How to manage marketing expense effectively using virtual cards

Ever since the digital boom, traditional and print marketing has lost its supremacy over its digital counterpart. In the marketing world of today, digital is king, and Pay-per-click (PPC) is the law of its land.

Digital ads and online campaigns are the focus of digital marketing teams worldwide. Especially in this post-Covid world, digital ad spending has become the primary route of inbound lead generation. As time continues to pass, this spending trend is only going to continue increasing. Rapid digitization has pushed marketing teams to up their efforts to spend more and more on digital marketing.

If you are a marketing agency or a company’s marketing team you also know very well how difficult it is to coordinate marketing expense management. Multiple teams handling multiple clients simultaneously running multiple campaigns? Sounds like a nightmare for your finance team.

If you know how hard marketing spending management can be you should also know how useful a credit card and expense management tool can be for you. But, there is an element of choice here - do you choose a corporate credit card or a small business one? Which provider do you go with?

What is marketing spending?

Marketing spending is referred to as the amount of money your marketing team has spent or allocated towards building and maintaining your brand’s image, creating awareness, and generating inbound leads. This includes spending on online promotional activities including social media, content marketing, paid advertising, SEO, outreach, PR campaigns, marketing tools, and more.

Type of industry, size of business, growth stage, intended audience and expansion goals are all factors that you must take into consideration when estimating your marketing spend. Based on this, again, what you will have to do is create a marketing budget. This budget and how well you stick to it or develop it will then determine how efficient your marketing expense management is.

Common marketing expenses for company

If you’re already invested in marketing chances are that your spending is distributed over multiple channels. While most of these channels are interrelated you should also consider allocating budgets to them individually. Let’s go over some of the common channels that you should be looking at if you haven’t already.

The first and most important aspect you should integrate into your marketing budget is branding, creating a positive and strong perception of your brand, its products, and services in the minds of your target audience. This could include your logo, mission statement, and a consistent theme throughout your company’s lifetime.

To enhance your brand and at the same time help increase your inbound lead generation you can invest in digital advertising on search engines, social media, and online marketplaces. SEO and outreach expenses are also important expenditures you need to incur if you want those top-ranking spots online.

PR campaigns are another common area marketing teams invest in to boost their brand’s presence in a given market. To manage recurring expenses for marketing tools and software, virtual cards for subscription management can help streamline payments and provide better control over your budget.

Put together, including digital ads, PR campaigns, and social media activity, your team also needs tools to manage all this activity. These tools are usually paid for and are another common part of marketing spend management.

Finally, the content that is to be used in all of the above, including graphically designed creatives, written content, images, etc. also need to be paid for and therefore integrated into your budget. Moreover, the people generating this material could be your employees or even freelancers, in either case, human resources also need to be accounted for in your marketing spend.

Thus, the HR team can also benefit from virtual cards as it empowers them to effectively manage the human resource part of the entire marketing spendings. Using virtual card payments for eCommerce business can help streamline and manage the entirety of these marketing expenses more effectively.

Problems of marketing expense management using credit card

Sharing card details

A common approach to marketing expense management includes using a shared company credit card between employees and teams to handle payments.

In practice this results in a situation where whenever a purchase is to be made, for instance, PPC ads or social media promotions, the card and its details will have to be first located, acquired and then there has to be a request generated for the payment which in turn will be possible only once approved.

This entire process is not only highly time-consuming and tedious but can also be risky, given that card details will have to be shared among multiple people.

Risk of card frauds

Using one single card for all activities across different teams can also serve to be a risky course of action.

The lack of structure in the card usage means it can be difficult to ensure accountability, visibility, and control over not only marketing spending but expense management in general. What this does in turn is it directly increases the chances of there being a fraudulent activity that can go unnoticed.

Because of the absence of any tool to manage cards, approvals, and keep track of expenses it can be easy for people to misuse the card for expenses that might not have been approved or even legal, to begin with.

Loss of credit cards

Losing your company’s credit card can unexpectedly put your critical marketing activity on complete hold, disrupting planned campaigns and delaying key initiatives.

Fraudulent activity and inefficiency aside, shared business credit cards are particularly risky to use because of the increased possibility of misplacement during frequent usage or the maxing out of the card itself, especially in high-demand periods.

Not only does the headache of reissuing and recollecting details arise but losing the card also means all your marketing spending could come to a total halt. This is far from being ideal and can be a cause for serious concern.

Take control of your marketing expenses with Volopay

Benefits of managing marketing spend using corporate virtual card

Real time tracking

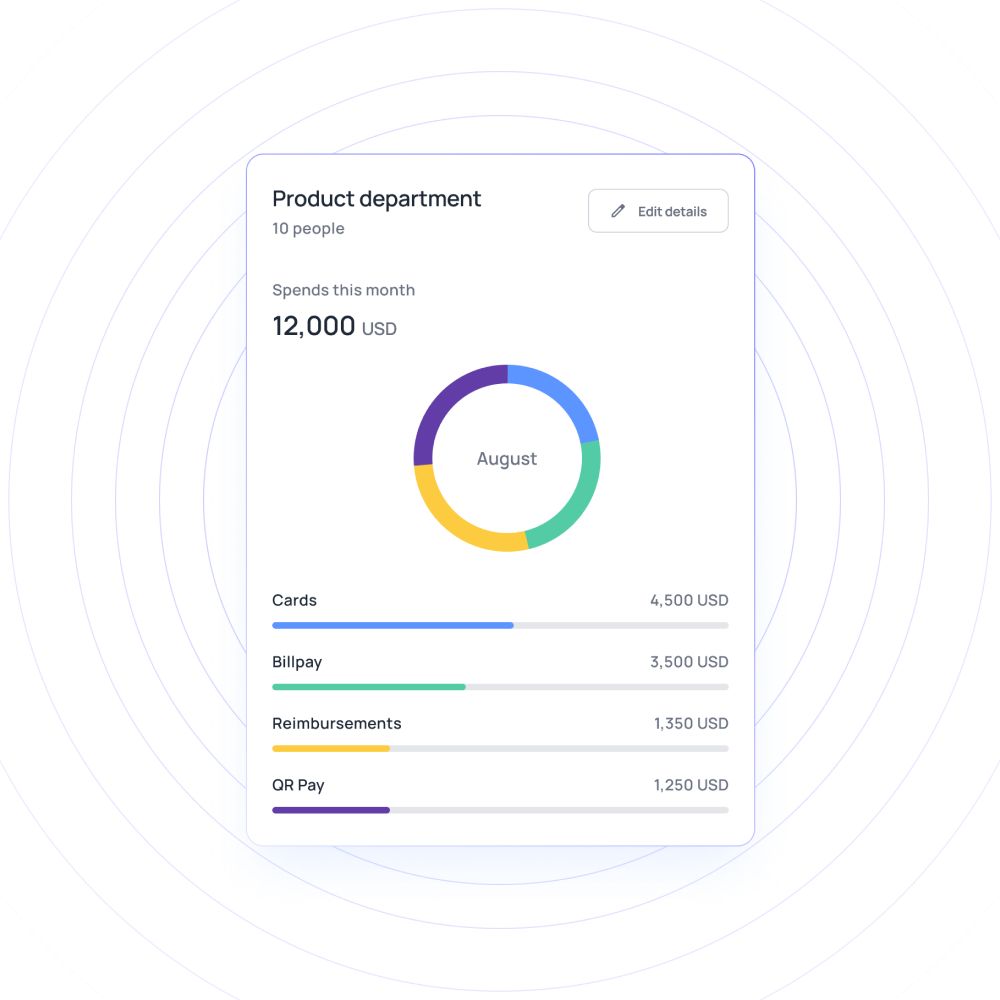

With corporate virtual cards, you can now experience marketing expense management with a centralized view of all spending, in real-time. Virtual cards come with expense management software that are extremely customizable and lets you track the updates, changes, and expenses made in real-time.

As a result, based on parameters you set, these platforms help you approve payment requests, reimburse spending and check unauthorized expenses without having to wait an entire month.

Safety

Virtual cards also have the obvious plus point of being impossible to misplace. The fear of theft or accidental loss of cards is completely removed because it literally takes a few clicks and a couple of seconds to block and then reissue the same card to the required individual.

Additionally, the benefits of virtual cards include features like 3-D security and security certification, ensuring that even if the card itself is lost, the data stored within it remains secure. This enhanced level of protection allows businesses to manage their expenses with confidence, knowing their financial information is safeguarded.

Faster payments

Most company-wide credit cards are not equipped with automated payment facilities. So, these cards usually require manual approvals before each and every payment is made.

Virtual cards, in contrast, come fitted with features that let you set limits, budgets, and pre-approved parameters that can automate this entire process. The need to approve every transaction is made a thing of the past and your payments processes become significantly faster.

Reduces the chances of frauds

Virtual cards are far safer than shared business credit cards, period. Using a corporate virtual card for payments means you can track spending, control budgets, and flag conspicuous behavior the moment it shows up in real-time.

Shared cards also run the risk of being blocked or considered fraudulent by bank software after overuse. This also means they can get blocked if the credit limit runs out, putting your company’s credit line at risk.

Using a virtual card for payment also means your transactions will be secured via far tighter layers of security. Such platforms are usually heavily guarded and equipped against fraudulent activity.

Chances of card getting blocked are very less

If your marketing team uses a single, shared, company credit card for every ad campaign for every client, the probability of it getting blocked is quite high. Repeated use means you are more likely to come up against your credit limit which in turn could cause transactions to get blocked or the card to get declined.

This form of card use can also trigger fraud alerts which can then compel ad programs to block your accounts, derailing campaigns. Keeping things separate by issuing different virtual cards for every account drastically cuts down the probability of these roadblocks. Separate virtual cards issued to different teams not only mean they won’t get blocked but also increases visibility and control to predict and curb blocking before it happens.

Virtual cards are customizable

Virtual cards are also heavily customizable. Some of the commonly customizable features include budget caps, multi-level approvals, currency, and in some cases even the design of the card itself.

Budget caps and approval systems are especially useful for your marketing teams because it sets an automatic limit on how much revenue is to be used for marketing spending without having to manually do the same on the marketing software. Preset caps on spending means there will be less your team will have to do to flag unauthorized behavior.

Reduces burden on the finance team

It goes without saying that the automated payments systems, pre-approval parameters, reimbursement facilities, fraud prevention, and integration capabilities are all factors that can significantly lighten the load on your finance teams.

By delegating the mundane, automatable, tasks to expense management software your finance team can spend more time on more specialized tasks that need human intervention.

If you also want to explore how virtual cards can help HR teams streamline their expense management processes, check out our blog on benefits of using virtual cards for HR teams.

Issue unlimited virtual cards to your employees

Factors to consider while choosing virtual card provider

Ease of issuing virtual corporate cards

On the face of it, virtual cards already have a headstart on physical cards courtesy of ease of issue or creation.

However, how easy this process is can differ from provider to provider. Your choice of corporate virtual card provider should be determined by whose procedure you find easiest.

Integration with other accounting software

The accounts integration capabilities offered by your virtual card provider must also be explained to ensure compatibility with your existing systems.

Many platforms advertise integration capacities; however, they might not always be seamlessly compatible with the accounting software that you have been consistently using.

Exchange rates

Currency exchange rate and other applicable fees, are other factors that must be laid out clearly.

Before you making choice, always compare the rates with other providers and choose the most sensible for your company.

Security measures offered

You must also ensure that the security measures your provider is offering are airtight and easy to understand and access.

The presence of 3-D security, security certification, and approval systems must be ensured.

Make marketing expense management easy with corporate virtual cards from Volopay

Need a corporate virtual card that does all of the above and more? Say hello to Volopay, your company’s best bet when it comes to marketing expense management.

Volopay provides unique, budget-specific cards that provide extra security for all online transactions. You can now create a virtual card for each online vendor (e.g. AWS, Google, LinkedIn, etc.) and never miss out on any payment due date.

Our virtual cards can be created as both one-time as well as monthly payment issues. One-time payment cards are tied to the available funds in a budget and expire in 7 days unless you specify a closing date. On the other hand, monthly cards automatically reset on the 1st of every month with the amount that is set as a limit when created and so are a perfect option for monthly marketing campaigns.

Creating virtual cards is almost as easy as riding a bike, it only needs a few clicks. All you need to do is go to the "Cards" tab on our Dashboard, navigate to Virtual cards and click on the add icon. There’s even a video tutorial to help you out!

Volopay’s system assigns unique numbers to each card. So, if a fraudulent activity does occur for one card, it will be isolated to that card. So you don't need to go through every single online vendor and change your card number.

Therefore, Volopay makes a pretty solid case if you’re looking for corporate virtual cards for marketing expense management. Customizable parameters, real-time reporting, control, visibility, and protection against fraud are all but assured. Never again do you have to worry about missing out on emerging marketing opportunities, lack of funds, or fraudulent activity. And of course, the best part is that you can create as many virtual cards as you need.

Related pages

Explore the benefits of virtual cards for B2B payments, including enhanced security, streamlined processes, cost savings, and improved cash flow.

Learn how virtual card payments for business travel offer control, security, real-time tracking, and simplified reconciliation.

Learn how virtual card payments help accounts payable teams streamline processes, improve security, and boost efficiency in managing payments.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free