Corporate credit card vs expense reimbursements

As the days of paper-based expense management continue to dwindle, its digital successor has made quite the impact on the finance world. Yet, there are still companies that prefer traditional expense reimbursements courtesy of the pros it continues to have.

Corporate credit cards were introduced as a part of the spending democratization wave that has been brought about by the digital revolution. Both small as well large corporations are increasingly looking at corporate credit cards as the future of expense reimbursement. Yet, a choice between the two will depend on what suits your organization the best.

What is corporate credit card?

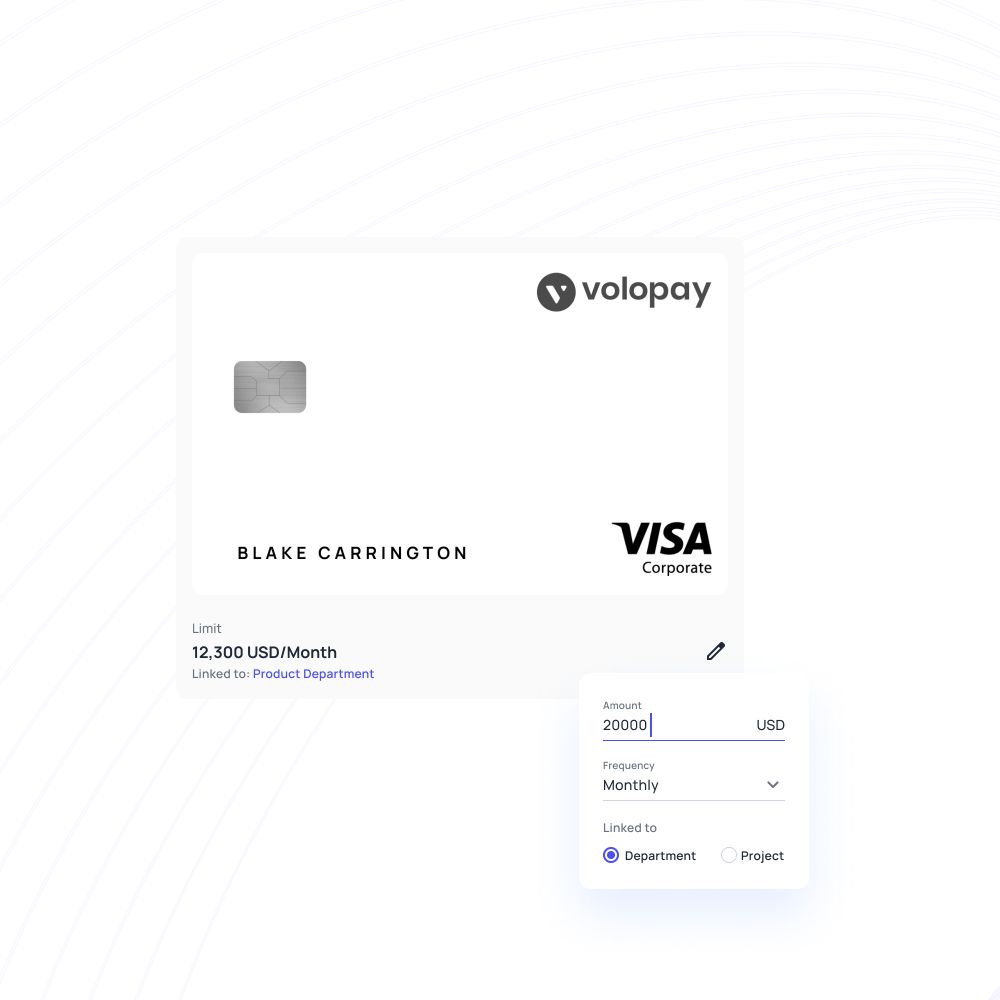

A corporate credit card is a card that a company may issue to a particular employee for making authorized business-related expenses; for instance, vendor payments, hotel stays, and travel tickets for a business trip. Corporate cards can be issued as both physical as well as virtual cards.

These cards come with expense management tools and a ton of other features like real-time reporting, analytics, and software integrations as well as cashbacks and rewards that make it much easier to manage company expense and cash flow records.

How do corporate credit cards work?

The use of corporate cards in businesses is similar to that of personal ones. You can use them over the counter or on any payment portal. Without a corporate card, however, an employee will have to use their personal resources, cash, or card, to make these out-of-pocket payments. Even if such expenses are reimbursed in the future there will be a period for which the transaction will have to be made out of the employee’s personal finances.

The corporate card, however, records these transactions in real-time and maintains a database containing the particulars of the same. It notifies the responsible individuals in case any approvals are required and ensures that the transactions are airtight, free of error, and reimbursed, if necessary, at the earliest. Additionally, reconciliation of corporate credit cards simplifies the accounting process by automatically categorizing and documenting transactions, reducing discrepancies and providing a clear financial overview.

Corporate credit card expense management

Most corporate credit cards come equipped with expense management tools that can make your accounting team’s lives much easier. Corporate cards record transactions, in real-time, on this software as well as on any accounting software it has been integrated into.

This feature is extremely useful for managing corporate reimbursement, making payments on time, and keeping track of your credit line. Because they can be used as both company expense cards as well as employee spending cards these cards become one-stop solutions for consolidating cash flow management in one place which therefore results in streamlining your expense management process.

Want to know more about our corporate credit cards?

Pros of corporate card

Employees should never have to fear having to pay out of their own pockets. Not only does this complicate the reimbursement process, but it can also cause significant stress to the employee. Using corporate cards instead enables the employee to rely on company money or credit instead of their own.

Real-time reporting, tracking, and approval features of corporate cards make the reimbursement process far more efficient. Not only does this save time but allowing employees to use company funds instead of their own makes the reimbursement process itself redundant.

With corporate credit cards, you never have to worry about maxing out your credit or unauthorized spending ever again. Corporate cards give you control over how much can be spent for each card, you can set spending limits that ensure expenses going above the limit are never completed in the first place.

Corporate credit cards provide real-time tracking of all business expenses, offering companies complete visibility over their overall spending. This instant access to how company cards are being used helps control expenditures and ensures financial management stays transparent and efficient.

Corporate cards not only come with additional layers of advanced security because they are often used by larger corporations to make significant spending decisions, but the internal monitoring, control, and visibility that they offer ensures a high level of security against fraud and unwanted expenditure.

Corporate cards come with valuable rewards such as cashbacks, discounts, and frequent flyer miles. These perks benefit businesses by offering additional value with every purchase, allowing employees to enjoy exclusive advantages and enhancing the overall company spending experience.

Corporate teams have different subscriptions with regular payments. For example, the marketing team might need to pay monthly subscriptions to services like Google, HubSpot, or Facebook. Virtual cards can be issued to manage these specific, recurring payments.

Expense management software linked to corporate cards automates record-keeping. This software ensures routine, error-prone tasks are completed swiftly and accurately, which would otherwise take your finance team hours manually, saving time and effort.

Corporate cards automate enforcing business expense policies. With integrated software, you ensure policies are adhered to without manual intervention, preventing violations and streamlining the approval process while maintaining control and compliance.

Cons of corporate cards

Supporting charges

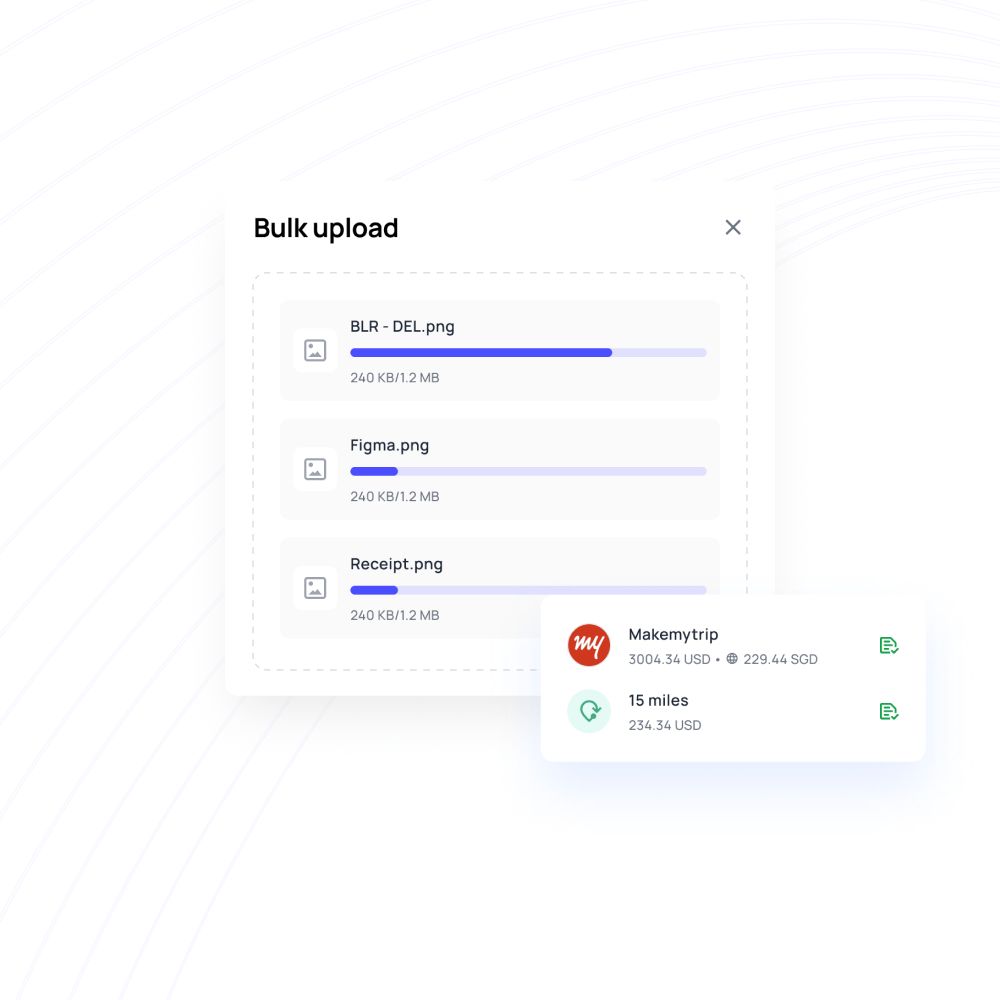

Even if transactions get recorded automatically, employees still need to continue turning in receipts to support the charges.

Tracking these down in the future can become a real hassle and time-consuming task.

Risk of lost or stolen cards

In case of physical corporate cards, like any other card, could also be misplaced or stolen. This could be extremely risky for the company’s finances.

Yet, this too can be controlled because it only takes a click or two to block a corporate card.

Overspending

Employees can run the risk of overspending due to the immediate reimbursement feature, which provides quick access to funds.

Some might even, accidentally or intentionally, not use the credit card for work expenses only. This freedom could be taken advantage of. However, the spending limit, real-time reporting, and tracking features do help prevent this.

Higher capital risk

The risk of losing capital at the hands of employees who overspend, misplace or try to put personal expenses on corporate cards is lower for personal credit cards in contrast to corporate ones.

Moreover, the threat of debt and fees accumulation is also a capital risk for company cards. Add on interest rates, annual fees, and foreign transaction fees this risk can become quite high.

Why do some companies prefer expense reimbursement?

Companies continue to stick with traditional forms of expense reimbursement for some reasons. A lack of trust towards employees, lower capital risk, and the absence of responsibility when it comes to shared cards are some of the reasons behind why it is so.

What is expense reimbursement?

The procedure followed by companies to pay back employees for out-of-pocket expenses is called expense reimbursement. It usually involves many steps starting from recording transactions, sharing receipts to approval, and consequent reimbursement.

Employees can be reimbursed for a number of expenses some of the most common ones being travel, mileage, office, or any other company expense.

Streamline your employee expense reimbursements with Volopay

Pros of employee expense reimbursements

With expense reimbursement companies do not have to fear loss or theft of the card itself when it comes to physical cards. It ensures that the liability of losing the card is on the employee and not on the company itself. Expense reimbursements are especially useful when they are automated.

You can get SaaS employee reimbursements platforms to do the receipt capturing, expense reporting as well as instant reimbursements for you. With these platforms, employee reimbursements become instantaneous and streamlined.

Auto checks and approvals make spending much easier for your employees and at the same time these features ensure error-free and efficient reimbursement for your company.

Moreover, using personal cards for purchases also means that employees can enjoy the perks, rewards, and cashbacks earned via purchases for themselves.

Cons of expense reimbursements

Companies across the globe are shifting away from traditional expense reimbursement and with good reason. Traditional corporate reimbursement does not come with any perks whatsoever.

It is an extremely time-consuming process that is highly susceptible to errors and inconsistencies.

The process itself is tedious and can take a full month to complete, that is assuming that the steps are carried out with absolute perfection. Completing reports, tracking down missing receipts, and maneuvering the approval process have to be done entirely manually.

Each expense report has to be checked for policy adherence and even this is not entirely free of the possibility of errors.

Corporate credit card vs Expense reimbursements: which one you should opt for your business?

When it comes to the question of corporate credit card vs expense reimbursements the choice you make will have long standing outcomes for your business. While most modern companies are moving towards using corporate credit cards for business purchases, there are still companies that prefer the traditional method of reimbursing expenses at the end of the month.

Ideally, you should opt for corporate credit cards given the high degree of convenience and efficiency that they bring. These cards eliminate the need for month-end reimbursements and make business purchases far easier to manage. However, if you’re still on edge about making this choice you can always opt for services like Volopay. Volopay provides both corporate cards as well as expense reimbursement facilities.

The best part is that reimbursements on Volopay happen instantaneously, in an automated fashion so the problems associated with traditional expense reimbursement processes are bypassed.

How Volopay brings corporate cards and expense reimbursements together?

Nobody likes making a choice and choosing between corporate cards and expense reimbursement might not always be an easy one for you. The best part is, you don’t necessarily have to. With Volopay you can opt for both corporate cards and reimbursement or any one of them depending on your business requirement.

Volopay’s expense reimbursement feature is available for free on the platform, yes you read that right. All you need to do is take a photo of the receipt, upload it, create a report and hit submit. The admin will approve the request and money is instantly reimbursed to the employee's bank account.

The platform also has corporate debit cards available on which companies can load money from their bank account. If debit cards are not your thing then you can just opt for our corporate credit card preloaded with a business credit line instead.

Volopay’s software is also equipped with control measures, spend limits and analytical tools. This means you’ll barely have to lift a finger if you want to ensure corporate card management and cash flow are on track. Moreover, what makes it even more convenient is that employees can request funds to their corporate card even when traveling directly from the app.

If that’s not enough the platform also comes with a seamless integration feature that allows you to sync your cards and Volopay expense reports with your pre-existing accounting software, without the fear of losing old data.

FAQ's

Only expenses related to business purposes are allowed to be made on compay credit cards.

There are many reasons why company credit cards should be used for business expenses. The most important advantage, however, is trackability. Company credit cards make it infinitely easier to manage and track business expenses.

Big businesses are ideal candidates for getting corporate credit cards. If your annual revenue is over USD 4 million you should definitely consider getting a corprate credit card for your business.

The best way to reimburse employees for expenses is to use an expense reimbursement software that can do the job for you. An even better option is using expense reimbursement softwares that come with their own corporate cards.

No, reimbursements are not subject to any taxation.

Trusted by finance teams at startups to enterprises.