7 Accounts payable process improvement ideas for businesses

Today, every aspect of business needs to be streamlined for companies to be able to stay at the top of the chain. The Accounts Payable process, in particular, falls under the category of business functions.

When you improve accounts payable process you take a significant chunk out of the resources, labor, and time that is usually spent on the process.

This can not only improve your accounting systems but also help you direct more resources, time, and effort toward actually growing your business.

Five stages in the accounts payable process

1. Invoice capture

Invoice capture is the process through which an invoice is received and then coded into your accounting system. This invoice is typically provided by a third party who has provided your company with some service.

In this part of the accounting cycle, data collected from an invoice is processed and entered into company’s ERP system. After reaching the ERP system the invoice will be matched against a purchase order and sent for payment.

For invoices that are non-PO, the AP department will create the record after receiving the invoice.

2. Invoice approval

As a next step, the PO must be matched with the invoice. It goes straight to payment if it matches.

If, however, it does not then the invoice has to follow an exception handling procedure where prior to payment authorization any and all discrepancies are resolved.

A typical approval routing workflow is maintained for non-PO invoices where the individual or business unit receiving the service or product has to go through the invoice.

This individual must verify receiving the service or product and determines when the date of payment can be set for. Apart from this process automation can also help simplify matching invoices to purchase orders.

3. Payment authorization

The next step after invoice approval is payment authorization. Once businesses categorize invoices as per payment deadline and priority they can then send batches of invoices along for payment authorization.

For payment to be authorized the invoice needs to be sent to the finance department and the individual who is responsible for authorizing the payment.

4. Payment execution

Once the invoice has been approved and payment has been authorized by the finance department the payment can then be actually made.

Depending on the process your AP department follows and the preferences of the vendor, payment may be made out through ACH, check, virtual card, or other payment methods.

5. Analytics and optimization

The last of the steps in accounts payable process involves diving deep into the numbers and data coming from internal processes to understand what is working for your company and what’s not.

At this stage, you must also asses the accounts payable KPIs to align the fiscal priorities of your organization with effective vendor relationship management.

Ultimately, your aim is to find better ways to improve accounts payable process, cut costs, make supplier relationships stronger and improve cash flow management.

Challenges in the accounts payable process

1. Slow processing when done manually

The Accounts payable process done manually is the stuff of nightmares for accounting and finance departments. It requires multiple steps where invoices have to be physically received and painstakingly processed.

Employees have to go through and match every single receipt with POs to ensure everything is in order. Moreover, the manual approval process often involves running after individuals for confirmation.

2. Invoice matching errors

The multiple steps in accounts payable process mean the room for error is also quite large. In particular, the step where invoices have to be individually matched with their POs invites plenty of human error.

It’s very easy to miss out on a few details when you’re processing piles of invoices at the same time, it can lead to duplicate payments, missed invoices, and even payments made out to the wrong recipient.

3. Payment fraud & theft

Employee theft and payment fraud are other concerning challenges that the accounts payable department face on a regular basis.

Especially for companies still processing AP via paper, this risk is quite high. Using paper checks makes this process particularly risky because it gives individuals access to sensitive information.

4. Higher chances of duplicate payments

Errors in the invoice processing step can have further ramifications down the line. It can lead to duplicate payments being made out to vendors or suppliers.

It’s easy to miss out on minor details when you’re doing your AP processing manually. Duplicate invoices can increase the cost to your company unnecessarily and this is why it is important to prevent duplicate invoice payments.

5. Strained vendor relationships

Slow AP processes, erroneous payments or delays can put pressure on your relationship with vendors and suppliers. Lack of clarity with regard to payment status means your vendors may become increasingly dissatisfied.

This can lead to delayed supplies, lower quality of goods and more far-reaching consequences.

6. Unauthorized purchases

There are also cases where your accounting or finance department may incorrectly approve a purchase, this can lead to an unauthorized purchase being made.

Unauthorized purchases not only cost you money but can in fact lead to more effort and resources being required to recover or reverse the purchase.

7. Disappearing invoices

When your team has to handle piles of paper invoices and receipts it’s inevitable that a few of them may go missing.

Disappearing invoices can be particularly harmful because they can damage your reputation in front of vendors, you’re going to have to ask for replacements and if you don’t you’re likely to miss the payment altogether.

8. Exception invoices and manual follow-up

Exception invoices or invoices that do not match with POs will require manual follow-ups to resolve the discrepancies. This will have to be sorted again and route for approval to be gained after multiple rounds of verification.

Key steps for accounts payable process improvement

1. Avoid costly duplicate and late payments

Using automated invoice matching is one of the best ideas for accounts payable process improvement. Automation can help you avoid the human errors that lead to costly duplicates and late payments being made out.

2. Reduce costs and manual effort by automating AP

Automation tools such as data capture can completely eradicate the need to manually verify and process invoices, thus leading to lesser time, effort, and money required in the overall accounts payable process.

3. Reduce paper trail

Digital invoices can be processed within seconds by accounting automation software. Not only the invoice processing but the end-to-end process of accounts payable can be automated and fully digitized to be done with much less paper.

4. Reduce processing costs & time

Digitization is probably the best accounts payable process improvement ideas out there. It can help you completely eradicate the costs and time that is associated with processing payments manually.

5. Prioritize important AP tasks by automating AP

By automating your AP process you can use software to automatically prioritize tasks that are more pressing. This can help you cut out unnecessary delays and improve your relationship with vendors.

6. Streamlining current existing workflow

The key to accounts payable process improvement is streamlining existing workflows. For managing invoices from the time you receive a bill to when you pay it, set up a standardized system to reduce errors and delays in the process.

7. Leverage analytics across AP processes

The numbers behind previous performance can tell you a lot about what’s working and what’s not. Leverage these numbers to improve accounts payable process by cutting out unnecessary steps and channels that do not make a profit anymore.

Suggested read: Importance of accounts payable data analysis for your business?

How can Volopay help in accounts payable process improvement?

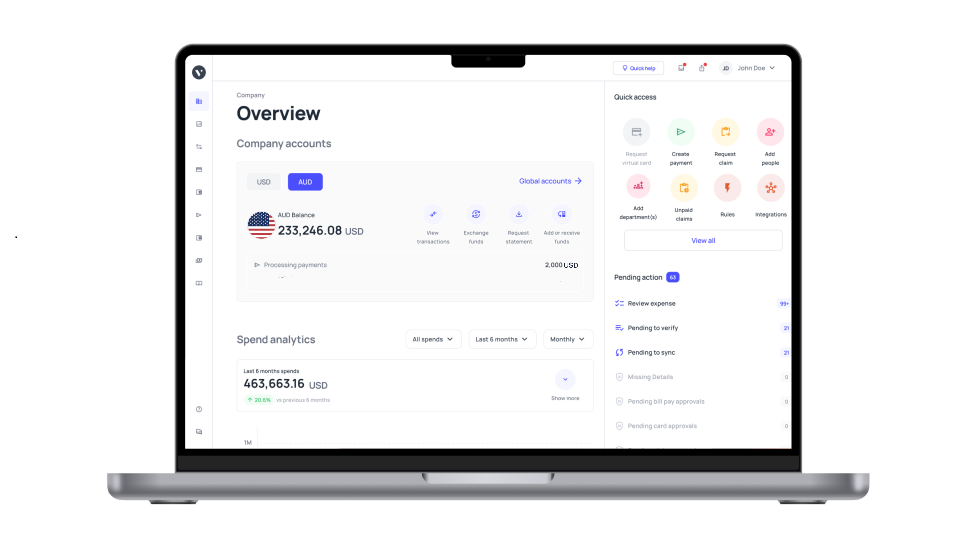

Volopay is comprehensive accounts payable automation and corporate card platform that is built to streamline the accounts payable process. The software has been designed with all of the pain points mentioned above in mind.

You can use Volopay to automate your AP process from end to end, starting with receiving an invoice to making the actual payment. With Volopay you can also create customizable workflows and integrate data with your accounting system.

In today’s competitive market businesses need all the tools they can use to stay ahead of the curve and Volopay is definitely one that can help you build one of the best accounts payable systems out there.