11 best company credit cards in the US for 2025

Looking for the best company credit cards in the US for 2025? You’re in the right place.

Enjoy features such as customized spending management, insightful financial tracking, and a suite of rewards tailored to your business needs with some of the best company credit cards in the US.

Whether you seek a credit card in the US for business to optimize expenses or boost employee perks, our guide has you covered.

What is a company credit card?

A company credit card is a financial tool specifically designed to facilitate business transactions and manage expenses. It enables you to separate personal and company expenditures efficiently, ensuring financial clarity and organization.

While some businesses may benefit from traditional credit cards, others might prefer a business charge card for its flexibility and lack of revolving debt.

With the best company credit cards, you gain access to a plethora of advantages, including rewards, cashback, loyalty points, travel protection, and robust expense management features.

Whether you prioritize rewards, cashback, or credit building, the best credit card in the US for business ensures that every transaction contributes to your company’s success.

Choose wisely to optimize your financial strategy and reap the benefits customized to your company’s needs.

How does a company credit card work?

The best company credit card in the US simplifies business finances for you by providing a designated card for company and employee-related transactions.

You distribute these cards among employees for expenses such as travel, entertainment, and business needs. Transactions are tracked in real time and can be integrated with your accounting systems for efficient reporting.

At the end of each billing cycle, your business pays a consolidated bill, making financial management easier. The best company credit cards also improve oversight and reduce administrative burdens for you.

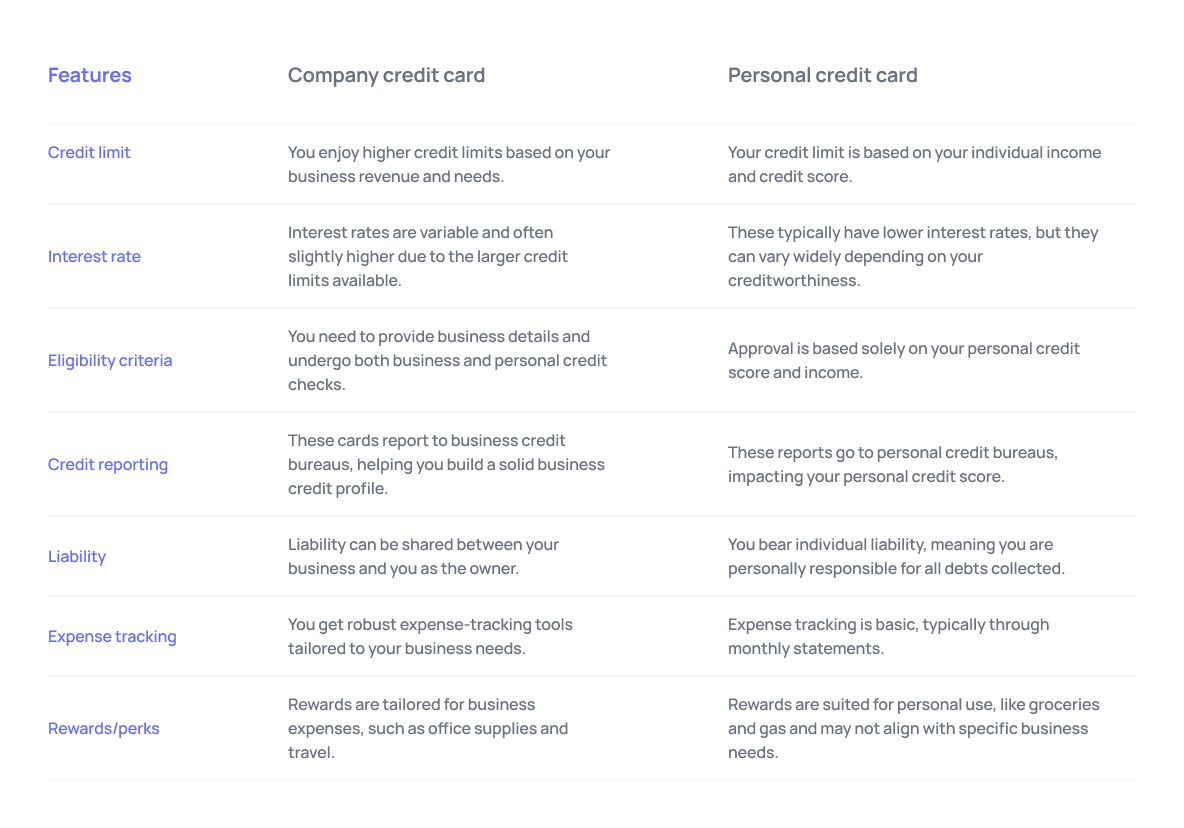

Company credit cards vs personal credit cards

The best company credit cards provide higher credit limits and business-specific rewards, making them a powerful tool for managing and optimizing your company’s financial operations. On the other hand, personal credit cards are designed for individual spending.

Choosing the right card depends on your unique needs and financial goals.

Empower your team with secure and smart cards

11 best company credit cards in the US for 2025

- Type of card

- Annual fee

- Intro APR

- Key perks

- Target audience

In the competitive landscape of business credit cards, choosing the best company credit card in the US can significantly impact your financial operations. Here are some key contenders to consider for the best credit card in the US for business.

1. Volopay corporate card

● Overview

Not a credit card, but Volopay provides you with a seamless alternative to traditional company credit cards, offering control over your business finances without the hassle of reimbursements or delays.

● Primary features

With Volopay’s corporate cards, you can set up multi-level approval policies, customize transaction limits, track spending in real time, use virtual cards for subscriptions, and integrate robust accounting tools to maintain complete control over your company’s funds.

● Setup process and requirements

Setting up Volopay is straightforward. Simply provide your basic business information and complete the verification process to get started.

● Advantages

Enjoy fast payments, easy expense tracking, a user-friendly dashboard, and flexibility for your remote teams with Volopay.

● Limitations

Implementing a new expense management system like Volopay may require some adjustment and training for your employees, leading to a minor learning curve initially.

● Target customers

Volopay is a great alternative to even the best credit card in the US for business expense management, enjoyed by startups and enterprises seeking efficient financial management without the hassle of traditional credit cards.

● G2 rating

Volopay has consistently been recognized as a G2 leader and high performer, maintaining its status through 2023 and into 2024. It currently has a 4.2 rating.

2. American Express company credit cards

● Overview

American Express offers you a range of best company credit cards tailored to your unique business needs. The business platinum card specifically stands out with its premium rewards and exclusive benefits.

Additionally, American Express also provides you with the corporate platinum card and business gold card, each designed to cater to your different business preferences and requirements.

● Primary features

American Express company credit cards offer you premium rewards, and travel benefits, which include the business platinum card’s 5x membership rewards points on flights and prepaid hotels, or the corporate platinum card's tailored business services.

Each card enhances your business spending with unique features.

● Setup process and requirements

The application process for American Express company credit cards involves providing your business and personal information for credit checks. Approval typically requires a good credit score.

Once approved, you’ll receive your card along with instructions on how to activate it and start using it for your business expenses.

● Advantages

With American Express company credit cards, you enjoy high reward rates, exceptional travel benefits, and comprehensive purchase protections, making them an excellent choice for your business.

● Limitations

While American Express company credit cards offer you extensive benefits, they come with higher annual fees and stringent credit requirements compared to other options.

Additionally, acceptance may vary depending on your vendor and region, which could be a minor inconvenience for your business, if you operate in areas with lower American Express adoption rates.

● Target customers

American Express company credit cards are perfect for you if your business prioritizes premium rewards, extensive travel benefits, and comprehensive purchase protections. These cards cater to various industries and business sizes, ensuring your needs are met.

3. Capital One Venture X Business

● Overview

The Capital One Venture X Business Card is a top choice for your business if you have high spending and want substantial travel rewards and premium benefits.

● Primary features

You earn 2x miles on every purchase, 5x miles on flights booked, and 10x miles on hotels and rental cars booked through Capital One Travel.

● Setup process and requirements

Applying for the Capital One Venture X Business card requires your business and personal information. Approval typically requires an excellent credit score, and once approved, you’ll receive your card with details on how to activate it.

● Advantages

The Capital One Venture X Business card offers you premium travel perks, such as an annual $300 travel credit for bookings through Capital One Travel and no preset spending limit.

You can also add employee cards for free, enhancing your business’s spending power.

● Limitations

To earn the 150,000-mile welcome bonus, you need to spend $30,000 in the first three months. Additionally, the annual travel credit is limited to bookings made through Capital One Travel.

● Target customers

This card is ideal for your business if you have high monthly expenses and frequent travel needs, offering rewards and travel benefits.

4. Chase Ink Business Preferred credit card

● Overview

The Chase Ink Business Preferred credit card is an excellent choice for your business if you are looking to maximize rewards on essential expenses.

With a substantial sign-up bonus and versatile rewards program, it’s a top contender for the best credit card in the US for business.

● Primary features

The card offers you a generous sign-up bonus along with the opportunity to accumulate valuable ultimate rewards points across various business expenditures. These earned rewards can be seamlessly transferred to 11 airlines and three hotel partners.

● Setup process and requirements

Applying for the Chase Ink Business Preferred credit card requires your business information and a good to excellent credit score (670-850).

The application process is straightforward, and once approved, you’ll receive your card to start earning rewards immediately.

● Advantages

This card provides you with one of the highest sign-up bonuses available, which is 100,000 points after meeting the spending requirement.

You also benefit from trip cancellation, interruption insurance, trip delay reimbursement, and primary car rental insurance.

● Limitations

To earn the 100,000-point sign-up bonus, you need to spend $8,000 in the first three months. Additionally, the card is subject to Chase’s 5/24 rule, which limits the number of new credit accounts you can open within 24 months.

● Target customers

The Chase Ink Business Preferred credit card is ideal for small business owners who have significant travel and advertising expenses, offering robust rewards and protections for various business-related purchases.

5. Brex corporate card

● Overview

The Brex corporate card is a powerful alternative to company credit cards, designed specifically for startups and enterprises.

It offers you a comprehensive suite of features to streamline your business spending and expense management.

● Primary features

With the Brex corporate card, you get worldwide card acceptance, both physical and virtual cards, and the ability to manage your card from your phone. Earn up to 7x back on spending, and enjoy high credit limits tailored to your business.

● Setup process and requirements

Getting started with the Brex corporate card is straightforward. You need to provide basic business information and demonstrate financial health through revenue or funding. There’s no personal guarantee required, making it easier for startups to qualify.

● Advantages

Brex offers you unparalleled flexibility with worldwide card acceptance, enterprise-grade security, and 24/7 customer support.

The card also integrates seamlessly with your expense management systems, ensuring compliance and real-time expense tracking.

● Limitations

While Brex provides excellent benefits, it may not be suitable for very small businesses with limited revenue. Additionally, its high credit limits are tied to your business’s financial health, which could limit availability.

● Target customers

The Brex corporate card is ideal for startups and enterprises looking for the best credit card in the US for business travel, procurement, and expense management.

6. U.S. Bank Business Platinum card

● Overview

The U.S. Bank Business Platinum card is a solid option for you if you're looking for a straightforward credit card to manage expenses efficiently. It focuses on offering you low interest rates along with no annual fees.

● Primary features

This card features a lengthy 0% introductory interest rate period on purchases and balance transfers for the first 18 billing cycles. Additionally, it provides you with robust purchasing power and flexibility without charging an annual fee.

● Setup process and requirements

Applying for the U.S. Bank Business Platinum card requires you to provide your business details, such as revenue and tax ID. Approval depends on both your business and personal creditworthiness.

● Advantages

The primary advantage of this card is the extended introductory interest-free period, which is perfect for financing your business expenses or consolidating existing debt.

Additionally, there are no annual fees, and you can add employee cards without extra costs.

● Limitations

This card does not offer you any rewards or cash-back programs, which could be a disadvantage if you’re looking to earn points on business purchases.

● Target customers

The U.S. Bank Business Platinum card is ideal for businesses that need to finance large purchases or manage debt with a long interest-free period.

7. United Business card

● Overview

The United Business card is perfect for business travelers who frequently fly with United Airlines.

● Primary features

This card earns you 2 miles per $1 spent on United purchases, dining, gas stations, office supply stores, and local transit.

You’ll earn 1 mile per $1 spent on all other purchases. Additionally, there’s a 75,000 bonus mile offer when you spend $5,000 in the first three months.

● Setup process and requirements

Getting started with the United Business card is straightforward. You’ll need to provide your business details and meet the spending requirement for the bonus miles. Approval requires good to excellent credit, typically between 670 and 850.

● Advantages

Enjoy perks like free checked bags, priority boarding, and inflight discounts, making your business trips more comfortable and cost-effective. Plus, earn 5,000 bonus miles annually if you hold a personal United card.

● Limitations

Redemption options are mostly limited to United Airlines and its partners, which might not be ideal if you prefer more flexible travel rewards.

● Target customers

This card is best for business owners who frequently fly with United Airlines and want to maximize their travel benefits.

8. Stripe corporate card

● Overview

The Stripe corporate card is designed for your fast-growing business as an alternative to company credit cards, providing a seamless way to manage your expenses with real-time reporting and simplified rewards.

● Primary features

With the Stripe corporate card, you earn 1.5% cash back on all purchases, across all categories. The card also offers you powerful tools like custom spend controls, real-time expense reporting, and integration with popular accounting software.

● Setup process and requirements

Setting up is easy, you only need a Stripe account. No paperwork or personal guarantee is required. Get started with a virtual card in minutes and watch your credit limit grow with your business.

● Advantages

Enjoy simplified rewards and 1.5% cash back on every business purchase you make. The Stripe corporate card provides you with comprehensive spend controls and fraud prevention. Real-time expense reporting makes managing your finances easy.

● Limitations

The card is currently available in invite-only mode, limiting its accessibility. Additionally, it requires a Stripe account, which might not suit your business if you are using other payment processing services.

● Target customers

The Stripe corporate card is ideal for fast-growing businesses looking for an expense management solution with simplified rewards. It's especially suited for companies already using Stripe for payment processing.

9. Wells Fargo Business Credit Cards

● Overview

Wells Fargo offers several business credit cards that cater to various business requirements. These cards allow you to track and control your business expenses while reaping rewards.

You can select cash back, travel rewards, or flexible financing options. The company's credit cards offer rewards such as unlimited 2% cash rewards, no annual fee on certain types, and an introductory 0% APR.

The company's business credit cards help businesses maintain financial control efficiently through easy online account management and expense tracking tools.

● Primary features

The Signify Business Cash℠ Card offers unlimited 2% cash rewards on all business purchases, with no categories to track and no earning limits.

It simplifies business expense management and maximizes cash-back benefits, thus making it a great choice for businesses seeking easy, high-reward credit solutions.

● Setup process and requirements

To apply for a Wells Fargo business credit card, you needs to provide basic business information and undergo a credit review.

The application process is easy and accessible for business owners looking for reliable financial solutions, and it can be done online or at a nearby branch.

● Advantages

Unlimited 2% cash back on all business purchases with no categories to track. No annual fee, saving your business a cost. Introductory 0% APR for 12 months on purchases, providing flexibility as well as savings for your business expenses.

● Target customers

Purchases APR becomes standard after the first 12 months of the introductory period. The approval is credit-based, and businesses must meet Wells Fargo's credit qualifications.

If balances are not paid in full, there may be charges for interest applied, so proper credit management would be necessary for cost efficiency.

10. Bank of America Small Business Credit Cards

● Overview

Bank of America offers a range of small business credit cards that match different business spending needs. No matter how much importance you give to cash back, travel rewards, or low-interest financing, their credit cards are an excellent option as they provide immense benefits.

The features such as unlimited rewards, no annual fee on some cards, and an introductory 0% APR also help businesses track their expenses without any trouble. Bank of America's online account management and expense tracking tools give businesses control over their finances with ease.

● Primary features

The Business Advantage Customized Cash Rewards Mastercard allows 3% cash back in a category of your choice, 2% on dining, and unlimited 1% on all other purchases.

This freedom lets businesses earn maximum rewards in the areas that fit their spending, thus providing higher overall savings and benefits.

● Setup process and requirements

To apply, businesses must provide their company details, financial records, and undergo a credit check. A good to excellent credit score is typically required.

The application process is straightforward, and once approved, businesses can start using their card to manage expenses and earn rewards.

● Advantages

Customizable cash-back categories, no annual fee, and introductory offers may be available. The flexibility in choosing reward categories helps businesses optimize their savings while benefiting from additional financial perks.

● Limitations

Cash back in selected categories may be subject to quarterly spending caps. Approval requires good to excellent credit, which may limit accessibility for some businesses. Additionally, higher-tier rewards may necessitate higher spending levels.

● Target customers

Customers Ideal for small business owners looking for flexible cash back rewards, expense management tools, and no annual fee options.

Businesses that prioritize earning rewards on their specific spending categories can benefit significantly from these credit card offerings.

11. PNC Bank Small Business Credit Cards

● Overview

PNC Bank offers several small business credit cards, each designed to meet different business needs, including cash rewards, travel rewards, and low-rate options. Their cards provide flexible reward programs, security features, and financial tools to help businesses manage expenses efficiently.

With low introductory APRs, expense tracking, and spending controls, PNC Bank allows businesses to gain better financial oversight while earning valuable rewards. All these make PNC Bank a strong contender for small business credit solutions.

● Primary features

PNC Bank offers cashback, reward points, and travel benefits on its small business credit cards. Other benefits are low introductory APRs, spending controls, and fraud monitoring services.

● Setup process and requirements

Applying for a PNC Bank small business credit card requires submitting business details, financial records, and a credit check. Strong financials and a good credit score enhance approval chances.

● Advantages

PNC Bank business credit cards provide flexible rewards programs, low-interest financing options, and strong security measures, making them a great tool for managing business expenses.

● Limitations

The rewards structure may be less competitive than other providers, and higher-tier cards may require an excellent credit score. Additionally, availability may be limited to certain regions.

● Target customers

PNC Bank small business credit cards cater to small and medium-sized businesses looking for financing flexibility, security, and rewards to enhance their expense management.

Manage your business expenses with Volopay cards

Why are company credit cards important?

Travel benefits

Many of the best company credit cards offer travel-related perks such as airline miles, hotel discounts, and travel insurance. These benefits can significantly reduce your business travel costs.

Cash flow flexibility

Using a company credit card provides immediate access to funds, which helps smooth out cash flow issues. You can make necessary purchases even during short-term financial dips.

Enhanced expense management

With the best company credit cards, you can easily track and categorize expenses, making bookkeeping simpler and more accurate. This feature is vital for managing budgets and preparing for the tax season.

Separation from personal expenses

Keeping business and personal expenses separate is essential for accurate financial reporting. A company credit card ensures clear boundaries, protects personal assets, and simplifies accounting.

Employee cards

Issuing employee cards allows you to streamline business spending and monitor expenses. You can set spending limits and track transactions in real time, enhancing control over company funds.

Protection from fraud

Company credit cards often come with robust fraud protection features. These safeguards help detect and prevent unauthorized transactions, ensuring your business’s financial security.

Controlled employee spends

With a company credit card, you can set specific spending limits for employees, ensuring adherence to budget policies. This control helps prevent overspending and misuse of company funds.

Wide acceptance

Company credit cards are widely accepted, making it easier for you to make purchases both online and offline. This universal acceptance simplifies transactions and expands purchasing options.

Key factors in choosing a company credit card for your business

Size of the business

The size of your business matters. Smaller businesses with revenues under $4 million should look for cards designed specifically for small businesses, offering targeted rewards and benefits.

Usage frequency

Consider how often you will use the card. If your business has low usage, prioritize cards with low or no annual fees. For frequent use, look for cards with significant rewards for reaching spending thresholds.

Global use

If your business involves international transactions or travel, choose a card that is widely accepted abroad, offers minimal foreign transaction fees, and includes global customer support.

Card benefits

Seek out the benefits that match your spending habits. For instance, if travel is a significant expense, select a card with travel benefits like airport lounge access, travel insurance, or a robust rewards program.

Type of industry

Different industries have unique spending habits. Select a card that caters to your industry, offering rewards that align with your typical expenses.

Spending categories

Evaluate your business’s primary spending categories. Choose a card that offers rewards or cash back in those specific areas to maximize benefits.

Credit limits

Make sure the credit limits meet your business’s spending needs. Higher credit limits can be crucial for businesses with substantial expenses.

Annual fees

Compare the annual fees of different cards. Ensure that the benefits you receive outweigh these costs.

Billing and payment options

Review billing cycles and payment options. Choose a card that aligns with your cash management practices to maintain smooth financial operations.

Advanced integration capabilities

Look for cards that can integrate with your accounting and financial platforms. This feature simplifies expense management, enhances reporting accuracy, and saves time.

Support services

Evaluate the level of customer service provided. Access to a dedicated account manager can make a significant difference in resolving your issues quickly.

Security features

Investigate the card’s security features and fraud prevention systems. Real-time alerts for unusual activity, multi-layered protection measures and robust fraud detection tools are essential.

Spend controls

If employees will use the card, consider one that allows you to set individual spending limits and restrictions, providing better control over expenses.

Issuer reputation

Research the issuer’s reputation and stability. Partnering with a reputable issuer not only ensures long-term service quality but also consistent support and reliability.

What are the eligibility criteria for obtaining a company credit card?

To secure the best company credit card for your business, you must meet specific eligibility criteria.

Here’s an overview of what you’ll require:

To apply for a company credit card, your business must be legally registered, financially stable, and have a good credit history.

Key requirements

● Official business name, address, and contact details

● Business type and industry categorization

● Legal business structure

● Federal tax identification number (EIN or SSN)

● Size of your workforce

● Projected annual business earnings

● Anticipated revenue

● Expected monthly credit card expenses

● Financial statements

Meeting these criteria will help you access the best company credit card in the US and organize your business expenses effectively.

Also, to better understand the ideal timing for issuing corporate credit cards to your employees, check out our detailed article, "When to issue corporate credit cards for employees." This guide provides detailed insights into the eligibility criteria and best practices for managing company credit cards effectively.

Looking for corporate cards to manage your business expenses?

How to manage company credit card after issuance?

Once you’ve secured the best company credit card, proper management is crucial for maintaining financial health.

1. Develop a spending policy and reconciliation procedure

Establish clear guidelines on acceptable card use, specifying allowed and prohibited expense categories. Implement a reconciliation process with strict deadlines for cardholders to submit receipts and explain charges.

Ensure your policy also includes a list of expenses you should never put on a business credit card, such as personal purchases, non-business-related travel, or items unrelated to company operations.

Suggested read: How to draft corporate credit card policy for your business?

2. Integrate with accounting software

Integrate your card provider’s system with your accounting software. This automates expense tracking and reporting, ensuring accuracy and saving time.

3. Monitor transactions

Regularly review transactions for each card. Monitoring helps catch errors or unauthorized spending early, allowing you to address discrepancies promptly.

4. Make timely payments

Ensure you always pay off your balance on time to avoid interest charges and penalties. Timely payments maintain your business’s good credit standing.

5. Define credit limits

Set specific credit limits for each cardholder based on their responsibilities and spending needs. This controls spending and reduces the risk of overspending.

6. Analyse spending trends

Assess spending patterns to identify cost-saving opportunities for your business. Analyzing trends can help negotiate discounts with frequent vendors and optimize your budget.

7. Adapt policies as necessary

As your business evolves, periodically review and update your credit card policies. Reflect on any changes in your business’s spending needs or financial strategies.

8. Provide employee training

Train cardholders on correct card usage, expense submission, and procedures. Proper training ensures compliance with your spending policies and helps in preventing misuse of the cards.

9. Review changes in agreements

Stay updated with any changes to your card’s terms or benefits. Adapt your spending strategies to take advantage of new offers or benefits.

By following these steps, you ensure the best company credit card in the USA works efficiently for your business, providing financial control and maximizing benefits.

Maximize business credit card benefits with Volopay’s corporate cards

Volopay’s business prepaid cards are designed to offer your business the best in expense management, helping you control and optimize your spending.

As one of the best company credit cards alternatives, Volopay provides a comprehensive suite of features that enhance financial oversight and efficiency.

1. Spend control through streamlined approvals

Implementing streamlined approval processes allows you to maintain tight control over expenses. With Volopay, you can set multi-level approval workflows, ensuring that all expenses are pre-approved by relevant stakeholders.

2. Manage vendor relationships with simplified payments

Volopay simplifies vendor payments and controls through vendor owners, enhancing your vendor relationships.

By using corporate cards, you can make timely payments, negotiate better terms, and take advantage of early payment discounts, all of which contribute to improved vendor trust and cooperation.

3. Real-time expense tracking

Volopay’s real-time expense tracking provides instant visibility into all transactions. This feature allows you to monitor spending as it happens, ensuring that expenses align with company policies and budgets.

4. Seamless integration with accounting systems

Volopay integrates seamlessly with popular accounting systems like Xero, QuickBooks, and Netsuite. This integration automates the transfer of your expense data, reducing manual entry and errors, and accelerating your financial reconciliation processes.

5. Automated categorization of expenses

Automated categorization helps with your expense reporting. Volopay’s system tags transactions with appropriate categories, making it easier for you to analyze spending and ensure compliance with your company’s financial policies.

6. Easy and quick reimbursements

Volopay’s corporate cards simplify the reimbursement process for you, allowing employees to submit claims easily and get reimbursed quickly. This reduces your administrative overhead and improves employee satisfaction.

7. Provision of multiple cards for employees

You can issue multiple corporate cards to employees, each with customized spending limits and controls. This flexibility ensures that your team has the funds they need while keeping expenses within budget.

Maximize the benefits of the best credit card in the USA for business by choosing Volopay’s corporate cards. With these features, you can enhance financial control, optimize spending, and drive your business forward.

Streamline expense management with corporate card

FAQs

Yes, multiple employees can be issued company credit cards under one account. This feature is designed to provide flexibility and ensure that each team member has the funds they need for business expenses—it’s an important feature to consider when evaluating the best company credit cards.

With Volopay, you can issue as many corporate cards as necessary, making Volopay a top contender for managing diverse business needs efficiently.

Yes, most company credit card providers also provide spending limits and controls—the complexity of these systems might vary from issuer to issuer. For instance, Volopay allows you to control and restrict company card usage for different employees or departments.

You can set custom spending limits, establish approval workflows, and restrict usage based on specific merchant categories.

These controls ensure that spending aligns with your company’s financial policies and help prevent unauthorized expenses, making Volopay one of the alternative options when evaluating the best credit cards in the USA for business.

If a company credit card is lost or stolen, you should immediately freeze or block the card. If your Volopay corporate card is lost or stolen, you can freeze/block it using the Volopay dashboard or mobile app.

This instant action prevents any unauthorized transactions. Additionally, you can report the incident to Volopay’s support team to arrange for a replacement card and investigate any suspicious activity.

Most large-scale bank providers do take some time to process the documentation for new company credit cards. Fintech providers have a quicker turnaround time.

You can issue new cards quickly through Volopay in cases of employee turnover or business expansion. The process is streamlined to ensure minimal disruption to your operations.

Yes, Volopay corporate cards support international payments, making them ideal for businesses with global operations by providing a reliable and convenient payment solution for international transactions.

Absolutely, you can use Volopay corporate cards for company travel expenses. These cards are equipped to handle various travel-related payments, including flights, accommodations, and meals.

By choosing Volopay, you get access to corporate cards that function at the same level as the best credit cards in the USA for business, offering comprehensive features that enhance control and provide unmatched flexibility for your business needs.