Complete guide on accounts payable document management

Accounts payable is more than paying bills on time. They are also responsible for documentation and records management. They should have proof for every dollar spent. And that documentation proof should be compliant.

The documentation should be timely, accurate, and accessible only to the authorized. In short, the number of tasks that AP teams process is unsurmountable. That proves how complex accounts payable document management can get.

But it is complex only for those companies who follow age-old accounting practices. It’s time to revamp the old models and adapt accounts payable document management software. This software can automate the entire payment process.

What is the workflow for accounts payable documentation?

When a company purchases anything from its vendors, they send a purchase order to the vendor. When the payment is due and the order is delivered, the vendor sends an invoice to the buyer.

The AP team matches both documents to see if they pay only for what’s received. For this mandatory verification, they need both of the above documents.

Once they send the payment, they receive proof of payment which is the receipt. Accounts payable document management involves maintaining all the above-mentioned documents. And yes, that holds true for every payment the AP team makes.

Putting together, it can be heaps of papers that need storage files and cabinets. For instance, if a company processes 100 invoices per month, it will have 300 documents or even more to take care of.

This is only an ideal case. Companies that make credit-based purchases and make partial payments deal with more documents. And let’s not leave out invoices sent with special clauses.

Payment delays also trigger more documents incoming from inconvenienced vendors. These are the (minimum) documents that an AP team will handle to move an order from procurement to payment smoothly.

Why are paper-based accounts payable systems ineffective?

Now we know how many documents are involved in a single transaction. Imagine the same for an AP team that churns out bill after bill. For them or anyone, paper-based documentation only adds up additional work and entangles everything.

Here is why you should move on to advanced AP documentation methods.

Papers can go missing

While processing a bill, you could easily lose one or a few important documents. It takes a mammoth effort to search for or get it back and invokes security concerns.

This delays the billing process disrupting the entire workflow. In the long run, you won’t be able to maintain compliance and will face auditing issues.

Real-time tracking is impossible

If a manager wants to know the status of outstanding or made payments, they have no way other than to examine a bunch of documents. Still, the message will not be clear.

The financial team must get inputs from the accounts payable to understand the financial state of affairs. But the communication will be ruptured, which leaves everyone in a hazy state.

Challenges with storing and accessing files

Paper files need safe and secure storage options to store for a long time. Most regulations require organizations to store documents for at least 3 to 5 years.

Hence, the bills will just keep accumulating and occupy more space. Remember that anyone can steal or break into them. Accessing a particular record will be challenging, too, even if you categorize and organize it perfectly.

Why is accounts payable document management important?

Document management is a part of accounts payable key tasks that demand equal importance. It is so important for accounts payable for the following reasons.

Regulatory compliance obligations

Depending on your location, your business needs to adhere to certain regulations set by local and federal governments. That applies to maintaining vendor contracts, POs, receipts, invoices, commonly accepted payment proof, etc.

Not maintaining these records properly will land your business in legal trouble. You will incur heavy penalties as well.

Scattered document & database

No company would want to maintain an unorganized and scattered record. Modern teams prefer transparency over anything. If your data records are all over the place, no one can fathom the current happenings of AP.

This leads to incorrect forecasting, budgeting, and cash flow prediction. This also opens the gate for financial fraud, and no one will even be aware of it occurring. It lessens accountability and productivity.

Avoid loss due to duplicate invoices

Duplicate invoices denote an invoice that gets processed twice. It happens a lot with paper invoices as they rarely capture the attention of processing teams who work on multiple invoices at a time.

The odds of getting the money back are low if you have identified the error after the payment. It involves multiple follow-ups with vendors. Even here, you need to produce relevant documents as proof of double payment.

More often, AP documentation management software comes with invoice processing too. If there is a duplicate invoice, it can detect and flag it right away.

Get real-time insights into accounts payable data

Why you should automate document management for your business?

Despite the size of a business, every AP team can definitely take help from automation. This is the beginning of streamlining payments and storing documents in a safe spot.

But there are more reasons why you should consider document management solutions.

1. Leads to efficient records keeping

Manual invoice processing is ineffective and time-consuming. Documents travel within teams a lot, increasing the average invoice processing time. It leads to duplicate invoices, fake receipts, missing invoices, and other adverse situations.

The team has to keep track of unpaid and half-paid invoices. But with this kind of documentation, they can’t achieve 100% efficiency.

For example, if one has to understand a transaction or process vendor-specific spending, it can take forever to sort documents out and synthesize them. It is not favorable for financial statement preparation and updated ledger maintenance either.

This inefficiency can negatively impact your accounts payable turnover ratio, making it harder to pay vendors on time and track outstanding balances effectively. It also complicates financial statement preparation and ledger maintenance.

2. Unified E - documents

E-documents are stored in electronic format. This is better than paper documents because they are indestructible. As they are stored securely in the cloud, they are not prone to virus attacks or theft.

Moreover, all AP documents are stored in one place that makes them accessible. Your accountants don’t have to use different systems.

You will always be audit-ready as your documents are automatically backed-up in one place. Audits will be quicker and more efficient, too, as all required documents are available under one window.

3. Cost & time-saving

Cloud storage solutions are expensive. So are hard disk backups. But accounts payable document management software is comparatively cheaper. They can be used to plan and send out your payments too.

As the same tool is used to manage multiple accounting tasks, your accounting budgets will be low. You can access documents in the same place where you make payments and manage books.

Your accountants save time that’s wasted following inefficient documentation practices. There is no manual workaround as everything is in digital format. They can work on billing tasks faster and store documents simultaneously.

How to organize your accounts payable?

Digital or not, the number of documents that need to be managed is the same. You can align your accounts payable functions in the following ways to organize AP documents properly.

When there is a lack of automation, accounts payable document management will be a painful and broken process. Anyone who wants to stay ahead in terms of data and cut manual work should choose automated accounting solutions.

This advanced ERPs automate bill processing end-to-end. Your invoices will be captured automatically and brought to the system. Even manual invoices are scannable and later uploaded to the system.

It also does PO matching where machine learning principles are used to compare two documents. Later, they travel through approval workflows connecting relevant authorities and getting approvals.

Once the payments are sent out, receipts will be available to download and that’s how you can automate your accounts payable and have a unified platform to store all AP documents.

How can accounts payable automation software help your business?

These cloud-based accounting applications can seem like an expensive investment for small businesses. But they are multi-purpose and serve way more benefits than accounts management.

Here is how accounts payable automation software will make your accounting team more efficient.

1. Streamline supplier payment processes

Vendor management is a wide department that needs separate attention. From receiving an invoice to making payment, the whole process has an extensive workflow.

Manually taking care of this needs more workforce depending on the total number of invoices. But an automated AP software streamlines this in a way where minimum human effort is required.

Problematic invoices are scanned and flagged instantly to avoid incorrect payments. With minimal resources, vendor payments go out on time with 100% accuracy.

2. Avoid payment delays

You need to make timely payments to ensure good relationships with vendors. You might incur additional penal fees if you consistently make late payments.

Suppliers don’t prefer working with such customers as their work depends on your timely payments. To be in their good graces and receive the best offers, you have to process invoices instantly and send payments as quickly as possible.

That’s only possible if you have automated payment systems that work independently and intuitively. Payment reminders also help you to track if you are on time and expedite if needed.

3. Document accessibility

Accounts payable document management software facilitates centralized document management. It’s easier to understand transactions for anyone at decision-making levels with the help of these documents.

As documents are linked to relevant transactions, a digital audit trail will be easy to conduct. Lately, many companies follow a remote workstyle and teams operate from different locations.

Documents getting stored in the cloud are favorable for employees as they can access them from anywhere.

Role-based functionality can be rolled out giving the right level of access to different employees. Now, no one has to worry about who gets to access these files internally.

4. Enhances audit readiness

An audit can happen anytime. You have to be always ready with fully-updated books and supporting documents. Whether it’s an internal or external audit, the auditor expects transparent and clean records.

If this is ensured, they won’t wait for inputs from accountants for the next steps. The CFO and other professionals, who usually get restless around audits, can finally relax.

As account data is readily available and has every minute detail associated with it, audits will be smooth and rapid.

What are the perks of automating your AP System with Volopay?

Planning to ditch your conventional accounting practices and switch to automated accounting? You should definitely know about Volopay.

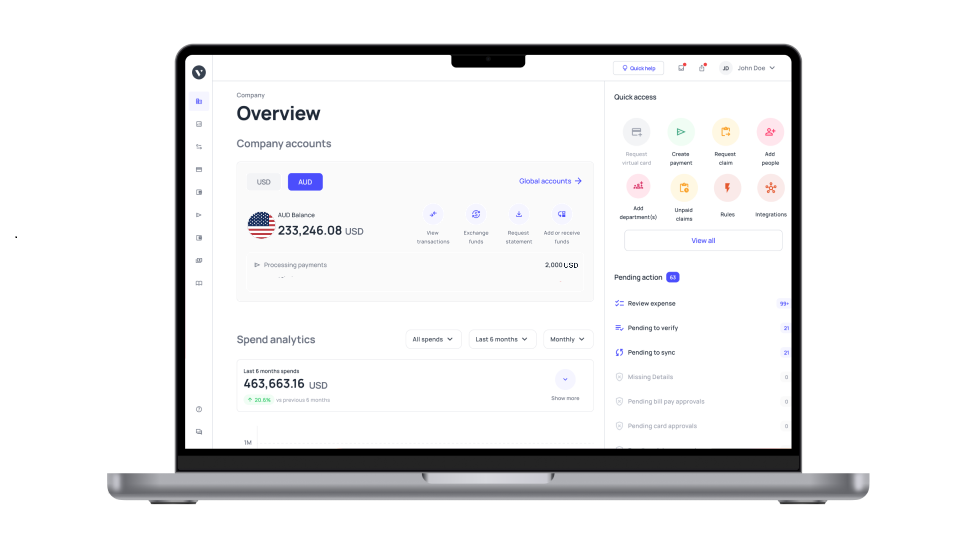

Volopay's accounts payable system is best suited for new-gen accounting and finance teams. With this, you can implement centralized accounting management and conduct entire accounting functions from one place.

1. It has payment tools to streamline your business payments. You can create multi-level workflows to automate approvals and quicken disbursements.

2. Schedule and make on-time payments and simultaneously store their records.

3. Integrations with other accounting software allow you to sync payments as soon as you make them. Without copy-pasting, you can achieve instant closing of books.

4. Accounts payable document management is achievable. You can access receipts, invoices, and other related documents within the application. It allows you to upload documents that are in manual format.

5. Expense reporting can be tracked too. With Volopay's expense management system, your employees can easily upload receipts to raise claim forms and track their requests in real-time.

6. Finance teams and managers can enjoy up-to-date and transparent reporting that’s available in the dashboard.

7. Be audit ready anytime with synced and updated payment records.

That’s how Volopay helps you in your accounting journey and automates it end-to-end.