What is a business charge card and how does it work?

The only time when you should pick a card at random, is when a magician asks you to; not when choosing a card for your business. The payments and banking infrastructure has evolved significantly over the past couple of decades, specifically when it comes to business cards.

Credit cards, debit cards, prepaid cards, corporate cards, and so much more. The variations are enough to put companies in a dilemma of choice. Among these different types of cards, is one that has been quite popular in the past few years known as a business charge card.

Many organizations across the globe have taken a liking to this type of card for its unique value proposition that fits in with the needs of many businesses. But they aren’t meant for everyone. Let’s dive a bit deeper to understand what charge cards are, how they work, their benefits when you should choose them, and how they differ from credit cards.

What are business charge cards?

A charge card is quite similar to a business credit card in the sense that it allows you to make payments and purchase things on a credit basis. Charge cards tend to have a very high limit of available credit, which in most cases makes it almost seem like there is no limit to how much you can spend using it.

Companies opt for them when their business spending is much higher than what is allowed on most credit cards. They act as great financial tools for companies with heavy expense requirements on a day-to-day basis or just larger payment amounts in general.

How do charge cards work?

A charge card has a repayment cycle just like a credit card, but it is of much shorter duration; usually, 30 to 60 days depending on the provider you choose. Another aspect of it is that you cannot make part payments of the credit you use. You must pay the full balance you have utilized during each cycle on the due date.

The spending limit on a charge card is typically much higher than a normal credit card, and in many cases, there is no pre-set limit. Transactions are approved based on your financial history, spending habits, and business credit score, making charge cards ideal for companies with larger expenses than those allowed by most credit cards.

Make secure and convenient business payments with corporate cards

When should you choose business charge card?

You must have heard of the phrase ‘I didn’t choose the thug life, the thug life chose me.’ Well, when it comes to charge cards, a similar saying applies - You don’t choose whether you should use a business charge card, the charge card chooses whether it can be used by your business.’

The reason we say this is because it is not easy to get a charge card and it is surely not meant for every company. A thorough financial check of your organizations’ dealings is conducted by the card issuer in order to determine whether you have the financial stability and business cash flow to use and continue using a charge card without becoming a defaulter. Only when your company has a positive cash flow and has already built a good reputation with an above-average credit score will you be eligible for a charge card.

How do charge cards affect your credit score?

A business charge card does not have a pre-set spending limit each month for credit utilization, but rather keeps fluctuating from one cycle to the next based on how you use it. But how much credit you’re using, commonly known as the ‘credit utilization rate is only one part of your business credit score.

Using a charge card still affects your credit score in the form of tracking your payment history, the age of your account i.e. how long you’ve been using the card, whether you have had new inquiries for more credit or cards, and your credit mix.

So since your payment history is tracked, you should definitely make it a point to pay the balance in full to show that your business is capable of making all credit payments on time. If not, you will be penalized with heavy fees and it will also end up hurting your credit score.

Another aspect regarding the usage of a charge card that can affect your credit score is whether your account is an open or a closed account. The longer your charge card account is open and is being used properly, the longer it will reflect in your credit history. A lengthy duration of credit usage without any payment issues is also a factor that improves your credit score.

Benefits of business charge cards

No debt and interest

Since the billing cycle of a charge card is very short, no interest rates or long-term debt accrues on the credit you use from it, ensuring financial flexibility for your business.

No spending limits

Business charge cards have fluctuating credit usage limits based on how much you use every month making it seem like there is no limit to business spending.

Make large purchases

If your business has reached a financial stage where providers deem you fit to use a charge card, then you can rest assured that you won’t have any problems spending large amounts of money for business purposes.

Great perks and rewards

The rewards and perks that you receive through a charge card are quite similar to those of a credit card, including discounts and loyalty benefits. Some charge cards also offer cashback in the form of a credit to pay off the credit you have utilized.

Simplify your business expenses with Volopay

Overview of charge card vs credit card

- Pre-set credit limit

- Annual fees

- Allowance of part payment

- Does it affect your business credit score

- Are interest charges applicable?

- Late payment fees

How does charge card differ from credit card?

The debate of using a charge card or a credit card is an ongoing one ever since it launched in the market. When it comes to your business, the type of card you should choose is highly dependent on what your accounts payable requirements are each month.

Very high credit limit

Probably the biggest differentiator for a charge card when compared to a credit card is the amount a business can spend using it. Since there is virtually no pre-set limit to the available credit, a company can make payments for large sums of money without worrying that their payment will be declined as in the case of a credit card that has a pre-set limit.

Of course, this also depends on the financials of your company and the kind of cash flow you have before receiving your charge card. Some may even consider a charge card to be a prepaid credit card because it is very difficult to obtain this type of card without having the capability to pay it off in the first place.

Smaller repayment cycle

A smaller repayment cycle makes it an obligation for the business to ensure that they are spending wisely and are capable of paying back borrowed credit in time.

Hefty defaulter fees

The penalty fees for not being able to pay back the amount of credit used through a charge card are quite high. There isn’t a specific rate of fee for late-payments and it all depends on the provider. But in general, the late payment fee for charge cards is much higher than a credit card.

Credit requirement

Due to the fact that you need to have a high income, positive cash flow, and excellent credit, charge cards are not easier to obtain than a credit card. Without a good financial history, your company will most likely not be eligible for a charge card. Charge cards usually require a credit score above 670.

Upgrade to Volopay corporate card: The modern business card solution

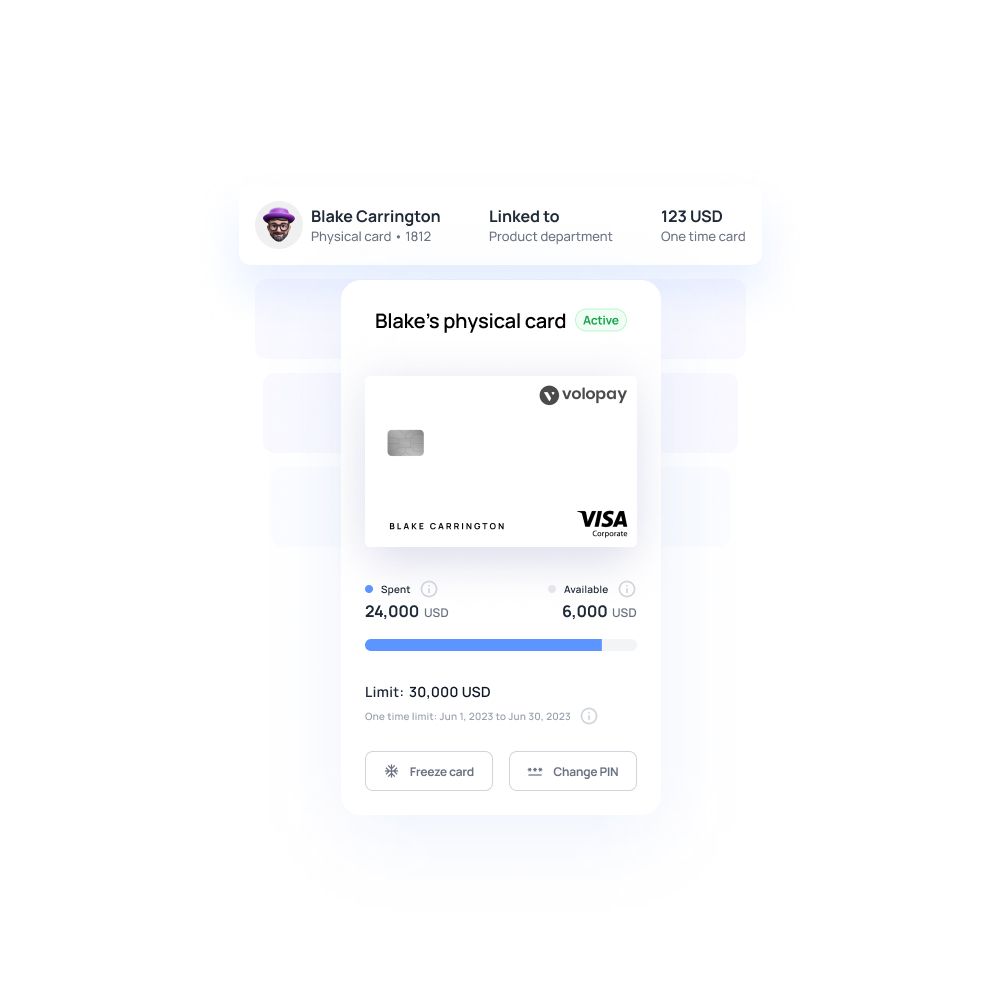

Volopay corporate cards combine the benefits of traditional business charge cards with modern features tailored to your needs. With no pre-set spending limits, they empower your business to handle large transactions seamlessly.

Beyond that, Volopay simplifies expense tracking, automates workflows, and integrates effortlessly with your financial systems. Enjoy real-time visibility into spending, faster approvals, and powerful analytics to optimize your finances. Unlike conventional charge cards, Volopay adds flexibility and transparency, making it the ultimate tool for smarter financial management.

Related pages

Understand the key differences between business and corporate credit cards, including eligibility, benefits, and tips for choosing the right option.

Learn the expenses to avoid on business credit cards, their impact, and strategies for effective corporate credit card management.

Explore the best company credit cards in the US for 2025, their benefits, key features, and tips for effective management.

FAQs

Yes, although a charge card does not track your credit utilization rate, it does track other factors that affect your credit score such as your payment history and how old your credit account is.

When repaying credit used from a charge card, there is no option to make part payments. So if you’re not able to pay the full amount, it will count as a late payment and the card issuer will charge you a late payment fee.

Unlike a credit card, a charge card does not have a pre-set spending/credit limit. The limit is usually kept so high that businesses won’t face any problems carrying out transactions with large sums of money.

Charge cards usually require a credit score above 670. The better your credit score is the higher your ceiling for spending through charge cards will be.