Corporate credit card expense management with Volopay

Your go-to guide to understanding corporate credit cards and how you can use them for everyday business expenses to simplify your spend management — all with Volopay

What are corporate credit cards?

The business world is growing at an unprecedented pace, fueled by the newest technological advancements to ease and even automate business processes. However, one of the most overlooked features in business today are corporate credit cards, a type of expense card that is issued to employees by their employers to conduct business-related transactions swiftly and efficiently.

Companies everywhere are so used to the traditional method of business credit cards that they more often than not miss out on the hassle-free accessibility and time-effective benefits that corporate expense cards have to offer. If all you’ve ever wanted in your business expenses is transparency, accountability, and control, using a corporate credit card for expense management is the way to go!

Corporate credit card vs business credit card: What's the difference?

Many people mistakenly think of corporate credit cards and business credit cards as the same, but understanding the key differences between business and corporate credit cards is crucial for making the right choice for your organization. Here are some key differences

Set spending limits and categories

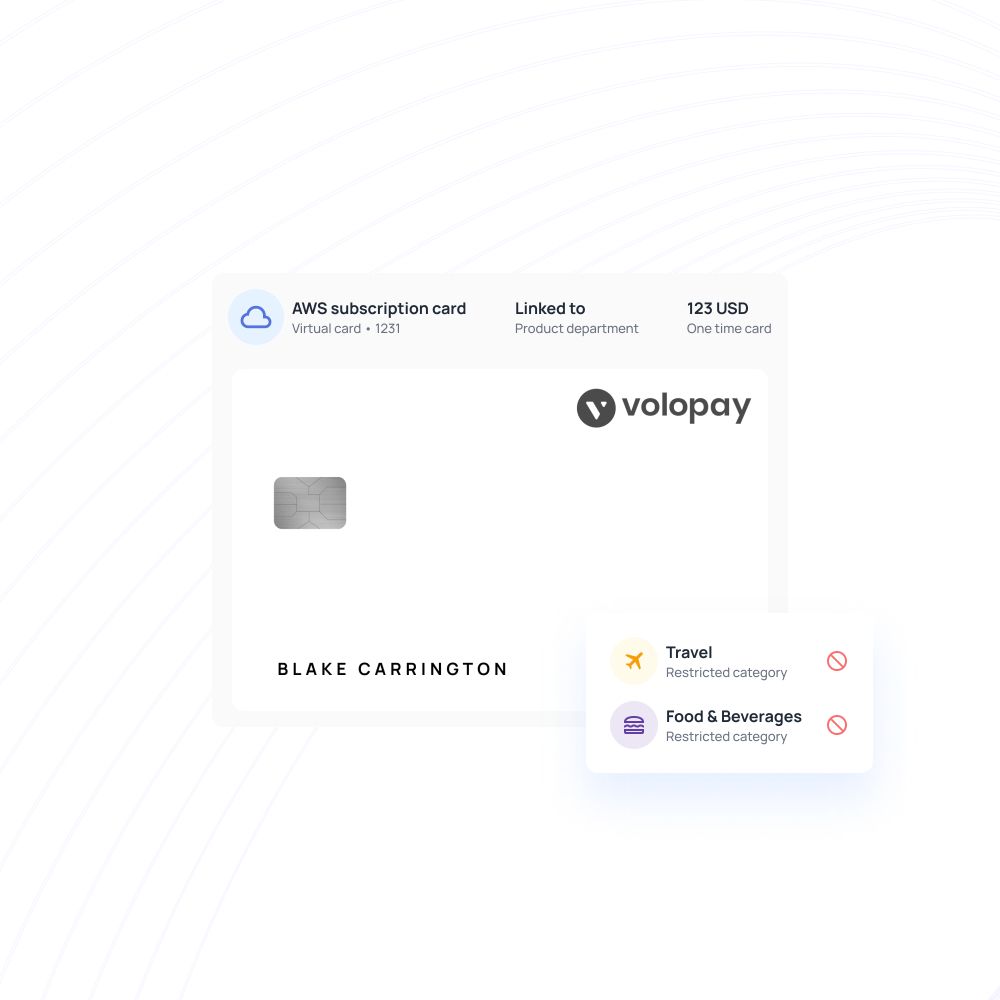

With business credit cards, while it is easy to set spending limits on each authorized card, it is very difficult to set spending categories.This lack of categorization can lead to unauthorized purchases and confusion. This gives your employees free rein to pay for different operations using the business credit cards which they weren’t supposed to.

On the other hand, with corporate expense cards, not only can you set spending limits, but you can also restrict spending categories so that the corporate cards are used by employees for activities they are authorized to do. This ensures that expenses are aligned with your company’s budget and guidelines.

Track real-time expenses

Who bought that $8 pumpkin spiced latte and chalked it up to a business expense? If you are using business credit cards, you’ll never find it out! Business credit cards do not provide the feature of expense tracking and reporting, and those who do provide this feature are average at best.

This lack of oversight can easily lead to financial mismanagement. The result? An increased risk of wasteful, uncontrollable expenditure can jeopardize the cash flow and credit score of your business. With corporate credit cards, you get real-time expense tracking and spending alerts that let you know of any misuse instantly. More on that later.

Safeguard your bank account

When using business credit cards, your cards must be linked to the company bank account which if not supervised closely, can lead to unforeseen expenditure, exhausting your credit limit earlier than expected, ultimately risking your business credit score.

When using corporate credit cards, especially the ones provided by Volopay, your corporate expense cards are not linked to your bank account but are linked to the department budget you’ve set for each corporate credit card. This ensures that your company bank account is not irreversibly affected by any unauthorized or personal spending by employees.

Manage your business expenses with corporate cards

How corporate credit cards make expense management easier?

In the battle of corporate credit card vs business credit card, we know who the clear winner is. Corporate expense cards are not just safer and more secure than business credit cards, even the management of corporate credit cards is much simpler & streamlined.

They are also extremely beneficial to have both for the employer and the employees, whether you have a well-established business or an SME. Here are some of the umpteen benefits of having a corporate credit card for expense management:

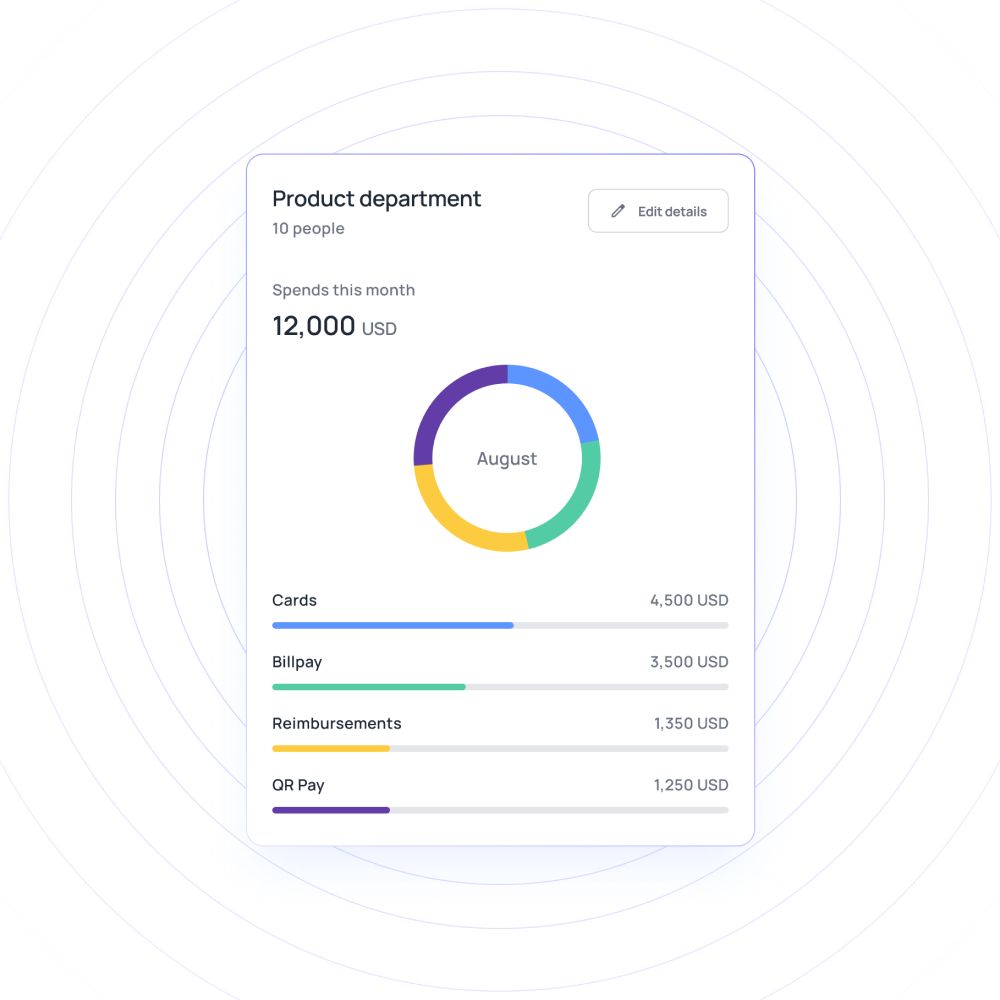

Centralized expense tracking

With corporate credit cards offered by expense management platforms like Volopay, you can see a live expense tracking dashboard, that keeps a note of all transactions so that you can exercise full control over how and where your money is being utilized.

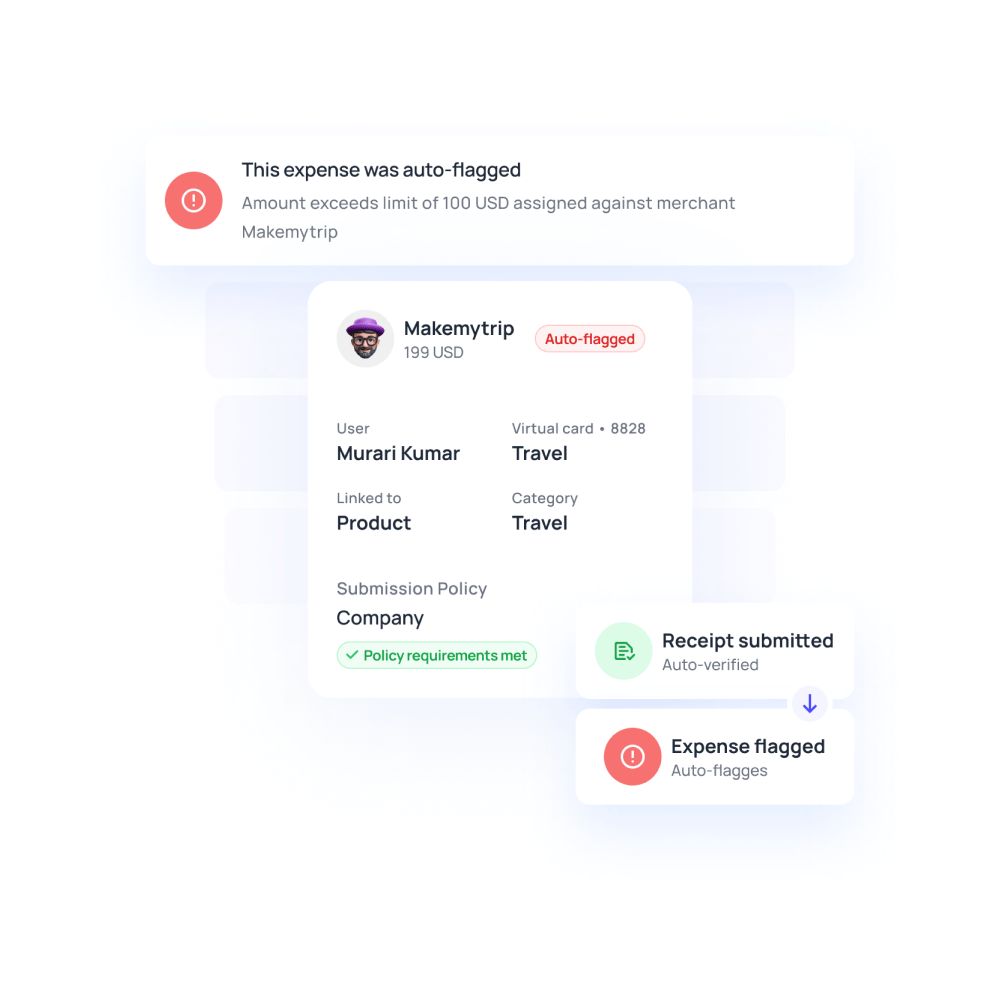

Corporate expense cards also come equipped with features such as real-time spending alerts to notify you if and when any expense policy set by you for a corporate card is being violated.

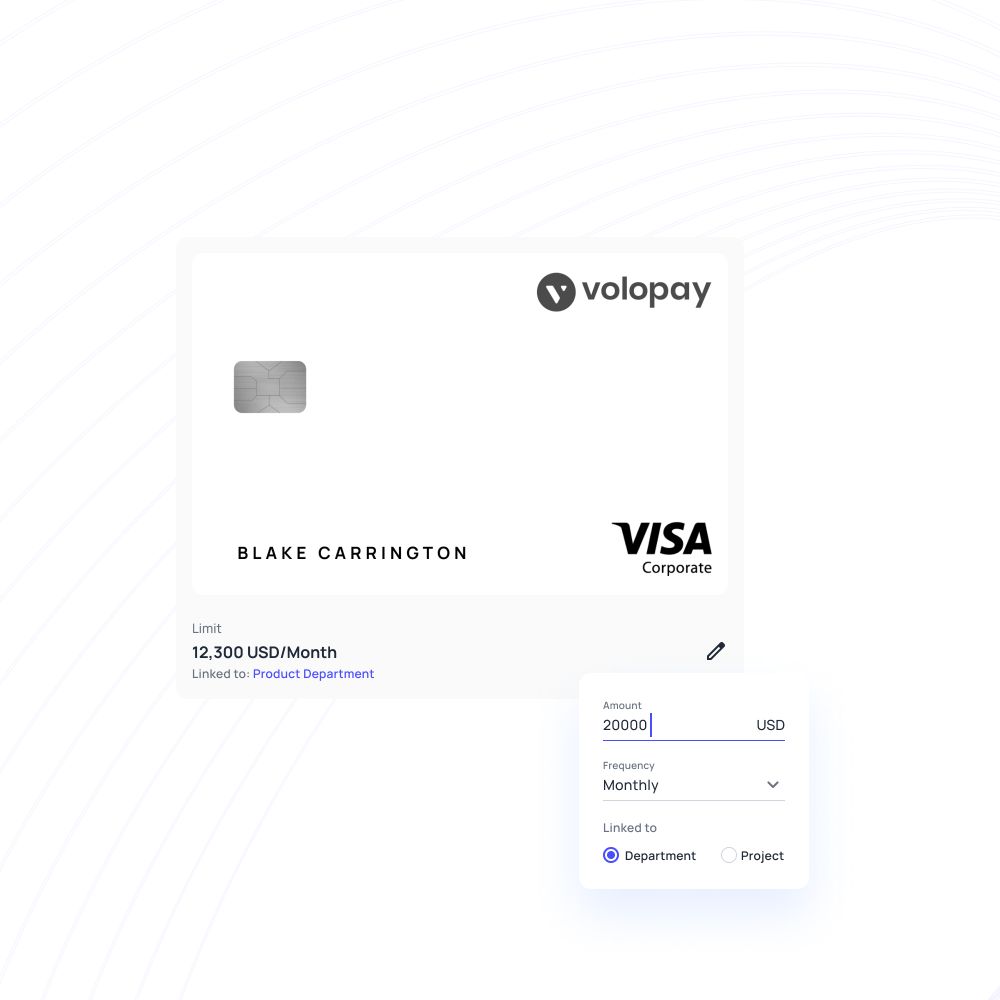

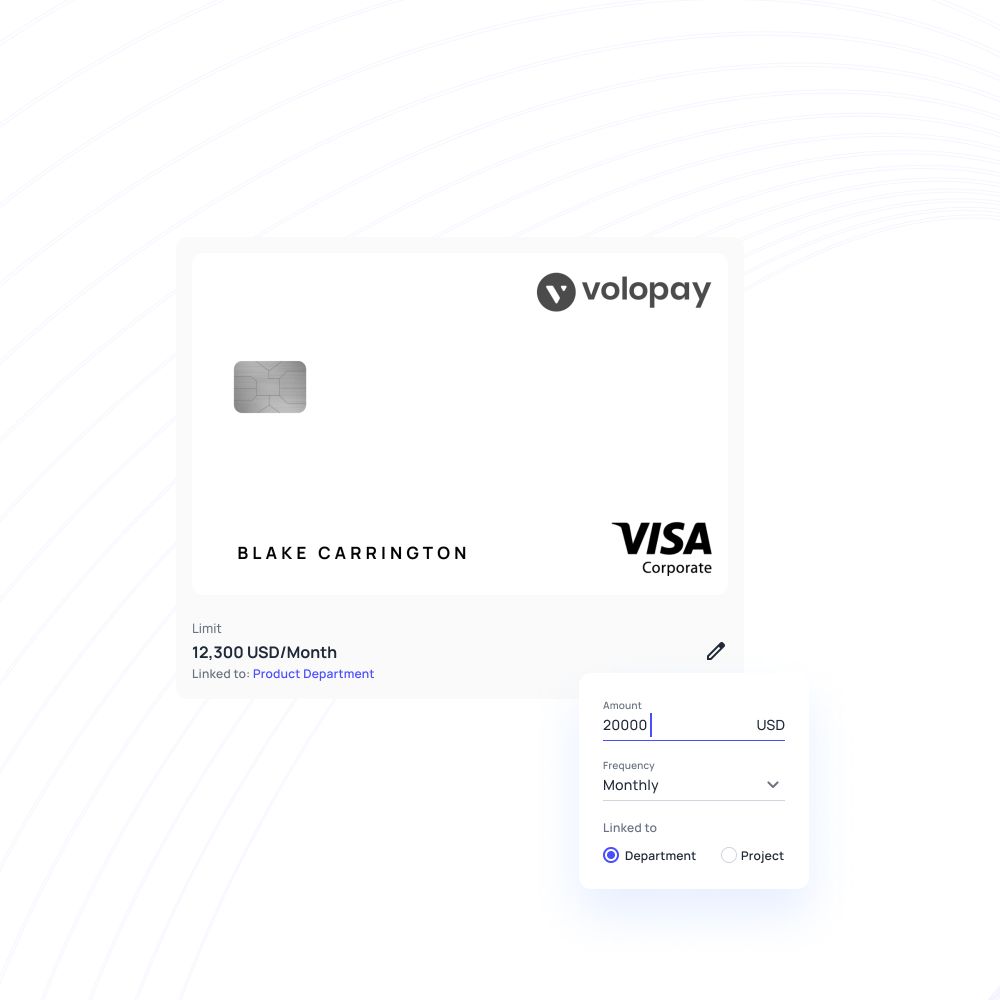

Individual card limit

With corporate credit cards, you can not only put a spending limit on every single card, you can even go ahead and restrict corporate cards under certain spending categories as well. This ensures that every corporate card is being used for the exact purpose it was created for.

For instance, if a corporate card is being created for travel purposes, creating the corporate credit card for specifically that purpose will avoid any possibility of wasteful or personal spending by the cardholder.

Limit fraud and misuse

Having corporate cards for business expenses created with a fixed budget limits the possibility of fraud or misuse.

In case you fear that an employee might be using the corporate credit card for personal spending, you can choose corporate credit cards with reconciliation software that can quickly distinguish between a business and personal expense automatically.

Access real-time data – whenever, wherever

One of the main issues with expense reports is the delay in receiving expense claims that can take a couple of weeks up to several months to be displayed. With business credit cards, the irregular nature of delayed or recurring payments can make your budgets go haywire. The solution?

Corporate expense cards provide real-time logging reports with the added convenience of purchase proof, eliminating the need for long-winded employee reimbursement hassle and a clear record of all company expenses, broken down into categories, team, cardholder, etc. This data is again stored in a cloud-based storage platform making it accessible, no matter where you are.

Easily issue instant virtual cards

Business credit cards, due to their access to your company bank account, are given to only the high-ranking authorities such as the CEO, VPs, other executives, and office administrator. What about the others? Other employees have to ask for these cards time and again whenever they need to make a business expense. It feels like you’re back in school, asking your teacher for the hall pass.

That’s why corporate expense cards are the ideal choice, as they can be given to anybody since they are allotted on a predetermined budget and are not linked to your company’s bank account. What’s more, you can also issue instant access to corporate virtual cards for your employees and see a clear view of who is spending your company money and where.

Benefits of using corporate credit cards for small businesses

Contrary to popular belief, small businesses too can reap the benefits of a corporate credit card program for small businesses and streamline their expense management workflow swiftly and efficiently. Here are a few ways you can use corporate credit cards for small businesses to your advantage:

Keep personal and business expenses separate

Sometimes you might feel the urge to put a business expense on your personal card, or your employee may feel the same sentiment to get some reward points, but it’s best to not blur the line between your personal and business expenses.

Having a dedicated corporate credit card allows you to restrict yourself and your employees from making any business purchases personally, keeping your financial records clean and your credit history pristine.

Monitor employee spending habit

A corporate expense card is the best way to keep track of any individual employee’s or team’s spending habits, providing tangible proof and records to identify who might be indulging in wasteful expenditure of precious company resources. With corporate credit cards and streamlined expense reimbursements in place, businesses can not only simplify tracking but also address fraudulent activities, embezzlement, or blatant misuse. These tools work hand in hand to safeguard your assets and ensure financial transparency.

Advanced security measures

One of the best features about corporate credit cards is the multiple levels of security they provide in terms of multi-level approval for every expense, thereby protecting your company against theft, fraud, and any possible misuse of corporate credit cards. You can set multiple authority channels according to the value of the business expense, whether it’s a low-cost expense or a high-cost one.

If found to violate the expense policies set by the authorities, you can easily block and freeze all activities on the account. Understanding these security measures is key to choosing the right corporate credit card for your business and safeguarding your organization’s financial security.

Cash rebates

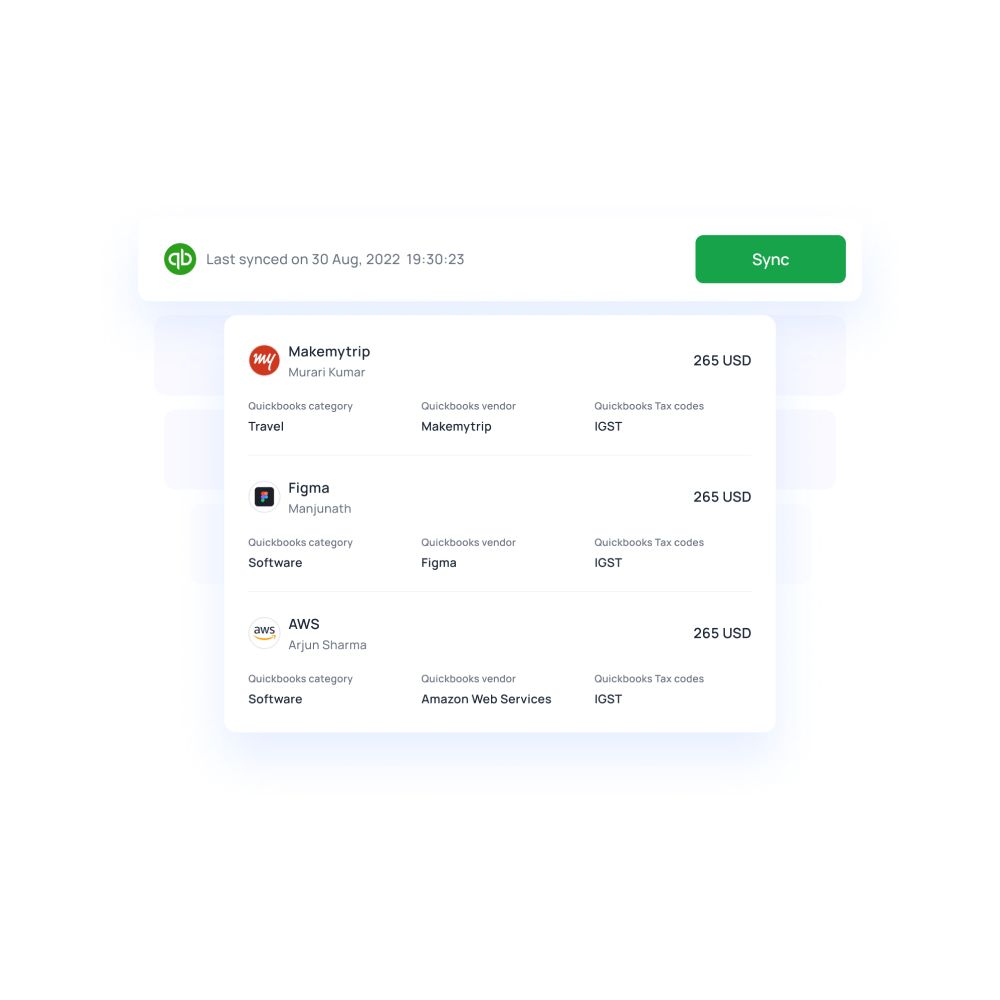

One of the best benefits of using corporate expense cards is the ability to earn cash rebates on purchases while also simplifying corporate credit card reconciliation through automated tracking and reporting. Cashback rebates differ for each provider, depending on the type of purchase made.

For example, a company that generates an overall expense of USD 3 million paid through a corporate expense card can rake in as much as USD 50,000 as a cash rebate!

This rebate can be further invested into an all-in-one financial spend management platform such as Volopay that provides auto-reconciliation with your accounting software along with various other features.

Empower your employees

When employees have to incur out-of-pocket expenses on business operations such as work trips, they can end up accumulating thousands of dollars worth of employee reimbursements, which is in itself a long and tedious process.

Corporate expense cards eliminate this problem by providing them the freedom to pay for stuff on the go using the company’s resources and digitally attach their receipt as proof of purchase. Not only the monetary benefit for the employees, equipping them with corporate credit cards instills in them a feeling of mutual trust and admiration that further improves collective team happiness.

The benefits are irresistible, but choosing the best corporate credit card provider for your company is a tricky business itself. Luckily, we can help you out here too.

Streamline your expenses with the smartest corporate cards in town!

Volopay makes expense management easy

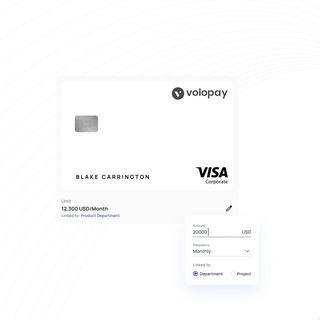

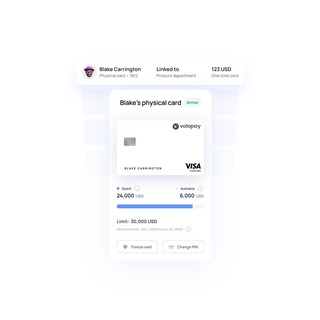

Volopay’s range of business prepaid cards and virtual corporate cards with in-built departmental budgets and spending limits adhering to expense policies allow you to foster a seamless expense management system in your business.

Set proactive controls on every single corporate card, send funds, and experience real-time tracking on our live dashboard. You can set custom policies and block activities such as international transactions and ATM withdrawals whenever you prefer.

Since every card is allotted to specific employees for specific business purposes, you can easily keep track of who is using company resources where and approve or reject as you go. What’s more, we also provide unlimited virtual cards with lightning-fast instant access.

Not just this, Volopay also provides seamless GPay support. You can add your 16 digit card to Google Pay directly and enjoy faster payments with just a few clicks! You can set recurring or one-time corporate cards based on your type of expense with just a click of a button.

But that’s not all! Volopay offers great cash back rebates of up to 5% on all FX transactions. The more you pay using corporate expense cards, the more you save, with no cap on saving!

FAQs

You can use Volopay corporate cards for a lot of expenses such as travel and airfare, vendor payment, routine subscriptions, etc.

Since the company is putting its own money or using our flexible credit line as the budget from which the card is allocated its spending limit, the company is ultimately responsible for the purchases made from corporate credit cards.

However, as each corporate expense card is allotted to a specific employee, you can quickly see which expenses are justified as a business expense and which aren’t. This makes it easy to hold the employee accountable for any personal expense made using your corporate credit cards.

To qualify for our corporate cards service, a company has to be a legitimate business registered in the specific market and qualify based on the guidelines set by our partner firms. Gambling, crypto-operations, etc. These are some of the prohibited business categories. To know more, feel free to reach out to us.

As an admin, you enjoy complete control over your corporate expense card. You can set up a departmental budget for the card, set the spending limit, restrict spending categories, create customized corporate credit card policies, set the card to a one-time use or recurring (for subscriptions), block and freeze any card in case of dubious activities.

The card tab includes all the card expenses that can be exported and seamlessly integrated with your accounting software. We integrate with top accounting software such as Xero, Quickbooks, Deskera, Netsuite and MYOB.

Chasing after receipts and invoices are certainly not what office managers are hired for. Volopay automates this process by letting each employee upload their receipts on the spot with our very handy mobile app.

With Volopay, one can simply upload a picture of a valid receipt for every transaction using our web platform or mobile app, eliminating big expense reports and saving time of finance managers wasted in reconciliation.

Related pages to corporate credit cards

Company credit card for employees are issued to pay for their business expenses. Know how and when to issue a corporate card.

Compare P-cards and corporate cards to determine which is best for your business, with insights on features and benefits.

Learn how corporate credit cards benefit companies, employees, and finance teams. Get tips on choosing the right card for startups and small businesses.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business.

Get started free