Comprehensive guide on multi-currency account in Australia

A multi-currency account is useful for businesses in Australia that frequently receive or send payments in foreign currencies. This way, companies can manage money in several currencies, making international transactions more efficient.

Since users can manage and hold several currencies through one account—a multi-currency account—it eliminates their need to maintain separate bank accounts for operating with each currency. Businesses can also save costs with multi-currency accounts as it reduces the currency conversion fees.

A multi-currency account is for businesses seeking to streamline their foreign transactions by managing them seamlessly through a single bank account.

What is a multi-currency account?

A multi-currency account, also known as a foreign currency account, offers the facility to handle, hold, and transact in numerous currencies.

With a multi-currency account, you can store money in more than one currency. This account differs from standard banks that only provide transactions in a single currency. Several online and offline banks offer a multi-currency account in Australia.

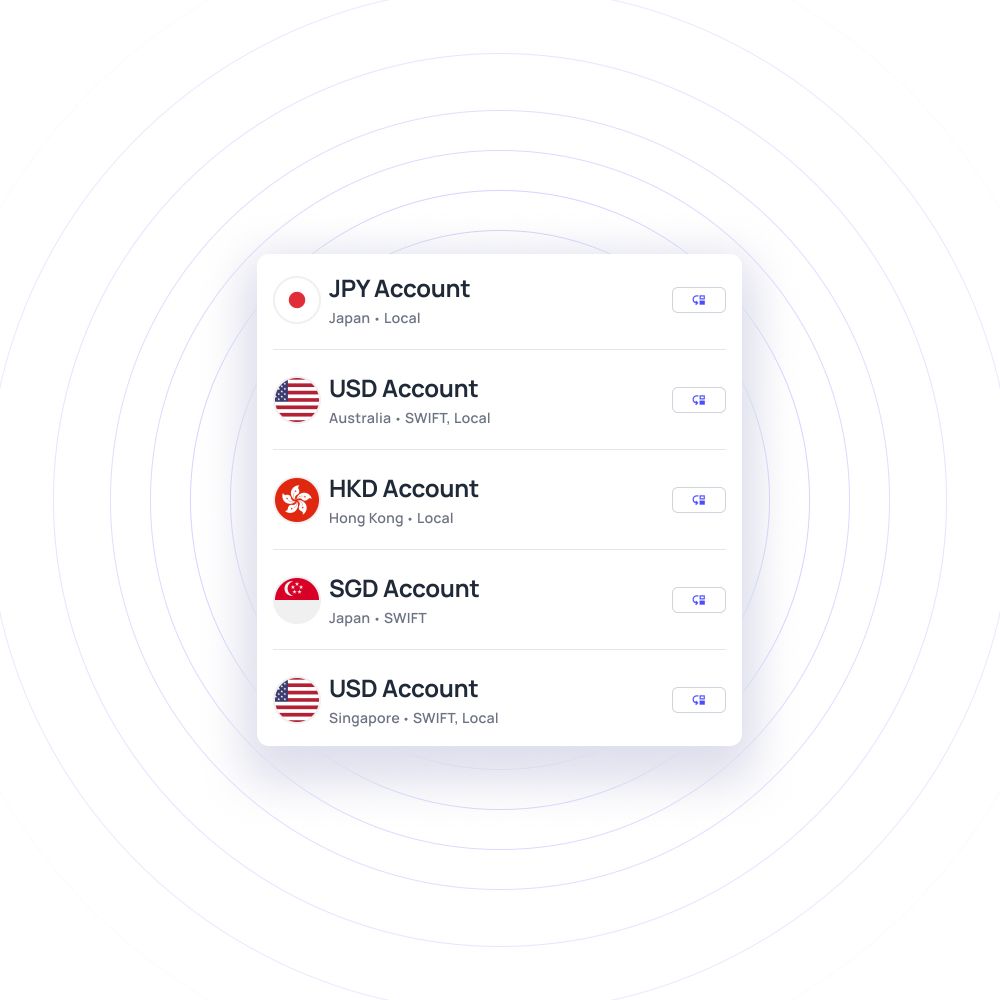

These accounts often include features like multiple balance accounts, where users can hold different balances in different currencies, each with a set of unique bank account details. It also provides flexibility to the user to create sub-accounts for other currencies.

How does a multi-currency account work?

A multi-currency account works like a regular account where you can deposit money, withdraw, and send and receive payments. With a multi-currency account, when you accept payment in a foreign currency, you can hold the money in the foreign currency or convert it to Australian dollars.

With a foreign currency account, you can hold balances in different currencies—including but not limited to USD, EUR, CAD, NZD, GBP, and JPY—which will be useful for individuals regularly engaging in international business. Whenever you receive funds in another currency, they will be deposited into the respective currency balance within your account.

You can buy or sell any foreign currency at the prevailing exchange rate, with the application of a small conversion fee levied by the bank for such an exchange transaction. This feature proves particularly useful when managing exposure to foreign exchange risks and paying in different denominations.

You can manage multiple currencies, monitor online currency balances, track rates, and execute transactions through your account.

Benefits of a multi-currency account in Australia

A multi-currency account is advantageous for businesses and individuals that regularly make international transactions. This account simplifies the need for having multiple bank accounts, gives flexibility to handle various currencies, and resolves international finance management.

Individual account for international transactions

With an individual foreign currency account, Australia businesses involved in global trade and transactions can benefit greatly.

The possibility of receiving, holding, and paying in different currencies without converting to AUD immediately protects you from the risk of unfavorable exchange rates, thereby reducing complexities associated with managing international finances.

Multi-currency accounts give you a clear overview of your foreign currency portfolio, which leads to smoother international business operations.

Seamless international payments

It can be a hassle to manage international payments, especially when you are dealing with different bank accounts for each currency.

With foreign currency accounts, Australia dollar accounts are enabled to manage global payments through a single bank account that streamlines the entire process.

A foreign currency account lets you create sub-accounts for each currency and keep track of them. With a sub-account, you can hold, transit, and manage multiple currencies without needing to convert them.

Cost savings on currency conversions

Traditionally managing several currencies and converting them to Australian dollars was expensive—but with a foreign currency account, you can easily convert currencies into Australian dollars and save costs on currency conversion.

A foreign currency account also helps you to reduce exchange rate fluctuation by simplifying the international payment system. You can also convert your foreign currencies to Australian dollars at your own pace. This way you can easily manage your time and save costs on currency conversion.

Improved cash flow

With a multi-currency account, you can record your foreign transactions, which maintains transparency in the process and improves the entire cash flow system.

A foreign currency account enables you to protect your revenue from high, mandatory transaction and conversation costs that negatively impact both cash flow and workflow.

These accounts ease out the entire process by streamlining the financial transactions. Additionally, the saved time on currency conversion and international transfers ensures that payments can be readily made to vendors and customers using an account holding local currency—crucial for last-minute or sudden payment needs.

Streamlined accounting

Managing international transactions and recording them is significantly efficient through multi-currency accounts. With this account, you can consolidate all your accounts into one and track your expenditures and expenses in a single place.

This way you won’t have to switch between business bank accounts, constantly updating and manually handling financial details, or needing to manually sync your international transactions.

This streamlines the entire accounting process, providing you with a clear view of your transactions.

Travel without financial worries

A multi-currency account makes business journeys smooth by taking your financial worries away.

With a multi-currency account, you have remote access to your expenses, anywhere at any time, providing you with a suitable option to manage your funds while traveling. You can transact in the local currency, which removes the concerns of high conversion costs, as well as the fear of declined payments.

Some business accounts also offer a corporate card that allows you to keep multiple currencies and use them while traveling. This makes the entire process more convenient, enabling you to travel without being strapped for cash.

Easier remittances

Multi-currency accounts simplify remittance by allowing you to send and receive money in several currencies directly.

Previously, the process of sending money internationally might’ve involved various steps, such as the conversion of currency, which is expensive due to high fees and unfavorable exchange rates, or long wait times due to multiple channels of transfer.

However, with a multi-currency account, you can have balances in different foreign currencies, which means you can send and receive money in the form of the recipient’s currency. This reduces the need for multiple conversions, reducing transaction costs and minimizing delays.

For more information on the costs involved in international transfers, check out our detailed guide on How much does it cost to transfer money internationally from Australia?

Simplify cross-border payments with Volopay's multi currency account

Key features to look for in a multi-currency account

Before opening a foreign currency account, Australia businesses need to go through the various offerings and compare their services.

Nonetheless, choosing the best financial provider can be a confusing task—these key points might help you understand your requirements better.

1. Wide range of supported currencies

Multi-currency accounts offer a wide range of supported currencies to support sending and receiving money from several countries in different currencies. This system streamlines the finance management process and eases the entire process.

To get the maximum benefit of this feature, you should ensure that the account supports all the major currencies your business transacts in—both sending to vendors and receiving from customers.

2. Competitive exchange rates

Converting from one currency to another can cost a hefty amount; but with a multi-currency account, you can conveniently convert currencies to and from Australian dollars, saving on FX charges.

You can also hold and manage funds in multiple currencies with multi-currency accounts, eliminating the need for constant conversion and associated fees. Moreover, many service providers offer competitive exchange rates and low fees for multi-currency accounts.

3. Low fees and transparent pricing

Handling international currencies can be costly but with a multi-currency account, you can easily manage your finances at a lower rate. These accounts often have lower currency conversion rates compared to traditional accounts.

A multi-currency account provides complete transparency to the users by giving a clear and easy-to-understand fee structure. The service providers usually offer a list of all the costs associated with your account, giving you complete insight of your expenses. This transparency ensures that you choose a provider that costs you the least.

4. Interest on balances

With a multi-currency account, you can earn interest on your account balance depending on the service provider. Interest on the balance in your account is credited regularly (e.g., monthly, or quarterly). The interest rate is calculated based on the daily balance or end-of-day balance.

Certain multi-currency accounts are also structured to pay interest on balances held in different currencies. The interest rate depends upon the currency and account provider, so do your research on what offerings you have.

5. Seamless currency management

Managing multiple currencies can be a troublesome task especially when you are engaging in international transactions. However, with a multi-currency account, you can seamlessly load money, transfer, and manage foreign transactions.

This removes the hassle of opening a separate account for each currency. It also gives you a bird’s eye view of how much you hold in each sub-account or wallet, improving how you manage and shift funds between accounts, and keeping your cash flow going.

6. Online and mobile banking access

Certain financial institutions also provide online and mobile banking facilities where you can handle your finances seamlessly. With online banking, you can manage multiple currencies through a single dashboard. You also get real-time updates of your balance in various currencies, through push notifications and online transaction records.

Furthermore, online banking provides easy currency conversion with a few clicks at a competitive exchange rate. With a multi-currency account online banking feature, you can manage several currencies from Australia, or while traveling abroad.

7. Advanced security measures

Multi-currency accounts provide advanced security measures that protect your data, funds, and personal information.

Several institutions provide two-factor authentication facilities, and data encryption to keep your finances safe and secure. Two-factor authentication is an extra layer of security where users have to provide two forms of information to access accounts. Data encryption ensures that not even the provider has access to sensitive information.

Check with banks that offer a multi-currency account in Australia about the security features. Ensure that they are certified, licensed, and compliant with regulations—they should function with the highest industry standard, both internationally and locally.

8. Integration with other financial services

Several banks offer integration with financial services as a benefit to your multi-currency account so that you can easily manage your international finances.

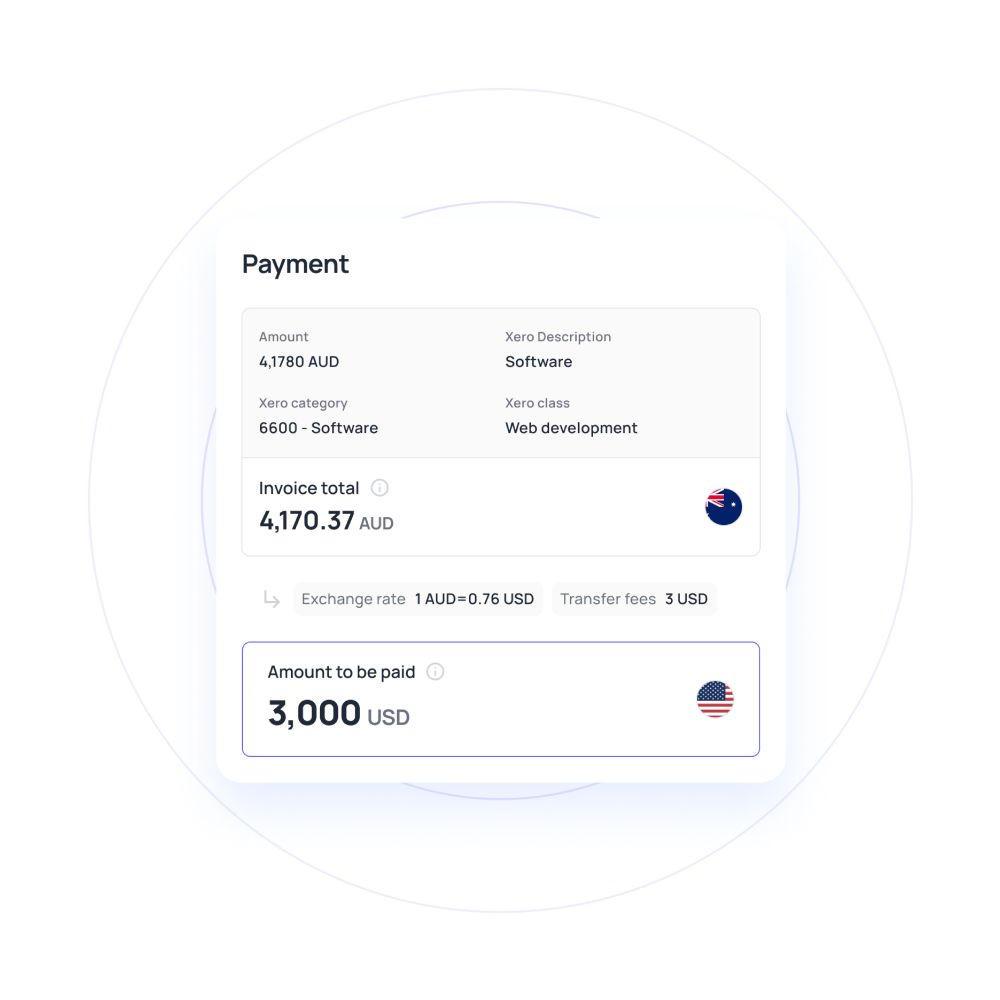

The multi-currency accounts offer, for instance, accounting integrations with accounting software such as QuickBooks, Xero, Netsuite, MYOB, etc. Businesses can seamlessly manage their finance, generate financial reports, and streamline their compliance and bookkeeping through this integration.

Before opening an account, it’s advisable to check with the provider whether they offer accounting integration with multi-currency accounts in Australia.

9. Global access and ATM withdrawals

Foreign currency accounts provide global access to payment facilities and ATM withdrawals to seamlessly access ATM facilities for a different currency. Multi-currency accounts often come with a linked debit card through which you can withdraw cash worldwide. Certain foreign currency accounts also charge minimum to no ATM withdrawal fees.

Many banks also offer ATM locator tools through which you can easily locate nearby ATMs and withdraw funds. The ability to use a foreign currency debit card also means that you can make direct terminal transactions at physical points of sale without paying conversion fees on your home currency.

10. Customer support and assistance

Great customer support is necessary to manage your accounts conveniently. Some banks have dedicated channels that provide customer support and assistance.

You can access customer support through phone, email support, or live chat support. In addition, some providers offer customer support in multiple languages, making it accessible to employees, vendors, and partners with different linguistic requirements.

It’s important to check with a provider to understand what kind of customer support they offer for foreign currency accounts, Australia and overseas.

11. Account setup and ease of use

You can easily set up your multi-currency account (based on the provider’s onboarding time) and once it’s set up, you can conveniently use it to manage your finances.

Several providers offer the facility to open multi-currency accounts online where you simply need to go through mobile apps or online platforms and initiate the account setup process.

You would also be required to provide documentation based on the provider’s requirements. Once the documentation is submitted you can wait for the approval and account setup.

If you want to open an account physically then you can visit a physical bank branch to complete the procedure of opening a multi-currency account in Australia.

12. Tax and regulatory compliance

Multi-currency accounts are subject to tax and regulatory compliance requirements similar to traditional bank accounts. Income earned or received in different currencies through a multi-currency account may be subject to taxation following local tax laws.

To understand tax and regulatory requirements it’s important to consult with the bank or service provider associated with your multi-currency account in Australia. You should also ensure that they’re licensed to handle these kinds of transactions and are doing it in a compliant manner.

13. Reputation and reliability of provider

Before opening a foreign currency account in Australia, it’s important to compare service providers or banks so that you choose a reputed and reliable one.

By opting for a reliable provider with verifiable standards of service, there is a reduced chance of putting your funds at risk.

A reputed financial provider provides financial security and keeps your finances safe, accessible, and compliant.

Selecting a reliable provider is essential for managing your multi-currency account effectively; to explore further options and make informed decisions, you can refer to our blog on the best business bank account in Australia.

Manage all your international expenses without any hassle

How to open a multi-currency account in Australia?

Research & choose a provider

Before opening a foreign currency account in Australia, it's important to thoroughly evaluate all your needs and conduct proper due diligence when selecting a provider.

There are several factors to weigh—the provider’s operational limits, whether their services are scalable, how well they can meet your business’s specific transactional needs, and more.

Additionally, assess the provider's fees, customer support, and reputation. Know exactly what you’re looking for when comparing providers and conducting your research, ensuring that they align with your business growth and financial goals.

Choose an account

Once you’ve settled on which service provider, you can consider between different options that they have.

Sometimes the same provider has different types of accounts, so you want to compare their features and capabilities.

Consider factors like the number of currencies available, how easy it is to move between currencies, the availability of online or mobile banking, and any extra value adds such as travel insurance or competitive charges. Ensure the accounts meet your specific needs, such as frequent travelers or global businesses.

Prepare the documents

The documents you might require to open a multi-currency account in Australia are personal identification: usually a primary document (such as a valid passport, an Australian driver’s license, or a national ID card), and a supplementary document (a birth certificate, or citizenship certificate).

Additionally, you’ll need to provide the name under which your business operates, certificate of registration of the company, your Australian Business Number (ABN) for tax purposes and your primary business address, and the valid identification of all the owners and partners that are associated with the business.

Apply for the account

Once you’ve collected all the required documentation you can apply for the account. Apply through the selected provider’s website or a branch of your choice, to open a multi-currency account in Australia.

Accurately fill out the application form with all the necessary details, and carefully upload or submit the required documents. Make sure to fully understand the terms and conditions before applying. If you have any questions or uncertainties about the application process, reach out to their customer service or onboarding team for the help, support, and clarification you need.

Account approval and funding

After you apply, your service provider or bank will go through your documents and approve your account. This timeline is dependent on each provider and what their approval process is—but, on an average, it shouldn’t take more than a few days or a week if you’ve followed their stipulated process.

Once approved, you will be notified about your account with its details. An initial deposit might be required by some providers or a minimum balance set for your account. Fund your multi-currency account by submitting the initial amount.

Activate account features

Once you’ve funded your account you can activate account features and start using the account. Activating your account features involves setting up online banking, downloading the provider's app, configuring multi-currency management tools, and setting up integrations.

You can also familiarize yourself with currency conversion tools and understand the basics of the account dashboard. Once you’ve understood the account management system you can seamlessly manage your international finances through the multi-currency account.

Costs associated with multi-currency accounts

Sometimes, opening a multi-currency account can have associated charges. The majority of service providers charge account maintenance fees on a monthly or annual basis.

Transaction fees may vary depending on the currency and amount applied to deposits, withdrawals, and transfers. There can also be fees associated with converting currencies based on the exchange rate margins.

If your provider isn’t transparent, you might also have to pay other additional costs including hidden charges such as inactivity fees, minimum balance penalties, and international wire transfer fees. Ensure that your provider is fully transparent about such fees and penalties as part of the application process.

Look through the fee structure of your selected provider before choosing a multi-currency account so that you can be safe from any hidden charges.

How to manage a multi-currency account effectively?

To manage multi-currency accounts efficiently you should keep track of the currency market and stay updated on conversion rates so that you can conveniently manage international finances from Australia. Some tools and apps help you check real-time exchange rates and send alerts to your phone.

If you operate in multiple markets, you could use this information to spread your funds across your different currency accounts to minimize risking cash flow or making losses. Allocate based on your needs (e.g., emergency fund, travel expenses, investments).

1. Stay informed about currency markets

To efficiently manage a multi-currency account it’s important to stay informed about the currency market. To keep yourself informed you can follow financial news portals, websites, and apps. Stay informed about geopolitical events, economic data releases, and central bank decisions that impact exchange rates.

Moreover, can use an economic calendar to track upcoming events—major announcements (such as interest rate changes) can significantly affect currency values. You can also use currency conversion tools to get real-time exchange rates.

2. Minimize currency conversion fees

To minimize currency conversion fees when managing a multi-currency account in Australia, consider choosing the right provider with low conversion fees. Additionally, rather than converting small amounts frequently, you can convert large sums of money less frequently to reduce currency conversion fees.

You should also stay informed and flexible as the currency market can fluctuate, affecting conversion rates. It helps your finance team plan effectively and take proactive steps to minimize costs.

3. Take advantage of account features

To effectively manage your foreign currency account you should take advantage of account features offered by your service provider.

You should look for features such as multi-currency wallets where you can utilize the ability to hold various currencies in a single account. This enables you to keep funds in the currency you require to use or expect to use, minimizing the need for frequent conversions.

Furthermore, you should take advantage of integrated banking and investment services, advanced security measures, mobile and online banking, budgeting, and financial tools to manage accounts efficiently.

4. Understand fee structures

It’s necessary to understand the fee structure that is associated with your account to effectively manage multi-currency accounts.

You should check with your service provider about the kind of fees associated with your foreign currency account. Australia has a plethora of providers with different fees and penalty plans, so make sure you understand them thoroughly.

There can be several fees such as currency conversion fees, foreign transaction fees, account maintenance fees, and wire transfer fees. You might also be required to maintain a minimum balance in your account.

5. Maintain strong security practices

Maintaining strong security practices is crucial to effectively manage a multi-currency account and safeguarding your finances.

You should use a strong and unique password for your account, enable two-factor authentication, monitor your account activity regularly, and update software to keep your computer, smartphone, and other devices up to date with the latest security patches.

With these steps, you can conveniently keep your account safe and secure. Also, make sure your service provider is certified and licensed to follow all data encryption and secure fund management protocols.

6. Keep track of transactions

You can conveniently keep track of your finances by using multi-currency accounts. To keep track of your transactions you can use online banking and mobile apps through which you can regularly monitor your account transactions on your bank's online banking portal or mobile app.

You can set up alerts and notifications to get real-time updates and keep an eye on bank statements to track the latest transactions. Also ensure that your account comes with the ability to immediately flag questionable transactions so that your real-time updates are put to effective use.

7. Leverage financial tools

To effectively manage your multi-currency account you should leverage financial tools such as currency conversion tools that provide real-time exchange rates for accurate currency conversions, and budgeting and expense tracking software that integrate with your multi-currency account to automatically categorize and track expenses across different currencies.

Moreover, you can use mobile banking apps, financial planning tools, and multi-currency wallets to manage your expenses.

Empower your business with Volopay’s multi-currency account

Multi-currency business accounts vs. personal accounts

Businesses often need a multi-currency account in Australia to manage international transactions, hedge against currency fluctuations, and simplify accounting for cross-border operations. They require features like bulk payments, integration with financial software, and multi-user access for efficient financial management.

Individuals, on the other hand, typically use multi-currency accounts for personal travel, online shopping in different currencies, or managing income from overseas. Their needs focus on ease of use, low fees, and competitive exchange rates.

While both seek convenience and cost savings, what can be considered a business investment for operations might be too expensive for personal use. Businesses require robust financial tools and integrated services, while personal users are looking for a simple dashboard to manage personal expenses.

More importantly, the volume of transactions and the types of vendors also vary with business and personal use—therefore acceptance rates and remittance methods also make a difference.

Understanding the differences between personal and business accounts is crucial when selecting a multi-currency account that meets your business needs; for a comprehensive overview, refer to our blog on personal bank account vs. business bank account.

Regulatory considerations for multi-currency accounts in Australia

Financial regulations such as reporting and tax implications need to be considered when dealing with a multi-currency account in Australia. In this regard, the regulatory landscape ensures that standards set by various authorities are adhered to by financial institutions and account holders.

Your provider is required to adhere to the Australian Prudential Regulation Authority (APRA), Australian Securities and Investments Commission (ASIC) as well as Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws.

Furthermore, foreign exchange regulations play a major role in maintaining transparency, and fairness, and facilitating the management of currency transactions.

1. Australian Prudential Regulation Authority (APRA)

In Australia, the Australian Prudential Regulation Authority (APRA) is responsible for ensuring the stability and soundness of financial institutions, including those that offer multi-currency accounts in Australia.

APRA’s rules ensure these institutions have adequate capital reserves and risk management practices to protect depositors. Compliance with APRA guidelines can help prevent financial crises, while promoting trust and reliability in multi-currency account services enhances the general good health of the economy.

2. Australian Securities and Investments Commission (ASIC)

The Australian Securities and Investments Commission (ASIC) regulates financial markets and protects consumers in Australia. ASIC's role in overseeing multi-currency accounts includes ensuring that financial institutions provide transparent information, fair trading practices, and adherence to financial services laws.

ASIC also enforces licensing requirements for institutions offering foreign exchange services, ensuring they meet stringent standards to safeguard account holders' interests and maintain market integrity.

3. Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF)

Compliance with Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws is crucial for managing multi-currency accounts. AML/CTF programs give Australian financial institutions the ability to detect illegal activities, as well as prevent them.

These can include laundering, terrorist financing, and more. It’s necessary for institutions to follow these programs and implement them in a robust manner.

Some of the programs’ facilities include performing due diligence with customers, monitoring transactions, flagging any activities that could be considered suspicious, and reporting such suspect activities to the Australia Transaction Reports and Analysis Centre (AUSTRAC). Adhering to AML/CTF regulations helps protect the financial system from exploitation by criminal entities.

4. Foreign exchange regulations

Foreign exchange regulations in Australia govern the conversion and transfer of currencies in multi-currency accounts. These regulations ensure transparency, prevent market manipulation, and protect consumers from unfair practices.

Financial institutions must comply with guidelines set by the Reserve Bank of Australia (RBA) and other relevant authorities. This includes adhering to reporting requirements for large transactions and maintaining accurate records. Compliance with foreign exchange regulations fosters a stable and trustworthy environment for managing multi-currency accounts.

Simplify your business financials with Volopay’s business account

Volopay’s business account simplifies financial management, reduces costs, and integrates various business finance functions into one platform, making it a game-changer for modern businesses.

With Volopay, you can manage expenses, issue corporate cards, automate accounts payable, integrate accounting software, and ensure security and compliance—all within a single, user-friendly interface.

Its robust capabilities for handling international transactions make it ideal for businesses operating globally, offering faster and more efficient payment solutions across borders.

Integrated expense management

Volopay’s multi-currency account in Australia comes with integrated expense management systems that keep track of all business expenses in real time and categorizes them accordingly. This simplifies financial reporting, enhances budget control, and ensures accurate recording and management of all expenses.

By employing Volopay’s foreign currency account, Australia businesses can monitor expenditures across multiple currencies, providing comprehensive oversight and facilitating better financial decision-making.

Issue virtual and physical corporate cards

Volopay provides an opportunity for businesses to issue virtual cards as well as physical corporate cards to their employees. These cards usually come with customizable spending limits and real-time tracking that ensures funds belonging to the company are utilized responsibly.

Online transactions are additionally safeguarded using virtual cards while point-of-sale business transactions can be paid through physical ones for better flexibility and control over businesses’ corporate expenses.

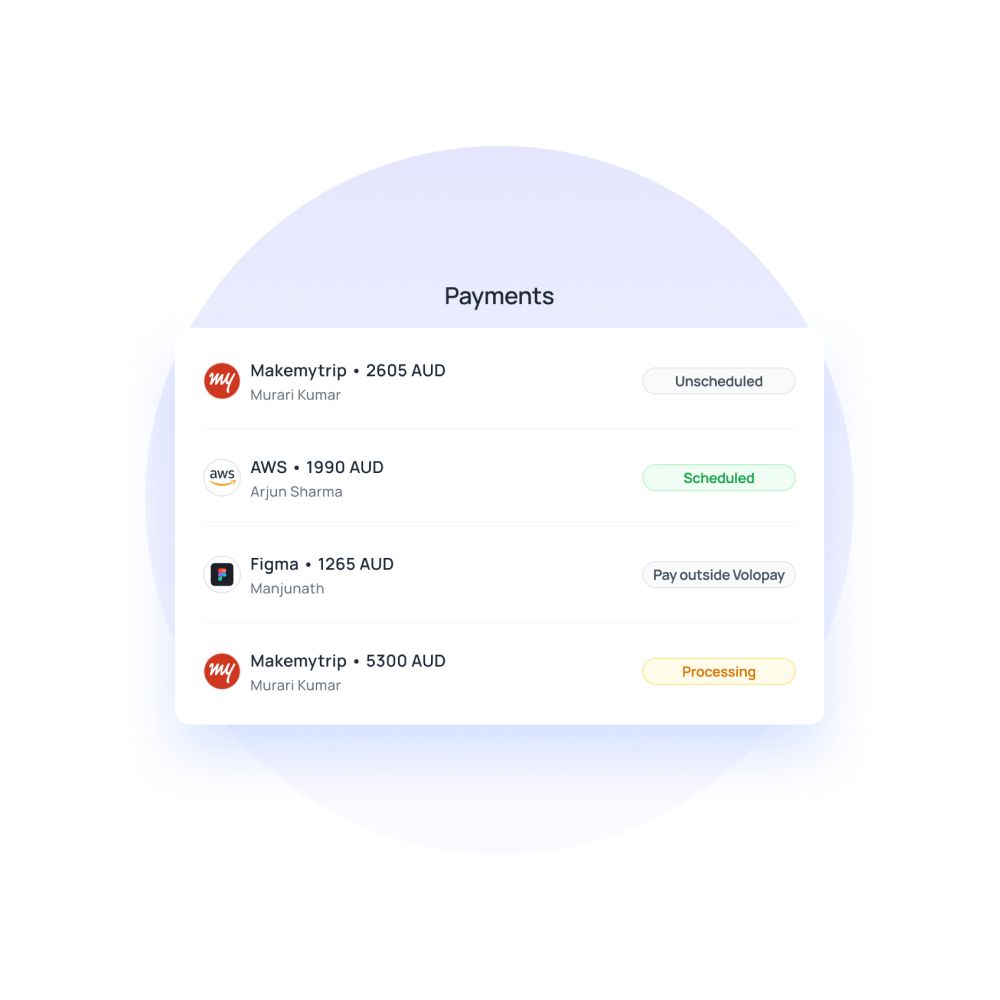

Seamless accounts payable automation

Volopay payable automation makes it easy for businesses to handle payments and reduce mistakes. The multi-currency account in Australia enables timely payments, simplified workflows, and improved supplier relationships.

Volopay’s foreign currency account in Australia can help businesses with their international remittances to enhance efficiency while meeting payment regulatory requirements, both locally and internationally.

Accounting software integration

Volopay is compatible with well-known accounting software, thus guaranteeing that all financial details are in sync and up to date. By doing so, there will be no need for any manual data entry.

This also mitigates the risk of errors and ensures accuracy; companies can import transactions easily, reconcile accounts, and generate financial reports, making it easy to manage company finances.

Enhanced security and compliance

Volopay emphasizes security and compliance measures that give peace of mind to all business owners. With advanced encryption, multi-factor authentication, and continuous monitoring, the platform ensures that all financial information is safe.

Moreover, Volopay complies with local and international regulations hence helping organizations evade expensive fines and legal issues. This focus on security and compliance has made Volopay trustworthy.

Faster domestic payments

Faster domestic payments are one of the benefits that businesses will get from using Volopay thus improving cash flow and operational efficiency.

The platform supports real-time payment processing enabling quick and secure payment transfers. This speed does not only improve liquidity but also enables companies to take advantage of early payment discounts as well as build stronger ties with suppliers.

Related articles on business accounts

Learn the step-by-step process of opening a business bank account in Australia, including required documents and key considerations.

Discover how to open a business account in Australia from overseas, including eligibility, required documents, and application process.

Learn what a corporate account is and why it’s essential for businesses, including its benefits, features, and setup process.

Unlock hassle-free multi-currency management

FAQs

How does a multi-currency account differ from a foreign currency account?

A multi-currency account, sometimes also known as a foreign currency account, simplifies holding, transferring, and receiving multiple currencies within a single account. A foreign currency account might sometimes be limited to a single foreign currency. A multi-currency account lets you expand to multiple sub-accounts so you can have dedicated wallets for more than one currency.

Yes, a multi-currency account can reduce currency conversion fees. Usually, with traditional banking, there are multiple levels of fees due to multiple conversions. In order to hold, manage, and transact in multiple currencies seamlessly, a multi-currency account is beneficial.

Any business involved in cross-border transactions needs a multi-currency account. If your business is always engaged in international activities then it is probable that you need to establish a multi-currency account for such purposes.

A business account makes it easier to manage cash flow, pay bills, collect payments, and keep track of transactions. With a business account, you can easily keep track of your finances.

With a foreign currency account, Australia businesses can save on costs related to currency exchange. Additionally, if you are traveling abroad, the foreign money accounts can offer you access to local currencies while you are there.

Certainly, you can acquire a corporate card that is associated with your multi-currency account thereby enabling you to spend money in various foreign currencies without conversion fees.

A multi-currency account makes it easy for businesses to go global by simplifying international transactions, minimizing conversion costs, and managing multiple currencies effectively. It also makes it easier to pay local employees and quickly manage accounts payable to local vendors.

Yes, multi-currency accounts can be used for processing payroll especially if the organizations have international employees making it easier to pay salaries in different currencies with no conversation intricacies.