6 common vendor management challenges and solution

Be it any business, vendors play a key role in getting the work done on time. In the manufacturing industry, you rely on your vendors for raw materials supply. If you don’t focus on building vendor relationships, your vendors might not support you unconditionally.

This is why vendor management matters to anyone in the business world. A vendor management system can help you maintain good relationships and ensure timely payments, illustrating the benefits of a vendor management system in optimizing processes and fostering collaboration.

Not all vendors are great too. There are unreliable and inconsistent vendors too. Managing vendors like this can become an unnecessary headache for you. With this article we will discuss some of the common vendor management challenges faced by businesses and its solutions.

What makes a vendor unreliable?

Some vendors comply with your vendor management policy and cooperate with you throughout the journey. And then some vendors test your patience by opting all the wrong ways.

An unreliable vendor is someone who

● Doesn’t communicate properly and always responds late

● Deliver poor quality goods consistently and don’t take in feedback

● Low or zero follow-ups post-delivery and no customer support

● Not being able to support when your company scales up

● Doesn’t comply with your company’s vendor management policy.

● Overall, providing low value for money

This list can go on depending on your field and industry. When you come across such issues, it can take a toll on your vendor management and the business outcome. You will be pushed to a situation where you must break ties with the current vendor and find a replacement.

In general, vendor management comes with umpteen responsibilities and challenges. An unreliable vendor can make this sound even harder.

6 common vendor management challenges

Unreliable vendors are abundant here. To save yourself from them, vendor management is the only solution. However, it’s not manageable if you prefer outdated vendor management methods.

Here are some vendor management challenges companies face when implementing a vendor management system. More than challenges, these can be taken as a general checklist to ensure that your vendor management system is all-inclusive.

1. Vendor compliance risk

Managing vendors is not child’s play. Without developing prior standards of what you expect from them, it will be hard to measure vendor performance. Every vendor operates differently. It’s your duty to identify who aligns well with your company’s vendor management policy and stays compliant.

Compliance check doesn’t just include their work quality but the overall performance expectations.

2. Vendor reputation risk

You choose your vendors based on affordability, requirements, and other factors, which are a part of your vendor selection criteria. But that doesn’t mean you can settle for less and accept substandard performance.

By choosing the wrong vendor, you can easily land in trouble. So, vendor management requires you to perform background checks to analyze their history. By performing this, you get to know about your vendor beyond what they have told you about themselves.

3. Lack of visibility

As vendor management is a collaborative process, having a centralized application can get everyone their approved level of access to your vendor’s data. Not having access to the vendor data can slow down the vendor management process and pile up payments and other essential tasks.

4. Vendor data storage

So, you have decided to bring in a vendor management system. The big question is where the data is going to be stored. Anything related to your vendor is sensitive information that you have to handle with utmost care.

So, you need a foolproof, safe and secure source to carry the vendor data for as long as you need. Storage remains a challenge for small businesses, as cloud storage seems to be the only safest but expensive option.

5. Manual vendor management system

Manually handling vendor functionalities turns your system prone to errors, inconsistent entries, and information loss. The inefficiencies in manual tasks will prolong the time to correct the past mistakes and include current updates. Picture wasting your employees' time and resources on data that’s good for nothing.

6. Vendor payment risk

Payment issues and risks can peak at any time while managing vendors. Your goal is to send the right amount to the right vendor on time. But depending on your vendor’s location and payment terms and methods, your goal can get affected too.

Late or wrong payments are a sign of unprofessional and sloppy vendor management.

How to protect you business from an unreliable vendor?

It won’t even take a day to cut off your relationship with a subpar, unreliable vendor. But you can meet a similar vendor anytime in the future.

In some cases, the loss can be huge and tangible. Here are the precautionary steps to take to protect your business from such vendors.

While building vendor relationships, you must also be aware that they can turn against you anytime and become untrustworthy.

1. Insurance to protect your business from receiving faulty items, shipping damages/incidents

There cannot be anything more frustrating than receiving damaged goods from vendors. What can bring in more stress is when your vendor fails to acknowledge the mess. Unless you have a robust vendor management policy, it can be impossible to convince the vendor.

Both parties must understand that shipping accidents happen and should be willing to take necessary steps according to the return and acceptance policies of the vendor. To cover the financial losses, it is advisable to go for liability insurance. Remember that happy returns don’t fetch merry experiences all the time.

2. Pay using credit cards for zero liability in case of fraud

Payment frauds and money theft are likely to happen when you make online transactions. Since your vendor is at the receiving end and can see where the payment comes from, they can skillfully commit this crime.

If you use your debit card or savings account, your account and whole funds are at stake as they get exposed. When you pay with credit cards, you get more protection and keep your original account behind the dark screen.

If there is a data-stealing or safety compromise, you can contact the bank, cut off the card and not pay for the expenses made after that.

3. Check invoice receipts to match it with the agreed price

It’s sad that vendors still pull this game to get more money from you. They send you goods first and later send the invoice with an increased charge (which can be an unnoticed mistake too). Always store the purchase order, which contains the list and quantity of the order. This way, you can match the invoice with the purchase order and validate if the quoted amount is correct.

To avoid sending the wrong amount, implement an automated vendor management system that can effectively automate vendor management processes by fetching and sending payments directly to the supplier on time. This ensures accuracy and timeliness in transactions, enhancing overall efficiency.

Additionally, maintaining a strong vendor network can reduce costs for businesses by encouraging competitive pricing and ensuring reliable service from trusted suppliers, minimizing such discrepancies and fostering long-term partnerships.

4. Set up terms and conditions with your vendors

Managing vendors benefit both you and your vendor monetarily and in other terms. In such relationships, laying down the conditions and policies can save some explanations in the future. Have a clear vendor management policy and educate your vendors about it. Whether it is a payment process or accepted shipping mode, sit with them and explain.

In return, learn about their business methods, delivery process, and other policies to not get surprised later. Make customized terms that both you and your vendor agree to and ensure strict adherence from both sides.

5. Ensure a contract note/agreement is in place

Put it in writing! No matter how big or small the deal is, write that down in a contract and legalize it. If you plan to save time by avoiding this formality, you might lose a lot later. This is because you have no proof to back up what you and your vendor have agreed upon.

It is not necessary that a crisis might occur in the future. But this is a measure you need to pull off damage control. A contract can carry the products or services your vendor sells to you, finally negotiated costs, quantity, duration, and other particulars.

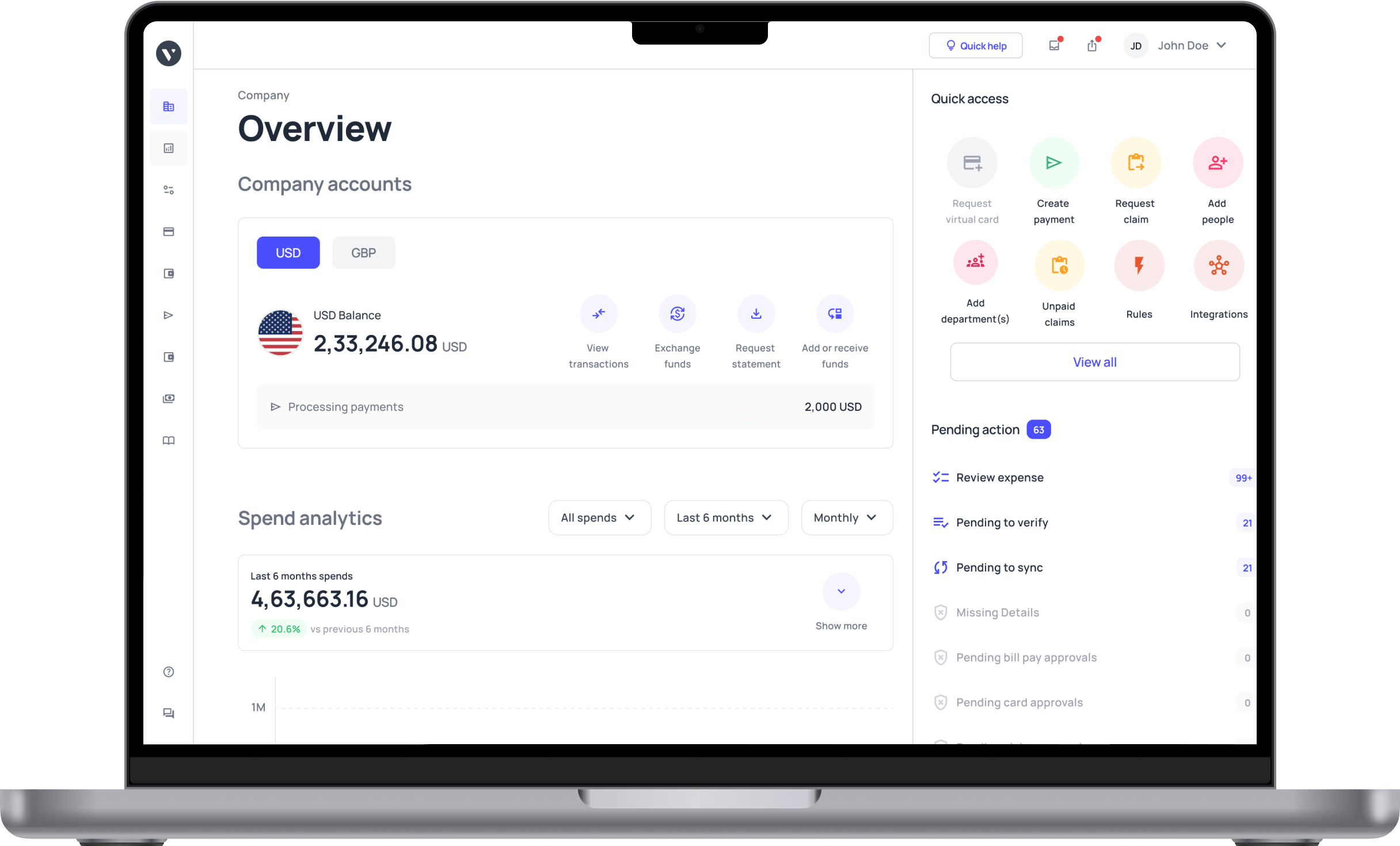

Manage all your vendor payments with Volopay

Vendor payouts are an essential aspect of vendor management. Paying on time helps in building vendor relationships and avoiding conflicts. You need an automated, accurate, and proactive vendor management system for managing vendors smoothly.

With Volopay, you can manage vendor payments effectively and handle even the most troublesome vendors. Whether they send the invoices late or on time, your AP team can quickly process or schedule them.

Vendor data storage is the biggest concern; companies pay a hefty sum to get cloud storage solutions. Volopay lets you manage your vendor database and payment records in a safe and secure fashion.

Whether it is an international or local transfer, Volopay has got you covered. You can make swift international vendor payments. Don’t let distance and increased Fx costs wreak havoc on your vendor relationships.

Integrate your vendor payments automatically as Volopay can connect and work with your other accounting software like Netsuite, Xero and Quickbooks. Save hours of work your employees spend manually taking care of accounts payable tasks and increase accuracy.