The 11 best corporate credit cards to consider in April 2025

With how fast-paced modern business industries are, it’s no surprise that businesses now require payment methods that can keep up with the demands. Faster, safer, and more accurate payments are crucial for business operations to carry on smoothly.

Businesses that know what is the best corporate card to support them in their transactions and expenses have an edge. By equipping employees with cards, they can easily make expenses while the finance team has full control of their spending. Track, manage, and control business spending effortlessly.

Not only are they capable of keeping up with the demands of ever-changing markets, but they are also able to maintain stronger relationships with suppliers and vendors by ensuring that payments are easy and delivered on time.

To choose the right corporate credit card programs for small businesses or large enterprises alike, it’s important to understand the key features to look for and determine which cards will benefit your business the most.

Explore the options available accordingly and find out what the best corporate credit card programs are for specific business needs.

What is a corporate credit card?

As the name suggests, a corporate credit card is a card that corporations can use to make business payments on a credit line.

Its function is to centralize business expenses and make them using a designated card rather than utilizing personal credit cards for business purposes.

Corporate credit cards can be handed to employees to allow them to make payments on behalf of the organization, while ensuring the safety and accuracy of these payments.

Rather than handing out petty cash or reimbursing every single individual out-of-pocket expense, the best corporate credit cards for large business owners and small businesses alike streamline the expense management process.

Businesses can get access to the best corporate credit card programs with ease in the modern business world.

With plenty of providers offering corporate cards to US businesses, some key features that businesses want to look for include automated expense records and accounting integrations.

How does a corporate credit card work?

Like other credit cards, the best corporate credit card programs are designed to make payments easier using a monthly credit allocation provided by the credit card provider.

Overall, a corporate credit card works almost the same as a personal credit card, especially when it comes to making payments.

Similar to a personal credit card, corporate credit cards can be tapped or swiped to make in-store purchases. They can also be used for online transactions by inputting the card details into a payment portal.

Once the card transaction has been authorized, it will use up the same amount of credit available on the card. At the end of the billing period, the credit used has to be paid back.

The key difference between a corporate credit card and a personal card is that companies are in charge of issuing cards to their employees upon receiving them from the provider.

Best corporate cards in 2025 - A detailed comparison

Best corporate cards in the US for 2025

- Spending controls

- Real time tracking

- Accounting integrations

- Virtual cards

- Card customization

- Individual employee cards

1. Volopay corporate card

● Overview

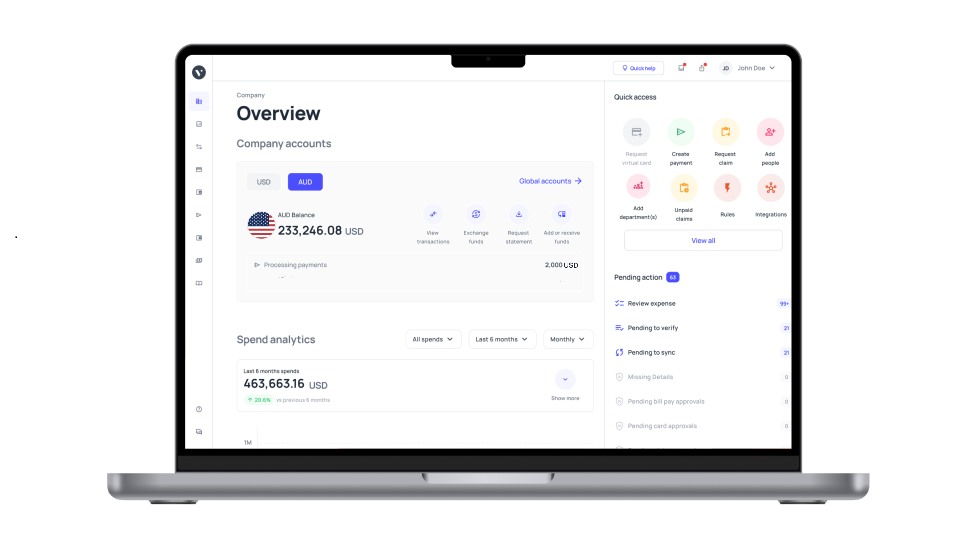

Volopay’s corporate card program offers virtual prepaid cards linked directly to a card management dashboard.

Card payments are taken care of from start to finish, starting with card issuance to general ledger reconciliation.

● Key features and benefits

Get features like automated multi-level approval workflows, accounting integrations, customizable spend controls, and many more by using Volopay corporate cards. Recording payments and controlling budgets are guaranteed to be effortless.

● Limitations

Volopay corporate cards are prepaid, meaning that businesses don’t get offered a credit line. While this may be a limitation for businesses specifically looking for credit, Volopay’s other features compete with the best corporate credit card programs.

● Fees and charges

Details on fees and charges depend on each business’s specific needs. Volopay is committed to appropriate and fair pricing without hidden fees. Businesses will know exactly how much they’re spending. Check Volopay’s pricing here.

● How to apply

Applying for Volopay corporate cards is a fully online process. Book a demo or speak with a sales representative to start the application process. There’s no need to go to a bank branch to start using Volopay cards.

2. Brex corporate credit card

● Overview

Brex is one of the best corporate credit card programs for businesses that have a lot of travel needs. Not only can businesses earn points quickly with Brex, but it also offers dedicated travel and expense management.

● Key features and benefits

Businesses can get high multipliers of points on certain categories of spending, allowing them to trade those points for rewards like airline miles to save on business expenses.

These rewards require a certain payment scheme but can be earned with no annual fees.

● Limitations

Brex incentivizes its users to earn higher rewards by making daily payments. Businesses that cannot meet the daily payment requirements will not be able to take full advantage of the rewards system.

● Fees and charges

The lowest annual fee Brex charges for its corporate credit cards is $0, but bigger companies that require custom controls will likely have to upgrade to the USD 12 per user/month plan or higher. You can check Brex’s pricing page here for any changes or updates.

● How to apply

Brex’s website offers a short form that business owners or finance managers can fill out to get started with the application process. Further details will be provided once the form is submitted.

3. Ramp Visa corporate card

● Overview

The Ramp Visa corporate card is designed to be an all-in-one corporate credit card complete with an expense management platform to streamline business expenses. Ramp aims to simplify the way businesses manage their finances.

● Key features and benefits

Businesses can get 1.5% cashback on all purchases made with a Ramp Visa corporate card. Ramp also offers a high credit limit along with its expense management features.

● Limitations

While Ramp can be one of the best corporate credit cards for large business owners, small businesses need to have at least USD 25,000 in a US business bank account to be able to qualify for the Ramp Visa corporate cards.

● Fees and charges

Businesses can start using the Ramp Visa corporate card for free with a USD 0 annual fee, but paid subscriptions are also offered to unlock more features like custom controls and multi-currency support. To know more details, check out their pricing page.

● How to apply

Getting started with Ramp requires businesses to either talk to a sales representative, book a demo, or immediately apply from their website. The application process can be done online.

4. The American Express corporate platinum card

● Overview

As a premium American Express card, the corporate platinum credit card is geared toward executives and travelers.

This card is suited for businesses that have frequent travelers who can benefit from airline credits, TSA precheck credits, and many more travel-related perks.

● Key features and benefits

Businesses can collect points with every purchase they make on their American Express corporate platinum card, with partnerships with many individual and corporate membership rewards programs.

● Limitations

Compared to other corporate credit card programs, American Express cards can have heftier annual fees. Businesses also don’t get an unlimited number of cards.

● Fees and charges

There is an annual fee for the American Express corporate platinum card, however, they also offer perks like airline fee credits, which if cardholders choose to use can make the annual fee even more worth it. To know more about the different fees and charges for this card head click here.

● How to apply

Potential American Express corporate platinum cardholders can make a call to American Express to begin the application process. The website states that making a call or requesting to be called is the only way to get started.

5. Bill Divvy corporate card

● Overview

Businesses get access to virtual corporate cards with Bill’s Divvy corporate card program, which means that businesses can provide every employee with cards.

● Key features and benefits

Depending on the credit payment scheme, Bill Divvy corporate cards have flexible reward rates while allowing every employee to get a card to use for business expenses.

● Limitations

Unlike some other corporate cards, Bill Divvy corporate cards offer no sign-up bonuses, with its rewards program starting at a lackluster baseline and requiring businesses to pay off their credit bills in full weekly instead of monthly to get better rewards.

● Fees and charges

Bill Divvy provides two types of company cards which come with different fees and charges. Although no charges are explicitly mentioned on their website, you can book a demo through their company card’s page to find out more.

● How to apply

Requesting a demo is required to get started with the Bill Divvy corporate card. All a potential Bill customer needs to do is fill out a form on the website to get a demo booking and access the application process.

6. U.S. Bank commercial rewards card

● Overview

Get rewards with the U.S. Bank commercial rewards card while maintaining tight control over business finances. The U.S. Bank offers expense management tools and accounting integrations.

● Key features and benefits

The rewards that businesses get from their U.S. Bank commercial rewards cards are customizable.

Businesses can choose to get a 1% rebate or get 5x points on car rentals, 4x points on accommodations, 3x points on airlines, and 1x points on every other purchase.

● Limitations

To use the U.S. Bank commercial rewards card, businesses must have an annual revenue between USD 10 million and USD 150 million, making it a steeper requirement for small businesses.

● Fees and charges

The U.S. Bank charges no annual fees for its commercial rewards card programs. Similarly, there are no platform fees applicable, unless the business wishes to apply for the bank’s full travel and expense platform. For any updates to fees and pricing structure, you can check out their corporate card page here.

● How to apply

Businesses can quickly fill out a short form on the U.S. Bank’s website to be connected with a sales representative and start the application process. Alternatively, calling or emailing directly is also an option.

7. Expensify Visa corporate card

● Overview

Expensify is a spend management software provider that also offers corporate cards that can be used by small business owners and large enterprises alike. Expensify Visa corporate cards come in both physical and virtual forms.

● Key features and benefits

Using Expensify’s Visa corporate cards guarantees businesses 1-2% cashback on every US transaction. Expensify also offers spend control features for all cards.

● Limitations

Due to the amount of services users can get with Expensify, there is a steeper learning curve. Even those who know what is the best corporate credit card for their business may not find it immediately intuitive.

● Fees and charges

Expensify charges USD 5 per user for businesses to start using their platform. Users will get cards and other spend management services. Cashback earned can also be used to pay the fees. For any updates to their fees, you can check out their pricing page here.

● How to apply

Businesses that would like to apply for an Expensify Visa corporate card can sign up through the website by answering a few simple questions and entering an email address or phone number before further details are provided.

8. Airbase corporate card

● Overview

As a virtual corporate card solution, Airbase allows users to easily manage recurring payments without having to carry around or manage physical plastic cards.

Every card that is generated is easily trackable, complete with a full audit trail.

● Key features and benefits

All transactions made on Airbase corporate cards are automatically recorded and synchronized with the general ledger.

With analytic features, fraud detection, and other tools like payment scheduling, Airbase helps manage business expenses better.

● Limitations

Users have reported that despite liking Airbase’s simple and easy-to-use platform design, there is also a lack of customization and advanced features, which larger businesses may want from their corporate credit cards.

● Fees and charges

Businesses that want to start using Airbase will have to consult with a sales representative on what their pricing scheme will look like. Airbase offers several pricing tiers depending on what the business needs out of the virtual cards they offer. You can check out their pricing over here.

● How to apply

Airbase offers product tours on its website and potential users can schedule a demo in just a few clicks. Businesses can apply for virtual cards after attending a demo or getting in touch with a sales representative.

9. HSBC corporate card

● Overview

The HSBC Corporate Card is designed to cater to the financial and operational needs of large enterprises and small businesses.

It offers comprehensive tools for managing expenses and provides global benefits that align with HSBC's international reach.

● Key features and benefits

Users get integrated expense reporting and tracking via HSBC's digital platform for their HSBC corporate card.

The card is an ideal choice for multinational corporations as it is accepted in over 200 countries. You can also set spending limits and category restrictions for employees.

● Limitations

Limited to HSBC account holders, which may restrict access for businesses banking elsewhere. The rewards program may not be as competitive as other providers in the market.

● Fees and charges

You can contact the HSBC team to know more about the fees and charges related to their corporate card and also visit their corporate card page to know more about it.

● How to apply

You can visit the HSBC corporate banking website or contact a local branch to fill out the application form for the corporate cards and submit the required documents, including business registration and financial statements.

10. Chase Ink business credit cards

● Overview

The Chase Ink Business Credit Cards offer a suite of options catering to small businesses and startups. These cards are known for their high rewards rates and flexible redemption options.

● Key features and benefits

Chase offers various types of business credit cards for companies that cover multiple different requirements including the Ink Business Preferred®, Ink Business Unlimited®, and Ink Business Cash®, and the Ink Business Premier® Credit cards, each tailored to different business needs.

No foreign transaction fees on specific cards such as the Ink Business Preferred®. Points can be redeemed for cash, travel, or gift cards through Chase Ultimate Rewards®.

● Limitations

The credit score requirements to avail these cards are high, making it difficult for new businesses with limited credit history to qualify.

● Fees and charges

To see a detailed breakdown of all the fees and charges related to these business credit cards, head over to this page.

● How to apply

Go to Chase’s business credit card page. Choose the appropriate Ink card that aligns with your business needs. Fill out the online application form with business details, including revenue and expenses. Wait for the company to approve or give feedback regarding your application.

11. Central Bank corporate card

● Overview

The Central Trust Bank offers mainly three types of business credit cards including - the Business Mastercard®, Commercial Mastercard Multi Card®, and the Business Prepaid card.

● Key features and benefits

When opting for these corporate cards you get the option to choose between multiple different billing cycles so that it best suits your business’s needs.

The card administrator has control allowing them to specify what types of spend categories can be accessed, place specific limits and vendor limits per employee and per spend category.

● Limitations

Limited rewards and benefits compared to larger banks. International acceptance may be lower, making it less suitable for global businesses.

● Fees and charges

You can visit Central Bank’s business credit card page to compare the available options and their pricing.

● How to apply

You can visit a local branch of the bank or visit their website and apply for the corporate card of your selection.

Still unsure which corporate card is right for you? Explore our side-by-side analysis of Volopay, Brex, Ramp, and Stripe to make an informed decision.

Use corporate cards to manage business expenses

What are the key features of a corporate credit card?

Different card providers will offer different unique features and the best corporate credit card programs for any particular business are always the ones with features that are best suited for the business’ specific needs.

However, there are key features that most if not all businesses will want in a corporate credit card.

Employee spending limits

Corporate credit cards are not loaded with infinite credit. Each card will have a predefined credit limit, meaning that employees are only able to spend according to the limit.

Once the credit has been spent, the cardholder or the business will have to pay back the credit bill before the limit refreshes.

Being able to decide what the limits are on employees’ corporate cards is a crucial feature for businesses. This ensures that cards are used responsibly.

Employee benefits

Not only do corporate cards make managing and paying for expenses less of a hassle for employees, but there are also other perks that employees can get by being cardholders.

Some of the best corporate credit cards for large business corporations offer travel insurance, lounge access, and other perks that make traveling more enjoyable for frequent business travelers.

Employees also don’t need to worry about cash advances or other complicated expense processes.

Company liability

Although there are different types of corporate card liability, the general bottom line is that the company is responsible for all business expenses made on these corporate credit cards.

Company liability allows individuals to not worry about their personal credit scores.

Even with an employee’s name registered as the cardholder, ideally the card is still issued to the company.

This feature encourages users to separate corporate expenses from personal spending.

Travel benefits and other incentives

One of the biggest reasons why corporate credit cards can be lucrative for large companies is that they often offer travel benefits or other forms of incentives, such as rewards and discounts.

Not only are businesses able to rack up points such as airlines or hotel miles for cheaper business expenses, but frequent business travelers may also get airport perks like lounge access, free drinks, or even travel insurance.

Specialized vendor discounts

To answer what is the best corporate credit card program for any particular business, it’s important to understand the business needs first.

Different cards may offer different discounts, with some cards offering specialized vendor discounts.

Logistics businesses, for example, may want to get a card that offer a lot of discounts in the logistics vendor space.

These discounts are also often more valuable for businesses compared to discounts from personal everyday credit cards.

Expense reporting and analytics

As corporate credit cards come with a complementary management dashboard, most programs have expense reporting features and built-in analytics.

Businesses should look for a platform that offers tools that can automate reporting and make it easier both for cardholders and the finance team.

Getting robust analytics is also key to strong card management. Take advantage of these analytics tools to make well-informed business decisions and plan budgets better.

Accounting integrations

Most of the best corporate credit card programs in the modern day offer accounting integrations that are easy to set up.

It should only take a few clicks to integrate the card management dashboard with whatever accounting system the business is already using.

Getting the ability to perform direct sync from one platform to another can significantly reduce the manual data entry work required to record expenses quickly and accurately.

Customizable controls

Modern corporate credit cards are all about suiting the company’s needs. A key feature that more corporate card programs are now offering is customizable control settings. Businesses can tune their settings to exactly what they need.

Smaller businesses may want to limit their monthly spending to a lower amount, while bigger businesses may want to automate approvals for smaller payments. Card controls are fully customizable to adapt to the business’ policies.

Advanced data security

Corporate cards should be able to offer a higher standard of security for businesses.

These cards don’t just replace cash as a payment method, but they also make funds easily accessible with just a single card.

Because of their convenience, corporate cards must have advanced data security features like encryptions, two-factor authentication, PIN numbers, and more.

Ensure that there are multiple layers of security to keep funds and sensitive data safe.

What are the benefits of corporate credit cards for your business?

The benefits of using corporate credit cards are varied, depending on what card program is selected by the organization.

Knowing the best corporate credit cards for large business organizations may help business owners and executives access the benefits that they wish to get from using these cards.

1. Expense management

Put simply, corporate credit cards are meant to streamline the expense management process for businesses.

Not only are businesses reducing the need for reimbursements and cash advances, but they can also easily track how the company funds are being spent.

Empower employees by giving them a payment tool that they can use with ease while still maintaining a high level of control. It’s easy to limit transactions and manage budgets with corporate cards.

2. Separation of business and personal expenses

Separating business expenses from personal spending is beneficial for businesses for a lot of reasons. It creates less confusion when accounting for each type of expense and promotes better budgeting.

When it’s clear which expense belongs to which category, businesses can easily track how much they’re spending.

Reconciling expenses also becomes smoother as separating business and personal expenses takes out the extra step of manually sorting each expense entry.

3. Enhanced spending controls

Considering that the best corporate credit card programs offer card management platforms with a full suite of control features, it’s no surprise that businesses that make the switch to corporate cards can access enhanced spend controls.

Plenty of providers have built-in customizable options to allow businesses to adjust the way they are controlling their spending according to their policies and needs.

Curbing overspending is easier with automated tracking, budgeting, and predefined limits.

4. Improved cash flow management

A company may know that it has funds but has no way to access them due to payment processing times.

Companies might also have to wait a few days until the customer has initiated the payment. Regardless of what the reason is, it will impact the business’ cash flow.

Corporate credit cards can help businesses improve their cash flow management, as it is possible to make purchases even without cash on hand.

5. Access to credit

Having access to a credit line can provide businesses with better ways to improve their cash flows. It also allows companies to have a safety net in case of delayed customer payments.

The ability to still make purchases helps businesses make time-sensitive payments and strategic expenses in a timely manner even when there is a delay in their cash inflow. However, keep in mind that every dollar still needs to be carefully accounted for.

6. Enhanced security measures

Most corporate credit cards are equipped with security measures that make them a safer payment alternative compared to cash.

Not only are cardholders required to create a PIN to use for in-store transactions, but online transactions also usually come with two-factor authentication.

If a card is compromised, corporate card providers also make it easy for the management team to freeze or block the card with just a few clicks.

7. Improved vendor relationships

Ensuring that vendor payments are made on time is key to maintaining good relationships with them. Using a corporate credit card makes it easy to initiate payments and settle them quickly with little hassle on both sides.

Vendors will appreciate it when they don’t have to jump through hoops to settle payments. Great vendor relationships also help with negotiating better deals and getting discounts for early payments.

8. Improved compliance and accountability

While corporate credit card misuse can be costly, the best corporate credit card programs in the US offer tracking features and built-in compliance tools that will improve the way businesses manage their spending.

Introduce a higher level of compliance and ensure that all employees are held accountable.

By utilizing automated approval workflows and flagging suspicious expenses, business owners can be rest assured that compliance with company policies and local regulations is maintained.

9. Real-time spend visibility

Most of the best corporate credit card programs available provide their users with a card management dashboard or application that automatically tracks card usage. Businesses can even opt to get email or text alerts when expenses go through.

Using corporate credit cards to make business expenses often provides a higher level of transparency. Get access to real-time spend visibility and always be aware of how every dollar is spent.

10. Quicker reimbursement process

Rather than struggling with tedious and slow reimbursement processes, corporate credit cards provide an alternative to making payments without having to use employees’ money.

Reduce the reimbursement workload to make the overall process faster.Corporate credit cards can also consolidate reimbursements.

Even with individual liability, the finance team no longer has to individually reimburse each purchase. Rather, they can send employees money once a month instead.

11. Flexibility and convenience

Rather than carrying wads of cash, the best corporate credit cards for large business enterprises offer more convenience and flexibility for making payments. Employees only need to carry a single card, making transactions on business trips easier.

With predefined credit limits, the finance team can also easily control how much employees are spending without having to go through the hassle of managing cash advances or reimbursements. Controlled spending is easier than ever.

12. Rewards and travel perks

One of the appeals of using a corporate credit card rather than a personal or debit card is that corporate cards often offer more rewards and travel perks.

For example, what is the best corporate credit card for a business that has a lot of travel needs may be one with lucrative airline miles rewards and airport lounge access.

Businesses can make traveling more comfortable for their employees while simultaneously saving money by racking up reward points.

Who holds liability for purchases on a corporate credit card?

Despite what its name suggests, corporations are not always fully liable for their corporate credit cards.

Depending on the structure the business chooses, the liability for the purchases on a corporate credit card can be the corporation’s liability or the individual cardholder’s.

Find out how each type of liability works on the best corporate credit card programs.

Corporate liability

With corporate liability, the company which the cards are under is fully liable for purchases made on the corporate credit cards.

Employees don’t need to pay their credit card bills and wait for the organization to reimburse them for the bill.

Rather, the company is billed directly for the credit usage. While this is less of a hassle for employees, the organization will have to exercise more control over expenses to minimize misuse.

Individual liability

An individual liability corporate credit card is the opposite of a corporate liability card. Cardholders are individually responsible for their credit bills during the end of the billing cycle, requiring them to pay off their transactions.

However, companies will reimburse employees after their credit bills are paid off.

Doing this introduces a higher level of responsibility on the employees and discourages them from misusing their cards, as reimbursements will have to be reviewed by the company first.

Joint liability

A joint liability card is exactly as it sounds, with both the cardholder and the company liable for expenses made on the corporate credit card.

However, this may mean different things for different organizations depending on the card payment scheme.

As a bottom line, both the company and the cardholder are jointly liable for transactions. Even if company policies state that the company will pay the credit bill, the cardholder will still be jointly liable for any card misuse.

Manage your business expenses with Volopay cards

Difference between corporate and business credit card

Corporate and business cards come in various forms, each catering to specific needs and purposes. These include credit cards, debit cards, and prepaid cards, which differ in how funds are managed and transferred. Among these, corporate credit cards and business credit cards are often discussed together, but they have distinct features and uses.

Business credit cards and corporate credit cards are often terms that are used interchangeably to talk about credit cards that are geared toward businesses, but there are some key differences between the two.

As the name suggests, a corporate credit card is designed with corporations in mind. Business credit cards, on the other hand, can be utilized by smaller business owners.

As a result, corporate credit cards often have more specific requirements compared to business credit cards, such as requiring the business to have more than a certain number of employees or meet the minimum revenue requirements.

Typically, the best corporate credit card programs will also only serve businesses that are registered corporations, while business credit cards can be used by any type of business, including sole proprietors.

Businesses that are not limited liability corporations will likely have better luck with business credit cards for that reason.

However, for companies that are looking for a tool that can help them better manage organization-wide expense management, corporate cards are the right choice.

The best corporate credit cards for large business owners should allow multiple cards to be assigned to multiple employees, with each card linked to a backend card management dashboard that helps track all card expenses.

Steps for efficient corporate credit card management

1. Establishing guidelines and policies

Introducing corporate credit cards to any organization is introducing a new workflow, so it is crucial that every employee that will be involved is clear on the expectations.

Establish guidelines on how to use corporate cards before allowing employees to use them.

Clear policies ensure that everyone is on the same page on what is the best corporate credit card management strategies.

2. Issuance of cards and assigning responsibilities

Employees who will be using the new corporate credit cards must first be assigned as cardholders and issued the cards. Businesses may need some basic information from the cardholder to issue the cards.

Check that every cardholder is familiar with their responsibilities when using the card. Assign clear responsibilities for everyone in the process, including cardholders, managers, approvers, and the finance team.

3. Making business-related purchases

Corporate credit cards should never be used for personal purchases. Make it clear to every employee that the sole purpose of these cards is to make business-related purchases.

Aside from that, encourage employees to streamline business expenses by using their cards instead of cash.

Familiarize them with corporate cards as the primary payment method and eliminate the need to make out-of-pocket expenses.

4. Monitoring spends in real time

Although a lot of corporate credit card programs offer automatic spend tracking, it is still important for businesses to take advantage of these features and regularly monitor the company spending patterns.

Make sure to get spend updates in real time and have them easily accessible to the finance team. Automatic updates and regular monitoring of expenses will help curb overspending and card misuse.

5. Expense categorization

Make expense categorization a habit in the corporate credit card management process. This helps businesses pinpoint how much budget a particular department or category needs to fulfill all its purchases.

Some of the best corporate credit cards for large business operations with complex needs can easily and automatically categorize expenses, taking away the hassle of manually reviewing and categorizing each expense entry.

6. Review and approval

Despite the credit limit of each card making it easier to control the company’s spending, it’s still important to review each individual expense.

A key step to good corporate credit card management is introducing approval workflow.

Many card providers offer these workflows built into their card management dashboard. Each expense can be automatically routed to the appropriate approval workflow to be quickly reviewed.

7. Reconciliation of expenses

Regularly reconcile expenses to ensure that every penny is accounted for. While this can be a time-consuming process to do manually, it’s important that businesses don’t skip the reconciliation process.

This is why the best corporate credit card programs for businesses offer real-time expense updates, accounting integrations, and automated reconciliation. Get a better handle on expenses while keeping the process hassle-free.

8. Enforcing compliance

It’s important that employees are not only just aware of the policies surrounding corporate cards but also comply with them. Managers, executives, and finance teams must take steps to enforce compliance.

The usage of automated tools that help with reviewing expenses and flagging suspicious activity will help in maintaining compliance. Let employees know that expenses are being regularly reviewed and misuse will have consequences.

9. Employee expense reporting

Make sure that employees make it a habit to report expenses accurately and on time. It’s best to always stay updated with expense reports to avoid unaccounted expenses and overspending.

Many of the best corporate credit card programs offer tools that can automate the expense reporting process. When the process is hassle-free, employees are guaranteed to be more keen to stay on top of it.

10. Executing timely reimbursements

If there are any reimbursements that need to be settled, ensure that they are executed in a timely manner. Businesses that use cards with individual liability may have to reimburse employees for card bills.

Late reimbursements will result in confusion, delays, and even employee dissatisfaction. It’s key that the business operation is not hampered by poorly planned reimbursement processes.

11. Continuous improvement

Chances are the corporate credit card management plan will need updates and revisions along the way. Companies will figure out what works for them and what doesn’t as they keep on using the card.

Make sure to continuously make improvements and consider feedback from employees. These steps will allow the business to make changes that make the corporate card management process more efficient.

Limitations of using corporate credit cards for your business

Long application process

A company has to collect a lot of documents to apply for a corporate credit card, not to mention the complex application process, which will require businesses to correctly fill out the fields and provide the right supporting documents.

Even with a smooth-sailing application, there may still be a long wait time to get the application reviewed. If there are any issues with the application, that will add more time.

Employee overspending

Most of the best corporate credit card programs will come with card management features, but the company will also have to enforce clear and strict policies to prevent employee overspending.

Without the right amount of oversight and a company-wide understanding of the policies, employees may be prone to overspending.

Issues may arise regardless of whether employees are overspending intentionally or otherwise, so be sure to keep a close eye on the credit limit.

Interest charges

A lot of corporate credit card programs offer interest-free payments so long as companies pay their bills on time and in full. However, installments, partial payments, and late payments may result in interest charges.

It’s important to make note of these interest charges before signing on with any corporate credit card program.

Make sure to ask what the rates look like as well as what the payment options are for interest-free credit repayment.

Annual fees and other charges

The best corporate credit cards for large business enterprises can be more costly compared to card programs for smaller businesses. Typically, larger businesses will need more features, better benefits, and a higher credit limit.

Card programs that can meet these requirements may have higher annual fees and extra charges. Keep in mind what the company’s budget is and make sure to get a corporate credit card that suits the budget.

Directly affects company credit score

Although corporate credit cards don’t often impact the owner’s personal credit score, they will directly affect the company’s credit score.

Poor management of corporate credit cards, misuse, or overspending can easily lead to poor credit.

Even with the best corporate credit card programs, companies will still have to establish clear policies and ensure that employees are using their cards wisely to not negatively impact the company’s credit rating.

Potential for vendor disputes

Vendor disputes are not unique to corporate credit card payments, but card payments that go through a payment gateway and are not done directly in person can sometimes lead to miscommunication.

These instances of miscommunication may lead to vendor disputes, which can be a hassle to manage. Businesses and their vendors are also relying on banks and credit card providers to help facilitate and resolve these disputes.

Prone to fraud and misuse

Like any other tool, corporate credit cards can be misused in the wrong hands. If a card is compromised or gets stolen, the finance team will have to work quickly to block access to prevent further misuse.

Without the right procedures and policies, corporate cards can be used as tools for fraud attempts. This is why it’s key for businesses to have clear policies and preventive measures for fraud and misuse.

Complex expense management

Introducing corporate cards to any organization adds another layer of expense management. In addition to managing cash advances, reimbursements, and transfers, the finance team will also have to account for card expenses.

While a card management dashboard can be a solid tool to help with managing card expenses, the team will need to be sure that they are comfortable with using the platform. It is also important to regularly monitor these expenses.

Minimum cardholder limit

Those who know what is the best corporate credit card may already know that some of the best programs have minimum cardholder limits.

This could mean that smaller businesses that require less credit or only have a few employees who can utilize corporate credit cards might not meet these requirements.

Businesses will have to meet these requirements by getting a higher credit limit than necessary or providing more employees with cards, or look for another card provider.

Fixed reimbursement cycles

Due to the way corporate card billing cycles work, the company’s reimbursement cycles will inevitably have to fall in line with them as well. This means that the organization will have to have fixed reimbursement cycles.

While this can provide better structure for the organization, it also leaves less room for flexibility. Urgent reimbursement needs may not be met accordingly depending on how far into the cycle they are.

Stay ahead of your expenses with our corporate cards

Documents required to apply for a corporate card in the US

Business registration details

As corporate credit cards are geared toward companies, most providers will require the business’ registration details to process the application.

Details such as the company name, registration number, and any other required legal details will be asked.

These are usually accompanied by documents that verify these registration details. Make sure to ask a representative from the provider what details and documents are needed.

Employer identification number

The employer, or owner, of the business will also be required to identify themselves. Although the corporate credit card will be applied for under the company’s name, it is still important to provide the employer’s identification.

A valid form of identification typically is an ID like a driver’s license. For expatriates, passports can also serve as a valid form of identification.

Credit report and history

Most of the best corporate credit cards for large business owners will ensure that business credit is entirely separate from personal credit, including how credit scores are measured.

Providers will ask for the business’s credit report and history during the application process, but if the business is new with minimal credit history, personal credit reports of owners and cardholders may be required.

Authorized signatory information

There needs to be someone acting on behalf of the business to sign documents and discuss contracts regarding corporate credit cards.

Whoever this authorized signatory is that represents the business, the credit card provider will need information about them.

This would include their ID, their position in the organization, and any other required documents to prove their identity and ties to the company.

Financial documents

Corporate credit providers need to be able to guarantee that their users are able to pay back their credit bills. When applying for a corporate credit card, providers are likely to ask for the business’s financial documents.

This could be in the form of bank statements from the past 6 to 12 months, but additional documents may also be required.

Business proof of address

Many corporate credit card providers only offer cards to businesses that have an entity that is registered and operating in the US.

To verify the business’ validity, providers may require proof of address alongside the registration details.

This would be a US office address or where the business’s operations are based in the US. Typically, residential addresses are not accepted.

Business bank account

Businesses are required to have a business bank account when applying for the best corporate credit card programs.

Typically, businesses are able to open a business bank account with the credit card provider if the provider offers banking capabilities.

However, some providers will require their users to have a business bank account that was created previously to be able to share past bank statements.

Company revenue

Some corporate credit card providers have a company revenue requirement that businesses have to fulfill before they are granted credit.

Not only will businesses need to state what their annual revenue is during the application process, but proof will also be required.

It is also not uncommon to state this information for the provider even without a minimum requirement, especially when requesting higher credit limits.

Card usage policy

A detailed card usage policy benefits the company more than it does the card provider. Regardless of whether the provider requires it to be submitted or not, the company should still draft a clear and concise policy to share with employees.

Having a card usage policy ready also helps answer any questions that the provider may have regarding on how the company is planning to use corporate credit cards.

How to choose the best corporate credit card for your business

With so many corporate card credit programs available on the market, finding what is the best corporate credit card for a specific organization can be a daunting task.

Here are some steps that companies can take to ensure that they are making the best decision for their business.

1. Determine your needs

Companies will not be able to decide what are the best corporate credit card programs for their organizations before they know they understand their business needs.

Before looking for corporate cards, it’s important to list down what uses the business has for cards and what pain points they will solve.

Having a clear objective in mind will make narrowing card provider options for the best fit a much easier task.

2. Lay out multiple options

Research is key in finding the best corporate credit card programs. For large business owners, they may want cards that are designed for large volumes of transactions or cross-border payments. Smaller business owners will aim for ease of use.

Regardless of what the business’s needs are, it’s good practice to lay out multiple options and compare and contrast them against each other. This way, the company is guaranteed to have the best option.

3. Review credit history

Before applying for a corporate credit card, companies will want to review their credit history. Unsecured corporate credit cards will require a good credit score for the business to get approved for one.

Businesses that don’t have a sufficient credit score or history may want to look for secured corporate credit cards or look for providers that allow them to apply with a personal credit score.

4. Compare fees and interest rates

Different card providers have different fees and pricing plans. Knowing what is the best corporate credit card for a particular business depends on what the budget is.

Make sure to set a budget for annual fees and other costs, as well as factor in interest rates.

It’s best to compare what the fees and interest rates are for multiple card providers. Keep in mind that the cheapest cards may not always have all the necessary features for the business.

5. Determine usage and compliance policies

Before applying for a corporate credit card program and issuing cards to employees, businesses should first create a usage policy and establish how to enforce policy compliance.

A policy helps to lay out the foundations for training employees on how to use their corporate credit cards.

Businesses will also be able to ensure that the card program they choose allows them to enforce these policies with ease.

6. Check for customer reviews and testimonials

The best corporate credit card programs don’t just have the most complete features. Advanced technology is one aspect to look at, but it’s equally important to find proof of what card providers are advertising.

Reading customer testimonials and reviews will give businesses a better understanding of how a particular card provider operates.

Complete features paired with great customer service and fast responses, for example, make a promising corporate credit card program.

7. Gather necessary documentation

Make the application process faster by knowing what the requirements are. While the application process may differ from provider to provider, most providers will typically require similar basic information and documentation.

Gathering all these documents in advance will make applying for a corporate credit card much smoother.

These documents may include business registration documents, licenses, identification documents, proof of residence, and more.

It’s always best to check which documents are necessary with a representative.

8. Submit application

Companies will have to fill out an application form to get a corporate credit card, which the provider will then review before a card is issued.

Make sure to completely fill out the application to avoid any complications during the review process.

Every application process may look a little different. It’s important to follow the application instructions carefully. Many businesses may prefer applications that can be filled out entirely online.

9. Integrate with expense management system

Make managing corporate credit cards easier by integrating them with the organization’s existing expense management system.

Many card providers offer integration capabilities, while some others have built-in expense management.

Regardless of which direction is taken, using an expense management system with corporate cards allows organizations to track and manage card spending.

Minimize overspending by getting automatic updates on transactions and setting customizable limits. Compromised cards can be easily spotted and actioned on.

10. Issue cards

Once a system is put in place and the cards are ready to use, the only thing left for a business to do is issue corporate cards to their employees.

Businesses should keep in mind the specifics of how to do this, as different providers may have different methods.

The bottom line is that companies will want to issue cards only to employees who have a good reason for using a corporate card.

Unlock financial flexibility with corporate cards

What are the best practices when opting for a corporate credit card?

While corporate credit cards can be great tools for managing businesses, there are key steps that companies will need to take to ensure that they have the utmost control over their card usage.

From introducing a clear policy to regularly monitoring expenses, here are some of the best corporate card practices.

Create clear usage policies

The best first step a company can take to ensure that corporate cards are used wisely and responsibly is to create clear usage policies that include all the details and expectations from their corporate credit implementation.

This gives every employee a framework to adhere to, allowing everyone to stay on the same page. Make sure that every action has enough details provided and that consequences for noncompliance are outlined accordingly.

Set up spend control

It’s not enough to just have clear and cohesive policies. Companies also need ways to enforce these policies, with spend controls being a key feature for good corporate credit card management.

The best corporate credit card programs will offer built-in spend controls. Take advantage of spend control features and ensure that the finance team is familiar with them.

They take out the stress from manual administrative work while maintaining a higher level of control.

Ensure proper communication of the program

It’s key to familiarize all employees with corporate cards and the program that the company is using. Employees should know what is the best corporate credit card program and what makes that program the best fit for the business.

Host training sessions and address any questions or queries employees have. Maintaining proper communication while using the corporate card program will ensure that everyone is using it accordingly and effectively.

Ensure adherence to policy

After employees have been familiarized with the policies, spend control features, and corporate credit card program, make it clear to everyone that adherence and compliance to the policies are of utmost importance.

Ensure that employees understand the gravity of the policies and why they are in place.

With the help of tools and features such as automated expense records and built-in spend controls, ensuring adherence is less stressful for the finance team.

Ensuring strict receipt documentation

Receipts serve as proof of employees’ purchases. This is why it’s important for any business to document all receipts for business expenses.

They can also be used to perform matches with the existing card expense records. Make sure that there are policies about how receipts should be documented.

Using a tool to digitally scan and store receipts will significantly improve the process, especially compared to manually storing paper receipts.

Timely submission of expense report

The best thing a business can do to manage their card spending accordingly is to ensure that employees are submitting expense reports on time.

This allows businesses to easily track how, when, and where every penny is spent. Delays in this process are costly, sometimes leading businesses to overspend or make duplicate payments.

Timely expense reports also help prevent fraud attempts and promote better accountability across the board.

Regular reconciliation and timely reimbursement

Corporate credit card reconciliation is key to any business. When introducing corporate credit cards to the organization, make sure that all card transactions are reconciled regularly for better visibility.

As a business scales, it will have more expenses. Some of the best corporate credit cards for large business owners help them tackle complex and time-consuming processes regardless of size.

Get access to automated reconciliation and reimbursement features to help with timely processing.

Review agreement changes

Corporate card programs are not stagnant. Even with the best corporate credit card programs, businesses may find themselves having to deal with agreement changes while utilizing these cards.

Make sure that these changes are reviewed accordingly and plans for the company’s card usage are outlined before they are implemented.

It’s important that any queries and questions are addressed with a representative of the card provider when changes happen.

Analyze spending patterns

One of the most effective ways to curb overspending is by keeping a close eye on the company’s business spending patterns.

It’s easier to see where the company might be overspending and where employees can make budget cuts.

Choose a corporate card program that provides advanced insights and makes it easy to visualize spending patterns.

It’s good practice to regularly review and analyze these patterns to come up with better budgets and forecasts.

Adjust policies when necessary

Creating a policy to ensure that corporate cards are used appropriately is a great start, but it is also equally important to continuously review these policies.

When circumstances change, policies must also be adapted accordingly. Take some time to perform regular reviews of the company’s corporate card usage and policies.

The company’s policies should support its needs and fit the company. It’s a good idea to get feedback from employees on existing policies.

Why Volopay corporate cards are the best solution for businesses

Your business can achieve new heights with Volopay. Access robust spend management features complete with corporate cards for making business expenses.

Volopay’s virtual prepaid cards compete with even the best corporate credit cards for large business organizations, with all the key features you’ll need.

1. Streamlined expense management

Streamline the way you manage your expenses with a virtual prepaid card like no other. Volopay’s corporate cards come with a card management platform where you can view all your card expenses.

Centralize the card expense management process from start to finish. All you need is your Volopay dashboard to generate virtual cards, top them up, record expenses, and sync with your general ledger.

2. Instant approval

Cut out delays in the approval process with Volopay. There’s no need to go from desk to desk to chase after approvers when just like the best corporate credit card programs, Volopay also offers automated approvals.

Set up predefined card limits to get instantly approved transactions. After each transaction is made and reported, route them for review and ensure that they go through the appropriate workflow automatically.

3. No hidden fees

We know how stressful hidden fees can be, especially when your budgets don’t account for them. Volopay is committed to being transparent with our fees so that you never get any surprises.

Ensure that you don’t have to deal with hidden fees with Volopay corporate cards. Complete with a card management dashboard to automatically calculate all your expenses, you’ll know how every single cent is used.

4. Unlimited virtual prepaid card

Even if you know what is the best corporate credit card, your business can benefit from a virtual prepaid card program. Every dollar you spend is guaranteed to be budgeted accordingly with prepaid cards.

With Volopay, it’s easy to generate as many virtual prepaid cards as your business needs. Each expense can have its own secure virtual prepaid card specifically generated for that purpose.

5. Real-time tracking

Volopay provides businesses with automated real-time tracking that helps you monitor how every single cent is spent by your organization. Know exactly when, where, and how your corporate cards are being used.

Finance teams don’t have to rely on slow manual expense records. Volopay’s real-time tracking improves accountability, visibility, transparency, and accuracy with very minimal hassle.

6. Latest compliance and security features

Our security features are on par with the best corporate credit card programs in the market, ensuring that your data and finances are protected. From two-factor authentication to data encryptions, you can rest assured.

Volopay also offers powerful tracking systems and automated flagging of suspicious activities. Enforcing compliance on your card expenses has never been easier with our platform.

7. Fast and secure payments

Make time-sensitive payments stress-free by using Volopay’s virtual prepaid cards. You don’t have to worry about payment delays with bank transfers when you can input your card number in any payment portal with ease.

Payments are instantaneous, allowing businesses to process transactions faster without compromising on security.

Every payment is easily trackable and two-factor authentication for each transaction can improve the security of your payments.

8. System integrations

Volopay offers robust system integrations with your accounting software. It only takes a few clicks to integrate other existing systems your business is already using with your Volopay account.

Get access to continuous direct sync to make closing your books easier and faster. You won’t have to stress about time-consuming accounting processes with integrations, ensuring efficiency and accuracy at the same time.

Get your Volopay corporate card today!

FAQs

Corporate credit cards typically feature a longer and more complex application process, but finding the best corporate credit card programs is a matter of finding the right fit for your business. Apply for the right program to make the process easier.

No. A corporate credit card is solely for your company’s expenses and will not affect your score. You may indirectly reap the benefits of a lower personal credit utilization score by only making business expenses on your corporate card.

Volopay offers prepaid cards that are customizable, as every business has different needs and use cases.

Find out what is the best corporate credit card for your company by noting down what your business needs are and picking the card that suits you best.

You can. Personal credit does not always affect a corporate credit card, with many corporate card providers not requiring a personal guarantee.

However, new businesses that don’t have a good business credit score yet may also want to look into secured corporate cards.

Yes. Pay vendors and suppliers worldwide in many different currencies with ease using your Volopay cards.

Volopay’s prepaid corporate card rivals the best corporate credit card programs and supports all your cross-border payment needs, so long as your vendors take card payments.

Depending on your corporate card provider, you may be able to withdraw cash from an ATM. Different providers will have different limitations.

Businesses that are looking for tighter controls and security may opt for cards that don’t allow ATM withdrawals.

Yes, you will be able to use your Volopay corporate cards anywhere that takes card payments. The best corporate credit card programs for large business owners allow them to expand and conduct business worldwide. Volopay does the same.

Volopay allows users to freeze and block compromised cards with just one click.

Paired with robust automated approval workflows, suspicious transaction flagging, and alerts of card usage, you are ensured the utmost security and reduced fraud risks when using Volopay corporate cards.