8 best practices for corporate credit card management

Uncontrolled card spending can seriously damage your business. Learn only the best corporate credit card management practices in the industry. Enjoy no-nonsense cashback on FX spends with Volopay corporate cards.

What is a corporate card and why is it important for my business?

A corporate card streamlines your business expenses into one centralized statement, highlighting every transaction along with the name of the employee who made the expense. These cards have become an indispensable tool for a business’ growth and success. Apart from maintaining cash flows by reducing the instances of cash advances, Corporate cards have a lot to offer for your business:

Innovative incentives & rewards

Security and transparency are not the only incentives you can enjoy with a corporate credit card. Many corporate cards issuing companies offer enticing incentives to employers., which helps business owners and CFOs like you make money, and save money with every expense.

Builds business credit score

Having a corporate credit card that you use for daily operational or travel expenses helps in building your business significantly. By paying your dues on time, you position yourself as a reliable and creditworthy business to credit companies and vendors, who can in turn help you in building your business credit score.

Eliminate reimbursements

With a corporate credit card, manual verification becomes unnecessary as expense policy is automatically enforced. A pre-loaded cards eliminate the need for out-of-pocket expenses by employees and gets instantly reported in the expense report, ready to be integrated with your accounting software!

Why is corporate credit card management essential for my business?

No amount of research can ever prepare you for the financial curveballs you get once you start your business but setting up a proper management system in place can safeguard your company and avoid pitfalls.

While having a card can streamline your expenses, simplify the reconciliation process, and even help you save, using it without a proper corporate credit card expense management in place can expose your business to fraud, embezzlement, and other financial risks.

Best practices for corporate credit card management

Create a corporate credit card policy

Corporate card policies come under a company’s accounting policy and set a clear set of rules and regulations around corporate cards issued in an employee’s name. Violations are safeguarded with extensive protocols, thereby protecting your business against instances of fraud or employee personal expenses.

Some of the key points to consider while drafting a corporate credit card policy are eligibility and responsibilities of the cardholder, limits on the card and its spending, following due process of submitting proof of receipt, and specific consequences that can arise in case of policy violation.

Set departmental budgets

Creating a budget for departmental expenses can save your accounts team a huge amount of time by simply taking the guesswork out of which department/employee spent how much on a particular card.

Departmental budgets can act as a pool and every cardholder is assigned a card out of that particular budget. This helps to maintain the spending limit of the business overall while helping you see whenever you surpass your set budget.

Set a distinction between corporate and personal expenses

It is of utmost importance to let your employees know what constitutes business expenses and what doesn’t. Sometimes employees use corporate credit cards to pay for personal expenses with the intention of paying the company later.

By letting them know what they can and cannot use the card for, you are also alleviating any lingering doubt or pressure of figuring things out on their own from the employees’ minds.

Issue a corporate credit card only when necessary

It takes a lot of trust from your side to issue a corporate credit card to your employees. However, there could be an employee who might treat it as fun and not a responsibility that it is.

That’s why it is essential to issue corporate cards to employees only when there is a real need for them. Making sure that your corporate card is in the right hands for the right reason is the best way to minimize instances of fraud, etc.

Monitor employee spending habits

One of the biggest benefits of using corporate cards for your company is the sheer transparency it provides in terms of tracking your employee’s spending habits.

Corporate cards record every single transaction made, allowing you to monitor your employee’s expense pattern with the credit statements and bank statements to filter out any discrepancies. You can also see if any employee is indulging in overspending and nip that habit in the bud quickly.

Get your expense reporting streamlined

Simplifying your expense reporting process is a surefire way to ensure that expense receipts are updated on time corresponding to the appropriate corporate credit card purchase. By investing in a smart expense tracking and uploading tool, all your employees have to do is simply update a digital version of the receipt, such as a photograph to the software for the admin to approve and they are done.

Integrate corporate cards with an accounting software

You learn how to choose a corporate card program, and find the one that best suits your business needs. Now when it comes to using your modern corporate card, why not unlock its full potential by integrating it with your pre-existing accounting software?

Look out for corporate credit card management programs that offer seamless integration with the accounting software you use. This one small step can potentially save up to hundreds of work hours reconciling corporate cards with your statements and then recording them manually.

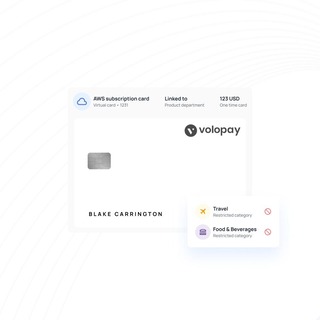

Set purchase categories

Take the guesswork out of where a corporate credit card can be used by laying down particular purchase categories for each card and its respective cardholder. This means that a card issued particularly for travel expenses may not be used for vendor payouts.

What this does is that it keeps track of expenses made by a particular employee or department and ensures that the budget the card falls under is being maintained as such. Coupled with your corporate card policy, this small yet ingenious trick might be just what you need in your arsenal!

Volopay makes corporate credit card management a hassle-free experience

Corporate credit card management might seem like a daunting task but it’s an essential process that will save time and money in the future. It becomes especially difficult if you’re doing it on your own. That’s why you need a complete financial management solution like Volopay.

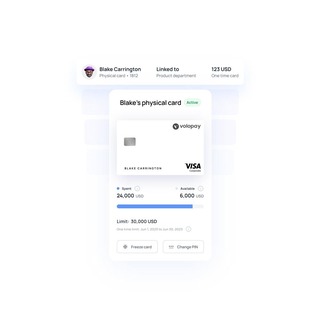

Volopay offers robust expense management features with physical and virtual cards. Our virtual cards are the safest way to pay online. You can create one-time virtual cards for single-use or create a recurring card for optimum subscription management – it’s all up to you.

Our virtual cards come with built-in spending limits that can be customized by you according to your needs. Simply set the limits and our powerful software will detect and reject expenses that do not comply automatically.

Additionally, you can empower your employees with corporate cards. Spend smarter with Volopay corporate cards that comes with proactive custom controls. You can block online transactions, ATM withdrawals, and international transactions of any card right with merely a few clicks.

Volopay allows real-time tracking so you can see when and where each card swipe occurs. Rewrite your corporate card policy on the go and set up multi-level approval flows for each card to handle payments, request or reject funds and manage your departments’ budgets.

All our cards come with the benefit of simplified paperless expense reporting. Employees can simply upload an image of their proof of purchase along with every expense to eliminate the paper trail and reimbursement complications at one go.

Sync with your accounting software

We offer automated accounting with premium accounting software such as Quickbooks, NetSuite, Xero, Deskera, and MYOB. Volopay also offers huge savings with our 5% cashback on all FX transactions, and a credit line of up to $500K, bringing money back where it belongs — in your business.

Related pages to corporate credit cards

Read the differences between credit, debit and prepaid cards in detail to understand what's best for your business.

Read our article to learn how corporate credit cards can help you to manage business expenses, save time & earn cashback on every spending.

Explore our article to learn how corporate credit cards can help businesses manage their accounts and track expenses more efficiently.

Get started with Volopay's corporate cards

FAQ's

Corporate credit card programs are designed for SMEs to streamline their online payments. With this, they get access to a platform where they can create and manage physical and virtual cards.

Unlike traditional credit cards, here, they have many features to control budgets and operations. They can have multiple cards assigned for each spend category with preset limits. Borrow credit from the provider or use pre-funding options to fund your expenses.

If you want to manage multiple business credit cards together, the Volopay card management system is the best solution. You can create, use, monitor, and discard cards in one location. They are best for monthly SaaS bills, online bill payments, and other online transactions. You can set unique budgets, controls, and workflows for each card.

Credit card management systems are very functional for small businesses. It gives owners a means to have one card for each of their payment categories. They have online payments and SaaS subscriptions which can be lined up using virtual cards. All cards can be managed from one place. As spending details are transparent, they can be assigned to employees too.