Corporate vs business credit card - Detailed comparison

Cheques and cash payments are outdated. With the revolutionizing world, business payment channels and methods have also evolved. Business and corporate credit cards are two of the new business payment and finance methods. Why are these better than the traditional methods?

This is because business employees don’t have to invest manual labor and time into it; just a few clicks and voila, payment is done. Plus, these cards come with various management features, which makes them a great tool for financial management.

Spending, receiving, and organization are all done through these small tools called business and corporate credit cards.

Which one wins the business vs. corporate credit cards battle is completely up to a business’s preference and requirements. Keep reading to learn the difference between business and corporate credit cards and which is right for your business.

What is a business credit card?

A business credit card, as the name suggests, is designed to help businesses make spending and investments. These cards do not serve personal spending purposes; these are curated, especially for small businesses, to help them keep their personal and business expenses separate.

Plus, business credit cards are beneficial for earning rewards and cashback and also serve tax management purposes. Business credit cards come with higher interest rates than conventional loans. This is because credit card debt is highly risky and unsecured.

Who can use a business credit card?

Business credit cards are for both small and large companies. Along with this, even sole proprietors can use a business credit card. It is not necessary that a business should have an established office or a certain number of employees.

Business credit cards can be used for making spends like purchasing raw materials, daily office expenses, travel expenses, etc. Some of the business credit cards are installed with limits and requirements that restrict the cardholders from using that card for personal expenses.

What is a corporate credit card?

The difference between business and corporate credit card is basically that the latter is issued to the employees of a company. The employees who get these corporate credit cards have authorized access to the company funds and can make expenses on the business’s behalf using these cards.

These expenses can be business travel tickets, office supplies, and other supplies. The employees will not be required to use their own cards or cash. Cashback and rewards are also perks offered with these cards.

Who can use a corporate credit card?

Corporate credit cards can be availed by the employees of a company. However, the company is required to pass the eligibility criteria, like two years of establishment, a certain limit on yearly revenue (this differs from provider to provider), business registration papers, and some other requirements. Small and large, both types of business employees can use these cards.

Business credit card vs. Corporate credit card - Key differences

1. Eligibility

● Business credit cards

SMEs, large businesses and sole proprietors, freelancers

● Corporate credit cards

Small, large, and startup businesses with employees and more than 2 years of establishment.

2. Liability

● Business credit cards

The business owner holds liability.

● Corporate credit cards

Business owners, individual employees, or both can be liable.

3. Fees

● Business credit cards

Charges are between 1.6% and 1.8%.

● Corporate credit cards

Charges higher than business credit cards.

4. Reward

● Business credit cards

Offers rewards and points to get a higher-category.

● Corporate credit cards

Business owners, individual employees, or both can be liable.

5. Interest rates

● Business credit cards

Up to 1.99% per month.

● Corporate credit cards

Up to 3.35% per month.

Get best corporate card for all your business needs

Corporate credit card vs. business credit card: Which one to choose?

Here are some more comparison points that can help you make the right decision.

1. Features

Spending limits and category restrictions can be set on both cards. Whether it is only the business owner using the card or, in the case of the corporate card where your employees are also using the cards, limits can be set.

Both cards offer rewards and cashbacks. Plus, both types of cards can be integrated with accounting software.

The difference arises when it comes to tracking and management tools. Business credit cards have basic functions, whereas corporate credit cards have high-tech expense tracking and real-time spend alert capabilities.

2. Company size

$4 million is the usual annual revenue requirement for corporate credit cards. Some providers also have a minimum number of employees category, for example, 15 employees.

Whereas business credit cards can be held by freelancers and sole proprietors as well. So the analysis is dependent on the personal credit profile of the business owner.

3. Transactions

The business owner or any authorized person can make transactions using the business credit card. On the other hand, corporate cards can be used by the owner and can be assigned to different employees to make spends.

4. Business type

Business credit cards can be used by all types of businesses. From large enterprises to freelancers and gig workers. However, corporate credit cards can be used by large and small businesses and startups as well.

Volopay cards for all your business transactions

Till now, you must have made a choice of the type of card you want for your business. So, let’s take the next step and choose the right provider, and the right provider is Volopay. Let us explain why.

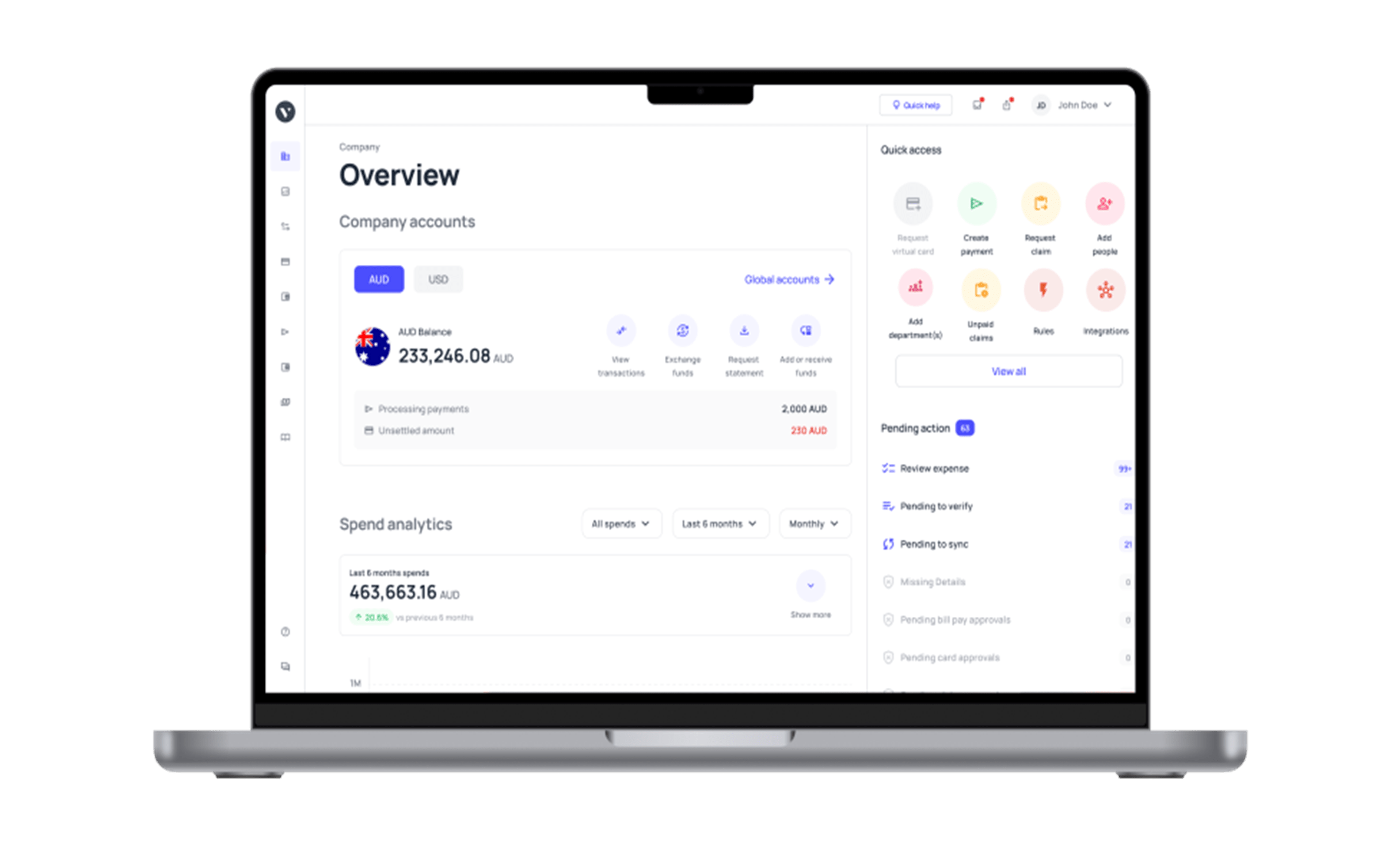

Volopay is an all-in-one expense management software that offers the best corporate cards. These cards are installed with features and tools that help a business establish complete control and management over their spends.

These features are real-time expense tracking, international transactions in more than 60 currencies, accounting integration, spend analytics, expense report management, unlimited virtual cards, credit offered on no personal guarantee, and many more.

FAQ's

No corporate credit cards have more high-tech features and higher loan amounts than business credit cards.

Corporate cards offer more robust spend controls and financial management features in comparison to business cards.

Business owners and employees of small and large businesses can use corporate credit cards to manage their business expenses.