Prepaid credit cards in Australia: Qualification criteria and how to get one?

Prepaid credit cards have revolutionized the traditional concept of credit by offering a novel way to manage finances. Their popularity stems from their flexibility and convenience, catering to diverse financial needs.

Initially conceived as an alternative payment method, these cards have evolved into versatile tools for budgeting, spending, and secure transactions in today's fast-paced financial landscape.

There are many providers who offer prepaid credit cards in Australia. Choosing the right one for your business will involve researching and understanding the different features and benefits that they offer.

What is a prepaid credit card?

A prepaid credit card functions similar to a credit or business debit card but with a fundamental distinction: it's not linked to a bank account. Users load funds onto the card beforehand, limiting spending to the preloaded amount.

Unlike conventional business credit cards, no credit is extended; hence, there's no accumulation of debt. Essentially, it operates on a "pay before you spend" model, empowering users to manage expenses without concerns about interest charges or credit score implications.

How do prepaid credit cards work?

1. Mechanism of loading funds

Users can load funds onto prepaid credit cards through various methods like direct deposit, bank transfers, or cash deposits at designated locations.

This process allows individuals to control the amount they spend, as the card balance cannot exceed the limit of the loaded amount.

2. Transaction process and limitations

Transactions with reloadable prepaid credit cards involve the same process as regular credit cards—swiping, tapping, or entering card details online.

However, these cards come with limitations. Once the prepaid amount is exhausted, further transactions are declined unless more funds are added.

3. Distinctions from traditional cards

Prepaid cards don't involve credit extensions, so there's no risk of accruing interest or affecting credit scores. They also don't require credit checks during issuance, making them accessible to individuals with varied financial backgrounds.

Additionally, they offer a level of privacy, as they aren't linked to personal bank accounts.

What are the perks of using prepaid credit cards?

Reduced risk of exceeding budget

Prepaid cards let users spend only the amount loaded in them. This removes the chance of overspending and aids in disciplined budget management.

This feature is particularly beneficial for businesses that want to let their employees make expenses freely but are also aiming to control their expenses effectively.

More secure than cash

Prepaid cards offer enhanced security compared to carrying cash. If lost or stolen, these cards can be reported and deactivated easily through a mobile app, preventing unauthorized use.

Additionally, many providers offer fraud protection, shielding users from liability for unauthorized transactions.

Convenient reload and usage

Users can conveniently reload prepaid cards through multiple channels, including online transfers, mobile apps, and retail locations. Their widespread acceptance of transactions, both online and offline, makes them a convenient payment method for employees.

Banking alternative

For individuals without traditional bank accounts or those looking to separate spending funds from their primary bank account, prepaid cards serve as an alternative. They offer similar functionalities without the need for a traditional banking relationship.

Safe payment alternative

Prepaid cards offer a safer alternative to carrying cash, especially during travel. They mitigate the risk of loss or theft while providing the flexibility of electronic payments worldwide.

Suggested read- Multi-currency wallet for global businesses

Financial control and budgeting

One of the most significant advantages of prepaid cards is the control they provide over finances.

Users can allocate specific amounts for various expenses, aiding in better budgeting and financial planning. This feature is instrumental for those aiming to improve their spending habits or manage irregular income.

Access a flexible payment solution for your business

What are the limitations of prepaid credit cards?

Fees/charges

Prepaid cards often come with various fees, including activation fees, monthly maintenance fees, ATM withdrawal fees, and reloading charges. Users should scrutinize the fee structure to understand the costs associated with using the card.

No elevation in credit scores

Unlike traditional credit cards, prepaid cards do not contribute to building credit history or improving credit scores. They operate independently of credit bureaus, so responsible usage doesn't impact credit ratings positively.

Load limits

Prepaid cards may have limitations on the maximum amount users can load onto the card. These load limits vary among providers and can affect the card's utility for significant expenses or transactions.

Withdrawal limitations

ATM withdrawal limitations are common with prepaid cards. Users might encounter restrictions on the amount they can withdraw daily or per transaction, potentially affecting access to funds in emergencies.

Reload options

While reload options for prepaid cards are versatile, certain methods might incur additional fees or have processing delays. Users should consider the convenience and cost implications when choosing reloading methods.

Factors to consider when choosing your prepaid credit card

Fee structure

Thoroughly review the fee structure associated with the prepaid card. Look out for activation fees, monthly maintenance charges, ATM withdrawal fees, inactivity fees, and other additional charges.

Some cards may offer fee waivers based on regular usage or direct deposit criteria. Understanding and comparing these will help you select a card that aligns with your financial habits and minimize unnecessary costs.

Security measures

Prioritize prepaid cards with robust security features to safeguard your finances. Look for cards equipped with EMV chip technology, two-factor authentication, fraud protection, and zero liability policies.

These security measures ensure enhanced protection against unauthorized transactions and fraudulent activities, offering peace of mind while using the card for transactions online or in person.

Reviews and ratings

Prioritize cards with positive user reviews and high ratings. These insights provide valuable information about the card issuer's customer service, ease of use, reliability, and any potential issues that other users might have encountered.

Online forums, review websites, and official issuer websites are great resources to gather this information.

Reload options

Evaluate the available reload options offered by the card issuer. These can include direct deposit, bank transfers, mobile apps, cash reloads at retail locations, and online transfers.

Consider the convenience, frequency, and associated fees of these options to select the most suitable method for all of your reloading needs.

Network acceptance

Ensure the prepaid card is accepted widely across various networks and merchants, both domestically and internationally.

Check for logos such as Visa, Mastercard, or other major payment networks to ensure broad acceptance, enabling you to use the card conveniently wherever you go.

Card type and usage

Consider the purpose for which you intend to use the prepaid card. Some cards are tailored for general spending, while others offer travel perks, rewards, or specific benefits for online purchases.

Assess the card's features, rewards programs, and benefits to match them with your spending habits and lifestyle needs.

Qualification criteria for obtaining a prepaid credit card

The qualification criteria for obtaining a business prepaid credit card can vary depending on the card issuer and the specific type of prepaid card. However, here are some common criteria that businesses may need to meet:

Business entity (need to have a registered entity)

To acquire a prepaid credit card for business purposes, it's generally required to have a registered business entity. This could be a sole proprietorship, partnership, limited liability company (LLC), or corporation, depending on the issuer's specific criteria.

The registration ensures the legal standing and legitimacy of the business entity applying for the card.

Business documentation

Applicants typically need to provide specific business documentation during the application process.

This might include copies of business registration certificates, tax identification numbers (TINs), articles of incorporation, or any other relevant legal documents that validate the existence and structure of the business.

Credit check

One of the advantages of prepaid credit cards is that they usually do not involve credit checks during the application process.

This accessibility makes them available to individuals and businesses, regardless of their credit history, making it an attractive option for those with limited or poor credit scores.

Business information

Applicants are generally required to furnish fundamental business information.

This includes details such as the legal business name, physical business address, contact information, and sometimes a brief overview or description of the nature of the business or its operations.

Employee information (if applicable)

For business cards intended for multiple employee use, issuers may ask for details about authorized card users.

This could include their names, positions within the company, and contact information. This information helps link the card to the business entity and manage usage across multiple employees.

Annual revenue details (if applicable - all providers may not ask for this)

Certain prepaid card issuers might request annual revenue details to assess the financial standing of the business. This information can assist in determining suitable spending limits aligned with the company's income.

However, not all providers may require this information, as the qualification criteria can vary significantly among different issuers.

Save on expenses with Australia’s best prepaid cards

Best practices for effective use of prepaid credit card

Set a budget

Establish a clear budget and allocate funds to the prepaid card accordingly. This helps in controlling expenses and prevents overspending by ensuring that expenditures align with financial goals.

Segregate expenses

Maintain a clear demarcation between business and personal expenses by using separate prepaid cards for each. This segregation simplifies accounting, bookkeeping, and tax filing processes.

Check acceptance

Before using the card, verify its acceptance at the intended locations, especially if planning to use it for international money transfers. Ensuring this will prevent inconvenience during transactions.

Load wisely

Strategically load funds onto the card based on planned expenses and financial capabilities. Avoid overloading the card with unnecessary funds to minimize the risk of loss or theft.

Monitor transactions

Regularly monitor card transactions through online portals or mobile apps provided by the issuer. This practice enables timely identification of any unauthorized or suspicious activities and facilitates accurate budget tracking.

Review T&Cs

Thoroughly review the terms and conditions provided by the issuer. Understand the fee structure, transaction limits, reload options, and other pertinent information to maximize the card's benefits and minimize avoidable costs.

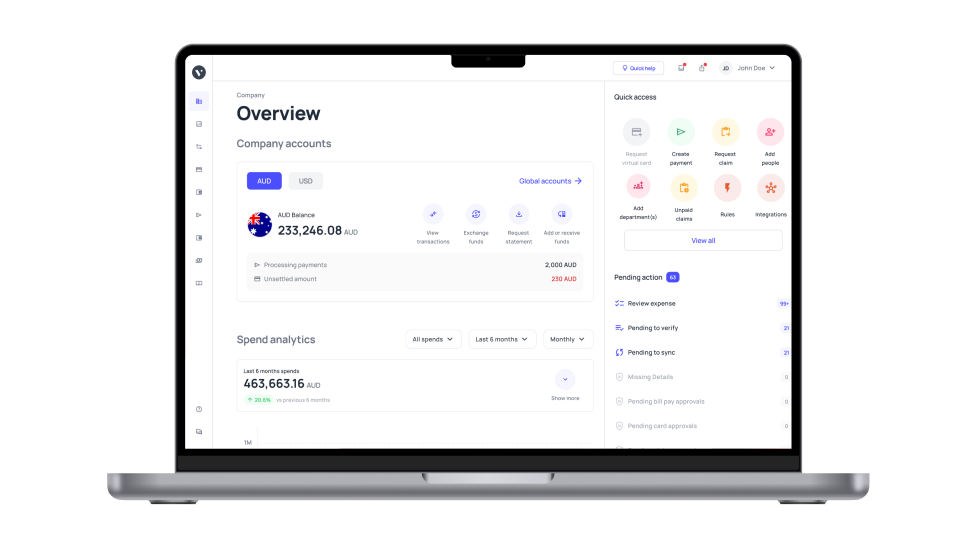

What makes Volopay the go-to choice for business prepaid cards?

1. User-friendly

Volopay offers a user-friendly interface and intuitive features, making it easy for businesses to navigate and manage their prepaid cards efficiently. Employees can also easily access the platform through our mobile app removing the need to constantly open your laptop for expense management tasks.

2. Adherence & safety

The platform prioritizes strict adherence to industry standards for security measures, ensuring the safety of transactions and sensitive financial information.

3. Transparent pricing, no concealed charges

Volopay maintains transparent pricing structures without hidden fees, allowing businesses to have a clear understanding of costs associated with card usage.

4. Use your funds anywhere

The flexibility of Volopay's prepaid cards enables businesses to utilize funds globally, facilitating transactions across various locations and currencies.

5. Automated payments for improved cash flow

Volopay offers automated payment capabilities, streamlining financial processes and enhancing cash flow management for businesses.

6. Effortless expense and transaction management

The platform provides tools for effortless transaction tracking and expense management, simplifying financial record-keeping and auditing processes. Transactions are recorded in real-time in a central ledger on Volopay’s platform.

7. Segregate expenses

Volopay enables businesses to segregate expenses by assigning different cards or categories, facilitating accurate accounting automation and expense allocation.

Get prepaid cards for effective expense management

FAQs

Prepaid credit cards don't require a specific credit score for approval. They are accessible to individuals regardless of their credit history, making them suitable for businesses with low or no credit scores.

Factors to consider include fee structures, card usage flexibility, network acceptance, security features, reload options, and additional benefits such as rewards or travel perks that align with your spending habits or the needs of your organization.

Different providers will have slightly differing periods within which they can deliver your prepaid credit cards. Some issuers may offer instant issuance in-person or virtually, while others might take a few days to process and deliver the card to your registered address.

Volopay's prepaid cards stand out due to their user-friendly interface, stringent security measures, transparent pricing devoid of hidden charges, automated payment capabilities, and effortless expense management through our web and mobile app.

Funds can be loaded onto a prepaid credit card through various methods, including direct deposit, bank transfers, cash reloads at designated locations, mobile apps, or online transfers from linked accounts.

Volopay employs robust security measures such as EMV chip technology, two-factor authentication, encryption protocols, and fraud monitoring to safeguard transactions from unauthorized access or fraudulent activities.

Yes, Volopay prepaid cards offer secure online transaction capabilities. The cards are equipped with advanced security features to protect against fraudulent online activities, ensuring safe and secure transactions for users. We also offer virtual prepaid cards that are tokenized in nature making them even more secure for online payments as compared to physical cards.