7 steps to implement accounts payable automation

Before you set up your AP automation software, there is planning to be done and certain considerations to be made before you go ahead and decide to shift your accounts payable process to a digital platform.

Getting a clear picture of where you stand and why you need to change your process is very important. Your accounts payable software implementation must be preceded by reviewing your existing AP process.

Identifying its shortcomings, creating a plan or proposal for improvements by involving all the necessary stakeholders, choosing appropriate software, and then finally training your AP staff and testing out the new system.

How to implement accounts payable automation?

1. Review the existing AP process

Analyze the current AP process and jot down all the problems you face when handling, processing invoices, and making payments. This will give you an understanding of where you are falling short and what improvements might be needed.

2. Identify the exact requirements

Once you have reviewed your existing AP system and way of working. The solutions to these problems are exactly what you need to be looking for when your business is considering accounts payable software implementation.

3. Create a wireframe & pitch deck to propose the plan

Now that you have a clear understanding of what your current problems are, you should create a proposal that lists out why the AP team members need to shift to a digital platform and how it will help them & the company.

4. Involve all stakeholders

In the decision-making process for the implementation of accounts payable software, ensure that you are involving all relevant stakeholders including the AP team and managers from other departments who be a part of this new ecosystem.

5. Choose an AP automation provider

Once everyone is on the same page internally, it is time to start looking for a suitable FinTech company or SaaS provider that meets your criteria and the stakeholders are comfortable with the pricing of the automation system.

6. Create an implementation plan

Once you have chosen a digital SaaS platform to handle your AP, create a plan to shift all existing financial information onto the new platform so that you can start streamlining your accounts payable processes.

7. Training and testing

Finally, you must onboard all your AP employees onto the new platform and train them to use the system. The first 2-3 months after onboarding will be the testing phase for you to determine whether all things are going smoothly or not.

Implement AP automation seamlessly with Volopay

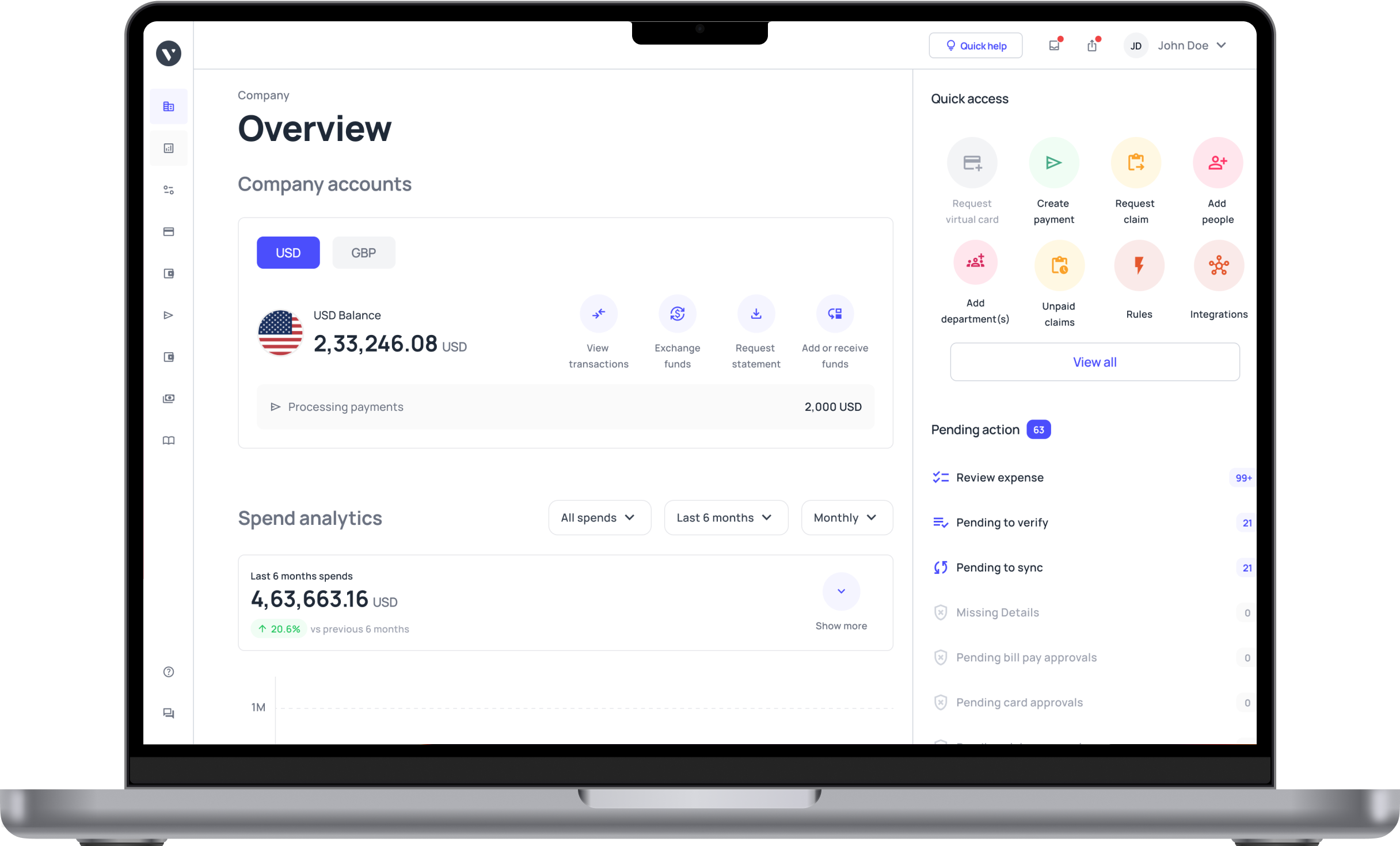

When it comes to accounts payable software implementation, setting up an account on Volopay is superfast thanks to our onboarding process and customer success team who are available at all times to provide support using the platform.

Our platform is an all-in-one expense management solution that not only lets you automate your AP processes but also provides other financial tools such as an accounting module to help you track, manage, and control all expenses.

With Volopay’s accounts payable module you get:

Multi-currency wallet

Multi-currency wallet allows you to make payments to vendors or suppliers in different countries without having to pay FX charges thanks to our infrastructure that supports 60+ currencies in over 100 countries.

Multi-level approval workflow

Using Volopay, you can set up multi-level approval policies with up to 5 levels of approvers for a payment. This will ensure that payments of different volumes are all going through an approval process.

Vendor dashboard

Our platform allows you to create and save all your vendor accounts within the platform for easy payments in the future. Be it an individual vendor or a corporate supplier of goods, you can make accounts for both and pay them conveniently.

AP automation

When you implement AP automation using Volopay, you get the ability to schedule payments and also set up recurring payments for vendors and suppliers who you have a contract with.

FAQs

There is no fixed time for you to implement an AP automation solution. It is completely dependent on how clear you are with your goals and intentions for moving to a software solution.

The major challenge when shifting to an automated AP solution is moving all the information from paper to the digital platform. It is a time-consuming task but worth the effort as it will streamline your entire AP process going forward.

While using digital systems like accounts payable software is much more secure than the traditional way of handling AP, there is always a minute probability of loss of data due to a security breach or some other reason. For such rare occasions, it is always advised to ensure that you back up your AP data from the software that you use.

While it is not needed, it is the company’s choice whether they want to have physical copies of invoices processed in their AP department. This is usually done for data backups in unforeseen circumstances. If the volume of paperwork is too much, businesses should ideally look to back up their information on separate digital hard drives or cloud servers.