Advantages and disadvantages of retained profit for businesses

Manufacturing and selling products and services are just one part of the business. A big part of business management is invested in handling and allocating the money that the business earns. What investments are needed?

What are loans or dividends that need to pay? How much is the profit, and how will it be divided between the shareholders? All such questions need to be answered.

When a business earns profits, there are majorly two areas where that money is spent: running operations and daily finances; the other is for paying the company’s shareholders.

Decisions related to both these spending areas are important and must be planned prudentially because these will definitely have long-term impacts on the success or failure of the business.

However, before you sit down to actually divide your profits, it is essential to understand basic terminology — retained profit, and the advantages and disadvantages of retained profit.

What is retained profit in business?

Retained earnings or profit is the money that the business is left with after giving all the company shareholders their dividends.

To calculate retention of profit, a company’s net income, shareholder’s dividends (stock and cash), and net income brought forward are needed. Why is it crucial to understand and calculate retained profit?

Along with being a performance measure of the financial stability of the business for the investors, it also helps in accurate planning of how much profit is available to be invested in fixed assets, paying off debt, or being reinvested in business operations.

In the accounting section, retained profit is recorded on the equity side and may also appear in the profit and loss account.

What are the advantages of retained profit?

1. Increased stock value

Amongst the many advantages of retained profits is increased stock value. Now, how does this happen? Basically, as retained profits are a part of the corporate balance sheet, it raises your company’s total balance sheet.

This is an advantageous effect that the stockholder equity has, which in turn presents an impressive image of your enterprise, ultimately attracting more investment.

2. Retained earnings are an easy source of financing

Market conditions and business profitability are highly volatile, which means that they can change course anytime. Hence, when your business keeps its retained profits, it builds a safety net by providing liquidity for low revenue situations.

During any emergency condition, your business would have funds to keep operations on and make basic payments. You would successfully sidestep the situation of taking a corporate debt or liability.

3. Funding for growth

The advantages of retained profit also stretch towards supporting the growth of the business. Reserving the company’s profits allows your company the space to do more developmental activities and research.

The retained profits can be invested into elements or assets that drive growth. These profits can be carried on, and the reserve can be increased by it for future investments.

What are the disadvantages of retained profit?

1. Chances of holding the retained earnings

Though retained profits can be a good thing for the business, if these retained profits do not create more money or do not bring in extra benefits, the stakeholders might ask for more dividends.

Along with this, the directors of the company have the power to restrict the value of the dividend, and they might set it too high, which would again mean that the business would be left with very minimum retained profits.

Hence, chances of holding on to the retained profits are slim and have to be wisely thought out.

2. Improper utilization of funds

Retained profits, as mentioned above, can be a great source of financing without taking on any liability.

However, this plan can only be successful when the profits are used according to a well-thought-out strategy. A business budget plan that clearly outlines all expenses and investments, along with their expected impacts, is essential for success.

Retained profits ultimately are the extra money the business earned. So, in the absence of a well-strategized plan, these earnings can be misused very easily.

Overspending on unnecessary supplies and investing just for the sake of locking the money but not getting any returns gives departments and projects budget raises without any major need.

3. Over-capitalization

Disadvantages of retained profits include over-capitalization. Over-capitalization is a term that refers to a business state where the assets of the company are lesser in value in comparison to its capital.

In simpler terms, a state where the business’s equity and debt are worth more than its assets. The market value of an overcapitalized company is lower than its current value, which shows that the company has inefficient capital management strategies.

But suppose you look at it from the retained profits perspective. In that case, a conservative dividend policy does not leave much behind to be retained by the company, which ultimately leads to overcapitalization.

How is retained profit calculated?

Retained profit calculation is done by adding the last term’s retained earnings to the current year’s net income and then removing the dividend share from the total.

According to this formula, retained earnings depend on the previous term’s profits as well.

The total for the current year can be positive or negative, which results on the basis of the current net income the business had generated from the time of the last calculation till now.

Retained profit is calculated over a regular period of time, i.e., annually, quarterly, or monthly. Along with this, retained profit totals to a negative also when the company pays big sums of money as dividends. Any factor that would affect the net income of the business would also affect the retained earnings.

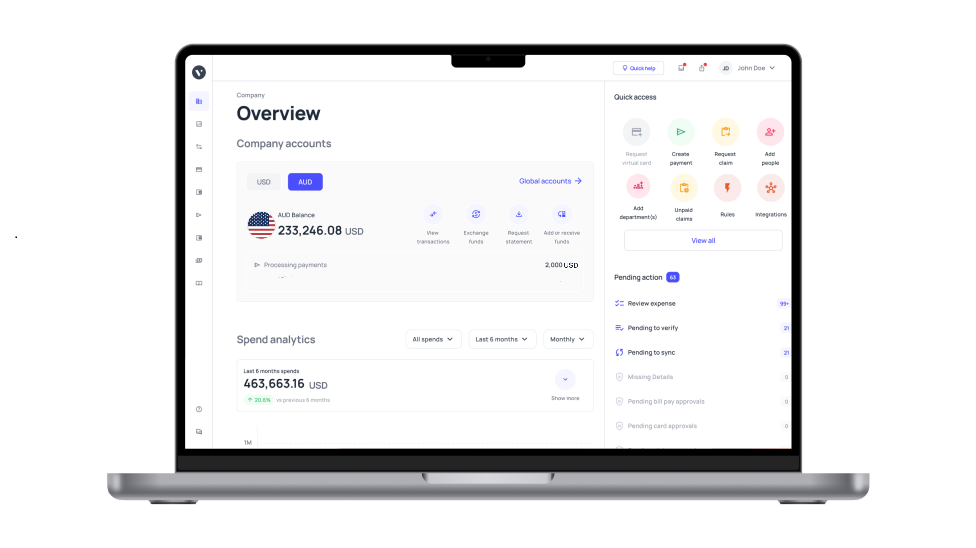

To manage this process efficiently, businesses leverage business budgeting software like Volopay which help track retained earnings, project future expenses, and ensure that funds are allocated correctly for growth and development.

The bottom line

Now you have reached the stage where you have all the information regarding the particulars of retained profit. You must be well aware of what it means, how retained profit calculation is done, and its importance.

As every coin has two sides, the advantages and disadvantages of retained profit both exist.

On the one hand, retained profit in the balance sheet enhances your company image, encourages stakeholders and other investors to put more money into the business, helps the company create a backup plan for emergency times, and strengthens the financial position of the business.

Whereas on the other side, the disadvantages of retained profit, like over-capitalization, inefficient use of funds, shareholders' dissatisfaction, etc., tend to have grave effects on the business’s reputation.

These two sides of the concept are undeniable. Hence everything comes down to your business planning and strategies. Retained profits need to be wisely spread out and turned into meticulous investments to get benefits out of it.

It is a company’s chance to make some more profit without taking any loan or debt, or liability. The retained profit money can be used for expansion, betterment of employee programs, improvement of important tech stack upgrades, and much more.