Effect of late payments to small businesses & how to handle them (Scripts included)

Late payments can devastate your small business operations, disrupting cash flow and threatening your company's financial stability. When clients delay payments beyond agreed terms, you face immediate challenges, from covering operational expenses to maintaining employee morale and planning growth initiatives.

The effect of late payments impacts your ability to pay suppliers, invest in opportunities, and sustain a competitive advantage in your market. Understanding these consequences and implementing effective ways to reduce payment delays is essential for protecting your business's financial health and ensuring long-term success in today's demanding business environment.

Cost of late payments for small businesses

Late payments impose severe financial strain on small businesses, directly impacting their ability to maintain healthy cash flow. When invoices remain unpaid beyond agreed terms, companies face immediate challenges meeting payroll obligations, paying suppliers, and covering operational expenses.

Many small businesses operate with minimal cash reserves, making them particularly vulnerable to payment delays. The financial burden extends beyond immediate liquidity issues; businesses often incur additional costs through emergency financing, credit line interest, or late fees to their own vendors.

Implementing online bill payments can help small businesses streamline outgoing payments, reduce delays, and maintain better control over cash flow.

How late payments trigger a domino effect in business operations

A domino effect occurs when one delayed payment sets off a chain reaction of financial complications throughout an organization. The ripple effect of late payments begins when unpaid invoices prevent businesses from settling their own obligations on time, making accurate business cash flow forecasts challenging.

This cascade forces companies to delay vendor payments, potentially damaging crucial supplier relationships and credit ratings. Employee morale suffers when payroll becomes uncertain, leading to decreased productivity and potential talent loss.

Marketing initiatives get postponed, growth opportunities are missed, and strategic planning becomes reactive rather than proactive. By automating the bill payment process, businesses can mitigate these risks, ensuring timely payments, maintaining strong supplier relationships, and preserving operational stability despite external delays.

The ripple effect of late payments on small business growth and financial health

The ripple effect of late payments occurs when delayed payments trigger a chain reaction of negative consequences across a business. When clients delay payments, you face more than a temporary inconvenience.

Late payments create cascading problems throughout your organization, affecting everything from daily operations to long-term strategy. Your cash flow tightens, employees worry about paychecks, suppliers lose trust, and growth plans stall.

Many of these issues stem from common mistakes startups make, such as not monitoring receivables closely or failing to enforce clear payment terms. Understanding these interconnected consequences helps you recognize why payment timing matters so critically to your business's health and future success.

How late payments trigger challenges

A single $10,000 late payment can paralyze your entire operation. You might delay ordering inventory worth $3,000, postpone hiring a needed salesperson, and miss a 2% early payment discount with your supplier.

This domino effect compounds quickly: one late payment affects five different business decisions. Your ability to respond to opportunities vanishes as you enter "survival mode", focusing on managing shortfalls rather than pursuing growth.

Immediate cash flow disruptions

Late payments immediately strain your working capital. If 30% of your invoices arrive late, you suddenly need to cover gaps averaging $15,000 monthly.

You're forced to tap emergency reserves, delay your own payments, or seek expensive short-term financing at 12-18% interest rates. Your cash conversion cycle extends from 45 to 70 days, leaving you scrambling to meet payroll, rent, and utilities while awaiting overdue funds.

Operational delays and setbacks

Without expected payments, your operations grind to a halt. A marketing agency awaiting $8,000 might postpone a software subscription renewal, delaying client projects by two weeks. A manufacturer can't purchase raw materials, pushing delivery dates back and risking contract penalties.

You decline a bulk purchase discount worth $2,500 because funds aren't available. These operational hiccups reduce your efficiency by 20-30%, directly impacting your service quality and competitive position.

Impact on employee productivity

Late payments create workplace anxiety that kills productivity. Your team spends hours chasing overdue invoices instead of generating revenue. Morale drops when they witness financial struggles or face delayed bonuses, and employees often report stress from payment uncertainties.

You might lose your best salesperson to a competitor offering stability and timely pay. This distraction costs you roughly 10–15 hours weekly in lost focus and efficiency across your entire team.

Strained client and supplier relationships

Payment delays damage your professional reputation across your network. When you pay suppliers late due to your own cash shortages, you lose early payment discounts averaging 2-3% and face potential COD requirements.

Suppliers may deprioritize your orders or tighten credit terms. Meanwhile, repeatedly chasing clients for payment strains those relationships, making future negotiations awkward. Supplier relationships also deteriorate after consistent late payments from buyers.

Consequences for business planning

Late payments make strategic planning nearly impossible. You postpone expanding into a new market requiring $25,000 investment because funds remain uncertain. Equipment upgrades get delayed six months, leaving you less competitive.

Your growth projections become meaningless when revenue timing is unpredictable. Banks view irregular cash flow as high-risk, denying you favorable loan terms. This planning paralysis keeps you reactive rather than proactive, sacrificing long-term growth for short-term survival.

Preparing your business before tackling late payments

Assess your current payment processes

Begin by examining your existing invoicing and collection systems. Review payment terms, invoice delivery methods, and follow-up procedures.

Generate an accounts payable aging report to track overdue invoices and identify bottlenecks causing delays. This baseline assessment helps you understand where improvements are needed and establishes metrics for measuring future success in reducing late payments.

Identify common late payment risks

Understanding potential vulnerabilities is crucial for prevention. Analyze patterns in your accounts receivable to spot high-risk clients, seasonal fluctuations, or unclear contract terms.

Research shows the effects of late payments on small businesses include cash flow disruptions and operational constraints. Document these risk factors to develop targeted strategies that protect your business from payment delays.

Map key stakeholders and responsibilities

Define who is responsible for each stage of your payment cycle. Assign clear roles for invoice creation, client communication, payment tracking, and collections. Include your accounting team, sales staff, and management in this framework.

Establish communication protocols between departments to ensure seamless coordination. When everyone understands their responsibilities, your payment management becomes more efficient and accountable.

Review compliance and documentation practices

Ensure your contracts, invoices, and payment terms comply with relevant regulations and industry standards. Verify that your documentation clearly states payment deadlines, late fees, and dispute resolution processes.

Maintain organized records of all transactions and correspondence. Proper documentation strengthens your legal position and provides evidence if collection actions become necessary.

Set clear goals for payment management

Establish specific, measurable objectives for improving your payment processes. Define target metrics such as reducing average collection time by specific days or decreasing overdue accounts by a set percentage.

Create realistic timelines for implementation and determine how you'll track progress. Clear goals provide direction for your team and help maintain focus on continuous improvement.

Effective strategies to reduce payment delays from vendors and clients

Payment delays can severely impact your business operations and financial stability. By implementing proactive strategies, maintaining clear communication with your vendors and clients, and monitoring your transaction success rate, you can minimize late payments.

Address payment disputes promptly

When payment disputes arise, respond immediately to prevent prolonged delays. Listen to your client's concerns, gather relevant documentation, and work collaboratively towards a resolution.

Establish a dedicated dispute resolution process with clear escalation paths. Quick, professional responses demonstrate your commitment to fair business practices and often lead to faster payment once issues are clarified and resolved.

Conduct credit checks on new clients

Protect your business by evaluating potential clients' financial stability before extending credit terms. Request credit references, review payment histories, and assess their business standing.

Handling late payments becomes easier when you've established appropriate credit limits based on risk assessment. This due diligence helps you make informed decisions about payment terms and identify clients who may require deposits or shorter payment windows.

Set clear payment terms in contracts

Eliminate ambiguity by explicitly stating all payment expectations in your contracts. Specify due dates, accepted payment methods, late fee structures, and consequences for non-payment.

Include details about invoicing schedules and early payment incentives. When both parties understand obligations upfront, you reduce misunderstandings and create enforceable terms that support timely payments throughout your business relationship.

Track outstanding payments consistently

Implement systematic monitoring of all receivables to identify overdue accounts quickly. Use accounting software or payment tracking tools to maintain real-time visibility into payment statuses.

Ways to reduce payment delays include establishing regular review schedules, flagging accounts approaching due dates, and prioritizing follow-up actions. Consistent tracking enables you to intervene early and maintain control over your accounts receivable.

Send friendly payment reminder templates

Develop professional reminder templates for different stages of the collection process. Send courteous notifications before due dates, gentle reminders for overdues, and firmer follow-ups for significantly late payments.

Personalize messages when appropriate while maintaining professionalism. Automated reminder systems ensure consistency and flexibility for relationship management. Timely, polite communication often resolves payment delays without damaging client relationships.

How to handle late payments professionally

Late payments can strain cash flow and client relationships, but handling them with professionalism preserves both your revenue and reputation. The key is escalating your approach gradually: starting friendly and becoming firmer only when necessary.

This guide provides practical scripts for every stage of the collection process, helping you recover payments while maintaining professional standards. Proper communication demonstrates respect for your clients while protecting your business interests and ensuring timely resolution.

1. Start with a polite reminder

Begin with a friendly, non-accusatory reminder, assuming the oversight was unintentional. Most clients appreciate gentler nudges and respond positively.

Email script

Hi [Client Name], I hope this message finds you well. I wanted to reach out regarding Invoice #[number] for $[amount], which was due on [date]. I understand things can get busy, so I'm sending a friendly reminder. Please let me know if you have any questions or if there's anything I can help clarify. I've attached the invoice again for your convenience. Thank you for your attention to this matter.

Text/message script

Hello [Name], just a quick reminder that Invoice #[number] ($[amount]) was due [date]. Let me know if you need a copy resent. Thanks!

2. Follow up firmly if payment is overdue

When your initial reminder goes unanswered, escalate with more direct language emphasizing urgency while remaining respectful.

Email script

Dear [Client Name], I'm following up on my previous message regarding Invoice #[number] for $[amount], now [X days] overdue. Immediate payment is needed to avoid service interruption or late fees as outlined in our agreement. Please remit payment by [specific date] or contact me immediately to discuss this matter. If payment has already been sent, please provide confirmation details.

Phone script

Hello [Name], I'm calling about Invoice #[number], which is now significantly overdue. Can you confirm when the payment will be processed? We need resolution by [date] to continue services without interruption.

3. Offer payment solutions or plans

Flexibility can recover payments that might otherwise become uncollectible losses.

Payment plan script

I understand that unexpected circumstances can affect cash flow. To help resolve this balance, I'd like to offer a payment arrangement. Would breaking the $[amount] into [X] monthly installments of $[amount] work for your budget? Alternatively, we could accept [percentage]% now with the remainder due [timeframe]. Please confirm which option works best, and I'll send an agreement today.

Partial payment script

If paying the full amount immediately isn't feasible, could you remit a partial payment of $[amount] today? This demonstrates good faith, and we can schedule the remaining balance for [specific date].

4. Send a formal past-due notice

A formal notice signals seriousness and documents your collection efforts for potential legal action.

Formal notice template

PAST DUE NOTICE

Invoice Number: [#] Original Amount: $[amount] Due Date: [date] Days Overdue: [X] Late Fees: $[amount] Total Amount Due: $[total]

This is a formal notification that payment is seriously overdue. Payment must be received by [final date] to avoid further action, including collection proceedings, credit reporting, or legal remedies. Failure to respond will result in [specific consequence].

Remit payment immediately to: [payment details]

For questions, contact: [contact information]

Note: Always include specific amounts, dates, and actionable consequences.

5. Keep communication professional and documented

Maintain detailed records of every interaction for accountability, dispute resolution, and potential legal proceedings.

Documentation best practices:

• Log all calls with dates, times, and conversation summaries

• Save copies of every email, text, and letter sent

• Record payment promises with specific dates and amounts

• Use certified mail for formal notices requiring proof of delivery

• Maintain professional tone in all communications. Never use threatening, abusive, or harassing language

Documentation script example

Per our conversation on [date], you agreed to submit payment of $[amount] by [date]. This email confirms that arrangement. Please reply to acknowledge receipt and confirm these terms. All correspondence regarding this account is being documented for our records.

How to automate and streamline late payment management

Schedule automatic email or SMS reminders before and after due dates, ensuring clients receive timely notifications without manual intervention.

Configure multi-stage reminders gentle pre due alerts, polite due-date notices, and firmer overdue messages that escalate appropriately, reducing payment delays while maintaining professionalism throughout the collection process.

Gain instant visibility into outstanding invoices, payment statuses, and cash flow projections through dashboard analytics.

Real-time tracking lets you identify payment trends, spot potential issues early, and make informed financial decisions. This proactive approach minimizes the effects of late payments on small businesses by enabling swift corrective action before problems escalate.

Accelerate payment cycles by digitizing approval processes and routing invoices automatically to stakeholders. Automated workflows eliminate bottlenecks, reduce approval times, and provide audit trails.

Clients receive invoices faster, and you maintain visibility into where each invoice stands, significantly shortening your payment collection timeline and improving efficiency.

You can set up systems that flag overdue accounts immediately and trigger escalation protocols automatically. Real-time monitoring alerts your team when payments become late, assigns follow-up tasks, and tracks collection progress.

This ensures no overdue invoice falls through the cracks, maintaining consistent collection efforts without requiring constant manual oversight or review.

Leverage automated reporting to analyze payment patterns, identify chronic late payers, and measure collection effectiveness. Reports reveal average payment times, outstanding receivables aging, and client payment behavior trends.

These insights help you refine credit policies, prioritize collection efforts, and make data-driven decisions that strengthen your financial position systematically.

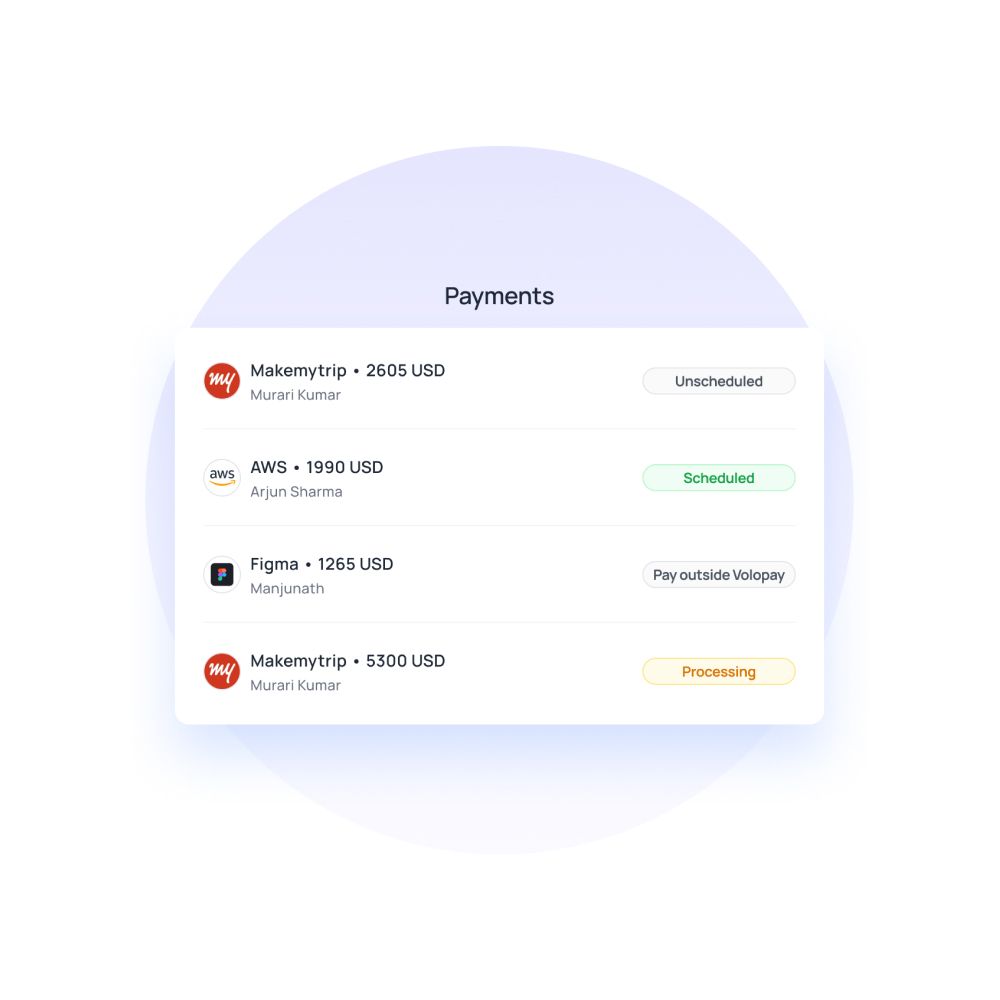

Manage and resolve late payments effortlessly with Volopay

Volopay's accounts payable automation software streamlines your entire payment management process, eliminating the hassles of manual tracking and follow-ups. With comprehensive automation tools, real-time visibility, and intelligent workflows, you can minimize late payments while maintaining strong vendor and client relationships, ensuring your business maintains healthy cash flow effortlessly.

Automate invoicing and reminders

Eliminate manual follow-ups by setting automated invoice generation and payment reminders through Volopay's intelligent system. Schedule customized reminder sequences that send timely notifications before due dates and escalate appropriately for overdue accounts.

This automation ensures consistent communication with clients, reduces administrative workload, and significantly improves your payment collection rates without constant manual intervention.

Real-time expense and payment tracking

You gain complete visibility into all incoming and outgoing payments through Volopay's centralized dashboard. Monitor payment statuses instantly, track outstanding invoices, and identify overdue accounts in real time.

This comprehensive oversight enables you to respond quickly to payment issues, maintain accurate financial records, and make informed decisions based on current cash flow data rather than outdated reports.

Set custom payment approval workflows

Design multi-level approval workflows tailored to your organizational structure and financial policies. Route invoices automatically to appropriate approvers based on amount thresholds, departments, or vendors.

Customized workflows accelerate approval cycles, maintain proper authorization controls, and create audit trails for compliance. The effect of late payments diminishes significantly when approvals move swiftly through streamlined digital processes.

Gain insights with detailed analytics

Access comprehensive real time reports analyzing payment trends, vendor performance, and cash flow patterns through Volopay's analytics dashboard. Identify chronic late payers, measure average payment cycles, and forecast future cash positions accurately.

These actionable insights help you refine credit policies, prioritize collection efforts strategically, and optimize working capital management for sustained business growth and financial stability.

Simplify vendor and client payments

You can process vendor payments seamlessly through Volopay's unified platform. Support multiple payment methods, including bank transfers, cards, and digital wallets, domestic and international payments giving vendors flexibility while maintaining control.

Batch payment processing saves time, automated reconciliation reduces errors, and transparent tracking ensures every payment is accounted for accurately and efficiently throughout your organization.

Integrate with accounting software

Connect Volopay seamlessly with popular accounting platforms like QuickBooks, Xero, and NetSuite for automatic data synchronization. Eliminate duplicate data entry, reduce reconciliation time, and maintain consistent financial records across systems.

Real-time integration ensures your accounting reflects current payment statuses, simplifying month-end closings and providing accurate financial reporting for better business decision-making.

FAQ's

SMEs can deal with late payments from customers by properly knowing their customers. Payment agreements should be clear between SMEs and their customers. The invoice must be prompt and correct.

Customers can be given a period of either 30, 60, or 90 days to make payments. The time to initiate payment should be mentioned in the payment agreement signed between SMEs and customers.

A partial payment is mostly seen as a late payment. It affects your credit score. Thereby, customers should make sure to initiate payment to vendors on time.

Common causes include poor cash flow management, invoice disputes or errors, inefficient approval processes, forgotten due dates, and administrative oversights. Some clients deliberately delay payments to manage their own cash flow. Unclear payment terms, missing documentation, and communication breakdowns also contribute significantly. Understanding these causes helps you implement preventive measures and address issues proactively.

You should monitor overdue payments daily or at a minimum weekly to maintain a healthy cash flow. Regular monitoring enables early intervention before small issues escalate into serious collection problems. Implement automated systems that flag overdue accounts immediately and generate regular aging reports. Consistent oversight ensures timely follow-ups, reduces bad debt risk, and maintains financial stability throughout your organization systematically.

Yes, late payments can involve legal consequences, including breach of contract claims, statutory interest charges, and collection lawsuits. Many jurisdictions allow businesses to charge late fees and interest on overdue amounts when specified in contracts. Persistent non-payment may justify legal action, credit reporting, or engaging collection agencies. Always document communications thoroughly and consult legal counsel before escalating disputes.

Yes, Volopay provides comprehensive real-time tracking of all outstanding payments through the centralized dashboard. You can monitor invoice statuses, view aging reports, identify overdue accounts instantly, and track payment progress continuously. The platform consolidates all payment data in one accessible location, eliminating manual tracking efforts and providing complete visibility into your accounts receivable and payable for better financial control.

Volopay automates your entire reminder process by scheduling customized notifications before and after payment due dates. You can configure multi-stage reminder sequences that escalate appropriately from friendly pre-due alerts to firmer overdue notices. The system sends reminders automatically via email or other channels, ensuring consistent follow-ups without manual intervention, significantly improving collection rates while reducing administrative workload.