9 best small business accounting software in Australia

Most business owners, executives, and finance professionals know what accounting software is. In fact, many businesses in Australia likely use accounting software to help them with accounting processes. They’re helpful in streamlining data storage, invoicing, paying bills, and many more.

With accounting software suites from a number of different providers becoming more accessible in Australia, it’s no surprise that there are now platforms specifically geared toward small businesses, designed to help them eliminate difficult and time-consuming processes. The earlier your business gets started with some of the best small business accounting software in Australia, the easier it will be for you to scale accordingly.

Why do businesses use accounting software?

There are many small businesses that have started their accounting processes using manual methods, such as writing reports by hand or using an Excel spreadsheet to keep track of their transactions.

For new business owners, this doesn’t pose a problem, especially when there are only a limited number of invoices to create and bills to pay. But as your business grows, you’ll have more income and expenses to track. Staying on top of your accounting becomes even more crucial, but also more difficult to do when there is more work involved.

A good solution to this problem is to look for a small business accounting software provider to help you out. Unlike the traditional manual accounting methods, you’ll be able to store all your data in one place and automate processes like invoice generation and sending them out to customers. Even your supplier bills can be paid on the same platform.

You want to use the best small business accounting software in Australia to be able to scale accordingly. When you have more income and expenses to manage, you’ll find yourself having to hire and train more people and will ultimately spend too much time on manual processes if you don’t use accounting software.

9 best small business accounting software to consider in 2025

1. MYOB

Overview

MYOB is an Australian-based platform that is designed particularly for Australian businesses. Its accounting software suite is called the MYOB Business software.

Features

Manage your accounting online with MYOB. Send invoices, receive payments, and manage your bills and payroll all on the same platform. There are also features to control your cash flow and inventory. You can subscribe the lowest MYOB Business plan for AUD 15/month for the first three months, and then AUD 30 after that. The highest tier MYOB Business AccountRight Premier starts at AUD 85/month.

Pros

One of the biggest plus points in MYOB’s favor is that because it is an Australian-based system, you can ensure that your accounting formats follow the generally accepted accounting principles (GAAP) in Australia. MYOB Business also has a user-friendly interface that makes it easy for small businesses to familiarize themselves with the platform.

Cons

Some customers find MYOB’s pricing to be steep and a little too expensive for what the platform offers. Compared to alternatives, there are better pricing plans that offer a more comprehensive set of features. MYOB Business also may not be as scalable compared to competitors and is only suited to small to medium businesses.

Bottom line

MYOB Business is a solid software suite that can help small businesses streamline their accounting processes. It’s best suited for businesses that are not looking for anything complicated but want a system that understands the Australian market. While it can be on the expensive side, over 1 million people in Australia and New Zealand use and trust MYOB.

2. Freshbooks

Overview

Freshbooks is simple, easy to use, and accessible for even very small businesses. While it has a full suite of features that bigger businesses can also take advantage of, anyone can make use of this software.

Features

What makes Freshbooks one of the best small business accounting software in Australia is that it’s easy to use and is accessible to amateur bookkeepers or business owners who want to do the accounting process themselves. You can easily track expenses and send invoices to up to 5 clients through Freshbooks at just AUD 5.75/month for the first 3 months. With more expensive plans starting at AUD 8.75/month, you can also get more advanced features such as time tracking.

Pros

Freshbooks is an intuitive platform that promotes a user-friendly interface, making it easy for anyone to get started with it. It also has a good mobile app that you can use on the go. With the more expensive plans, you also get access to features to help you manage projects and time tracking.

Cons

While Freshbooks starts cheap, there is an additional charge for adding more members onto the platform. At AUD 16 per user per month, this expense can add up if you have a lot of employees to onboard onto the platform. Freshbooks’ inventory tracking system is also on the weaker side.

Bottom line

Given the simplicity of Freshbooks, the software is often recommended for very small businesses with just a couple of employees. You can get started with a plan as low as AUD 23/month if you’re content with basic money management and invoicing features. Keep in mind that the Lite plan only allows you to send invoices to up to 5 clients.

3. Xero

Overview

As a popular name amongst the best small business accounting software in Australia, Xero’s features can help you with every financial aspect of your business.

Features

Managing invoices, bills, and payroll are all easy to do with Xero. You also get the ability to reconcile bank transactions. Xero doesn’t have a free trial and starts at AUD 32 per month, with its highest tier being AUD 115 per month. The higher-tier plans also give you the option of bulk transaction reconciliation, multi-currency functions, project tracking, and more.

Pros

Xero has a user-friendly interface that makes it easy to use. Unlike many of its competitors, you can add multiple users onto your Xero account without having to worry about expensive expensive add-ons. There are no user limitations that you have to adhere to. Xero also has a good mobile application.

Cons

Although you can track inventory with Xero, it doesn’t allow you to create inventory assemblies. You may be better off with another platform if you need a more complete inventory management solution. Keep in mind that the time entries feature can also only be used with projects.

Bottom line

Despite Xero’s starter plan being accessible for sole traders, you don’t get a lot of features for its price. It is, however, ideal for small businesses that have quite a few people on the team and would be able to make the most of Xero’s mid-tier plans. It’s an easy system to learn and with the additional features, you’ll have all your bases covered.

4. QuickBooks

Overview

Considered a popular choice for small business accounting software, Quickbooks can be the right choice for your business due to its numerous features and customization options.

Features

You can get started with Quickbooks at just AUD 12.50 per month for the first 3 months, letting you access basic features such as income and expense tracking, along with the ability to send unlimited invoices. With GST and bank account integration, you automate your accounting processes even further. Higher plans starting at AUD 20/month allow you to add more users and manage supplier bills.

Pros

There are plenty of customization options that you can get with Quickbooks, particularly when it comes to reporting. Between these and the ability to manage suppliers in multiple currencies, you can configure the software to what you need. Quickbooks also offers both time tracking and inventory management, which can be invaluable for your business.

Cons

Quickbooks is known as a more expensive software suite, especially compared to other alternatives. This may be a little over their budget for an accounting system for small businesses. There is also a limitation on the number of users you can onboard, which is based on which plan you select.

Bottom line

Due to its expensive price point, many small businesses may shy away from Quickbooks. It is best suited for small businesses that have a large technology budget and know that they can quickly scale to make the most of the software. When you find the right use for Quickbooks, however, you’re guaranteed to be able to streamline your accounting processes by a lot.

5. Zoho Books

Overview

You may have already heard of the Zoho suite, which is a software suite that offers multiple platforms for your business convenience. As its accounting software, Zoho Books can be the small business accounting software for you.

Features

You get plenty of features with Zoho Books, starting with invoice management and payments. If your business makes less than AUD 50,000 per annum, you are eligible to start with Zoho Books for free. With the free plan, you also get features like taxes, payment gateways, and reports. Paid plans with additional features start at AUD 16.50 per month, going up to over AUD 300 per month.

Pros

Zoho Books offers a lot of depth when it comes to the features that you can get with the software. With an easy-to-navigate user interface, you’ll find that you can get a lot of customization options and many different form and report types to suit your business needs.

Cons

Given that Zoho Books has a lot of features, it can be too complex to navigate for smaller businesses that only require a simple accounting system. When you start using these more detailed features as your business grows, you may also have to spend considerably more money to be able to scale accordingly.

Bottom line

With its free plan, Zoho Books is appealing because you won’t have to break the bank to get started if your business is relatively small and new. However, because of its complex suite of features, it can be useful to businesses of all sizes. You can make the most of Zoho Books if you plan to use the entire Zoho suite.

6. Wiise

Overview

Wiise is an enterprise resource planning (ERP) platform for Australian businesses. With accounting tools and capabilities, your finance management is in good hands with the Wiise software suite.

Features

Boasting a platform built specifically for Australian businesses, Wiise can help you manage many different business processes on a single platform. With its accounting capabilities, you can streamline your general ledger, accounts payable, and accounts management hassle-free. This entire ERP will cost you AUD 138 per full user/month on the lower-tier annual subscription. This goes up to AUD 210 per full user/month for the premium tier.

Pros

If you want a system that can help you manage multiple business processes, Wiise has multiple functions. You won’t need to integrate with an external ERP as you can manage sales, warehouses, projects, jobs, and more in-house. Wiise also allows you to manage multiple entities and consolidate information across many companies.

Cons

There’s no denying that Wise’s pricing is a lot more expensive than its competitors. While you get a lot more features, a small business may not be at a stage where it can make use of all of an ERP platform’s features. Wiise’s integration capabilities are also mainly only focused on the Microsoft 365 suite.

Bottom line

If you’re looking for the best small business accounting software in Australia for scalability, Wiise can be the right answer for you. With its robust features, you’re guaranteed to be able to grow your business without a hassle. When your business reaches the enterprise level, you will still be able to use the platform. Just keep in mind that it can be a steep price for small businesses.

7. Netsuite

Overview

As a popular and reputable small business accounting software suite, Netsuite is used by many businesses worldwide due to its robust accounting functions.

Features

Use Netsuite to easily record transactions, manage accounts payable and receivable, keep your books updated, and complete more accounting tasks. It offers features such as general ledger functions, cash management, tax management, and even asset management. To get a detailed pricing plan for your organization, you will have to get in contact with a Netsuite representative or get started with its free product tour.

Pros

As a cloud-based accounting platform, Netsuite has a relatively complete suite of features to ensure that all your accounting needs can be managed accordingly on just a single platform. It tracks and manages your financial activities well. For those familiar with accounting tasks, Netsuite is a great tool to aid you.

Cons

Netsuite can be a little difficult to use for beginner accountants and business owners, as it has a bit of a steep learning curve. You may be required to hire a consultant or pay an additional fee to Netsuite to get access to its advanced customer support. This is not ideal for small businesses.

Bottom line

Netsuite is suited for businesses of many sizes, starting from small businesses in the early stages to mid-sized and larger businesses. With its goal of putting all accounting work in one place, you can rest assured that your processes will be hassle-free thanks to its automation tools. Used by over 37,000 customers, Netsuite is also guaranteed to be a trustworthy accounting software provider.

8. Sage

Overview

The Sage suite offers several different products, with the Sage Intacct being its finance and accounting software to help businesses maintain their reports and ledger accordingly.

Features

Sage Intacct introduces itself as a finance software suite, offering features such as finance reporting, automated general ledger management, accounts payable and receivable management, and many more. If you have a multi-entity business, you can also manage their accounting processes more efficiently with Sage. To get detailed pricing information, you’ll have to put in a request and get in contact with a representative from the company.

Pros

Get deep and meaningful insights into your business finances with Sage Intacct. The features Sage offers are quite in-depth and advanced, with a great reporting system and plenty of customizable record and transaction forms. Sage also has integration capabilities with Microsoft 365, which is useful if your business uses it.

Cons

Sage is geared toward a Windows operating system, which can make it difficult to use on Apple Mac computers. Businesses that favor Mac computers will have to run Microsoft Windows on a virtualized environment to be able to use Sage. Due to its comprehensiveness, it also may not be the easiest to use for beginners.

Bottom line

The Sage Intacct product is loved and trusted by many professionals, with over 22,000 businesses using it. If you are in need of a small business accounting software suite that has complex and robust features, this could be the right solution for you. However, keep in mind that you may have to spend more time familiarizing yourself with the features and training employees.

9. Patriot

Overview

Patriot is a simple accounting software suite that doesn’t have a lot of complex features, but could be well suited for small to medium businesses looking to get started.

Features

The Patriot accounting software allows you to send invoices and payment reminders to clients easily. You can also pay your bills and track your expenses on the same platform. To access these features, Patriot’s small business accounting software plan starts at USD 20 per month. There are also add-ons and an additional payroll software plan that you can purchase if needed.

Pros

One of the best things about Patriot is how accessible it is for small businesses. Not only does it have a competitive price that is affordable for those on a lower budget, but Patriot also is easy to use. The navigation is straightforward and beginners or amateur accountants won’t have trouble with it.

Cons

There are some features that Patriot may still lack in compared to competitors. For example, you don’t get inventory tracking and management with the Patriot accounting software. Some features also have limited capabilities, with a lack of report customization and minimal fields in records such as your contact and product records.

Bottom line

Due to Patriot’s simplicity, this software is best suited for small to medium businesses that aren’t looking to grow into large enterprises in the near future. If you’re just starting out with your business and plan to keep it small, Patriot could be the right choice for you. It’s reasonably priced and uncomplicated, which is ideal for small business owners dipping their toes into accounting.

Revolutionize your financial workflows

How can small businesses benefit from accounting software?

It’s easy to assume that only larger businesses that are starting to become overwhelmed with their manual accounting processes can take advantage of accounting software. But the truth is that starting to use accounting software as soon as possible—even before you run into any issues—will benefit businesses of all sizes.

Using a small business accounting software suite helps you maintain accuracy. Even if your accounting processes are manageable when your operations are on the smaller side, manual data entry and bookkeeping still mean that you’ll be prone to human errors.

Not only are these errors often time-consuming to fix and may cause delays when you have other tasks to accomplish, but they can also go undetected. In such cases, you may find yourself with issues such as a mismatched balance or inaccurate forecasting several months down the road. This will be costly for your business in the long run.

Instead, you should opt to research the best small business accounting software in Australia so that you can make the appropriate upgrades for your business, but beware of free accounting software plans. They may seem like a solid solution for a low budget, but you’ll soon find that they come with a lot of limitations. Not to mention that add-ons can be costly. Get your account upgraded once you feel comfortable with the platform to get access to more features.

Improving your company’s bookkeeping from the get-go and familiarizing yourself with an accounting system saves you time and money in the long run.

What are the key features to look out for in accounting software?

Financial reporting

One big reason why accounting software is so valuable for any business is that you’ll get better visibility of your overall financial year performance hassle-free in less time. Other than maintaining your ledger and your books, one thing that you want to have from any small business accounting software is good financial reporting features.

Easily documenting your finances in the form of balance sheets, cash flow statements, income statements, and many more is key. The more report types are available on your accounting software, the more convenient it will be for you. You’ll be able to pick and customize what kind of report you want and generate it in just a few clicks.

General ledger management

Getting a good overview of your business’s financial health is often dependent on your general ledger, as it is meant to offer a summary of all your transactions and journals. When you’re researching different providers to pick an accounting software suite for your business, make sure that you ask providers if they provide good general ledger management tools.

The general ledger needs to be well-organized and easy to read. Entries such as sales or bill payments made through your accounting system or another expense management system that is integrated with the software should also be automatically posted onto your general ledger to ensure that it is always up to date.

Bank reconciliation

One of the things that often takes up a lot of time during the accounting process is reconciliation. When performed manually, you’ll have to match up every transaction on your bank statement with your accounts, which is not only tedious and repetitive but can also lead to errors.

You want the best accounting software for small business Australia has to offer as you’ll be able to automatically perform reconciliation. All you have to do is connect your bank accounts and integrate them with your accounting software to automatically reconcile your accounts in just a few clicks. No hassle is required!

Billing and invoice processing

You can lay out all your accounting data on an Excel sheet, but a good accounting system for your business does more than just store your accounting data. With the best small business accounting software in Australia, you’ll be able to automate the billing and invoicing processes within your organization.

If you have a large customer base, manually creating invoices can be time-consuming. Instead of having to generate all invoices by hand and manually send each one through email or physical mail, you want to pick an accounting software provider that allows you to do the entire invoicing process on one accounting system.

Data storage

Investing in a good data storage system can be costly, especially when you consider all the important backup systems you have to put in place to ensure that your data won’t get lost. With good small business accounting software, however, you can get your data storage sorted out for you hassle-free.

You want a system that allows you to store your accounting data in a secure cloud server. This way, you’ll be able to access your data from anywhere. Easily usable filters and search functions are also key to making organizing your data as simple and streamlined as possible.

Cross-platform integration

Your accounting software has to work in tandem with other processes in your business for it to work smoothly. You may already be using an enterprise resource planning (ERP) platform to simplify sales and purchasing processes.

Ideally, you want your accounting software to integrate seamlessly with other platforms such as an ERP system. (enter) Instead of having to enter the same set of data twice, you can directly sync your data from one system to another. It reduces the amount of manual work and guarantees better accuracy. Make sure you pick an accounting software provider with integration capabilities with other platforms you use.

Real-time updates

The best small business accounting software in Australia can offer real-time updates on your transactions. For example, if you can create invoices on your accounting software, you want to get updates on whether or not the invoice has been paid. It’s also best if you can automatically have your journal entries updated and mapped to the right accounts as soon as a transaction happens.

Instead of leaving it to the end of the month, quarter, or fiscal year to view and reflect on your financial health, you can get a complete overview at any time. Make sure you miss no transaction!

What are the factors to decide on accounting software?

1. Easy-to-use

The point of using accounting software for your business is to make your processes easier. For this reason, the accounting software provider you choose must be able to guarantee that the platform it offers is easy to use.

When you implement a new system, you’ll have to ensure that your team has sufficient knowledge and training on it before they can start using it. The longer you have to spend hosting training sessions, the later it will be before you can reap the software’s benefits.

Pick small business accounting software that is user-friendly, time saving and easy to navigate for all employees.

2. Integration

Even for a small business, accounting software is likely only one of the many tools and systems that you use to manage your processes. While you can automate many of your accounting tasks by using the best small business accounting software in Australia, you can only get so far without integration capabilities.

Instead of entering your account data and expenses manually across multiple systems, integration allows you to only do it once and sync that data with all your systems. It helps you avoid data silos and ensures accuracy.

Pick an accounting system with the right integration capabilities for your business.

3. Scalability

Any business wants to quickly scale. However, scaling your business can come with a number of challenges, particularly when considering how to keep up with your processes. The bigger your business is, the more time you will have to spend on your records and accounting.

When choosing the best small business accounting software in Australia, make sure that you take scalability into account.

A particular platform may seem like it’s the best for your business right now, but you want a platform that is sustainable and can grow alongside your business. Your accounting software should be able to keep up with higher demands as you scale.

4. Pricing

The best accounting software for small business Australia has to offer will undoubtedly incur a cost. However, not every provider will have the same pricing plan.

It’s important that you consider what your business needs are and what kind of budget you have for your small business accounting software. How cheap or expensive an accounting system should be depends on your business.

Regardless of how much you’re paying for the accounting software, make sure that you’re getting your money’s worth. Important features should be included in your plan. Compare and contrast pricing options offered by different providers in the market to find the most suitable one that suits your business.

5. Data security

Trusting a third party with sensitive information like your accounting information can feel like a huge risk. Before you pick a provider, make sure that your accounting software provider can guarantee that your data is safe.

Ask a representative what security measures are in place to ensure that your data is well-protected. Industry-standard certifications are a must-have for any provider. This allows you to gauge whether or not they have the appropriate procedures.

You also want to consider what other features they offer to customers. Two-factor authentication, for example, is a great way to ensure data security. Providers that allow different levels of access may also be preferable.

How can Volopay help small businesses in need of accounting software?

Every business in need of accounting software will also want to know how to make the most of the software to manage its finances better. Whether that is utilizing every feature to streamline many different processes within the organization or integrating it with other systems already in use, you don’t want to let your small business accounting software go to waste.

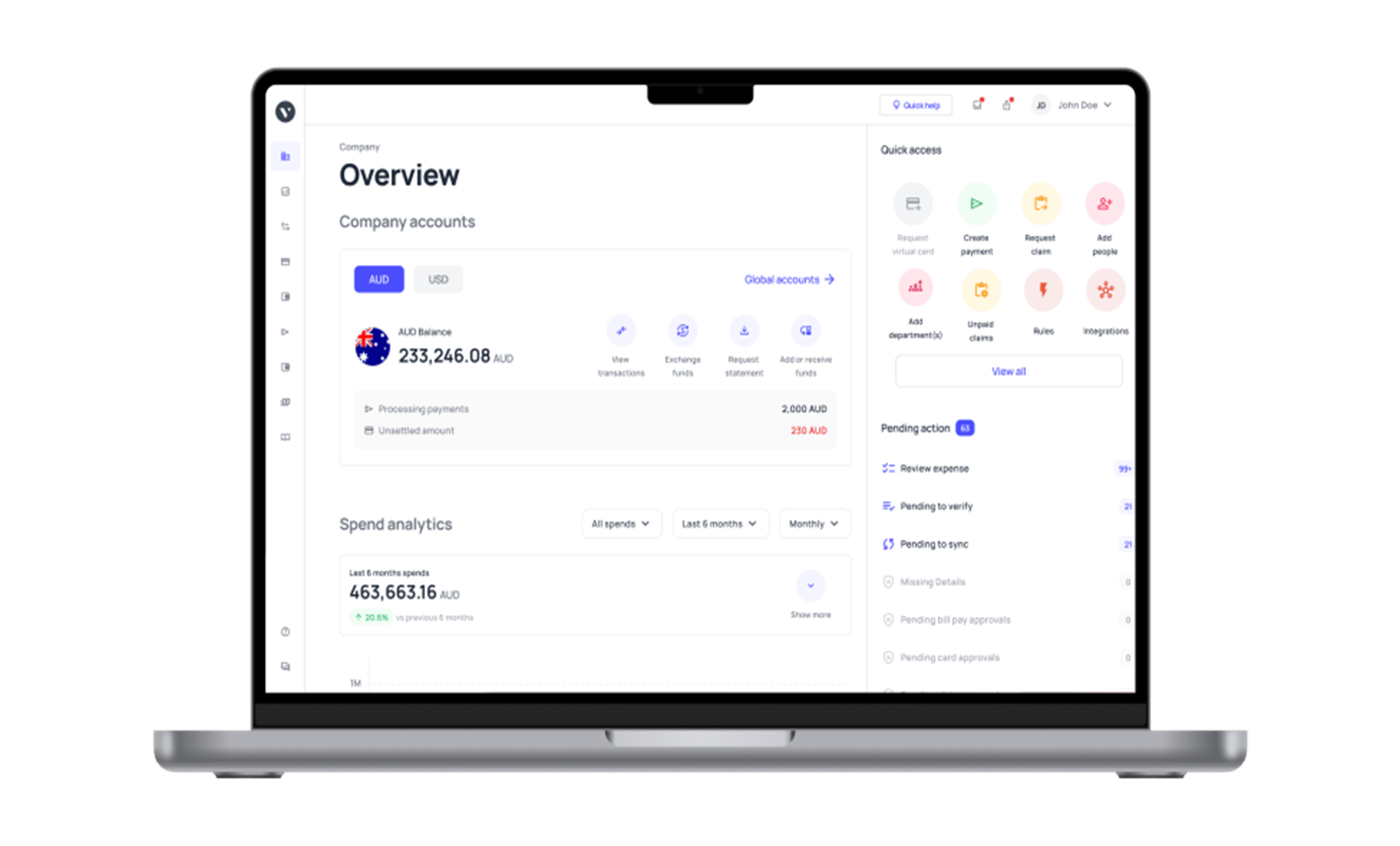

It’s important to build an ecosystem for your accounting software. Use other tools parallel with it to streamline finance management and accounting even further. An all-in-one expense management solution, like Volopay, can be just the right tool for you.

Volopay offers an expense management platform that is easily integrated with your accounting software. With Volopay, you can cover all types of company expenses and manage them all in one place. Get access to integration capabilities that allow you to integrate Volopay with the accounting software of your choice.

All it takes is a few clicks to set up the integration. You can even map out categories and accounts to automatically categorize transactions made through Volopay. With the direct sync function, you’ll be able to sync data between your Volopay account and accounting platform without having to do any work!

Not to mention that Volopay has other features that will further streamline your expense management. Pairing our corporate card feature with easy vendor and payment management, you’re guaranteed to be able to track and control every penny in your account.

Assign each employee with a physical Volopay card or generate as many virtual cards as you want. Employee expenses, business travel spending, and subscriptions are easy to manage with cards that are designated for specific purposes. Each transaction is also automatically recorded on your Volopay ledger, which can be directly synced with your accounting software.

Make the most of your accounting software of choice by using it in tandem with Volopay.

Bring Volopay to your business

Get started now

FAQs

No, these two are not exactly the same thing. However, accounting software automation and expense management automation often work in tandem to streamline your business finances.

Every business can benefit from using accounting software, including small businesses. While it may be viable to do your accounting processes manually on an Excel spreadsheet, it will be time-consuming to do and difficult to scale.

Yes. Volopay offers integration with accounting software. You can even directly sync your Volopay account with a number of the big and reputable accounting software providers on the market.

Yes. Regardless of what accounting platform you’re using, as long as it supports Universal CSV, you’ll be able to integrate your Volopay account with ease.

Yes. You won’t have to worry about manual data matching or entering your data twice across multiple platforms. You can get a two-way sync and ensure that every update is the same.