8 Reasons to digitize accounts payable process

With every year that passes by, businesses tend to adopt new technologies in order to scale, grow, and make their business processes more efficient.

The last couple of decades have seen a shift towards making processes digital. We have moved from the industrial age to the digital age. This has affected all areas of a business including finance and accounting.

Companies have started to digitize accounts payable for the many advantages it provides such as reduced errors, less manual work, faster processing, financial reports with deeper insights, and overall improved operational efficiency.

What is meant by the digitization of accounts payable?

Digital transformation in accounts payable refers to moving the operational processes involved in processing AP payments from a manual or analog process to a digital platform.

When a business starts using a software application to manage and control all its accounts payable processes, it is said that they have a digital accounts payable system set in place.

When organizations digitize their accounts payable it usually entails moving all paper records onto a software cloud platform on which many users from the company can easily access and carry out necessary AP functions.

Being able to collaborate is just one of the many benefits that a business yields from adopting a digital system for the accounts payable process.

Why should businesses digitize accounts payable?

The traditional way of managing accounts payable involved manual data entry, handling of paper checks, and processes that aren’t only inefficient but also prone to many errors that can end up costing your business a lot of money.

Digitization of the accounts payable process and deployment of modern financial tools help solve many problems such as duplicate payments, detecting errors, and slow invoice processing.

A digital accounts payable system also ensures that your accounting team is making the optimum utilization of their time conducting AP tasks and in turn creating bandwidth to analyze finances and implement a better financial strategy.

Key reasons to digitize your accounts payable

1. More convenient to use

Accounts payable software is designed in such a way that it helps finance and accounting teams conduct and manage their tasks much more effectively than if they were to do it without the digital system.

Through a single login, users can view and access all AP activities easily without needing to hunt through multiple files, programs, or physical papers.

Since these software applications work through the internet and data is managed over cloud systems, users can safely and remotely access their AP dashboard from anywhere using a compatible device.

2. It saves time and money

When you digitize accounts payable in your business, the biggest and most notable benefit is of course the amount of time your employees save and also the reduction in operational costs thanks to higher efficiency.

Rather than AP team members having to sit and manually enter all the data from vendor invoices to process them, an AP system helps you automatically capture data from invoices and create a bill to process it.

This saved time for your accounting department translates to more time invested in analyzing the financial health of the company and deriving useful insights to improve performance.

3. Errors are drastically reduced

Whenever a lot of work has to be done manually, the chances of mistakes occurring are quite high. And depending on the volume of work, this can be a major issue many accounts payable teams face.

Features like automatic capturing of data from invoices keep errors to a minimum. Since all invoices can be managed on a single dashboard, you will also be able to see their statuses to ensure that you do not miss out on a due date.

4. Improved Collaboration

Another benefit that organizations gain is a significant boost in collaboration. The traditional ways of handling AP tasks required a lot of back and forth between the accounts payable department and other team members.

But thanks to a centralized digital accounts payable system, AP team members and managers can now easily view, match, verify, and approve invoices without a lag in communication.

Related read: How can your finance team collaborate more effectively?

5. High-level security & privacy

When accounts payable are handled in the traditional way, using paper and stored in physical locations, there is always a threat to the security and privacy of the company’s financial information.

Unforeseen circumstances like theft or fires can cause the loss of important information to the company. This is also one of the major reasons that businesses choose to digitize accounts payable.

Not only is it much safer and secure thanks to robust IT infrastructure, but you can also create backups and store them safely with you on separate digital hard drives.

6. Benefits of Automation

A major change that using a digital system for accounts payable brings to the table is the aspect of automation. An AP software application should be able to help your accounting team do their task much faster in as less time as possible.

A few examples of automation in AP software include the ability to automatically source invoices from channels like emails, data capture through OCR, invoice matching, scheduling payments, and creating recurring payments.

7. Improves vendor relationships

When you implement an online AP system, it is not just your company who benefit from it. Your vendors and suppliers are also entities that feel a direct impact from a better AP process in the form of faster payments received.

When they notice that you are a client who always pays on time, they are more likely to give you benefits like early payment discounts. This improves their cash flow, saves you money, and overall builds a healthy business relationship.

8. Get data and analytics

One way to measure the effectiveness of business operations is by measuring its financial impact on the organization. Without a digital system, creating financial reports and coming up with insights takes a lot of time.

To visualize KPIs such as invoice aging, payment mix, and rebates across operating suppliers companies need to digitize accounts payable. Doing this gives you access to information at all times and the ability to look at spending analytics.

Suggested read - How digitizing payments can boost business growth?

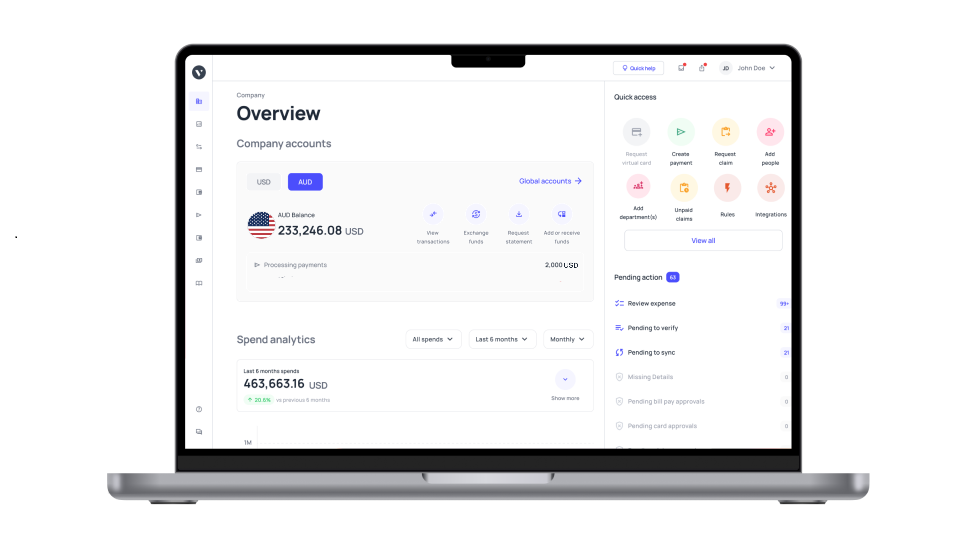

Digitize accounts payable process with Volopay

Volopay is a complete suite of financial tools for businesses to manage their expenses. Our platform has an accounts payable module that helps companies in the following ways:

Vendor management

Volopay users can create and manage vendor accounts right from the platform and store all their important information so that payments can be made to them easily in the future. You can create both individual and corporate vendor accounts.

Approval workflows

You get to create custom approval workflows to ensure that no payment is made from your company budget on Volopay without it first being approved by a manager. You can set up to 5 levels of approvers spending on the payment volume.

Multi-currency wallet

With Volopay you can hold and send money in 60+ currencies and make payments both domestically and internationally in over 100 countries. You can transfer money to the vendors in their local currency and avoid hefty FX charges.

Related read- Multi-currency wallets to improve your business finances

Automation

Another reason you should digitize accounts payable is for the automation that we provide. Volopay lets you schedule payments so that you don’t forget to pay a supplier and then have to deal with late payment fees.

Free remittances

Lastly, when you use our platform to wire transfer money, you don’t have to pay any remittance fee that you would otherwise have to pay to banks.

Automate your manual accounts payable process

FAQs

Invoice digitization refers to the shifting of invoice processing systems to a digital platform. This includes using e-invoices instead of paper invoices and also processing the payment of the invoice through a digital platform.

Volopay has a robust digital infrastructure that ensures that all our client's data is encrypted and protected using stringent security protocols.

When you digitize accounts payable, certain software applications provide you with a feature called 3-way invoice matching. This uses AI and ML technology to automatically detect discrepancies between the details on an invoice, its relevant purchase order, and the goods delivered receipt.