Debt to equity ratio - Definition, formula and calculation

Working with a certain amount of debt is an essential part of running a business. When equity falls short, debt can be a crucial tool to keep things moving.

But how do you know when you’ve taken on too much debt? And at what point does it become detrimental? This is where the debt-to-equity ratio comes into play.

This key accounting metric helps you understand the balance between your company’s debt and equity, giving you a clear picture of whether you’re in a safe zone or heading toward risky financial territory.

By using the debt-to-equity ratio formula and, hence, knowing how to calculate debt-to-equity ratio you can distinguish between healthy debt levels and potentially harmful ones, ensuring better financial decision-making for your business.

What is the debt-to-equity ratio?

Debt and equity are some of the most fundamental concepts in finance. Debt refers to any money that is borrowed by an entity; debt typically needs to be repaid, usually along with some form of interest.

On the other hand, equity refers to ownership in a firm, encompassing the shares owned by investors.

Understanding these concepts alongside how to calculate debt to equity ratio is vital for assessing a company's risk profile, overall stability, financial structure, as well as evaluating its operating cash flow to ensure the company generates enough cash to meet its debt obligations.

1. Debt

Debt refers to the amount of money borrowed by a company that must be repaid, often with interest, over time. This borrowed capital is used to finance various business operations, from expanding facilities to purchasing inventory.

Debt can come in several forms, including loans, bonds, and credit lines, each with specific terms and conditions. To find out the total amount of debt an organization holds, the formula that is typically used is long-term debts + short-term debts.

2. Equity

Equity represents the ownership value held by shareholders in a company, reflecting the residual interest in the company's assets after all liabilities are subtracted. It includes common stock, preferred stock, retained earnings, and additional paid-in capital.

Equity signifies the net worth of a company from the perspective of its owners and is crucial for assessing financial health and stability.

The formula to calculate equity is:

Equity = total assets − total liabilities

This formula accounts for total assets, which represent everything owned by the company, and total liabilities, which cover all debts and financial obligations.

Calculating equity allows stakeholders to assess the residual value available to shareholders after liquidating all assets and settling all debts.

Good vs. bad debt ratio

Knowing the difference between a good and bad debt ratio is crucial for financial health, it helps you fully understand how to use the debt-to-equity ratio formula as well as leverage cash flow forecasting to manage debt levels effectively.

A good debt ratio indicates balanced, sustainable borrowing, promoting growth and stability, while a bad debt ratio signals excessive debt and high risk, jeopardizing financial stability and long-term success.

1. Good debt ratio

● Moderate and sustainable

An optimal debt ratio balances the use of debt for growth with the preservation of financial stability.

A moderate and manageable debt ratio ensures that a company is not overwhelmed by its liabilities, enabling it to fulfill its financial commitments without the danger of fiscal strain. Such a prudent approach lays the groundwork for enduring growth and stability.

● Investment in growth

Investing in growth is another crucial aspect of a good debt ratio. When used wisely, debt can finance expansion projects, new product development, and market penetration, driving revenue and profitability.

By maintaining a reasonable debt level, companies can harness these opportunities without compromising their financial health.

● Low financial risk

Additionally, a good debt ratio minimizes financial risk. Companies with lower debt levels are less vulnerable to economic downturns and interest rate fluctuations, ensuring smoother operations and better resilience.

This low-risk profile attracts investors and strengthens the company’s position in the market, promoting sustained growth and success.

2. Bad debt ratio

● Excessive debt

A bad debt ratio indicates a company has taken on excessive debt, often leading to financial instability. When debt levels are too high, the company may struggle to meet its debt obligations, increasing the risk of default and financial distress.

This over-reliance on borrowed funds can strain cash flow and limit the company’s ability to invest in growth opportunities.

● High risk

High risk is a significant consequence of a bad debt ratio. Companies burdened with excessive debt are more vulnerable to economic downturns and interest rate hikes, which can drastically affect their financial health.

High debt levels can also scare off potential investors and creditors, making it more challenging to secure additional funding when needed.

● Poor management of capital structure

Ineffective management of capital structure is a key indicator of a bad debt ratio. An imbalance between debt and equity can result in inefficient resource allocation, increased capital costs, and reduced investment returns.

This poor oversight weakens the company's financial stability and jeopardizes its long-term viability.

What is negative debt-to-equity ratio?

A negative debt-to-equity ratio indicates that a company's liabilities exceed its shareholders' equity, suggesting that it has more debt than the value of its equity.

This situation often arises when a company has incurred significant losses, resulting in negative retained earnings.

Such a ratio is a red flag for investors and creditors, as it highlights potential financial instability and increased risk of insolvency. Companies with a negative debt-to-equity ratio may struggle to secure additional financing and face higher borrowing costs.

It also reflects poor financial health and mismanagement, which can jeopardize the company's long-term viability.

In essence, if you implement the debt-to-equity ratio formula and get a negative result, it signals that the company in question is in a precarious financial position.

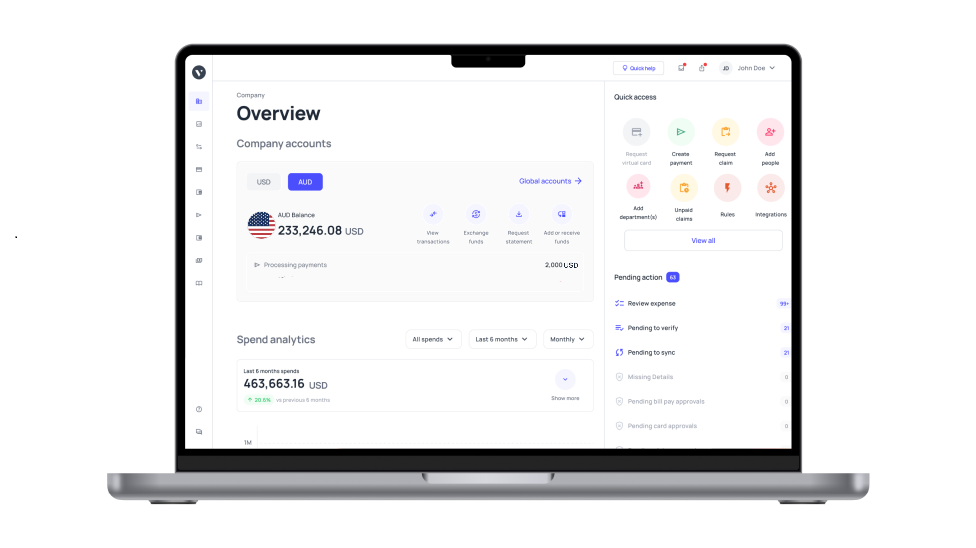

Streamline business finances with Volopay's expense management system!

How to calculate debt to equity ratio for your business?

Going about how to calculate debt to equity ratio is far less intimidating in practice than it sounds in theory. Generally speaking, the steps mentioned below will provide a robust blueprint for calculating the debt-to-equity ratio for most businesses:

1. Components of debt to equity ratio

● Total liabilities

Total liabilities represent the aggregate of all debts and financial commitments a company is responsible for to outside entities.

These obligations include short-term liabilities like accrued expenses, accounts payable, and short-term borrowings, alongside long-term liabilities such as bonds payable, long-term loans, and deferred tax liabilities.

They offer an all-encompassing snapshot of the company's indebtedness and fiscal responsibilities that are due.

● Shareholders equity

Shareholders' equity signifies the remaining interest in a company's assets once liabilities have been subtracted. This equity comprises common stock, preferred stock, retained earnings, and additional paid-in capital.

Fundamentally, it represents the owners' stake in the company's assets and acts as an indicator of the business's net value. Shareholders' equity is vital for evaluating a company's financial stability and its ability to settle debts using its assets.

2. Formula for debt to equity ratio

The formula for how to calculate debt to equity ratio is straightforward:

Debt-to-equity ratio = total liabilities / shareholders’ equity

To put it in words, the debt-to-equity ratio formula requires a company's total liabilities to be divided by the shareholders’ equity.

This formula provides a numerical value that indicates the proportion of a company’s financing that comes from debt compared to equity.

3. Steps to calculate debt to equity ratio

● Determine total liabilities

To find the total liabilities, sum all current and long-term liabilities listed on the company’s balance sheet. This figure represents the total amount of debt the company owes to creditors and other external parties.

● Calculate shareholders equity

To calculate the figures for Shareholders’ equity the total liabilities of the company must be subtracted from its total assets.

Alternatively, it can be found directly on the balance sheet. Ensure you account for all components of equity, including retained earnings, common stock, and any additional paid-in capital.

● Apply the formula

After ascertaining the total liabilities and computing the shareholders' equity, you can calculate the debt-to-equity ratio.

This is done by dividing the total liabilities by the shareholders' equity, resulting in a numerical value indicative of the debt-to-equity proportion within the company's financial framework.

4. Example calculation

Let's consider an example to illustrate the calculation of the debt-to-equity ratio. Suppose we have a company, XYZ Corp., with the following financial data:

Total assets: $500,000

Total liabilities: $300,000

Shareholders’ equity: $200,000 (calculated as total assets - total liabilities)

First, verify the components:

Total liabilities: $300,000

Shareholders’ equity: $200,000

Next, apply the formula:

Debt-to-equity ratio = total liabilities / shareholders’ equity

Debt-to-equity ratio = 300,000 / 200,000

Debt-to-equity ratio = 1.5

This indicates that for every dollar of equity, XYZ Corp. has one dollar and fifty cents in debt. A debt-to-equity ratio of 1.5 suggests that the company utilizes a combination of debt and equity financing, with a greater reliance on debt.

In summary, calculating the debt-to-equity ratio involves understanding its components—total liabilities and shareholders' equity—applying the formula, and interpreting the result. This ratio is vital for stakeholders to assess a company's financial leverage and risk, ensuring informed decision-making regarding investments and financial strategies.

Related read: How does financial liability function in an acquisition?

When to use the debt-to-equity ratio?

The debt-to-equity ratio is a versatile and essential metric used in various aspects of financial analysis and decision-making.

Whether assessing financial health, conducting a comparative analysis, evaluating creditworthiness, making strategic decisions, choosing investments, or monitoring changes over time, knowing how to calculate debt to equity ratio provides critical insights that help stakeholders navigate the complexities of corporate finance, here's how:

1. Financial health assessment

The debt-to-equity ratio is a critical tool for assessing a company’s financial health. It provides insight into how a company finances its operations and growth, balancing debt against equity.

A lower ratio suggests a more financially stable company with less reliance on borrowed funds, while a higher ratio may indicate potential financial risks due to excessive debt.

By examining this ratio alongside departmental budgeting, stakeholders can determine if the company maintains a healthy balance between debt and equity, which is crucial for long-term sustainability and operational efficiency.

2. Comparative analysis

Comparative analysis involves evaluating the debt-to-equity ratio of a company against its peers or industry benchmarks. This comparison helps identify how a company stands relative to its competitors.

For instance, if a company has a significantly higher debt-to-equity ratio than the industry average, it might be taking on more risk than its peers.

Conversely, a lower ratio could indicate a more conservative financial approach. Comparative analysis is essential for investors and analysts who want to understand a company’s position in the market and its relative financial risk.

3. Creditworthiness evaluation

Lenders and creditors rely on the debt-to-equity ratio to assess a company's creditworthiness. Generally, a lower ratio is seen positively, suggesting the company carries less risk and is more capable of meeting its debt obligations.

Conversely, a high ratio can indicate financial instability and a higher risk of default, complicating the company's efforts to secure loans or attract investors.

By evaluating this ratio, creditors can make well-informed decisions about extending credit and determining interest rates, thereby minimizing their exposure to excessive risk.

4. Strategic decision-making

For company management, the debt-to-equity ratio is a vital metric in strategic decision-making. It helps determine the best mix of debt and equity financing for new projects or expansions.

For instance, if the ratio is already high, management might opt to issue more equity instead of taking on additional debt to avoid over-leveraging and ensure they can still improve cash flow.

Conversely, if the ratio is low, the company might decide to finance growth through debt, taking advantage of lower borrowing costs.

By understanding their debt-to-equity ratio, managers can make informed decisions that align with the company’s financial goals and risk tolerance.

5. Investment decision

Investors use the debt-to-equity ratio to gauge a company’s financial stability and growth potential. A lower ratio often attracts investors looking for stable, low-risk investments, as it indicates the company is not heavily reliant on debt.

Conversely, a higher ratio might appeal to risk-tolerant investors who are interested in companies with aggressive growth strategies financed through debt.

By evaluating this ratio, investors can make informed decisions about where to allocate their funds, balancing their risk preferences with potential returns.

6. Monitoring changes over time

Monitoring changes in the debt-to-equity ratio over time provides valuable insights into a company’s financial trajectory. An increasing ratio might indicate that the company is taking on more debt, which could signal growth initiatives or potential financial stress.

A decreasing ratio could suggest improved financial health and reduced reliance on borrowed funds. By tracking these changes, stakeholders can identify trends, assess the effectiveness of financial strategies, and anticipate future financial challenges or opportunities.

This ongoing analysis is crucial for maintaining a comprehensive understanding of the company’s financial dynamics and ensuring long-term success.

Achieve financial balance- get started with Volopay today!

Why calculating debt to equity ratio is important for your organization?

1. Provides a snapshot of a company's financial leverage

The debt-to-equity ratio is particularly important for gauging the financial leverage of a company.

It is an important metric that banks, investors, and other financial institutions use to determine how well a company has been using debt to finance its operational expenses.

It reveals how good a company is at balancing its costs and profits. Lenders may choose to calculate debt-to-equity ratios to gauge exactly how fruitful their investment will be in your company.

2. Help to identify potential problems with a company's debt levels

Another important internal reason why knowing how to calculate debt to equity ratio is important is because it helps identify problems with a company’s debt levels.

The debt-to-equity ratio gives companies an idea of how well-balanced debt financing is with profits generated.

By analyzing this ratio along with the cash flow statement, you can assess whether the company has taken on too much debt, which could weaken its financial leverage.

3. Helps to assess the riskiness of its financial position

The debt-to-equity ratio is an important signifier of how risky the financial position of a company truly is. Companies aim to finance their operations with a delicate balance of funds and debt.

The balance of these two is shown by the debt-to-equity ratio. If the ratio is too high that might mean too much debt has been taken and the company runs the risk of not being able to pay it back.

If it is too low, however, that might indicate that the company is not making full utilization of available resources.

Interpretation of debt to equity ratio

Here are a few key pointers you can keep in mind when interpreting the debt-to-equity ratio:

● High debt to equity ratio

First, a higher ratio indicates that a company is more leveraged and has more debt relative to equity. This can also mean that too much debt is being used.

● Compare with peers

Compare the total debt-to-equity ratio of a company to peers in your industry. Use industry benchmarks to determine the value of your numbers.

● Use in conjunction

The total debt-to-equity ratio is just one metric and it should be considered in conjunction with other ratios.

Understanding the limitations of debt to equity ratio

When learning how to calculate debt to equity ratio it is important to keep in mind that the metric does come with certain limitations. The debt-to-equity ratio is not a uniformly valued metric.

While a high debt-to-equity ratio might be common for one industry, another might call for lower debt-to-equity ratios. Given below is a list of shortcomings that the D/E ratio comes with:

1. Does not consider the type of debt a company has

The debt-to-equity ratio fails to account for the type of debt a company has. Whether the debt is short-term or long-term will have an impact on the financial leverage of the company as well.

2. Does not take into account the interest rate on the debt

Interest rates on the debts taken by a company is also not accounted for by the debt-to-equity ratio. The rates of interest also have a role to play in determining how easily a company will be able to pay loans back.

3. Does not consider the timing of the debt payments

The timing of debt payments must also be accounted for when determining financial health. The debt-to-equity ratio does not do this, however.

Whether the debt is due at the beginning of the financial year or the end will have an impact on how efficiently the company is able to pay its debts back.

4. Does not take into account the value of the collateral backing the debt

Debt is always taken against collateral. The debt-to-equity ratio fails to acknowledge this. The assets that are used as collateral will definitely have a say in the financial leverage of the company.

Boost your financial health with Volopay

Factors influencing debt to equity ratio

The debt-to-equity ratio is influenced by various factors, including a company's size and lifecycle stage, industry norms, and economic conditions.

Understanding these elements is crucial for evaluating a business's financial leverage, risk profile, and overall stability, aiding in more informed financial decision-making

1. Business size and lifecycle stage

The size and lifecycle stage of a business significantly impact its debt-to-equity ratio. Startups and small businesses often have higher ratios because they rely more on debt financing to fund their growth and operations.

These companies might not yet have substantial retained earnings or equity investments. Conversely, mature businesses usually have lower debt-to-equity ratios as they generate more revenue and have accumulated equity over time.

These established firms often have greater access to equity financing options and may prefer using their own resources rather than incurring additional debt.

As a business grows and stabilizes, its ability to balance debt and equity improves, often resulting in a lower ratio.

2. Industry norms

Industry norms play a crucial role in shaping how the debt-to-equity ratio formula is calculated. Different industries have varying capital structure requirements and risk profiles.

For example, capital-intensive industries like manufacturing, real estate, and utilities typically have higher debt-to-equity ratios due to the significant investment needed in infrastructure and equipment.

These industries often rely on debt to finance their operations and expansion. In contrast, technology and service-based industries may have lower ratios since they require less capital investment and may prefer equity financing.

Understanding industry-specific benchmarks helps stakeholders assess whether a company's debt-to-equity ratio is healthy or a potential cause for concern.

3. Economic conditions

Economic conditions also heavily influence the debt-to-equity ratio. During economic expansions, companies might take on more debt to capitalize on growth opportunities, resulting in higher ratios.

Favorable economic conditions can lead to lower interest rates, making debt financing more attractive. Conversely, in economic downturns, companies may struggle with cash flow and reduce their reliance on debt to avoid financial distress.

They might focus on paying down existing debt and improving their equity base, leading to lower debt-to-equity ratios.

Additionally, during uncertain economic times, lenders may tighten their credit terms, making it harder for companies to access debt financing, further impacting the ratio.

Effortless expense management with Volopay

Volopay is a leading expense management platform designed to simplify and streamline corporate spending.

By offering advanced features such as automated expense tracking, real-time spending insights, and seamless integration with accounting systems, Volopay ensures efficient and hassle-free management of business expenses.

1. Automated expense tracking

Volopay's automated expense tracking is a key feature that streamlines financial management for businesses. The need to manually log and categorize each transaction is eliminated.

Volopay ensures that expenses are tracked and recorded instantly, minimizing errors and conserving time.

This automation frees employees to concentrate on their primary responsibilities instead of tedious administrative tasks.

Moreover, it guarantees precise documentation of all expenses, offering a dependable record for financial analysis and auditing purposes.

2. Real-time spending insights

Volopay delivers instantaneous insights into spending, empowering businesses to make swift, informed financial choices. The platform's comprehensive analytics and reporting capabilities offer a transparent overview of expenditure.

This clarity assists companies in recognizing spending trends, spotting irregularities, and adjusting their budgets and policies accordingly.

With current financial information at their disposal, businesses can enhance cash flow management, curtail superfluous expenses, and guarantee that their expenditures are in line with strategic objectives.

3. Integration with accounting systems

Another key feature of Volopay is its seamless integration with accounting systems. The platform is crafted to integrate effortlessly with widely used accounting software like QuickBooks, Xero, and Netsuite.

This integration guarantees automatic synchronization of all expense data with the company's accounting system, which removes the need for manual data entry and minimizes the chance of discrepancies.

It simplifies the reconciliation process, secures consistency in financial records, and improves accounting precision.

Volopay's integration with existing accounting tools streamlines financial management and aids businesses in sustaining a unified and productive workflow.

Empower and automate your business financial processes with Volopay

FAQs

The more current your debt-to-equity ratio is the better picture you will have of your financial leverage.

The debt-to-equity ratio calculation utilizes the total liabilities of a company, including non-current liabilities.

No, accounts payable are not included in the debt section and therefore not in the calculation of debt to equity ratio.

A company might increase its debt-to-equity ratio to finance growth opportunities, invest in new projects, or take advantage of favorable interest rates, leveraging debt for potential higher returns.

In mergers and acquisitions, knowing how to calculate debt to equity ratio helps assess the financial stability and leverage of the target company, influencing valuation, negotiation, and the decision-making process.

An organization's cost of capital may rise due to an increased debt-to-equity ratio. Because it reflects a greater financial risk, high debt-to-equity ratio can lead to elevated interest rates and the possibility of reduced credit ratings.

Yes, a company can exhibit a negative debt-to-equity ratio, which occurs when its liabilities exceed its assets. This condition often indicates financial instability and a potential risk of insolvency.

A higher debt-to-equity ratio can negatively impact a company's credit rating, as it suggests higher financial risk and increased likelihood of default, making the company less creditworthy.

A heightened debt-to-equity ratio suggests increased financial leverage and risk, which can elevate the likelihood of financial distress and bankruptcy if the company struggles to fulfill its debt commitments.