Comparing the 4 best business travel rewards credit cards in Australia

If you are planning a big trip that will require you to fly or drive, the best credit card for business travel can help you save money with rewards points. Commonly referred to as "miles," this airline currency may be redeemed for free flights, hotel stays, and other benefits. Although the premise is the same, several airlines use different names for their money, such as ‘Reward Points’.

Reward points can be used to book flights, hotels, or even car rentals. You can also transfer your rewards points to various leading airline and hotel affiliates. The best credit card for business travel offers the most miles per dollar spent.

However, selecting the right card isn’t as simple as it sounds. Some cards offer more rewards than others, so it’s important to consider various factors. For those who prefer a budget-friendly approach, the best prepaid travel cards in Australia can also provide great solutions for managing travel expenses.

The following best business travel rewards credit cards let you redeem your award miles for flights and other enticing benefits, making your wildest vacation fantasies a reality.

4 best business travel rewards credit cards in Australia

1. Emirates Citi World Mastercard

The Emirates Citi World Mastercard makes up to 60,000 extra Emirates Skywards Miles available, with the annual fee reduced by fifty percent the first year. This is the market's best business credit card for Emirates Skywards miles, and it comes with lounge passes, Emirates limo transfers, and complimentary travel insurance.

You may also be compensated for any difficulty caused by an emergency medical condition, delayed checked-in baggage, aircraft delays, and other unforeseeable events.

Pros

● Earn 60,000 Skywards Miles on your first purchase within 90 days after card approval.

● One complimentary ride to and from the airport per year when flying Emirates

● Zero percent on balance transfers for 9 months.

Cons

● The annual fee from the second year is $299

How to apply

You must be a member of Emirates Skywards to be eligible to earn Skywards Miles with the card. Getting started with Emirates Skywards is easy, just head on over to their official website. If you open a Citi account, you have six months to furnish your Emirates Skywards membership number. So it’s important to have your personal details ready to complete the online application

Terms and conditions

● Rewards program: Emirates Skywards

● Annual fee: $149 for the first year, $299 for subsequent years

● Purchase Rate: 21.49 % p.a.

● Min credit limit: $15,000

● Max credit limit: $100,000

● Interest-free period: Up to 55 days on purchases

● Foreign currency conversion fee: 3.4%

● Bonus points: 60,000

Eligibility criteria

● Age and Residence: You must be at least 18 years of age and an Australian citizen or permanent resident.

● Minimum Income: $75,000 p.a

2. Westpac Altitude Platinum Card

The Westpac Altitude Rewards Platinum Card allows you to use your points in various ways without paying a rewards fee. It earns 1 to 3 points per $1 spent on qualifying purchases, with the greatest earn rate available for flights booked with Qantas or Jetstar.

It provides retail gift cards, cash back, access to a number of partner airlines, their own online store, and a one-of-a-kind 'pay by points' option. Furthermore, when you shop with certain partners, you will earn points faster.

Pros

● 110,000 bonus Altitude Points offer

● $49 first-year annual fee

● Introductory balance transfer of 0% p.a. for the first 24 months

● Earn up to 3 Altitude Points per $1 spent, uncapped

● Complimentary travel insurance covers

Cons

● A one-time 1% balance transfer fee applies

● The standard annual fee of $150 is high

● Only offers up to 45 days interest-free on purchases, as opposed to most cards with 55 days

● Tiered earn rate makes points potential more difficult to estimate

How to apply

Fill out the online application for the Altitude Platinum Credit Card, and you will receive an answer within 60 seconds.

Terms & conditions

● Rewards program: Westpac Altitude Rewards

● Annual fee: $49 for the first year ($150 thereafter)

● Purchase Rate: 19.99 % p.a.

● Min credit limit: $6,000

● Max credit limit: $30,000

● Interest-free period: Up to 45 days on purchases

● Foreign currency conversion fee: 3%

● Bonus points: 110,000

Eligibility criteria

● Minimum income: $30,000 p.a.

● Residency: Permanent resident or Australian citizen. Students are not eligible, and temporary visa holders must apply through migrant banking.

3. NAB Rewards Business Signature Card

The NAB Rewards Business Signature credit card combines a customizable rewards program with the characteristics of a business account. This business travel rewards credit card also includes business unapproved activity coverage, transport insurance coverage, and a 24/7 personal concierge service that you may utilize to save time when booking flights, lodging, entertainment events, and restaurant reservations when hosting guests.

Pros

● 100,000 bonus points after $4,000 in the first 60 days of account opening

● 1.25 NAB Rewards points per dollar spent, uncapped

● 24/7 Visa Premium concierge service

Cons

● $175 annual fee is high

● Does not offer overseas travel insurance covers or lounge passes

Terms and conditions

● Rewards program: NAB Rewards

● Annual fee: $175

● Purchase Rate: 18.5% p.a.

● Min credit limit: $5,000

● Max credit limit: $50,000

● Interest-free period: Up to 44 days on purchases

● Foreign currency conversion fee: 3%

● Bonus points: 100,000

How to apply

The NAB Rewards Business Signature may be applied for online. If you have a MYOB or Xero account, you may connect securely to the program and save time uploading the necessary business paperwork.

Eligibility criteria

● To be eligible for the bonus points offer, you must apply for a new NAB Rewards Business Signature card and not have held a NAB business card within the last 12 months.

● Age and residency requirements: You must be at least 18 years of age and an Australian citizen or permanent resident.

4. The American Express Explorer Credit Card

The American Express or AMEX Explorer is one of the few best business travel rewards credit cards that gives you a travel credit every year. This credit is worth $400 and can be used toward a trip booked with American travel to Australia or another country. This card gives new customers 70,000 bonus points, which can be redeemed for $350 worth of Webjet bookings and certain store purchases.

It has the best points-to-spend ratio of any Amex business credit card on the market today, with 2 points for every $1 spent.

Pros

● 70,000-point Membership Rewards boost

● $400 annual travel credit

● Two complimentary annual airport lounge passes

Cons

● Standard purchase rate of 20.74% p.a. is quite steep

● $395 annual fee is high if you cannot make full use of the travel benefits

Terms and conditions

● Rewards program: Membership rewards

● Annual fee: $395

● Purchase Rate: 20.74% p.a.

● Min credit limit: $3,000

● Interest-free period: Up to 55 days on purchases

● Foreign currency conversion fee: 3%

● Bonus points: 70,000

How to apply

Apply online for the American Express Explorer Credit Card — it takes no more than 10 minutes, and you will hear back from the company in under a minute.

Eligibility criteria

● Minimum income: You must have a yearly gross income (before taxes) of at least $65,000 to qualify.

● Age and residency: You must be an Australian citizen, 18 years or above, permanent resident, or possess a current long-term visa to be eligible for residency (12 months or more). Student visas are not accepted.

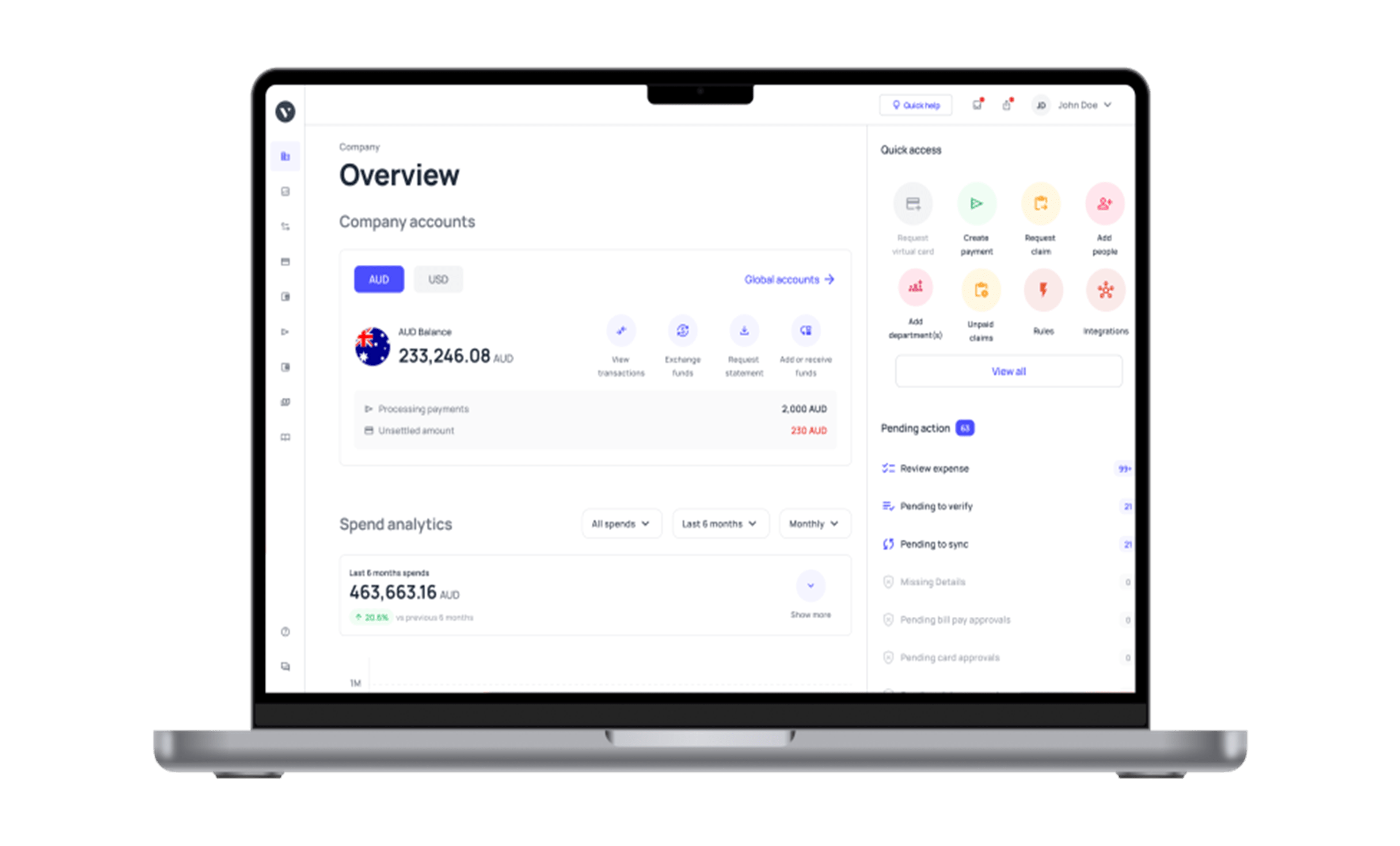

Volopay corporate cards give you the best of both worlds

Taking professional advice into consideration to obtain the best business travel rewards credit card, you must obtain a credit card for business travel if you intend to pay off your monthly bill in full.

If you believe you may eventually carry a balance, you might want to apply for a low-interest credit card. You can acquire a rewards card for regular purchases and a low-interest card for larger purchases or unanticipated expenses that you might not be able to pay off right away if you want the best of both worlds.

Considering the best case scenario for your company, it is your responsibility to make the business operation simpler and easier for your employees. This will only happen through smart automation and the utilization of the right tools. Volopay is the solution to all your business finance needs.

The corporate cards offered by Volopay are designed to enable your employees to spend wisely and not hamper the company funds.

Along with this, the corporate credit card is the perfect solution for getting a line of credit that would boost your cash flow and entail the benefits of rewards. Furthermore, you get seamless control over your business expense, along with direct accounting integration.