How to calculate opportunity cost in business?

When making business decisions, you want to be sure that the decisions you make are the best ones in the situation.

If presented with new opportunities, you also want to be well-informed about what they could provide to your business before you embrace these opportunities.

To do this, you should know how to calculate opportunity cost in business and ensure that you are making the best decisions based on these results.

What is opportunity cost in business?

Opportunity cost is the benefits or returns lost when selecting one alternative over another.

If a business is faced with the opportunity to enter a new market, it could decide whether they want to hire someone who has experience in the new market, or stick to its current staff and have them learn the new market.

Whichever choice they choose, the option that has been foregone is the opportunity cost. For business reasons, the importance of opportunity cost is to compare two options to see which is more beneficial.

When referring to opportunity cost, it’s about calculating costs that have yet to happen. Opportunity cost is not the same as a sunk cost, which is money your business has already spent.

How to calculate opportunity cost in business?

In fiscal management there are two approaches to calculating opportunity costs - one simple opportunity cost formula and another more complicated, detailed one:

● Formula 1

Opportunity cost = FO (foregone option, which is the best option that you didn’t choose) - CO (chosen option)

The foregone option is the most profitable option that you did not choose. In short, the opportunity cost of any decision is the amount you will lose out on when choosing an option. This does not mean that your decision is bad, merely that it does come with a cost.

Calculating opportunity cost often is difficult to do with exact measures, thus resulting in calculations being gauged through estimating instead. It is especially difficult when the cost isn’t immediately obvious.

Hence, the estimation of what the cost may look like to calculate opportunity cost in business.

An example of calculating opportunity cost in business would be offering discounts or lower price rates. Say your product is a digital marketing service and you own several tiers of what you offer.

You could have the choice between selling the premium version of your service for USD 5,400/year or creating a more basic plan for a cheaper price of USD 1,200/year.

For the premium plan, you could gain 150 customers. With the cheaper plan, you could potentially get up to 100 customers. The opportunity cost calculation will look like this:

Opportunity cost = USD 5,400 x 50 - USD 1,200 x 150

Your opportunity cost will come out to be USD 270,000 - USD 180,000 = USD 90,000

However, just because there might be an upfront cost in the opportunity cost calculations, this does not mean that in the long run, this won’t change. With the cheaper plan, you could ultimately end up retaining customers for longer than a year.

● Formula 2

NPV = FCF0 +(FCF1)/ (1 + r)1 +.......+ (FCFn)/ (1 + r)n

NPV = Net Present Value

FCF = Free Cash Flow

r = Discount rate

n = Number of periods

This approach to calculating opportunity cost is done by factoring it into the NPV or Net Present Value formula. In the face of two mutually exclusive options the governing rule that guides decision-making is the NPV value, i.e. the option with highest NPV is to be chosen.

If the other option, however, gives a singular, more immediate return then the opportunity cost can be added to the C0 total costs incurred. What this does is it changes the decision-making approach and you choose the option that has an NPV greater than 0 instead of the one that has the highest NPV.

Opportunity costs associated with invoice terms for sellers

Another common opportunity cost for business that comes up is associated with invoice terms. Every business has a product to sell.

When you sell a product, it is common that you will have invoice payment terms for your customers. Therefore, it is a good idea to calculate opportunity cost in business with regard to invoice terms.

Invoice terms refer to the terms you outline on your invoice informing your customers of the deadline for their payments.

Usually, this means that you will have to begin production and possibly even deliver your product to your customers before you get paid. However, having invoice terms can be beneficial for your business for several reasons.

1. Helps sell more products

Giving your customers a grace period before they have to pay for your products instead of paying for production could help you sell more products. Customers are more likely to spend more if they don’t have to pay immediately.

2. Competitors do the same thing

For a lot of industries, most of your competitors probably already have invoice terms. Not having invoice terms will make you less competitive in your industry. Customers may end up choosing competitors who have invoice terms instead.

3. Customers always expect invoice terms

Considering that plenty of big corporations have invoice terms, customers are likely to already expect it from your business when you enter the negotiation stage with them.

When you say that you don’t have invoice terms or require customers to pay for production to start, this could turn them away.

However, offering invoice terms that allow your customers to pay at a later date comes with opportunity costs. For a lot of small businesses, this could mean cash flow shortages.

There’s also a risk that even with deadlines set by your business, your customers could end up with late payments, pushing back your cash flow.

The outstanding amount for the months that they would have otherwise been paid is considered an opportunity cost for business.

While this opportunity cost might not show up in your profit and loss statement or other financial documents, it still could negatively impact your business in the months when you are waiting on payments.

This shows the importance of opportunity cost and why you should calculate opportunity cost in business. Keep in mind that short-term monetary costs could still mean long-term gains.

Volopay’s interest-free credit line for SMEs & all enterprises

When you calculate opportunity cost in business, you may become discouraged to make certain decisions because of what it may cost you upfront.

Despite the fact that opportunity cost for business could decrease throughout the years, it could still negatively impact your cash flow in the beginning.

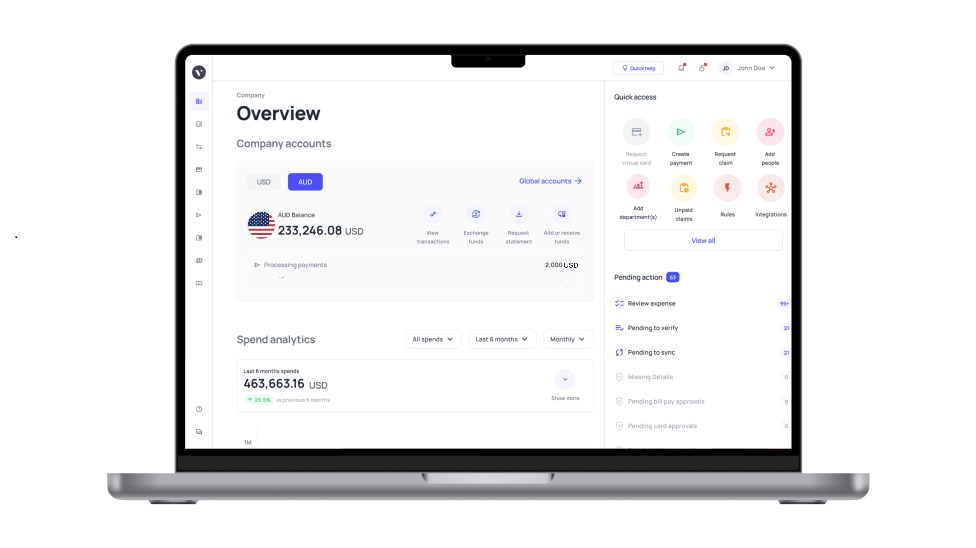

Volopay offers you an interest-free credit line to tide you through the periods when you are waiting on your investments to pay off.

This way, you can calculate opportunity cost in business associated with invoice terms without fearing the numbers.

You get to sell more products, your customers will be happier and likelier to repeat their orders, and your business becomes more competitive.

With Volopay’s credit line, you get a grace period in between waiting for your customers to settle your invoices.

When your customers make their payments, you can easily make your credit repayments and don’t have to worry about interest rates.

Suggested read - How corporate cards help manage small business credit line

Streamline your expense management with Volopay

FAQs

The importance of opportunity cost with regard to cash flow lies in cash flow projections. Opportunity cost can be taken into account for forecasting future cash flow but is not actually included in the cash flow statements.

Opportunity cost is not included in the IRR calculation. However, it can be tied to IRR. An investment is marked as having a positive NPV if the IRR is higher than the opportunity cost of the capital.

The constant opportunity cost for business refers to opportunity cost that remains constant even if the benefits of the opportunity change. For example, when calculating the cost of production of a particular product, the cost will remain constant in proportion to the rate of production. It is different from decreasing opportunity costs, which could happen if you get discounts for purchasing in bulk.