Best prepaid travel cards to consider in Australia for 2026

In 2026, navigating international transactions has become easier than ever before, thanks to the emergence of the best prepaid travel cards tailored specifically for corporate travel needs.

These innovative financial tools offer a plethora of advantages, from seamless transactions and secure payments to favorable exchange rates and expense management features.

Whether your company seeks to streamline travel expenses, eliminate currency conversion hassles, or enhance financial control, knowing which business travel cards are best in Australia will help you in empowering your business to venture confidently into the global marketplace.

What are prepaid travel cards?

Before you can start using one you need to first acquaint yourself with what is a prepaid travel card first.

Prepaid travel cards for business are versatile financial instruments designed to simplify international travel expenses, function similarly to debit or credit cards, but with a key distinction: they are preloaded with a specific amount of money, usually in the currency of the destination country.

These cards offer convenience and security, as they can be used for purchases and ATM withdrawals abroad, sparing travelers from carrying large sums of cash. With the ability to lock in exchange rates before travel, prepaid cards also provide protection against fluctuating currency values.

Furthermore, some prepaid travel card Australia options offer additional features like expense tracking, reload options, and multi-currency functionality, making them indispensable tools for businesses and individuals seeking cost-effective and efficient solutions for their travel needs.

How do prepaid travel cards work?

Prepaid travel cards function as reloadable payment cards that are funded in advance. To get started, users must first obtain a prepaid travel card from a financial institution or service provider.

They can load the card with funds by transferring money from their bank account or through online platforms. The best prepaid travel card is typically available in different currencies, allowing users to select the currency of their choice or opt for a multi-currency card.

Once loaded, the prepaid travel card works similarly to a debit or credit card. Users can make purchases at point-of-sale terminals or online, and withdraw cash from ATMs worldwide.

The card is accepted wherever the payment network (e.g., Visa, Mastercard) is recognized.

When making transactions, the prepaid travel card deducts the appropriate amount from the available balance. If the card doesn't have sufficient funds in the transaction currency, it automatically converts the required amount using the prevailing exchange rate.

Some business travel cards also offer additional features such as mobile apps for managing funds, transaction notifications, and the ability to reload the card remotely.

5 Best prepaid travel cards in Australia

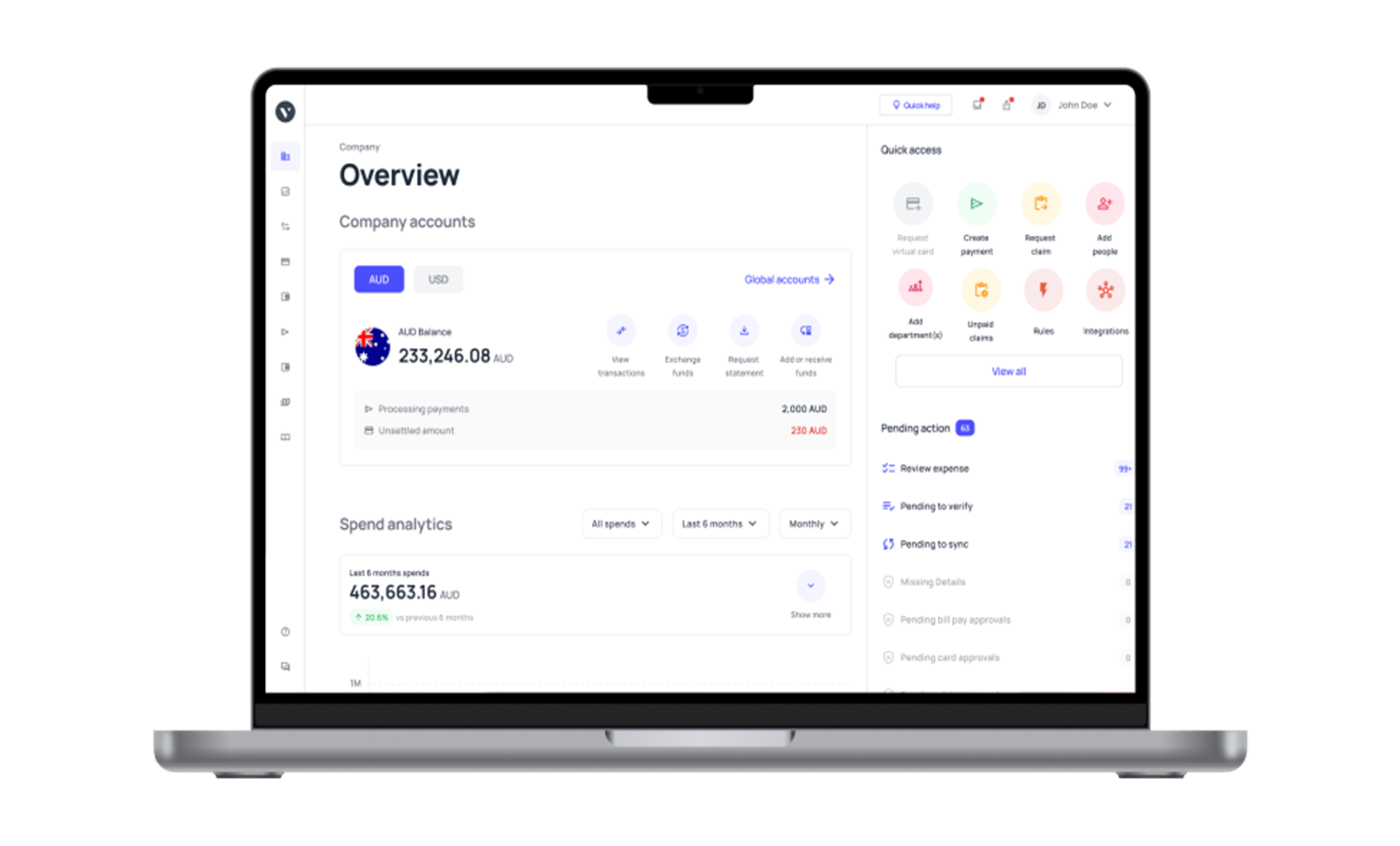

1. Volopay prepaid travel card

Volopay prepaid cards are one of the best prepaid travel card in Australia, these cards are specifically designed for businesses and offer comprehensive travel expense management solutions. This financial technology platform provides innovative corporate card solutions with integrated expense tracking and control features.

Features:

● Virtual card and physical corporate card for easy payment options. Unlimited virtual card generation at no additional cost.

● Real-time expense tracking and categorization.

● Automated receipt capture and expense reporting.

● Customizable spending limits and controls for each card.

● Integration with popular accounting software for streamlined financial management.

● Advanced security features, including instant card lock/unlock and transaction notifications.

Pros:

● Seamless expense management with real-time tracking and reporting.

● Customizable controls to manage spending and budgeting.

● Integration with accounting software for simplified financial management.

● Enhanced security measures for peace of mind.

● Dedicated customer support for assistance and guidance.

Cons:

● Availability may be subject to specific eligibility criteria.

Currency Availability:

Volopay prepaid cards support approximately 60+ currencies, including major currencies such as USD, EUR, JPY, GBP, AUD, CAD, and many more.

Reviews:

● Users have praised the seamless expense management capabilities and user-friendly interface.

● The integration with accounting software and customizable spending controls have also been appreciated. Businesses value Volopay's attentive customer support, which provides prompt assistance and guidance.

2. Qantas Travel Money Card

The Qantas Travel Money Card is a popular choice for businesses in Australia. It is a multi-currency prepaid travel card offered by Qantas, Australia's leading airline. The card allows users to load and spend money in multiple currencies, making it convenient for international business travel.

Features:

● Supports up to 11 currencies, including AUD, USD, EUR, GBP, and more.

● Offers competitive exchange rates.

● Can be linked to the Qantas Frequent Flyer program, allowing users to earn points on eligible purchases.

● Provides 24/7 global assistance for lost or stolen cards.

● Offers the ability to lock/unlock the card remotely for added security.

Pros:

● Wide range of supported currencies.

● Integration with the Qantas Frequent Flyer program allows users to earn points.

● Competitive exchange rates.

● Convenient online management and tracking of transactions.

● Access to emergency cash via Mastercard networks.

Cons:

● May incur reload fees depending on the method of reloading.

● Some users have reported occasional issues with customer support.

Currency Availability:

● The Qantas Travel Money Card supports multiple currencies, including AUD, USD, EUR, GBP, NZD, JPY, CAD, HKD, SGD, THB, and AED.

Reviews:

● Users appreciate the convenience of earning Qantas Frequent Flyer points while using the card. However, some have reported issues with customer support and occasional reload fees.

● Overall, the Qantas Travel Money Card is well-regarded for its range of currencies and integration with the airline's loyalty program.

3. Travelex Money Card

The Travelex Money Card is a widely recognized prepaid travel card available for businesses in Australia. It offers flexibility and security for international travel expenses, backed by Travelex, a leading foreign exchange provider.

Features:

● Supports up to 10 currencies, including AUD, USD, EUR, GBP, CAD, and more.

● Competitive exchange rates.

● Contactless payment feature for quick and convenient transactions.

● Offers online account management and mobile app access.

● Provides emergency assistance and card replacement services.

Pros:

● Multiple currency support.

● Competitive exchange rates.

● Contactless payment for added convenience.

● Online and mobile access for easy account management.

● Reliable customer support.

Cons:

● Some users have reported occasional issues with reloading funds.

● May incur fees for certain transactions or ATM withdrawals.

Currency Availability:

● The Travelex Money Card supports 10 currencies, including AUD, USD, EUR, GBP, CAD, NZD, JPY, SGD, HKD, and AED.

Reviews:

● Users appreciate the convenience and security offered by the Travelex Money Card, along with competitive exchange rates. However, some have reported occasional issues with reloading funds.

● Overall, it is well-regarded for its broad currency availability and reliable customer support.

4. Cash Passport Platinum Mastercard

The Cash Passport Platinum Mastercard is a widely accepted prepaid travel card that offers businesses in Australia a range of features and benefits. It is issued by Mastercard and can be used at millions of locations worldwide.

Features:

● Supports up to 11 currencies, including AUD, USD, EUR, GBP, NZD, and more.

● Competitive exchange rates.

● Chip and PIN technology for enhanced security.

● Offers additional cardholder benefits like emergency cash access and 24/7 global assistance.

● Allows for online management and tracking of transactions.

Pros:

● Wide range of supported currencies.

● Competitive exchange rates.

● Enhanced security features.

● Emergency cash access and global assistance.

● Convenient online account management.

Cons:

● Some users have reported occasional issues with customer service response times.

● May incur fees for certain transactions or ATM withdrawals.

Currency Availability:

● The Cash Passport Platinum Mastercard supports multiple currencies, including AUD, USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB, and AED.

Reviews:

● Users appreciate the wide range of supported currencies and the enhanced security features of the Cash Passport Platinum Mastercard. However, some have reported occasional delays in customer service response times.

● Overall, it is recognized for its currency availability and convenient online account management.

5. ANZ Travel Card

The ANZ Travel Card is a prepaid travel card Australia offered by ANZ Bank, one of Australia's leading financial institutions. It is a versatile card designed for businesses that frequently engage in international travel.

Features:

● Supports up to 10 currencies, including AUD, USD, EUR, GBP, NZD, and more.

● Competitive exchange rates.

● Chip and PIN technology for added security.

● Offers online account management and mobile app access.

● Provides emergency cash and card replacement services.

Pros:

● Multiple currency support.

● Competitive exchange rates.

● Enhanced security features.

● Convenient online account management.

● Reliable customer support

Cons:

● May incur fees for certain transactions or ATM withdrawals.

● Some users have reported occasional issues with card reloads.

Currency Availability:

● The ANZ Travel Card supports multiple currencies, including AUD, USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, and THB.

Reviews:

● Users appreciate the convenience and security features of the ANZ Travel Card. However, some have reported occasional issues with card reloads.

● Overall, it is recognized for its broad currency availability and reliable customer support.

Business travel now made easy

What are the benefits of using prepaid travel cards?

1. Currency conversion and exchange rates

The prepaid travel cards Australia has to offer can simplify currency conversion for businesses operating in multiple countries. These cards support various currencies, allowing employees to load funds in the currency of their destination.

This feature eliminates the need for frequent currency conversions and associated fees. Some prepaid travel cards even offer favorable exchange rates, enabling businesses to save on conversion costs.

By locking in exchange rates in advance, companies can mitigate the impact of fluctuating currency values, ensuring budget predictability for their travel expenses.

2. Expense management and control

One of the key advantages of prepaid travel cards for business is the ability to manage travel expenses effectively. These cards provide detailed transaction records that can be easily monitored and tracked online or through dedicated mobile apps.

This streamlines the expense management process, making it easier to reconcile and report travel expenses. Businesses can set spending limits and customize card usage based on specific employee roles or travel requirements.

Such control helps prevent overspending and improves overall financial management.

3. Simple reimbursement process

The best prepaid travel card for your business can streamline the reimbursement process for businesses. Employees can easily track their expenses using transaction records and provide accurate reports to the finance department.

This eliminates the need for cumbersome paper receipts and simplifies the reimbursement workflow. Businesses can expedite the reimbursement process by directly loading funds onto the prepaid travel cards, ensuring employees have access to the necessary funds promptly.

4. Dedicated business features

Many prepaid travel cards offer dedicated features tailored specifically for businesses.

These features include corporate branding on the cards, customized spending limits for different employee roles, and the ability to allocate funds for specific purposes (e.g., accommodation, meals, transportation).

Some cards also integrate with expense management software, allowing for seamless integration of travel expenses into company financial systems. These dedicated business features enhance the overall efficiency and effectiveness of travel expense management.

5. Cost savings

Prepaid travel cards can lead to significant cost savings for businesses. They eliminate the need for expensive foreign transaction fees typically associated with credit or debit card usage abroad.

By taking advantage of favorable exchange rates offered by some prepaid travel card providers, businesses can further reduce currency conversion costs.

Additionally, the ability to set spending limits and monitor expenses in real-time helps control unnecessary spending and identify cost-saving opportunities.

6. Enhanced security

Security is a top concern for businesses during travel. Prepaid travel cards offer enhanced security features that protect against loss, theft, and fraudulent activities. In the event of a lost or stolen card, businesses can quickly report it and have the card blocked to prevent unauthorized use.

Some cards also provide additional security layers such as PIN protection, chip and PIN technology, and the option to lock/unlock the card remotely. These features provide businesses with peace of mind and mitigate the risk associated with carrying cash or using traditional payment methods abroad.

It's time to switch to Volopay!

Prepaid travel cards - Factors to consider when choosing one

Reputation and reliability

Select a prepaid travel card from a reputable financial institution or service provider. Research customer reviews, ratings, and industry reputation to ensure reliability and trustworthiness.

Look for established providers with a track record of delivering quality services and strong customer support.

Accessibility and acceptance

Verify the accessibility and acceptance of the business travel cards. Ensure that the card is widely accepted at destinations relevant to your business travel.

It should be usable at a range of merchants, including hotels, restaurants, and retail outlets, and compatible with major payment networks such as Visa or Mastercard.

Card security

Consider the security features offered by the prepaid travel card. Look for features like PIN protection, chip and PIN technology, and the ability to lock/unlock the card remotely.

Enhanced security measures minimize the risk of card theft, fraud, or unauthorized use, protecting your business and employees during travel.

Card limits

Evaluate the card limits imposed by the provider. Consider factors such as maximum card balance, daily spending limits, and ATM withdrawal limits.

Ensure that the limits align with your business's travel needs and requirements, allowing sufficient flexibility without compromising financial control.

Currency availability

Check the currencies supported by the prepaid travel card. Depending on your business travel destinations, it is crucial to choose a card that supports the required currencies.

Multi-currency cards are particularly beneficial if your business operates in multiple countries, allowing for seamless transactions and avoiding excessive currency conversion fees.

Fees and charges

Take into account the fees at which these cards are acquired, along with the list of additional charges that may be incurred while using them. The purpose of the card is to save you money; so over-paying to use it would be counterproductive.

Exchange rates

Consider the exchange rates offered by the prepaid travel card provider. Some providers offer favorable exchange rates, while others may have higher markups.

Favorable rates can significantly impact your business's cost savings on currency conversions. Compare rates offered by different providers to choose the most advantageous option.

Terms and conditions

Thoroughly review the terms and conditions associated with the prepaid travel card. Pay attention to factors such as card expiry dates, card replacement policies, liability policies for lost or stolen cards, dispute resolution processes, and any other relevant conditions.

Understanding the terms and conditions ensures transparency and prevents any unexpected surprises.

Cardholder support

Assess the level of customer support and assistance provided by the prepaid travel card issuer. It is essential to have access to reliable customer support for prompt assistance in case of any issues, lost cards, or emergencies during business travel.

Look for providers with accessible helplines, online chat support, or dedicated customer service representatives.

Additional features and benefits

Consider any additional features and benefits offered by the prepaid travel card. Some cards may provide expense management tools, real-time transaction notifications, mobile apps for easy card management, or integration with expense tracking software.

Assess these additional features to determine if they align with your business's specific requirements and provide added value.

Use Volopay cards- The best solution for all your business needs!

Volopay prepaid travel cards offer a range of features to assist businesses in efficient financial management. They provide both virtual and physical cards, customizable spending limits, real-time expense tracking, and automated receipt capture.

Businesses can easily categorize expenses, manage vendors and subscriptions, and benefit from competitive foreign exchange rates. Volopay prioritizes security and control with features like instant card freezing, transaction restrictions, and real-time notifications.

The debit cards also support multi-currency wallets, allowing businesses to transact in various currencies. Detailed analytics and reporting features provide valuable insights into spending patterns and individual cardholder activity.

With Volopay prepaid cards, businesses can streamline expense management, enhance control, and make informed financial decisions.

In summary, Volopay debit cards provide businesses with efficient expense tracking, automated receipt capture, customizable spending limits, and enhanced security features.

They enable businesses to manage vendors, subscriptions, and multi-currency transactions while offering detailed analytics and reporting capabilities. Volopay debit cards are a valuable tool for businesses seeking efficient financial management and control.