Benefits of using virtual cards for B2B payments

The market for B2B payments and transactions is growing rapidly. With an expected compound annual growth rate of 6% from 2022 to 2030, it’s no surprise that those involved in B2B payment transactions want the whole process to be more streamlined.

Luckily, the increasing popularity of virtual cards has opened some opportunities for making B2B payments. With the flexibility offered by corporate virtual credit and debit cards, businesses can generate cards easily and take advantage of benefits like reward systems and more efficient accounting. Gone are the days of paper invoices, sharing one corporate card across multiple departments, and manual reconciliation. B2B payments are easier than ever with virtual cards.

What are virtual cards for B2B businesses?

B2B Virtual cards are like a card housed online, containing a 16-digit card number, created digitally for a one-time purchase at set amounts. Nothing can beat their convenience, security, and speed which have helped them gain traction in the B2B payments industry.

A unique number is assigned to each virtual card, ensuring security and lowering risk. Employees can now use a card payment in more situations, while still adhering to their employer's pre-approved spending policies.

Important features of virtual cards

• Approvals to gain control over overspending.

• View all spend owners and automate accounting.

• Taking control away from vendors.

• Reduce the risk of fraud and its consequences.

• Increase employee productivity by making online purchases easier for them.

• SaaS software subscriptions and renewals.

Financial challenges every businesses face today

Not able to manage your cashflows

Putting numerable hours in managing expense reports

Having a fear of fraud

Difficulty in reconciling your payments

Not able to manage your budget

Difficulty in managing subscriptions

How do virtual cards for businesses work?

Depending on your card issuer and the platform you use to manage your account, the process for using a virtual card may differ slightly. Overall, the first step is to set up an account with your card issuer & then pretty much the steps outlined below:

• Create and instantly issue employees their own virtual cards.

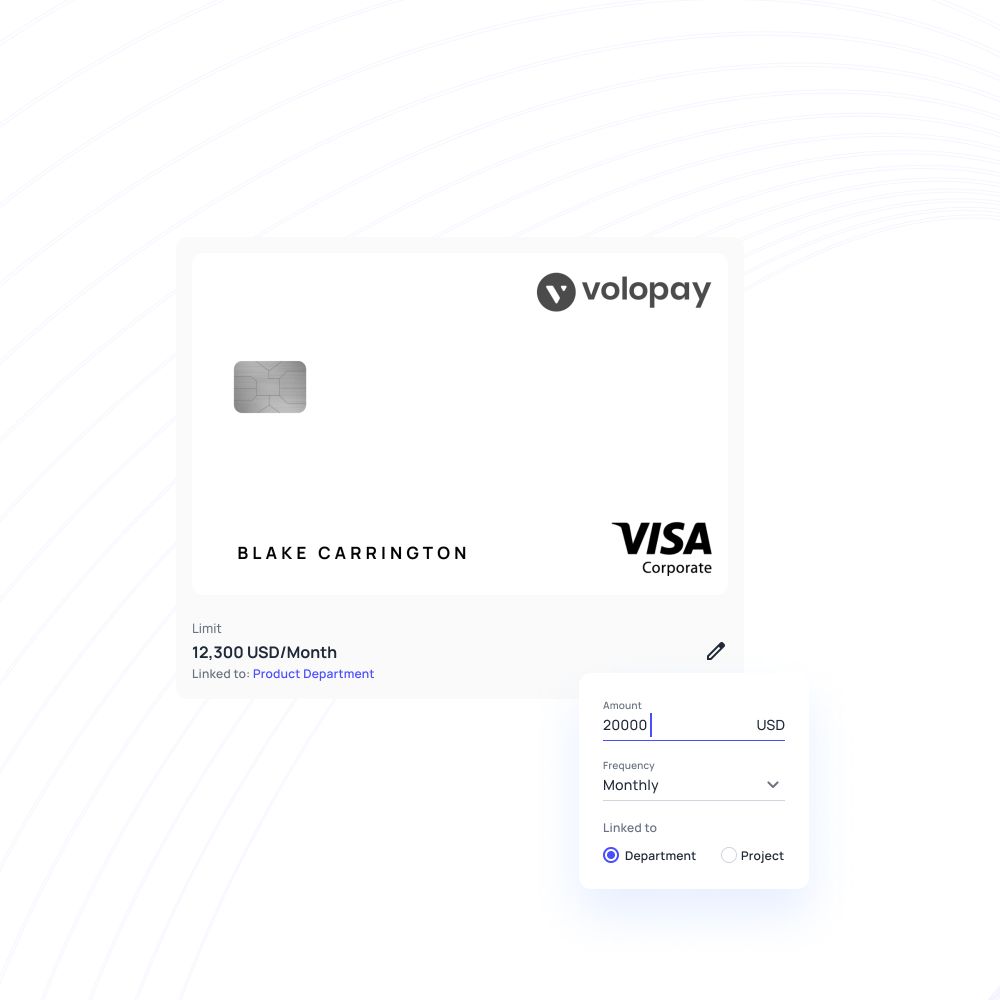

• Set custom spending limits with a pre-determined budget for each employee’s card.

• Set approval workflows to accept and reject card funds requests.

• Pay online or in-store through your phone app by accessing virtual cards.

• Snap and upload photos of receipts for easy expense reporting.

• Get real-time insights into employees’ spending through an easy-to-use interface.

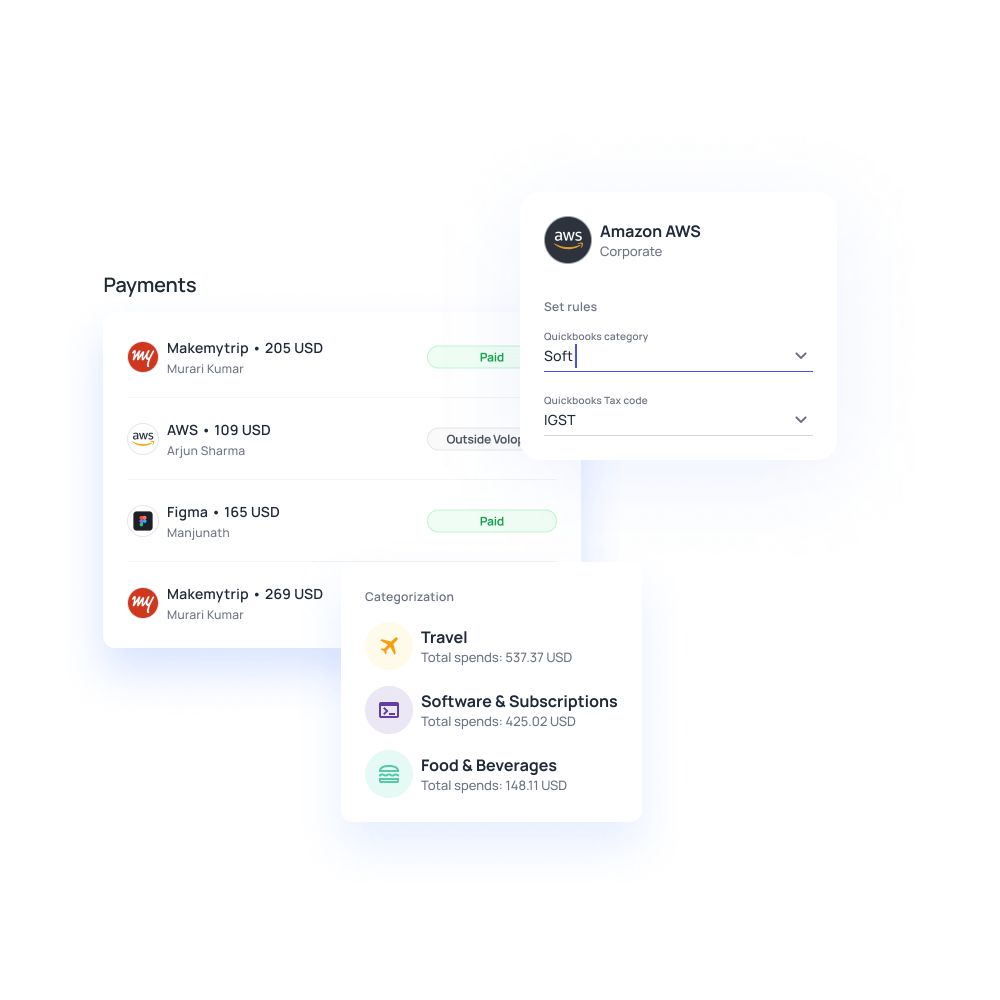

• Exports all your expense data to your accounting software and reconciles expenses easily.

Streamline your B2B payments with virtual cards

What are the benefits of B2B virtual cards as a payment solution?

What happens in B2B payments? Payment arrangements are established, bills are sent, and then they wait for the payment to begin. After you receive a payment, you may have to wait for the funds to clear before you can utilize them. When paying suppliers, the roles are reversed, yet the process may be just as time-consuming.

Volopay redefines the payment criteria for the b2b payment industry. At the same time providing flexibility, security, and convenience.

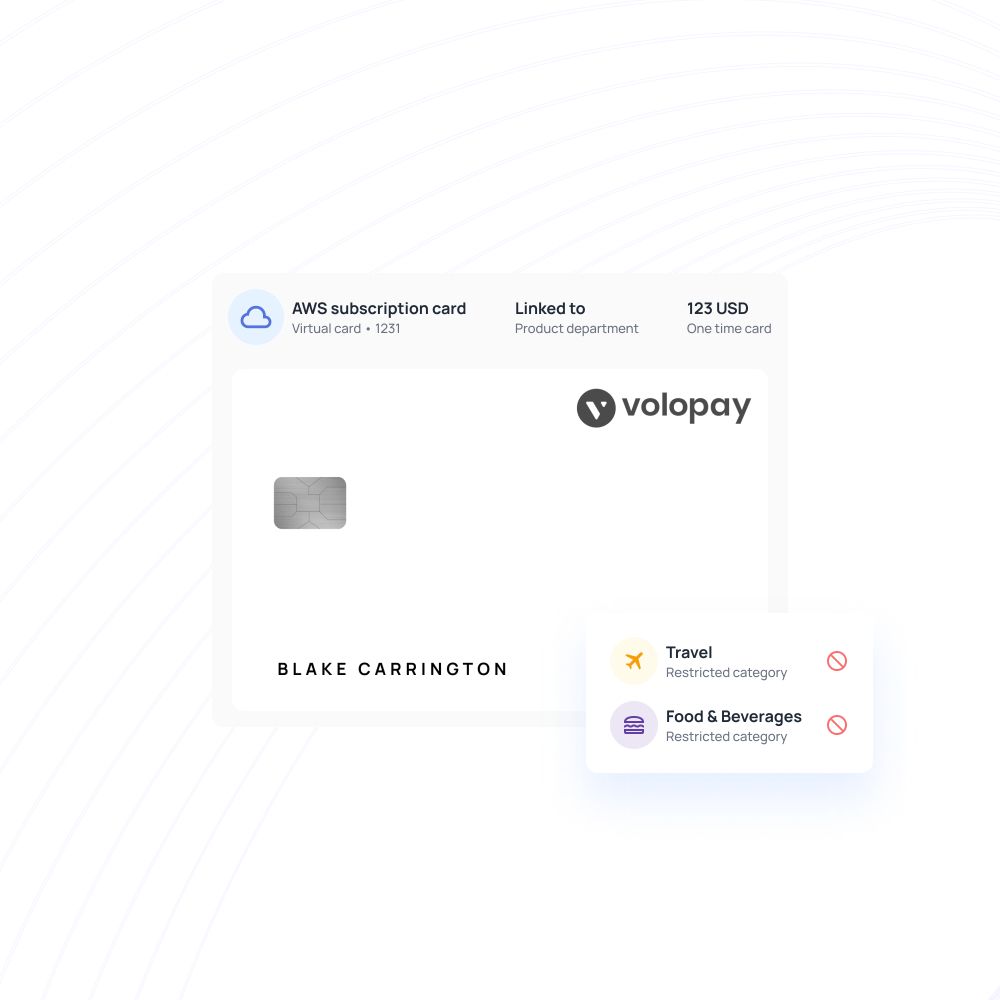

Volopay’s virtual credit cards are one-of-a-kind cards that add an extra layer of protection and control to online transactions. Users can create and assign a separate card for each online retailer, giving them the ability to handle them appropriately while also isolating their primary account from any fraudulent behavior related to that vendor.

Unlimited virtual cards

You can give each employee a separate virtual card and prefix budgets in them with Volopay. This eliminates the need for employees to share cards, increasing their independence and creating transparency.

You have complete control over your finances

There is no accurate tracking of your budgets with traditional business cards. Volopay allows you to track where, when, and why of your money in real-time on a single platform. Create specific budgets according to the cardholder & requirements.

Improve cashflows

Because payments are made promptly using virtual card payments, your company's working capital can be optimized. Finance teams, in particular, notably account payable teams, will no longer be required to hold funds for longer than necessary. By gaining real-time insights into overspending, saving opportunities, duplicate subscriptions, and effectively managing marketing expenses with virtual cards, you can easily streamline your cash flow.

Boost employee productivity

There's no need to be concerned over who owns the business card or where it was last seen. Eliminate manual trades and lengthy approval processes to save time and money. Employees and management can concentrate on their primary responsibilities rather than wasting time on administrative activities.

Make easy bill payments

Pay your domestic and international bills faster with our Bill Pay feature. You can make immediate payments against the invoice of each vendor. Send money to more than 130 countries worldwide with SWIFT & non-SWIFT payment options.

Easy reconciliation

Integrate your expenses with your accounting systems to keep your books up to date and accurate. Reconcile and report expenses with all the automated coding.

Subscription management

Virtual cards give you the flexibility to manage all of your recurring online subscriptions from a single dashboard. You can easily pause or cancel any subscription while leaving the others unaffected, making subscription management with virtual cards more efficient and streamlined. You can also empower the HR team with virtual cards to manage recurring payments for every subscription your HR team is currently using.

Reduce the risk of fraud

As every employee has their own virtual card, so it eliminates the need of sharing company cards which reduces a very high risk such as theft, loss, and data breach.

Reduced costs and quicker processing

Payment processing is not free, and some ways are more expensive than others. Virtual payments are five times less expensive than check processing. Furthermore, virtual payments can clear in one to two days, compared to seven to ten days for check payments.

To learn more about how virtual cards can support your business, check out our blog on the benefits of virtual cards for businesses.

Are Volopay's B2B virtual cards secure?

Volopay's virtual card takes security to heart by making it nearly hard for your credit card information to be stolen or scammed. We follow VAPT (Vulnerability Assessment and Penetration Testing) on our network and applications every 2 months.

Also, we do not store any of your card details or any sensitive data, and our partners are all fully PCI DSS compliant. Additionally, the cards are exclusively visible to you, there is no risk of cloning or fraud.

FAQ's

You can generate as many virtual cards as you need. As virtual cards are easy to create and don't require anything much other than the necessary information, you can effectively issue all your employees each an individual virtual card.

You use your virtual card in a similar way that you would use a physical card. The only difference is that virtual cards don't have a physical form. Therefore, when you make online payments, you would do exactly what you would when paying with physical cards, which entails entering your card and payment details. When you make on-ground payments, it'll be a similar process as physical cards, except that you would require a device like your mobile phone to display your virtual card and NFC technology to receive the payment.

Yes. However, the POS machine or terminal in-store needs to have NFC technology to enable charging virtual cards.

After you find a suitable card issuer for your business needs, create and set up an account. Then, all you have to do to create virtual cards is to fill out the necessary card details. You can generate your cards instantly after that and they will be ready to use.

If your virtual card is a debit or prepaid card, you can transfer money from your card account to your other bank accounts, such as a checking account. Alternatively, you can also use payment gateways to make card payments to bank accounts, just like you would with a physical card.

Trusted by finance teams at startups to enterprises.

Related pages

Discover the benefits of virtual cards for eCommerce, including secure transactions, fraud protection, and streamlined payments.

Learn how virtual card payments for business travel offer control, security, real-time tracking, and simplified reconciliation.

Learn how virtual card payments help accounts payable teams streamline processes, improve security, and boost efficiency in managing payments.