6 best travel and expense management software in Australia

Business travel is an integral component of many enterprises, fostering growth opportunities, client interactions, and market expansions. However, with the benefits of corporate travel come the complexities of managing expenses. The challenges businesses encounter in handling travel expenses, including tracking, reconciling, and ensuring compliance, underscore the need for efficient and streamlined solutions.

In Australia's dynamic business landscape, navigating these hurdles necessitates robust travel and expense software. However, choosing the right software for your business can be a confusing task. To help you make the right decision, let’s explore the best T&E management software solutions tailored for businesses operating in Australia.

Why is T&E management important?

Travel and Expense (T&E) management is crucial for several reasons, contributing to the overall efficiency, financial health, and compliance of an organization. Efficient travel and expense (T&E) management serves as a cornerstone for businesses, providing multifaceted advantages:

1. Budget planning

T&E management tools empower businesses to create comprehensive budgets by accurately tracking travel expenses. This enables organizations to set realistic financial goals and allocate resources judiciously, ensuring optimal utilization of funds.

2. Financial visibility

With robust T&E software, businesses gain real-time visibility into expenditure patterns. This visibility is instrumental in identifying trends, monitoring spending behaviors, and promptly addressing any anomalies. Such insights enable proactive financial strategies, reducing unnecessary costs and enhancing overall financial health.

3. Decision-making insights

Detailed data analytics derived from T&E management software offer actionable insights. Businesses leverage these insights to make informed decisions, whether in negotiating better vendor contracts, identifying cost-saving opportunities, or refining travel policies for maximum efficiency.

4. Legal and tax compliance

Compliance with tax and legal regulations is critical. The travel and expense management software that you choose will most likely be preprogrammed to follow the legal and tax compliance measures in the region in which your business operates.

T&E software facilitates adherence to various regulatory frameworks by ensuring accurate documentation, expense categorization, and adherence to corporate policies. This minimizes the risks associated with non-compliance, such as penalties or legal implications.

5. Employee satisfaction

Simplifying and expediting the expense reimbursement process through efficient T&E management fosters employee satisfaction. Administrative employees don’t have to run behind employees to submit their expense reports anymore.

Quick reimbursements and streamlined processes reduce administrative hassles, empowering employees to focus more on their core responsibilities and boosting morale within the workforce.

The holistic benefits derived from effective travel and expense management underscore its indispensable role in optimizing financial processes and ensuring regulatory adherence within businesses.

What is travel and expense management software?

Travel and expense management software refers to a specialized suite of digital tools designed to streamline and automate the processes involved in managing corporate travel expenses. This software encompasses a range of functionalities, including expense reporting, receipt tracking, policy compliance enforcement, and reimbursement management. It simplifies expense submission by allowing employees to capture receipts, submit claims, and track expenditures digitally.

Moreover, these platforms often integrate with accounting systems, offering comprehensive financial visibility and aiding in budget management. Travel expense management software ultimately serves as a centralized solution to effectively control, monitor, and optimize business travel-related expenditures.

6 best travel and expense management software

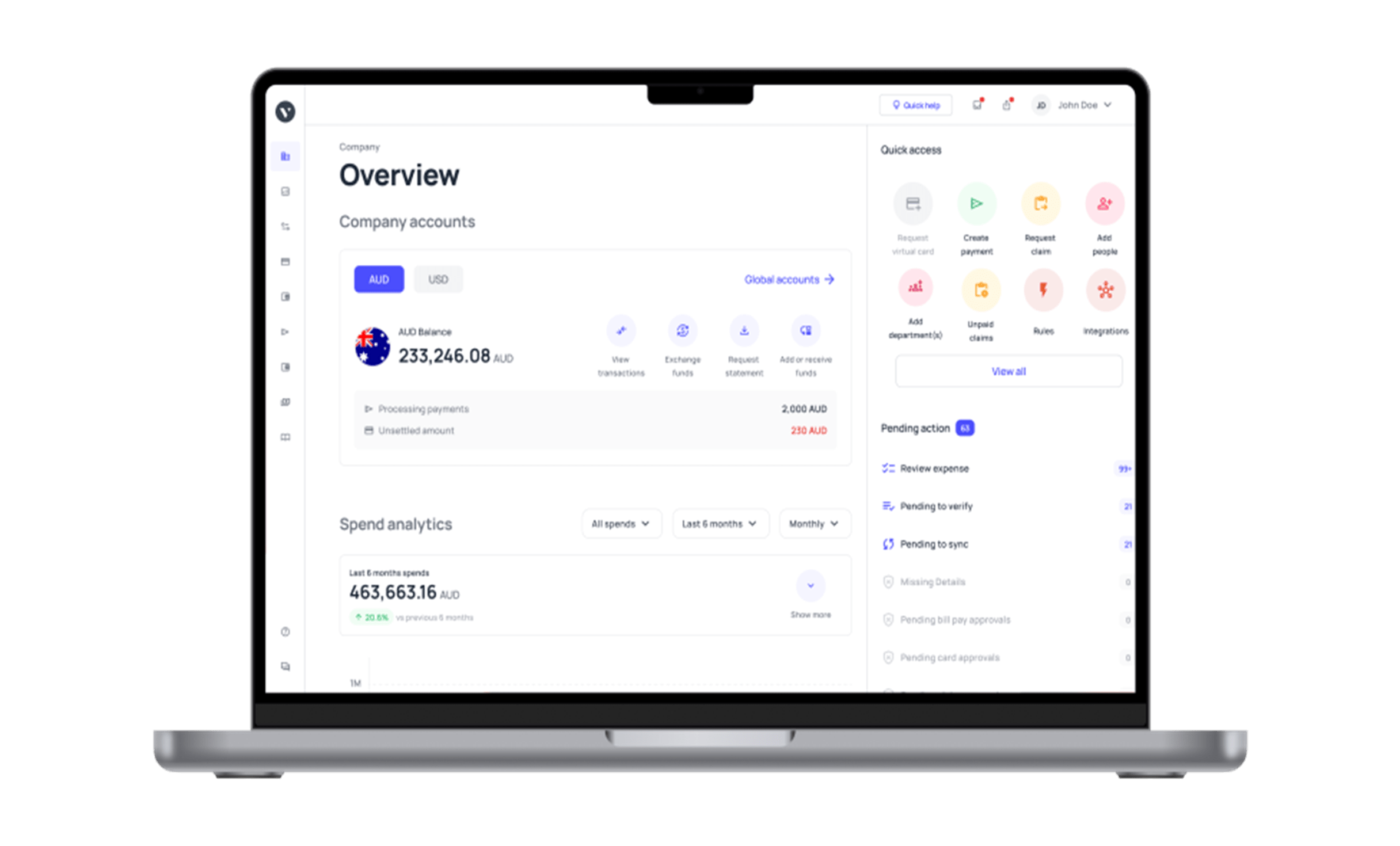

1. Volopay

Volopay is a financial solution provider founded in the year 2020 that offers corporate cards, automated expense management, and accounting integrations that streamline financial operations, helping businesses save time and money while elevating the role of their finance teams.

Set up process and requirements

Volopay offers a straightforward setup process with minimal requirements, typically requiring account creation and configuration of user permissions. You can easily invite your employees to join and access the platform through their email IDs.

Fees & Pricing

Pricing structures vary based on features, usage, and the region within which your business operates. Generally, Volopay offers competitive pricing tailored to business needs.

Key features

Volopay has a robust set of features such as automated expense reporting, mobile accessibility, integration capabilities, receipt scanning, OCR technology, real-time tracking and visibility, multi-currency support, customizable approval workflows, analytics & reporting tools, corporate cards(both physical cards and virtual cards), and much more.

Pros & Cons

Pros include comprehensive automation and a user-friendly interface. Cons may involve pricing for additional features.

G2 Rating

Volopay enjoys positive ratings for its ease of use and customer support on G2 with an average rating of 4.2 out of 5.

2. SAP Concur Australia

SAP Concur is one of the world’s leading brands for integrated travel, expense, and invoice management solutions, driven by a relentless pursuit to simplify and automate these everyday processes for businesses.

Set up process and requirements

SAP Concur involves a more extensive setup process, including configuration, data migration, and user training.

Fees & Pricing

SAP Concur's pricing models vary, typically with subscription-based plans and additional fees for specific features.

Key features

End-to-end expense management, policy compliance, integrations, and advanced reporting. Their mobile app guides employees through business trips, charges are directly populated into expense reports, and invoice approvals are automated. By integrating near real-time data and using AI to analyze transactions, businesses can see what they’re spending, improve compliance, and avoid possible blind spots in the budget.

Pros & Cons

Pros include robust features and scalability. SAP Concur solutions help eliminate tedious tasks, make work easier, and support businesses to run at their best. Cons may include a steep learning curve and higher costs for additional functionalities.

G2 Rating

SAP Concur garners positive ratings for its feature-rich platform and has an average rating of 4 out of 5 stars on the G2 platform.

3. Zoho Expense

Zoho Expense is online travel and expense management software that helps businesses streamline corporate travel, automate expense reporting, gain complete control over spending, accelerate reimbursements, and get crucial financial insights to stay two steps ahead. Available as web-based and mobile applications, Zoho Expense offers an expense reporting experience that fits your existing workflow by integrating with other applications in your current software ecosystem.

Set-up process and requirements

Zoho Expense offers a user-friendly setup process, requiring account creation and customization of expense policies.

Fees and pricing

Zoho Expense typically offers competitive pricing with scalable plans based on business needs.

Key features

Streamlined expense tracking, receipt scanning, policy enforcement, and insightful reports. Apart from the expense management side of corporate travel, Zoho Expense also offers its customers the ability to plan travel and book flights through self-booking tools. You can also do things like track ticket prices so you can book them at lower prices, automate visa requests, and receive notifications for important flight alerts.

Pros & cons

Pros include ease of use and cost-effectiveness. Cons may involve limited integrations and customization options.

G2 Rating

Zoho Expense receives positive ratings for simplicity and value for money with an average rating of 4.5 out of 5 stars on G2.

4. TravelPerk

TravelPerk is the next-generation business travel platform pioneering the future of business travel. TravelPerk’s all-in-one platform gives travelers the freedom they want whilst providing companies with the control they need. This results in saved time, money, and hassle for everyone.

Set-up process and requirements

TravelPerk involves a relatively smooth setup process, requiring account creation and configuration of travel policies.

Fees and pricing

TravelPerk's pricing models vary, generally offering subscription-based plans and additional fees for premium features.

Key features

Travel booking integration, expense management, policy compliance, and real-time tracking. TravelPerk has one of the world’s largest travel inventories with powerful management features, 24/7 customer support, state-of-the-art technology, and consumer-grade design, all of which enable companies worldwide to get the most out of their travel.

Pros & cons

Pros include integrated travel booking and expense management. Cons may include pricing and limited customization.

G2 Rating

TravelPerk receives positive reviews for its travel-centric features and ease of use with an average rating of 4.6 out of 5.

5. Weel Expense Management

Weel is a corporate card and spend management platform that empowers teams to better manage, control, and streamline company spending. Weel's easy-to-use web and mobile apps include instant virtual company cards, bill pay, spend controls and budgeting, a real-time transaction feed, automated expense reporting, powerful accounting integrations, subscription spending management, reimbursements, and exclusive rewards.

Set-up process and requirements

Weel Expense Management offers a straightforward setup process, typically requiring account creation and policy configuration.

Fees and pricing

Weel's pricing structures may vary, offering cost-effective plans with basic and advanced features.

Key features

Expense tracking, receipt scanning, policy enforcement, and customizable approval workflows.

Pros & cons

Pros may include ease of use and cost-effectiveness. Cons might involve limited integrations and advanced functionalities.

G2 Rating

Weel Expense Management gathers positive reviews for simplicity and value and has an average rating on G2 of 4.6 out of 5 stars.

6. Egencia - Amex GBT(American Express Global Business Travel)

Egencia is one of the world’s leading B2B travel platforms, providing software and services to manage travel, expenses, and meetings and events for companies of all sizes. They have built the most valuable marketplace in B2B travel to deliver unrivaled choice, value, and experiences. With travel professionals across the world, their customers and travelers enjoy the powerful backing of American Express Global Business Travel.

Set-up process and requirements

Egencia involves a structured setup process, including account creation, travel policy setup, and user training.

Fees and pricing

Egencia's pricing models usually involve subscription-based plans and additional fees for premium features.

Key features

Travel booking integration, policy compliance, expense tracking, and reporting tools.

Pros & cons

Pros may include integrated travel booking and expense management. Cons may involve pricing and complexity.

G2 Rating

Egencia receives positive feedback for its travel-focused features and customer service with an average rating of 4.4 out of 5 stars on G2.

Experience hassle-free reimbursements

Common challenges in managing business travel expenses

1. Policy compliance

Matching company travel policies with diverse regulations and ensuring consistent adherence across employees remains a constant challenge. Differences in interpretation or awareness of policies might result in overspending or non-compliant expenses.

These still remain common issues for finance teams to figure out and solve. The best way to resolve these issues is by using T&E software that mandates policies and rules in the financial workflow of managing corporate travel expenses.

2. Receipt management and documentation

Collating, organizing, and preserving receipts and documentation from multiple transactions can be arduous. Lost receipts or errors in documentation can lead to inaccuracies in expense reports, hindering the reconciliation process.

It is a tedious process for employees and even more so for the finance department to rectify errors in expense reports. Automated travel and expense management software that helps employees submit receipts digitally without having to hold onto them till the end of the month is a great solution.

3. Delayed reimbursement

Lengthy approval cycles and bureaucratic hurdles often delay reimbursements to employees. This delay not only impacts their financial liquidity but also discourages timely and accurate expense submissions. Using T&E management software can help you fast-track the reimbursement process and keep delays to a minimum.

4. Tracking and visibility

Inadequate real-time visibility into expenditure patterns makes it challenging for businesses to track spending trends. This lack of visibility may result in overspending or hinder the identification of cost-saving opportunities.

When your organization implements and uses travel and expense management software, you’ll be able to track expenses in real-time making it much easier to control spending.

5. Auditing and compliance checks

Conducting regular audits to ensure compliance with company policies and legal regulations requires substantial time and resources. Manual auditing processes are prone to errors and might miss potential irregularities.

An automated system like T&E software can help flag issues that might be missed by a human. This reduces the time that finance teams spend on finding errors and instead helps them use their time efficiently to solve the problems.

6. Manual expense reporting and reconciliation

Overreliance on manual processes for expense reporting and reconciliation increases the risk of human errors, leading to discrepancies in financial records and prolonged reconciliation timelines.

Switching to an automated system can help reduce errors and make the overall reconciliation process much more efficient. There are places where human interference is required, but for routine tasks like documentation and data entry, it is much better to use automated software.

7. Difficulty in accessing funds

Employees facing difficulties in accessing necessary funds for business expenses encounter disruptions in travel plans. This can lead to frustration, and delays, and impact overall productivity during business trips.

It is much better to have prepaid solutions like corporate cards linked to travel and expense management so that employees are not stuck in the middle of their operations while traveling waiting for seniors to approve fund disbursals.

8. Chances of expense fraud

Manual processes and inadequate oversight create loopholes for fraudulent activities, including exaggerated claims, fictitious expenses, or non-compliant spending. Detecting such fraudulent activities becomes challenging without robust monitoring systems.

Most T&E software nowadays comes with robust security and fraud prevention measures that help finance teams make sure that there aren’t any fraudulent attempts internally.

What are the benefits of using travel expense management software?

1. Enhanced accuracy and reduced errors

The traditional system of expense reporting for corporate travel includes many manual processes that can lead to errors.

Automation significantly reduces human errors associated with manual data entry. By automating expense submission and approval workflows, the software ensures accuracy in expense reporting and accounting records.

This accuracy is pivotal for financial audits and regulatory compliance.

2. Cost savings and expense control

T&E management software serves as a strategic tool for cost containment.

By analyzing historical spending data and identifying trends, businesses can negotiate better rates with vendors, optimize travel itineraries, and implement policies that encourage cost-conscious behavior among employees.

This proactive approach translates into tangible cost savings, allowing businesses to allocate resources more efficiently.

3. Streamlined reimbursement process

Automation within T&E software expedites the reimbursement process significantly.

Employees can effortlessly submit their travel expense claims through user-friendly interfaces such as the web app or the mobile app of the T&E management software. This drastically reduces the processing time for reimbursements.

Quick reimbursements improve employee satisfaction and enhance financial predictability within the organization.

4. Improved policy compliance

T&E management software automates policy enforcement by flagging non-compliant expenses in real time. It ensures adherence to company travel policies and regulatory guidelines, minimizing the risk of overspending or non-compliance issues.

Implementing a software system capable of real-time issue detection improves compliance by addressing problems promptly, rather than after the damage has already occurred.

5. Reduced manual burden (documentation burden)

Automation eliminates the need for manual collection, sorting, and inputting of receipts and documentation. Integration with digital receipt capture tools or business credit card feeds automates expense capture, minimizing errors and saving employees substantial time typically spent on administrative tasks.

Most travel and expense management software in the market already include digital receipt capture tools.

6. Better visibility and reporting

Without a centralized system for tracking company’s travel expenses, it's difficult to obtain a complete picture generate comprehensive reports.

Advanced reporting in T&E software offers comprehensive visibility into spending patterns. Customizable dashboards and detailed analytics enable businesses to make data-driven decisions, identify cost-saving opportunities, and fine-tune travel policies for maximum efficiency.

Simplify your expense management

What are the key features to look for in travel expense management software?

Integration capabilities

The variety of integrations that a software application offers can also be a major factor in how well it fits into your business ecosystem.

Seamless integration with existing accounting systems, enterprise resource planning (ERP) software, or other business tools ensures smooth data synchronization.

This integration minimizes manual data entry, avoids duplication of efforts, streamlines processes, and provides a unified view of financial data.

Mobile accessibility

Mobile-friendly applications enable easy expense submissions and approvals on the go.

Travelers can instantly capture receipts, submit expenses, and track approvals, enhancing efficiency and ensuring compliance while on the move.

A mobile app version of your travel and expense management software enables employees and managers to handle expenses on the go, eliminating the need to frequently use laptops.

Automated expense reporting

The first and probably one of the most fundamental features you should look for in a T&E management software that will help you save a lot of time is the level of automation you can perform. Efficient software automates expense reporting processes, allowing users to capture expenses effortlessly. This automation minimizes manual data entry, ensuring accuracy and consistency in expense records.

Automated workflows streamline approval processes, thereby accelerating the reimbursement cycle and reducing administrative burdens.

Customizable approval workflows

Flexible approval workflows tailored to the organization's hierarchy and specific policies expedite the approval process.

Customizable workflows accommodate various approval paths, ensuring compliance and quickening reimbursement cycles.

Many software tools also let you create customizable approval workflows tailored to different departments within an organization. Each of these workflows can be configured with custom rules and criteria to effectively accommodate the unique needs and preferences of each department.

Receipt scanning and OCR technology

Advanced Optical Character Recognition (OCR) technology within the software enables the automatic extraction of data from receipts. This feature eliminates manual input errors, accelerates expense processing, and enhances accuracy in expense reporting.

Having this feature in the software you choose will significantly impact the overall efficiency of your finance operations over time.

Real-time tracking and visibility

Real-time tracking features offer instant visibility into ongoing expenses. This visibility empowers managers to monitor spending in real time, identify trends, and take immediate actions to control costs or address policy deviations.

This feature lets managers and senior folks have peace of mind regarding when and how the employees are spending their budgets.

Support for multiple currencies

Software with multi-currency capabilities simplifies expense reporting for international travel. It automatically converts expenses into the user's base currency, ensuring accuracy and consistency across different currencies.

This feature will be extremely useful for companies that have employees traveling internationally, enhancing and simplifying the reimbursement process significantly.

Analytics and reporting tools

Robust analytics and reporting systems provide comprehensive insights into spending patterns, policy compliance, and expense trends, allowing for a thorough analysis of the organization's finances.

Detailed reports and customizable dashboards empower businesses to make data-driven decisions, optimize policies, and identify cost saving opportunities.

What makes Volopay the #1 choice for your expense management needs?

Volopay emerges as the premier choice for expense management due to its comprehensive suite of features designed to streamline and optimize every aspect of the expense management process. The platform seamlessly integrates cutting-edge technology with user-centric design, providing a holistic solution for businesses of all sizes.

With Volopay, users experience unparalleled accounting automation in expense reporting, significantly reducing manual efforts and ensuring accuracy in financial records. The platform's intuitive mobile accessibility empowers traveling employees to effortlessly submit expenses and track approvals on the go, enhancing efficiency and compliance.

Volopay's robust integration capabilities with accounting systems and its utilization of OCR technology for receipt scanning ensure seamless data synchronization and error-free expense capturing. Real-time tracking and multi-currency wallets enable businesses to gain instant visibility into expenses across various currencies, facilitating proactive cost control.

Moreover, Volopay's customizable approval workflows, coupled with advanced analytics and reporting tools, empower organizations to tailor processes, gain actionable insights, and make informed decisions, ultimately driving operational excellence and financial prudence.

Volopay stands as the forefront choice, offering a sophisticated, user-friendly, and all-encompassing expense management solution, that addresses the diverse needs of modern businesses.

Travel expense management simplified!

FAQs

Volopay stands out as an excellent choice for managing business expenses due to its comprehensive features, including automated expense reporting, mobile accessibility, real-time tracking, and seamless integration capabilities.

Efficient management of business expenses involves leveraging technology-driven solutions like Volopay, which streamline expense reporting, automate workflows, enforce policy compliance, and provide detailed analytics for informed decision-making.

Volopay simplifies the reimbursement of travel expenses by automating the submission, approval, and reimbursement processes. Employees can submit expenses through the platform, which are then routed through customizable approval workflows and reimbursed efficiently.

Travel expense processing refers to the entire workflow involved in managing and reimbursing expenses related to business travel. It includes capturing receipts, submitting expenses, approval workflows, and reimbursement procedures, all of which are streamlined by Volopay.

Companies prefer Volopay due to its user-friendly interface, extensive automation, real-time tracking, multi-currency support, and robust reporting tools. It offers a comprehensive solution that simplifies expense management for businesses of all sizes.

Volopay's automated expense reporting uses advanced technology, including OCR for receipt scanning and integration capabilities with accounting systems. It automates data extraction, minimizing manual efforts, ensuring accuracy, and expediting the reimbursement process.