Benefits of AP automation and seamless ERP integration for your business

Every organization needs an efficient system to run distinctive departments collaboratively.

Enterprise resource planning software is accountable for that. In short, ERP is an application that acts as a unified platform for all business activities like procurement, supply chain, accounting, inventory, and more.

Modern applications have integration facilities that automatically connect different applications with ERP. For instance, an ERP AP system syncs account payable data with enterprise planning software.

Without AP integration, it’s quite difficult to feed accounts payable data into ERP. That leads to another set of inaccuracies and errors. ERP automation grease the wheels for accounting and other teams to seamlessly integrate and transfer data.

How can AP automation and ERP systems work together?

ERP and AP automation can go hand in hand, but some limitations exist. Most ERP systems have basic accounts payable features as in-built options. But that can only be used for receiving invoices or making payments.

Your team will still have to rely on semi-automated or manual ways to organize AP functions. And that won’t be fully efficient. There is also one more issue when it comes to relying only on ERP systems.

When your company scales and increases its operations, your accounting team won’t have the bandwidth to handle it. To accommodate that additional workload, your ERP systems alone can’t support it.

As you keep growing, you will have no options left other than upgrading your ERP systems. This can get you the additional expense management functionalities you need.

But if you are in need of a comprehensive expense management solution, then get an invoicing system that supports AP integration and automation.

If your accounts payable software can communicate and sync with ERP automatically, your accountants don’t have to shift data manually. Thus by pairing your AP with ERP, you can facilitate a seamless flow of data from one to another.

Benefits of integrating AP automation with your ERP system

1. Streamlined approvals

When approvals are obtained manually, the approver is presented with very little information. It’s hard to make decisions out of it and pass that down. They might not even be aware of the requests waiting for their attention.

It’s an extra effort from the accountants’ end to check this and update approvers regularly. Also, it’s either sent through emails or shared in person as manual files. Both are clunky and time-consuming.

ERP automation puts an end to these messy processes. Each approver will be given a role and relevant access to the system. They can log in anytime to see pending approvals and approve/reject on the go.

Approval Workflows can be created to pass an expense request from one stage to another automatically. It even allows multiple approvers for further filtering and authorization.

No need to remind approvers manually, as ERP AP systems send push notifications themselves. Whenever an expense is processed, the approval request springs up and reaches the approver's inbox.

Admins have the privilege to modify workflows and customize them based on different parameters. You will no longer waste time waiting to hear from approvers. By utilizing ERP automation, you send out payments more quickly.

2. Paperless financial processes

Dealing with papers is always messy. Think about the same for hundreds of invoices a company might receive in a week. The risk of losing, missing, or duplicating invoices is very high.

Committing either one of these errors can bare you heavy money loss in the form of penalties. Sensitive data lying in a vulnerable manner where anyone can access them raises red flags.

There are still suppliers who send manual invoices. You can’t help but feed them into the system manually. Data loss or mistyping can again happen. In any way, manual files and copies are hard to maintain and demand heavy manual labor.

That’s why ERP automation is a safe bet. Even if it’s a manual invoice, it gives you the option to scan and upload. And you never have to store anything in paper copies.

If you store it in paper format, it can take forever for you to find a document. However, ERP AP systems have readily accessible data.

This is also a money-saving solution as you don’t invest in paper and copy machines anymore. In other ways, paperless solutions are also easy on the environment and an eco-friendly way to deal with complex business tasks.

3. AP visibility

Accounts payable holds very important data that’s needed to understand spending and prepare budgets. The onus of sharing this data with everyone involved is with the accounting team.

Also, the company needs to look at and analyze where its money goes. Traditional ways of accounting offer little to no room for visibility. There is no real-time view of what goes out.

It’s even harder if you make payments through different platforms (credit cards, bank transfers, cash). At the end of the month, you will have to collect all statements and records to summarize your overall expenditure.

But automated ERPs are more transparent and offer a real-time picture of accounts payable happenings. Any expense that’s made through the system gets instantly recorded. So are the ones that are waiting in line to be processed.

Hence you can see the status of payments anytime from anywhere. It’s very helpful for finance leaders to observe and make financial decisions relying on up-to-date data.

By leveraging this data, they can identify patterns and trends, find the most and least expensive categories, and prepare accurate budgets.

4. Reduced errors

Manually entering and transferring data is bound to have errors. They are hard to avoid if your accountants keep processing and entering data on a regular basis. These errors might be small number swaps or missed entries.

Only at the month's end, do accountants get an opportunity to process data and find the error’s source. Their entire day gets wasted only on finding and rectifying these mishaps.

Most business owners are negligible towards this drawback. They assume that their employee becomes efficient if they do the same tasks repetitively. It’s too late when they realize this and find alternative solutions.

What works better here to reduce errors is ERP AP systems. There are low or zero chances for workers to do manual entries here. It not only reduces your employees’ workload but makes their work error-free.

Whether it’s creating a bill or sending money to a vendor, data gets inputted without human effort. If your accounts payable system also promises AP integration with ERP, you can further increase productivity.

You can reconcile expenses easily and even achieve continuous closing.

5. Reduced manual labor

Your production increases as your company grows. It’s the ERP that can be there and accept the increased workload. If you don’t have one or not a fully-functional one, your employees bear the brunt.

The accounting team receives more invoices to process. The majority of the day goes by creating invoice entries, sending for approvals, scheduling payments, maintaining records, etc.

If even half of these tasks are not automated, they will be exhausted by the day’s end. And that will take a hit on their productivity. Their shoddy work affects the team and the company too.

Manual labor only leads to reduced work quality and worn-out teams. They must be provided with what they want to work at full efficiency. And that’s the duty of the companies they work for.

That’s why modern teams go for ERP AP systems. It minimizes manual labor and automizes every boring and monotonous task. With the same amount of members, you can handle twice the workload or even higher.

Human intervention gets minimized giving more time to employees to focus on other tasks. They no longer use multiple systems and keep uploading data from one system to another. With a unified platform, they control everything.

6. Enhanced productivity

It’s smooth sailing from here as everything is automated and works in auto-pilot mode. Repetitive tasks are the most time-consuming. Especially, they will be required to stay cautious to not make any mistakes.

As they are taken care of, employees finally have time to breathe and handle core tasks. This increases the productivity of employees and helps them work collaboratively without bombarding others with requests.

In the era of remote workstyle, employees get the least chance to establish communication with teams. They need modern ERP automation techniques to keep them connected. Unlike AP, ERP is a wide term that involves cross-functional teams.

That can be easily accomplished with ERP automation. As everyone knows their roles and responsibilities and is backed by intuitive software, every core function will be carried out smoothly.

Employees will work with higher productivity and deliver what’s expected. With decentralized responsibilities, it’s far easier to finish goals on time.

How Volopay can help you create an integrated ERP system

You might already be familiar with ERP systems and might be using one too. Now all you need is an accounts payable system with AP integration. Half of the businesses don’t understand what AP integration can do for them.

They turn their AP integration into a DIY project and manage with whatever they have. It necessarily shouldn’t have to be this way. Given your long-term growth and convenience, you should solutions that will keep supporting seamlessly.

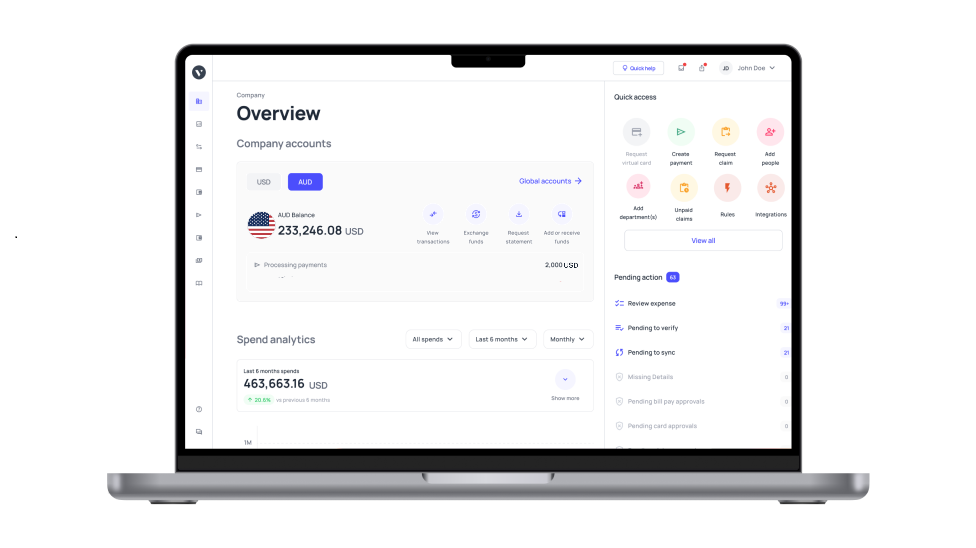

Volopay comes with AP integration possibilities that allow you to connect with your main enterprise resource planning software. Make and sync payments from the same place.

Volopay gives you an extensive platform to streamline your payments in one location. You get real-time visibility of your expenses and maintain all AP records there.

Workflows are there to route payments through approvals till it's out for delivery. ERP automation is very essential for unchaotic expense management. Get Volopay today and set up your ERP AP system.