Purchasing card (P-card) - Meaning, types, and benefits

Companies are becoming more efficient with the advancement of technology. To eliminate issues relating to spending, P-cards are introduced. It stands for Purchasing cards.

A purchasing card is quite beneficial for a business as it helps in the efficient management of business spending.

Purchasing cards offer the advantage of initiating electronic business payments for the purpose of purchasing goods & services. The purpose and meaning of p-cards should be clearly understood before acquiring them.

What is a purchasing card and where can it be used?

Purchasing cards are quite important when your employees need to make electronic payments on behalf of the company. Employees can directly pay using a corporate purchasing card for business expenses.

P-cards can make vendor payments with security and efficiency. It also helps in processing utility bills for small-scale businesses. This card is generally acquired by the government or corporate sectors.

The purchasing card is issued to a business entity. A person to whom the card is allocated by an employer is known as the cardholder. A p-card meaning should be clearly understood.

Purchasing card for business is not merely a plastic card issued to companies. Purchasing cards can also convert into account numbers.

How purchasing card payments work?

Employees must have used business credit cards or debit cards. A corporate purchasing card is used in a similar manner. P-cards are issued with a card number, CVC code, and an expiry date. They can be used either online or in-store.

It is essential to know that purchasing cards are completely similar to the merchants who accept payments initiated by the cardholder. P-card is valid because it contains the name of the organization to whom the card is issued.

The payment processing system of purchasing cards is similar to credit cards. Corporate purchasing cards bring relief to businesses because it assists in managing business spending in a systematic way.

Let us understand what is purchasing card used for with an example-

Suppose that an employee requires new software to work on a business project. An employee would need to wait for the manager's approval in the absence of a purchasing card.

With p-cards, the employees can initiate a request through their p-card software. Managers receive it within seconds and approve it on time. They need not leave their desk for approval purposes.

Once the request is approved, employees get access to the funds. They can easily purchase resources without the employer's interference. Later, the payment receipt is directly sent to the finance department to update their accounting entries.

Types of purchasing cards

All purchasing cards have a relatively similar goal, which is to improve and streamline an organization’s expense management. However, there are several different types of cards that may suit your needs better than others.

1. Corporate purchasing cards

All types of purchasing cards are typically designed for organizations, but a corporate purchasing card is specifically aimed at companies and corporations.

You will need to be a registered company to apply for corporate purchasing cards. These can be issued to employees for them to use as a charge card.

2. Business purchasing cards

Like corporate purchasing cards, a business purchasing card is a type of commercial card intended to make purchases on behalf of your business.

It’s a generalized card that can be used to make all sorts of business purchases, such as office supplies and employee expenses. Typically, there are fewer requirements for a business card.

3. Government purchasing cards

Like businesses, government bodies have to make expenses to ensure that they run smoothly.

They can take advantage of government purchasing cards to do this, which will help them manage their budgets more efficiently. These are relatively similar to purchasing cards for business entities but tailored to government bodies.

4. Non-profit organization purchasing cards

Non-profit organizations might not be eligible for certain purchasing cards, such as corporate purchasing cards.

The good news is that several banks and card providers also offer purchasing cards specific to non-profit organizations. These may have special offerings such as a 0 USD annual fee or no interest rates on purchases.

5. Travel purchasing cards

Traditional, travel corporate cards function very similarly to personal credit cards. The biggest difference is that they are used specifically to make business travel expenses.

However, travel purchasing cards have an added layer to them, allowing managers and executives to set further spending limits before the cards are used for travel purposes.

6. Fleet purchasing cards

Fleet purchasing cards, often referred to as just fleet cards, are cards your employees can use to make vehicle expenses.

These cards are typically issued to employees who work with the company’s transportation, with usage such as fuel, maintenance, parking, and more. It is one of the best payment methods to track fuel expenses.

7. Virtual purchasing cards

A virtual purchasing card isn’t all that different from its standard physical counterpart. They function almost exactly the same, except virtual cards don’t have a physical form.

There are also some more flexible features with virtual purchasing cards, such as the ability to customize expiry dates and adjust spending parameters.

8. One-time use purchasing cards

With virtual cards, you get the ability to also issue only single-use cards. These one-time-use purchasing cards are useful when you don’t intend to make a repeat purchase with the vendor.

They introduce a higher level of security as they expire after their initial transaction, rendering the card data useless in the future.

9. Travel and entertainment (T&E) Cards

As the name suggests, travel and entertainment, or T&E cards are used to make purchases related to the two categories.

These are useful for activities such as business trips, coffee meetings, client dinners, and more. Every employee equipped with a T&E purchasing card can easily make these purchases.

Perfect corporate card solution for your business

P-cards vs. corporate cards

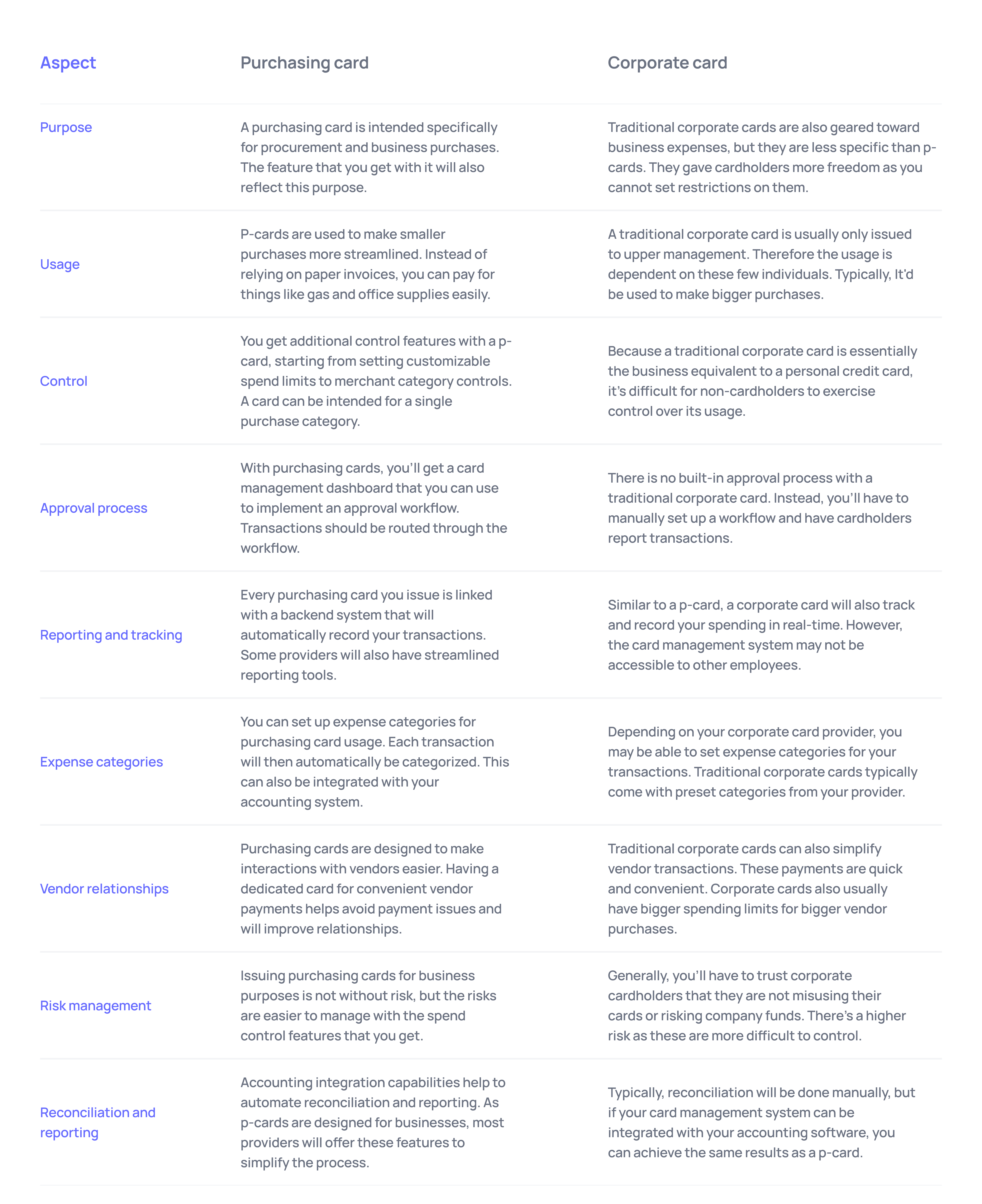

As a general rule, corporate cards are now used to define many different types of cards, including corporate purchasing card. However, there are some key differences between a purchasing card and a traditional corporate card. One may be geared toward mass employee usage, while the other is largely used by upper management and executives.

Pros and cons of using p-cards

Pros

● Streamlined procurement

The procurement process is notoriously long and complicated, but it doesn’t have to be.

Using a corporate purchasing card is more efficient for smaller purchases than a bank transfer. Employees can easily swipe the card or enter card data online to make a purchase.

● Cost savings

There’s a lot of administration work that needs to be done to manage paper invoices effectively.

Using a p-card for your business purchases helps you eliminate the admin costs associated with procurement. You also will be spending less on papers and storage.

● Improved efficiency

When your procurement process is streamlined, the overall business operations will also become more efficient.

For one, there’s less manpower required to procure goods or services from your vendors. There’s also no wait time necessary when you need something immediately.

● Enhanced vendor relationships

The more streamlined your vendor payments are, the happier your vendors will be.

You’ll ensure that payments are accurate and timely with a p-card. Not only are you avoiding late fees, but you’ll also instill trust in your vendors and improve relationships.

● Transaction monitoring

Every time an employee swipes their purchasing card or uses it to make an online purchase, the transaction details will be updated in real-time on your card management system.

If a card is misused or an inappropriate transaction is made, managers can spot and address it immediately.

● Flexible spending limits

Using purchasing cards for business purposes allows you to set individual spending limits for each card you issue.

You can even set other spending parameters, such as which vendors or merchant categories a card can be used for.

● Easier expense tracking

Most purchasing cards have a dedicated card management and tracking dashboard.

Every purchase made through a p-card will be automatically recorded on the dashboard, making it easier to track expenses. All it takes is a few clicks to see how your money is used.

● Reduced cash handling

While cash can be a fast way to make payments, they’re also risky.

You can misplace them and there’s no easy way to track them. By using a purchasing card, you’re reducing the amount of cash you need to handle.

Cons

● Risk of misuse and fraud

Without proper procedures and guidelines, there’s a higher risk of misuse and fraud with purchasing cards.

Your employees will have easy access to company funds when you equip them with cards, so it’s important to ensure that card usage is tracked in real-time.

● Data security concerns

It’s understandable to be concerned about your data security when phishing and skimming are common fraud attempts.

Not to mention that using purchasing cards means trusting your data with a third party. You’ll have to ensure that your personal and card data is not misused.

● Non-compliance

An employee can unfortunately choose to disobey company or industry policies and rules on procurement and card spending.

This results in non-compliance and could be an issue for the entire organization. If your business is not enforcing its policies, you could end up with penalties.

● Transaction fees

Your purchasing card provider will charge a percentage on each transaction you make.

These are typically charged to vendors as the merchants, but if you use cards for vendor payments, your vendors might include a card surcharge when you make the payment.

● Limited supplier acceptance

While using purchasing cards is good for streamlining the procurement process, not all your suppliers accept cards as a payment method.

There could also be a minimum amount for card transactions, which adds more limitations. Your p-card may not be an option everywhere.

● Accountability challenges

Issuing a purchasing card effectively hands the expense responsibility over to the cardholder.

However, the money they’re using comes from company funds. This means that you need to establish some accountability guidelines. It’s a tough line to balance authority and responsibility.

● Overlooked discounts

There are several ways you could get discounts for your business purchases.

Traditional corporate cards issued to upper management, for example, may offer discounts, cashback, or point-based rewards.

Vendors may offer discounts if you buy in bulk. Smaller purchases with a purchasing card may not qualify.

Why use a purchasing card for business expenses?

You might be wondering if it is worth acquiring a purchasing card for business. The advantages of having a purchase card for your business expenses are listed below.

1. Greater spending flexibility

Most small businesses are concerned about control over their business spending. However, spending is an integral part of business operations. Businesses need to spend on purchasing resources and assets.

It is important to have proper control over business spending. If a business lacks the proper management of spending, it is probably because of inefficient payment methods.

Corporate purchasing cards offer great flexibility for business spending. Businesses can set limits on the rates and kinds of purchases by acquiring a p-card.

2. Customized limits

Users with a corporate card need to contact providers to set new spending limits and privileges. It becomes a hectic process. On the other hand, purchasing cards offer the ease of spending limit customization.

Companies can alter their business spending limits directly through an online app. The online application is an additional benefit to the companies who acquire a purchasing card.

3. Easy approval for funds

If an employee requires new resources for product execution, he may send requests to the manager through p-card software. Once the manager approves it, the employee gets access to the funds.

The manager need not move from his desk for approval purposes. Purchasing cards offer the ease of approving funds which was previously a hectic task for managers. Businesses can effectively meet employees’ demands within seconds.

4. Easy accounting reconciliation

In the absence of cards, accounting reconciliation was done manually. It is a human tendency to commit errors. The invention of p-cards replaced the manual work done by the finance department.

Procurement card providers offer the benefit of accounting reconciliation efficiently. The finance department is free from the stress of matching physical receipts against bank statements.

5. Flexibility to manage recurring expenses

Recurring expenses are those expenses that keep repeating in a firm, such as expenses for advertisement and purchase of resources. The employees are not required to rely upon the higher authority to pay for recurring expenses.

They get full access to the business fund through a simple request process done through p-card software. It brings flexibility to the business to manage recurring expenses.

6. Real-time spend data

Businesses find it difficult to trace which employee has made what payment through their corporate card. On the other hand, procurement cards offer real-time visibility over the spent data.

The finance team can find all the details relating to the payment initiated by the employees through p-cards. The tasks done by the finance team are made simpler with the procurement cards.

Challenges of using p-cards and its solutions

1. Risk of fraud and misuse

● Challenges

When you allow employees easy access to company funds via purchasing cards for business purposes, there’s a risk that employees may misuse the card. You must be vigilant of any fraud attempts.

● Solution

It’s important to monitor your purchasing card usage regularly. Set up spend guidelines and leverage technology to track how employees are using their cards. Ensure that everyone knows the consequences of card misuse.

2. Non-compliance and policy violations

● Challenges

As with every other finance-related process in your organization, there is a risk of non-compliance when you issue cards. Employees could use their assigned cards inappropriately and violate your policies.

● Solution

The clearer the policies you set are, the less likely it is that you’ll run into policy violations. You want to be clear and firm about the consequences of non-compliance and address them immediately.

3. Data security and privacy concerns

● Challenges

Trusting your data with a third party like a p-card provider can be daunting, especially when you consider fraud attempts. Losing your card data to a criminal could result in a loss of funds.

● Solution

The best way to ensure that your data is secure is to find a reputable provider to work with. Check if they have industry-standard certifications and security measures. Flexible card blocking and freezing are also a must-have.

4. Lack of spend visibility

● Challenges

It’s hard to tell how your employees are using company funds without regular monitoring, especially when the cards are used out of the office. You’ll need to trust your employees with their card spending.

● Solution

Make sure that your purchasing card provider has a card management dashboard integrated with your cards. This allows you to view transactions easily and will help you track your spending accurately in real-time.

5. Vendor acceptance

● Challenges

Not all vendors will accept card payments. Even with vendors that accept cards, they may prefer other payment methods like cash, cheque, or electronic transfers for cheaper transaction fees.

● Solution

Ensure that your vendors know that card payments are not only convenient but also secure and fast. When you pick a card provider, you also want to ask about the card’s acceptance network. A higher acceptance is always preferable.

6. Complex reconciliation and reporting

● Challenges

You’ll have to reconcile your accounts and procurement records with the spending made through your purchasing cards. This is a time-consuming and complex process when performed manually.

● Solution

Accounting integration and automated reconciliation can help you reduce the complexities. With all your transaction data in one place, it’s easier to compare accounts and records to ensure that all transactions are valid and accurate.

7. Lack of control and oversight

● Challenges

It’s harder to appoint someone to oversee purchasing card payments when each cardholder has full authority to use their card. It’s not just the procurement manager who has control over funds.

● Solution

Set and customize spend parameters for the cards you issue. This way, you know that the spend categories they are being used on are pre-approved. The procurement manager should also make use of the spend tracking features on your card dashboard.

8. Vendor discount loss

● Challenges

You could miss out on vendor discounts if you purchase their products or services in smaller quantities. While the p-card is useful for these smaller purchases, the discount loss will add up.

● Solution

Negotiate with your vendors if it’s possible to get a discount regardless. If you spend a significant amount on multiple transactions over a monthly period, you may still be eligible. This could be handy for things like periodic refueling.

9. Integration with accounting systems

● Challenges

The end-of-month process of closing your books can be a tedious one. The last thing you want to do is make it worse with manual data entry for small p-card purchases.

● Solution

A good card provider will have integration capabilities available to you. Before you pick a provider for your purchasing cards, ask if you’ll be able to integrate your existing accounting systems. You can also get help setting up the integration.

10. Employee resistance

● Challenges

It’s no secret that change can be difficult to implement, especially when your employees are already used to and comfortable with current processes. They may not want to change how they do things.

● Solution

It’s equally important to introduce change slowly and incrementally. Before you let your employees use purchasing cards for business expenses, ensure that they first know what is a p-card. Host training sessions and address the issues and concerns employees have.

Best practices for managing p-cards

Establish clear policies and procedures

Make sure that you have clear purchasing card policies before you start issuing and using the cards.

It helps to get everyone on the same page and certain of what the expectations are.

All employees should know what is a p-card and how to use it.

Employee training and education

Using a corporate purchasing card instead of other payment methods may be a huge change for your employees.

To reduce friction and ensure that everyone is comfortable with the change, hold training sessions and ensure that your employees understand what is a p-card.

Selective card issuance

You can issue purchasing cards to every employee, but you’ll want to be sure that every person who is issued a card has a need for it.

By doing this, you can effectively reduce the likelihood of unauthorized purchases, thereby simplifying the process of tracking and managing your expenses.

Data security and privacy

Implement privacy and security measures to guarantee that your card is secure and used wisely.

Every cardholder should be aware of the policies regarding lost or compromised cards.

You also want to emphasize how important it is to keep your card details private.

Setting and monitoring spending limits

Most purchasing card providers give you the ability to customize spend limits for each individual card you issue.

Leverage these features and set the spend parameters you want before you allow your employees to use their cards.

Managers need to regularly monitor spending.

Transaction documentation and receipts

Although your card management system should be able to update transactions in real-time, you want to make transaction documentation a company policy.

Encourage employees to document each purchase and attach its corresponding receipt for complete transaction details.

Transaction approval workflow

While payments made through your purchasing cards are automatically processed, you still want to set a post-transaction approval workflow.

After employees send their transaction reports, route them for approval from managers.

For bigger purchases, you may want a multi-level approval workflow.

Regular auditing and reconciliation

Monitoring your cards regularly will significantly reduce misuse, but you’ll also want formal reconciliation and audit processes.

It’s good practice to reconcile your card transactions at the end of every month.

Audits should be conducted at least once a year to ensure accuracy and compliance.

Vendor and supplier relationships

If you intend to switch from traditional payment methods to p-cards with existing vendors, it’s a good idea to notify them in advance.

Ensure that your vendors accept purchasing card payments and reassure them that this introduces a higher level of convenience.

Internal controls and oversight

While cardholders are responsible for their own card usage, you still want to appoint a manager to oversee expenses.

Encourage managers to monitor and adjust the controls of individual cards over time.

Implement an internal control process to ensure no card is being misused.

Reporting and analytics

With all the expense data that you have, it’s good practice to utilize data analytics tools to identify spending patterns and room for improvement.

You want to generate reports based on your p-card data and use them for your future decision-making.

Continuous improvement

Implementing and managing p-cards is not a one-size-fits-all process.

As you monitor card usage, you’ll want to make tweaks along the way and continuously improve the process.

This could mean adjusting spend limits, issuing new cards, or even switching providers.

How can we help - Volopay!

Volopay corporate cards are not your traditional corporate or business credit cards. You get to issue easily trackable cards with a credit line—made for simplified business purchases. Equip your employees with purchasing cards and enable easier access to company funds, while still maintaining a higher level of control and security. You’re guaranteed simplified procurement with Volopay!

As an all-in-one expense management platform, all sorts of business expenses can be viewed, tracked, and managed through our dashboard. Purchasing cards are great for smaller purchases, but what happens when you need to procure a large quantity of products? Your Volopay business account can help you take care of that.

From employee expenses and reimbursements to bill payments and multi-currency wallets, Volopay offers the best expense management features to address all your business needs.