Pros and cons: Corporate cards vs employee reimbursements

Managing employee expenses or business expenses is the responsibility of every manager in the company. The top-level management is not the only one in charge of the costs incurred; so are the middle-level employees. Hence, it becomes crucial to get hold of the entire company spending in such a complex cobweb.

Employee expense reimbursement

Employee reimbursements are the age-old method of paying employees for their money spent on the company’s expenses. Employees are required to pay from their pockets at the point of spending, and later submit the receipts or other proof of documents to validate purchases.

Companies then verify the details submitted by the employee and approve the reimbursement. Some companies make employees fill out forms or maintain an expense report.

Why businesses need corporate cards?

Corporate credit cards, on the contrary, use a digital approach for employee expenses. Employees are issued a physical card for carrying out purchases or payments on behalf of the company.

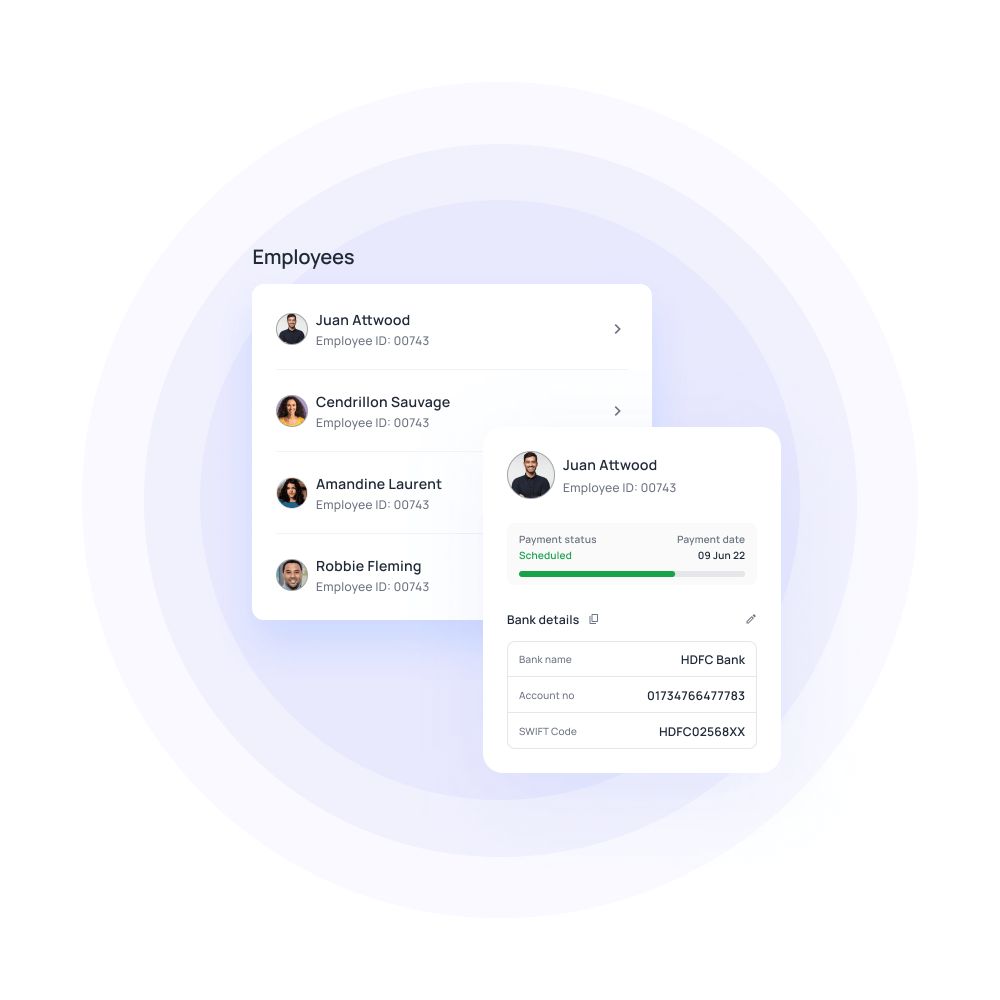

Timely funds are loaded into the employees’ company cards according to their spending requirements. All the employee cards are linked to a central software where all details regarding the past and ongoing transactions are displayed.

Pros of reimbursement

Ideal fit for small enterprises

Expense reimbursements are the most suitable choice for those organizations that comparatively have a smaller workforce or less frequency of payouts. In such a scenario, reimbursement helps in scaling the financial process and eases the reconciliation of transactions.

Chances of less fraud

As the employee will be paying for the expenses first hand, they are less likely to incur the costs than their purchasing power. Also, there’s less possibility of forging receipts as the company finance controller will cross-check all the invoices and other documentation manually. Hence, reducing the chances of any fraud or malpractice.

Paper-less reimbursements

Expense reimbursement software is the modernized way for traditional paper cheque reimbursements. This software displays real-time insights into the company's financial health at a single point in time. The software is enabled with policy check features that help improve reimbursement policy compliance, prevent duplicate entry, and make the analytics more data-driven.

Cons of reimbursement

Reimbursements were never the way to check or control the company’s spending. Yet many companies stick to reimbursements because of the lack of faith in their workforce or when companies are adamant about giving employees financial autonomy.

Though the company will reimburse the amount later after verification, what if the employee does not have enough funds to make the payment? There’s a possibility that the employee is required to make a purchase of $100, but they possess only $65. Therefore, this system of reimbursing them won’t add any advantage to the company.

The traditional reimbursement method involves a lot of input in terms of energy and time. The finance manager needs to manually check on the receipts of transactions and reconcile them into the accounting system. There are high chances of duplicate entries while creating expense reports too. This results in the overall hampering of financial statements.

Manage your business expenses with corporate cards

Pros of corporate cards

Improved accountability

Issuing physical cards to each employee will mark every payment done by their card against their name. This establishes accurate accountability for every purchase and payment made.

Automation is key

Corporate cards work based on automation, AI, and API. Using a tech-savvy spend management tool helps in simplifying accounting work. All expenses incurred via corporate cards are automatically logged into the expense management system linked by.

Multiple functions

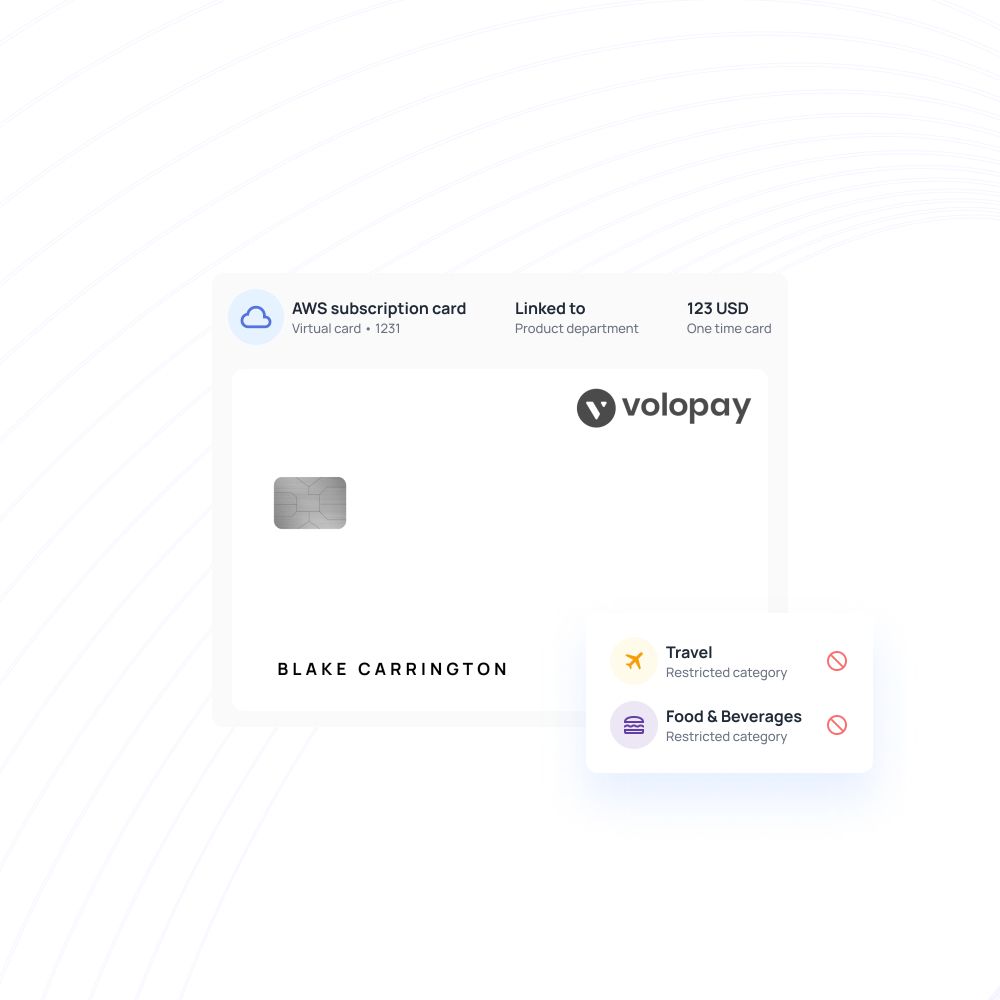

Corporate cards cater to the functions of expenses and finance management and promote a healthy spend culture. Corporate cards help in better compliance reports, proving useful while employees undertake a business trip, subscription management, and money transfers.

Cons of corporate cards

Corporate credit cards are not necessarily the ideal fit for every organization. Selecting a corporate card program will cost them unnecessary extra bucks.

Since every employee is allotted a personal card, there are chances that employees out-smart the company and use these cards for their personal purchases. Or, more often than not, employees do not opt for cost-effective options and tend to choose more luxurious options.

Corporate cards are just another card with card details, expiration dates, and CVV. Hence, these cards also can get scammed if placed in the wrong hands. Employees can also misplace these cards, which causes a massive threat to the company's finances.

Volopay offers both corporate cards and reimbursements

Corporate cards

- Managing and paying for all business subscriptions through a single platform.

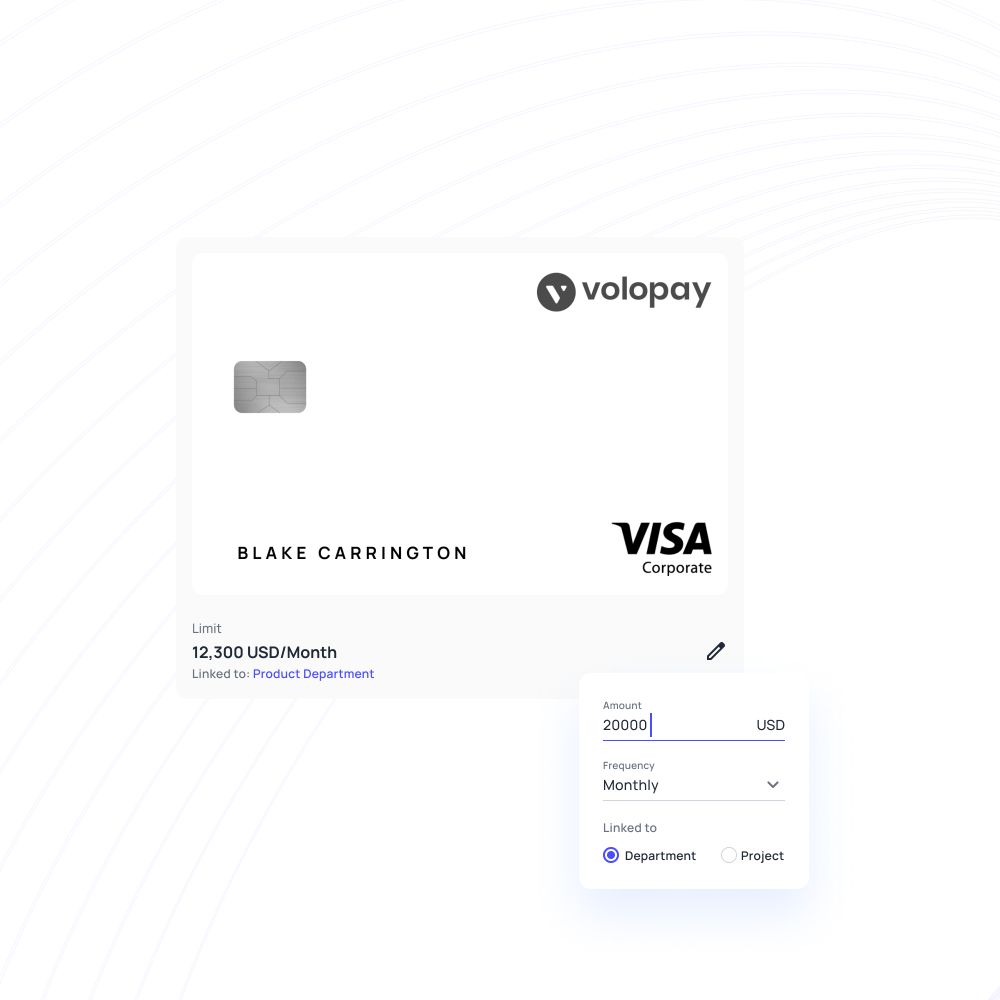

- Helps in better company expense policy compliance via setting spend limits and enforcing policy rules.

- We offer a 5-level approval system for fund requests.

- Individual spend limits for each Volopay corporate card.

Reimbursements features

- A dedicated reimbursement platform for quick and instant reimbursement approval.

- Automated expense reports for each month with detailed statements of each transaction.

- A ledger for each expense category to analyze the total expenditure made for these expenses.

- Smart spend analytics is based on employees' spending over time.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free

Related pages to corporate credit cards

Discover how corporate cards help manage employee expenses, offering real-time tracking, control, and policy compliance for smarter spending oversight.

Learn how to detect, prevent, and address corporate card misuse by employees through clear policies, tracking tools, and smart approval workflows.

Set spending boundaries with corporate cards. Learn how setting limits boosts control and ensures compliant expense management for businesses.