7 key benefits of multi currency account

No matter where you live, in this digital age our worlds are more connected than ever. Businesses are constantly looking for global markets to tap into, outsourcing entire departments offshore and constantly scouting avenues to expand online. As globalization continues to shape the future of business, the need for companies to hold a multi-currency business account has never been greater.

Whether you are already trading internationally, or are maybe looking to move beyond your home market so you can tap into overseas opportunities, you must be aware of the hassles that come with dealing with FX transactions. One of the best ways to overcome these hurdles is via a multi-currency business account.

What is multi currency business account?

Multi-currency business accounts have eradicated the need to maintain individual accounts in different territories or countries for each currency you have to deal with. It is a type of account using which you can receive, pay, and hold multiple currencies. These accounts enable you to do multi-currency transactions through a single platform.

Foreign currency accounts are especially useful for those who travel frequently and have to conduct business in multiple countries. They help you save on currency exchange fees and manage all your international transactions in one place.

International currency accounts have also gained popularity as investment options outside of India. Saving some money in foreign currency accounts has come out as a useful way of protecting individuals or business entities from exchange rate volatility, particularly US Dollars, and Euro accounts.

How does it work?

A multi-currency business account works like a standard bank account as it lets you send, receive and withdraw money as and when required. Typically, they let you access funds via debit cards, electronic payments, and wire transfers. You don't’ normally have access to a physical branch, but customer support is offered online or over the phone.

These accounts also sometimes come with fees associated with transactions made. This could come as a monthly account fee, a deposit or withdrawal charge for payments in currencies above a certain value or to a certain customer, or a charge for deposits or transfers of certain currency notes.

Advantages of multi currency business account

Lower transaction cost

Previously, businesses would have to open separate accounts for different countries and currencies. Each of these banks would charge an account maintenance fee. Foreign banks often also require hefty minimum balances for you to be eligible for account openings. There may also be transaction-level charges, especially for any foreign wire transfers.

A foreign currency account helps you reduce these business banking charges, as all you need to pay is a nominal single account fee. No minimum account balance is required and forex conversions are offered at extremely competitive rates.

Easier reconciliation and accounting

Multi-currency accounts make your end-of-month accounting seem like a breeze. You or your finance team will have to spend much less time reconciling.

Because these cards give you the ability to issue invoices in one currency and get paid in the same, you will have no more obstacles in trying to match invoiced and paid amounts in different currencies. Moreover, there will also be fewer accounting adjustments required to accommodate exchange rate differences.

Saves money on foreign exchange fees

If your company only has a single currency account (i.e. an account that can hold only your home currency and no other), you are losing out on money via foreign exchange charges per international currency transaction.

Every time you receive money in a different currency your bank will convert the amount to your home currency. For every transaction, the bank has to do this for it charges a substantial foreign exchange commission to convert these funds.

For a business that receives regular payments in different currencies, these costs can snowball. One of the biggest advantages of a foreign currency account is that because it can hold multiple currencies this conversion becomes redundant. Therefore, the need to charge conversion fees itself is eradicated.

Better supplier relationships

A happy supplier means better deals on material, consistent service, and a budding business relationship. Also, a supplier who gets paid in their preferred currency doesn’t have to wait or pay for conversions is bound to be a happy supplier.

A multi-currency account helps keep your business in the good books of your partners, suppliers, and clients. Everybody likes to get paid in their own currency without the burden of conversion costs, a foreign currency account helps do all this with ease.

Faster transactions

The faster your turnaround speed is the more streamlined your cash flow will be. We all know how slow cross-border payments can be. Instead, if you can carry out transactions in local currencies your process will not only be more efficient, it’ll also be quicker because you’re technically accessing local payment networks.

With a multi-currency business account being used online or via an app, you can leverage digital wallets to carry out faster transactions ensuring a smoother cash flow in your business.

Expense management

An international currency account is also extremely useful in making expense management a whole lot easier for your finance teams. These accounts cancel the need to match invoiced and paid amounts in different currencies. Accounting adjustments required to accommodate exchange rate differences also become much easier.

Moreover, because these accounts function similar to holding accounts, you can wait it out until exchange rates are favorable enough for you to convert currencies.

Basically, multi-currency business accounts provide you with a single platform to conduct all forex transactions; this also means all your transactions are logged in one structured place from where your finance teams can manage expenses.

Easy and convenient

As we’ve already observed, a multi-currency account consolidates all your forex transactions, across currencies and geographies, into one singular platform from where you can manage it all. It helps you protect revenue from high, obligatory, transaction and conversion costs that negatively impact both cash flow and workflow.

With a multi-currency wallet, this process becomes even more seamless, as it allows you to hold and manage multiple currencies in one place, making transactions simpler and more cost-effective.

These accounts ensure that all the obstacles that usually come when dealing with various currencies are taken care of without your effort being needed. So, all these when put together make for an international trading experience for you that is both easy and convenient.

Pay and hold multiple currencies in a single business account

Who needs multi currency business account?

The general criteria for needing to open multi-currency accounts for your business is quite simple - if you are trading internationally, needing to manage and pay with different currencies in varying geographies, you definitely need to get a multi-currency business account. Some other, more specific cases where a global business account is bound to be useful include:

● If you trade internationally; both exporting and importing services can benefit from multi-currency accounts.

● For online sellers working across several marketplaces, such as Amazon, these accounts can be useful.

● You are an independent contractor or freelancer who regularly works with international clients.

● If you operate an e-commerce store and sell goods or services in multiple currencies.

● You have staff working abroad and, or, overseas freelancers on your payroll.

Why choose Volopay for business account needs?

While it is easy to understand why you need a multi-currency business account, it’s not the same when deciding who to get it from. Here are some of the reasons why you should choose Volopay business account for your business.

Corporate cards

Volopay’s corporate card facility is another useful feature to consider. You can issue unlimited virtual and physical cards to your teams or employees and never have to worry about expense reimbursements, invoice management, or credit lines anymore.

Support service

We are strong believers in the happy customer policy. We make sure that from onboarding to the years you’ll spend working with us there will be complete support and dedicated service from Volopay. Our teams are always present, all hands on deck, to tackle any issues you might face and answer all questions you may have.

Integration with accounting software

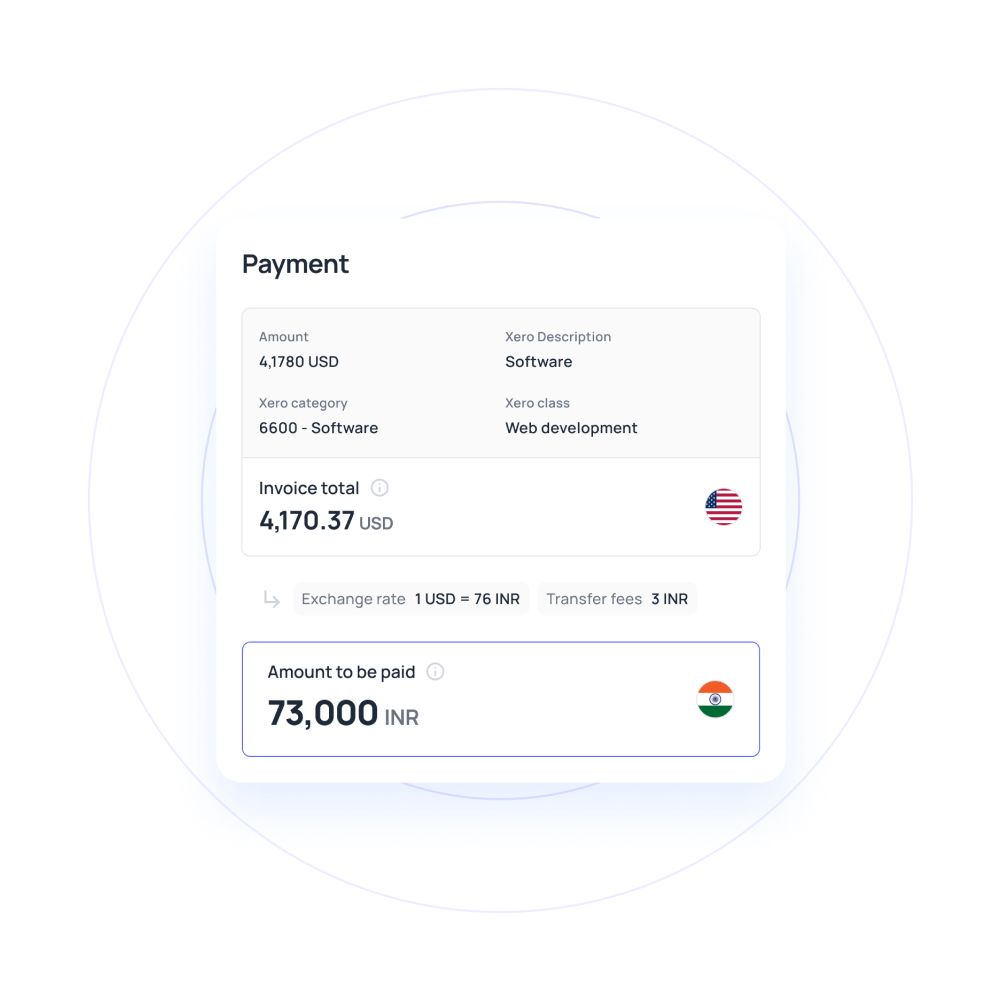

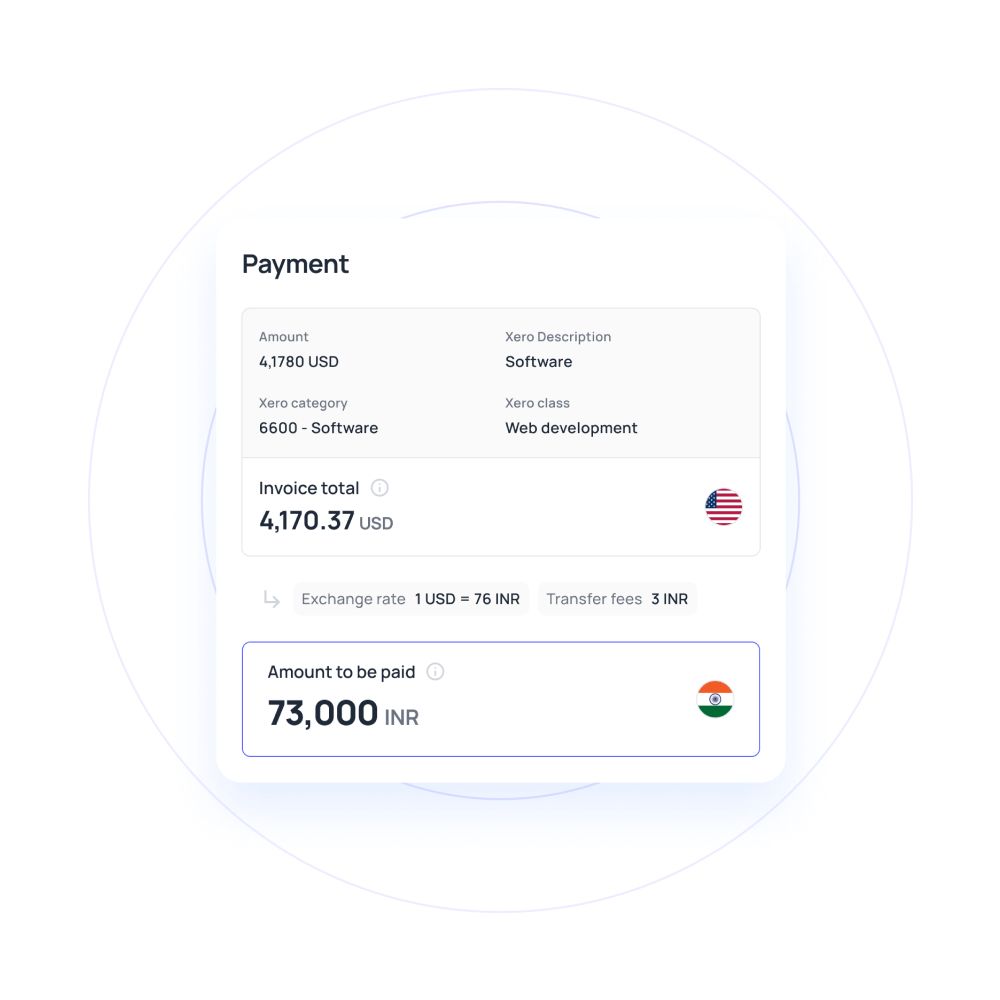

When you open multi-currency accounts with Volopay you also get the benefit of application integration services. This means that if and when you move to Volopay you do not have to transfer data or move on from your older accounting software. In fact, Volopay can be fully integrated with pre-existing software, e.g. Xero, Quickbooks, etc., without the fear of data loss or corruption.

Approval workflow

The system also comes fitted with a streamlined automated approval workflow. Multi-layered approvals with the capacity to have customized parameters preset by you for auto-approvals are now real, yes. You can now have subscriptions to services from multiple countries and preset your multi-currency account to pay them all at the same time without you having to lift a finger.

No limitations on transaction

Volopay is especially great because of how rare obstacles are when trying to complete a transaction smoothly. Unlike most other providers, ours has no cap whatsoever on how much you can or how much you have to spend in a transaction, both forex and domestic.

In fact, with Volopay you can trade in over 100 different currencies. Being able to trade in so many currencies also means that you can conduct pretty much all your forex transactions on one unified platform.

Unified spend management software

Volopay comes with a highly nuanced spend management software that is equipped with a whole list of features that make expense management seem like a breeze. Not only can you consolidate all currency transactions in one place you can also get tools that help you analyze and make the most of your transaction data.

You can track expenses, manage invoices and create detailed spend reports for your expenses. You can also enjoy automated approval workflow and receipt mapping.

Enhanced security

Volopay stands right up there with the best when it comes to how seriously we take our security measures. Multiple layers of code and regular, rigorous, checks on our security system ensure the absence of any mishaps or fraudulent incidences. Our security systems are on par with, if not better than, the tightest bank-grade securities out there.

Trusted by finance teams at startups to enterprises.