10 best virtual credit card providers in Australia in 2025

The increase in virtual credit card popularity in Australia is happening for a good reason, as this digital payment method helps businesses easily and securely make payments.

Benefits like simpler employee expenses, better reconciliation, and enhanced security are pushing business owners to look at the best virtual credit card providers Australia has to offer to take advantage of these features.

Empower employees and increase overall business efficiency by using virtual cards for making, tracking, controlling, and managing all kinds of business expenses.

What is a virtual credit card?

A virtual credit card is exactly what it sounds like—a credit card that can be used for payments without having a physical form. It is a digital payment method that utilizes a unique 16-digit card number, expiry date, and CVV, which can be keyed into payment portals to make purchases.

Businesses can generate single or multi-use virtual cards depending on their use cases, allowing them to make payments more securely and create and delete cards as needed.

How does a virtual credit card work?

Virtual credit cards are not that different from their physical counterparts. However, the one obvious main difference is that a virtual credit card does not have a physical plastic form to swipe or tap.

Rather, transactions are made when someone inputs the card data into a payment portal. To access this information, cardholders will need internet access to open the card management dashboard or mobile app that hosts their virtual cards.

There are also ways for cardholders to use virtual credit cards in Australia for offline purchases. By adding their cards to a digital wallet like Apple Pay or Google Pay, they can make payments by tapping their phone at the card machine in stores.

Best virtual card providers in Australia in 2025 - Top picks

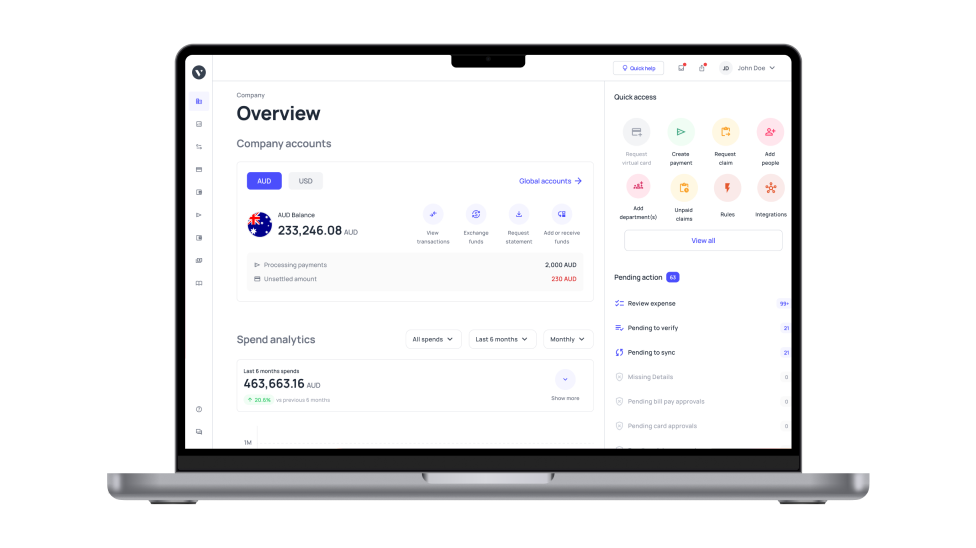

1. Volopay

● Standout features

- Get unlimited virtual cards with Volopay. Businesses that want to streamline vendor invoice management can use Volopay to generate as many virtual cards as they need.

- Each card will be linked to the card management dashboard, where all card details and transactions can be viewed.

- Built-in spend control features also make it easy to limit spending accordingly.

● Fees

Volopay offers various pricing plans tailored to your business needs. For detailed information on their plans and associated fees, please visit pricing page.

● Security

- Volopay is ISO and PCI DSS certified.

- It also complies with the ASIC standard of security, ensuring that it has industry-standard measures to protect its customers’ data.

- With built-in spend controls, businesses can not only set spending limits and expiry dates but also limit who has access to cards.

● Pros

- Get automated approval workflows, which each virtual card expense report must be routed through, to simplify expense reporting.

- Spot non-compliant transactions and address them quickly with Volopay.

- It’s easy to assign fixed budgets and expiry dates to each virtual card. One-time and recurring payments can both be made using Volopay cards.

● Cons

- Volopay is not a bank, but it does have licensed banking partners in Australia.

● Reviews

On most sites, Volopay has over 4.3 out of 5 stars as its rating average, with users generally happy with the platform. Users have claimed that the platform is overall easy to use and that issuing virtual cards for payments is a simple process.

2. Commonwealth Bank

● Standout features

- Larger businesses can open a virtual card account with Commonwealth Bank to manage travel and procurement expenses.

- Rather than having multiple payment methods to pay suppliers, all EFT suppliers can be transitioned into the card model by using virtual cards.

- Recurring payments can also be tied to a virtual card rather than an individual employee card.

● Fees

- To obtain specific details about Commonwealth Bank's virtual card fees, it's recommended to contact a Commonwealth Bank relationship manager directly.

● Security

- Commonwealth Bank is one of the biggest banks in Australia, so customers can be assured that it has the right certifications for security.

- CommBank also offers additional security features such as card request approvers and customizable yet defined spend controls.

● Pros

- The CommBank virtual credit card can simplify expense reconciliation and reduce the need for reimbursements. Equip employees with virtual cards to make business transactions.

- All cards are linked to a single account, so only a single account needs to be reconciled.

● Cons

- Interest rates for CommBank credit cards can be high.

● Reviews

- Amongst customer reviews, Commonwealth Bank does not score particularly high and is instead in the mid-range. However, given that it is still one of Australia’s most popular banking solutions, it is still considered a reputable card provider. CommBank also offers a comprehensive suite of features.

To learn more about the business cards offered by CommBank, visit our blog on Commonwealth Bank business credit cards.

3. HSBC Bank

● Standout features

- HSBC has a Virtual Cards Online Portal that allows businesses to generate unique virtual card numbers to make card-free payments, all through a backend system.

- The cards can be integrated with the business’ procure-to-pay system, making it easy to pay invoices.

- Businesses can even make invoice payments in batches with this virtual credit card provider.

● Fees

- For comprehensive information regarding HSBC's virtual card fees and charges, please reach out to an HSBC relationship manager.

● Security

- Businesses get fraud protection and zero liability for deliberate card misuse perks with HSBC, which helps ensure better fund security.

- Built-in spend controls also allow businesses to determine individual card spend limits, expiry dates, as well as merchant categories.

● Pros

- There’s no need for physical cards that are tied to an individual or a department—cards can be purpose-driven.

- Partnering with Allianz Australia Insurance, businesses can get zero corporate liability perks for deliberate card misuse.

● Cons

- As an international bank, Australia-based businesses may prefer going with a local provider that has more presence in the country.

● Reviews

- As a bank popular in Australia and internationally, it’s no surprise that HSBC is one of the best virtual card providers. However, despite its popularity and numerous perks, some customer reviews state that HSBC does not always have the most responsive customer service.

4. Airwallex

● Standout features

- Airwallex offers virtual cards for businesses in multiple currencies.

- These cards can be used globally for a number of expense categories, enabling easy payments for travel, entertainment, advertising, subscriptions, and many more.

- Airwallex cards can be created in just a few clicks and used by employees almost instantaneously.

● Fees

- Airwallex provides virtual cards with various features. For detailed pricing information, please contact an Airwallex sales representative.

● Security

- As with every other virtual card provider, Airwallex virtual cards cannot become lost as they don’t have a physical form, which reduces fraud attempts.

- Airwallex business account admins can also create and delete virtual cards as they see fit, all in a matter of minutes.

● Pros

- Businesses that use Airwallex can get virtual cards in multiple currencies, all with low FX rates. These cards are accepted globally.

- All cards are centralized and their information is easily accessible through a dashboard, which promotes better transparency.

● Cons

- Airwallex does not have comprehensive multi-level approval workflows for virtual card transactions.

● Reviews

- Users of Airwallex have noted that they get charged lower international transaction fees compared to competitors. However, since Airwallex has a suite of different payment features, its virtual cards seem to be used less often compared to other features such as its international transfer capabilities.

5. American Express

● Standout features

- Plenty of American Express business credit cards in Australia offer virtual counterparts for their physical cards, but its standout product for businesses is the American Express Go tool.

- The Amex Go portal enables businesses to easily create virtual cards and send them to the Amex Go mobile app, which employees can use to make business payments.

● Fees

- American Express offers a range of business card programs, each with its own fee structure. For specific details on fees and charges, please refer to their business cards page.

● Security

- As a reputable credit card provider and network, American Express is guaranteed to have industry-standard security measures.

- With the American Express Go portal, the finance team can also track all virtual card transactions and control business spending.

● Pros

- American Express virtual cards can be used worldwide wherever Amex is accepted. The foreign transaction fee is 1%.

- Issuing virtual cards can happen instantaneously. Admins will be able to set customizable spend limits and expiry dates.

● Cons

- American Express cards are generally on the more expensive side, with its lowest business card annual fee being AUD 149.

● Reviews

- It’s no surprise that American Express is considered one of the best virtual credit card providers globally. While they can be expensive, Amex cards tend to have a lot of useful perks and rewards, especially for travel and entertainment expenses, which businesses can use.

6. Capital One

● Standout features

- While not an Australia-based virtual card provider, US-based businesses or businesses that have a US entity can make use of Capital One virtual cards to transact in Australia or with Australian vendors.

- Cardholders can generate unique virtual card numbers through the digital Capital One Assistant, Eno, or the mobile app.

● Fees

- Capital One’s virtual card offerings come with varying fees depending on the chosen card program. For detailed information on their fees and charges, please visit their business credit cards page.

● Security

- Businesses can get added security with Capital One’s virtual cards, as they can disguise the physical card’s actual card number.

- Paying with Eno-generated virtual cards with unique numbers can prevent fraud attempts like skimming when making business purchases online.

● Pros

- A Capital One virtual credit card can be added to Google Pay for ease of use.

- Capital One allows users to lock and unlock cards as needed. Eno also centralizes card information.

● Cons

- One downside is that only certain Capital One cards have virtual counterparts, meaning that businesses will need to get an eligible Capital One physical card first.

● Reviews

- Capital One’s digital assistant Eno has generated positive reviews for its virtual credit cards. It is generally considered a benefit due to how easy it is to use and generate virtual cards. However, a downside that users may dislike is that there are no customizable spend limits.

7. Wise

● Standout features

- As a company known for its international payment services, it’s no surprise that that’s what Wise virtual cards excel in.

- While the Wise card is not necessarily a business-only service, business owners and entrepreneurs can still take advantage of it. All personal or business Wise customers in Australia can get access to free virtual cards.

● Fees

- Wise provides virtual cards as part of their account services. For detailed information on their fees and charges, please refer to their pricing page. For the most accurate and up-to-date information, it's advisable to consult the respective providers directly or visit their official websites.

● Security

- Wise is regulated by ASIC, meaning that it complies with Australian data security standards.

- Businesses that use Wise can also rest assured that they have easy access to freeze and unfreeze features. Any cards that are compromised can be replaced instantly.

● Pros

- Hold different currencies in Wise virtual cards.

- Wise’s virtual cards can be added to several different digital wallets to make in-store contactless payments easier.

● Cons

- Businesses looking to issue multiple virtual credit cards in Australia may not find that feature with Wise, as each account is limited to up to 3 virtual cards at a time.

● Reviews

- Wise is generally regarded as a trustworthy and reliable service, especially given its reputation as a major payment company. Its card program is a decent service that can be used easily for international transactions, though keep in mind that some reviews mention limited customer support.

8. MoneyMe virtual credit card

● Standout features

- MoneyMe’s Freestyle Virtual Credit Account provides a fully digital credit solution for your business, eliminating the need for a physical card. Once approved, you can instantly access your virtual card and use it for Tap n Pay in-store or online transactions. The quick and fully online application process lets you start using your card within minutes, making it a convenient option for managing expenses.

● Fees

- MoneyMe offers flexible credit limits and interest-free periods. However, the interest rates and fees depend on your credit profile. For detailed information, visit MoneyMe's page.

● Security

- MoneyMe enhances security by keeping your virtual card within your digital wallet, reducing the risk of loss or theft. You can monitor transactions and control spending through the MoneyMe app, giving you real-time oversight of your business expenses.

● Pros

- Instant access to your virtual card upon approval.

- Up to 55 days interest-free on purchases.

- Ability to transfer funds to your bank account or make direct payments.

● Cons

- Requires a compatible device for Tap n Pay transactions.

- Fees and interest rates vary based on your credit profile.

● Reviews

- Users appreciate the quick approval process and seamless integration with digital wallets. However, it’s essential to review the terms to ensure it suits your financial needs.

9. NAB virtual corporate card

● Standout features

- The NAB Virtual Corporate Card provides a digital payment solution for your business, residing securely in your device’s digital wallet. It supports in-store tap and pay transactions via Apple Pay or Google Pay and enables online purchases.

You can issue virtual cards quickly, allowing your employees and contractors to access funds for business expenses securely and efficiently.

● Fees

- NAB doesn't publicly disclose specific fees for its virtual corporate card. For accurate details, visit NAB's page.

● Security

- NAB enhances security by eliminating physical card risks and enabling swift management of card issuance and cancellations. This feature reduces the chances of fraud and unauthorized access.

● Pros

- Quick issuance for immediate use.

- Integration with major digital wallets for seamless transactions.

- Enhanced control over business expenses through easy management of card access.

● Cons

- Fee details aren’t publicly available.

- Requires compatible devices for tap and pay functionality.

● Reviews

- Businesses value the NAB Virtual Corporate Card for efficiently managing expenses and securely providing employees with payment options. For more insights, consider reaching out to existing users or contacting NAB representatives.

10. Westpac virtual card

● Standout features

- Westpac's Dynamic Virtual Cards cater to institutional, corporate, and government customers, enabling fast and secure 'tap and go' payments. These cards can be used both online and in-store via digital wallets, offering greater control over business expenditures and simplifying transaction processes.

● Fees

- Westpac hasn’t disclosed specific fees for its Dynamic Virtual Cards. For detailed information, visit Westpac's page.

● Security

- Westpac enhances security by offering dynamic control over card usage, including setting spending limits and immediate cancellation if needed. This feature reduces risks associated with physical cards and unauthorized transactions.

● Pros

- Quick deployment for immediate business needs.

- Compatibility with digital wallets for seamless ‘tap and go’ payments.

- Improved control and monitoring of corporate spending.

● Cons

- Fee details are not readily available.

- Requires digital wallet-compatible devices.

● Reviews

Westpac's Dynamic Virtual Cards are praised for their flexibility and the control they offer in managing business expenditures. For detailed feedback, consider consulting directly with Westpac or existing corporate clients.

Make secure and convenient business payments

Importance of virtual credit cards for businesses

Businesses that work with the best virtual credit card providers in Australia are able to get an edge. Managing payments, finances, and security is easier with these beneficial virtual card features:

1. Streamlines expense tracking

Payments made through a virtual credit card can easily and automatically be recorded via a card management system.

The finance team can enjoy more streamlined expense tracking and ensure that they know how every penny is used under the company’s name.

2. Enhances spend control

The card management dashboard also promotes a higher level of accountability.

Employees know that company spending is tracked accordingly and will avoid making non-compliant payments. Managers and finance teams can also set spending limits and block merchants accordingly.

3. Improves vendor management

By assigning one virtual card to each vendor, businesses can streamline vendor payments and management.

No more worrying about when and how to pay vendors—virtual cards can help schedule recurring payments to ensure no vendor deadline is missed.

4. Easily voided if compromised

Blocking and freezing virtual credit cards in Australia are simple tasks.

Many virtual card providers offer a card dashboard that allows businesses to easily click a button to freeze or block compromised cards. This request can be instantly executed with some providers.

5. Boosts convenience

Employees don’t have to carry around physical plastic cards to input the right card and CVV numbers when making business transactions from their desks.

All they have to do is log into the card management system or open their digital wallets to access virtual card.

6. Increases fraud protection and security

A virtual credit card is less likely to become compromised compared to its physical counterpart. This is due to the fact that the card information is all stored securely in the digital sphere.

Single-use cards also prevent cyber criminals from stealing account data.

7. Improves working capital

It’s easier to manage cash flow and liquidity with virtual credit cards. Getting business credit provides organizations with alternative payment options.

Virtual credit cards are also typically easier to get approved for compared to something like bank loans.

There are lot more benefits that businesses can get by using virtual cards. Read our blog to know in detail about the use cases of virtual cards.

Things to consider while choosing a virtual card for your business

Review spending limits and restrictions

Each virtual credit card provider will have its own spending limits and restrictions.

Make sure to review all the limits and restrictions thoroughly and examine them in relation to the company’s needs. For example, a daily limit of AUD 500 per card will not bode well for businesses with subscriptions that cost more than that.

Check for liabilities

Some virtual card providers have programs where the individual cardholder is liable for the credit card usage, while others weigh the card liabilities on the company name that it is under.

Each company will have its own preferences, but having virtual cards with company liabilities often streamlines the whole process.

Assess fees

There will be fees attached to almost any card program. Whether that is an annual fee, a late credit payment fee, or even an additional fee for each virtual card generated.

Ideally, businesses will want a card provider that allows an unlimited number of virtual cards for free. Assess what works best for the organization.

Ensure access to multiple cards if needed

Considering that a big plus point to virtual credit cards is that businesses can generate multiple of them to streamline vendor and expense management, keep a look out for card providers with this capability.

If having unlimited cards is why an organization is looking for a provider, it’s important to make sure that it can access this feature.

Evaluate international transfer capabilities and FX rates

Not all virtual cards can be used internationally, but this feature is a must-have for businesses that have a lot of foreign transactions.

The best virtual credit card provider will have excellent international transfer capabilities, along with competitive FX rates. The more competitive the rates are, the less businesses will have to spend on foreign exchange.

Related read: All about international money transfer regulations in Australia

Prioritize enhanced security measures

Virtual cards are generally more secure than their physical counterparts, but prioritizing security is still of utmost importance. Ensure that the card provider of the company’s choosing has enhanced security measures.

This should be non-negotiable. Features like encryptions, block or freeze functions, OTP authentication, and user authority levels are some to look out for.

Check for real-time spending visibility

The best virtual credit cards in Australia will have real-time tracking features, which are extremely valuable for spend management.

Having automatic real-time transaction updates gives finance teams full visibility of how company funds are being used. With this, overspending is less likely to happen, which is why it’s a key feature to look out for.

Consider provider reliability

As virtual cards are linked to sensitive information and company finances, businesses will want to know how reputable and reliable their card providers are.

Find out which card providers are the best in the country and read reviews or customer testimonials. This can give a good picture of the providers’ reliability.

Take into account the ease of use

While a learning curve is manageable with the right training, it’s still important for businesses to consider whether or not their virtual credit card is easy to use.

Card dashboards that are intuitive and only require minimal training make it easy for both the finance team and other employees to start using virtual cards.

Criteria for businesses to apply for virtual credit cards

1. Company registration

Businesses searching for the best virtual credit card for corporate usage often need to be registered as a company. If the aim is to get one of those card programs, then it’s important to be able to prove that the company is a registered entity in Australia.

Personal virtual credit cards, on the other hand, can be used by sole traders and freelancers.

2. Financial standing

As with most, if not all, forms of credit, virtual credit card providers will want to know whether or not their customers are credit-worthy.

It’s common for card providers to ask for financial information, such as a customer’s bank account records, during the application process. Businesses that are of solid financial standing are more likely to be approved for virtual credit cards.

3. Company scale

Depending on the card provider and program, some cards may only be available for businesses above or below a certain scale.

For example, a virtual credit card program with an AUD 0 annual fee may be geared toward small businesses. Companies with a number of employees above a certain threshold might not be eligible for the zero annual fee card.

4. Banking information

The virtual card provider will want to know the business’ banking details. Not only is this necessary to potentially link cards to, but it also helps providers gauge their customers’ financial health.

Many providers will require a dedicated business banking account from the company. Providers may also ask to look at bank statements from up to 6 months to a year ago.

5. Annual revenue

Other than asking for bank statements, many providers will require details on the business’ annual revenue during the virtual credit card application process.

Some card programs, especially ones that are considered higher-tiered and have more perks, will only be available for companies with higher annual revenues. These premium cards are typically more expensive, hence the annual revenue threshold that must be met.

6. Card intent

Some providers may want to know what the business’ intent with a virtual credit card is. This is to ensure that all their customers spend responsibly and can pay back their credit usage.

Before researching virtual cards and applying for one, make sure that the company has a good reason to get these cards. Stating this reason to the provider may be required.

7. Identification papers

Banks and other financial institutions that offer virtual cards have a KYC (know your customer) process that they will perform before approving an application. This is why it’s important for businesses to provide identification papers of their directors.

For some financial institutions in Australia, more than one document is needed. Make sure to collect all the required identification documents to speed up the process.

Virtual cards for secure and fast payments

Applying process to get a virtual credit card

Identify the requirements of your business

Before even applying for a virtual credit card, it’s important to first understand why a business may want one. Businesses should make sure that they only get a virtual card because they need one.

Identifying what the company’s requirements are for getting a virtual card also helps the company determine which virtual card providers will be the best fit for them.

List what features are must-haves to solve the company’s pain points.

Explore virtual credit card service providers

Once there is a clear outline of what the business needs from virtual credit cards in Australia, the finance team can begin looking at their options.

Explore some of the best and most reputable virtual card providers and see what they have to offer.

Keep in mind that the best-suited provider for one organization may differ from another organization’s, as it depends on which provider can meet their needs.

Collect documents

Before sending in the application, make sure that all the required documents are ready. Typically, the best virtual credit card provider will require documents that serve as proof of identity and residency.

Virtual cards that are geared specifically for businesses may also require the business’ ABN or a document that proves that the business operates in Australia.

Send in your application

Filling out the application form is much easier when the business is well-prepared. Other than preparing the necessary documents, make sure to get the details on what the application form requires. If it is possible to access and fill out the form online, that should be the easiest way.

The rest of the process will go smoothly if every field in the form is filled correctly. Double-check the application and send it accordingly.

Await approval

There will be a wait time after sending in the application, as the card provider will have to review the application and approve it. Typically, this takes around a few days to two weeks, but some virtual credit card providers may be able to expedite the process. Some businesses may get instant approval.

If there hasn’t been any word from the provider, it’s a good idea to get in contact with someone and check in on the application.

Activate your virtual card

When an application is successfully approved, the card provider will notify the organization. This is also when virtual cards can be created and activated. Approved customers will typically be provided with a card management dashboard or mobile app login.

It’s through those platforms that businesses will be able to activate their virtual cards. The process shouldn’t take more than a few clicks and can be done in under five minutes.

Guidelines for secure usage of virtual credit cards

Consistently monitor transactions

Virtual credit cards typically come with a mobile app or web dashboard that serves as the cards’ control center.

These platforms can also be used to view and track all card transactions. It’s good practice to consistently monitor and regularly review the transaction records to ensure they all comply with company policies.

Enable OTP authentication

For increased security, enable OTP authentication.

Each transaction made with a virtual card should ideally require the cardholder to fill out an OTP, typically sent to the cardholder’s phone number. This ensures that the cardholder can confirm that they have authorized the transaction by inputting the OTP they have received.

Provide employee training

Make sure that employees are equipped with the necessary knowledge before they start using virtual credit cards for business purposes.

Outline all card-related policies and host training sessions to familiarize them with the cards and their dashboard. Employees should know how to make virtual card payments as well as what to do when a card becomes compromised.

Promptly report lost or stolen cards

There should be clear policies on what to do if card data is stolen.

While a virtual credit card cannot be lost the same way a physical card could be, it can still be compromised if a cybercriminal gets their hands on the card information. It’s important to make sure any compromised cards get reported immediately.

Regularly review security protocols

Businesses should have security protocols in place before beginning to use virtual credit cards in Australia, but it’s not enough to just outline them once.

It’s important for companies to regularly review and revisit their security protocols, as this ensures that they are airtight. Changes in the business, market, or regulations should also be taken into account.

Set expenditure limits

Some of the best virtual card providers allow businesses to set their own expense limits on their cards. Take advantage of this to ensure that cards are being used accordingly.

With card programs that allow an unlimited number of virtual cards, businesses may also want to set individual limits for each card.

Conduct transactions solely on secure platforms

Even with the best virtual credit card security features, businesses must still exercise caution when using these virtual cards.

Transactions should also be conducted with trustworthy and verified vendors on secure platforms. Using cards on suspicious and non-verified platforms may make it more likely for the cards to get hacked and compromised.

Establish a multi-level approval process

It’s a good idea to establish a multi-level approval process for new cards and spend limit upgrades. Doing this ensures a higher level of accountability.

A multi-level approval workflow helps companies make sure that both direct managers and upper management know how the virtual cards are being used.

What makes Volopay virtual cards the ideal choice for your business?

1. Customize and adjust card limits

Each virtual card generated with Volopay can have its own unique limit.

But what sets Volopay apart and makes it one of the best virtual card options in Australia is that you can customize and adjust card limits easily.

All you need is access to the Volopay dashboard to do this!

2. Simple application process

Applying for Volopay cards is easy. As one of the best virtual card providers in Australia, Volopay’s application process is fully online.

To initiate the process, all you need to do is fill out the required fields and upload the necessary documents.

No branch visits are necessary for the Know Your Customer (KYC) process prior to approval.

3. Instant approval

There are no long wait times with Volopay virtual cards.

Your initial application can be immediately approved if all the fields are filled out accordingly.

Once the application has been successfully approved, each virtual card can be generated, approved, and activated instantly.

4. Unlimited virtual cards available

One thing that makes Volopay better than a virtual credit card is that you’re not limited to just one card, nor do your virtual cards have to be linked to physical cards.

With Volopay, businesses have the flexibilty to generate an unlimited number of virtual cards to meet their specific needs.

Each vendor, subscription, or project can have its own designated card for extra convenience.

5. Enhanced vendor management efficiency

Volopay is an all-in-one platform designed to help your business manage finance processes.

With vendor management features, you can also assign each virtual card you create to a vendor, to simplify vendor payouts.

Schedule recurring payments easily and ensure that each vendor is paid promptly and accurately. No more confusion over your vendors and payment deadlines!

6. Transparent pricing with no hidden fees

All of Volopay’s pricing is delivered to you with utmost transparency.

Anything that will incur a cost will be communicated so that the finance team can plan accordingly.

Volopay believes in fair pricing and will not charge you with hidden fees—you’ll know exactly what you’re paying before applying for new cards or making transactions.

Take charge of your business expenses

FAQs

Some virtual card providers have online application forms that businesses can easily fill out. To get a virtual credit card online, businesses should look for a provider that has an online application option.

Volopay is one virtual card provider that allows you to do your application entirely online. Businesses will need to prepare the necessary documents, such as proof of identity, business licenses, and more. These can be uploaded online when filling out the application.

Make sure to check whether or not a card provider will require a branch visit after sending the online application. Businesses that want to do the process entirely online should avoid forms with that requirement.

Limitations and restrictions will greatly depend on the individual virtual card provider. Some card providers may have a daily spending limit, while others may have a limited acceptance rate or are not useable for international transactions.

One thing to keep in mind with virtual credit cards in Australia is that they typically can only be used for online transactions unless they are added to a digital wallet to use in-store.

Yes, though it will ultimately depend on your card usage and credit repayment.

Given that virtual credit card limits are typically not extremely high, they can be easier to obtain than some other forms of credit, such as bank loans or invoice financing. Like any other credit card, virtual cards often have lower barriers of entry.

This means that businesses looking to improve their credit can apply for a virtual card and get a lower credit limit to start building their credit. However, keep in mind that businesses must use their virtual credit cards responsibly. Credit repayments should always be made on time and in full.

When researching virtual card providers, make sure to look up their reputations in Australia.

Having a reputable provider is the first step to ensuring the security of your business’ financial information. It’s also a good idea to check if they have industry-standard certifications, which would indicate that they have the security measures required in place.

Get in contact with your provider to ask for more details. Make sure that the provider is able to provide answers on how they intend to protect your business’ data and funds.

Some good features to have are two-factor login authentication and OTP authentication. These can significantly reduce the chances of hackers accessing your data and misusing your cards.

Businesses looking to apply for virtual cards online are in luck because Volopay is a virtual card provider that has a fully online application.

While some banks may require a branch visit as part of the KYC process, that’s one step that you don’t have to worry about with Volopay. Simply fill out the form online and submit all the required documents—Volopay will get back to you as soon as possible!

Yes. Two big integration capabilities that you’re guaranteed to have with Volopay are accounting and digital wallet integrations.

Volopay’s virtual cards can be linked to Apple Pay and Google Pay, allowing cardholders to use the cards for in-store purchases via their digital wallets. All a cardholder has to do is tap their phone to make a payment.

With its accounting integration features, businesses can also rest easy when it comes to bookkeeping. Volopay offers direct accounting integration with a number of popular Australian accounting services, such as MYOB, Xero, Quickbooks, and more.