How to open a business checking account in 2025?

Opening a business checking account is a convenient way to manage your company’s finances. As an entrepreneur or small business owner, opening a business checking account is crucial to maintaining finances and credibility.

With a business checking account, you can keep your business’s money safe and it enables you to make and accept payments, write and cash checks, streamline accounting and tax preparation, and much more.

You can easily open a business account by visiting a brick-and-mortar bank or online. This article will show you how to easily open a business bank account and streamline your financial processes.

What is a business checking account?

A business checking account is similar to a personal checking account but under your company’s name. You can open a business checking account online and offline at your convenience. It is an account dedicated to your business transactional needs, with specific business-friendly features.

By opening a business checking account, you can seamlessly manage your business finances and keep your personal finances separate from your company’s finances. When you open a business checking account you can control payroll services for employees, vendor payments, write and cash checks, streamline accounting and tax preparation, and more.

How does a business checking account work?

A business checking account enables you to easily keep track of and control your company finances. These accounts allow you to make deposits and withdraw funds, make purchases, pay bills, and schedule online bill payments.

Additionally, you can also deposit checks, order checks under your business name, and provide debit cards to your employees. Business checking accounts also provide payroll management tools.

Moreover, business checking accounts will help you with bookkeeping, and tax preparation. To access all these facilities, you must open a business checking account. While opening a business checking account you should consider fees, interest rates, and introductory offers.

Why do you need a business checking account?

1. Segregation of expenses

You can easily segregate your expenses by opening a business checking account. Segregation of expenses refers to the process of separating and categorizing your spending. With a business checking account, you can do this by using account transactions and automation features to categorize and track your business spending.

2. Streamlined record-keeping

Streamlined record-keeping is all about creating a system that makes managing your finances efficient and less time-consuming. When you open a business account you can manage this online and offline.

Because payments and receivables are recorded in real time, and auto-sorted, it creates a reliable and easy-access record of all business transactions.

3. Access to business financing

A business checking account can provide access to business financing, such as loans and lines of credit to help a business grow.

Establishing a relationship with your bank by opening a business checking account creates a positive banking history, which can be advantageous when applying for loans or credit in the future. It also helps boost your business credit score.

4. Convenient check issuance

Business checking accounts designed for convenience often come with features that simplify the process of ordering and managing checks.

By opening a business checking account with convenient check issuance features, you can save the waiting time between ordering checks, receiving them, and being able to make payments.

5. Effortless debit card transactions

Business checking accounts can offer several features that make debit card transactions effortless and convenient for your business.

These include widespread network access, mobile wallet compatibility, real-time tracking, and spend control. When you open a business checking account you can effortlessly manage your debit card transactions online and offline.

6. Convenient ACH transfers

Convenient ACH transfers are a major advantage of many business checking accounts. ACH (Automated Clearing House) transfers allow you to electronically move money between your business checking account and other bank accounts.

By opening a business checking account, you initiate transfers and receive transfers, which saves you time and improves cash flow.

7. Efficient wire transfers

Business checking accounts can play a role in facilitating efficient wire transfers, but the efficiency itself depends on the features offered by the bank.

An efficient international wire transfer works as a convenient way to send money and pay bills to a recipient living a different country using a different bank account.

A good business checking account provider makes it easy to initiate wire transfers, offers competitive transfer fees, does not have hidden costs, and reduces transfer delays. All of this also comes with real-time updates and transaction records.

8. Monitoring cash flow

With a business checking account, you can seamlessly monitor your cash flow. You can track your income and expenses, both internally as well as with external vendors and customers.

A crucial aspect of monitoring cash flow is maintaining a cash flow statement. This financial document provides a detailed overview of how cash is moving in and out of your business.

This feature is essential for any business, especially small businesses, to understand their financial health and make informed decisions (about future growth, budget planning, and scalability).

9. Tracking payments

By opening a business checking account, you can easily keep track of your business payments. With the manual tracking option, you can track your payment through a spreadsheet.

Some providers offer automated payment tracking, as well as native integrations with accounting software like QuickBooks or Xero. Most banks also offer online banking tools that allow you to view your transaction history.

10. Protection of liabilities

A business checking account helps you to protect personal assets from your business’s liabilities. You can keep your business and personal funds separate by opening a business checking account.

This way personal assets are protected from creditors and lawsuits if your business falls into debt or is sued. A business checking account also makes the audit process easier and will protect you from fraud.

11. Simplification of taxes

By opening a business checking account, you can avoid mixing business and personal transactions, which can make it harder to file taxes accurately. Also, some business checking accounts are integrated with accounting software, which improves the ability to categorize expenses and identify deductions.

The dedicated business account also ensures compliance with regulations surrounding business transactions and account requirements.

12. Elevated professionalism and credibility

Opening a business checking account under your company’s name gives credibility to your business by adding legitimacy and professionalism.

When exchanging payment information with clients or vendors, you'll be providing them with a business account name and details, which looks more established and reliable compared to a personal account.

Keep track of your company finances with Volopay

Requirements for opening a business checking account

These are the general documents typically required to open a business checking account in the US. For specific requirements of a particular bank, it's always a good idea to check their website or contact them directly.

To open a business checking account, you'll generally need

● Personal address and contact information

● Two forms of identification (Government-issued IDs, such as a driver’s license or passport)

● Your tax ID number (TIN)

● Business license

● Business mailing address

● Business formation documents

● Organizing documents filed with the state

● Business documentation (Certificate of Good Standing)

● Social Security Number (SSN) (for sole proprietorship)

● Employee Identification Number (EIN) (for corporation, partnership, or limited liability company (LLC))

● Certificate of assumed name/Doing Business As (DBA) name (if you're conducting business under a name distinct from your legal name)

● Ownership/partnership agreements (for a business with multiple owners)

● Articles of Organization (for LLCs)

● Articles of Incorporation (for corporations)

● Initial deposit

● Any other relevant legal or regulatory documents

Factors to consider when opening a business checking account

1. Cash deposit limits

Some banks may have limits on how much cash you can deposit at a time. While opening a business checking account you should consider how much cash you typically handle and choose an account with limits that won't hinder your business operations.

2. Transaction limits

It’s important to check transaction limits while opening a business checking account. Some accounts may limit the number of checks you can write or debit card transactions you can make per month. There might also be caps on how much you can spend on one transaction.

3. Transaction fees (wire fees or ATM fees)

While opening a business checking account you should be aware of any per-transaction fees associated with your account, such as wire transfer fees or ATM fees. This is necessary to know if you need steady cash access so you can plan the frequency of withdrawals and transfers.

4. Monthly fees

Many business checking accounts have a monthly maintenance fee. When opening a business checking account, you should look for an account with a fee that fits your budget, or consider options that waive the fee by maintaining a minimum balance. The fees should be balanced by the benefits the account provides.

5. Minimum account balance requirements

Some accounts require you to maintain a certain minimum balance to avoid fees. When opening a business checking account choose a bank with a minimum balance requirement that you can comfortably maintain, as well as a fee that is affordable for you to shoulder.

6. Bundled services

Some banks offer bundled accounts that combine your checking account with other business services, like merchant services or online payroll, for a discounted rate. While opening a business checking account, consider if these bundled services would benefit your business. Also, compare the fee structures of these services, and compare them to the benefits of the services.

7. Interest rates

Interest rates on business checking accounts vary by bank, ranging from 0.10% to 5% APY (Annual Percentage Yield). Choose a bank to open a business checking account that provides an interest rate based on your convenience. Take into account the growth and scaling plans for your business when forecasting.

8. Online payment options

When opening a business checking account, you should look for an account that offers convenient online features like remote bill pay and mobile banking to manage your finances efficiently. These services should also be compliant with data protection requirements and offer security.

9. Access to lines of credit

Opening a business checking account with a particular bank may give you easier access to lines of credit or other loan products offered by that bank. A line of credit (LOC) is a revolving credit line that allows a business to withdraw money as needed during a draw period.

10. Customer service

When considering a bank to open a business account with, customer service reputation and accessibility are crucial. Ensure that they offer support channels that work for you, whether by phone, online chat, or in person. Turnaround times are also important so that business operations aren’t hindered.

How to open a business checking account in the US?

To open a business checking account in the US, you'll need to provide documents that verify your business's registration and identity.

You can also consider the type of bank account you want to open. Opening a business bank account is a crucial step in establishing your business finances. Here's a breakdown of the process

1. Choose between online or brick-and-mortar business bank accounts

To open a business checking account, the first decision is whether to go with an online-only bank or a traditional brick-and-mortar bank—both have their pros and cons.

● Online-only banks

These banks offer convenience and often have lower fees due to lower overhead costs. They typically have a user-friendly online platform for managing your account and provide remote access to all services. However, if you need access to in-person customer service or offline deposit options, then they may not be the most convenient.

● Brick-and-mortar banks

Traditional banks offer the benefit of face-to-face interaction with customer service representatives and may have features like night deposit and safety deposit boxes. However, they can also have higher fees and require you to visit a branch for certain services. Their online banking options might also be limited in user-friendliness or robust workflows.

For more guidance on choosing the right checking account for your business, check out this guide on the best business checking accounts in the US.

2. Find the ideal bank for your business requirements

Once you've chosen an account type, compare features offered by different banks to find the one that best suits your business needs. Here are some key factors to consider when you are opening a business checking account:

● Fees

While opening a business checking account you should consider a bank account with low or no monthly maintenance fees, low per-transaction fees, and minimum balance requirements that you can comfortably maintain.

● Availability

When opening a business account, evaluate the need and accessibility of branches and ATMs, particularly if your business frequently handles cash. For online banks, ensure strong digital access and reliable customer support.

● Additional product offerings

Some banks offer bundled accounts that combine checking accounts with other business services, like merchant services or online payroll, at a discounted rate. Some might also streamline access to loans or credit.

● Payment options

Before you open a business checking account, look for a provider that offers features like online bill pay, mobile banking, and the ability to accept electronic payments, which can streamline your business's financial capabilities.

3. Keep your documents ready

When opening a business checking account, prepare all the documents you need. These can include a government-issued ID, address, business license, DBA name (if applicable), tax ID number, a social security number if you are a sole proprietor, and EIN for corporations, partnerships, and LLCs.

4. Submit your application

Once you have shortlisted a bank and collected the documents based on the bank's requirements, you can submit your application to open a business checking account. You can open a business bank account online or offline based on the bank that you’ve selected.

5. Open your business checking account

Once you’ve submitted your application, the bank will go through your application and approve it if everything is accurate and meets their requirements. After the approval to open a business checking account, you can follow the onboarding and setup process.

6. Deposit funds in your account

Once you’ve opened your business account, you will need to deposit the initial amount to activate your account. You can deposit funds in your account either via electronic transfer, check, or cash based on the bank’s policies—the minimum deposit requirement varies from bank to bank.

7. Activate your account

Now that you’ve submitted the initial amount to your bank account, you can finally activate your bank account by setting up online banking and ordering any necessary checks or debit cards. You can also start accessing other services, particularly if you’ve opted for bundled business services.

Transform your business finances with Volopay

How to manage your business checking account?

Once you’ve opened a business checking account, you can seamlessly manage your account by reviewing your financial statements regularly, using online banking, setting up a direct deposit, and using a budgeting system.

1. Categorize expenses

By opening a business checking account, you’ll separate business activities from a personal account. This separation ensures clear financial boundaries between personal and business finances, simplifying accounting and tax preparation. Expenses can be categorized based on vendor type, purpose, and department when maintaining records.

2. Reconcile monthly

When you open a business bank account you can regularly reconcile your bank statements with the company's cash records, accounting for outstanding checks or deposits in transit. This process ensures accurate tracking of financial transactions and balances. It’s also better to do this frequently instead of waiting for quarter- or year-end reconciliation.

3. Maintain financial records

To maintain accurate financial records, businesses often connect their ledgers to accounting software, such as QuickBooks and Xero. Some banks offer integrations with this accounting software. This makes it easy to maintain your financial records and ensures they follow all tax and legal compliance requirements.

4. Monitor account activity

You can regularly monitor your account activity by opening a business checking account. Regular monitoring helps you identify discrepancies, stay on top of cash flow, and detect unauthorized transactions. Utilize online banking services to check your account balance, track transactions, and receive real-time alerts for unusual activity.

5. Manage cash flow

A business checking account can help you track your company's cash flow. This can be done by maintaining a record of all made and received payments and enabling debit cards and checks for purchases. You can seamlessly manage, track, and improve cash flow by opening a business checking account for your company.

6. Comply with regulations

When you open a business checking account, your financial provider and your business need to comply with regulations. These regulatory requirements are based on your business type, industry, and location, and there may also be specific regulations regarding business banking practices (to be followed by the provider).

7. Utilize online banking features

Business checking accounts may offer a variety of online banking features such as immediate check deposit using a mobile device or smartphone, paying vendors or employees online, securely transferring funds, and viewing monthly statements. Some banks also offer online management of spend controls.

8. Manage authorized users

By opening a business checking account, you can authorize users (who can be any trusted individual, such as an accountant, bookkeeper, employee, or business partner). Each authorized user will have a unique ID and password that gives them access only to the accounts and services specified by the account administrator.

Open a Volopay business account for seamless financial management

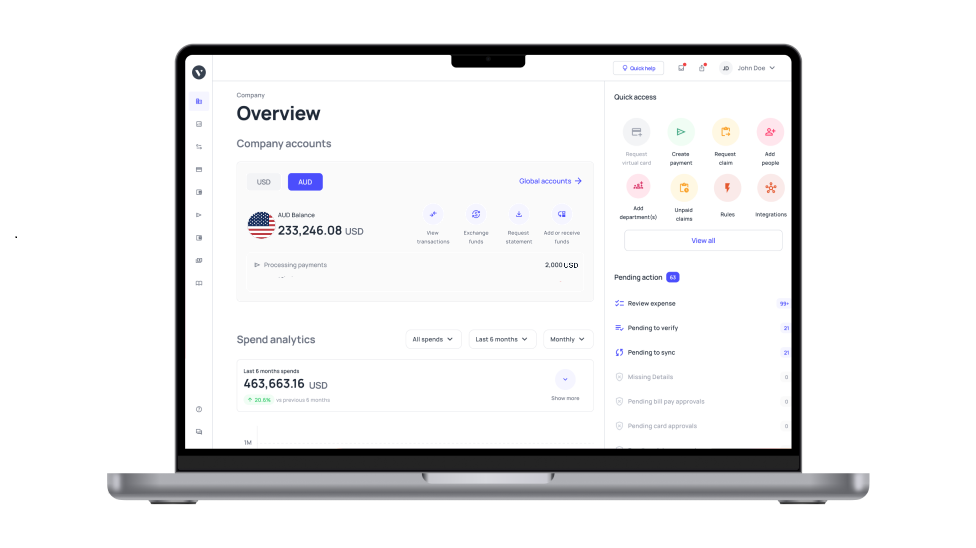

Volopay has a comprehensive business account platform that is intended to simplify your expense management processes. While Volopay is not a traditional business checking account, it provides an alternative with robust capabilities that simplify financial management for companies.

By opening a business bank account with Volopay, you get access to tools that enhance efficiency and control over your financial operations. Get a modern solution that streamlines expense management, provides real-time insights, and integrates seamlessly with your accounting systems.

1. Access a worldwide multi-currency account

With Volopay you can access a global multi-currency account. A multi-currency account is a type of account that lets you hold and send money in different currencies, making transactions in local currencies faster and more affordable.

2. Easily transfer funds locally

With Volopay you can easily make domestic transfers, ensuring quick and smooth transactions to local vendors and partners. These transactions come with competitive fee structures to ensure you’re not spending more than necessary.

3. Conduct international money transfers seamlessly

By opening a business account with Volopay you can seamlessly transfer money internationally, enjoying competitive exchange rates and faster transaction times compared to traditional banking methods.

4. Simplify your accounts payable process

Streamline your accounts payable with automated workflows, reducing manual work and ensuring timely vendor payments with Volopay. The account payable process is further streamlined by the ability to schedule payments and manage invoices.

5. Effortlessly handle employee payments

With Volopay you can issue corporate cards to your employees, create department and project-specific budgets, and set multi-level permissions to put a cap on unnecessary spending. Merchant controls add an additional layer of compliance.

6. Implement multi-level approval workflows

By opening a business account with Volopay you can implement multi-level approval workflows, ensuring compliance while reducing errors. The maker-checker process also creates transparency in the financial framework.

7. Facilitate quick and hassle-free reimbursements

With Volopay you can simplify the employee reimbursement process with automated systems, making it easy for employees to submit claims and receive payments promptly. Mileage claims can also be easily settled from the dashboard.

8. Manage users smoothly

Manage users without difficulty on the Volopay platform. You can assign departments to each user, and issue them unlimited cards with unique spend limits and controls. User onboarding is quick and easy for all employees.

9. Optimize your bookkeeping procedures

With Volopay you can optimize your bookkeeping by reducing the workload on your accounting team. Improve bookkeeping efficiency through automated data entry, advanced mapping rules, and native integrations to accounting software.

10. Centralize vendor management on a single dashboard

Volopay lets you centralize all vendor details and transactions, making it easier to manage relationships and payments. You can set up payments to vendors in advance, and automate the process of managing invoices.

11. Access virtual and physical card options

Volopay provides you access to physical and virtual card options, offering flexibility and control over business expenses. Physical cards can be ordered through the platform, and unlimited virtual cards created to suit unique business needs.

12. Integrate with accounting and HR systems

You can seamlessly connect Volopay with your existing accounting and HR software, ensuring a smooth flow of financial data and reducing manual entry. It makes compliance and auditing easier, as well as streamlining payroll management.

13. Access real-time account information

Stay updated with real-time insights into your account activity, helping you make informed financial decisions quickly. These include transaction notifications, card issuance and fund requests, as well as detailed transaction histories.

14. Automate accounting tasks

You can automate repetitive accounting tasks, such as expense categorization and reconciliation with Volopay. Advanced mapping rules let you create triggers to tag transactions, reducing errors and eliminating the need for manual data entry.

Streamline your financial processes with Volopay

FAQs

Yes, it's possible to open a business checking account online. Opening a business checking account online can save time by eliminating the need to visit a bank branch or collect documents in person.

Many types of businesses can open a business checking account, including, sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

Common fees associated with opening or maintaining a business checking account are monthly maintenance fees, cash deposit fees, ATM fees, excess transactions, and overdraft fees. Their structures and conditions vary from provider to provider.

Opening a checking account depends on whether you have all your paperwork in order. A good financial history can help boost this, though it’s not mandatory. You could get approved to open a business bank account the same day (if going to the bank in person) or in as little as 10 minutes when doing it through online banking.

Yes, some business checking accounts do have minimum balance requirements to open a business checking account. These requirements can vary depending on the bank and the type of account you choose to open a business bank account.

When closing a business checking account, you can check the fees and penalties associated with the account, check for any outstanding payments, and collect the necessary documents to close your business account. Once you send the formal request to close the account, you might need to open a new business account to transfer the remaining funds if you are still running a business.

Yes, some banks offer a facility to link business accounts to accounting software. You can link your business checking account to accounting software to track financial transactions in one place and keep your books up to date.

Different banks offer different types of overdraft protection for business checking accounts. The most common types of overdrafts are standard overdraft coverage, business overdraft line of credit, debit card overdraft service, transfer from other accounts, and overdraft protection transfer service.

Yes, Volopay's business account is accessible online and through mobile banking. Volopay’s online payments remove the need to carry physical cash or checks, though the physical cards do allow ATM withdrawals and POS transactions if you need them.

Yes, you can open multiple business bank accounts. There's no limit on how many business accounts you can have. To find the right number for you, determine which types of business bank accounts you need (business checking, savings, CDs, or cash management).

Yes, you can easily integrate Volopay’s business account with accounting software. Volopay's expense management dashboard integrates seamlessly with major accounting software including Xero, QuickBooks, MYOB, NetSuite, Deskera, and more.

Volopay offers multi-currency support, virtual cards, automated accounting integration, custom spend controls, policy enforcement, and real-time transaction information. Volopay’s fees are also lower than those of traditional business bank accounts making it the most cost-effective choice for businesses.