Guide to vendor reconciliation process in accounts payable

How do large companies with a significant number of vendors maintain up-to-date vendor payment data? They take the vendor reconciliation process seriously and turn this tedious process into an accomplishable goal.

It’s possible for small and medium-sized businesses to achieve this structuring and maintain accurate records. As vendor payments account for a significant portion of your cash outflow, they must be given importance beyond the settlement stage.

That’s where vendor reconciliation happens. Most accounting teams process double payments when they don’t reconcile accounts payable payments instantly. To achieve optimal business performance and mess-free enterprise resource planning, the vendor reconciliation process is a must.

What is the vendor reconciliation process?

The vendor reconciliation process in accounts payable is a matching activity where you compare vendor documents from different stages.

You will match your paid and unpaid invoices with bank statements or receipts to know how much is paid and how much you still owe them.

Other documents like vendor statements, purchase orders, and goods receipts, can also be included in this process for accurate matching.

A vendor statement is a document that lists all paid and unpaid invoices and credit notes. When these documents are compared in line, every discrepancy will be noted and prepared in the form of a vendor reconciliation report.

Vendor reconciliation workflow for a business

The vendor reconciliation process in accounts payable is crucial for maintaining accurate financial records and strong vendor relationships.

This process involves systematically gathering documents, verifying opening balances, matching line items on vendor statements with invoices, and resolving any inconsistencies.

A thorough approach ensures financial accuracy and fosters transparency and trust with vendors.

Gather documents

The first step of the vendor reconciliation workflow involves collecting all pertinent documents, such as vendor statements, invoices, purchase orders, and payment records. It is essential to verify that these documents are current and comprehensive to prevent any inconsistencies during reconciliation.

Systematic organization of these documents, whether in physical files or digital formats, allows for better accessibility and referencing. The use of accounting software can simplify this step by consolidating all documents on a single platform, thereby improving efficiency and precision.

Checking the opening balance

Once the documents are gathered, the next step is to check the opening balance on the vendor statement against the business's records. The opening balance should match the closing balance from the previous reconciliation period.

Any differences at this stage could indicate errors or omissions in the records. It's essential to verify that all previous transactions have been accounted for and accurately recorded. This step serves as the foundation for a successful reconciliation, ensuring that the starting point is correct.

Match the line items on the vendor statement with the invoices

Once the opening balance is confirmed, the focus shifts to aligning the line items on the vendor statement with the corresponding invoices. This requires a meticulous comparison of each transaction on the vendor statement with the business’s invoices and payment records.

Ensuring all purchases, returns, and payments are correctly recorded and match the amounts and dates on the vendor statement is crucial. This step helps uncover any discrepancies between the vendor's records and the business's records.

Reconcile inconsistencies

Inconsistencies often arise during the matching process, and the next step is to reconcile these differences. Common inconsistencies include missing invoices, duplicate entries, or errors in transaction amounts. Each discrepancy must be investigated thoroughly to determine the cause.

For instance, a missing invoice might be due to delayed delivery or misplacement, while duplicate entries could result from clerical errors. By systematically addressing each inconsistency, the business can ensure that its records align with the vendor's statement.

Resolve inconsistencies

Once inconsistencies are identified, the final step is to resolve them. This may involve contacting the vendor to clarify discrepancies, requesting missing invoices, or adjusting entries in the accounting system.

Clear communication with the vendor is crucial to resolving issues promptly and maintaining a good relationship. Additionally, updating the business's records to reflect any corrections ensures that future reconciliations are more accurate.

Implementing checks and balances, such as periodic reviews and audits, can also help prevent similar issues in the future.

Optimize your finances with AP process automation

Common challenges in vendor statement reconciliation

Like most other financial processes, vendor statement reconciliation also comes with its own unique set of challenges. Here are some hurdles organizations commonly face when working with the vendor reconciliation process in accounts payable:

1. Time-consuming

Accountants have plenty of things on their plates already. To block time to do a time-consuming activity is itself a challenge. It can take hours to verify 100+ lines of entries of all vendors keeping 3 to 4 applications open.

Also, vendor statements are mostly in different formats (PDFs, Excel sheets, printed paper, etc). As the verification process is manual, it’s natural for the task to be a productivity killer and waste time.

It’s bad from employers’ point of view too. No employer would want to waste their employees’ billable hours on gruelling activities.

2. Manually checking all the statements for discrepancies

The objective of the vendor reconciliation process in accounts payable is to find discrepancies between the vendor statements and the ledger. Checking them manually for all statements is a big task that needs all the attention.

Also, it doesn’t stop with spotting the difference of why an entry is absent in one of the records. They must also dive into that and research if it’s a human error or if the payment didn’t get through.

That involves contacting and communicating with other people and departments involved.

3. High volume of transactions

One of the most significant challenges in vendor reconciliation is dealing with a high volume of transactions. Businesses, especially large ones, often engage in numerous transactions with their vendors daily. This volume can make it difficult to track and reconcile each transaction accurately.

The sheer number of entries requires meticulous attention to detail, making the process time-consuming and prone to errors. Manual reconciliation under these conditions can be particularly daunting, leading to missed discrepancies and potential financial inaccuracies.

4. Inconsistent data formats

Inconsistent data formats between the business’s accounting system and the vendor’s statements can complicate the reconciliation process.

Vendors may provide statements in various formats, such as PDF, Excel, or even paper documents, which can be challenging to integrate with the business’s digital records.

This inconsistency requires additional time and effort to standardize the data before reconciliation can begin. The lack of a uniform format can also lead to errors in data entry, further complicating the reconciliation process.

5. Missing or inaccurate information

Missing or inaccurate information is another common issue that hampers vendor reconciliation. Incomplete records, such as missing invoices or payment details, can create discrepancies that are difficult to resolve.

Inaccurate data entries, whether due to human error or system glitches, can lead to mismatches between the business’s records and the vendor’s statement.

These issues necessitate additional time and resources to investigate and correct, delaying the reconciliation process and increasing the risk of financial misstatements.

6. Lack of automation

Numerous businesses continue to use manual processes for vendor reconciliation, which tend to be inefficient and susceptible to errors. Without automation, employees are required to manually compare line items, verify balances, and resolve discrepancies.

This manual method is both time-consuming and more likely to result in errors due to fatigue or oversight. Automated reconciliation tools can enhance the process by automatically matching transactions, identifying discrepancies, and generating reports, thus reducing the workload and improving accuracy.

7. Duplicate transactions

Duplicate transactions pose a significant challenge in vendor reconciliation. These can arise from multiple entries of the same invoice or payment, either due to clerical errors or system faults. Identifying and resolving duplicate transactions is crucial to avoid overpayments and ensure accurate financial records.

However, detecting duplicates can be tricky, especially in a high-volume environment where transactions may not be immediately recognizable as duplicates. Businesses need robust processes and tools to identify and eliminate these duplicates efficiently.

8. Communication gaps with vendors

Effective vendor communication is crucial for successful reconciliation. Communication gaps may occur for several reasons, including different time zones, language barriers, or delayed responses. Such gaps can hinder the timely resolution of discrepancies and extend the reconciliation period.

To address these challenges, it's important to establish transparent communication channels and keep consistent contact with vendors. Moreover, appointing a specific point of contact for each party can simplify the communication flow and expedite the resolution of any issues.

9. Complex vendor agreements

Vendor agreements frequently include specific terms and conditions that can complicate the reconciliation process. These terms may encompass discounts, rebates, or special payment arrangements that must be accurately recorded.

Misunderstanding or neglecting these terms can cause discrepancies between the vendor’s statement and the business’s records. To overcome this challenge, businesses must ensure they fully comprehend and correctly implement the terms of each vendor agreement.

This might require regular reviews of the agreements and training for employees involved in the reconciliation process.

What are the essential metrics to track in vendor reconciliation?

Monitoring key metrics in vendor payment reconciliation yields critical insights into the process's efficiency, accuracy, and overall effectiveness.

By tracking metrics such as reconciliation cycle time, accuracy rate, discrepancy resolution time, cost per reconciliation, number of unresolved discrepancies, timeliness of vendor payments, and compliance with reconciliation frequency, companies can pinpoint improvement opportunities and devise strategies to enhance the reconciliation process.

Reconciliation cycle time

Reconciliation cycle time measures the total time taken to complete the reconciliation process from start to finish. This metric is vital for understanding how efficiently the reconciliation process is being managed.

A shorter cycle time indicates a streamlined process, whereas a longer cycle time may suggest bottlenecks or inefficiencies that need addressing. Reducing the reconciliation cycle time can lead to faster identification and resolution of discrepancies, improved cash flow management, and enhanced vendor relationships.

Accuracy rate

The accuracy rate is a measure of how correctly the reconciliation process is performed. It reflects the percentage of reconciliations that are free from errors or discrepancies.

A high accuracy rate indicates that the reconciliation process is being conducted meticulously and that the financial records are reliable. Conversely, a low accuracy rate suggests frequent errors that could undermine the integrity of financial statements.

Regularly tracking this metric helps businesses identify areas needing improvement and implement measures to enhance accuracy.

Discrepancy resolution time

The discrepancy resolution time measures the average duration required to address discrepancies after their identification. This metric is vital for evaluating the reconciliation process's efficiency and the team's promptness.

Extended resolution periods can hinder the reconciliation process and jeopardize vendor relations. By tracking this metric, businesses can pinpoint persistent problems, enhance vendor communication, and devise methods to accelerate the resolution of discrepancies.

Cost per reconciliation

The cost per reconciliation metric calculates the total expenses incurred during the reconciliation process. This includes the cost of labor, technology, and any other resources used.

Understanding the cost per reconciliation is essential for evaluating the financial efficiency of the process. High costs may indicate inefficiencies, such as excessive manual labor or outdated systems.

By tracking this metric, businesses can identify opportunities to reduce costs, such as investing in automation tools or optimizing workflows.

Number of outstanding discrepancies

The total number of outstanding discrepancies is a measure of unresolved issues at any point in time. This metric sheds light on the reconciliation process's efficiency and the team's capacity to manage discrepancies as they occur.

An elevated count of outstanding discrepancies could signal process inefficiencies, resource shortages, or vendor communication problems. Consistent tracking of this metric enables businesses to address unresolved issues promptly and implement measures to decrease their occurrence.

Vendor payment timeliness

The timeliness of vendor payments measures the promptness with which payments are made to vendors according to agreed-upon terms. This metric is vital for preserving strong vendor relationships and upholding the business's image as a dependable partner.

Delays in payments can strain these relationships, incur potential penalties, and cause supply chain disruptions. Monitoring this metric allows businesses to detect and address payment process delays, ensuring vendors receive timely payments.

Reconciliation frequency compliance

Reconciliation frequency compliance measures how consistently the reconciliation process is conducted according to the established schedule. Regular and timely reconciliations are essential for maintaining accurate financial records and promptly identifying discrepancies.

This metric helps ensure that the reconciliation process is not neglected or delayed. Tracking compliance with the reconciliation schedule enables businesses to identify lapses and reinforce the importance of timely reconciliations.

Automate your business’s AP process now

Why is vendor statement reconciliation important for your business?

The vendor reconciliation process in accounts payable forms an indispensable part of business operations. All businesses need to work with and pay some form of vendors, contractors, or suppliers and these payments need to be reconciled. Vendor payment reconciliation must be practiced with regularity and some of the more general benefits of regularly reconciling payments made to vendors include:

Prevention of costly mistakes

The vendor reconciliation process in accounts payable helps prevent costly mistakes arising from inaccuracies in financial records.

Mistakes like overpayments, duplicate payments, or missed payments can have significant financial consequences. Regular reconciliation allows businesses to catch and correct errors before they become larger issues.

Preventing these mistakes saves money and reduces the administrative burden of resolving disputes and rectifying errors, contributing to overall operational efficiency.

Improved cash flow management

Effective vendor reconciliation significantly improves cash flow management. Keeping track of all transactions and promptly addressing discrepancies ensures an accurate reflection of the business's cash position.

This precision allows for better planning and allocation of resources, ensuring sufficient cash is available to meet operational needs and invest in growth opportunities.

Improved cash flow management helps maintain liquidity, reducing the risk of financial strain and enabling smoother day-to-day operations.

Stronger vendor relationships

Regular vendor reconciliation fosters stronger relationships with suppliers. Accurate and timely reconciliation ensures that vendors are paid correctly and on time, which enhances trust and reliability.

This positive relationship can lead to more favorable terms, such as discounts or extended credit periods, and can also make vendors more willing to collaborate and support the business during challenging times.

Moreover, resolving discrepancies quickly and transparently demonstrates professionalism and respect for the vendor's business, further strengthening the partnership.

Enhanced financial accuracy

Vendor statement reconciliation plays a crucial role in ensuring the financial accuracy of a business. By regularly comparing internal records with vendor statements, businesses can identify and correct discrepancies, ensuring that all transactions are accurately recorded.

This meticulous process helps prevent errors in financial statements, which can have significant implications for decision-making, reporting, and compliance.

Enhanced financial accuracy also builds confidence among stakeholders, including investors, auditors, and management, by demonstrating that the business maintains precise and reliable financial records.

Increased financial transparency

Financial transparency is crucial for fostering trust among stakeholders and adhering to regulatory standards. Vendor reconciliation enhances this transparency by offering a detailed and precise account of the company's financial dealings.

Consistent reconciliation facilitates the prompt identification and documentation of any irregularities, guaranteeing the reliability and thoroughness of financial reports.

Such transparency is vital for complying with regulations, succeeding in audits, and preserving the trust of investors and other interested parties. Moreover, it encourages internal responsibility and aids in making more informed financial choices.

Streamlined business operations

Vendor reconciliation is a powerful tool for streamlining business operations. By implementing a systematic reconciliation process, the time and effort needed to manage accounts payable are greatly reduced.

The use of automation tools can boost efficiency by automatically matching transactions and highlighting discrepancies for review. Such streamlined operations liberate valuable resources, permitting employees to concentrate on strategic tasks instead of manual reconciliation.

The resulting efficiency gains lead to cost reductions and heightened productivity, allowing the business to function more efficiently and maintain a competitive edge.

A step-by-step approach to the vendor reconciliation process

We have put together the best practices that you can follow for an effective vendor reconciliation process. If followed step by step, you will have an efficient vendor reconciliation method that produces fewer errors.

1. Conform supplier statements to one single statement template

When your vendor documents are in different formats, it can take longer to go through them. Confine all your vendor statements in one format (either PDF or a sheet or any comfortable form) and proceed with the reconciliation.

This not just brings uniformity but also helps in organizing them in a particular location. A Uniform template simplifies the job for reconciliation solutions to load and verify automatically.

2. Inspect the line items accurately

The first step in the vendor payment reconciliation process is to meticulously inspect each line item on the vendor statement. This involves a detailed review of all transactions, including invoices, payments, credits, and debits.

Ensuring that every entry is accurate and corresponds to an actual transaction is crucial. This step helps in identifying any discrepancies early in the process, such as missing invoices or incorrect amounts.

Accurate inspection lays the groundwork for a smooth and effective reconciliation, minimizing errors and ensuring that all financial data is reliable.

3. Match the vendor statements

After an accurate inspection of the line items, the next step involves reconciling the vendor statements with the company's internal records. This requires a thorough comparison of each transaction listed on the vendor statement against the corresponding entries in the company's accounting system.

This procedure is crucial for detecting any inconsistencies, like discrepancies in amounts or dates, across the two records. Accurate recording and accounting of all transactions are imperative to uphold financial precision and transparency.

4. Allocation of credit notes and discounts

After matching the vendor statements, the next step is to allocate credit notes and discounts accurately. Credit notes issued for returned goods or billing adjustments need to be correctly recorded and matched with the relevant invoices.

Similarly, any discounts agreed upon, such as early payment discounts, should be applied accurately to the corresponding transactions. Proper allocation of credit notes and discounts ensures that the business pays the correct amount to the vendor, preventing overpayments and maintaining accurate financial records.

5. Mark the mismatched entries and clear them with the vendors

The anomalies can be for these reasons.

• The payment must have gone long back but is received very late. Such payment entries will be present in both records or one of them but with timing differences.

• Omissions which is mainly because of human errors.

• One or both parties are missing documents to prove the transaction resulting in improperly aligned entries.

• In some cases of online invoicing, vendors delete lines that are paid. If you don’t reconcile on time, you will end up paying again, noticing the difference in the amount owed.

And, if you cannot match a vendor statement entry with either a credit note or an invoice in the system and are using an invoicing software, then check the invoices that are stalled for any reason.

Check invoices with errors or unapproved invoices.

Check in the Goods Receipt Invoice Receipt (GRIR) record to see if the receipt is regarding goods/services that are received but not invoices. See if you can identify the PO number in the statement.

Verify this against your valid purchases and investigate further.

6. Conduct regular reviews and audits

Regular reviews and audits are essential components of the vendor reconciliation process. Periodic reviews help in ensuring that the reconciliation process is consistently followed and that any discrepancies are promptly addressed.

Audits, whether internal or external, provide an additional layer of scrutiny, ensuring that the reconciliation process is thorough and accurate. Regular reviews and audits help in maintaining financial integrity and compliance, and they provide valuable insights for improving the reconciliation process.

7. Continuous improvement

The final step in the vendor payment reconciliation process is to focus on continuous improvement. This involves regularly evaluating the reconciliation process to identify areas for enhancement.

Implementing feedback from reviews and audits, adopting new technologies, and updating procedures can help streamline the process and improve its efficiency.

Continuous improvement ensures that the reconciliation process evolves to meet changing business needs and remains effective in maintaining financial accuracy and transparency.

Encouraging a culture of continuous improvement also helps in fostering a proactive approach to identifying and resolving issues before they become significant problems.

How does automated vendor reconciliation differ from manual processes?

The automated vendor reconciliation process in accounts payable differs significantly from its manual counterpart in terms of speed, accuracy, scalability, real-time reporting, and cost efficiency.

This comparison explores these differences, highlighting how automation enhances efficiency and accuracy, scales seamlessly with business growth, and provides timely financial insights, thereby improving overall financial management.

Speed and efficiency

● Automated process

Automated vendor reconciliation significantly enhances speed and efficiency. The automation process finalizes reconciliations much quicker than manual techniques. These systems swiftly gather, sort, and align transaction data from multiple sources autonomously.

With the ability to process large data volumes rapidly, they cut down the reconciliation period from days to mere minutes. Automation also removes the necessity for labor-intensive manual data entry, prone to postponements.

This acceleration permits more regular reconciliations, keeping financial records continuously updated.

● Manual process

In contrast, manual reconciliation is much slower and less efficient. It requires employees to manually collect and review transaction data, match line items, and identify discrepancies.

This process is labor-intensive and time-consuming, often taking several days to complete for even moderate volumes of transactions. Manual reconciliation also involves repetitive tasks that can lead to employee fatigue and decreased productivity.

The slow pace of manual processes limits the frequency of reconciliations, potentially leading to outdated financial records and delayed discrepancy resolution.

Accuracy and error reduction

● Automated process

Automation excels in accuracy and error reduction. Automated systems follow precise rules for transaction matching and discrepancy identification, greatly reducing the risk of human error.

These systems can cross-verify data across multiple records and highlight inconsistencies that might be missed manually. This heightened accuracy ensures reliable financial records, which are crucial for effective financial reporting and decision-making.

● Manual process

The manual vendor reconciliation process in accounts payable is more prone to errors due to human involvement in data entry, transaction matching, and discrepancy identification. Mistakes can result from oversight, fatigue, or misunderstanding, leading to inaccurate financial records.

The need to correct these errors adds time and effort, further diminishing the efficiency of the manual process and potentially causing serious consequences for financial reporting and compliance.

Scalability

● Automated process

Automation offers exceptional scalability in vendor reconciliation. Automated systems can manage increasing transaction volumes without requiring additional time or effort.

As a business grows, these systems can seamlessly accommodate higher workloads, ensuring continued efficiency and effectiveness in the reconciliation process.

This scalability allows businesses to maintain accurate financial records without needing extra personnel or resources.

● Manual process

Manual reconciliation lacks scalability. As transaction volumes grow, the time and resources required for manual reconciliation increase proportionally. Scaling manual processes would necessitate hiring more staff, which adds to operational costs and complexity.

Moreover, the likelihood of errors and inefficiencies rises with increased transaction volumes, making manual reconciliation increasingly impractical for large or rapidly growing businesses.

Real-time reporting and insights

● Automated process

One of the key advantages of automated vendor reconciliation is real-time reporting and insights. Automated systems can continuously process and update transaction data, providing real-time visibility into financial records.

This capability allows businesses to generate up-to-date reports and gain insights into their financial health at any time. Real-time reporting enables proactive decision-making, timely discrepancy resolution, and enhanced financial control.

Businesses can quickly identify trends, monitor cash flow, and address issues as they arise.

● Manual process

Manual reconciliation does not offer real-time reporting. The time-consuming nature of manual processes means that financial data is only updated periodically, leading to potential delays in reporting.

This lag can result in outdated financial information, which hampers timely decision-making and discrepancy resolution. Businesses relying on manual reconciliation may struggle to maintain accurate and current financial records, limiting their ability to respond quickly to financial issues and opportunities.

Cost efficiency

● Automated process

Automated vendor payment reconciliation tends to be more cost-effective over time. Although automation technology requires an upfront investment, the subsequent operational costs are usually reduced.

Automation diminishes the necessity for substantial manual work, which translates into personnel cost savings. Moreover, the enhanced precision and swiftness of automated reconciliation decrease the likelihood of expensive mistakes and the efforts needed for corrections.

As time passes, the financial benefits from lowered labor and error-related costs can compensate for the initial automation expenditure.

● Manual process

Manual reconciliation is less cost-efficient due to the high labor costs associated with manual data entry and transaction matching. The need for a larger workforce to handle increasing transaction volumes adds to operational expenses.

Furthermore, the higher error rate in manual processes can lead to significant costs related to error correction, missed discrepancies, and potential compliance issues. The cumulative costs of labor and error-related expenses make manual reconciliation a more expensive option over time.

Automate invoices and payments with Volopay!

How can your business benefit from automated vendor reconciliation?

The efforts you put in to pull execute the reconciliation are worth it. But the benefits are splendid when you have an automated reconciliation solution. Some noteworthy benefits of the vendor reconciliation process are:

Enhance fraud detection and prevention

Automated vendor payment reconciliation greatly improves fraud detection and prevention in businesses. These automated systems come with sophisticated algorithms and analytics capable of swiftly spotting irregular patterns or inconsistencies in transaction data.

With constant transaction monitoring, they can identify potential fraud much sooner than traditional manual processes. Moreover, automation minimizes the chance of human error, which can inadvertently conceal fraud.

Strengthened fraud detection and prevention help preserve the financial integrity of the business and decrease the risk of incurring losses from fraudulent activities.

Streamline compliance and reporting

Compliance and reporting, crucial aspects of financial management, can be enhanced by automated vendor reconciliation. Such systems guarantee the accuracy, currency, and regulatory adherence of financial records.

They facilitate the rapid production of detailed and accurate reports, simplifying compliance with regulations and audit preparation. Moreover, automation offers an easily accessible audit trail, promoting transparency and accountability in financial reporting.

Streamlined compliance and reporting processes help businesses evade regulatory fines and foster trust among stakeholders.

Integration with financial systems

A major benefit of the automated vendor reconciliation process in accounts payable is the seamless integration it offers with current financial systems. These tools can connect with accounting software, enterprise resource planning (ERP) systems, and various financial management platforms.

Such integration guarantees smooth data transfer between systems, lessens the necessity for manual input, and decreases mistakes. Integrated systems afford a comprehensive perspective of a business's financial status, which aids in better-informed decision-making.

The improved efficiency from this integration contributes to the optimization of financial operations.

Enhanced vendor relationship management

Automated vendor reconciliation is key in improving vendor relationship management. Prompt and precise reconciliation guarantees that vendors receive accurate payments on schedule, which builds trust and dependability.

Automation grants vendors instant access to payment updates and reconciliation records, enhancing clarity and dialogue. Robust vendor relationships may result in better terms, like discounts and longer payment durations, and increase vendors' readiness to assist the business in difficult periods.

Ultimately, better vendor relationship management leads to a stronger and more effective supply chain.

Invoice automation

Automated vendor reconciliation also provides significant benefits to businesses by streamlining the invoice processing workflow. These systems facilitate invoice management by automatically extracting and matching data from electronic invoices, thus minimizing the need for manual data entry.

Such automation not only speeds up the processing of invoices but also diminishes the potential for errors that come with manual input. With timely and precise recording of invoices, companies can expedite approval and payment processes.

Enhanced efficiency fosters robust vendor relations and may lead to early payment discounts, thereby improving cash flow management.

Integration with accounting system

Using automated systems for vendor reconciliation process in accounts payable offers the significant advantage of seamless integration with current accounting systems. These tools connect effortlessly with accounting software, facilitating the synchronization of data in real time.

Such integration ensures accurate recording of all financial transactions in the accounting system, thereby obviating the necessity for redundant entries. Real-time updates enable businesses to maintain precise financial records and obtain an all-encompassing perspective of their fiscal status.

Eliminating manual data entry not only curtails errors but also conserves critical time, freeing finance teams to focus on more strategic tasks.

Manage all vendor details and payment data

Automated vendor reconciliation allows businesses to efficiently manage all vendor details and payment data in one centralized platform. This centralization provides easy access to comprehensive vendor information, including contact details, payment terms, and transaction histories.

With all relevant data in one place, businesses can quickly resolve discrepancies, track payment statuses, and ensure timely payments.

Effective management of vendor details and payment data also enhances vendor relationships by providing transparency and reliability in financial dealings.

Comprehensive financial tools

Automated reconciliation systems often come with comprehensive financial tools, including corporate cards and expense management systems. These tools enable businesses to streamline expense tracking and reporting, ensuring that all expenditures are accurately recorded and reconciled.

Corporate cards can be integrated into the reconciliation process, allowing for automated matching of card transactions with vendor invoices. Expense management systems further simplify the process by categorizing expenses, generating automated expense reports, and ensuring compliance with corporate policies.

These tools provide a complete financial management solution, enhancing control and oversight of business expenditures.

Boost productivity

A business's overall productivity can be significantly enhanced with the help of an automated vendor reconciliation system.

It reduces the time and effort required for manual reconciliation, enabling employees to dedicate their attention to higher-value tasks such as financial analysis, strategic planning, and vendor relationship management.

Automation eliminates monotonous tasks, decreases employee burnout, and lowers the likelihood of mistakes. This boost in productivity contributes to more streamlined operations, facilitating the more strategic allocation of resources and improved financial outcomes.

Save time with automated invoice processing

Large-scale businesses that receive heaps of invoices don’t have time to inspect statements one at a time. They rather employ digital solutions that do end-to-end invoice automation.

It saves time and serves as a useful registry when reconciliation is performed. The software has every invoice that the company has received, leaving no room for discrepancies.

Or even if it’s spotted, you can always find the source. That’s how smart businesses keep their accountants engaged in important tasks where human supervision is mandatory.

Easily track and manage invoices

Automated accounting systems collect and enter invoice details as soon as they arrive. You will have ways to convert your paper invoices into electronic ones.

Therefore, you won’t lose any, or worse, have a hard time finding it during the reconciliation process. Apart from reconciliation, timely vendor payments will also be taken care of.

Helps in avoiding payment processing errors

Mistakes in invoice entry are disastrous. You may waste both your time and money and pay later. There are endless possibilities for errors to happen in the manual processing environment.

Many companies don’t realize such mistakes till an audit happens or forget it altogether. But invoice processing applications automatically capture them and have confirmation popups to review every action.

Automated accounting reconciliation

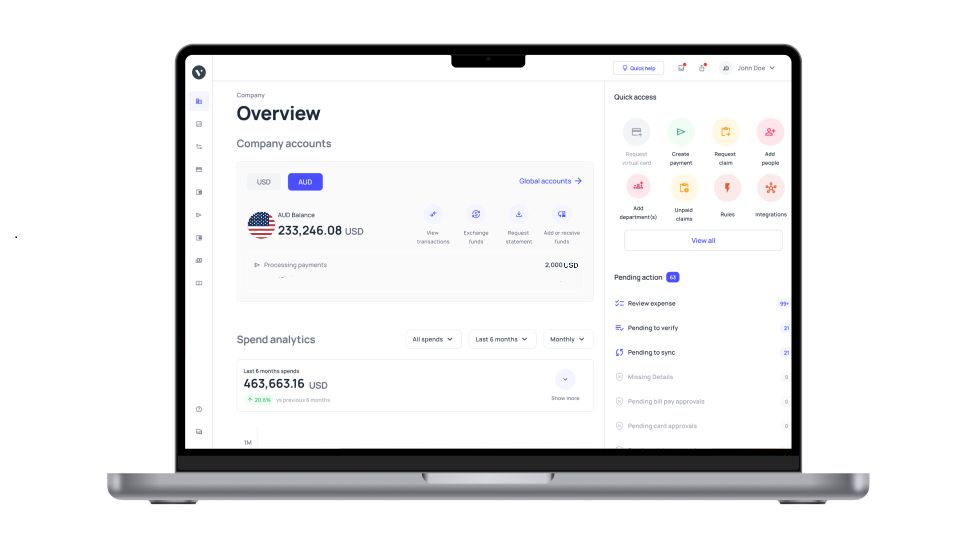

Modern accounting applications like Volopay reduce manual processing and help with achieving instant accounting reconciliation. Successfully made a payment and have no follow-ups regarding it?

You might as well reconcile it with one click to automatically update it in your GL. These applications come with extensive tools required to manage your accounts payable single-handedly.

Along with this, they come with integration features to connect with other accounting systems, making quick reconciliation possible.

Digital audit trail and real-time insights

In a complex accounting environment, understanding each entry in a GL requires effort. It leads to a series of conversations or emails tagging every related department. Digital audit trails put an end to these distressing email threads.

You know what a payment is and track its source with digital audit trails. There will be increased transparency among teams.

With the availability of real-time accounting data on hand, the finance teams can make data-backed financial decisions.

Volopay helps you streamline the vendor reconciliation process efficiently

Not just vendor payments, every business payment must be streamlined and auto-reconciled for a pain-free accounting experience.

That’s what Volopay does, giving accountants time to breathe. Our motto is simple. Automate, Pay, Integrate. Here is how we help our customers achieve ultimate accounting standards at the best prices.

• Invoice automation from start to end - receive invoices and process them automatedly. Set up approval systems and notify the approvers in a noticeable fashion. Schedule and pay right on time with our accounts payable system.

• Integrate with every accounting app you use and transfer data from one another seamlessly. Volopay works well with most common accounting apps like Quickbooks, Netsuite, Zero, and others.

• Three-way verification of invoices - verify your invoices with PO to pay correctly.

• Manage all your vendor and their payment data in one place. Update this from time to time.

• Other than invoice automation, you also can have corporate cards, monthly credits, expense reports, and payroll.

Automate your billing and accounting reconciliation with Volopay today and help your employees work productively.

Manage your entire accounts payable life cycle!

FAQs

Yes, automated vendor payment reconciliation software can integrate seamlessly with existing accounting systems, enabling real-time data synchronization. This integration ensures accurate financial records, reduces manual data entry, and enhances overall efficiency by providing a unified view of financial transactions.

Timely vendor statement reconciliation is crucial for maintaining accurate financial records, preventing discrepancies, and ensuring that vendors are paid correctly and on time. It helps avoid potential financial disputes, improves cash flow management, and fosters strong relationships with vendors.

Outsourcing vendor reconciliation can improve efficiency in accounts payable cycle by leveraging specialized expertise, reducing the workload on in-house teams, and ensuring timely and accurate processing of transactions. This allows internal resources to focus on more strategic tasks, improving overall financial operations.

Precise vendor reconciliation process in accounts payable is crucial as it guarantees the correct recording of all financial transactions, which upholds the integrity of financial statements.

It aids in efficient cash flow management, minimizes the risk of discrepancies, and ensures adherence to financial regulations, thus serving a vital function in comprehensive financial management.

Vendor reconciliation is integral to internal audit processes, offering a comprehensive and precise record of financial dealings. It aids auditors in confirming the accuracy of financial accounts, spotting inconsistencies, and ensuring adherence to accounting regulations, thereby facilitating a comprehensive and efficient audit.

Yes, automated vendor reconciliation can reduce operational costs by minimizing manual labor, reducing errors, and streamlining processes. The efficiency gained from automation leads to faster processing times, fewer mistakes, and lower administrative costs, ultimately contributing to cost savings for the business.

Incorrect vendor reconciliation may result in financial discrepancies, leading to overpayments or missed payments. This can harm vendor relationships and create cash flow problems.

Additionally, it can cause inaccurate financial reporting, raise compliance risks, and lead to potential legal and reputational damage for the company.

Volopay offers a high degree of customization with its flexible features, which can be tailored to the unique needs of diverse businesses. It is adept at managing expenses, integrating with accounting systems, and configuring approval workflows, making it adaptable to a range of business requirements.

Automation streamlines the vendor reconciliation process in accounts payable through the automatic matching of transactions, identification of discrepancies, and real-time updates to financial records.

This eradicates the need for manual data entry and minimizes the likelihood of errors, resulting in a more effective and precise reconciliation process.

Yes, Volopay can handle multiple payment methods, providing businesses with the flexibility to manage various types of payments seamlessly. This capability supports efficient payment processing and helps streamline financial operations across different payment platforms.