Best fuel cards for businesses in Australia - Top picks for 2025

Businesses, especially logistics, commercial fleets, distributors, and retail service providers, are directly affected by the increasing expenses of fuel. The challenges revolving around fuel expenses are not declining anytime soon. It is because more and more vehicles are being purchased.

Almost all businesses require fuel-powered vehicles to conduct daily operations smoothly. It’s no surprise that many want the best business fuel card Australia has to offer. Those in the logistics, transport, or retail industries may traditionally benefit the most, but there’s no denying that a fuel card for business can make a difference to businesses of all sizes and sectors. .

Vehicles demand fuel to run, and the increased demand for fuel is directly proportional to the increased fuel price.

However, businesses are making efforts to cope with this challenge. This article contains the best fuel cards for small businesses to help them manage their fuel expenses efficiently.

What is a fuel card?

A fuel card functions similarly to a credit card. It makes the payment process simpler for businesses purchasing fuels like petrol, diesel, or gasoline. It also allows businesses to keep track of the money spent on fuel.

Fuel cards for small businesses are a good investment. Just like a business credit card, fuel cards are linked with an account. The charge is deducted from the user’s bank account whenever the fuel card is swiped for making a fuel-related payment.

With the best fuel cards for small businesses, there is no requirement to preserve fuel receipts for tally purposes. Companies can have a single tax statement with all the purchase records and items.

Types of fuel cards

1. Business fuel cards

Several different cards can fall under the business fuel cards categories. Though primarily used to describe cards specifically designed for fuel expenses made by businesses, there are some business credit cards that also serve a similar purpose and can get small businesses fuel rebates.

2. Fleet fuel cards

Fleet fuel cards are not that different from business fuel cards.

However, consistent with its name, fleet fuel cards also target large-scale operations with a fleet of hundreds or thousands of vehicles. These cards are typically used by businesses that refuel thousands of liters each month.

3. All-brand fuel cards

As the name suggests, an all-brand fuel card for business can be used at most if not all fuel station brands across Australia.

While these cards make it easy to refuel anywhere, they typically have a higher monthly fee and fewer deals.

4. Single-brand fuel cards

A single-brand fuel card is designed for one fuel station brand. Shell cards or BP fuel cards are good examples of this type of card in Australia.

Some of these cards may be usable in other fuel stations, but there will be a surcharge.

5. Brand-specific fuel cards

Similar to single-brand business fuel cards, Australia also has brand-specific cards. These are attached to the particular brand in the card name and likely can only be used at those brands. As a trade, businesses can get better deals with them.

How do fuel cards work?

The fuel cards Australia has to offer function similarly to credit cards. When a fuel card is swiped at a fuel station, the total of the transaction is charged to the card.

Rather than directly pulling funds from the cards, however, fuel cards are linked to a bank account or credit card, which will be charged the total monthly bill at the end of the billing period, just like a credit card.

The biggest difference between a fuel card and a credit card is that fuel cards are designed specifically for fuel and vehicle-related purchases. Companies looking to control fuel usage better may want to use the best business fuel card Australia has to offer.

7 best fuel cards for small businesses in Australia

1. Fleet cards

● Standout features

Given the popularity of Fleet cards in Australia, the name is almost synonymous with fuel cards. Some people even use fleet and fuel cards interchangeably, but the name-brand Fleet cards are premium fuel cards Australia businesses can use across the country. Unlike single-brand fuel cards, Fleet cards can be used at almost all fuel stations.

What sets Fleet apart is that businesses only need one card for all business vehicle-related expenses. These cards can be used not only for refueling but also for oil changes and vehicle repairs. They are well-suited for companies with larger fleets that want to centralize their vehicle expenses.

● Fees

Fleet card fee details can be gained by speaking to a sales representative and opening an account, which can be done for free.

● Pros

1. Fleet cards are a good premium option for businesses looking to easily refuel and take care of vehicle expenses from anywhere.

2. Businesses with large fleets can take advantage of the volume-based discounts for cost efficiency.

3. It’s easy to customize and manage Fleet cards according to the company’s business needs.

● Cons

1. Because it’s not brand-specific, businesses get fewer fixed deals on fuel with Fleet cards. Those with smaller fleets may not benefit.

2. Replacing a Fleet card is expensive, costing AUD 15 per replacement card.

3. While there’s a Fleet card mobile app, its only use is to locate fuel stations. They are not made to manage cards.

2. Shell card

● Standout features

Shell cards are some of the most accessible fuel cards Australia has for new businesses. This is because there is no requirement for how long the business has been registered and active. Anyone who has an ABN can apply for Shell cards and save money at Shell fuel stations.

As a popular fuel brand, businesses won’t have difficulties finding Shell stations to refuel at. Using a Shell card at any Shell fuel station nets businesses a fixed discount of 2 cents/liter for regular fuel and 4 cents/liter for premium fuel. Filling up fuel at Shell Coles Express also helps businesses earn Flybuys points.

● Fees

There’s no joining fee, but each Shell card that a business uses has a monthly fee of AUD 2.50/month.

● Pros

1. New businesses can benefit from Shell cards without a wait time.

2. Get access to the Shell Card Portal to view and manage all the Shell business fuel cards. Australia businesses can order and cancel cards, streamline GST, access transaction reports, and more.

3. Get Shell fuel discounts and earn Flybuys points by using this card.

● Cons

1. Though Shell is widely available in Australia, keep in mind that Shell fuel card users are limited to Shell stations and must work around that.

2. Businesses cannot make manual payments for Shell cards, as Shell only takes bank account or credit card direct debit.

3. New businesses with no credit history get shorter credit terms.

3. WEX Motorpass

● Standout features

If a Fleet card does not do it for businesses looking for multi-brand fuel cards, they may want to look at the WEX Motorpass fuel card for business. Businesses that operate in sectors such as plumbing, electricity, repair, and other sectors with a good number of tradespeople will be able to really benefit from the WEX Motorpass.

When a tradesperson is on the road and going from one job to the other, it’s easiest to refuel at whatever the closest fuel station is. The WEX Motorpass’ ability to refuel at any station helps to ensure that a tradesperson’s daily work goes smoothly.

● Fees

WEX Motorpass’ monthly fee starts at AUD 5/card for 1-5 cards, but the fee per card goes down when businesses get more cards.

● Pros

1. The WEX Motorpass is a flexible premium card that can be used Australia-wide.

2. Card users get a fixed 1-cent/liter discount at all stations that accept WEX Motorpass except for LPG.

3. Customize which WEX Motorpass card type to give drivers, such as a fuel-and-oil-only card or one that allows drivers to buy food and drinks.

● Cons

1. Each new card costs businesses AUD 8.80.

2. A 1.5% surcharge is applied to all Coles Express purchases.

3. There are a number of negative reviews of WEX Motorpass that are unhappy with their customer support team, so make sure to look into it closely when considering this fuel card.

4. AmpolCard

● Standout features

An AmpolCard is a good choice as the best fuel card for small business. Australia has around 1,900 Ampol fuel stations across the country. Businesses that have a lot of operational vehicles that are constantly on the go will be able to rest easy knowing that they can refuel almost anywhere.

The benefit of the AmpolCard being a brand-specific card, unlike the Fleet card or WEX Motorpoass, is that businesses get fixed discounts at Ampol stations.

It’s also a good card for transport and logistics businesses as it offers discounts for some other items purchased at Ampol stations, such as engine oils.

● Fees

AmpolCard charges a fee of AUD 2.95 per month for each vehicle that is registered to and carries a fuel card with the brand.

● Pros

1. Get a fixed discount of 2 cents/liter on regular fuels and 4 cents/liter on premium fuels at Ampol stations across the country.

2. Businesses can save even more money by linking their Everyday Rewards account and gaining points while swiping the AmpolCard to refuel.

3. AmpolCard seamlessly integrates with Xero and MYOB, two popular accounting software providers.

● Cons

1. AmpolCard offers some extra services and programs, but their fees can add up for businesses with a large fleet.

2. While Ampol stations can be found Australia-wide, businesses looking to be able to use a fuel card to refuel anywhere may want to look at an all-brand fuel card for business instead.

5. 7-Eleven Card

● Standout features

The 7-Eleven fuel cards Australia has to offer, often called 7-Eleven Fuel Passes, are great for businesses on a budget.

Not only do they have low fees, they are also highly customizable. When getting a card, businesses can decide whether they want a card that is registered to the driver and vehicle, just the driver, or just the vehicle.

Businesses can set up their 7-Eleven cards to include other purchases at 7-Eleven stations, such as oils, car wash, and convenience store items. The ability to customize as needed comes in handy for businesses that want to assign different card usage on different occasions.

● Fees

The 7-Eleven card, also known as the 7-Eleven Fuel Pass, starts at AUD 2.50 per month/card. There are no transaction fees when swiping the card.

● Pros

1. Businesses can get up to 44 payment-free days, though payments are actually due 14 days after the billing statement.

2. Get a minimum ongoing discount of 2 cents/liter at 7-Eleven stations.

3. Each card can be customized according to the business needs and driver requirements before drivers start using it for purchases.

● Cons

1. There are less than 1,000 7-Eleven locations where the card can be used, making the 7-Eleven card’s coverage often limited.

2. Businesses using the 7-Eleven card should note that there are high fees for payments other than with direct debit.

3. Currently, there are no rewards programs associated with this fuel card.

6. BP Plus fuel card

● Standout features

One advantage to using the BP Plus fuel card for business fuel expenses is that businesses can take advantage of the card to earn Qantas Rewards points. Businesses that engage in a lot of travel will highly benefit from this.

However, the points system isn’t the only thing that the BP Plus fuel card offers. As discounts with this card ramp up according to the fuel transaction volume of an organization, those looking to scale may find this card attractive.

Its BP Plus mobile app is also a standout that helps businesses do a number of things, including send receipts and locate fuel stations.

● Fees

If businesses get three or more cards, each card starts at AUD 2.20 per month or AUD 26.40 per annum.

● Pros

1. When paired with the BP Plus mobile app, managing vehicle expenses with the BP Plus card is simple and seamless.

2. If a business is registered with the Qantas Business Rewards program, it can use the BP Plus fuel card to earn rewards with Qantas.

3. Get direct accounting integration with Xero.

● Cons

1. BP Plus fuel cards can be expensive for very small businesses, as each card costs AUD 4.95 if a business has 2 or fewer cards.

2. Although there are around 1,400 BP stations across Australia, not all BP locations support the BP Plus app, which is this card’s standout feature.

7. Pumacard

● Standout features

For businesses operating in Queensland or West Australia, the Pumacard is a solid option. Although Puma has over 400 stations nationwide, the bulk of them are in the aforementioned states and best suited for businesses in those regions.

The good news is that when drivers are traveling to places outside of the Puma coverage, the card can be used at WEX Motorpass partner locations with a transaction surcharge. Businesses who frequent Puma stations get the best of both worlds with easy payments and discounts at those stations while still being able to use them elsewhere whenever needed.

● Fees

Pumacards cost AUD 2.50 per card/month, with additional fees such as an AUD 3.85 paper statement fee for each statement.

● Pros

1. While the Pumacard is an open-loop card and is accepted at other stations for a fee, businesses who want to limit drivers to just Puma merchants can use the Pumacard Direct card.

2. Get discounts and deals with other affiliated merchants for parking, accommodation, repair, tires, taxis, and other purchases.

● Cons

1. With only over 400 stations, Pumacards have a more limited coverage, unless businesses are willing to shell extra money to cover the transaction surcharge fee at non-Puma stations.

2. There are no fixed discounts. Fuel discounts are tailored based on a business’ agreements with Puma depending on the fuel volume per month.

Get the perfect fuel card for your small business

Benefits of fuel cards for small businesses

1. Detailed reporting

It’s no secret that expense reports are tedious and burdensome. Due to the amount of labor that goes into expense reporting, employees may be reluctant to do detailed reports in a timely manner.

With fuel cards, however, transactions will be automatically recorded in real time. Employees will just have to fill out preset fields to complete their fuel expense reports. This also aids the company in streamlining the process by ensuring all necessary details are filled in.

2. Reduced admin costs

Eliminating manual data entry for fuel card transaction records also reduces admin costs. Businesses won’t have to spend long hours on fuel transaction reporting and manually recording expenses.

A faster process turnover time also means that the organization needs less administrative labor. This will cut down the amount of money businesses have to spend on compensating and training employees, especially because fuel cards are not too difficult to use.

3. Easily accessible locations

Many fuel stations in Australia accept at least one fuel card. These cards are easy to use and the locations where they can be used are relatively accessible.

Most companies will not have to go out of their way just to get to a fuel station that will accept fuel cards, especially because that will defeat the purpose of the cards. Aimed to streamline fuel expenses, these cards can be used all over Australia.

4. Protection against fraud

Every transaction gets automatically logged and businesses will get better visibility over their expenses.

If anyone is attempting fraud or lying about fuel card usage, the finance team can immediately spot it and put an end to it.

Unlike corporate cards or prepaid cards, a fuel card for business is also only usable for the purpose of buying fuel. Deliberate card misuse is less likely to occur.

5. Monitoring fuel usage

When all refuel transactions are charged to fuel cards, Australia businesses can easily monitor their fuel usage thanks to their automated transaction updates.

Not only that, but companies can also limit how much is spent on fuel per week.

Any oddity in fuel usage, such as fuel running out in a day or two before another fuel card transaction, will be noted by the finance team and can be addressed accordingly.

6. Efficient expense management

Equipping every employee who needs it with fuel cards is a surefire way to streamline expense management.

Instead of having to manually track how much each employee has spent on fuel, the finance and management teams can simply take a look at the dashboard.

Each individual card can be given its own limit, allowing organizations to manage role-specific expenses with ease, too. Viewing, tracking, and controlling fuel expenses is more efficient with a fuel card for business.

7. Simplified accounting

One huge benefit of using the fuel cards Australia has for businesses is that many card providers offer accounting integration capabilities.

Rather than having to perform manual data entry and stress over bookkeeping, the finance team can directly sync transaction data.

All fuel card purchases are automatically logged. Reconciliation can happen on just a single platform. When paired with the direct sync, accounting records are guaranteed to have improved accuracy with less hassle.

8. Enhanced financial oversight

The first step to maintaining a business’s financial health is by getting a better overview of it. The features that a fuel card for business has are guaranteed to help businesses enhance their visibility over spending.

A stronger financial oversight will lead to more control. Businesses can track their fuel spending patterns accordingly and prevent overspending by setting appropriate spend limits.

Gain enhanced financial awareness and oversight with fuel cards.

Streamline transportation expenses with Volopay

Key considerations while choosing a fuel card for your business

1. Fuel station network

Not every fuel card for business can be used in all fuel stations in Australia.

It’s important to consider how big the card’s fuel station network is, as well as whether or not the stations that the business frequents are in the network.

2. Security measures

Make sure that whichever is the fuel card provider of choice has the necessary security measures to protect company funds.

Built-in spend control features, for example, can help limit monthly spending. Compromised fuel cards should also be easy to lock.

3. Fee structure

The best business fuel card Australia has to offer is likely not free. Make sure to research each fuel card provider’s fees.

These could be annual fees, new card fees, transaction fees, and more. Examine the fee structures in detail to avoid hidden fees.

4. Acceptance rate

The last thing any organization wants is to swipe a fuel card only to have it rejected by the system.

Look up customer testimonials to determine whether or not the best fuel card for small business Australia has to offer has a high acceptance rate.

5. Payment flexibility

As most fuel cards are post-paid and charged to the business monthly, it’s a good idea to look for a card provider with flexible payment options.

This could be alternative payment methods or even flexible and customizable payment dates.

6. Discounts and savings

Many fuel cards have deals that allow businesses to save some money at fuel stations.

In fact, using one of the many fuel cards Australia has can be better than paying in cash. See how much the business can save in fuel card discounts.

7. Reporting capabilities

Businesses want fuel cards to streamline their operations, whether that is on-field or for reporting purposes. For this reason, it is crucial to look at a fuel card’s reporting capabilities.

Automated reporting makes it easier for the finance team and other employees.

8. Interest-free periods

Get a fuel card for business that has a sufficient interest-free period for payments.

Some fuel cards may only give businesses a week or two to make payments before they start charging interest fees, though others may have longer periods.

9. Loyalty programs

Some of the best business fuel cards Australia has to offer have loyalty programs that help businesses save even more money.

By spending a certain amount or making a certain number of transactions per month, for example, businesses can get cashback on their fuel cards.

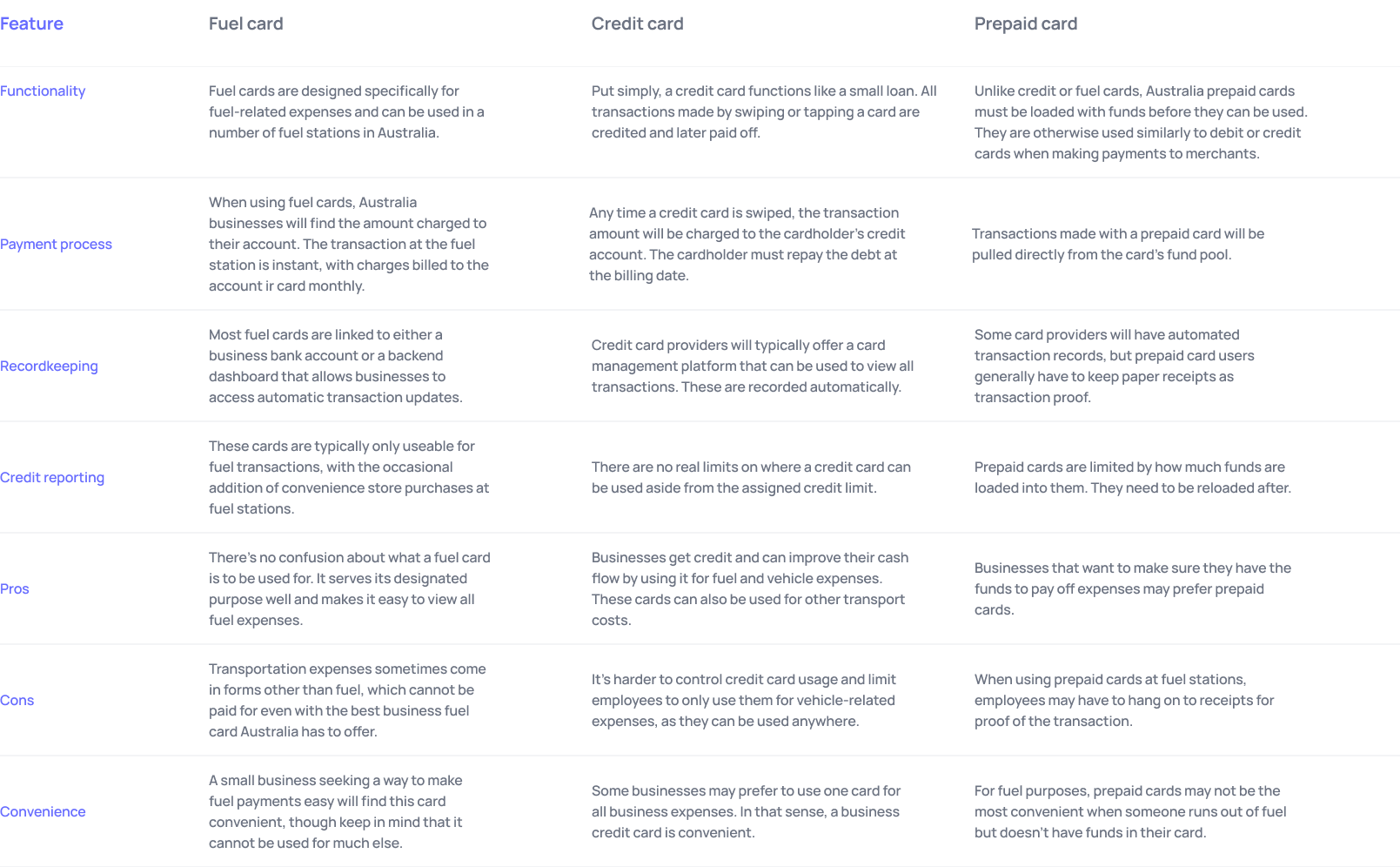

Fuel card vs credit card vs prepaid card

At a glance, fuel cards, credit cards, and prepaid cards can serve the same purpose when it comes to making fuel and vehicle-related purchases.

However, there are some key differences between all three. Businesses may compare and contrast them to decide which is the best for them to use.

Simplified transportation expense management with Volopay

Managing transportation expenses across multiple platforms and cards can be cumbersome. Hence, to simplify your expense management we recommend Volopay, which offers an all-inclusive solution on a single platform. Experience the convenience of streamlined transportation expense tracking and management with Volopay and its unique features.

1. Simplified expense management

There’s no need to spread yourself thin and juggle multiple platforms to make and manage expenses. Using Volopay allows your team to centralize all finances, making them easily accessible and even simpler to maintain.

Get Volopay corporate cards and use them to make all transportation and vehicle-related expenses.

Every single transaction will be automatically recorded. Should the system flag one as non-compliant, it will be forwarded for further review.

2. Enhanced control

Get a range of spend control features with your Volopay account. You can use Volopay to set and enforce budgets within the organization with ease.

By assigning a budget for transportation-related expenses and applying customizable spend limits to each Volopay card you generate, employees are bound to spend according to company policies.

Use Volopay cards as a controllable alternative to the business fuel cards Australia has to offer.

3. Tailored expense allocation

Each Volopay card can be loaded with any amount you decide it should have.

Easily customize budgets through the dashboard and assign individual card limits before you issue them to employees. Allocate the fuel budget accordingly and set it to automatically refresh each month.

Enforcing budget compliance and making sure you have controlled spending doesn’t have to be complicated with Volopay.

4. Real-time tracking

Every transaction made through the Volopay platform will be automatically recorded in real time, regardless of where these transactions occur. So long as transportation expenses are paid with a Volopay card, the finance team can get access to powerful real-time tracking.

Know exactly when, where, and how your fuel budgets are used at all times. All this information is effortlessly available in just a few clicks!

5. Comprehensive reporting

It’s not just automatic real-time transaction updates that you get with Volopay. As an all-in-one finance management solution, Volopay has robust expense reporting and automated approval workflow features.

Employees will be automatically notified of and asked to fill out missing expense report details once transaction records have been updated, which they can easily complete before the reports are routed for approval.

6. Convenient payments

Employees don’t need to worry about how to make payments for transportation purposes when they have access to Volopay cards. Eliminate the need for complicated reimbursement processes and unsecured cash advances.

All your employees have to do is tap, swipe, or input their card data to make payments. It serves as more than just a fuel card for business—it also works for rideshares, taxis, and more.

7. Ultimate alternative

No more stressing out over managing and controlling your expenses—Volopay has you covered. With an all-in-one solution, you don’t have to worry about searching high and low for payment methods, receipts, and reports.

All that you need to manage your business expenses is at your fingertips. Unlike fuel cards, Australia businesses can make all expenses with Volopay, while maintaining each one is categorized automatically and accordingly.