How can virtual cards help with cash flow management?

A strong cash flow ensures that your business has the financial stability to operate and grow. Managing the cash inflow and outflow within an organization is one of the most important tasks that finance teams have to deal with on a daily basis.

With the development of technology and its integration within businesses, new tools can help make processes efficient. In the current economic environment, cash flow management with virtual cards is emerging as an effective way to keep cash flow in check.

Importance of virtual cards in managing business cash flow

Virtual cards are digital payment cards that allow businesses to make purchases online. They work just like physical cards, but do not have a tangible form and cannot be used with POS machines.

Virtual cards are issued by financial institutions and other NBFCs. They can be used for a variety of payment purposes for online purchases and depending on the card provider may also be usable for some offline payments through Google Pay and Apple Pay.

Here are some reasons why virtual cards for cash flow management are becoming more prominent:

1. Improved payment processing

Virtual cards streamline the payment process, making it faster and more efficient. This means businesses can pay bills and expenses more quickly, reducing the time it takes for payments to clear and freeing up cash flow.

2. Better control over cash flow

With virtual cards, businesses can set limits on spending, ensuring that expenses stay within budget. This helps prevent overspending and ensures that cash flow is managed effectively.

3. Reduced risk of fraud

Virtual cards provide an added layer of security compared to traditional payment methods. They can be restricted to a single transaction known as single-use virtual cards.

This reduces the risk of fraud and unauthorized transactions as once a purchase has been made through the single-use card, there are no more funds left and it automatically expires within the set period.

Benefits of cash flow management with virtual cards

Virtual cards can be the best way to manage all your business cashflows and some of the benefits include are:

Reducing the risk of fraud and unauthorized transactions

Virtual cards have built-in security features that help prevent fraudulent activity. These cards use the tokenization method which allows the card to generate a unique number that is not directly traceable to a business bank account.

So even if your virtual card details are compromised, a fraudster will not be able to steal money from your account. Additionally, you can also temporarily freeze or permanently block a card through the provider's platform.

Streamlining payment processes and reducing overspending

Virtual cards simplify payment processes, making them faster and more efficient. When you create a virtual card, you get the option to set a custom expiry date.

So if you were to use a virtual card for a SaaS subscription, and you want to use the tool for only 6 months, then while creating the virtual card you can set the expiry date to six months from the day you make the subscription payment.

This reduces the risk of payment errors and overspending.

Improving cash flow visibility and control

Each transaction that happens through a virtual card is instantly recorded in the online ledger of the card provider's platform.

This can be accessed at any time and you don't have to wait for monthly card statements to see the expenses that have been made. This provides businesses with greater visibility and control over their cash flow.

Enhancing financial flexibility and liquidity

Some virtual card providers allow businesses to create unlimited virtual cards. This enables a business to manage its cash flow the way they want.

The team can either create multiple cards to pay and track separate vendors or create virtual cards based on spending category. The ability to choose and manage your business expenses in such a manner provides financial flexibility and liquidity.

How modern businesses are using virtual cards for cash flow management

1. Virtual cards for online purchases

Many Australian businesses are using virtual cards for online purchases. Virtual cards can be used for everything from software subscriptions to office supplies.

No matter what expense is being made, each transaction is recorded in real-time allowing the finance team and managers to stay on top of budget spending.

2. Virtual cards for employee expenses

Virtual cards can be used to pay for employee expenses, such as travel and entertainment. They provide a convenient way for employees to pay for expenses while ensuring that spending stays within budget.

It is much better than petty cash which cannot be tracked easily and money can leak easily.

3. Subscriptions and recurring payments

Virtual cards are ideal for managing subscriptions and recurring payments. They can be set up to automatically pay for recurring expenses, reducing the risk of missed payments and late fees.

Autolock dates or custom expiry dates can also be set to ensure that there is no wastage of budget once a subscription is not needed anymore.

4. Manage their travel expenses

Using a virtual card, you can book travel-related expenses such as flight tickets and hotel rooms. They provide a convenient way for businesses to manage their travel expenses while providing greater control over spending.

Related read: Best prepaid travel cards in Australia for 2024

How can Volopay help improve business cash flow?

A business is able to improve its cash flow when it has the flexibility to make payments flexibly and control business expenses efficiently with complete visibility of transactions at all times.

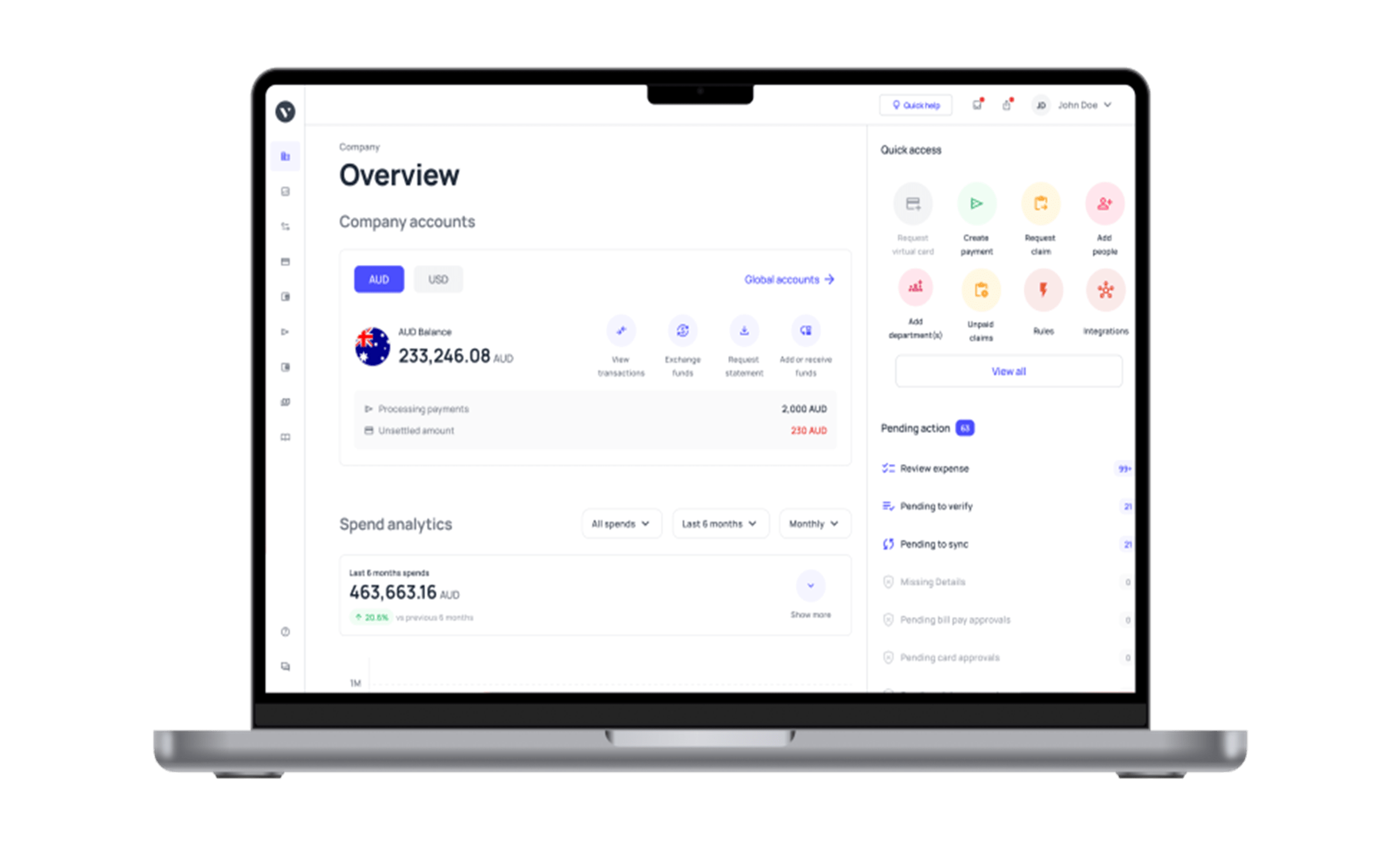

This is only possible when a company uses an expense management system like Volopay that is able to automate the tracking and control functions.

Additionally, you also need modern payment infrastructure and tools to effectively be cash flow positive.

Cash flow management with virtual cards is one of the many ways new-age Australian businesses are offloading the burden of manual tasks and optimizing for more strategic work.

To understand this concept more clearly, here are two ways in which Volopay solves your cash flow problems:

1. Virtual cards

Firstly you can create unlimited virtual cards using Volopay. This ensures that there are no delays in payments no matter how many employees you have. People won’t need to share the same card and can use individual virtual cards instead.

Each virtual card has a spending limit above which the user can’t spend. This ensures control over budgets and removes the chance of overspending. Lastly, it is much safer than using petty cash as it can’t be stolen or lost.

Plus, it is much more secure to use for online purchases than a normal card because of tokenization.

2. Interest-free credit line

An issue that many businesses face is the monthly liquidity crunch they face due to an imbalance in cash inflow and outflow. The rate at which your company needs to spend might be more than the rate at which you receive money from your clients.

In such a situation where you don’t have enough liquid cash, having access to a credit line can make things really smooth. Our credit line does not have preset criteria. We check the financial health and stability of each customer individually to determine whether they should get access to credit and how much of it.

Volopay’s credit line can be used in sync with our money transfer feature on our platform and the corporate cards we offer(both physical and virtual). A business needs to optimize and find creative ways to cut costs without sacrificing the quality of output.

Volopay’s expense management software is one such tool that allows finance and accounting teams to do their best work and brings efficiency to the system.