be able to get an Australian debit card for business.

The person applying for the debit card on behalf of the business, as well as all signatories, must also be over the age of 18 years old.

For a card to be legitimately registered under your business name, it must also be linked to a business bank account which you will draw your funds from. Following this reasoning, you must also have a business bank account.

What are the required documents for applying for business debit cards in Australia?

You’ll need to open a business bank account to apply for business debit cards. As a result, for most banks and financial institutions in Australia that offer business debit cards, you will be required to first provide the necessary documents for opening a business bank account.

Depending on what your business structure is, you may be required to submit different documents. As a general rule, however, you’ll need at least one of the following documents.

1. Proof of identity

Regardless of your business structure, you’ll have to provide some proof of identity. This could be your driver's license or passport.

Some institutions may also require further documentation, such as your proof of residency in Australia.

2. Customer ID

If you already have an eligible business bank account for your business debit card, you could also speed up the application process.

You’ll be required to provide your customer ID and prove that you have an account with the bank or financial institution.

3. Business licenses

You will also need to prove that you have a business that operates in Australia. Documents stating your Australian Business Number (ABN) or Australian Company Number (ACN) will be required. Companies will also have to provide their company registration documents.

Simplify your business spending

What are the factors to consider when choosing a business debit card?

Accessibility and convenience

Consider how easy it is to create and use a business debit card with your provider of choice. You’ll want to go with a provider that makes business debit cards easily accessible to you. Your cards should also have a high acceptance rate.

Integration capabilities

You’ll have plenty of other systems that you use for your business, such as your accounting software. To streamline the bookkeeping process, get the best business debit card to easily integrate with your accounting platform. It’s guaranteed to save you time.

Transaction limit

Depending on how big your business transactions are, you may have to carefully consider card transaction limits.

A card with a smaller daily limit will not suit you if you need to make a few big expenses on a particular day each month.

International transaction fee

A card provider may charge you a small fee when you use your business debit card for transactions in other countries and currencies.

Know what the fees are and look for cards that offer a low fee or no fees at all.

Security features

Having a card management dashboard is ideal for any debit card for business. It allows you to have easy access to the freeze and block functions.

You may also want to consider providers that offer merchant category blocking and additional control features.

Eligibility and requirements

Not every provider has the same requirements for business debit card eligibility. When you’re researching card providers, you want to consider what they require from a business.

Make sure that your business is meeting those requirements before you start your application.

Terms and conditions

The terms and conditions provided by a bank or financial institution regarding business debit cards should not be overlooked.

If there is anything in the terms that is a deal breaker to you, you must know about it before deciding to use the card.

Business needs and requirements

The best business debit card for you may differ from what it would be for a different business. Before you choose the card for you, make sure that you evaluate and understand your business needs and requirements. This helps in picking the right debit card.

Multi-currency support

If your employees go on a lot of business trips, the best business debit card for you is one that offers multi-currency support.

Instead of contending with international transaction fees and exchange rates, you’ll want to be able to hold money in multiple currencies.

Better customer support

Two providers can have identical robust card features on paper. But the reality is that you may run into issues with your card.

Look into customer testimonials or reviews and see which provider offers the best customer support experience.

All-in-one cards for your business — Volopay cards!

Get the best corporate card for your business with Volopay. Say goodbye to complex and tedious manual business expense management and replace cash in advance and reimbursements with convenient physical debit cards.

With Volopay, each employee can have their own debit card. Instead of passing around the director’s personal debit card, every card will be directly linked to your business bank account. No more card sharing is necessary when trying to take care of business expenses!

You can set up easily customizable spending controls and limits for each card you issue. Give any card its own budget. Once the threshold has been reached, the cardholder won’t be able to spend any more on their debit card for business until the budget refreshes.

You’ll feel secure in equipping your team with cards from one of the best business debit card providers in Australia. Every transaction made on any card will be automatically recorded on your Volopay dashboard in real-time. With simplified expense reporting features, you’re guaranteed to accurately know how your company funds are being spent.

Use your Volopay cards for local and international business transactions with ease. Employees can add their cards to Apple Pay or Google Pay for even better convenience!

FAQs on business debit cards

Put simply, it is a debit card designed specifically for business expenses. It keeps your company funds and spending entirely separate from your personal finances.

Yes. Using a business debit card helps you separate personal expenses from business spending and streamlines your expense management.

Yes. You can get Volopay prepaid cards when you have a Volopay account. These will be directly linked to your account for your convenience.

You’ll have to create a Volopay account to start using our cards. The application process can be done fully online. Get started through our website.

One thing that sets Volopay apart from other debit card providers is that you can issue multiple cards even with just a single business bank account.

Every employee can get one business debit card. Even better, each card will be directly linked to your card management dashboard. Track and manage all expenses in no time!

It takes less than a week before you can start using your Volopay cards. After the onboarding process has been completed, you can immediately order your cards. Activation is simple and can be done as soon as you receive them.

Yes. Volopay is an all-in-one solution that allows you to manage all company expenses on a single platform, which includes your card expenses. Execute, track, and manage cards, vendor payouts, payroll, reimbursements, and more with Volopay. Direct sync and integration capabilities with accounting software will further streamline your finance processes.