A complete guide to OCR invoice processing in accounts payable

OCR invoice processing is revolutionizing accounts payable management by automating the handling of invoices. Utilizing OCR software invoice processing allows you to accelerate your workflow, reducing the need for manual data entry and minimizing errors.

With invoice OCR, you can effortlessly extract critical information from invoices, optimizing both speed and accuracy in processing. Implementing OCR invoicing technology enables you to manage high volumes of invoices with ease, keeping your financial records accurate and current.

This advanced technology speeds up invoice processing times, improving overall efficiency and precision in your accounts payable operations. By integrating OCR invoice processing into your business, you not only modernize your financial management practices but also boost your competitiveness in the market.

Embracing OCR software invoice processing ensures a smoother workflow, allowing your team to focus on strategic tasks rather than manual data entry. This approach helps you maintain an efficient, error-free invoicing system, critical for a fast-paced financial environment.

What is OCR invoice processing?

OCR invoice processing uses optical character recognition (OCR) technology to automate the handling of invoices. Invoice OCR plays a crucial role by converting scanned or digital invoices into editable and searchable text. This process eliminates the need for manual data entry, streamlining your invoice approval workflow and reducing errors.

OCR invoicing technology captures and extracts essential details such as invoice numbers, dates, and amounts from documents. This extracted data is then accurately entered into your financial systems. By employing OCR software invoice processing, you can handle high volumes of invoices more efficiently, speeding up processing times and maintaining precise records.

Integrating OCR invoice processing into your accounts payable operations ensures faster, more accurate data management. This technology not only enhances efficiency but also helps you maintain up-to-date financial records. By adopting OCR invoicing, you modernize your invoicing process, making your accounts payable system more effective and less prone to manual errors.

How is invoice processing automated through OCR technology?

Manual invoice processing is plagued with inefficiencies such as slow data entry, high error rates, and difficulties in managing large volumes of invoices. These issues often result in delayed payments, inaccurate financial records, and increased operational costs, making it challenging to maintain smooth financial operations.

OCR invoice processing offers a solution by automating the extraction and handling of invoice data. Invoice OCR technology is central to this automation, as it scans and interprets invoice documents, converting them into editable and searchable digital text.

This process captures critical details such as invoice numbers, dates, and amounts, which are then automatically entered into your financial systems, reducing the need for manual input. OCR invoicing transforms how you manage invoices by improving accuracy and efficiency.

OCR software invoice processing speeds up the workflow, minimizing human errors and ensuring that your financial records are precise and up-to-date. By integrating OCR invoice processing into your operations, you simplify the invoice handling process, allowing for quicker processing and fewer discrepancies.

This automation not only enhances efficiency but also frees up your team to focus on other tactical tasks, ensuring timely payments and precise financial management while reducing the overall workload and operational costs.

What are the common challenges of manual invoice processing?

Manual invoice processing often presents several challenges that hinder efficiency and accuracy. Issues such as lengthy processing times, increased risk of errors, and difficulties in managing approvals and payments can significantly impact your financial operations.

Understanding these common challenges can help you recognize the benefits of transitioning to OCR invoice processing and invoice OCR technology.

1. Time-consuming process

Manual invoice processing is notoriously slow, requiring substantial time and effort to enter data and manage invoices. The repetitive task of manually inputting information from invoices leads to inefficiencies and delays.

This time-consuming nature of manual processing not only hampers productivity but also increases the risk of errors. Adopting OCR invoicing and OCR software invoice processing can dramatically reduce processing times by automating data extraction and entry, allowing your team to focus on more strategic tasks.

2. Risk of human error

The reliance on manual data entry in invoice processing introduces a significant risk of human error. Errors such as incorrect data entry or missed information can lead to inaccurate financial records and costly mistakes. These inaccuracies can affect payment schedules and overall financial management.

By integrating OCR invoice processing and invoice OCR technology, you minimize the risk of human error, as OCR software invoice processing automates data extraction and ensures more accurate data handling, improving the reliability of your financial operations.

3. Delayed approvals and payments

Manual invoice processing often leads to delays in approvals and payments due to inefficient workflows and bottlenecks. The lack of automation means that invoices may sit in queues waiting for review, approval, or processing. These delays can result in missed payment deadlines and strained vendor relationships.

Transitioning to OCR invoice processing and invoice OCR helps speed up the approval process and ensures timely payments by automating invoice handling and providing real-time tracking and updates through OCR software invoice processing.

4. Lack of visibility and control

Manual invoice processing can obscure visibility and control over your financial operations. Without real-time insights, it becomes challenging to track the status of invoices, manage approvals, and ensure compliance. This lack of visibility can lead to missed deadlines and poor financial oversight.

Implementing OCR invoice processing improves transparency and control, as OCR software invoice processing provides real-time updates and centralized access to invoice data, enabling better management and oversight of your accounts payable.

5. Security and compliance risks

Handling invoices manually exposes your business to security and compliance risks. Sensitive financial data is vulnerable to unauthorized access, and manual processes can lead to non-compliance with regulations. Inadequate security measures and potential for data breaches can jeopardize your financial information.

By adopting OCR invoice processing, you enhance security and compliance, as OCR software invoice processing includes features like secure data handling and audit trails, ensuring that your financial data is protected and regulatory requirements are met.

6. Scalability issues

Manual invoice processing struggles with scalability, especially as your business grows. Handling an increasing volume of invoices manually becomes increasingly cumbersome and prone to errors. This lack of scalability can hinder your ability to manage financial operations effectively.

Transitioning to invoice OCR resolves scalability issues, as OCR software invoice processing automates data entry and management, allowing you to efficiently handle larger volumes of invoices without sacrificing accuracy or efficiency.

7. Data inconsistencies

Data inconsistencies are a common problem in manual invoice processing, resulting from human errors, miscommunications, or outdated information. These inconsistencies can lead to inaccurate financial records and complicate reconciliation efforts.

Adopting OCR invoice processing helps mitigate these issues by automating data extraction and ensuring that all information is accurately captured and integrated into your financial systems.

OCR software invoice processing provides consistent and reliable data handling, reducing the risk of discrepancies and improving overall data integrity.

8. Payment duplication

Manual invoice processing increases the risk of payment duplication, where invoices might be paid more than once due to errors in tracking or data entry. This not only wastes resources but can also strain vendor relationships.

Implementing OCR invoice processing helps prevent payment duplication by automating invoice tracking and validation. OCR software invoice processing ensures accurate and efficient handling of invoices, reducing the likelihood of duplicate payments and improving financial control and accuracy.

Adopt OCR technology for your business with Volopay today

What is the importance of OCR in accounts payable?

OCR invoice processing speeds up the handling of invoices by automating data extraction from documents. With invoice OCR technology, you eliminate the need for manual data entry, significantly reducing processing times.

This faster processing allows you to handle a higher volume of invoices efficiently, accelerating your accounts payable workflow. By adopting OCR invoicing, you streamline operations and ensure that invoices are processed promptly, enhancing overall productivity and responsiveness.

OCR invoice processing enhances accuracy in accounts payable by minimizing human errors. Invoice OCR technology accurately captures and converts data from invoices into digital formats, reducing mistakes associated with manual data entry.

With OCR software invoice processing, you ensure that invoice details are correctly extracted and integrated into your financial systems. This improvement in accuracy not only helps in maintaining precise financial records but also reduces the likelihood of costly errors and discrepancies.

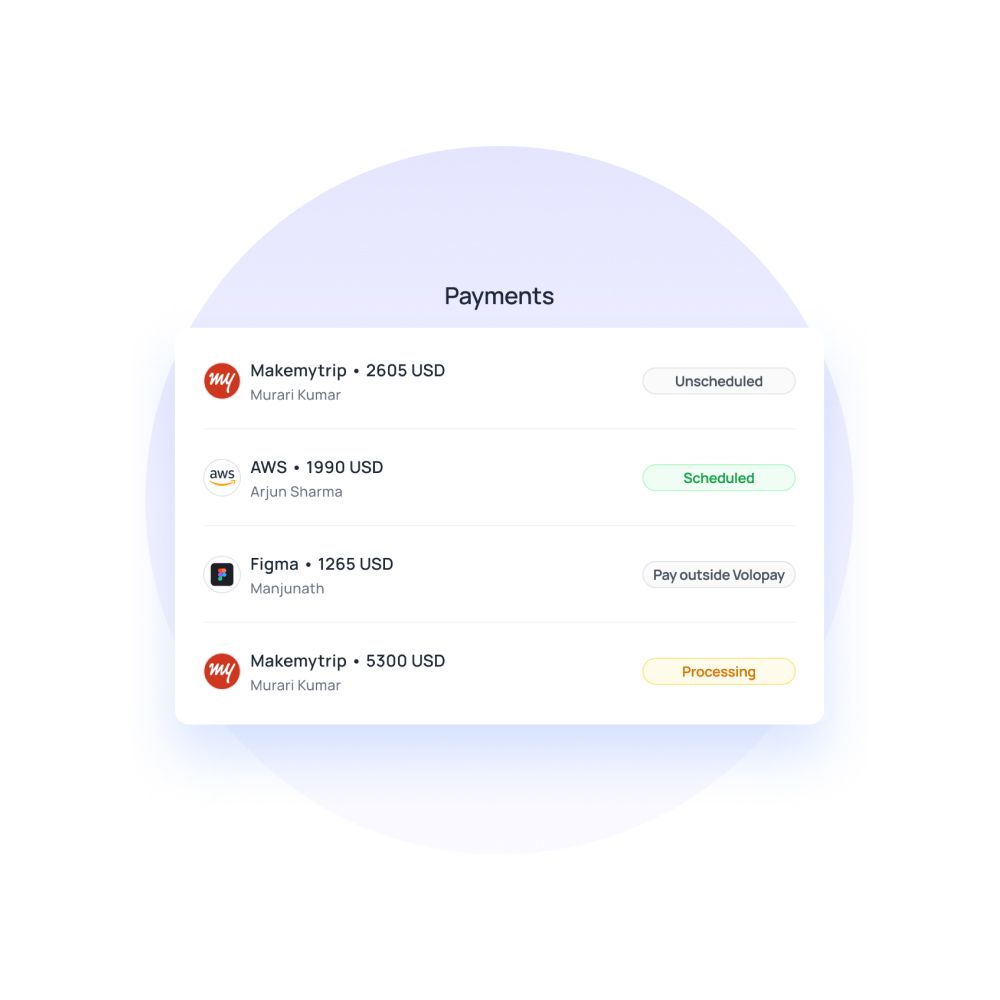

OCR invoice processing provides real-time updates on invoice status, improving visibility and control over your accounts payable processes. Invoice OCR technology enables you to track and monitor invoice progress as it moves through various stages of approval and payment.

By using OCR software invoice processing, you ensure that you have up-to-date information on invoice handling, allowing for timely decision-making and better management of financial operations.

Implementing OCR invoice processing leads to significant invoice processing cost reductions. By automating data entry and invoice management with invoice OCR technology, you reduce the need for manual labor and minimize errors, which in turn lowers operational costs.

OCR invoicing streamlines processes and decreases the time spent on invoice handling, allowing your team to focus on higher-value tasks. This increased cost efficiency helps optimize your overall financial management and resource allocation.

OCR invoice processing improves data access by digitizing invoice information and making it easily searchable and retrievable. With invoice OCR technology, you convert physical invoices into digital formats that are readily accessible.

This enhanced data access enables you to quickly locate and review invoice details, improving decision-making and operational efficiency. By adopting OCR software invoice processing, you gain better control over your invoice data and facilitate more effective financial management.

OCR invoice processing streamlines workflows by automating various aspects of invoice management. Invoice OCR technology reduces the need for manual intervention, simplifying the data extraction and entry process.

With OCR invoicing, you create a more efficient workflow that integrates seamlessly with your financial systems. This streamlining of workflows not only speeds up invoice processing but also enhances overall operational efficiency, contributing to a more effective accounts payable function.

OCR invoice processing significantly boosts accounting efficiency by automating the extraction and management of invoice data. With invoice OCR technology, you streamline invoice handling, reduce manual input errors, and improve the overall accuracy of financial records.

OCR invoicing enhances your accounting processes by integrating with financial systems, allowing for smoother operations and more effective financial management. This boost in efficiency leads to faster processing and better control over your accounts payable functions.

By integrating OCR invoice processing, you boost productivity in accounts payable. Invoice OCR technology automates repetitive tasks, such as data entry and validation, freeing up time for your team to focus on more strategic activities.

With OCR invoicing, you handle a larger volume of invoices more efficiently, leading to quicker turnaround times and improved overall productivity. This increase in productivity enhances your accounts payable operations and contributes to better financial management.

OCR invoice processing offers scalable solutions for managing an increasing volume of invoices. As your business grows, invoice OCR technology can easily adapt to handle larger amounts of data without sacrificing accuracy or efficiency.

OCR invoicing provides the flexibility needed to scale your accounts payable operations, ensuring that you can manage more invoices effectively. By using OCR software invoice processing, you future-proof your financial processes and maintain optimal performance as your business expands.

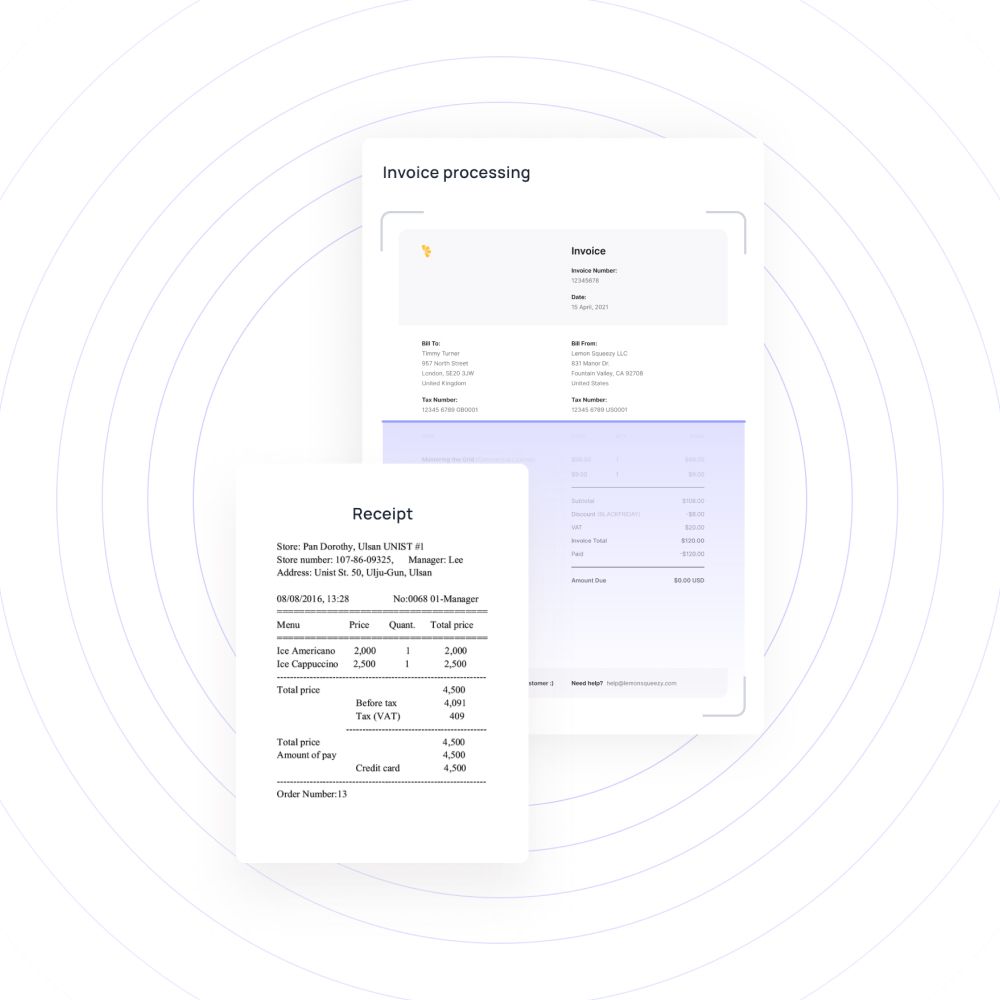

How does OCR invoice processing work?

OCR invoice processing is a sophisticated technology that automates the extraction and management of invoice data. By leveraging invoice OCR, you can convert paper invoices into digital formats efficiently.

The process involves several key steps, from creating digital versions of invoices to exporting and archiving the data. This automation streamlines invoice management and reduces manual errors, enhancing your overall accounts payable operations.

Creating/uploading digital invoice version

The first step in OCR invoice processing is creating or uploading a digital version of the invoice. You convert paper invoices into digital images using scanners or digital cameras. This initial digitization allows invoice OCR technology to work effectively.

By ensuring that all invoices are available in digital format, you prepare them for further processing and automation through OCR software invoice processing.

Enhancing image quality

OCR invoice processing involves enhancing the quality of the digital invoice image to improve recognition accuracy. Image enhancement techniques, such as adjusting contrast, removing noise, and correcting distortions, ensure that the invoice OCR technology can accurately process the invoice data.

By improving image quality, you optimize the effectiveness of OCR software invoice processing, leading to more reliable data extraction.

Processing invoice image

Once the invoice image is enhanced, OCR invoice processing continues with the processing of the image. This step involves analyzing the digital invoice and preparing it for text recognition.

Invoice OCR technology assesses the layout and structure of the invoice, enabling it to effectively interpret and extract data. OCR software invoice processing ensures that the processing phase sets the stage for accurate data extraction.

Text recognition

Text recognition is a crucial part of OCR invoice processing. Invoice OCR technology uses optical character recognition to identify and convert text from the digital invoice image into machine-readable format.

This step involves detecting various characters, numbers, and symbols present in the invoice. OCR software invoice processing ensures that text recognition is accurate, allowing for the effective extraction of invoice data.

Character segmentation

Character segmentation is an essential step in OCR invoice processing, where the technology isolates individual characters from the invoice image. Invoice OCR technology segments the text into distinct characters and symbols, making it easier to convert them into digital text.

This process enhances the accuracy of OCR software invoice processing by ensuring that each character is correctly identified and processed.

Text and data extraction

After character segmentation, OCR invoice processing focuses on text and data extraction. Invoice OCR technology extracts relevant information from the digital invoice, such as invoice numbers, dates, and amounts.

This step converts visual data into structured digital formats, facilitating integration with your financial systems. OCR software invoice processing ensures accurate and efficient extraction of key invoice details.

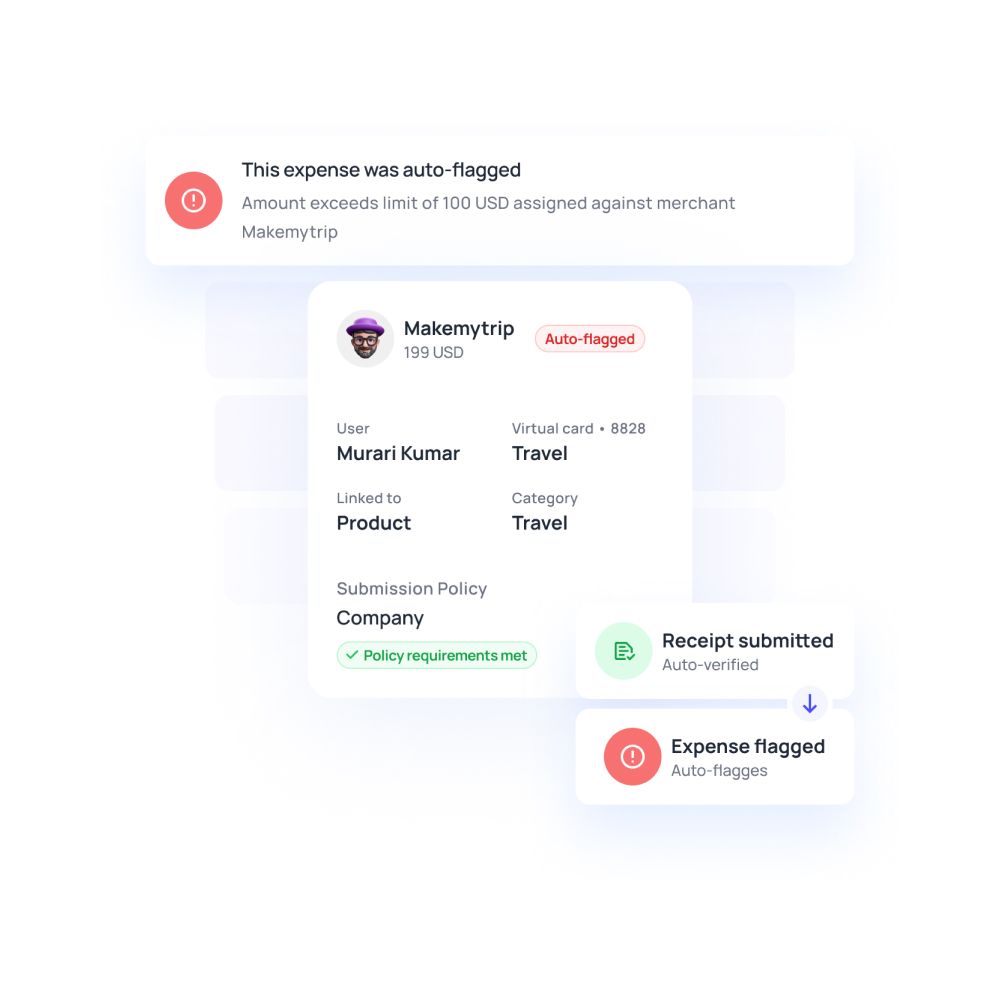

Validating invoice accuracy

Validating invoice accuracy is a critical aspect of OCR invoice processing. After data extraction, invoice OCR technology verifies the extracted information against predefined rules and criteria to ensure correctness.

This step helps identify and correct any errors or discrepancies in the data. By validating the accuracy of the extracted data, OCR software invoice processing ensures reliable and accurate invoice management.

Managing exceptions and errors

OCR invoice processing includes managing exceptions and errors that may arise during data extraction. When invoice OCR technology encounters issues such as unclear text or formatting discrepancies, it flags these exceptions for manual review.

OCR software invoice processing provides tools for addressing and correcting errors, ensuring that all invoices are accurately processed and validated.

Exporting extracted data

Once the data is validated, OCR invoice processing involves exporting the extracted information to your financial systems. Invoice OCR technology facilitates the transfer of data into accounting software or databases, ensuring seamless integration.

By exporting the extracted data efficiently, OCR software invoice processing supports smooth financial operations and accurate record-keeping.

Archiving the data

The final step in OCR invoice processing is archiving the data. After extraction and validation, invoice OCR technology stores the processed invoice data in a secure digital archive.

This ensures that all invoice information is easily retrievable for future reference or audits. OCR software invoice processing helps manage and preserve financial records, supporting compliance and long-term data management.

What methods does OCR use for invoice processing?

OCR invoice processing employs various methods to efficiently handle and manage invoice data. By leveraging technologies like invoice OCR, you can optimize data extraction and processing.

The primary methods include templates, machine learning, on-premise solutions, and cloud-based systems. Each method has unique features that enhance OCR invoicing and OCR software invoice processing to meet diverse business needs.

Templates

In OCR invoice processing, templates play a significant role in improving accuracy and efficiency. Invoice OCR technology uses predefined templates to recognize and extract data from invoices based on their layout and structure.

These templates guide the OCR software invoice processing by identifying key fields and information, making it easier to handle invoices with consistent formats. Templates help standardize data extraction and streamline the processing of various invoice types.

Machine learning

OCR invoice processing leverages machine learning to enhance the accuracy and adaptability of data extraction. Invoice OCR technology utilizes algorithms that learn from historical invoice data to recognize and interpret different invoice formats and structures.

Machine learning enables OCR software invoice processing to improve over time by analyzing patterns and making adjustments based on real-world examples, resulting in more accurate and efficient data handling.

On-premise

OCR invoice processing can be implemented on-premise, where the invoice OCR technology is installed and managed within your organization’s infrastructure. On-premise solutions offer greater control over data security and integration with existing systems.

By using OCR software invoice processing on-premise, you maintain direct oversight of the processing environment and ensure that all invoice data remains within your organization's network.

Cloud-based

OCR invoice processing also benefits from cloud-based solutions, which offer flexibility and scalability. Invoice OCR technology deployed in the cloud provides access to powerful processing capabilities without the need for extensive on-premise infrastructure.

Cloud-based OCR software invoice processing allows you to scale resources as needed, access data from anywhere, and leverage advanced features and updates without managing hardware or software locally.

Suggested read: Key benefits of cloud-based invoice approval

Seamlessly integrate Volopay’s Magic Scan into your business

Types of AP documents extracted with OCR

With OCR invoice processing, you efficiently extract data from invoices. Invoice OCR technology captures key details such as invoice numbers, dates, & amounts, converting them into digital formats. This process reduces manual data entry and improves accuracy, making invoice management more efficient through OCR invoicing.

OCR invoice processing also handles purchase orders by extracting relevant information. Invoice OCR technology identifies and digitizes details like order numbers, item descriptions, and quantities from POs'. This streamlines your procurement process, enhancing efficiency and accuracy in handling orders through OCR invoicing and OCR software invoice processing.

OCR invoice processing facilitates the extraction of data from receipts. Using invoice OCR technology, you can capture details such as transaction amounts, dates, and vendor names from scanned receipts. This automation simplifies expense tracking and reconciliation, improving accuracy and efficiency in handling receipts through OCR invoicing

OCR invoice processing extends to extracting data from contracts and agreements. Invoice OCR technology digitizes key elements such as contract terms, dates, and parties involved. This process enhances document management by automating data capture and improving accessibility through OCR software invoice processing.

With OCR invoice processing, you can extract data from financial statements and reports. Invoice OCR technology converts text and numerical data into digital formats, facilitating better analysis and reporting. This automation streamlines financial management and improves accuracy in handling statements and reports through OCR invoicing.

OCR invoice processing effectively manages tax documents by extracting essential information. Invoice OCR technology digitizes data from forms such as W-2s, 1099s, and VAT returns. This automation enhances accuracy and compliance, simplifying tax preparation and reporting through OCR software invoice processing.

OCR invoice processing supports the extraction of data from expense reports, by capturing details like employee names, expense categories, amounts, and dates from scanned reports. This automation streamlines expense management and reimbursement processes, improving accuracy and efficiency through OCR invoicing.

OCR invoice processing also manages regulatory and compliance documents. Invoice OCR technology extracts data from forms and reports required for compliance purposes. This automation ensures accurate record-keeping and adherence to regulations, enhancing your compliance management through OCR software invoice processing.

With OCR invoice processing, you extract data from bank statements efficiently. Invoice OCR technology digitizes details like transaction dates, amounts, and account numbers from scanned statements. This automation streamlines reconciliation processes and improves financial oversight through OCR invoicing.

Invoice OCR technology also includes extracting data from delivery notes, you can capture key information such as delivery dates, item descriptions, and quantities. This process enhances logistics management and ensures accurate record-keeping through OCR software invoice processing.

OCR invoice processing enables the extraction of data from credit memos. Invoice OCR technology captures information such as credit amounts, reasons for issuance, and dates from scanned memos. This automation simplifies credit management and enhances accuracy through OCR software invoice processing.

OCR invoice processing handles payment remittances by extracting relevant data. Invoice OCR technology captures details like payment amounts, dates, and remittance references from scanned documents. This automation improves payment tracking and management through OCR invoicing.

What are the advantages of using OCR for invoice processing in accounts payable?

OCR invoice processing offers several advantages for your business’s accounts payable function. By implementing invoice OCR, you streamline operations and improve overall efficiency.

OCR invoicing solutions provide faster processing, accurate data extraction, and simplified compliance, ensuring that your invoice management becomes more manageable and reliable.

These advantages extend across various industries and business sizes by utilizing OCR software invoice processing, thus benefiting the overall automation of the invoice process.

1. Supports automated invoice processing

With OCR invoice processing, you automate time-consuming manual tasks. Invoice OCR technology captures invoice data, converts it into digital formats, and processes it automatically. This reduces the need for human intervention, minimizing errors and expediting your workflow thus automating your invoice processing.

Automation through OCR invoicing allows you to focus on more value-added tasks, significantly improving your accounts payable efficiency.

2. Manages various document formats

OCR invoice processing is capable of handling multiple invoice formats, whether paper-based or digital. Invoice OCR technology easily extracts data from various types of invoices, including PDFs, scanned images, and Word documents.

This flexibility in OCR invoicing simplifies your document management, ensuring that all formats are processed accurately through OCR software invoice processing.

3. Streamlines invoice handling

OCR invoice processing streamlines how you manage invoices by automating data capture and reducing manual data entry. Invoice OCR technology quickly extracts relevant data and routes it to the appropriate system.

By utilizing OCR invoicing, you cut down on administrative work, ensuring a smoother and faster workflow through OCR software invoice processing.

4. Extracts data from images

OCR invoice processing excels at extracting data from scanned images. Invoice OCR technology converts image-based invoices into editable and searchable text, making it easy for you to manage even non-digital documents. This capability enhances your ability to handle diverse document types, ensuring data accuracy with OCR invoicing.

5. Generates scanning codes for invoices

With OCR invoice processing, you can implement barcode or QR code scanning to simplify invoice handling. Invoice OCR technology generates these codes, which help in tracking and organizing invoices.

These codes allow for quicker scanning and retrieval, making your OCR invoicing process more efficient and organized through OCR software invoice processing.

6. Systematically organizes invoices

OCR invoice processing helps you organize invoices systematically. Invoice OCR technology classifies and categorizes invoices based on key data points like invoice numbers, dates, and vendor information. This systematic organization ensures quick retrieval, enhancing your document management with OCR invoicing.

7. Tracks audit trails

OCR invoice processing provides robust audit trail capabilities. Invoice OCR technology keeps a detailed record of all processed invoices, tracking changes, approvals, and payments. This feature enhances transparency and accountability in your invoice management, ensuring compliance with OCR software invoice processing.

8. Ensures compliance and regulatory adherence

OCR invoice processing helps ensure compliance by capturing and storing data in a format that adheres to regulatory requirements.

Invoice OCR technology tracks essential details such as tax information and payment terms, reducing the risk of errors. Compliance is simplified, ensuring your operations align with legal and industry standards through OCR invoicing.

9. Centralizes document storage

OCR invoice processing centralizes all your invoice-related documents into a single digital repository. Invoice OCR technology stores invoices in an organized manner, making it easy for you to access, search, and retrieve any invoice. This centralized storage improves efficiency and ensures better document control through OCR software invoice processing.

What are the disadvantages of automated invoice scanning?

While OCR invoice processing offers various benefits, it's important to consider some of its limitations. Automated invoice OCR technology can face challenges with handling specific invoice formats, unstructured data, and high upfront costs.

Additionally, issues with accuracy, particularly with handwritten text or damaged documents, can impact its efficiency. Understanding these disadvantages of OCR invoicing can help you make informed decisions when implementing OCR software invoice processing in your business.

Inability to handle unknown invoice formats

One limitation of OCR invoice processing is its inability to handle unfamiliar invoice formats. Invoice OCR technology relies on predefined templates or machine learning algorithms to recognize and process data.

If your business receives invoices in unrecognized or complex formats, OCR invoicing may struggle to extract accurate information. This can lead to delays or errors, especially if your business deals with a wide range of invoice styles in OCR software invoice processing.

Difficulty with unstructured data

OCR invoice processing often has difficulty processing unstructured data. Invoice OCR works best with structured or semi-structured documents where information is organized consistently.

If your invoices have unstructured formats or lack standardization, OCR invoicing may not accurately capture all relevant data. This limitation requires manual intervention to ensure accuracy, reducing the benefits of OCR software invoice processing.

Upfront costs and implementation challenges

Implementing OCR invoice processing comes with upfront costs and challenges. Invoice OCR technology often requires investment in software, hardware, and training.

The cost of setting up OCR invoicing systems and integrating them into your current workflow can be significant, especially for smaller businesses. These initial expenses can slow down adoption, making OCR software invoice processing less accessible for some.

Accuracy issues with handwritten text

OCR invoice processing can struggle with accurately reading handwritten text. Invoice OCR technology is more effective at processing printed or typed documents.

When dealing with handwritten invoices, OCR invoicing may misinterpret characters, leading to data entry errors. This limitation can be a problem if your business frequently receives invoices that include handwritten details in OCR software invoice processing.

Inability to handle damaged or faded documents

Another challenge with OCR invoice processing is its inability to handle damaged or faded documents. Invoice OCR technology relies on clear, legible text to extract data.

If an invoice is torn, smudged, or has faded text, OCR invoicing may not capture all the necessary details, leading to incomplete or inaccurate data extraction in OCR software invoice processing. This can lead to significant errors in the overall process.

Limitations in handling exceptions

Finally, OCR invoice processing can struggle with handling exceptions. Invoice OCR technology is designed to follow predefined rules for data extraction, so if an invoice deviates from the standard format or contains unexpected details, OCR invoicing may fail to process it correctly.

Exceptions like partial payments, disputes, or corrections often require manual review, reducing the efficiency of OCR software invoice processing.

Revolutionize your business with cutting-edge OCR technology today

How does OCR invoice processing benefit various industries?

OCR invoice processing plays a pivotal role across multiple industries by enhancing data accuracy, reducing manual labor, and speeding up invoice workflows. Whether in supply chain management, healthcare, or law firms, adopting invoice OCR technology significantly boosts operational efficiency.

By automating routine tasks like data extraction, OCR invoicing improves the speed of transactions and cuts down on human errors. In any industry, OCR software invoice processing helps streamline operations, contributing to improved productivity and overall success.

1. Supply chain management

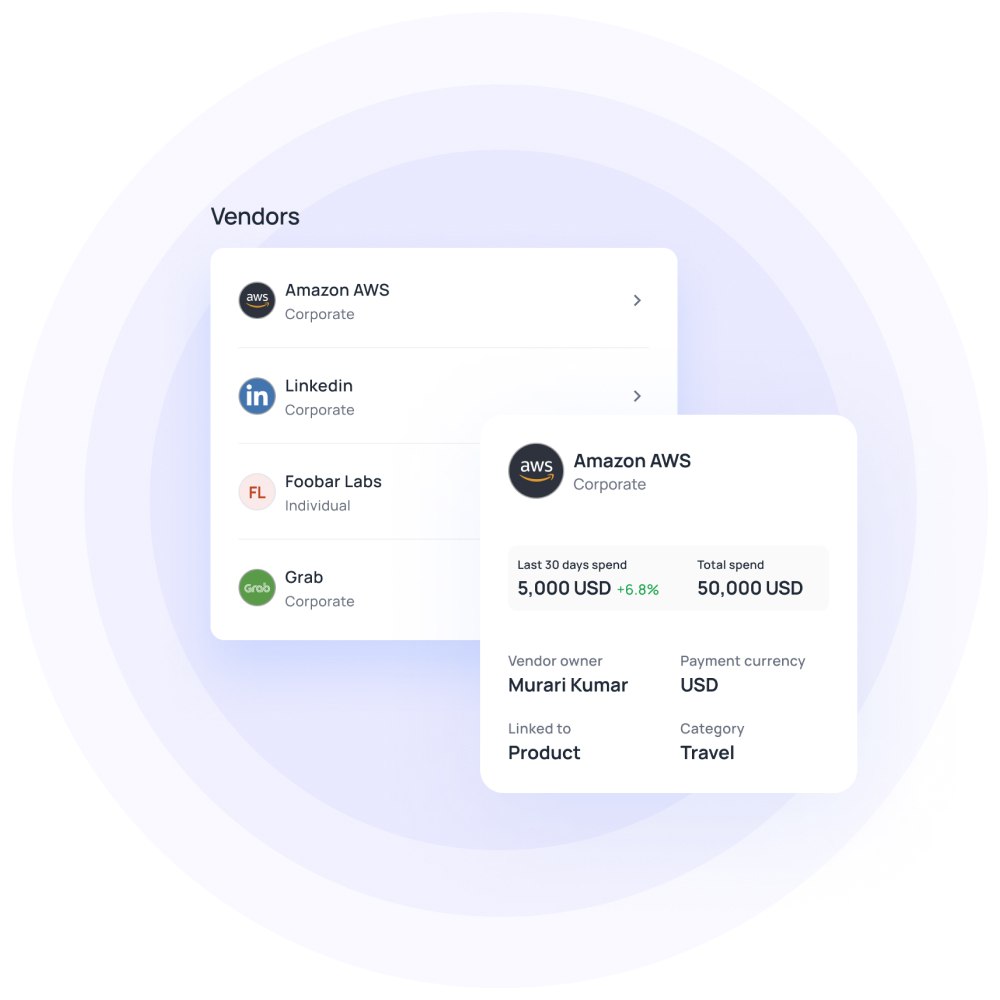

In supply chain management, OCR invoice processing helps you track and manage a vast number of invoices, simplifying invoice reconciliation across multiple suppliers. Invoice OCR ensures you can process and validate invoices quickly, reducing bottlenecks.

With OCR invoicing, supplier invoice processing becomes more streamlined, allowing faster approval and payment. It also offers valuable insights into supplier performance by making invoices easily accessible through OCR software invoice processing, thus improving decision-making and operational efficiency in your supply chain.

2. Law firms

For law firms, OCR invoice processing helps manage the large volume of invoices related to legal services and vendor expenses. Using invoice OCR, you can swiftly extract relevant details, like service dates and charges, ensuring accurate billing.

OCR invoicing also reduces manual entry errors, safeguarding sensitive financial data. OCR software invoice processing improves billing transparency and ensures quick access to historical records, which is crucial for legal auditing and compliance, streamlining administrative workflows and resource allocation.

3. Healthcare

In healthcare, OCR invoice processing significantly reduces the administrative burden of handling medical billing and supplier payments. Invoice OCR speeds up the process of scanning and processing invoices for medical supplies, equipment, and services, reducing human error.

OCR invoicing ensures that payments are processed promptly, leading to better vendor relationships. With OCR software invoice processing, you can also maintain compliance with regulations, keeping a clear audit trail, and ensuring the proper handling of sensitive financial data in your healthcare facility.

4. Retail

Retailers benefit from OCR invoice processing by improving the speed and accuracy of handling invoices from numerous suppliers. Invoice OCR allows your business to automate payment cycles, ensuring that inventory is replenished without delays.

OCR invoicing also minimizes manual data entry, which reduces errors and expedites payment approval. The integration of OCR software invoice processing provides real-time insights into your financial operations, helping you manage cash flow better and enhancing your relationship with suppliers in the fast-paced retail environment.

5. Hospitality

In the hospitality industry, OCR invoice processing helps streamline invoicing for services, inventory, and suppliers. Invoice OCR eliminates the need for manual data entry, reducing time spent on accounts payable.

OCR invoicing ensures that invoices are accurately processed and payments made promptly, which enhances vendor relations.

With OCR software invoice processing, you can access real-time financial data, making it easier to track expenses, manage cash flow, and maintain an efficient operation in a sector where quick payments are crucial for smooth operations.

6. Banking

In the banking industry, OCR invoice processing improves the handling of complex invoices, often tied to financial services and lending operations. Invoice OCR enables you to manage high volumes of invoices quickly and accurately, reducing manual processing time.

OCR invoicing ensures compliance with industry regulations by maintaining accurate, up-to-date records. With OCR software invoice processing, you can process payments more swiftly, offer better service to clients, and maintain an accurate audit trail, which is critical for banking compliance and reporting.

7. Manufacturing

In manufacturing, OCR invoice processing helps manage invoices tied to raw materials, equipment, and other production-related expenses. Invoice OCR automates the extraction of crucial invoice details, speeding up the payment approval process.

OCR invoicing reduces human errors, which can lead to costly delays in production schedules. With OCR software invoice processing, you gain real-time insights into expenses and supply chain efficiency, allowing you to make informed decisions to optimize manufacturing operations while improving relationships with suppliers.

What role does machine learning play in enhancing OCR for invoice management?

Integrating machine learning with OCR invoice processing has significantly transformed how businesses manage invoices. By learning from past data, machine learning improves the overall performance of invoice OCR solutions.

Through OCR invoicing, your system becomes smarter over time, adapting to different formats and enhancing data extraction capabilities. With OCR software invoice processing, you can process more invoices faster, improving accuracy while reducing manual intervention and errors, leading to more efficient accounts payable operations.

OCR and machine learning integration

When you combine OCR invoice processing with machine learning, the system continuously learns and improves its performance. This integration helps your business identify invoice layouts, recognize patterns, and automate tasks with greater accuracy.

Using invoice OCR, the machine learning algorithms identify unique formats, which boosts accuracy and minimizes the time spent manually correcting errors. This seamless OCR invoicing integration enhances your system’s overall performance, providing reliable OCR software invoice processing to handle various document types.

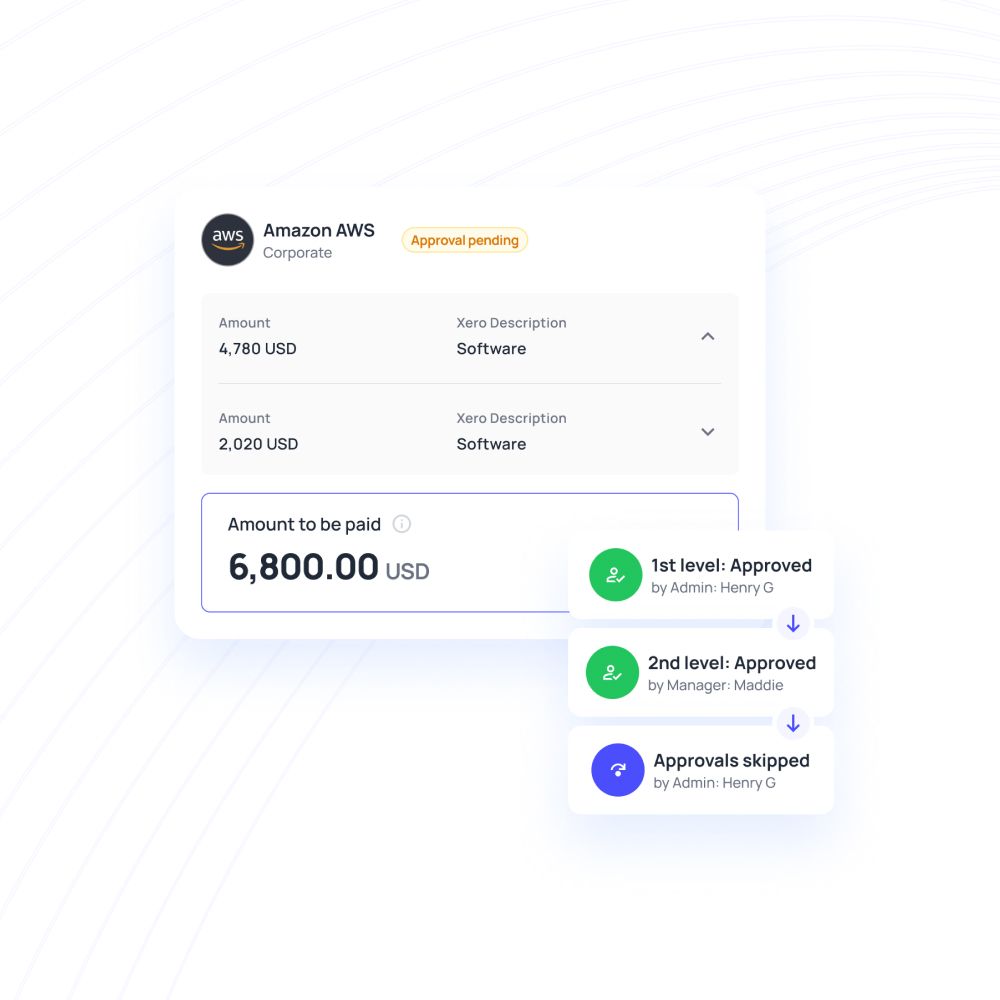

Automated approver routing

Machine learning enables OCR invoice processing to automate invoice approval routing efficiently. By analyzing past approval patterns and understanding workflow nuances, the system can automatically assign invoices to the correct approvers. Through invoice OCR, this ensures faster approvals, reducing bottlenecks.

With OCR invoicing, the approval process becomes quicker and more accurate, improving your team’s workflow. This capability in OCR software invoice processing not only saves time but also helps in managing compliance by routing invoices correctly.

Enhanced pattern recognition

Machine learning helps OCR invoice processing improve pattern recognition, allowing the system to accurately extract data from various invoice formats. As you use invoice OCR, the machine learning algorithms adapt to new patterns and document layouts, minimizing errors.

With OCR invoicing, it becomes easier to handle multiple suppliers with unique invoice formats. This enhanced capability of OCR software invoice processing reduces the need for manual intervention, speeding up the process and ensuring consistency across different documents.

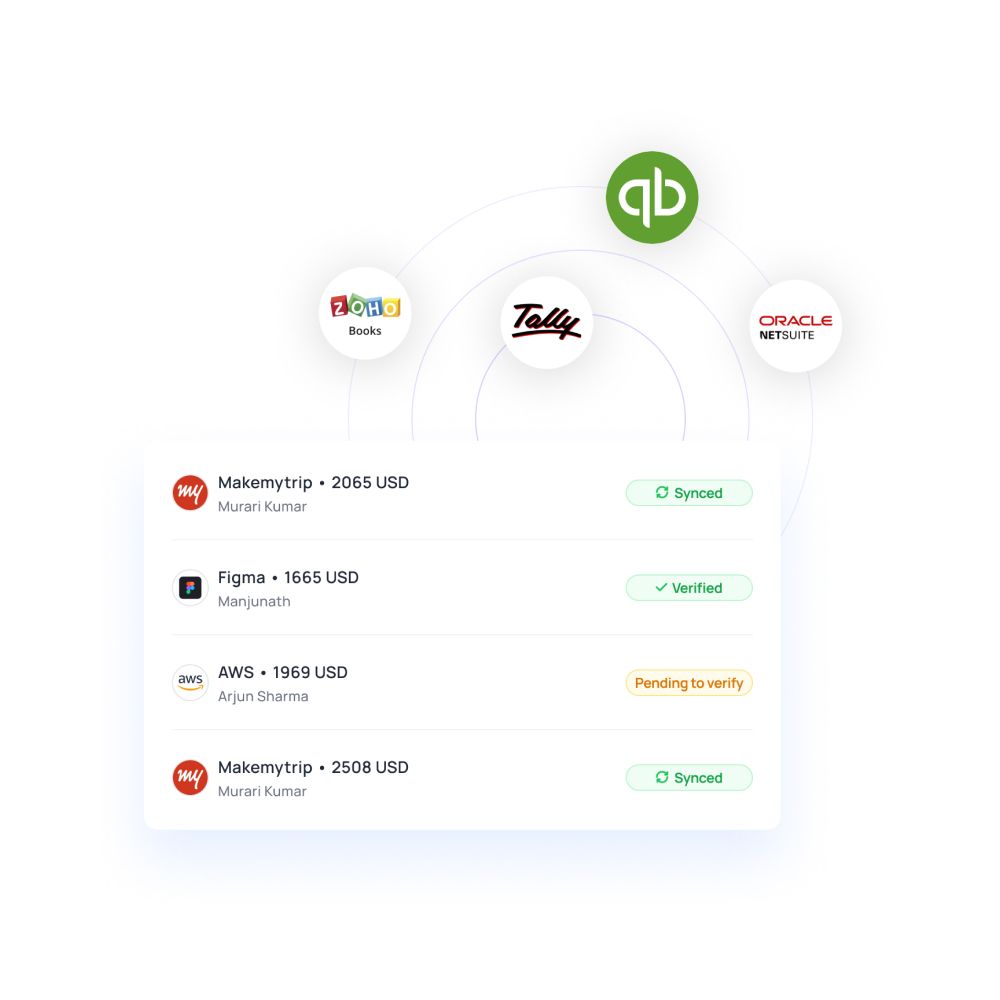

Integrations with AP systems

Machine learning in OCR invoice processing offers seamless integration with your AP systems. Invoice OCR ensures that extracted data is directly synced with your accounts payable software, reducing manual data entry.

Through OCR invoicing, machine learning helps the system map invoice data to the correct fields, increasing data accuracy. This integration with OCR software invoice processing optimizes your AP workflow, leading to faster payment cycles and improved financial control across your organization.

Automated ledger matching

Machine learning in OCR invoice processing also automates the process of manual invoice matching to corresponding ledgers. Invoice OCR systems can quickly cross-reference invoices with purchase orders and receipts, ensuring consistency.

Through OCR invoicing, machine learning algorithms detect patterns in financial transactions, enabling faster reconciliation. By incorporating OCR software invoice processing, your business reduces manual effort and enhances accuracy in matching invoices to financial records, improving overall accounting processes.

Better character recognition

Machine learning enhances OCR invoice processing by improving character recognition accuracy. Invoice OCR systems become better at recognizing characters from scanned documents, even if the quality is poor or the text is handwritten.

Using OCR invoicing, machine learning algorithms learn from previous errors, improving data extraction over time. This leads to better accuracy in OCR software invoice processing, ensuring that important details like invoice numbers and amounts are captured correctly, minimizing the need for manual corrections.

Integrating OCR with manual review

Manual review plays a crucial role in detecting duplicate invoices, which may be missed by OCR invoice processing. While invoice OCR can recognize text and patterns, duplicates that slip through can lead to overpayments.

Your team can manually review flagged entries, ensuring duplicates are identified and corrected. By combining OCR invoicing with manual checks, you reduce the risk of duplicate payments, improve financial accuracy, and enhance the reliability of OCR software invoice processing.

Although OCR invoice processing can extract data from invoices, manual review helps in accurately categorizing expenses. Invoice OCR may not always understand the context of specific charges, especially with complex line items.

Manual intervention ensures that expenses are categorized correctly, improving overall financial reporting. With OCR invoicing and human oversight working together, you can ensure that your OCR software invoice processing aligns with your business’s financial structure and meets accounting standards.

Manual review provides valuable feedback to improve the performance of OCR invoice processing over time. By identifying recurring errors in invoice OCR, your team can adjust the system’s algorithms to better handle similar situations in the future.

This ongoing feedback loop between manual review and OCR invoicing leads to continuous improvement. The result is an ever-evolving OCR software invoice processing system that becomes more accurate and reliable with each review cycle.

Handwritten invoices often pose challenges for OCR invoice processing systems due to varying handwriting styles and legibility issues. While invoice OCR can recognize typed text, it struggles with handwritten content. Manual review helps by verifying and inputting handwritten data accurately.

By incorporating manual checks into OCR invoicing, you ensure that even handwritten invoices are processed correctly. This combination improves the overall efficiency and accuracy of OCR software invoice processing, reducing the risk of errors.

Non-standard invoice formats are often challenging for OCR invoice processing systems to handle. Invoice OCR may struggle with unconventional layouts, leading to errors in data extraction. The manual review helps in identifying and resolving these issues.

By allowing human intervention in OCR invoicing, you ensure that non-standard formats are processed correctly. This collaboration between manual review and OCR software invoice processing helps you maintain accuracy and handle diverse invoice formats seamlessly.

OCR invoice processing systems may occasionally flag certain invoices as exceptions due to errors in recognition or formatting. Manual review is essential for resolving these exceptions quickly. Through invoice OCR, invoices that don’t meet predefined standards are flagged for human review, allowing for a quicker resolution of issues.

This partnership between OCR invoicing and manual exception handling ensures that invoices are processed efficiently, minimizing delays in payments and improving the effectiveness of OCR software invoice processing.

Boost efficiency with Volopay’s OCR technology

What are the best practices for implementing OCR in accounts payable?

Implementing OCR invoice processing in accounts payable can streamline your operations and reduce manual tasks. However, to fully leverage the potential of invoice OCR, following best practices is essential.

These include understanding your business needs, training your team, and ensuring smooth integration with AP systems. When done correctly, OCR invoicing can save time, increase accuracy, and boost productivity. Adopting these practices will ensure your OCR software invoice processing is efficient and scalable for future growth.

Standardize invoice formats

Standardizing invoice formats can significantly improve the efficiency of OCR invoice processing. Invoice OCR systems perform best when they encounter consistent structures. By ensuring that invoices follow a uniform format, you minimize errors during OCR invoicing and maximize data extraction accuracy.

This best practice not only improves OCR software invoice processing results but also accelerates the overall invoice-handling process by reducing manual intervention.

Identify business needs

Before implementing OCR invoice processing, it’s crucial to identify your business needs. Understanding the specific requirements of your accounts payable process ensures that the invoice OCR system aligns with your objectives.

Determine how OCR invoicing can reduce manual work, improve accuracy, and handle high invoice volumes. By assessing your needs, you can select the most effective OCR software invoice processing solution that optimizes your operations and addresses your company’s unique challenges.

Implement Optical Character Verification (OCV)

Integrating Optical Character Verification (OCV) with OCR invoice processing adds an extra layer of accuracy. OCV validates the recognized characters, ensuring they match expected results based on predefined rules.

This verification step enhances invoice OCR reliability, especially when dealing with critical financial data. By combining OCR invoicing with OCV, you reduce the risk of incorrect data extraction and strengthen the overall performance of OCR software invoice processing.

Optimize image quality

The quality of images used in OCR invoice processing directly affects the accuracy of data extraction. Invoice OCR relies on clear, high-quality scans to recognize and process information. Optimizing image quality, such as adjusting resolution and contrast, enhances OCR invoicing performance.

Ensuring that scanned invoices are legible and free of distortion helps the OCR software invoice processing system capture data correctly, minimizing errors and reducing the need for manual review.

Integrate with AP systems

To maximize the benefits of OCR invoice processing, seamless integration with your existing accounts payable systems is essential. Invoice OCR can automate data entry, but when linked with your AP software, it ensures that extracted data flows directly into your payment workflows.

This integration simplifies OCR invoicing by removing the need for manual data transfer, streamlining OCR software invoice processing, and providing real-time updates throughout the payment process.

Provide training to AP staff

Training your accounts payable team on how to use OCR invoice processing tools effectively is a key best practice. Invoice OCR can automate many tasks, but human oversight remains important.

By offering training on OCR invoicing, you enable your team to manage exceptions, validate data, and oversee system performance. Proper training ensures that staff can maximize the advantages of OCR software invoice processing, increasing the overall efficiency of your AP department.

Expand OCR to other documents

While OCR invoice processing focuses on invoices, expanding its use to other accounts payable documents can enhance efficiency. Invoice OCR can be applied to purchase orders, receipts, and contracts, making OCR invoicing more versatile across your AP department.

Extending the capabilities of your OCR software invoice processing ensures that all document types are handled swiftly, leading to a more comprehensive and streamlined approach to document management.

Implement robust security measures

Security should be a priority when deploying OCR invoice processing in your accounts payable system. Invoice OCR deals with sensitive financial information, and safeguarding this data is critical.

Implement encryption protocols, user access controls, and regular audits to ensure that OCR invoicing operates within a secure framework. By building strong security measures into your OCR software invoice processing system, you protect your company from potential fraud and data breaches.

Continuously monitor performance

Regularly monitoring the performance of your OCR invoice processing system ensures ongoing improvements. Invoice OCR technology can encounter issues over time, such as misreading data or struggling with new formats.

By continuously tracking the effectiveness of your OCR invoicing solution, you can make necessary adjustments. Monitoring helps you identify areas for optimization, ensuring that your OCR software invoice processing remains efficient and reliable as your business scales.

Assess & evaluate OCR solutions

Not all OCR invoice processing systems are created equal, so it’s important to assess different solutions before implementation. Evaluate various invoice OCR tools based on accuracy, speed, and compatibility with your existing AP systems.

Consider how well they handle complex invoices and if they integrate with your workflows. By thoroughly assessing OCR invoicing options, you’ll choose the best OCR software invoice processing solution that meets your business’s needs and long-term goals.

Key features to look for in an OCR software

When selecting OCR software invoice processing tools, focus on features that optimize your accounts payable workflow. High accuracy, seamless integration, and strong security are critical for OCR invoice processing success.

Look for solutions that support multiple languages, handle large volumes, and offer a user-friendly interface. By identifying these key features, you’ll ensure your OCR invoicing process runs smoothly.

Effective OCR software invoice processing improves efficiency, minimizes errors, and accelerates document handling, allowing you to focus on more strategic tasks in your AP department.

High accuracy and recognition

OCR invoice processing relies on the accuracy of data extraction to ensure seamless handling of invoices. Look for software that offers high recognition capabilities, reducing manual reviews and minimizing errors.

High accuracy ensures that your invoice OCR system can handle various formats, layouts, and languages, increasing efficiency in your AP department. Advanced recognition features, paired with error correction, ensure smooth OCR software invoice processing even when dealing with complex invoice structures.

Multi-language support

OCR invoice processing becomes more effective when the system supports multiple languages. With invoice OCR, you can manage documents from global vendors, ensuring seamless OCR invoicing across different regions. Multi-language support expands the reach of your OCR software invoice processing, making it versatile for diverse business needs.

Advanced recognition capabilities

Your OCR invoicing system must have advanced recognition features to accurately process different document types. Whether scanning invoices, receipts, or contracts, the OCR software invoice processing should capture data precisely. These capabilities reduce errors, enhance accuracy, and streamline the overall AP workflow.

Document preprocessing

Effective OCR invoice processing starts with document preprocessing. Advanced systems offer image enhancements and template matching, which improve recognition accuracy. With these features, your invoice OCR system can handle varying document quality, making OCR invoicing more efficient.

By enhancing document quality before processing, you ensure that your OCR software invoice processing system can extract the right data from each invoice.

Image enhancements

Improve the quality of documents before OCR invoice processing by using image enhancement features. Enhancing the clarity of scanned invoices ensures that the invoice OCR system captures all the necessary data accurately. Better image quality leads to fewer errors in OCR software invoice processing, increasing overall efficiency.

Template matching

Template matching allows your OCR invoicing system to recognize recurring invoice formats. This feature accelerates OCR invoice processing by identifying the layout and structure of documents quickly. Matching templates reduce the time spent manually adjusting the OCR software invoice processing system to handle each invoice.

Data validation and error correction

Data validation and error correction are essential in OCR invoice processing to ensure accuracy. Invoice OCR software with automated validation rules can detect potential errors and flag them for review.

Additionally, having features that highlight errors allows your AP team to quickly address issues in the OCR invoicing process, ensuring smooth and accurate OCR software invoice processing.

Automated validation rules

Your OCR invoicing software should include automated validation rules to catch errors during OCR invoice processing. These rules verify the accuracy of extracted data, ensuring that invoice OCR results are reliable. By automatically flagging discrepancies, your AP team can quickly resolve any issues.

Error highlighting

When errors occur in OCR invoice processing, the system should highlight them for easy identification. Invoice OCR solutions with error highlighting improve accuracy by allowing your team to correct mistakes in real time. This feature simplifies the OCR invoicing process and reduces manual intervention.

Integration capabilities

A crucial feature of OCR invoice processing is its ability to integrate seamlessly with your existing AP systems. The invoice OCR solution should have strong API availability, enabling smooth OCR invoicing workflows.

Integrating OCR software invoice processing with your AP systems ensures that all data flows seamlessly from extraction to payment processing, reducing manual data entry and increasing efficiency.

Seamless integration with AP systems

To maximize efficiency, ensure your OCR invoicing system integrates smoothly with existing accounts payable software. OCR invoice processing should directly transfer extracted data into your AP workflows, automating the data entry process for greater accuracy.

API availability

Look for OCR invoice processing software that offers API integration. This enables your invoice OCR system to communicate with other applications in your AP environment, streamlining OCR invoicing and data transfer. API availability increases flexibility in your OCR software invoice processing system.

Unlock the power of OCR automation today

User-friendly interface

An intuitive and user-friendly interface is essential for efficient OCR invoice processing. Look for software that offers an easy-to-navigate dashboard and customizable workflows. This ensures that your team can manage invoice OCR tasks effortlessly, reducing the learning curve and improving OCR software invoice processing speed.

Intuitive dashboard

A well-designed dashboard simplifies the OCR invoicing process by offering a clear overview of tasks and data. OCR invoice processing becomes more manageable when the interface is intuitive and easy to navigate, leading to better workflow management.

Customizable workflows

Your OCR invoice processing software should allow for customizable workflows. This flexibility ensures that invoice OCR processes can be adapted to your business's unique needs. Customizable workflows enhance OCR invoicing efficiency, making it easier to handle various document types.

Scalability

Scalability is a key factor to consider in OCR invoice processing. The software should be capable of handling large volumes of documents while allowing for customization as your business grows. A scalable invoice OCR solution ensures that your OCR invoicing process can expand alongside your business without compromising performance.

Handling high volumes

Choose an OCR invoice processing system that can handle high volumes of documents. As your business grows, the invoice OCR system should scale to meet the increasing demand without slowing down the OCR software invoice processing speed.

Scope for customization

Ensure that your OCR invoicing software allows for customization to fit specific business needs. Customization ensures that OCR invoice processing remains efficient, even as your document handling requirements evolve.

Security features

Security is crucial in OCR invoice processing since it involves handling sensitive financial data. Ensure that the invoice OCR system includes robust data protection measures and audit trails. These features help safeguard information, making your OCR software invoice processing more secure.

Data protection

Look for OCR invoice processing software that provides data protection features like encryption. Invoice OCR systems should ensure the confidentiality and security of sensitive data during the OCR invoicing process.

Audit trails

Audit trails are important for maintaining transparency in OCR invoice processing. They provide a record of all actions taken during the invoice OCR process, allowing you to monitor compliance and trace any errors in the OCR software invoice processing workflow.

Reporting and analytics

Advanced reporting and analytics capabilities allow you to track the performance of your OCR invoice processing system. By analyzing key metrics, you can make informed decisions and improve your invoice OCR workflow. These insights are crucial for optimizing OCR invoicing processes and ensuring the efficiency of your OCR software invoice processing system.

Performance metrics

Track performance metrics within your OCR invoice processing system to ensure accuracy and efficiency. Invoice OCR systems that offer real-time reporting help you monitor the effectiveness of your OCR invoicing process, enabling continuous improvements.

Insights for decision-making

Your OCR invoice processing software should provide actionable insights through analytics. By understanding patterns and trends within your invoice OCR process, you can make informed decisions that enhance the efficiency of OCR software invoice processing.

Support and training

Look for OCR invoice processing software that offers comprehensive support and training. This ensures your team can fully utilize the invoice OCR system, handling any issues that arise. Additionally, having access to a strong support community allows your team to get the most out of OCR invoicing tools.

Comprehensive support

Ensure that your OCR invoice processing software provider offers comprehensive support services. Whether it's troubleshooting or system updates, having reliable support ensures that your invoice OCR solution runs smoothly.

Community and resources

Access to a community and resources enhances your team’s ability to use the system effectively. Engaging with other users can provide valuable tips and insights for optimizing your OCR software invoice processing setup.

Transform your invoice processing with Volopay's Magic Scan

Elevate your OCR invoice processing with Volopay’s Magic Scan. Powered by advanced AI, this tool streamlines invoice OCR, saving you time and reducing errors. With its ability to handle multiple currencies, languages, and bulk submissions, Magic Scan optimizes your OCR invoicing workflow thus ultimately improving your overall invoice management process.

Seamless integration with your accounts payable system ensures real-time updates and enhanced accuracy. Experience the next generation of OCR software invoice processing with Volopay, allowing you to focus on growing your business while automating tedious tasks.

1. AI-powered OCR technology

Volopay’s Magic Scan uses cutting-edge AI-powered OCR invoice processing to automate and accelerate data extraction. This smart invoice OCR technology quickly processes invoices with remarkable accuracy, minimizing manual input.

Whether you're handling printed or digital documents, Magic Scan’s AI ensures that your OCR invoicing tasks are done efficiently. With its intelligent learning capabilities, the system adapts to your needs, ensuring your OCR software invoice processing continues to improve over time, enhancing accuracy and reducing operational delays.

2. Time efficiency

Magic Scan significantly reduces the time spent on OCR invoice processing. By automating data extraction, it enables faster invoice OCR, ensuring that your documents are processed within minutes rather than hours.

With the ability to handle bulk invoices simultaneously, you no longer have to wait for individual documents to be manually reviewed. This increase in speed enhances your overall OCR invoicing workflow, allowing your team to focus on more critical tasks and leaving the repetitive work to the OCR software invoice processing.

3. Multi-language support

Volopay’s Magic Scan supports multiple languages, making it ideal for businesses with global operations. Whether you're handling invoices from different countries, Magic Scan’s OCR invoice processing can accurately extract data in various languages.

This feature enhances the invoice OCR system's versatility, ensuring your business can process invoices from any region. With multi-language support, you’ll streamline OCR invoicing no matter the language, increasing the efficiency of your OCR software invoice processing.

4. Manages multiple currencies

Magic Scan simplifies OCR invoice processing by automatically managing multiple currencies. This feature is essential for businesses dealing with international suppliers. The invoice OCR system quickly recognizes different currencies and adapts the processing accordingly.

By automating this aspect of OCR invoicing, you eliminate errors that often arise when manually converting currencies, streamlining global payments, and ensuring smoother OCR software invoice processing.

5. Enhanced accuracy

Volopay’s Magic Scan excels in delivering enhanced accuracy in OCR invoice processing. By leveraging AI, it captures data more precisely, reducing human errors commonly associated with manual invoice OCR tasks.

Whether you're processing typed or handwritten documents, the system ensures that your OCR invoicing results are reliable. The system’s ability to self-improve with time makes it an essential tool for businesses looking to minimize errors in OCR software invoice processing.

6. Seamless bulk submission

Magic Scan allows for seamless bulk submission, improving your OCR invoice processing speed. This feature enables you to upload multiple invoices at once, ensuring fast and efficient invoice OCR without compromising on accuracy.

Handling bulk documents in a single process saves time and resources, making your OCR invoicing workflow far more productive. This level of efficiency is critical for businesses managing large volumes of invoices in their OCR software invoice processing.

7. Real-time expense updates

Volopay’s Magic Scan ensures real-time expense updates during OCR invoice processing. As soon as invoices are processed, your invoice OCR system will immediately update the relevant expense reports.

This transparency allows you to monitor and track payments effectively, ensuring that your OCR invoicing tasks align with real-time financial data. Having real-time updates within your OCR software invoice processing system ensures accuracy and improves overall financial management.

FAQs

OCR technology can handle a variety of invoices, including printed and digital formats. Whether it’s a PDF, image, or scanned copy, OCR invoice processing ensures accurate extraction. It also supports invoice OCR for different languages and currencies.

OCR technology ensures high-level security during OCR invoice processing. It encrypts data, protecting sensitive information from unauthorized access. This secure invoice OCR system complies with industry standards to safeguard financial documents and prevent breaches during OCR invoicing tasks.

Implementation time for OCR invoice processing varies based on system complexity and integration needs. Typically, invoice OCR solutions are set up within a few weeks, depending on customization and OCR software invoice processing requirements. Continuous training speeds up system optimization.

OCR systems use advanced image correction during OCR invoice processing to enhance poor-quality invoices. Through OCR invoicing, the system adjusts brightness, contrast, and resolution to improve accuracy. However, extremely damaged documents might require manual intervention in invoice OCR workflows.

Yes, OCR software invoice processing extends beyond invoices. It handles a wide range of documents like receipts, purchase orders, contracts, and reports. The flexibility of OCR invoicing ensures seamless processing of financial, legal, and administrative files.

OCR technology processes both printed and handwritten invoices during OCR invoice processing. However, printed invoices result in higher accuracy in invoice OCR. While OCR invoicing can read handwritten text, results may vary based on handwriting legibility in OCR software invoice processing.

In case of a misreading, review and correct the error manually in the OCR invoice processing system. Most invoice OCR platforms allow error correction, improving the accuracy of future OCR invoicing tasks by learning from mistakes within the OCR software invoice processing system.

If the OCR invoice processing system cannot read a section, it flags the error for manual review. This ensures that incomplete invoice OCR tasks are addressed, maintaining accuracy in your OCR invoicing workflow by focusing on hard-to-read areas.

Yes, many OCR invoice processing systems integrate with mobile applications, allowing you to capture invoices on the go. Mobile integration ensures quick invoice OCR, offering convenience and flexibility in your OCR invoicing process for seamless document management.

During OCR invoice processing, the system identifies partial or incomplete invoices and flags them for review. This prevents errors in invoice OCR and ensures that your OCR invoicing process is accurate. Manual review ensures corrections and completes the OCR software invoice processing tasks.

Bring Volopay to your business

Get started now