How to start a business in the US from India

As your business expands, you actively pursue international initiatives to expedite your growth. By learning how to start a business in the USA from India, you gain access to a vast market and a dynamic economy, enhancing your business growth potential.

Open a company in the USA from India to further expand your customer base, enjoy a favorable business climate, and benefit from robust legal protections.

Additionally, business opportunities in the USA for Indians let you utilize USA payment processes to optimize your operations and engage with the USA investor community to secure funding and mentorship.

This strategic move sets your business on a path to global success.

Can you register a business in the USA from India?

Yes, you can open a company in the USA from India.

You’ll need to find a registered agent in your chosen state to handle legal notices for you. Decide on the state where you want to register your business and be prepared for a thorough process.

After registration, you need to obtain an employer identification number (EIN), set up a bank account, acquire necessary licenses, and fulfill your tax obligations.

You might find it helpful to use private companies to help you consolidate—they’re equipped on the know-how to start a business in the USA from India, although they typically charge a fee.

Selecting the right business structure for your company

To know how to start a business in the USA from India, you need to navigate various legal and administrative processes, including selecting a suitable structure for your business. This decision impacts your taxes, compliance obligations, and operational flexibility.

The USA recognizes several business structures, which are: sole proprietorship, partnership, limited liability company (LLC), S corporation (S Corp), and C corporation (C Corp). However, for foreign citizens like you, the viable options are primarily LLCs and C corporations.

1. Limited Liability Company (LLC)

An LLC is a popular choice for small business opportunities in the USA for Indians due to its flexibility and simplicity. It combines the liability protection of your corporation with the tax benefits and provides you with the operational ease of a partnership.

● Advantages

One of the primary benefits of an LLC is that it provides you with limited liability protection. This means your personal assets are protected if your business incurs debt or faces legal issues.

LLCs are considered pass-through entities for tax purposes. This means that your business does not pay taxes on profits. Instead, profits and losses are passed on to the LLC’s members (owner), who report them on their personal tax returns.

This can simplify the tax filing process for you and often result in lower overall tax rates.

LLCs offer you flexibility in management and operations. There are fewer formalities and record-keeping requirements. You can either manage the business yourself or appoint managers.

● Disadvantages

LLCs may not be the best choice if you plan to grow your business significantly or seek outside investors. They cannot issue stock, which can limit your ability to attract investment capital.

Since LLC income is passed through to you as the owner, you may be subjected to self-employment taxes on your shares of the profit. This can sometimes result in higher tax liabilities for you as compared to corporate structures.

2. C-Corporation (C-Corp)

A C-Corporation is ideal to open a company in the USA from India if you are looking to scale your business significantly, attract investment, or eventually plan to go public.

It is a separate legal entity from its owners, which offers you substantial flexibility and benefits, but it also comes with more complex regulations.

● Advantages

Like an LLC, a C-Corp provides limited liability protection to its owners; that is, your personal assets are shielded from business debts and legal actions.

C-Corps can issue multiple classes of stock and an unlimited number of shares, making it easier for your business to attract investors and raise capital. This is particularly beneficial for you if you plan to scale quickly or go public.

C-Corps lets you pay corporate income taxes on their profits, which can sometimes be lower than personal income tax rates.

● Disadvantages

As a business owner opting for a C-Corp structure, you’ll encounter complexity and higher costs. Establishing and maintaining a C-Corp requires you to handle extensive record-keeping, reporting, and compliance requirements.

Moreover, you’ll face the challenge of double taxation. This means profits are taxed at the corporate level and then again at your individual level when you distribute them as dividends.

Criteria for starting a business in the USA from India

Once you’ve decided on the business structure for your company, you need to meet specific criteria to successfully open a company in the USA from India. There are certain requirements you need to address to get your business up and running smoothly.

1. State

Choose the state where you want to register your business. In the USA, incorporation happens at the state level.

This means that you register your business with the government of a specific state (federal-level registration requirements may depend on the type of company, as well as tax compliance rules).

You can research each state’s regulations to find the best fit for your business needs.

For business opportunities in the USA for Indians, many like to consider Delaware (C-Corps) for its strong corporate laws or Wyoming (LLCs) for its low costs and privacy.

However, you should conduct research on each state’s regulations as well as how they tie into the federal requirements before you make a decision, based on your business needs and capabilities.

2. Business name

Select a unique name for your business. Ensure that your chosen name isn’t already in use by another company in the state where you are registering. You can further check the availability of the name on the state’s secretary of state website.

This step helps you avoid legal issues and brand confusion in the future.

3. Identify a registered agent

While working on how to start a business in the USA from India, you need to designate a registered agent in the state where you register your business. This can be an individual or a business entity with a physical address in that state.

Your registered agent will handle legal documents and official correspondence for your business, helping you stay compliant with state and federal regulations.

Having a reliable registered agent ensures you won’t miss important notices and can focus on running your business smoothly.

4. File the paperwork

To officially register your business, file the necessary paperwork, such as the articles of organization for an LLC or the articles of incorporation for a C-Corp.

This paperwork typically includes your business name, purpose, address, and owner details. Submit these documents to the state’s secretary of state office.

5. Licenses and permits

You might need specific licenses and permits to operate and open a company in the USA from India legally. Look into what’s required for your business type and apply for the necessary licenses at the state, local, and federal levels.

This step is crucial to ensuring your business complies with all regulatory standards, so you can operate without legal issues.

6. Registration fees

When you file your paperwork, you’ll need to pay registration fees. These fees vary depending on the state and the type of business structure you choose.

Make sure to budget for these costs as part of the setup stage while planning how to start a business in the USA from India. Planning ahead will help you avoid any delays in getting your business registered.

7. Employer identification number (EIN)

You’ll need an employer identification number (EIN) for your business’s tax purposes. If you’re incorporating, apply for the EIN after registering your LLC or C-Corp.

Note that filing requires a social security number (SSN) or individual taxpayer identification number (ITIN).

Once you have your ITIN, apply for the EIN online through the Internal Revenue Service (IRS) website. Your EIN is essential for tax, banking, and hiring—compliance is a necessity and good practice when exploring business opportunities in the USA for Indians.

8. Business bank account

Once you have your EIN, open a business bank account. This account is essential for managing your finances, paying taxes, and receiving payments.

Having a separate business bank account helps you maintain clear financial records and ensures professional handling of your business transactions.

By following these steps, you ensure you are legally aligned to open a company in the USA from India and set up for success.

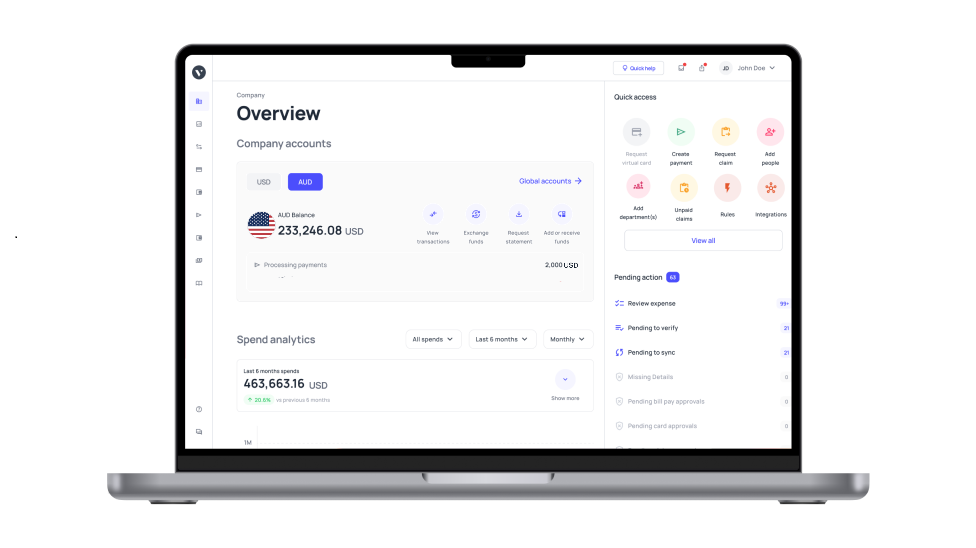

Streamline your financial processes with Volopay's business account

Expenses associated with operating an American company

When you are working out how to start a business in the USA from India, it’s essential to understand the various expenses involved. Operating costs can vary based on your business type, location, and size.

Here’s a breakdown of the common expenses you’ll encounter as you seize business opportunities in the USA for Indians.

1. Starting expenses for company setup

Setting up your company involves initial costs such as filing fees, name reservations, and registered agent fees. These costs vary by state, ranging from $50 to $850.

Budgeting for these expenses ensures a smooth setup process, helping you open a company in the USA from India without unexpected financial hurdles.

2. Number of employees, along with their remuneration and benefits

Your expenses will increase based on the number of employees you hire. Consider salaries, benefits, and any other compensation packages.

Employee-related costs might seem significant but they help you maintain a productive workforce, which is the core of your business operation.

3. Rental expenses and utility bills (if you have a physical space)

If you need a physical space, factor in rental costs and utility bills. These expenses vary by location but are crucial for businesses requiring an office.

Ensuring you have a budget for these recurring costs helps maintain a stable operational environment.

4. Equipment and supplies (might include shipping materials or machinery)

Depending on your business type, you’ll need to invest in equipment and supplies. This can include shipping materials, machinery, or office supplies.

These initial and ongoing costs are necessary for smooth business operations and for achieving your business goals.

5. Advertising or marketing expenses

To reach your target audience, you’ll need to spend on advertising and marketing. This can include online campaigns, print media, or other promotional activities.

Effective marketing is crucial for building your brand and attracting customers in the competitive American market.

6. Payment of local, state, and federal taxes

Your business will be subjected to local, state, and federal taxes. The amount depends on your profits and business structure.

Staying on top of these tax obligations is essential to avoid legal issues and ensure compliance as you explore business opportunities in the USA for Indians.

7. Insurance premiums or legal charges, if necessary

Depending on your industry, you might need insurance and legal services. Insurance protects against risks, while legal services ensure you comply with regulations. These costs are necessary for safeguarding your business and ensuring long-term stability.

8. Yearly expenses for regulatory compliance and taxation

Maintaining regulatory compliance and managing tax obligations involve ongoing costs. Annual fees for compliance, state franchise taxes, and reporting fees can range significantly.

Budgeting for these yearly expenses ensures your business remains compliant and avoids penalties.

Challenges of registering a business in the USA as an Indian citizen

There are certain key areas to consider as you navigate the process of opening a company and tapping into business opportunities in the USA for Indians.

Visa obligations

Obtaining the correct visa is essential. Investor visas like the E-2 or EB-5 require significant financial investment and meeting specific criteria. Make sure you’re conducting thorough research to decide which visa type is most relevant to your case.

Operational logistics

Managing operational logistics from India can be complex. You’ll need to coordinate time zones, supply chains, and communication channels effectively.

This can be challenging but is crucial for maintaining smooth business operations as you open a company in the USA from India.

Cultural differences

Understanding and adapting to cultural differences is vital. Business practices, customer expectations, and workplace norms in the USA can differ significantly from those in India.

Being aware of these differences helps you build strong relationships with your customers and local employees, as well as a successful business.

Competitive market environment

The US market is highly competitive. You’ll face competition from established local and international businesses. To succeed, you need a robust business strategy that stands out in this competitive landscape.

Economic uncertainty

Economic fluctuations can impact your business. Changes in market conditions, exchange rates, and economic policies can affect your profitability and growth. Staying informed and adaptable is key to navigating economic uncertainties.

Advantages of registering a business in the USA as an Indian citizen

When you start a business in the USA from India, you can unlock numerous benefits. Here’s a detailed look at the advantages of exploring business opportunities in the USA for Indians.

Entry into an extensive market

By registering your business in the USA, you gain access to one of the largest and most diverse markets in the world. This extensive market provides numerous opportunities allowing you to reach a broad customer base.

Availability of capital

The USA offers abundant funding opportunities, including venture capital, angel investors, and government grants. This availability of capital can help you secure the necessary funds to grow your business rapidly.

Consistent legal and regulatory framework

The USA has a well-established and transparent legal system. This consistent legal and regulatory framework ensures that your business operates smoothly, providing a stable environment for growth.

Global credibility

Registering a business in the USA enhances your global credibility. This can attract international clients and investors, boost your company’s reputation, and open doors to global markets.

Access to talent

The USA is home to a diverse and highly skilled workforce. You can hire top talent from various fields, enhancing your business’s innovation and competitiveness.

Tax benefits

Certain states offer tax incentives for businesses. By strategically choosing your location, you can take advantage of these tax benefits to reduce your overall tax burden and increase profitability.

Brand visibility

Operating in the USA can significantly increase your brand’s visibility. A presence in the USA market can enhance your brand’s recognition and reputation, both locally and internationally.

Potential for collaboration

The USA business environment encourages collaboration and partnerships. You have the potential to collaborate with leading companies, research institutions, and industry experts, driving innovation and growth.

Networking opportunities

The USA hosts numerous business events, trade shows, and networking opportunities. Participating in these events allows you to connect with industry leaders, potential partners, and clients, expanding your business network.

Path to citizenship

Registering a business in the USA can be a step towards obtaining US citizenship. Investor visas like the EB-5 provide a pathway to permanent residency, enabling you and your family to live and work in the USA.

By understanding these advantages, you can effectively capitalize and open a company in the USA from India to achieve significant growth and success.

Open your Volopay business account for hassle-free transactions

Key considerations post registering your business in the USA

Once you open a company in the USA from India, there are several key considerations to keep in mind to ensure your business thrives and sustains growth.

Legal and compliance obligations

After registering, you must adhere to various legal and compliance obligations. Stay updated with state and federal regulations, file annual reports, and maintain proper records to ensure your business remains compliant and avoids legal issues.

Currency exchange and financial management

Effective financial management is crucial. Monitor currency exchange rates, especially when transferring funds between India and the USA. Use financial tools and services to manage transactions efficiently and mitigate currency risk.

Taxation laws

Understanding USA taxation laws is essential. Familiarize yourself with the federal, state, and local taxes applicable to your business. Consider hiring a tax advisor to ensure you meet all tax obligations and take advantage of any available tax benefits.

Hiring and employment laws

When hiring employees, comply with USA employment laws, including the minimum wage, work hours, and benefits. Understanding these laws helps you avoid legal complications and ensures a fair and productive work environment.

Banking and payments

Set up a business bank account to handle transactions smoothly. Ensure you choose a bank that offers services tailored to your business needs. Efficient banking and payment systems are vital for maintaining cash flow and financial stability.

Start your company in the USA with Volopay's business account

Launching your business in the USA from India can be challenging, but Volopay simplifies financial operations for you, offering a comprehensive solution to manage your business finances consistently.

Access a global multi-currency account

With Volopay, you get a global multi-currency account, allowing you to hold and send money in various currencies.

This is particularly beneficial when dealing with international vendors, making it a key tool for you if you are looking into how to start a business in the USA from India.

Simplify domestic money transfers

Volopay’s platform enables efficient domestic money transfers for you. You can pay suppliers, vendors, and other partners swiftly, ensuring smooth business operations as you open a company in the USA from India.

Transfer money internationally

You can easily transfer money internationally with Volopay, minimizing hassles and reducing costs associated with cross-border transactions. This feature is essential for business opportunities in the USA for Indians dealing with overseas partners.

Secure the most competitive rates possible

Volopay ensures you get competitive exchange rates, saving your business money on every transaction. This is crucial for maintaining profitability and managing costs effectively.

Manage vendor relationships

You can efficiently manage vendor relationships through Volopay’s system. Keep track of your vendor payments, meet contract terms, and analyze spend metrics to maintain strong business partnerships.

Track spends in real-time

Real-time expense tracking helps you monitor and control your company’s spending. This feature provides immediate insights into your financial health, allowing you to make informed decisions quickly.

Enhance your accounts payable processes

You can further automate your accounts payable processes with Volopay. Automate invoice processing, approvals, and payments to ensure accuracy every time, helping your business scale efficiently.

Utilize corporate cards for transactions

Volopay offers corporate cards for easy business transactions. These cards are integrated with the expense management system, simplifying payments and tracking for you.

Streamline employee payments and reimbursements

You can easily manage employee payments and reimbursements with Volopay. You can automate the approval as well as the payment processes to ensure timely and accurate reimbursements for your transactions.

Manage expenses with multi-level approvals

Implement multi-level approval workflows to manage expenses for your business. This Volopay feature ensures that all your expenditures are scrutinized and approved by the appropriate personnel, maintaining financial discipline.

Optimize bookkeeping procedures

Volopay enhances your bookkeeping procedures by automating data entry, reconciliation, and reporting for your business. This leads to accurate financial records for you and compliance with regulatory requirements.

With Volopay’s business account, you can efficiently start a business in the USA from India, manage your financial operations, and capitalize on business opportunities in the USA for Indians. Schedule a demo today to see how Volopay can help you streamline your business finances.

Start your US business journey with Volopay

FAQs

No, you do not need to be a USA resident with a social security number to open a company in the USA. You do, however, need to obtain an EIN (which requires you to have an ITIN).

It is also recommended that you find a local agent or representative to help you manage the legal obligations, as well as local correspondence and management.

The most common and preferable company structures for foreign entities are the limited liability company (LLC) and the c corporation (C-Corp). An LLC offers flexibility in management and the benefit of pass-through taxation.

On the other hand, C Corps is advantageous for raising capital through stock issuance or going public in the future. Both structures are beneficial, and the final decision is case-dependent for those looking to open a company in the USA from India.

The cost of establishing a company in the USA from India varies based on the state of incorporation, legal fees, registered agent fees, and the cost of obtaining an employer identification number (EIN).

Additionally, having a USA resident partner with a social security number can reduce these costs significantly.

No, Unlike many other countries, the USA does not mandate a minimum capital requirement, making it easier for the flourishment of business opportunities in the USA for Indians.

You can acquire a US address for registering your company by using the services of a registered agent.

Yes, a local registered agent is necessary to carry out the registration process and act as your official point of contact in the USA.

An individual taxpayer identification number (ITIN) is required if you need to comply with USA tax reporting and are not eligible for a social security number.

No, you do not need to register your business in every state. You only need to register in the state where you plan to conduct business or have a nexus.

A nexus can be created by having a client, management post, or some sort of vendor or supply chain in that state.

There are no specific limitations on transferring earnings from your USA business to India. However, you must comply with both USA and Indian tax laws and foreign exchange regulations.

When establishing a presence in the USA, consider factors such as the bank’s international reach, services offered, fees, ease of online banking, support for multi-currency accounts, and a strong reputation for serving international clients.

Yes, businesses can integrate Volopay’s business account with existing accounting software. Volopay offers seamless integration, speeding up reconciliation and providing specific checks for sorting and verifying transactions.

The requirements for opening a business account with Volopay are dependent on your company type, as well as the local regulations of where you operate.

In general, these include identification, registration proof, as well as certifications and KYB documents. In order to fully understand the documentation needed for your account, sign up for a demo with a team.