How to reduce business banking charges?

Business bank accounts and charges associated with them can seem insubstantial at the beginning. As your business continues to grow, however, hidden banking costs surge, cutting down a huge lump out of your cash flow. Business checking and savings accounts have maintenance and other charges that may vary accordant to your expense limits.

Is this preventable? Can a business owner still enjoy no fees business checking account and corporate banking solutions at normal pricing while safely making transactions? It is. Modern payment solutions are very straightforward with their pricing plans and offer the same level of convenience as your bank does.

Are business bank accounts necessary?

Business bank accounts are necessary for many reasons. First, if you want to keep your business and personal finances separate, which you should. Second, if you wish to separate accounting records of your business payments and incomes.

Other reasons include obtaining a bank loan with the associated bank, receiving interest for the money stored in business accounts, and shaping up exemplary financial practices from the start. Legally speaking, when you register your entity as a corporation or an LLC, a business checking account would be mandatory to begin your financial operations.

Check this out: Factors to consider when choosing a business account

Impact of business banking fees on profit margins

Although business bank accounts are necessary for day-to-day functioning, we cannot deny the fact that they cost money. They are expensive to obtain as well as to maintain.

When we say profit margin, we mean the deduction of expenses from the overall income. Traditional banks charge account maintenance fees and other hidden costs. Also, they might impose charges if you have exceeded the limitations on the number of transactions or total amount.

Piling costs

It can be hard to keep track of rising bank costs, and it’s equally unfavorable to abide by their regulations. Before you realize it, charges can add up and increase business banking expenses. When expenses increase, the profit margin decreases, causing you to compromise with other significant expenditures.

Even if you manage to find a bank that doesn’t charge for transactions beyond restrictions, you will still be bound to pay the bank for operations, paper statements, ATM withdrawals, etc. For a scaling business, this can be too much to handle. If you don’t scrupulously go over the banking fee statements, you will be in for surprises later when this expense devours your profit margin.

What are some common and hidden fees charged by traditional banks?

Some of these charges are known by all, whereas some can take you by surprise. You might not have heard of them, but still, be charged by your bank.

Account maintenance fees

The maintenance fee is one of the most-known by all as it’s clearly stated around the time of account opening. Depending on the type of the account, provider, location, minimum capital invested, and transactions handled, this fee changes. The average accounts maintenance fee charged by banks as per the reports from money reports is around $14.

ATM fees

Banks spend a considerable amount of money maintaining ATM facilities, and these charges get added to your liability every time you withdraw cash from your business account. Though online banking has been replacing cash payments slowly, the need for quick cash to carry out local transactions still exists. However, ATM charges have been increasing and the usage has been reduced, especially among business customers.

Overdraft fees

Overdraft fees are the first clause to be checked with your bank to reduce business fees. Overdraft is a fee charged when you run into moments like check bouncing. When you initiate a money transfer higher than your current deposit, the bank halts the transaction and sends you an overdraft bill. You will have to bear the overdraft fee, which will be around $30 to $40, depending on the bank. If the receiver is a creditor or a business party, they might be charged.

To avoid this from happening, a few banks provide overdraft protection facilities. You will still be charged here to avail of this facility as the bank will advance you the money to carry out the transaction. Overdraft protection fee is almost the same range as overdraft fees, and you will pay back the money borrowed from the bank that fulfilled the payment.

Minimum balance fees

There are minimum balances to be maintained in banks for business accounts. Generally, accounts with minimum balance requirements will not have an accounts maintenance fee. If you spend more than the minimum account balance to be maintained, you will have to endure charges or pay account maintenance fees. This minimum account balance can never be touched, and it’s like an interest-free loan you are rendering to your bank.

Paper statement fees

Businesses that maintain manual records opt to receive paper statements from the bank every month. As an initiative to promote eco-friendly measures, banks charge paper statement fees that may vary from $2 to $5.

Checks fees

At the time of account creation, banks provide one or two checkbooks for free. Once they run out, if you need extra leaves or a new book, banks charge you to supply that.

Inactivity fees

Banks have a hard time dealing with dormant and inactive accounts with no incoming or outgoing transactions. To make the account owner active again or close their accounts, banks force an inactivity fee for every month the account has been dormant.

Foreign transactions fees

Business bank FX costs are a considerable burden on many businesses. FX charges are very high when you send money from traditional bank accounts to your vendors or employees living in another country. The expected range of the fx fee is 3 to 5% of the total transaction.

Multiple user fees

For every other partner going to be added to the account, the bank can charge you anywhere from $5 to $10. When two people are equally involved in a business, keeping the other one in the dark can be tricky. You will have to pay the bank for every user you add, which can be shunned if you use modern payment and expense management solutions.

How to avoid paying business banking fees and charges?

A business bank account always stays busy when compared with personal accounts. You know how and when all these charges get built up and become a liability at the month-end. Too much effort has to be put in if you have to stop them from creeping into your business banking fees.

Prefer online banking

Online banking is a no-brainer as most businesses have shifted to online banking solutions. If you use online banking services, not only do you make the transaction within seconds, but you also end up preventing check, ATM, and debit card transaction fees. Though cash transactions are dying, there are still vendors who accept checks. Check payments also carry the risk of obtaining an overdraft fee from the bank if checks bounce. It’s normal not to know the current balance available in the account when you write a check. Online banking puts an end to it.

Beware of the transaction limitations

Predict your monthly expenses range before obtaining your business bank account. This way, you can make sure that you won’t be in a position to encroach on the limits. In an attempt to attract businesses to open business bank accounts, banks provide attractive offers for a certain period. Find the best deals and utilize them. Make a rule never to disturb the minimum balance in your account and keep note of the number of payments you make. To bring down the number of transactions, try making bulk payments. Schedule payments in a way that wouldn’t exceed the permissible limit and intimate your suppliers likewise.

Decline overdraft protection

Since 2010, it has been illegal to charge overdraft fees without customers’ consent. Always opt not to go for overdraft protection. Link your accounts (savings and current) if possible, to help prevent overdraft.

Go for email statements

Email statements are already in effect, and many countries have started accepting e-documents for taxation purposes. If given an option, go for email statements right away.

Need smarter tools to manage payments?

How a no-fees business banking account solution can eliminate the high cost of banking

New-gen banking solution

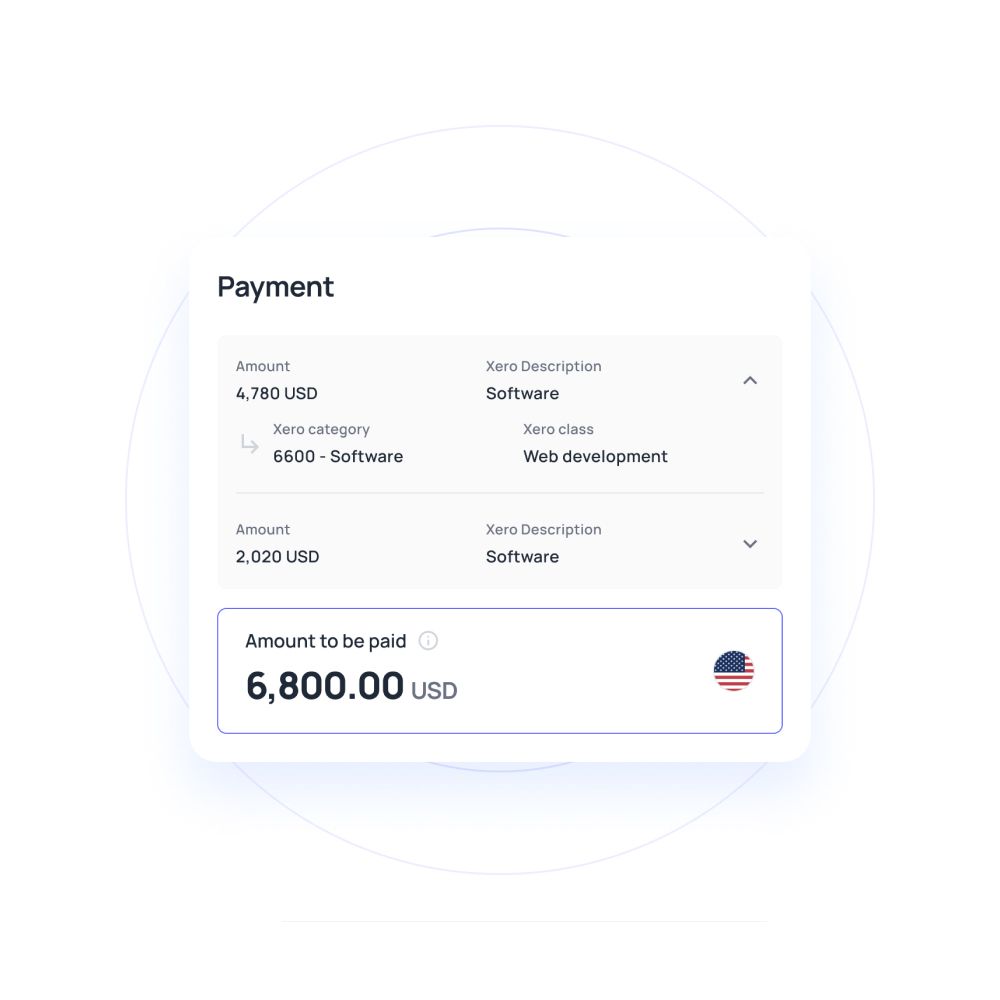

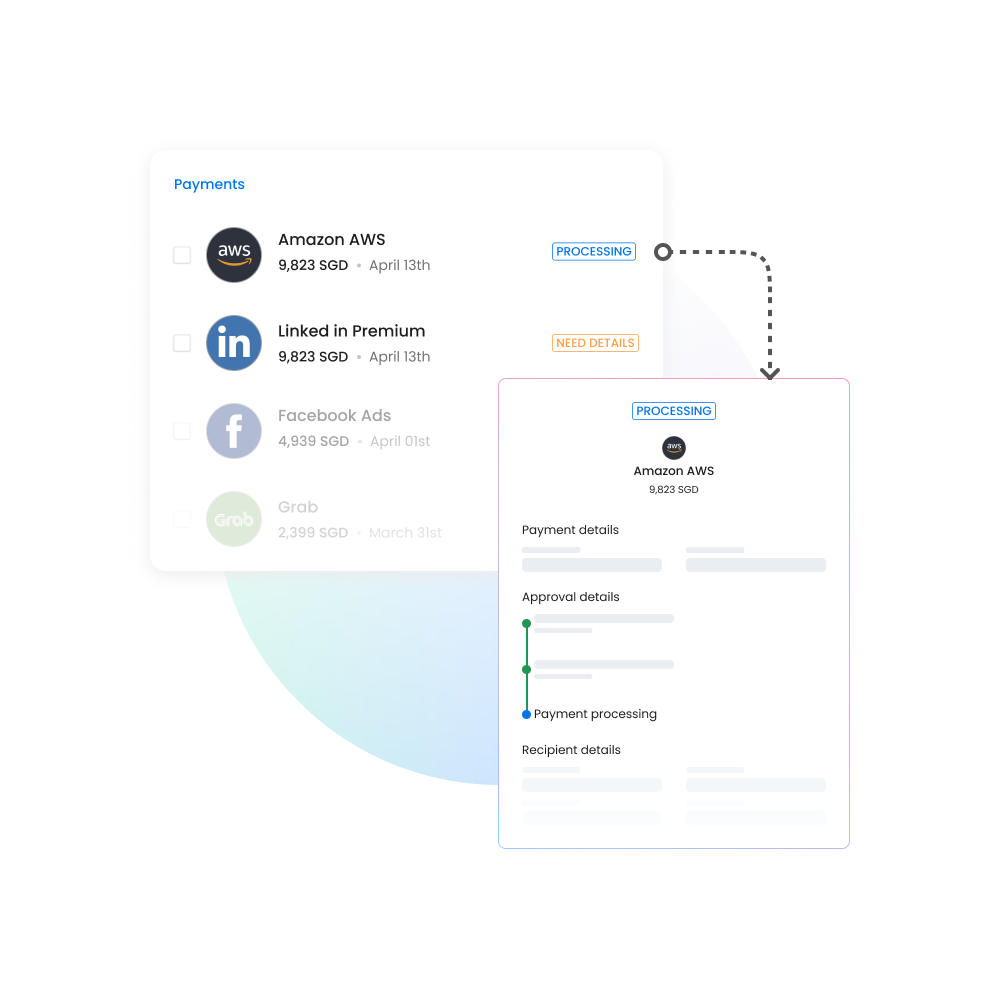

Volopay's alternative banking solution is indeed for new-gen business owners who like versatile features in their banking application with the safety and privacy of a traditional bank. If you can get an all-in-one app that automates and schedules payments, stores receipts and payment records, offers timely insights about your spending patterns, and at last allows you to set budgets safely and securely, would you say no?

Smart expense management

When you bring in a smart expense management system, you cut down your bank's indirect and hidden business banking fees. As you limit the transactions you make through your bank account and switch to this platform, cost incurred from your business account charges will reduce. You can load your money into your wallet and take care of the expenditures. Maintain the money in your no-fees business banking account as capital deposit and enjoy the convenience of modern payment systems.

Stay a step ahead

Modern banking solutions are a step ahead already as they satiate every customer's financial need. They reduce banking fees and offer services at a meager cost. This fee would be far more reasonable than the direct and hidden expenses a business user bears with a traditional bank.

Limitless and transparent

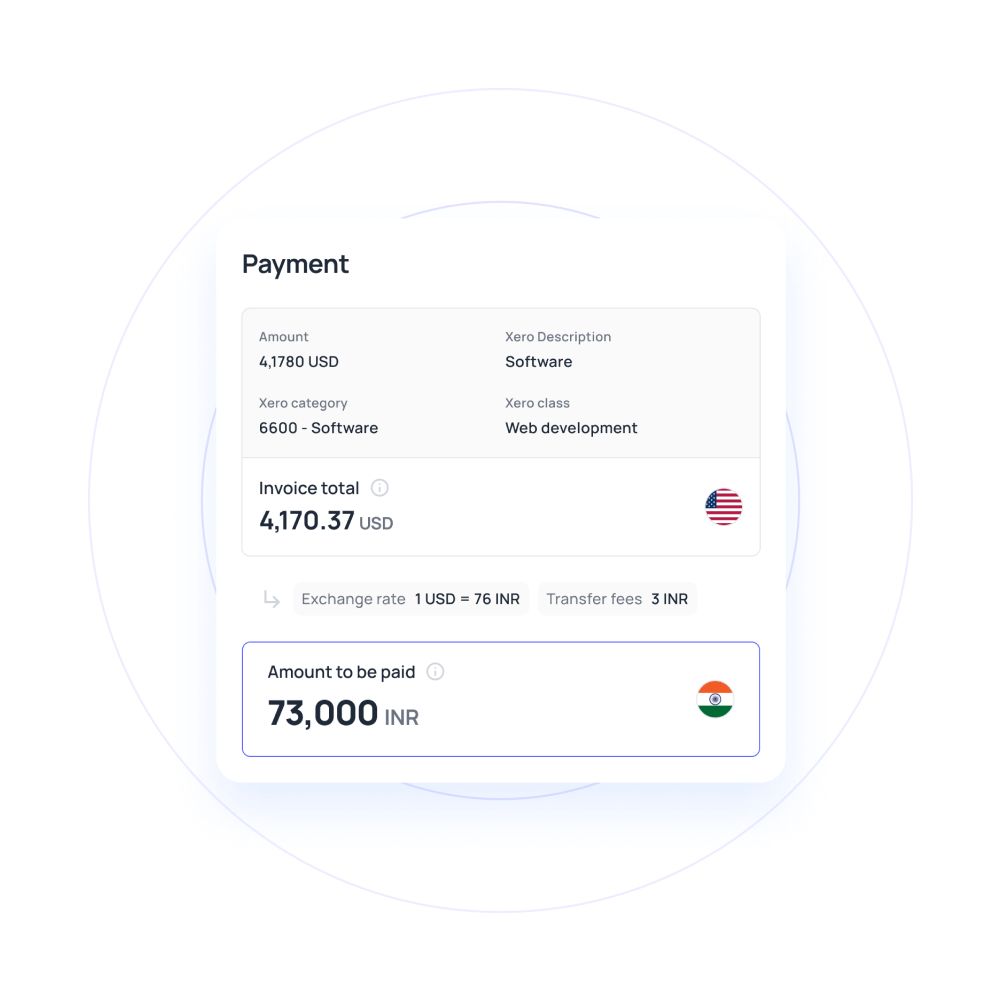

Volopay doesn’t limit the number of transactions or money you send to your suppliers and others. Other than the upfront platform usage charge, there are no ambiguous terms or hidden business account charges intended to get money from you.

Business accounting for the future

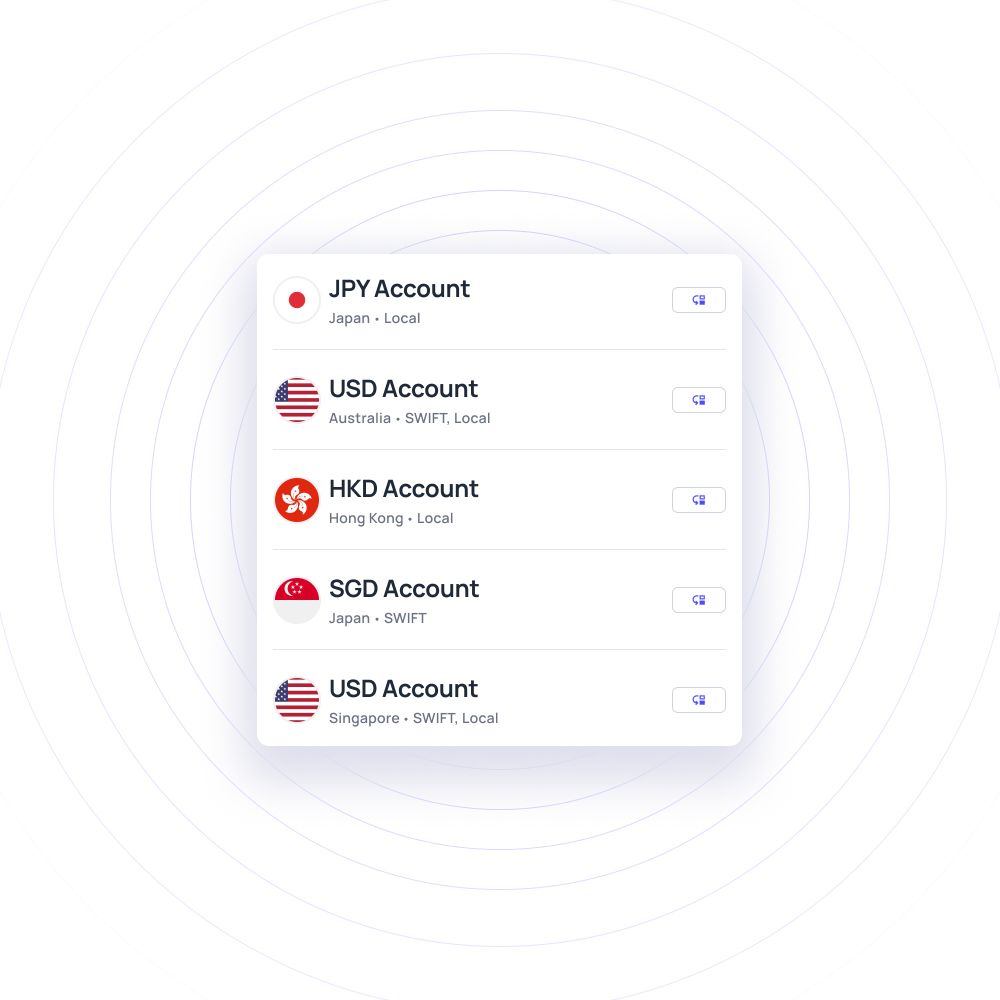

Put an end to business banking fees by switching to a modern banking solution with Volopay's business account. FX transaction fees are competitive, especially compared to traditional bank charges. Enjoy the privileges of a modern expense management strategy by using corporate cards, reimbursements, and bill payments all in one place.

Without relying on a business bank account’s online banking platform, you can send money to local and international vendors, all at a competitive rate. Spend like a local with Volopay and carry money in foreign currencies.

Related page: 7 key benefits of multi currency account